AEM Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEM Bundle

AEM's competitive landscape is shaped by a complex interplay of forces, from the bargaining power of its customers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any business looking to thrive in this market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AEM’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration is a key factor in the semiconductor test equipment industry. AEM, like its competitors, depends on a select group of highly specialized suppliers for critical components and advanced technologies. This limited pool of specialized providers means these suppliers can wield considerable influence, potentially dictating terms and pricing to AEM.

The global semiconductor supply chain has faced significant disruptions, particularly in recent years. These vulnerabilities, such as shortages of raw materials and manufacturing capacity, have amplified the bargaining power of suppliers. For instance, lead times for critical semiconductor components have extended, and prices have increased, directly impacting the cost structure for equipment manufacturers like AEM.

AEM's advanced test and handling solutions, particularly for demanding sectors like AI and High-Performance Computing (HPC), often necessitate highly specialized components. These unique inputs, if critical to AEM's differentiated product offerings, grant suppliers significant leverage. For instance, the proprietary nature of certain semiconductor materials or advanced optical components used in AEM's equipment can make switching suppliers difficult and costly, thereby increasing supplier bargaining power.

Switching suppliers in the semiconductor equipment sector, like for Advanced Energy Materials (AEM), often involves significant hurdles. These can include the expense and time required for integrating new components, the rigorous qualification processes that must be passed, and the potential need for costly re-designs of existing equipment. These complexities directly translate into higher switching costs for AEM.

When switching costs are high, AEM's current suppliers gain more leverage. This increased bargaining power is especially pronounced for suppliers providing critical, long-term components that are deeply embedded in AEM's manufacturing processes and product designs. For instance, if a specialized sensor or a custom-made vacuum chamber is difficult and expensive to replace, the supplier of that part can command more favorable terms.

Threat of Forward Integration by Suppliers

The threat of forward integration by AEM's suppliers could significantly shift the balance of power. If key component providers, particularly those with advanced technological capabilities, decide to manufacture their own test equipment, they could directly compete with AEM. This would not only reduce AEM's customer base but also potentially force pricing concessions.

While this is a less frequent concern for highly specialized component suppliers who lack the expertise in complex test system integration, it remains a relevant consideration for larger technology firms. For instance, if a major semiconductor manufacturer were to develop its own testing solutions, it could leverage its existing market position to gain traction.

In 2024, the trend towards vertical integration in the semiconductor industry, driven by supply chain resilience concerns, could increase the likelihood of such a move by some suppliers. Companies might see developing in-house testing capabilities as a strategic advantage to control their product lifecycle and quality assurance more effectively.

- Potential for Supplier Competition: Suppliers integrating forward into test equipment manufacturing could directly challenge AEM's market share.

- Impact on Pricing: Increased competition from suppliers might lead to downward pressure on AEM's pricing.

- Industry Trends: The ongoing push for supply chain control in the tech sector in 2024 could incentivize suppliers to explore vertical integration.

- Specialization as a Mitigant: The threat is generally lower for suppliers focused on highly niche or specialized components.

Importance of AEM to Suppliers

The relative importance of Adobe Experience Manager (AEM) as a customer to its suppliers significantly impacts supplier bargaining power. If AEM constitutes a substantial portion of a supplier's annual revenue, that supplier's ability to dictate terms or raise prices may be lessened, as they have more to lose by alienating AEM. For instance, in 2024, many cloud infrastructure providers experienced robust growth, with companies like Amazon Web Services (AWS) reporting significant revenue increases. If AEM is a major client for such a provider, their leverage over the provider is amplified.

Conversely, if AEM represents only a small fraction of a supplier's overall business, particularly for large, diversified companies, AEM's bargaining power is diminished. Such suppliers are less dependent on AEM's business and can more easily absorb the loss of AEM as a customer, thereby increasing their own negotiating strength. This dynamic is particularly relevant in the software and cloud services sectors where consolidation is common, and major players serve a vast array of clients, making any single customer's contribution less critical to their overall financial health.

The influence of AEM's customer importance varies greatly across its diverse supply chain. For critical software components or specialized cloud services where AEM might be a primary client, suppliers may exhibit less power. However, for more commoditized inputs or services, where AEM is a minor customer among many, the supplier's bargaining power is likely to be higher, allowing them to potentially command better terms.

