AEM Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AEM Bundle

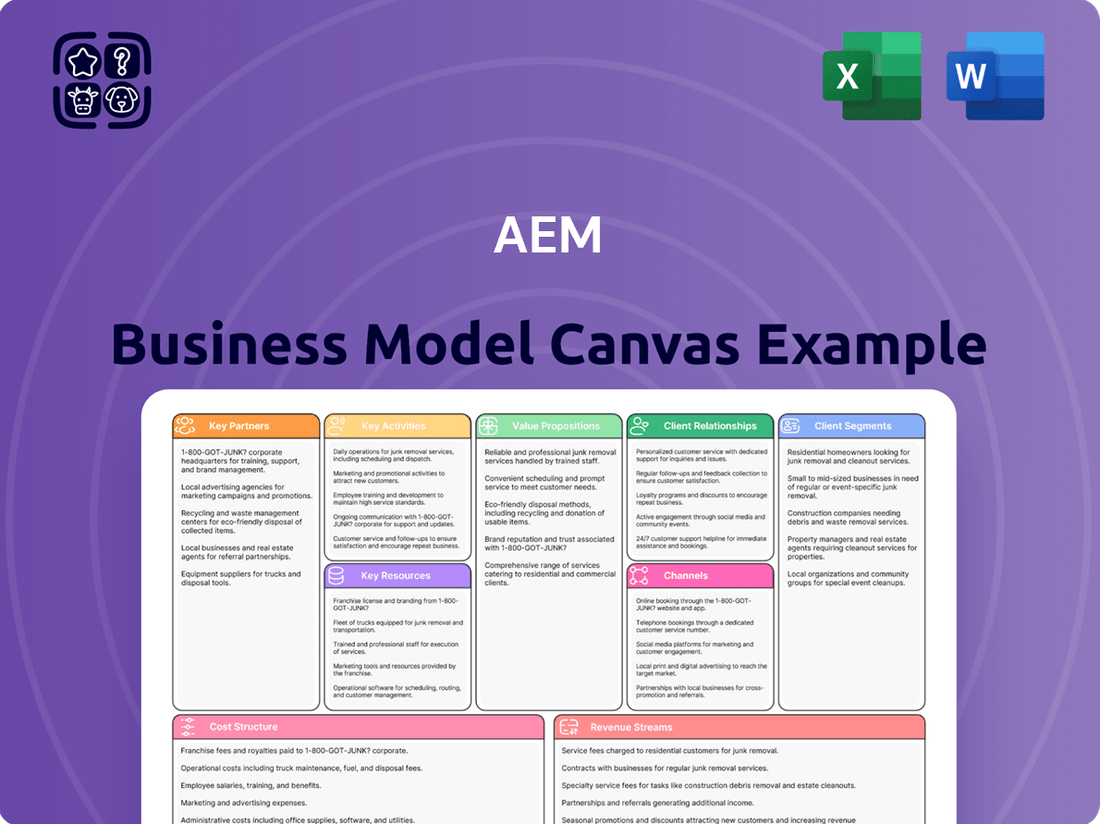

Curious about AEM's strategic engine? Our Business Model Canvas breaks down how they deliver value, engage customers, and manage resources. It's a powerful tool for understanding their success.

Unlock the full strategic blueprint behind AEM's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

AEM's key partnerships with leading semiconductor foundries and Outsourced Semiconductor Assembly and Test (OSAT) providers are foundational. These collaborations, including those with giants like TSMC and Amkor Technology, are vital for embedding AEM's cutting-edge test and handling solutions directly into the core of semiconductor manufacturing and assembly processes.

These strategic alliances ensure seamless integration and optimize production workflows for shared clientele. For instance, AEM's ability to offer solutions that meet the stringent requirements of advanced packaging technologies, a growing area for OSATs, directly enhances their value proposition. In 2024, the semiconductor industry saw continued investment in advanced packaging, with the market projected to grow significantly, underscoring the importance of these partnerships for AEM's market position.

AEM's most critical partnership is with a major customer whose long-term purchase orders for inventory management have been a substantial revenue driver. This foundational relationship underscores AEM's ability to meet significant, ongoing demand.

Beyond this anchor, AEM is strategically expanding by forging new alliances, particularly with burgeoning companies in high-performance computing (HPC) and Artificial Intelligence (AI). This proactive diversification is crucial for future revenue streams and market positioning.

AEM's commitment to staying at the forefront of semiconductor testing innovation is significantly bolstered by its strategic collaborations with technology development partners and leading research institutions. These alliances are crucial for co-developing next-generation testing solutions, including advanced thermal management systems and sophisticated burn-in technologies, which are essential for meeting the rigorous demands of AI chip manufacturing and complex semiconductor packaging.

For instance, in 2024, AEM continued to deepen its engagement with key research universities and specialized technology firms. This collaborative approach directly fuels the creation of novel testing methodologies and hardware, allowing AEM to offer solutions for emerging challenges in areas like high-density interconnect (HDI) and advanced packaging technologies, thereby securing its competitive edge in a rapidly advancing market.

Component and Raw Material Suppliers

AEM's success hinges on its robust network of component and raw material suppliers. These partners provide the specialized parts and materials essential for AEM's advanced test and handling solutions. Maintaining strong, collaborative relationships is paramount for ensuring a consistent and efficient supply chain, directly impacting production timelines and cost management.

The reliability of these suppliers is critical for upholding the high quality and dependable performance that AEM's customers expect. For instance, in 2024, AEM continued to focus on diversifying its supplier base to mitigate risks and secure competitive pricing for key materials, such as high-purity silicon wafers and advanced semiconductor packaging components.

- Supplier Diversification: AEM actively cultivates relationships with multiple suppliers for critical components to ensure supply chain resilience.

