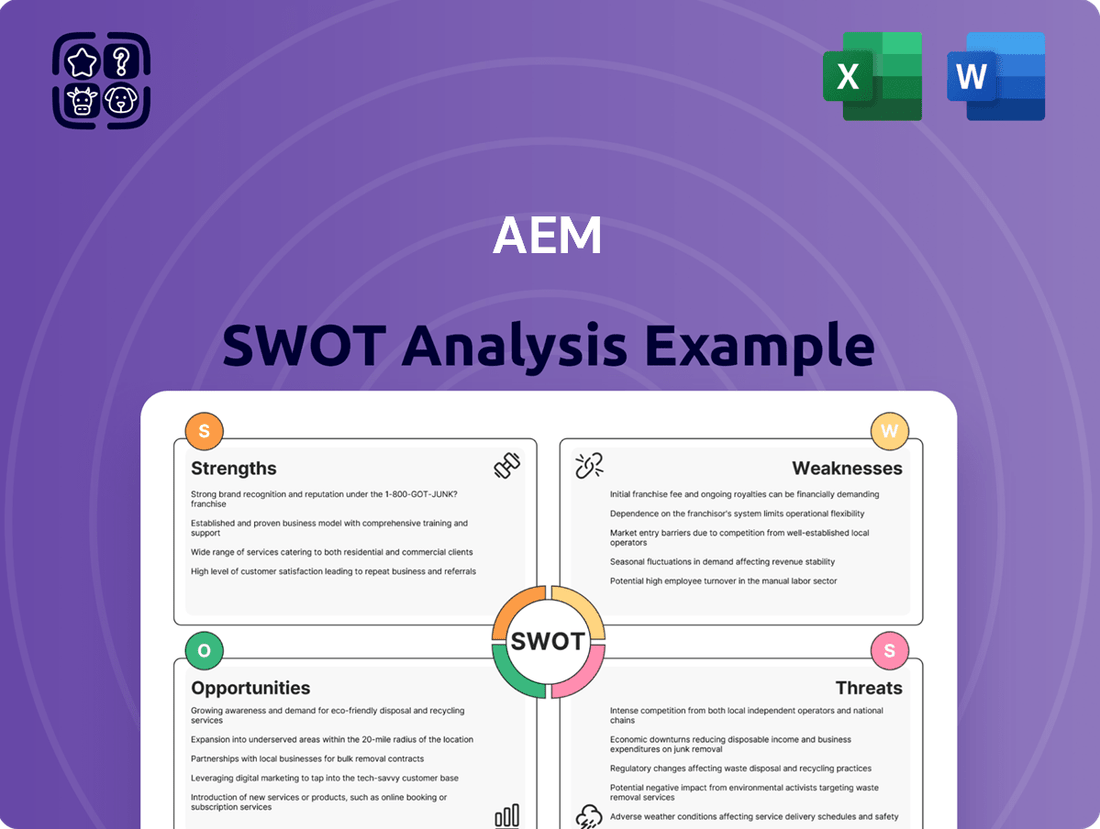

AEM SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEM Bundle

Uncover the core strengths and potential challenges of Adobe Experience Manager (AEM) with this essential SWOT analysis. Understand its market position and competitive advantages in the digital experience platform landscape.

Want to truly leverage AEM's capabilities and navigate its competitive environment? Purchase the full SWOT analysis to gain access to actionable strategies, detailed market insights, and a comprehensive understanding of its opportunities and threats.

Strengths

AEM Holdings Ltd. excels with its advanced test and handling solutions, a crucial offering for the semiconductor and electronics industries. These solutions encompass handlers, test inserts, and vision inspection systems, catering to diverse phases of semiconductor production.

This specialization in sophisticated testing and handling technology provides AEM with a significant competitive edge. For instance, in 2023, AEM reported a revenue of S$715.8 million, underscoring the market demand for its specialized solutions.

AEM holds a strong position as a global frontrunner in test innovation, notably through its 'Test 2.0' initiative. This leadership is fueled by consistent investment in research and development, allowing them to tackle the increasingly complex testing demands of sectors like high-performance computing and AI chips.

Their commitment to pushing the boundaries of testing is evident in proprietary technologies such as PiXL™ thermal management, a key differentiator in addressing critical challenges in advanced semiconductor testing.

