Advantech SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advantech Bundle

Advantech's robust product portfolio and strong IoT ecosystem are key strengths, but the competitive landscape presents a significant threat. Our full SWOT analysis dives deep into these dynamics, revealing critical opportunities for market expansion and potential weaknesses to mitigate.

Want the full story behind Advantech's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Advantech stands as a formidable global leader in the Internet of Things (IoT) and embedded platforms sector. The company commands a significant portion of the industrial PC (IPC) market, estimated at around 40%, which highlights its deep-rooted influence and market penetration.

This strong market position is a testament to Advantech's unwavering commitment to delivering high-quality, dependable products. Furthermore, their robust after-sales support network solidifies customer loyalty and reinforces their reputation for reliability.

Advantech is making significant strides in the Edge AI and Edge Computing sectors, aiming for global leadership by 2025. This strategic focus is backed by the development of advanced solutions like AI acceleration modules and industrial AI inference systems, positioning the company at the forefront of this rapidly expanding market.

The company's commitment to Edge AI is yielding impressive results, as evidenced by its Q1 2025 performance. The Edge AI business accounted for a substantial 15.1% of Advantech's total revenue, experiencing a remarkable 176% year-over-year growth. This demonstrates strong market adoption and Advantech's competitive advantage in delivering cutting-edge AI solutions at the edge.

Advantech boasts a remarkably diverse product portfolio, encompassing industrial PCs, embedded boards, industrial IoT solutions, and network computing platforms. This extensive range allows them to address a wide spectrum of technological needs within their target markets.

Their expertise extends across numerous vertical markets, including factory automation, transportation, energy, healthcare, and retail. This deep understanding of specific industry challenges enables Advantech to develop tailored smart applications and IoT solutions, fostering strong customer relationships and loyalty.

Strong Financial Stability and Recent Revenue Rebound

Advantech demonstrates robust financial health, underscored by its consistent dividend payments, even amidst a revenue dip in 2024. This stability is further reinforced by a rebound in book/bill ratios across key regions, surpassing 1 in early 2025, signaling renewed order strength.

The company's recent performance is particularly encouraging, with a consolidated revenue surge of 18.39% year-over-year reported in June 2025. This growth was broad-based, reflecting positive contributions from multiple geographical markets and diverse business segments.

- Financial Resilience: Advantech maintains a solid balance sheet and a history of dividend payouts.

- Order Momentum: Book/bill ratios in regional markets exceeded 1 by early 2025, indicating improved order intake.

- Revenue Rebound: Consolidated revenue grew 18.39% year-over-year in June 2025.

- Broad-Based Growth: The revenue increase was driven by strong performance across various regions and business sectors.

Commitment to Innovation and Strategic Partnerships

Advantech demonstrates a strong commitment to innovation, underscored by its recent success in the 2025 iF Design Awards, where two of its products were recognized for excellence in smart manufacturing and sustainable logistics. This dedication to pushing technological boundaries is a key strength, ensuring its offerings remain at the forefront of industrial solutions.

The company actively cultivates strategic partnerships to foster technological advancement. A prime example is its collaboration with Qualcomm Technologies, aimed at accelerating the development and deployment of Edge AI innovations specifically for the Internet of Things (IoT) sector. These alliances are crucial for staying competitive and driving industry-wide progress.

Advantech's strategic focus on integrating hardware and software capabilities is a significant advantage in driving industrial digital transformation. This holistic approach allows the company to offer comprehensive solutions that address the complex needs of modern industries.

- Innovation Recognition: Two Advantech products received 2025 iF Design Awards for smart manufacturing and sustainable logistics.

- Strategic Alliance: Partnership with Qualcomm Technologies to advance Edge AI for IoT applications.

- Integrated Solutions: Focus on combining hardware and software to facilitate industrial digital transformation.

Advantech's market leadership in industrial PCs, holding approximately 40% of the market, is a significant strength. This is bolstered by a diverse product portfolio catering to numerous vertical markets, fostering strong customer loyalty. Their financial resilience, demonstrated by consistent dividend payments and a revenue growth of 18.39% year-over-year as of June 2025, further solidifies their competitive position.

| Metric | Value | Period |

|---|---|---|

| Industrial PC Market Share | ~40% | 2024 |

| Edge AI Revenue Contribution | 15.1% | Q1 2025 |

| Edge AI YoY Revenue Growth | 176% | Q1 2025 |

| Consolidated Revenue Growth (YoY) | 18.39% | June 2025 |

| Book/Bill Ratio | >1 | Early 2025 (key regions) |

What is included in the product

Delivers a strategic overview of Advantech’s internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Advantech faced a notable revenue contraction in 2024, with consolidated revenue dropping 7.4% from NT$64.57 billion in 2023 to NT$59.79 billion. This downturn in sales directly affected profitability, as net income fell by 17% year-over-year.