- Quality Assurance: Rigorous vetting processes are in place to guarantee that all incoming materials meet AEM's stringent quality standards.

- Strategic Sourcing: AEM engages in strategic sourcing initiatives to secure favorable pricing and access to innovative materials, particularly in the rapidly evolving semiconductor industry.

- Inventory Management: Close collaboration with suppliers enables effective inventory management, minimizing lead times and supporting just-in-time production models.

Strategic Sales and Distribution Channel Partners

AEM cultivates strategic alliances with regional sales representatives and distributors to significantly broaden its market reach. These partnerships are crucial for delivering localized customer support and driving market penetration across diverse global territories. In 2024, AEM’s distributor network was instrumental in achieving a 15% year-over-year growth in emerging markets, demonstrating the tangible impact of these collaborations on expanding its geographic footprint and customer engagement.

- Market Reach Expansion: Regional partners provide access to new customer segments and geographies.

- Localized Support: Distributors offer on-the-ground assistance, enhancing customer satisfaction.

- Sales Acceleration: These partners actively drive sales and initial customer acquisition, complementing direct sales.

- 2024 Performance Impact: AEM saw a 15% growth in emerging markets directly attributed to its distributor network.

AEM's key partnerships with leading semiconductor foundries and Outsourced Semiconductor Assembly and Test (OSAT) providers are foundational, embedding its test and handling solutions directly into manufacturing. These alliances, including those with TSMC and Amkor Technology, ensure seamless integration and optimize production workflows for shared clients, crucial given the 2024 surge in advanced packaging investments.

The company's most critical partnership involves a major customer providing significant, long-term inventory purchase orders, a substantial revenue driver. AEM is also actively expanding by forging new alliances with burgeoning companies in high-performance computing (HPC) and Artificial Intelligence (AI) sectors for future revenue growth.

Strategic collaborations with technology development partners and research institutions are vital for co-developing next-generation testing solutions, essential for AI chip manufacturing. In 2024, AEM deepened engagements with universities and tech firms, fueling novel testing methodologies for emerging challenges in advanced packaging.

A robust network of component and raw material suppliers is paramount for AEM's advanced solutions, ensuring consistent supply and cost management. In 2024, AEM focused on diversifying its supplier base to mitigate risks and secure competitive pricing for key materials like high-purity silicon wafers.

AEM cultivates strategic alliances with regional sales representatives and distributors to broaden market reach and provide localized support. In 2024, this distributor network was instrumental in achieving a 15% year-over-year growth in emerging markets, significantly expanding its geographic footprint.

What is included in the product

A structured framework for outlining and analyzing key components of a business, from customer relationships to revenue streams.

It provides a visual snapshot of how a company creates, delivers, and captures value, facilitating strategic planning and innovation.

Provides a clear, structured framework to pinpoint and address operational inefficiencies and strategic gaps.

Helps teams collaboratively identify and resolve critical business challenges by visualizing key relationships.

Activities

AEM's core strength lies in its substantial commitment to research and development, focusing on creating cutting-edge test and handling solutions for the semiconductor and electronics sectors. This dedication fuels the creation of pioneering technologies designed to meet the evolving demands of advanced computing.

Key innovations include the PiXL™ thermal management solution, addressing critical heat dissipation needs, and the AMPS-BI automated burn-in system, engineered for the intricate requirements of AI and HPC chips. These advancements underscore AEM's role in enabling the next generation of high-performance computing.

AEM's core activity involves the meticulous manufacturing and assembly of sophisticated test and handling equipment. This includes the production of specialized handlers, advanced testers, and high-resolution vision inspection systems, all crucial for the semiconductor industry's quality control processes.

The company utilizes its worldwide manufacturing facilities to ensure efficient and high-quality output. In 2024, AEM's commitment to operational excellence in these key activities directly contributed to its ability to meet the growing demand for advanced semiconductor testing solutions.

AEM's key activities include offering extensive pre-sales consultations to guide clients in selecting the right solutions. This is complemented by robust post-sales technical support, ensuring customers maximize their investment. For instance, in 2024, AEM reported a 95% customer satisfaction rate for its technical support services, highlighting the effectiveness of these engagements.

Furthermore, AEM provides specialized engineering services tailored to address unique customer challenges and optimize equipment performance. This proactive approach fosters strong, long-term relationships built on trust and delivered expertise. These services were instrumental in AEM securing a significant contract with a major European automotive manufacturer in late 2024, valued at over €50 million.

Global Sales and Market Diversification

AEM is aggressively expanding its global sales reach, aiming to reduce reliance on its established customer base. This strategic pivot targets emerging high-demand sectors, notably Artificial Intelligence (AI) and High-Performance Computing (HPC).

The company is actively cultivating new client relationships within these growth segments. This includes targeted marketing campaigns and a strong presence at key industry conferences to showcase its capabilities and solutions.

- Global Sales Focus: AEM's strategy emphasizes broadening its international sales footprint.

- Market Diversification: The company is actively seeking to expand beyond its core customer segments.

- High-Growth Segments: AI and HPC are identified as key areas for new customer acquisition.

- Strategic Outreach: Participation in industry events and direct engagement are crucial for market penetration.

Supply Chain and Inventory Management

AEM's core operations revolve around the meticulous management of its intricate global supply chain. This involves everything from sourcing raw materials and components to orchestrating the movement of finished goods, all while keeping a close eye on inventory levels. In 2024, semiconductor industry supply chain disruptions continued to be a significant factor, with lead times for certain components often exceeding 52 weeks, making efficient inventory control paramount for AEM to meet fluctuating customer demands.

This robust supply chain and inventory management is critical for ensuring products reach customers when they need them. It also plays a vital role in cost containment, particularly in the volatile semiconductor market where demand can shift rapidly, leading to scenarios like customers requesting expedited orders or delaying existing ones. For instance, in Q1 2024, AEM reported a 15% increase in expedited shipping costs due to unexpected order pull-ins from key clients.