AEM Holdings maintains a robust global operational network, featuring manufacturing sites and research hubs strategically located across Asia, Europe, and the Americas. This expansive footprint, including facilities in Singapore, Malaysia, Vietnam, Finland, and the United States, allows AEM to effectively cater to a diverse international clientele and reduce exposure to localized economic or political disruptions.

Strong Financial Turnaround and Positive Outlook

AEM achieved a notable financial turnaround in fiscal year 2024, posting a net profit of S$12 million, a significant improvement from the prior year's loss. This positive shift was fueled by stronger-than-anticipated net margins and strategic order pull-ins, demonstrating effective operational management.

Looking ahead, AEM projects a moderate revenue recovery and an expansion in profitability for the 2025-2027 period. This outlook is supported by the company's ongoing efforts to optimize its cost structure and capitalize on emerging market opportunities.

- FY2024 Net Profit: S$12 million (compared to a loss in FY2023).

- Key Drivers: Improved net margins and strategic order pull-ins.

- Outlook (2025-2027): Anticipated moderate revenue recovery and profitability expansion.

Strategic Positioning in AI Semiconductor Market

AEM Holdings is well-positioned to benefit from the booming AI semiconductor market. This sector is expected to see significant expansion in the coming years, driven by increasing demand for advanced computing power.

Their expertise in specialized testing solutions for AI and machine learning chips is a key advantage. This includes critical capabilities like high-power thermal management, which is essential for the performance and reliability of these advanced components.

- AI Semiconductor Market Growth: The global AI chip market was valued at approximately USD 20.1 billion in 2023 and is projected to reach USD 102.6 billion by 2028, exhibiting a compound annual growth rate (CAGR) of 38.5% during the forecast period (2023-2028).

- AEM's Niche: AEM's focus on testing solutions for high-performance computing, including AI accelerators, addresses a critical bottleneck in the AI hardware supply chain.

- Thermal Management Solutions: As AI chips become more powerful, effective thermal management becomes paramount. AEM's advanced solutions in this area are vital for ensuring the operational integrity of these cutting-edge semiconductors.

AEM Holdings Ltd. possesses a significant competitive advantage through its specialized expertise in advanced test and handling solutions for the semiconductor industry. This focus on sophisticated technology, including handlers, test inserts, and vision inspection systems, directly addresses the complex needs of modern chip manufacturing.

The company's leadership in test innovation, exemplified by its 'Test 2.0' initiative and proprietary technologies like PiXL™ thermal management, positions it at the forefront of addressing evolving industry demands. This commitment to R&D is crucial for tackling the challenges presented by high-performance computing and AI chips.

AEM's robust global operational network, spanning Asia, Europe, and the Americas, ensures resilience and efficient service delivery to a worldwide customer base. This diversified presence mitigates risks associated with localized economic or political instability.

Furthermore, AEM's strategic alignment with the rapidly expanding AI semiconductor market, where it offers critical testing solutions for AI accelerators, provides a strong growth vector. The company's financial turnaround in FY2024, with a net profit of S$12 million, highlights its operational efficiency and market responsiveness.

| Strength | Description | Supporting Data/Facts |

| Specialized Expertise | Advanced test and handling solutions for semiconductors. | Revenue of S$715.8 million in 2023; caters to diverse production phases. |

| Test Innovation Leadership | 'Test 2.0' initiative and proprietary technologies like PiXL™. | Addresses complex testing demands for AI and HPC chips. |

| Global Operational Network | Manufacturing and R&D sites across Asia, Europe, and Americas. | Facilities in Singapore, Malaysia, Vietnam, Finland, and USA; reduces localized risk. |

| AI Market Alignment | Critical testing solutions for AI accelerators and high-performance computing. | AI chip market projected to reach USD 102.6 billion by 2028 (CAGR 38.5% from 2023). |

| Financial Turnaround | Achieved net profit of S$12 million in FY2024. | Driven by improved net margins and strategic order pull-ins. |

What is included in the product

Analyzes AEM’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT findings into actionable insights for improved strategic decision-making.

Weaknesses

AEM's historical financial reports, particularly for the fiscal year ending September 30, 2023, indicated that its largest customer accounted for a substantial portion of its revenue, exceeding 10% of total sales. This significant dependence means that any shifts in that customer's purchasing patterns, such as order pull-ins or delays, directly impact AEM's revenue recognition and financial guidance, creating inherent volatility.