This variability means that AEM must carefully assess its supplier relationships. For example, a key data analytics provider that relies heavily on AEM for 15% of its revenue in 2024 might be more accommodating to AEM's requests than a large cloud hosting service provider for whom AEM represents less than 1% of its multi-billion dollar annual revenue.

The bargaining power of suppliers for Adobe Experience Manager (AEM) is influenced by several factors, including supplier concentration, switching costs, and the threat of forward integration. In 2024, the semiconductor industry's focus on supply chain resilience has heightened the importance of these dynamics.

High switching costs, such as the expense and time for component integration and qualification, grant suppliers significant leverage over AEM. This is particularly true for specialized components integral to AEM's advanced solutions. The threat of suppliers integrating forward into test equipment manufacturing, while less common for highly niche providers, remains a consideration, especially as industry trends in 2024 encourage greater supply chain control.

AEM's importance as a customer also shapes supplier power. If AEM represents a substantial portion of a supplier's revenue, the supplier's leverage is reduced. Conversely, for commoditized inputs where AEM is a minor client, suppliers wield more power, potentially commanding better terms. This variability necessitates careful management of AEM's diverse supplier relationships.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Adobe Experience Manager's (AEM) position in the Digital Experience Platform market.

Quickly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force with an intuitive, color-coded dashboard.

Customers Bargaining Power

Customer concentration at AEM Holdings has historically presented a significant challenge, with a notable reliance on a single key customer. This dependence has granted that customer substantial bargaining power, enabling them to influence AEM's operations, such as dictating order timings for inventory management, which in turn affects revenue predictability.

While AEM has been making strides in diversifying its customer portfolio, the lingering effects of this past concentration mean that the bargaining power of customers remains a relevant force. For instance, in the semiconductor industry, large original equipment manufacturers (OEMs) often hold considerable sway over their suppliers due to the sheer volume of business they represent.

For semiconductor and electronics firms, changing test and handling equipment is a significant undertaking. This often means substantial expenses for re-tooling machinery, re-qualifying products and processes, and managing potential interruptions to their production lines. These considerable upfront investments make customers hesitant to switch providers.

AEM's approach, particularly with its integrated Test Cell Solutions (TCS), further elevates these switching costs. By offering specialized, end-to-end solutions, AEM embeds its technology deeply into a customer's workflow. This integration means that a customer would not only need to replace AEM's equipment but also potentially reconfigure their entire testing and handling setup, thereby solidifying AEM's position and diminishing customer leverage.

Customer price sensitivity in the semiconductor industry is a significant factor. Large manufacturers, facing fierce competition, are keenly focused on controlling their production expenses, making them highly attuned to the cost of essential components and equipment. This sensitivity means that pricing strategies for test equipment providers must carefully consider the overall cost structures of their clientele.

However, the burgeoning demand for sophisticated test equipment to handle advanced chips, particularly those powering AI and High-Performance Computing (HPC), is creating a dynamic shift. For these cutting-edge solutions, the need for performance and reliability may, to some extent, temper extreme price sensitivity. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to grow substantially, indicating a willingness to invest in specialized equipment that can ensure the quality of these high-value components.

Customer's Ability to Backward Integrate

Customers, particularly large semiconductor manufacturers, possess the potential to backward integrate, meaning they could develop or enhance their own in-house test and handling capabilities. This reduces their dependence on external service providers like AEM Holdings. For example, a major chipmaker investing in its own advanced testing infrastructure could significantly shift the bargaining power dynamics.

While this route demands substantial capital expenditure and specialized technical know-how, it represents a persistent long-term risk. The mere threat of such integration can empower customers to negotiate more favorable terms from AEM, influencing pricing and service level agreements.

- Potential for In-House Testing: Major semiconductor firms can invest in and expand their own testing and handling operations.

- Reduced Reliance: This capability reduces their need for external suppliers, thereby increasing their bargaining power.

- Investment and Expertise Barrier: Significant capital and specialized skills are required for successful backward integration.