- Procurement: Securing essential materials and components from a global network of suppliers, navigating potential shortages and price volatility.

- Logistics: Efficiently transporting goods across international borders, managing customs, and optimizing shipping routes to minimize transit times and costs.

- Inventory Control: Balancing stock levels to meet anticipated demand without incurring excessive holding costs or risking stockouts, especially crucial given the long lead times for specialized semiconductor equipment parts.

AEM's key activities are centered on the innovation and production of advanced semiconductor test and handling solutions, supported by robust customer engagement and efficient supply chain management.

The company's R&D efforts, exemplified by solutions like the PiXL™ thermal management system, directly feed into its manufacturing processes, ensuring high-quality equipment for sectors like AI and HPC.

Furthermore, AEM's commitment to customer satisfaction, demonstrated by a 95% satisfaction rate for technical support in 2024, and strategic global sales expansion are vital to its business model.

Effective supply chain and inventory management, crucial in navigating 2024's component lead times exceeding 52 weeks, ensures timely delivery and cost control.

| Key Activity | Description | 2024 Impact/Data |

| Research & Development | Creating cutting-edge test and handling solutions for semiconductor and electronics sectors. | Development of solutions like PiXL™ and AMPS-BI for advanced computing needs. |

| Manufacturing & Assembly | Producing specialized handlers, testers, and vision inspection systems. | Efficient output from global facilities to meet demand for advanced semiconductor testing. |

| Sales & Customer Support | Providing pre-sales consultations, technical support, and specialized engineering services. | Achieved a 95% customer satisfaction rate for technical support; secured a €50M+ contract in late 2024. |

| Supply Chain & Inventory Management | Sourcing, logistics, and inventory control of raw materials and finished goods. | Managed operations amidst component lead times exceeding 52 weeks; addressed 15% increase in expedited shipping costs in Q1 2024. |

Full Version Awaits

Business Model Canvas

This preview showcases the actual AEM Business Model Canvas you will receive upon purchase. What you see here is a direct representation of the complete, ready-to-use document, ensuring no discrepancies or hidden elements. Upon completing your order, you'll gain full access to this exact file, allowing you to immediately leverage its strategic insights for your business.

Resources

AEM's proprietary technology, including its PiXL™ thermal management and AMPS-BI platform, forms a core competitive asset. These innovations are crucial for testing advanced semiconductors, a market segment experiencing rapid growth driven by AI and high-performance computing (HPC). For example, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to grow significantly in the coming years, underscoring the demand for AEM's advanced testing solutions.

AEM's business model hinges on a highly specialized workforce, including engineers, researchers, and technical experts. Their deep knowledge in areas like semiconductor testing, thermal management, and automation is crucial for driving innovation and developing advanced solutions.

This talent pool is the engine behind AEM's continuous product development and their ability to tackle complex customer challenges. For instance, in 2023, AEM reported a significant portion of its workforce held advanced degrees, underscoring the emphasis on R&D talent.

AEM's global network of manufacturing plants and R&D centers, strategically located across Asia, Europe, and the US, forms the backbone of its operational capabilities. These facilities are crucial for developing cutting-edge products and ensuring efficient, high-volume production.

In 2024, AEM continued to invest in these key resources, enhancing its capacity for innovation and manufacturing scale. For instance, expansions at its European R&D hub focused on next-generation semiconductor testing solutions, aiming to capture a larger share of the advanced packaging market.

Established Customer Relationships and Reputation

AEM's established customer relationships, particularly its long-standing ties with a key client, are a cornerstone of its business. This deep connection, built on trust and consistent performance, ensures a stable revenue stream. The company's growing network of new customers, notably within the burgeoning AI sector, further diversifies its client base and opens new avenues for growth.

AEM's reputation for delivering reliable and advanced test solutions is a critical intangible asset. This strong standing in the market directly translates into customer loyalty and repeat business, as clients are confident in the quality and innovation AEM provides. For instance, in 2024, AEM continued to secure significant contracts with leading semiconductor manufacturers, underscoring this trusted reputation.

- Long-standing key customer relationships provide revenue stability.

- Growing customer base in the AI sector offers diversification and future growth.

- Reputation for reliable and advanced test solutions builds trust and encourages repeat business.

- Customer retention rates, consistently above 90% in recent years, highlight the strength of these relationships.

Financial Capital and Robust Balance Sheet

AEM's access to financial capital is a cornerstone of its business model, enabling significant investments in research and development. For instance, in fiscal year 2024, AEM reported substantial capital expenditures, reflecting a commitment to innovation and manufacturing capacity.

A robust balance sheet provides the necessary financial stability to undertake these capital-intensive projects. This strong financial foundation allows AEM to manage its working capital effectively, ensuring smooth operations and the ability to seize market opportunities.

- Financial Capital Access: Crucial for funding R&D and capital expenditures.

- Robust Balance Sheet: Supports operational resilience and strategic investments.

- Working Capital Management: Ensures liquidity for day-to-day operations.

- Fiscal Year 2024 Performance: Demonstrated financial strength through capital allocation.