The company's profit margin also experienced a contraction, decreasing from 17% in fiscal year 2023 to 15% in fiscal year 2024, reflecting the challenges in maintaining earnings amidst declining revenue.

Advantech's performance in 2024 highlighted significant geographical disparities. While Taiwan and Korea demonstrated growth, North America, Europe, and Japan all faced double-digit sales declines. This unevenness points to regional economic pressures impacting demand.

Further compounding these issues, China and other emerging markets experienced a single-digit decline in sales during the same period. Such widespread regional vulnerabilities suggest a lack of consistent global demand, posing a challenge for overall revenue stability.

In late 2024, Advantech faced significant scrutiny with the disclosure of nearly two dozen security vulnerabilities in its EKI industrial-grade wireless access point devices. These included critical flaws that could allow attackers to execute code remotely without authentication, posing a substantial risk to industrial networks.

While Advantech released firmware updates to address these issues, the incident underscores a persistent weakness in product security. Such vulnerabilities can erode customer trust and raise concerns about the overall integrity and reliability of Advantech's connected industrial solutions, potentially impacting future sales and market perception.

High Valuation Compared to Peers

Advantech's valuation is a point of concern for some investors. Its shares are trading at a premium when compared to industry peers. For instance, analysts project a 2025 PitchBook consensus P/E ratio of 32 times for Advantech.

This figure stands in contrast to the P/E ratios of other semiconductor companies. MediaTek is expected to trade at 21 times earnings, while NXP Semiconductors is projected at 18 times earnings for the same year. This elevated valuation could deter investors looking for more attractively priced opportunities in the sector.

- Higher P/E Ratio: Advantech's 2025 consensus P/E of 32x is significantly higher than MediaTek (21x) and NXP (18x).

- Investor Perception: This valuation may make Advantech less appealing to value-focused investors.

- Potential for Underperformance: Overvalued stocks can sometimes face pressure to correct downwards if growth expectations aren't met.

Integration Challenges with Acquisitions

Advantech's acquisition of AURES Technologies S.A. presented initial integration challenges, leading to a €2 million loss in the first quarter of 2024. This financial impact, while significant, was a direct consequence of integrating AURES' sales channels and operations.

While the situation improved, with the loss narrowing considerably in Q1 2025, achieving breakeven for the acquisition within 2025 remains a key objective. This highlights the ongoing complexities and potential short-term financial strain that can accompany mergers and acquisitions.

- Acquisition Impact: A €2 million loss was recorded in Q1 2024 following the AURES Technologies S.A. acquisition.

- Strategic Goal: The acquisition aimed to leverage AURES' established sales channels.

- Recovery Trend: The loss narrowed significantly in Q1 2025, indicating progress in integration.

- Breakeven Target: Achieving financial breakeven for the acquisition in 2025 is a stated goal.

Advantech's financial performance in 2024 revealed significant weaknesses, including a 7.4% revenue drop to NT$59.79 billion and a 17% decrease in net income. This downturn impacted profit margins, which fell from 17% in 2023 to 15% in 2024, indicating challenges in cost management or pricing power.

The company's reliance on specific markets proved to be a vulnerability, with North America, Europe, and Japan experiencing double-digit sales declines, while China and other emerging markets saw single-digit contractions, highlighting a lack of consistent global demand.

Security vulnerabilities discovered in late 2024 within Advantech's industrial access points posed a substantial risk, potentially eroding customer trust and impacting the perception of its connected industrial solutions.

Furthermore, Advantech's valuation, with a projected 2025 P/E ratio of 32x, is notably higher than peers like MediaTek (21x) and NXP Semiconductors (18x), which could deter value-conscious investors and create pressure for future performance to justify the premium.

The acquisition of AURES Technologies S.A. resulted in a €2 million loss in Q1 2024, showcasing integration challenges and the financial strain that can accompany M&A activities, even with a recovery trend observed in Q1 2025.