- Long-Term Threat: Even the possibility of integration influences customer negotiation leverage.

Availability of Substitute Products/Services for Customers

Customers in the semiconductor test equipment market possess significant bargaining power due to the widespread availability of substitute products and services. Several key players, including Teradyne, Advantest, and Cohu, offer comparable solutions for essential components like handlers, test inserts, and vision inspection systems.

This competitive landscape means customers aren't locked into a single supplier. For instance, a fabless semiconductor company can readily switch between providers for automated test handlers if pricing or performance becomes unfavorable. This ease of switching directly amplifies customer leverage.

- High Availability of Substitutes: Customers can choose from multiple semiconductor test equipment manufacturers.

- Competitive Offerings: Companies like Teradyne, Advantest, and Cohu provide similar handlers, test inserts, and vision inspection systems.

- Enhanced Customer Leverage: The presence of alternatives empowers customers to negotiate better terms and pricing.

Customers in the semiconductor industry wield substantial bargaining power, largely due to the high concentration of demand and the significant switching costs associated with AEM's specialized solutions. While AEM's integrated offerings create barriers to switching, the sheer volume represented by major clients and the potential for backward integration by customers remain key factors influencing price and terms. The availability of substitutes from competitors like Teradyne and Advantest further amplifies this customer leverage.

The semiconductor industry's customer landscape is characterized by a few dominant players. For instance, in 2023, the top 10 semiconductor companies accounted for a significant portion of global revenue, highlighting the concentration of buying power. This means that a single large customer can represent a substantial percentage of a supplier's revenue, giving them considerable sway in negotiations.

| Factor | Impact on AEM | Example/Data (2023-2024) |

|---|---|---|

| Customer Concentration | High bargaining power for key clients | AEM's historical reliance on a single major customer |

| Switching Costs | Reduces customer power (for AEM) | Re-tooling and re-qualification expenses for customers |

| Backward Integration Potential | Threatens AEM's revenue | Major chipmakers investing in in-house testing capabilities |

| Availability of Substitutes | Increases customer power | Competitors like Teradyne, Advantest, Cohu offering similar solutions |

| Price Sensitivity | Customers push for lower costs | Focus on production expenses by large semiconductor manufacturers |