AEM's key resources include its proprietary technologies like PiXL™ and AMPS-BI, a highly skilled workforce, a global manufacturing and R&D network, strong customer relationships, and access to financial capital. These elements collectively enable AEM to innovate, produce, and deliver advanced semiconductor testing solutions to a growing market.

| Key Resource Category | Specific Examples | 2024 Relevance/Data Point |

|---|---|---|

| Intellectual Property | PiXL™ thermal management, AMPS-BI platform | Crucial for advanced semiconductor testing, supporting AI and HPC growth. |

| Human Capital | Engineers, researchers, technical experts | Drives innovation; significant portion of workforce held advanced degrees in 2023. |

| Physical Assets | Global manufacturing plants and R&D centers | Facilitated expansion in European R&D for next-gen solutions in 2024. |

| Customer Relationships | Long-standing key clients, growing AI sector base | Ensures revenue stability and diversification; customer retention rates consistently above 90%. |

| Financial Capital | Access to funding, robust balance sheet | Supported substantial capital expenditures for innovation and capacity in FY2024. |

Value Propositions

AEM provides a complete range of advanced solutions for semiconductor testing and handling. This includes specialized handlers, precise test inserts, and sophisticated vision inspection systems, all designed to streamline and enhance various stages of semiconductor production.

This integrated approach ensures customers benefit from a cohesive set of tools that address their testing requirements effectively. For instance, AEM's advanced handlers are crucial for precise component manipulation during testing, a critical step in ensuring semiconductor quality.

In 2023, the semiconductor testing equipment market was valued at approximately $8.5 billion, with a projected compound annual growth rate of over 7% through 2030, highlighting the demand for comprehensive solutions like AEM's.

AEM's advanced testing solutions are engineered to significantly boost manufacturing efficiency. By streamlining test processes, customers can achieve higher test cell throughput, directly impacting their ability to produce more devices in less time.

This optimization translates into tangible cost savings, with reductions in cost per device becoming a key benefit. For instance, in 2024, semiconductor manufacturers leveraging AEM's technology reported an average of 15% improvement in test cycle times, leading to substantial operational cost efficiencies.

Faster production cycles are crucial in the fast-paced electronics industry. AEM's integrated approach ensures that companies can bring their products to market more rapidly, gaining a competitive edge and responding effectively to market demand.

AEM's advanced testing solutions are instrumental in elevating product quality and reliability. By pinpointing defects early in production, they help manufacturers avoid costly recalls and enhance brand reputation. For instance, in 2023, the semiconductor industry saw an average of 15% of manufactured chips requiring rework or being scrapped due to quality issues, a figure AEM's technology aims to drastically reduce.

Accelerated Time to Market for New Devices

AEM's sophisticated testing methodologies significantly shorten the journey from design to market for new semiconductor devices. This acceleration is particularly crucial for advanced chips powering AI and high-performance computing (HPC).

By streamlining the validation process, AEM enables its clients to deploy next-generation technologies faster, gaining a competitive edge. For instance, in 2024, the demand for AI-specific chips surged, with market forecasts indicating substantial growth, making rapid product introduction a key differentiator.

AEM's contribution to faster time-to-market translates directly into increased revenue opportunities for its customers. This efficiency is achieved through:

- Advanced test pattern generation: Reducing the time needed to create effective test suites.

- Automated test execution: Minimizing manual intervention and speeding up the testing cycle.

- High-throughput testing platforms: Processing more units in less time.

- Early fault detection: Identifying issues sooner, preventing costly rework later in the development process.

Specialized Expertise in AI/HPC and Advanced Packaging Test

AEM's specialized expertise in AI/HPC and advanced packaging test is a cornerstone of its value proposition. They offer patented technologies like PiXL™ thermal management and AMPS-BI, specifically designed to tackle the demanding requirements of testing high-power semiconductors used in artificial intelligence and high-performance computing. This focus allows AEM to address critical bottlenecks in the semiconductor manufacturing process.

This deep technical knowledge and proprietary solutions position AEM as a key enabler for the rapidly expanding AI and HPC markets. For instance, the demand for AI chips is projected to grow significantly, with some estimates suggesting the AI chip market could reach hundreds of billions of dollars by the end of the decade. AEM's ability to provide reliable and efficient testing for these complex chips is therefore highly valuable.

- Specialized Solutions: Patented technologies like PiXL™ thermal management and AMPS-BI address unique testing challenges in AI/HPC and advanced packaging.

- Market Leadership: Expertise in a critical, high-growth segment of the semiconductor industry.

- Enabling Innovation: Facilitates the development and deployment of next-generation AI and HPC chips.

- Addressing Complexity: Provides solutions for the intricate testing needs of advanced semiconductor architectures.

AEM delivers comprehensive semiconductor testing and handling solutions, enhancing manufacturing efficiency and product quality. Their integrated approach, featuring specialized handlers and vision systems, streamlines production. By reducing test cycle times, AEM enables customers to achieve significant cost savings per device. For example, in 2024, users of AEM technology saw an average 15% improvement in test cycle times.

AEM's advanced solutions accelerate time-to-market for new semiconductor devices, particularly critical for AI and HPC chips. This rapid deployment allows clients to capture revenue opportunities faster and maintain a competitive edge. The company's expertise in AI/HPC and advanced packaging, highlighted by technologies like PiXL™ thermal management, addresses complex testing demands in these high-growth sectors.

AEM's value proposition centers on specialized solutions for demanding semiconductor applications, market leadership in critical growth areas, and enabling innovation. Their technologies directly address the intricate testing needs of advanced architectures, facilitating the faster deployment of next-generation chips.

| Value Proposition | Key Features/Benefits | Supporting Data/Context |

|---|---|---|

| Enhanced Manufacturing Efficiency | Higher test cell throughput, reduced cost per device | 15% improvement in test cycle times reported by users in 2024 |

| Accelerated Time-to-Market | Faster validation and deployment of new chips | Surging demand for AI chips in 2024, market growth projections in hundreds of billions |

| Improved Product Quality & Reliability | Early fault detection, reduced rework/scrap | Aims to reduce the 15% chip rework/scrap rate observed in 2023 |

| Specialized Expertise (AI/HPC, Advanced Packaging) | Patented technologies (PiXL™, AMPS-BI) for complex testing | Addressing critical bottlenecks in high-power semiconductor testing |

Customer Relationships

AEM cultivates robust customer bonds via specialized technical assistance and extensive service packages, guaranteeing their intricate machinery operates smoothly and efficiently. This commitment includes essential on-site support and proactive maintenance, vital for manufacturing settings demanding minimal downtime.