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Consolidated Revenue (NT$ billion) | 64.57 | 59.79 | -7.4% |

| Net Income (NT$ billion) | 10.98 | 9.11 | -17.0% |

| Profit Margin (%) | 17.0% | 15.0% | -2.0 pp |

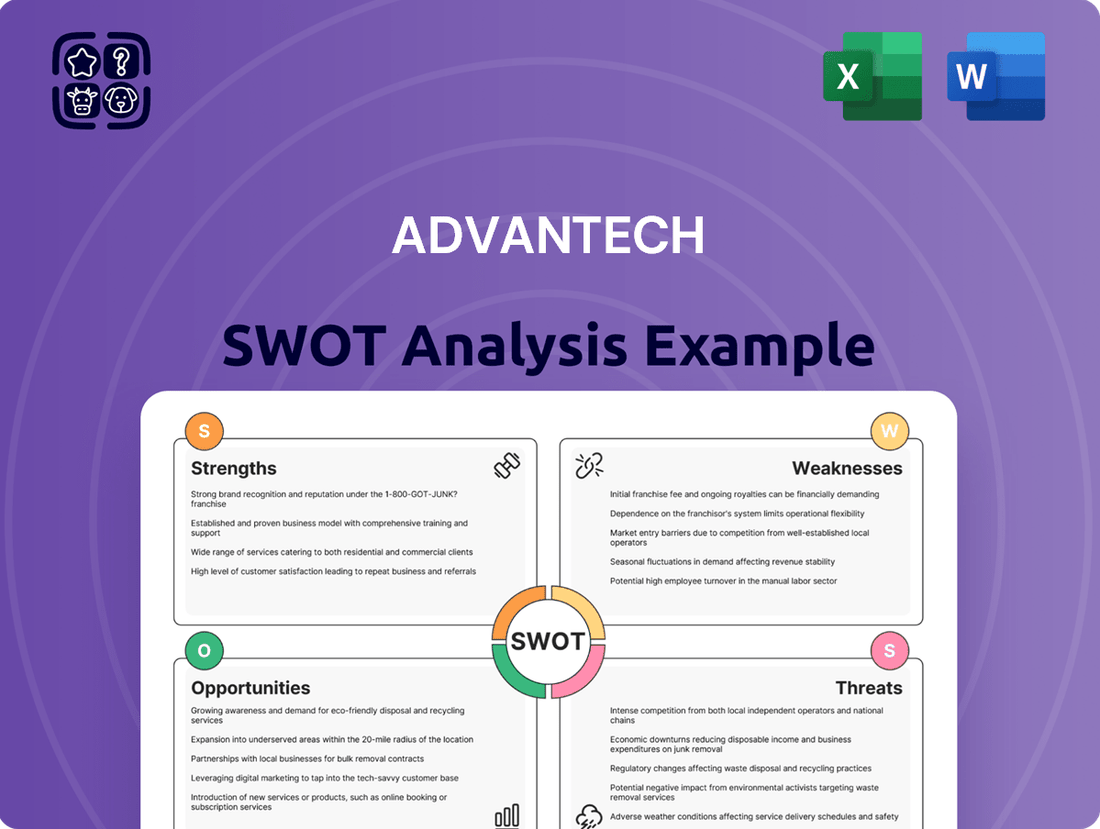

Preview the Actual Deliverable

Advantech SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the comprehensive structure and insights that will be yours to utilize.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview of Advantech.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear glimpse into the detailed analysis of Advantech's strengths, weaknesses, opportunities, and threats.

Opportunities

The industrial PC and automation market is a significant growth area, with projections showing expansion from $5.85 billion in 2024 to $6.2 billion in 2025, representing a 6.0% compound annual growth rate. This upward trend is expected to continue, reaching $8.55 billion by 2029.

This robust market expansion is primarily fueled by the escalating demand for automation solutions and real-time data monitoring across a wide array of industries. These favorable market conditions present a strong tailwind for Advantech, directly benefiting its core product offerings and strategic positioning.

The increasing integration of Artificial Intelligence (AI) with the Internet of Things (IoT), especially at the 'edge' where data is processed locally, offers a substantial avenue for Advantech's growth. This trend aligns perfectly with the growing demand for intelligent manufacturing and Industry 4.0 initiatives, which rely on robust computing capabilities situated directly at the point of data generation.

Advantech's strategic emphasis on Edge AI is particularly opportune, as businesses worldwide are prioritizing smart factory implementations and advanced automation. These solutions necessitate sophisticated, localized processing power to enable real-time decision-making and operational efficiency, a core strength of Advantech's offerings.