What You See Is What You Get

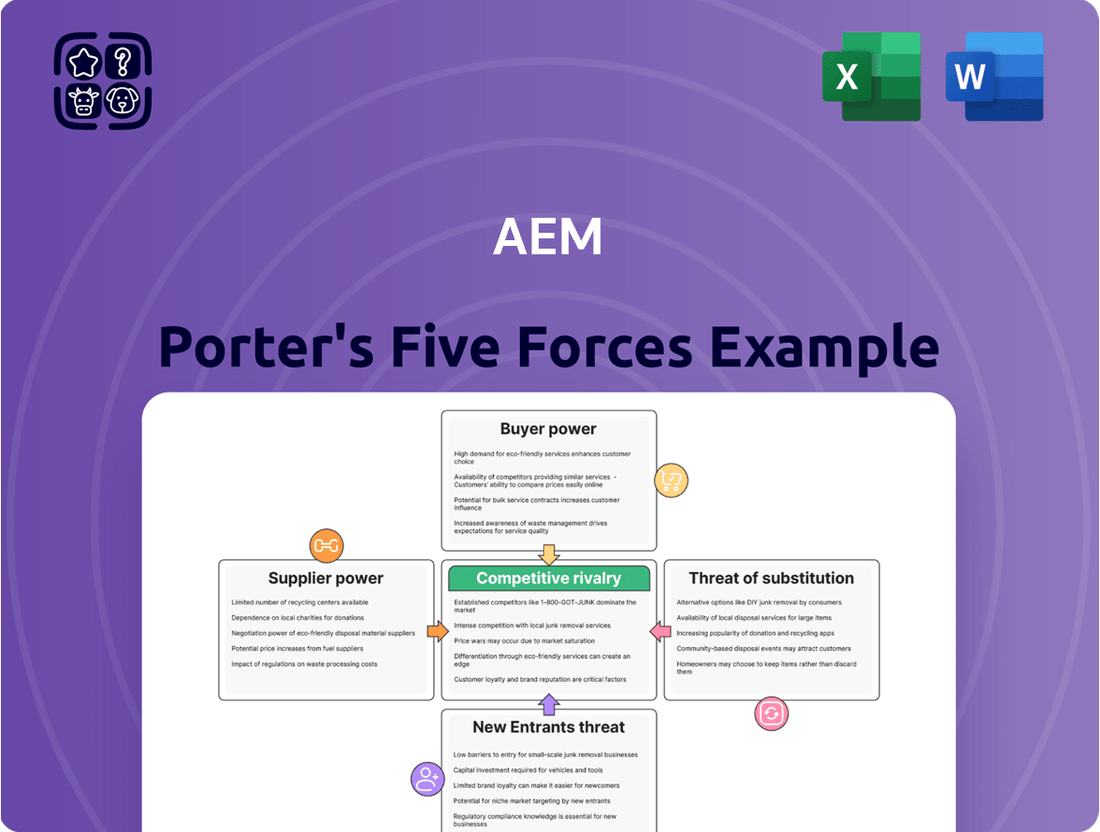

AEM Porter's Five Forces Analysis

This preview showcases the complete AEM Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape relevant to Adobe Experience Manager. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises or placeholder content.

Rivalry Among Competitors

The semiconductor test equipment market is quite concentrated, featuring a few dominant global players alongside a scattering of more specialized companies. Key competitors like Advantest and Teradyne are giants in this space, with Cohu also holding a significant position.

In 2023, Advantest reported net sales of approximately ¥272.7 billion (around $1.8 billion USD at the time), while Teradyne's 2023 revenue was reported at $3.7 billion. Cohu's 2023 revenue reached $1.1 billion. The substantial revenue figures of these leading firms underscore the market's maturity and the significant resources required to compete effectively.

The semiconductor industry, and by extension the test equipment market, is enjoying significant expansion. This growth is largely fueled by the surging demand for artificial intelligence (AI), high-performance computing (HPC), and sophisticated packaging solutions. For instance, the global semiconductor market was projected to reach $689 billion in 2024, a notable increase from previous years, according to industry forecasts.

A burgeoning market environment can often temper the intensity of competitive rivalry. When the overall pie is getting larger, companies have the opportunity to grow their revenues and operations by capturing new demand rather than solely by aggressively taking market share from existing players. This dynamic can lead to a more collaborative or at least less cutthroat competitive landscape, at least in the short to medium term.

AEM's commitment to advanced test and handling solutions, featuring proprietary PiXL thermal technology and AMPS-BI for AI/HPC applications, is a key differentiator. This focus on cutting-edge technology allows AEM to stand out in a competitive landscape.

By emphasizing technological superiority, AEM can mitigate intense price competition. This strategy enables the company to compete on the basis of performance and innovation, rather than being solely driven by cost, which is crucial for maintaining market share and profitability.

Exit Barriers

High exit barriers in the semiconductor test equipment sector mean companies find it tough to leave the market. This is often due to the massive, specialized nature of their assets, like advanced testing machinery, which have little value outside the industry. For instance, Teradyne, a major player, invests billions annually in R&D, creating a significant sunk cost. This forces them and others to continue competing fiercely, even when market conditions are unfavorable, rather than abandoning their investments.

These significant exit barriers directly fuel competitive rivalry. Companies are essentially locked into the industry, compelling them to fight for market share. This can lead to price wars or aggressive innovation cycles as firms try to outmaneuver rivals rather than seek an exit. The substantial R&D commitments, often in the hundreds of millions of dollars for leading firms, further cement this situation.

- Specialized Assets: Semiconductor test equipment is highly specific and costly, making resale difficult.

- High R&D Investment: Continuous innovation requires massive, ongoing research and development spending.

- Long-Term Customer Relationships: Established trust and integration with chip manufacturers create switching costs for buyers.

- Brand Reputation: A strong reputation built over years is difficult to replicate and abandon.

Strategic Stakes

The semiconductor test equipment market carries immense strategic importance, especially as artificial intelligence and high-performance computing demand ever more sophisticated chips. Companies in this space have significant stakes in capturing or holding onto market share, driving continuous innovation and aggressive competitive strategies.