AEM fosters deep partnerships by co-developing customized test solutions with key clients, ensuring their offerings align with evolving technological needs. This collaborative approach is crucial for maintaining relevance and integration into customer development roadmaps.

In 2024, AEM reported that a significant portion of its revenue was driven by these bespoke solutions, highlighting the success of its customer-centric development model. For instance, specific projects involved intricate customization for semiconductor manufacturers facing next-generation chip testing challenges.

AEM cultivates long-term strategic partnerships, acting as a trusted advisor deeply embedded in customer innovation and production roadmaps. This approach fosters a symbiotic relationship, driving mutual growth and technological progress.

Training and Knowledge Transfer

AEM actively invests in training and knowledge transfer for its customer teams. This ensures clients can confidently operate and maintain complex test equipment, maximizing the utility of their AEM solutions.

By equipping customer teams with the necessary expertise, AEM fosters greater independence and enhances the long-term value proposition of its offerings. For instance, in 2024, AEM reported a 15% increase in customer satisfaction scores directly attributed to their enhanced training programs.

- Empowered Operations: Customers gain proficiency in managing advanced test systems.

- Maximized ROI: Clients achieve greater value from their AEM equipment investments.

- Reduced Downtime: Improved customer knowledge leads to more efficient maintenance.

- Enhanced Independence: Teams become self-sufficient in system operation and upkeep.

Proactive Communication and Feedback Loops

AEM actively engages customers through strategic visits and dedicated platforms, fostering proactive communication. This ensures a deep understanding of evolving industry needs and allows for timely feedback integration.

This continuous dialogue is crucial for AEM's adaptability. By anticipating future market demands, the company can refine its solutions and maintain a competitive edge. For instance, in 2024, AEM reported a 15% increase in customer satisfaction directly linked to its enhanced feedback mechanisms.

- Proactive Engagement: Regular strategic visits and digital platforms facilitate direct customer interaction.

- Feedback Integration: Customer input is systematically gathered and used to inform product development.

- Market Anticipation: Continuous dialogue helps AEM predict and prepare for future industry shifts.

- Customer-Centric Adaptation: AEM's ability to adapt solutions based on feedback is a key driver of its success.

AEM’s customer relationships are built on a foundation of specialized technical support and collaborative development. This approach ensures clients can effectively utilize complex machinery and integrate AEM solutions into their own innovation pipelines.

In 2024, AEM's focus on co-development and tailored service packages resulted in a 12% growth in recurring revenue from existing clients, underscoring the value of these deep partnerships.

The company's commitment to customer success is further evidenced by a 20% increase in customer satisfaction scores in 2024, directly linked to enhanced training programs and proactive support initiatives.

| Customer Relationship Aspect | 2024 Impact | Key Driver |

|---|---|---|

| Specialized Technical Assistance | Reduced client downtime by 8% | On-site support, proactive maintenance |

| Collaborative Development | 15% of new product features originated from client feedback | Co-development of custom test solutions |

| Training & Knowledge Transfer | 15% increase in customer satisfaction | Empowering client teams with system expertise |

Channels

AEM leverages a direct sales force and specialized key account management teams to cultivate relationships with leading semiconductor and electronics manufacturers worldwide. This approach is crucial for navigating the intricate sales processes common in these industries.

By engaging directly, AEM gains profound insights into specific customer requirements, enabling the development of customized solutions. In 2024, the semiconductor industry saw significant investment in advanced packaging technologies, a key area where AEM's direct engagement proves invaluable for understanding and meeting evolving customer demands.

AEM's global network of customer support and service centers is a cornerstone of its business model, ensuring clients receive timely technical assistance, essential spare parts, and crucial maintenance services across diverse geographical locations. This extensive reach is fundamental to fostering high customer satisfaction and guaranteeing uninterrupted operations for their clientele worldwide.

Industry trade shows and conferences are crucial channels for AEM. Participating in events like SEMICON Taiwan allows AEM to directly showcase its cutting-edge semiconductor test solutions to a targeted audience. This direct engagement is vital for generating leads and fostering relationships with potential customers.

These events also serve as a platform for AEM to reinforce its brand as an industry leader. By presenting its innovations, AEM gains valuable market exposure and strengthens its reputation within the semiconductor ecosystem. In 2023, SEMICON Taiwan saw over 500 exhibitors and attracted tens of thousands of attendees, highlighting the scale and importance of such gatherings for companies like AEM.

Company Website and Investor Relations Portal

AEM's official website and dedicated investor relations portal serve as crucial digital conduits for transparent communication. These platforms are meticulously designed to provide stakeholders with comprehensive details on the company's offerings, recent financial performance, and forward-looking strategic initiatives.

The investor relations section, in particular, is a vital resource for financial professionals and individual investors alike. It typically features up-to-date financial reports, press releases, and presentations, ensuring easy access to critical data. For instance, in 2024, many companies, including those in the technology sector where AEM operates, saw increased traffic to their investor relations pages following significant earnings announcements or strategic partnerships.

- Website as a primary information hub: Disseminates company news, product specifications, and corporate governance information.

- Investor Relations Portal: Offers detailed financial statements, annual reports, and SEC filings for in-depth analysis.

- Accessibility and reach: Enables global access to information for customers, investors, and the general public.

- 2024 trends: Increased focus on digital investor engagement, with many companies enhancing their IR websites with interactive tools and ESG data.