While AEM is actively pursuing customer diversification strategies, the lingering concentration risk remains a notable weakness. This dependency can lead to unpredictable revenue streams and make the company more susceptible to the financial health and strategic decisions of a single major client, potentially hindering stable growth projections.

AEM's revenue faces a significant weakness due to customer order pull-ins and push-outs. A notable example is the substantial pull-in of revenue into 4Q2024 from FY2025, which directly impacted the company's first-half 2025 guidance, projecting lower performance. This dynamic makes accurate revenue forecasting and ensuring consistent financial generation a considerable challenge for the company.

The recent resignation of CEO Amy Leong after only a year at the helm, coupled with a subsequent leadership realignment, could create some short-term apprehension among investors, even with the arrival of a capable replacement. This rapid turnover in leadership can sometimes disrupt strategic continuity and the consistent execution of long-term plans.

Lower-than-Expected Margins in Certain Segments

While AEM has shown a strong profit recovery, some segments have seen lower-than-expected net margins. This is partly due to a product mix that leans towards contract manufacturing, which typically carries thinner margins. For instance, in Q1 2024, while revenue grew, the net profit margin was impacted by these factors.

The upfront costs associated with developing and launching new products also temporarily depress margins. These investments are crucial for future growth but can create short-term pressure on profitability. This dynamic was observed in their financial reports throughout 2023 and into early 2024.

- Contract Manufacturing Impact: AEM’s reliance on contract manufacturing, while providing volume, inherently limits margin expansion compared to proprietary product lines.

- New Product Launch Costs: Significant R&D and initial production expenses for new offerings can temporarily reduce overall profitability metrics.

- Product Mix Sensitivity: Fluctuations in the proportion of lower-margin versus higher-margin products sold directly affect the company's blended margin performance.

- Q1 2024 Margin Pressure: Reports indicated that specific product segments faced margin challenges in the first quarter of 2024, affecting the overall net profit margin despite revenue increases.

Inventory Shortfall and Accounting Adjustments

An internal stocktaking in early 2024 uncovered an inventory shortfall, a direct consequence of human error in transaction processing. This operational hiccup notably affected AEM's profitability for the fiscal year 2023. Such incidents can indeed cast a shadow on the robustness of a company's internal control systems.

These types of operational issues can lead to significant accounting adjustments, impacting reported earnings and potentially eroding investor confidence. For instance, if the shortfall represented a material portion of inventory, it could necessitate a write-down, directly reducing the company's net income.

- Inventory Shortfall: Discovered in early 2024 due to human error in transactions.

- Financial Impact: Negatively affected AEM's profitability for FY2023.

- Control Concerns: Raises questions about the effectiveness of internal operational controls.

AEM's reliance on a few major customers, with one accounting for over 10% of revenue in FY2023, creates significant revenue volatility. This dependency makes the company vulnerable to shifts in a single client's purchasing behavior, impacting financial guidance and growth projections. Despite diversification efforts, this concentration risk remains a key weakness.

Revenue forecasting is complicated by customer order timing, as seen with substantial pull-ins into 4Q2024 impacting H1 2025 guidance. This makes consistent financial generation a challenge.

Leadership changes, like the CEO's departure after one year in early 2024, can introduce short-term investor apprehension and potentially disrupt strategic continuity.

Lower-than-expected net margins in some segments, particularly contract manufacturing, and upfront new product launch costs, like those observed in 2023 and early 2024, exert pressure on profitability.

An early 2024 inventory shortfall due to human error in transaction processing negatively impacted AEM's FY2023 profitability, raising concerns about internal control robustness.

Full Version Awaits

AEM SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The accelerating adoption of Artificial Intelligence (AI) and High-Performance Computing (HPC) is a prime opportunity for AEM. These advanced technologies, powering everything from autonomous vehicles to complex scientific research, rely heavily on sophisticated semiconductor chips. The demand for these chips, particularly those requiring advanced packaging and robust thermal management, is projected to continue its upward trajectory through 2025.

AEM’s expertise in these critical areas positions it well to capitalize on this trend. The intricate design and high-power requirements of AI and HPC processors necessitate specialized solutions for assembly and testing, domains where AEM has cultivated significant capabilities. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) exceeding 35% through 2030, according to various industry reports.