This intense focus on market position fuels substantial investments in research and development. For instance, in 2023, major players like Advantest and Teradyne continued to pour billions into developing next-generation testing solutions to meet the evolving needs of advanced semiconductor manufacturing.

- High Stakes in AI and HPC: The growth of AI and high-performance computing directly translates to increased demand for advanced semiconductor testing capabilities, making market leadership critical.

- Sustained Investment in Innovation: Companies are compelled to invest heavily in R&D to stay ahead, developing equipment that can handle the complexity and speed of new chip designs.

- Market Share as a Key Metric: Maintaining or expanding market share is a primary objective, leading to fierce competition and strategic maneuvering among key industry participants.

Competitive rivalry in the semiconductor test equipment market is intense, driven by a concentrated industry structure and high barriers to entry. Key players like Advantest and Teradyne, with 2023 revenues of approximately $1.8 billion and $3.7 billion respectively, invest heavily in R&D, creating a high-stakes environment where innovation and market share are paramount.

The burgeoning demand from AI and HPC sectors, projected to drive the global semiconductor market to $689 billion in 2024, tempers some of the rivalry as companies can grow by capturing new demand. However, substantial exit barriers, including specialized assets and long-term customer relationships, lock firms into continuous competition, often leading to aggressive strategies focused on technological superiority to mitigate price wars.

| Company | 2023 Revenue (approx.) | Key Focus Areas |

|---|---|---|

| Teradyne | $3.7 billion | Semiconductor test, robotics, industrial automation |

| Advantest | $1.8 billion (¥272.7 billion) | Semiconductor test equipment, system level test |

| Cohu | $1.1 billion | Semiconductor test, burn-in, inspection |

SSubstitutes Threaten

While direct substitutes for semiconductor test equipment are scarce, the rise of advanced design-for-testability (DFT) methods presents an indirect threat. These techniques, integrated during the chip design phase, aim to build in self-testing capabilities, potentially lessening the need for exhaustive external testing equipment in certain applications.

For instance, companies heavily investing in DFT might reduce their capital expenditure on certain types of automated test equipment (ATE). This shift could impact the market share of traditional ATE providers if DFT becomes a widespread industry standard, effectively substituting some of their services.

Large semiconductor manufacturers increasingly possess the resources and expertise to develop their own advanced testing solutions. For instance, in 2024, major players in the semiconductor industry continued to invest heavily in R&D, with some allocating over 20% of their revenue to innovation, which could include building out internal testing infrastructure. This backward integration presents a direct substitute for external providers like AEM, as companies can tailor solutions precisely to their evolving needs.

The growing power of software-based simulation and modeling tools presents a significant threat to traditional physical testing methods in chip design. These advanced digital platforms can now replicate complex scenarios, allowing engineers to catch design errors much earlier in the development cycle. This reduces reliance on expensive and time-consuming physical prototypes.

For instance, in 2024, the EDA (Electronic Design Automation) market, which encompasses these simulation tools, was projected to reach over $13 billion, showcasing the substantial investment and adoption of these digital alternatives. The ability of these software solutions to perform virtual testing and validation means fewer physical test benches and specialized equipment may be required, impacting the demand for certain types of hardware.

Evolving Semiconductor Materials

The threat of substitutes for Advanced Energy Materials (AEM) is evolving with the emergence of new semiconductor materials. While not direct replacements for AEM's current offerings, these innovations could alter the landscape of testing requirements and methodologies. For instance, wide bandgap semiconductors like Gallium Nitride (GaN) and Silicon Carbide (SiC) are gaining traction in high-power and high-frequency applications, potentially necessitating different testing protocols than traditional silicon-based devices.

Organic semiconductors and nanomaterials also present a longer-term threat by offering alternative pathways for electronic device fabrication. This shift could introduce new testing paradigms, impacting the demand for AEM's existing testing solutions. The market for SiC devices alone was projected to reach approximately $7.4 billion by 2025, indicating a significant growth area that may require specialized testing capabilities.

- Emerging Materials: Wide bandgap semiconductors (GaN, SiC), organic semiconductors, and nanomaterials are developing as alternatives.