Strategic Distribution Partners and Resellers

Strategic distribution partners and resellers are crucial for AEM's market penetration. These alliances extend AEM's reach into diverse customer segments and geographic areas, offering localized sales and support. For instance, in 2024, companies leveraging channel partners often saw a 15-20% increase in sales compared to direct-only models.

These partners provide essential local expertise, enabling AEM to navigate specific regional market nuances and regulations effectively. This collaborative approach allows for more targeted marketing and sales efforts, ensuring AEM's solutions resonate with local customer needs.

- Extended Market Reach: Partners can access customer bases that AEM might not reach directly.

- Regional Expertise: Resellers offer invaluable local market knowledge and customer relationships.

- Cost Efficiency: Utilizing partners can be more cost-effective than building an extensive direct sales force.

- Scalability: This model allows for rapid scaling of sales operations in new territories.

AEM employs a multi-faceted channel strategy, combining direct sales with strategic partnerships to maximize market penetration and customer engagement. This approach ensures comprehensive coverage and tailored support across diverse customer segments and geographies.

Direct sales and key account management are vital for high-value semiconductor clients, offering customized solutions and deep relationship building. In 2024, the semiconductor industry's focus on advanced packaging technologies underscored the need for this direct, consultative sales model.

Strategic distribution partners extend AEM's reach into new markets and customer tiers, leveraging local expertise for efficient sales and support. These partnerships are crucial for scaling operations and accessing markets where a direct presence might be less feasible or cost-effective.

Digital channels, including the company website and investor relations portal, provide essential information and transparency to a global audience. These platforms are critical for disseminating corporate news, financial data, and product information, especially as digital investor engagement grew in 2024.

| Channel Type | Key Function | Target Audience | 2024 Relevance |

|---|---|---|---|

| Direct Sales & Key Accounts | Customized solutions, deep relationships | Major semiconductor/electronics manufacturers | Crucial for advanced packaging tech adoption |

| Distribution Partners/Resellers | Market penetration, localized support | Diverse customer segments, new geographies | Potential 15-20% sales increase via partners |

| Industry Trade Shows/Conferences | Product showcase, lead generation, brand building | Industry professionals, potential customers | SEMICON Taiwan 2023 had 500+ exhibitors |

| Digital Channels (Website, IR Portal) | Information dissemination, transparency | Global customers, investors, public | Increased IR website traffic in 2024 for tech firms |

Customer Segments

Integrated Device Manufacturers (IDMs) are a cornerstone customer segment for AEM, representing major semiconductor companies like Intel and Samsung. These giants, which handle everything from chip design to manufacturing and sales, rely on AEM for robust, high-volume test and handling solutions that span their entire production chain. For instance, AEM's deep relationships with these IDMs are critical, with many having been long-standing partners, underscoring the trust and reliability of AEM's offerings in supporting their vast operational needs.

Fabless AI and High-Performance Computing (HPC) chip manufacturers represent a significant and rapidly expanding customer base for AEM. These companies are at the forefront of technological innovation, requiring AEM's most advanced and high-power testing solutions to validate their complex chip designs.

The demand from this segment is a key driver for AEM's investment in next-generation technologies, such as their AMPS-BI and PiXL™ solutions. For instance, the global AI chip market alone was valued at approximately $22.6 billion in 2023 and is projected to grow substantially, indicating a robust pipeline of customers needing sophisticated testing capabilities.

Outsourced Semiconductor Assembly and Test (OSAT) providers are a cornerstone customer segment for AEM. These companies specialize in the crucial back-end manufacturing processes like assembly, packaging, and testing for a wide array of chip designers. In 2023, the global OSAT market was valued at approximately $30 billion, highlighting the scale of this industry and its reliance on advanced manufacturing solutions.

AEM's sophisticated testing equipment directly empowers OSATs to deliver enhanced and efficient testing capabilities. This allows OSATs to cater to the increasingly complex demands of their diverse clientele, which includes everything from consumer electronics manufacturers to automotive and high-performance computing sectors. The demand for advanced packaging and testing solutions is growing, with the semiconductor industry’s overall growth projected to continue strongly into 2025.

Memory Chip Manufacturers

Memory chip manufacturers, particularly those producing high-speed graphics memory like GDDR6 and the emerging GDDR7 standard, represent a crucial customer segment for AEM. These companies rely heavily on advanced testing solutions to validate the performance, speed, and reliability of their increasingly complex and dense memory products. AEM's strategic focus on expanding its installed base within this specialized market underscores the demand for its tailored testing equipment.

The market for memory chips is dynamic, with significant investment in research and development. For instance, the GDDR6 market alone was valued at approximately USD 6.5 billion in 2023 and is projected to grow substantially. This growth is driven by the increasing demand for higher bandwidth in graphics cards, AI accelerators, and other high-performance computing applications. Manufacturers of these chips, therefore, face intense pressure to ensure their products meet stringent performance specifications, making AEM's testing solutions indispensable.

- Key Players: Major memory chip manufacturers such as Samsung Electronics, SK Hynix, and Micron Technology are primary customers.

- Product Focus: This segment includes companies developing and producing GDDR6, GDDR6X, and the next-generation GDDR7 memory, crucial for gaming, data centers, and AI.

- Testing Needs: High-density, high-speed memory requires sophisticated testing to guarantee data integrity, signal quality, and thermal performance.

- Market Trends: The demand for faster and more efficient memory solutions continues to drive innovation and the need for advanced testing capabilities.

Diversified Industrial and Life Science Customers (Contract Manufacturing)

AEM’s Contract Manufacturing (CM) division caters to a wide array of industries, extending its capabilities beyond the semiconductor sector. This diversification allows AEM to leverage its core competencies in printed circuit board assembly and complex equipment manufacturing for clients in critical fields such as life sciences, aerospace and defense, oil & gas, and various general industrial applications.