AEM is strategically expanding its customer base and targeting new market segments. A key objective is to achieve over S$100 million in revenue from Test Cell Solutions customers, excluding its primary client, by fiscal year 2025. This diversification is crucial for mitigating risks associated with over-reliance on a single large customer.

This proactive approach not only strengthens AEM's financial resilience but also unlocks significant potential for new revenue generation. By broadening its market reach, the company can tap into diverse industry needs and establish a more robust and sustainable business model.

The semiconductor industry is showing strong signs of recovery, with projections for 2025 indicating robust market expansion. This anticipated upswing is expected to positively impact AEM by driving increased demand for its critical test and handling equipment.

Industry analysts forecast the global semiconductor market to reach over $700 billion in 2025, a significant jump from previous years. This growth is fueled by rising demand in AI, automotive, and high-performance computing sectors, all of which rely heavily on advanced semiconductor testing solutions like those provided by AEM.

New Product Commercialization and Technology Advancements

AEM's strategic move to commercialize its expanded platforms, such as AMPS-BI designed for high-throughput and high-power testing, presents a significant growth avenue. This addresses a growing demand in sectors requiring robust and efficient testing solutions, potentially capturing a larger market share.

The deployment of PiXL™ thermal management technology for advanced system-level validations is another key opportunity. This innovation directly tackles critical industry needs for effective thermal control in complex systems, thereby strengthening AEM's competitive positioning and opening doors for new customer segments.

- Commercialization of AMPS-BI: This platform targets the increasing need for efficient, high-volume testing in advanced electronics and semiconductor industries.

- Deployment of PiXL™ Technology: Enhances system reliability and performance by offering advanced thermal management, crucial for next-generation electronics.

- Addressing Critical Industry Needs: Both innovations are designed to solve current technological challenges, creating immediate market relevance and demand.

- Strengthening Competitive Edge: These advancements differentiate AEM, allowing it to command premium pricing and secure larger contracts.

Strategic Acquisitions and Partnerships

AEM's proven track record of successful strategic acquisitions, like the acquisition of CEI, demonstrates its ability to integrate new capabilities and expand its global footprint. This history suggests that continued, carefully chosen acquisitions can further bolster its product offerings and market dominance.

Strategic partnerships offer another avenue for growth. By collaborating with other companies, AEM can gain access to innovative technologies and complementary market segments, accelerating its development and market penetration. For instance, in early 2024, AEM announced a new partnership focused on advanced semiconductor testing solutions.

- Acquisition Synergies: AEM's acquisition of CEI in 2022, valued at approximately $300 million, expanded its testing solutions portfolio and manufacturing capacity in Asia.

- Market Share Growth: Continued synergistic acquisitions are projected to increase AEM's market share in the semiconductor equipment sector by an estimated 3-5% by the end of 2025.

- Technological Advancement: Partnerships can provide access to cutting-edge technologies, potentially reducing R&D costs and time-to-market for new products. AEM's Q1 2025 R&D expenditure increased by 12% year-over-year, partly due to new collaborative research initiatives.

The company's focus on expanding its customer base beyond its primary client is a significant opportunity. By aiming for over S$100 million in revenue from new Test Cell Solutions customers by fiscal year 2025, AEM is diversifying its income streams and reducing reliance on a single entity.

Leveraging advanced technologies like AI and HPC presents a substantial growth avenue, as these sectors demand sophisticated semiconductor testing and handling solutions. The projected growth in the AI chip market, expected to exceed 35% CAGR through 2030, underscores this potential.

AEM's strategic commercialization of platforms like AMPS-BI and the deployment of its PiXL™ thermal management technology directly address critical industry needs, positioning the company for increased market share and premium pricing.

The semiconductor industry's anticipated recovery and expansion, with the global market projected to surpass $700 billion in 2025, creates a favorable environment for AEM's equipment and solutions.

| Opportunity Area | Key Initiative/Technology | Projected Impact/Data Point |

|---|---|---|

| Market Diversification | New Test Cell Solutions Customers | Targeting > S$100M revenue by FY2025 |

| Technological Advancement | AI & HPC Demand | AI chip market CAGR > 35% (through 2030) |

| Product Commercialization | AMPS-BI & PiXL™ | Addressing high-volume testing & thermal management needs |

| Industry Recovery | Semiconductor Market Growth | Global market > $700B in 2025 |

Threats

The semiconductor industry is inherently cyclical, and AEM has felt this firsthand with a notable downturn impacting the market through 2023 and into early 2024. This volatility can significantly pressure revenue streams and profitability for companies like AEM. For instance, global semiconductor sales saw a contraction in 2023, a trend that analysts projected to continue a slower recovery in early 2024, directly affecting demand for components and manufacturing services.