- Testing Impact: These materials may demand different or entirely new testing requirements and paradigms.

- Market Shift: While not immediate substitutes, these technologies represent a potential long-term shift in the underlying semiconductor industry.

- Growth Potential: The SiC market, for example, is a rapidly expanding segment that could drive demand for new testing solutions.

Shift in Manufacturing Paradigms

Future shifts in how semiconductors are made, like big leaps in chiplet technology or new ways to package them, could mean that current testing equipment becomes less useful. This creates a threat of substitutes if these new manufacturing methods require different, potentially cheaper or more efficient, testing solutions.

For example, the increasing complexity of advanced packaging, where multiple smaller chips (chiplets) are integrated, demands sophisticated testing that goes beyond traditional methods. Companies that can adapt their testing strategies to these evolving paradigms will be better positioned.

- Advancements in Chiplet Technology: The integration of multiple chiplets into a single package presents new testing challenges, potentially creating demand for specialized testing equipment.

- Novel Packaging Approaches: Innovations like 2.5D and 3D packaging require different validation and reliability testing protocols compared to traditional monolithic chips.

- AEM's Strategic Focus: AEM's investment in advanced packaging solutions, including its involvement in the Advanced Packaging Technology Consortium, positions it to address these evolving testing needs and mitigate the threat of substitutes by offering relevant solutions.

- Market Adaptability: The ability of testing equipment manufacturers to pivot and develop solutions for these new manufacturing paradigms will be crucial in the face of potential substitute threats.

The threat of substitutes for semiconductor test equipment is multifaceted, encompassing both technological advancements and shifts in manufacturing processes. While direct replacements are rare, the evolution of design-for-testability (DFT) and the increasing sophistication of software simulation tools offer indirect substitutes by reducing the reliance on traditional physical testing. Furthermore, the emergence of new semiconductor materials and advanced packaging technologies necessitates adaptable testing solutions, creating potential for new, more specialized equipment to emerge as substitutes for current offerings.

The growing adoption of advanced simulation and modeling tools within the Electronic Design Automation (EDA) sector presents a significant substitute threat. In 2024, the EDA market was projected to exceed $13 billion, indicating substantial investment in software-based solutions that can virtually test and validate chip designs. This trend can reduce the demand for physical test equipment by enabling earlier detection of design flaws.

The semiconductor industry's ongoing exploration of novel materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) also poses a potential substitute threat. The SiC market, for instance, was anticipated to reach approximately $7.4 billion by 2025, signaling a growing segment that may require entirely different testing methodologies and equipment than those used for traditional silicon-based devices.

Innovations in chiplet technology and advanced packaging, such as 2.5D and 3D integration, are reshaping testing requirements. These complex architectures demand sophisticated validation protocols, potentially creating opportunities for new, specialized testing solutions to emerge as substitutes for conventional equipment, impacting the market for existing providers.

Entrants Threaten

Entering the semiconductor test equipment market, particularly for cutting-edge solutions, demands immense financial outlay. Companies need to invest heavily in research and development to create sophisticated testing technologies, alongside establishing state-of-the-art manufacturing facilities and acquiring highly specialized machinery. For instance, companies like Advantest and Teradyne, leaders in the field, consistently report billions in annual revenue, reflecting the scale of investment required to compete at their level.

The threat of new entrants in the semiconductor test and handling equipment sector is significantly mitigated by the substantial intellectual property held by established firms like AEM. These companies, including AEM, have invested heavily in developing and patenting proprietary technologies for both testing and handling semiconductor devices. For instance, AEM's portfolio includes patents covering advanced handling solutions and innovative testing methodologies, creating a robust barrier to entry.

New companies entering this market would face the considerable challenge of either developing their own unique intellectual property from scratch or incurring the costs and complexities associated with licensing existing patents. This IP hurdle, coupled with the capital investment required for R&D and manufacturing, makes it difficult for newcomers to compete effectively against incumbents with established technological advantages.