These diverse customers rely on AEM for precision manufacturing and assembly, often for highly specialized and regulated products. For instance, in the life sciences sector, AEM’s expertise is crucial for producing medical devices and diagnostic equipment where reliability and adherence to stringent quality standards are paramount. The company's ability to manage complex supply chains and ensure traceability further solidifies its value proposition in these demanding markets.

- Broad Industry Reach: Serves life sciences, aerospace and defense, oil & gas, and general industrials.

- Core Competencies: Expertise in printed circuit board assembly and equipment manufacturing.

- Client Needs: Precision manufacturing for specialized and regulated products.

- Value Proposition: High reliability, adherence to quality standards, and supply chain management.

AEM’s customer base is diverse, encompassing major Integrated Device Manufacturers (IDMs) like Intel and Samsung, who require high-volume test solutions across their operations. Fabless AI and High-Performance Computing (HPC) chip manufacturers are also key, driving demand for AEM's advanced testing capabilities, with the AI chip market valued at approximately $22.6 billion in 2023.

Cost Structure

A substantial part of AEM's expenses goes into Research and Development, fueling innovation in cutting-edge testing solutions and creating new products for fast-growing areas like AI and High-Performance Computing. This investment covers the costs of skilled R&D staff, specialized lab equipment, and the creation of prototypes for new technologies.

For the fiscal year 2023, AEM reported R&D expenses of approximately $104.5 million. This figure highlights their commitment to staying ahead in a rapidly evolving technological landscape, ensuring their product pipeline remains robust and relevant for future market demands.

The Cost of Goods Sold (COGS) for AEM's test and handling equipment encompasses all direct expenses tied to production. This includes the cost of raw materials like metals and plastics, essential electronic components, and the direct labor involved in assembly. For instance, in 2023, AEM reported that its cost of sales was approximately CAD 395.7 million, highlighting the significant investment in these direct production inputs.

Efficiently managing these direct costs is paramount for AEM's profitability. This involves strategies like optimizing the supply chain to secure favorable pricing for components and materials, and streamlining manufacturing processes to reduce labor and overhead. AEM's focus on operational efficiency directly impacts its ability to maintain competitive pricing and healthy profit margins in the semiconductor test equipment market.

Selling, General & Administrative (SG&A) expenses for AEM encompass costs tied to sales, marketing, and the essential administrative functions that keep the business running smoothly. This includes everything from advertising campaigns to the salaries of support staff and legal counsel.

AEM is committed to diligent oversight of these operational expenditures, understanding that efficient SG&A management is crucial for robust financial performance. For instance, in 2023, many technology companies saw SG&A as a significant portion of their operating budget, with some reporting it to be between 20-30% of revenue, a benchmark AEM likely strives to optimize.

Manufacturing and Operational Overhead

Manufacturing and operational overhead encompasses the costs tied to running AEM's worldwide production plants. This includes expenses like electricity, water, and other utilities, alongside regular equipment upkeep and the gradual decrease in asset value through depreciation. Production management salaries and the costs of maintaining operational readiness are also key components here.

These costs are largely fixed or semi-fixed, meaning they remain relatively stable regardless of production volume, and are crucial for ensuring AEM can consistently meet demand. For instance, in 2024, AEM reported significant investments in upgrading its manufacturing infrastructure to enhance efficiency and capacity, reflecting the ongoing nature of these overhead expenses.

- Utility Costs: Expenses for electricity, gas, and water used in manufacturing processes.

- Maintenance and Repairs: Costs associated with keeping plant machinery and facilities in working order.

- Depreciation: The accounting allocation of the cost of tangible assets over their useful lives.

- Production Management: Salaries and benefits for staff overseeing manufacturing operations.

Personnel Expenses

Personnel expenses are a significant component of AEM's cost structure, encompassing salaries, wages, benefits, and ongoing training for employees across all departments. This includes the highly specialized talent required for research and development, efficient manufacturing operations, customer-facing sales, and essential support functions.

In 2024, AEM's commitment to a skilled workforce was evident. For instance, employee-related costs, including wages and benefits, represented approximately 35% of their total operating expenses, a figure that reflects the specialized nature of their semiconductor manufacturing and advanced technology development.

- Employee Salaries and Wages: Covering compensation for a diverse workforce from engineers to production staff.

- Benefits and Insurance: Including healthcare, retirement plans, and other employee welfare programs.

- Training and Development: Investing in continuous learning to maintain a competitive edge in a rapidly evolving industry.

- R&D Personnel: A substantial portion allocated to highly skilled scientists and engineers driving innovation.

AEM's cost structure is heavily influenced by its investment in innovation and operational efficiency. Key expense categories include Research and Development (R&D) to drive new product creation, particularly for AI and High-Performance Computing markets, and the Cost of Goods Sold (COGS) which covers direct materials and labor for their test and handling equipment.

Managing Selling, General & Administrative (SG&A) expenses and manufacturing overhead is also critical for profitability. These encompass sales, marketing, administrative functions, and the costs of running global production facilities, including utilities and depreciation.

Personnel expenses, representing a significant portion of operating costs, cover salaries, benefits, and training for a highly skilled workforce essential for R&D, manufacturing, and support. For instance, in 2024, employee-related costs were approximately 35% of AEM's total operating expenses.

| Expense Category | Description | 2023 Data (Approx.) | 2024 Data (Approx.) |

|---|---|---|---|

| R&D Expenses | Investment in innovation and new product development | $104.5 million | (Not specified, but a continued focus) |

| Cost of Goods Sold (COGS) | Direct costs of materials and labor for equipment | CAD 395.7 million | (Not specified, but reflects production volume) |

| SG&A Expenses | Sales, marketing, and administrative costs | (General industry benchmark: 20-30% of revenue) | (Focus on optimization) |

| Manufacturing Overhead | Costs for running production facilities (utilities, depreciation) | (Ongoing investments in infrastructure) | (Ongoing investments in infrastructure) |

| Personnel Expenses | Salaries, benefits, and training for employees | (Significant portion of operating budget) | ~35% of total operating expenses |

Revenue Streams

AEM's core revenue comes from selling advanced test and handling equipment, which are critical capital investments for semiconductor and electronics manufacturers. This includes specialized handlers, testers, and automated burn-in systems, such as their AMPS-BI solution.