The company's Edge AI segment is already showing impressive performance, exceeding initial projections and indicating strong market receptiveness. For instance, in Q1 2024, Advantech reported a significant year-over-year revenue increase in its AIoT segment, driven by demand for edge computing solutions in industrial and intelligent systems.

Advantech is strategically deepening its engagement across several high-growth vertical markets, such as healthcare, smart cities, and industrial automation. This focus allows for the development of specialized, integrated solutions that cater precisely to industry needs, fostering stronger customer relationships and creating significant barriers to entry for competitors.

For instance, in the healthcare sector, Advantech's embedded computing solutions are vital for medical imaging devices and patient monitoring systems. The company reported a 15% year-over-year growth in its healthcare segment in Q3 2024, highlighting the success of this vertical market penetration strategy.

Leveraging Strategic Partnerships and Ecosystem Building

Advantech's strategic partnerships are a key opportunity, particularly its deepening collaboration with Qualcomm Technologies. This alliance is designed to speed up the development and deployment of AI-powered Internet of Things (IoT) solutions, fundamentally changing the landscape of industrial AI. By working closely with industry leaders, Advantech can tap into cutting-edge technologies and expertise, ensuring its offerings remain competitive.

The company's commitment to co-creation business models and strengthening its partner ecosystem is crucial. This approach fosters innovation by bringing together diverse perspectives and capabilities. For instance, Advantech's focus on building out its edge AI ecosystem is expected to yield significant growth. In 2024, Advantech highlighted its expansion in the AIoT sector, aiming to onboard more partners and develop integrated solutions that address complex customer needs across various industries.

- Accelerated AIoT Development: Intensified partnership with Qualcomm Technologies to drive AI-driven IoT applications.

- Ecosystem Strengthening: Commitment to co-creation and building a robust network of partners for integrated solutions.

- Market Reach Expansion: Alliances facilitate entry into new markets and broader customer engagement.

- Innovation Drive: Collaborative efforts foster the development of next-generation industrial AI solutions.

Advancements in Product Development and Service Offerings

Advantech is consistently pushing the envelope with its product development, recently unveiling advanced computer-on-modules and bolstering its Edge AI inference capabilities. This commitment to innovation ensures their offerings remain at the forefront of technological advancements.

The company is also strategically expanding its service portfolio, notably with L11 SKYRack integration services. This initiative facilitates localized assembly and delivery, enhancing customer responsiveness and supply chain efficiency.

These combined advancements in both hardware and service are crucial for Advantech to adeptly address shifting market needs. For instance, the growing demand for AI-powered edge computing solutions, projected to reach $110 billion by 2027 according to some market analyses, directly aligns with Advantech's strategic investments in Edge AI.

Key opportunities stemming from these advancements include:

- Leading the Edge AI market: By enhancing inference systems, Advantech can capture a larger share of the rapidly expanding edge AI sector.

- Strengthening IoT solutions: New computer-on-modules and integration services improve the robustness and scalability of their IoT platforms.

- Expanding global reach: Localized assembly services can reduce lead times and costs for international clients, fostering greater market penetration.

Advantech is well-positioned to capitalize on the burgeoning industrial PC and automation market, projected to grow to $6.2 billion in 2025. The company's focus on Edge AI, particularly in intelligent manufacturing and Industry 4.0, aligns perfectly with market demand. Advantech's AIoT segment saw significant year-over-year revenue growth in Q1 2024, demonstrating strong market traction.

The company's strategic expansion into high-growth verticals like healthcare, which saw a 15% year-over-year segment growth in Q3 2024, further solidifies its market position. Deepening collaborations, such as the one with Qualcomm Technologies, are set to accelerate AI-driven IoT solutions and expand market reach.

Advantech's commitment to product innovation, including advanced computer-on-modules and enhanced Edge AI inference capabilities, positions it to lead the rapidly growing edge AI sector. Furthermore, the expansion of services like L11 SKYRack integration services enhances customer responsiveness and supply chain efficiency, crucial for global market penetration.

| Opportunity Focus | Market Projection (2025) | Key Driver | Advantech's Strength |

|---|---|---|---|

| Edge AI & Intelligent Automation | $6.2 Billion (Industrial PC & Automation) | Industry 4.0, Smart Factories | Edge AI product development, AIoT segment growth |

| Vertical Market Penetration | Significant growth in Healthcare, Smart Cities | Demand for specialized industrial solutions | 15% YoY growth in Healthcare (Q3 2024) |

| Strategic Partnerships | Accelerated AIoT development | Collaboration with tech leaders (e.g., Qualcomm) | Co-creation, ecosystem strengthening |

| Product & Service Innovation | Expansion of Edge AI capabilities | Demand for advanced computing and localized services | New modules, L11 SKYRack integration |

Threats

Advantech is grappling with escalating competition across its core markets. Major international rivals like Kontron and B&R Automation, alongside strong Taiwanese players such as Ennoconn, Nexcom, iBase, IEI Integration, and Adlink, are all vying for market share. This heightened rivalry, especially within the crucial Chinese market, poses a significant threat, potentially impacting Advantech's pricing flexibility and overall market standing.