Existing players in the Advanced Electronic Manufacturing (AEM) sector often leverage significant economies of scale, allowing them to spread high fixed costs like specialized equipment and R&D across a larger production volume. For instance, major AEM companies might have production facilities capable of manufacturing millions of units annually, driving down per-unit costs considerably. This scale directly translates into lower pricing power for new entrants who cannot immediately achieve similar output levels.

Furthermore, the experience curve plays a crucial role, as established firms have honed their processes over years, leading to greater efficiency, reduced waste, and optimized supply chains. This accumulated expertise in developing and deploying complex test solutions, for example, can shave off significant time and cost from product development and manufacturing cycles. A new entrant would face a steep learning curve and substantial investment to replicate this operational mastery, making it challenging to compete on cost and quality from the outset.

Customer Relationships and Brand Loyalty

The threat of new entrants is significantly lowered by the critical importance of customer relationships and brand loyalty in the semiconductor equipment sector. Building trust and forging long-term partnerships with major semiconductor manufacturers is paramount, a process that takes considerable time and effort. New players must overcome the hurdle of establishing credibility and convincing customers, who often have deeply ingrained relationships with established suppliers, to switch their allegiance. AEM's success, underscored by its extensive and loyal customer base, including its primary customer, demonstrates the strength of these established bonds as a formidable barrier to entry.

Key factors contributing to this barrier include:

- High Switching Costs: Semiconductor manufacturers invest heavily in specific equipment and processes, making it costly and disruptive to change suppliers.

- Supplier Qualification Processes: New equipment suppliers must undergo rigorous and lengthy qualification procedures, often taking years to complete.

- Established Trust and Reliability: Existing relationships are built on a foundation of proven performance, reliability, and responsive service, which new entrants struggle to replicate quickly.

Regulatory Hurdles and Standards

The threat of new entrants in the semiconductor industry is significantly dampened by substantial regulatory hurdles and rigorous industry standards. Companies aiming to enter this space must contend with complex compliance requirements related to quality, reliability, and performance. For instance, adherence to standards like ISO 9001 and specific automotive or aerospace certifications can demand extensive investment in testing infrastructure and quality control processes, potentially costing millions before a single chip is produced.

Navigating these regulatory landscapes is not only time-consuming but also capital-intensive. New players must invest heavily in research and development to meet these exacting specifications, often requiring specialized expertise and advanced manufacturing capabilities. By 2024, the global semiconductor market, valued at over $600 billion, reflects the maturity and established nature of its players, making it exceptionally difficult for newcomers to penetrate without significant upfront investment in compliance and technological advancement.

- High Capital Investment: New entrants face enormous upfront costs for R&D, manufacturing facilities, and compliance.

- Stringent Quality Standards: Meeting industry-specific quality and reliability benchmarks is a major barrier.

- Regulatory Compliance: Navigating complex and evolving global regulations adds significant time and expense.

- Intellectual Property: Established players hold extensive patents, making it challenging for new entrants to operate freely.

The threat of new entrants into the semiconductor test equipment market is notably low due to substantial capital requirements for R&D, manufacturing, and specialized machinery. For example, companies like Advantest and Teradyne, key players, demonstrate this with billions in annual revenue, reflecting the immense investment needed to compete. This high financial barrier makes it exceedingly difficult for newcomers to establish a foothold.

Established firms, including AEM, possess significant intellectual property and patents, creating a formidable barrier. New entrants must either develop their own IP or license existing technologies, a costly and complex undertaking. This, combined with the capital investment, hinders effective competition against incumbents with established technological advantages.

Economies of scale and the experience curve further suppress the threat of new entrants. Incumbents can spread high fixed costs and benefit from years of process optimization, leading to lower per-unit costs. Newcomers struggle to match this efficiency and cost-effectiveness, facing a steep learning curve and substantial investment to achieve similar operational mastery.

Customer loyalty, high switching costs, and rigorous supplier qualification processes also significantly deter new entrants. Semiconductor manufacturers are reluctant to disrupt established, trusted relationships with proven suppliers. The lengthy and demanding qualification procedures mean new companies face considerable time and effort to gain customer acceptance, further solidifying the position of existing players.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, investor presentations, and industry-specific market research reports. We also leverage data from financial news outlets and government economic indicators to provide a comprehensive view of the competitive landscape.