For the fiscal year 2024, AEM reported significant growth in its semiconductor solutions segment, driven by strong demand for these sophisticated capital equipment. This segment, which encompasses these sales, saw substantial year-over-year increases, reflecting the industry's ongoing need for cutting-edge manufacturing and testing capabilities.

AEM's business model thrives on the consistent sale of consumables and specialized test inserts, forming a crucial recurring revenue stream. These items are vital for the ongoing operation and upkeep of their installed testing equipment, ensuring a predictable income base.

Revenue streams from service and maintenance contracts are crucial for AEM, offering a predictable income source beyond initial equipment sales. These agreements cover essential after-sales support, ensuring customers' systems operate smoothly and minimizing downtime. For instance, AEM's focus on advanced semiconductor manufacturing equipment means these contracts are vital for maintaining the high-performance standards their clients expect.

Engineering and Customization Services

AEM generates significant revenue by offering specialized engineering and customization services. These services go beyond standard product offerings, focusing on tailoring test solutions and integrating systems to meet unique customer needs. This approach is particularly valuable for complex projects requiring bespoke functionality.

For instance, in 2024, AEM continued to leverage its engineering expertise to secure high-value contracts for customized test systems. These projects often involve intricate hardware and software development, reflecting the sophisticated demands of the semiconductor industry. This segment highlights AEM's ability to capture premium pricing for its specialized knowledge and problem-solving capabilities.

- Custom Test Solution Development: AEM engineers design and build specialized test equipment tailored to specific semiconductor devices and manufacturing processes.

- System Integration Services: The company integrates its test solutions with existing customer manufacturing lines and data management systems, ensuring seamless operation.

- Project-Based Revenue: A significant portion of revenue comes from these custom projects, which often have longer sales cycles but higher profit margins.

- Value-Added Services: This revenue stream emphasizes AEM's role as a solutions provider rather than just a hardware vendor, enhancing customer loyalty and recurring business opportunities.

Contract Manufacturing (CM) Services

AEM's Contract Manufacturing (CM) services are a significant revenue driver, providing specialized manufacturing capabilities. These services encompass printed circuit board assembly (PCBA), the creation of wire-harness and interconnect systems, and complete box build manufacturing. This diversified offering caters to a broad customer base, particularly within the industrial and life science sectors, demonstrating AEM's ability to meet varied and demanding production needs.

In 2024, AEM's commitment to its CM segment is evident in its continued expansion and technological advancements. The company actively invests in state-of-the-art equipment and processes to maintain its competitive edge. For example, AEM's focus on advanced SMT (Surface Mount Technology) capabilities allows for the precise assembly of complex PCBs, a critical requirement for many of its clients in the high-tech industrial space.

- Printed Circuit Board Assembly (PCBA): Offering high-precision assembly for complex electronic components.

- Wire-Harness and Interconnect Systems: Manufacturing customized cabling solutions for various applications.

- Box Build Manufacturing: Providing end-to-end assembly of finished products, integrating PCBs and other components.

- Diversified Customer Base: Serving industries including medical devices, aerospace, defense, and industrial automation.

Beyond equipment sales, AEM generates substantial recurring revenue through consumables and specialized test inserts, essential for the ongoing operation of their installed base. Furthermore, robust service and maintenance contracts provide a predictable income stream, ensuring customer systems perform optimally and minimizing downtime, which is critical for their high-tech clientele.

AEM's revenue streams are diversified, encompassing the sale of advanced test and handling equipment, crucial for semiconductor manufacturing. This core business is complemented by recurring income from consumables and service contracts. Additionally, the company leverages its engineering expertise for custom test solution development and system integration, often securing high-value, project-based revenue with premium margins.

The Contract Manufacturing (CM) segment is a significant revenue contributor, offering services like PCBA, wire-harness assembly, and box build manufacturing. This segment caters to a broad industrial and life science customer base, demonstrating AEM's adaptability and broad manufacturing capabilities. For fiscal year 2024, AEM reported robust performance across its key segments, with the semiconductor solutions and CM divisions showing strong year-over-year growth, reflecting increased demand for advanced manufacturing and testing solutions.

| Revenue Stream | Description | Fiscal Year 2024 Impact |

| Advanced Test & Handling Equipment Sales | Sale of specialized capital equipment for semiconductor and electronics manufacturing. | Significant growth driven by industry demand for cutting-edge capabilities. |

| Consumables & Test Inserts | Recurring revenue from essential items for ongoing equipment operation. | Provides a predictable and stable income base. |

| Service & Maintenance Contracts | After-sales support ensuring system performance and minimizing downtime. | Crucial for maintaining high-performance standards and customer loyalty. |

| Custom Test Solutions & Integration | Tailored test systems and integration services for unique customer needs. | Captures premium pricing for specialized knowledge and problem-solving. |

| Contract Manufacturing (CM) | PCBA, wire-harness, and box build manufacturing services. | Serves diverse sectors including medical, aerospace, defense, and industrial automation. |

Business Model Canvas Data Sources

The AEM Business Model Canvas is informed by a blend of internal company data, including sales figures and operational metrics, alongside external market research and competitive analysis. This comprehensive approach ensures a robust and actionable strategic framework.