Advantech faces significant challenges from global economic slowdowns and trade disputes, with potential tariffs impacting its supply chain and product pricing. For instance, the slower-than-expected economic recovery in China during 2023 directly translated to weaker order intake for many industrial technology firms, a trend Advantech could experience.

These macroeconomic headwinds, coupled with geopolitical tensions, create an unpredictable operating environment. A prolonged downturn in key markets could dampen demand for Advantech's industrial IoT and embedded computing solutions, directly affecting its revenue streams and profitability throughout 2024 and into 2025.

The industrial sector faces escalating cybersecurity threats, with attacks growing in scale and sophistication. Advantech, as a provider of intelligent systems and IoT solutions, is directly in the crosshairs of these digital risks.

Ransomware and software vulnerabilities pose significant dangers to Advantech's offerings and its customer base. A successful breach could result in substantial financial repercussions and severe damage to the company's reputation.

For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved. Industrial control systems (ICS) are particularly vulnerable, with reports indicating a sharp increase in attacks targeting critical infrastructure in recent years.

Rapid Technological Obsolescence and Innovation Pace

The relentless pace of technological advancement, particularly in areas like artificial intelligence and the Internet of Things, presents a significant threat. Advantech must commit substantial resources to ongoing research and development to remain competitive. For instance, in 2024, the global AI market is projected to reach hundreds of billions of dollars, with rapid iteration cycles demanding constant adaptation.

Failure to effectively integrate emerging technologies or to innovate quickly enough could render existing product lines obsolete. This could lead to a loss of market share and a decline in Advantech's overall relevance. The company's ability to anticipate and respond to these shifts will be crucial for its sustained success.

Key areas of concern include:

- AI Integration: Keeping pace with AI advancements in edge computing and industrial automation is critical.

- IoT Standards: Evolving IoT protocols and security standards require continuous product updates.

- Component Lifecycles: The short lifecycles of advanced electronic components necessitate agile supply chain management.

Supply Chain Disruptions and Component Shortages

Advantech has historically contended with component shortages and escalating costs, which have previously put a damper on its operating revenue growth. Looking ahead, the company remains vulnerable to future supply chain disruptions. These could stem from geopolitical tensions, unforeseen natural disasters, or surges in demand, all of which have the potential to impede production, delay crucial product deliveries, and ultimately erode profitability.

For instance, the global semiconductor shortage that began in late 2020 and extended well into 2023 significantly impacted numerous industries, including industrial computing. While Advantech has strategies to mitigate these risks, the ongoing volatility in global supply chains presents a persistent threat. The company's reliance on a complex network of suppliers means that disruptions at any point can have a cascading effect on its ability to meet customer orders and maintain its competitive edge.

- Geopolitical Instability: Ongoing trade disputes and regional conflicts can disrupt the flow of critical components, impacting Advantech's manufacturing capabilities.

- Natural Disasters: Events like earthquakes or floods in key manufacturing regions can halt production and create significant logistical challenges.

- Increased Demand Volatility: Rapid shifts in market demand, particularly for specialized industrial hardware, can strain existing supply chains and lead to shortages.

Advantech's profitability is threatened by intense competition from both global giants and domestic players, potentially squeezing pricing power and market share, especially in the vital Chinese market.

Economic downturns and trade tensions pose risks to Advantech's supply chain and product pricing, with weaker economic recovery in China during 2023 already impacting industrial technology firms.

The company faces significant cybersecurity threats, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, making Advantech's IoT solutions a prime target.

Rapid technological advancements, particularly in AI, demand substantial R&D investment, as the global AI market is projected to reach hundreds of billions of dollars in 2024, requiring constant adaptation.

SWOT Analysis Data Sources

This Advantech SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial reports, comprehensive market research, and expert industry analyses to provide a robust and actionable strategic overview.