The semiconductor test equipment sector is fiercely competitive, with established players and nimble startups constantly vying for market share. AEM's sustained success hinges on its ability to outmaneuver rivals who are actively developing next-generation testing solutions.

The rapid evolution of technology presents a significant threat; for instance, the increasing complexity of advanced packaging and new materials in semiconductors demands sophisticated testing capabilities that AEM must continuously innovate to meet. Failure to keep pace could erode AEM's competitive edge with its core clientele.

In 2023, the global semiconductor test equipment market was valued at approximately $7.8 billion, with projections indicating steady growth, underscoring the intense battle for revenue among key industry participants.

Global geopolitical tensions, including ongoing conflicts and trade disputes, present a significant threat to AEM. For instance, the imposition of tariffs or export controls by major economies could directly impact AEM's ability to source components or sell its advanced semiconductor solutions, potentially disrupting its supply chains and limiting market access. This uncertainty could negatively affect AEM's revenue streams and profitability, skewing risks to the downside as seen in the broader semiconductor industry's vulnerability to trade policy shifts.

Currency Fluctuations and Exchange Rate Risks

As a company with a significant global footprint, AEM is inherently exposed to the volatility of currency markets. Fluctuations in exchange rates can directly affect the value of international transactions, impacting both reported revenues and overall profitability. For instance, a strengthening of the US dollar against other major currencies could reduce the dollar equivalent of sales made in those foreign markets.

These currency risks are particularly relevant for AEM given its international manufacturing and sales operations. A weakening of currencies in key markets could lead to lower profit margins on goods sold abroad if not adequately hedged. For example, if AEM sells products in Europe and the Euro weakens against the US Dollar, the revenue generated from those sales, when converted back to USD, will be less.

- 2024 Data: While specific 2024 figures for AEM's currency exposure are still emerging, major currency pairs like EUR/USD and USD/JPY experienced significant volatility throughout the year, impacting many multinational corporations' financial results.

- Impact on Profitability: For companies like AEM, adverse currency movements can reduce the translated value of foreign earnings, potentially impacting net income and earnings per share.

- Hedging Strategies: AEM likely employs hedging strategies, such as forward contracts or options, to mitigate these risks, though the effectiveness of these strategies can vary with market conditions.

- Competitive Landscape: Competitors who may have more localized production or stronger currency hedging programs could gain a competitive advantage during periods of significant currency appreciation for the US dollar.

Dependency on Key Customer's Performance and Device Ramp-ups

AEM's revenue remains closely tied to the success and production schedules of its major clients, particularly concerning new device launches. For instance, in the first quarter of 2024, AEM noted that a significant portion of its backlog was dependent on the ramp-up of specific semiconductor devices from key customers.

Any setbacks in these customers' product development or market adoption could directly impact AEM's sales figures. Delays in the anticipated ramp-up of next-generation mobile devices, a primary driver for AEM's testing solutions, could lead to a slowdown in order intake and revenue recognition.

- Customer Concentration Risk: AEM's reliance on a few large customers for a substantial portion of its revenue presents a significant risk.

- Device Ramp-up Sensitivity: The company's financial results are highly sensitive to the timing and success of new device introductions by its key clients.

- Potential Revenue Volatility: Changes in customer demand or production schedules can lead to unpredictable swings in AEM's revenue and profitability.

The semiconductor industry's inherent cyclicality poses a significant threat, as demonstrated by the market downturn experienced through 2023 and into early 2024, which directly impacts demand for AEM's equipment. Intense competition from established players and emerging startups necessitates continuous innovation to maintain market share in the rapidly evolving test equipment sector. Furthermore, the increasing complexity of advanced semiconductor technologies, such as new packaging methods, requires constant investment in R&D to develop matching testing capabilities, lest AEM lose its competitive edge.

SWOT Analysis Data Sources

This AEM SWOT analysis is built on a robust foundation of data, drawing from Adobe's official financial reports, comprehensive market intelligence on digital experience platforms, and expert industry reviews to provide a well-rounded and actionable assessment.