Advantech Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advantech Bundle

Uncover the strategic potential of Advantech's product portfolio with our insightful BCG Matrix preview. See where their innovations are positioned as market leaders or emerging opportunities.

Don't miss out on the full picture! Purchase the complete Advantech BCG Matrix to gain detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investments and product development strategies.

Equip yourself with the knowledge to make informed decisions. Get the full report and transform your understanding of Advantech's market standing into a competitive advantage.

Stars

Advantech has set a clear goal to be a top player in Edge Computing and Edge AI by 2025, seeing this as a prime time for tech convergence. This strategic move includes substantial financial backing and a revamped brand to seize the rapid expansion in this sector.

The company's commitment is reflected in its aggressive market positioning, aiming to capitalize on the projected growth of the Edge AI market, which was estimated to reach $10.8 billion in 2023 and is expected to grow significantly in the coming years.

Advantech is making significant investments in its AIoT software platforms, such as WISE-IoT and Solution Ready Packages (SRPs). This strategic focus on industrial applications within AIoT is designed to capture robust market growth. For instance, the global AIoT market was valued at approximately USD 21.7 billion in 2023 and is projected to reach USD 179.4 billion by 2030, growing at a CAGR of 35.1% during the forecast period.

This expansion is a cornerstone of Advantech's strategy to accelerate the development and adoption of the AIoT ecosystem. By providing comprehensive software solutions, the company aims to simplify the deployment of AIoT technologies for various industrial sectors.

Advantech is strategically focusing on high-performance computing and Edge AI for burgeoning fields such as 5G, networking, healthcare, transportation, and industrial automation. Their commitment to developing specialized Edge AI acceleration modules and integrated industry systems places them advantageously within these fast-evolving markets.

AI-Integrated Robotics Solutions

Advantech is actively positioning itself in the AI-integrated robotics sector, a rapidly expanding market. Their offerings include robust edge AI computing platforms crucial for deploying AI capabilities directly at the point of operation.

This strategic focus is supported by key partnerships and ongoing product development, signaling Advantech's ambition to become a leader in this high-potential segment. The company is investing in technologies that enable intelligent automation and data processing for robotic applications.

- Market Growth: The global robotics market, particularly the segment integrating AI, is experiencing significant expansion. For instance, the AI in Robotics market was valued at approximately USD 13.5 billion in 2023 and is projected to reach over USD 45 billion by 2030, growing at a CAGR of around 18-20% during this period.

- Advantech's Role: Advantech's rugged edge AI computing platforms are designed to withstand demanding industrial environments, providing the necessary processing power for real-time AI inference in robotics.

- Strategic Importance: The company's investments in this area are aimed at capturing a substantial share of this burgeoning market, leveraging its expertise in industrial computing and connectivity.

Edge AI Computing Platforms with High Market Share

Advantech's Edge AI Computing Platforms are indeed stars in their BCG Matrix, boasting a significant market share fueled by the relentless growth in global AI and edge computing. Their commitment to innovation, evidenced by the introduction of new AI servers and Software Development Kits (SDKs), solidifies this strong market position.

The company’s extensive portfolio of edge computing solutions caters to a wide array of industries, from smart manufacturing to intelligent transportation. For instance, Advantech reported substantial growth in its AI and IoT segments in 2023, with specific product lines contributing significantly to this upward trend. This expansion is directly linked to the increasing demand for real-time data processing and localized AI inference at the network's edge.

- Market Dominance: Advantech commands a high market share in the edge AI computing platform sector.

- Growth Drivers: The rapid global development of AI and edge computing technologies are key growth catalysts.

- Innovation Pipeline: Continuous advancements, including new AI servers and SDKs, reinforce their star status.

- Industry Adoption: Broad adoption across diverse industries like smart manufacturing and intelligent transportation highlights platform versatility.

Advantech's Edge AI Computing Platforms are clearly stars in their BCG Matrix. They hold a strong market position, driven by the massive global expansion in AI and edge computing. Advantech's ongoing innovation, including new AI servers and SDKs, further cements their leading role.

The widespread adoption of these platforms across various industries, from smart manufacturing to intelligent transportation, underscores their versatility and market appeal. This strong performance is directly tied to the increasing need for localized AI processing and real-time data analysis at the network edge.

| Key Metric | 2023 Value | Projected 2025 Value | Growth Driver |

| Edge AI Market | $10.8 Billion | Significant Growth (Specific 2025 data not yet finalized, but trend indicates strong upward trajectory) | Demand for real-time analytics and localized processing |

| AIoT Market | $21.7 Billion | Projected $179.4 Billion by 2030 (CAGR 35.1%) | Convergence of AI and IoT across industries |

What is included in the product

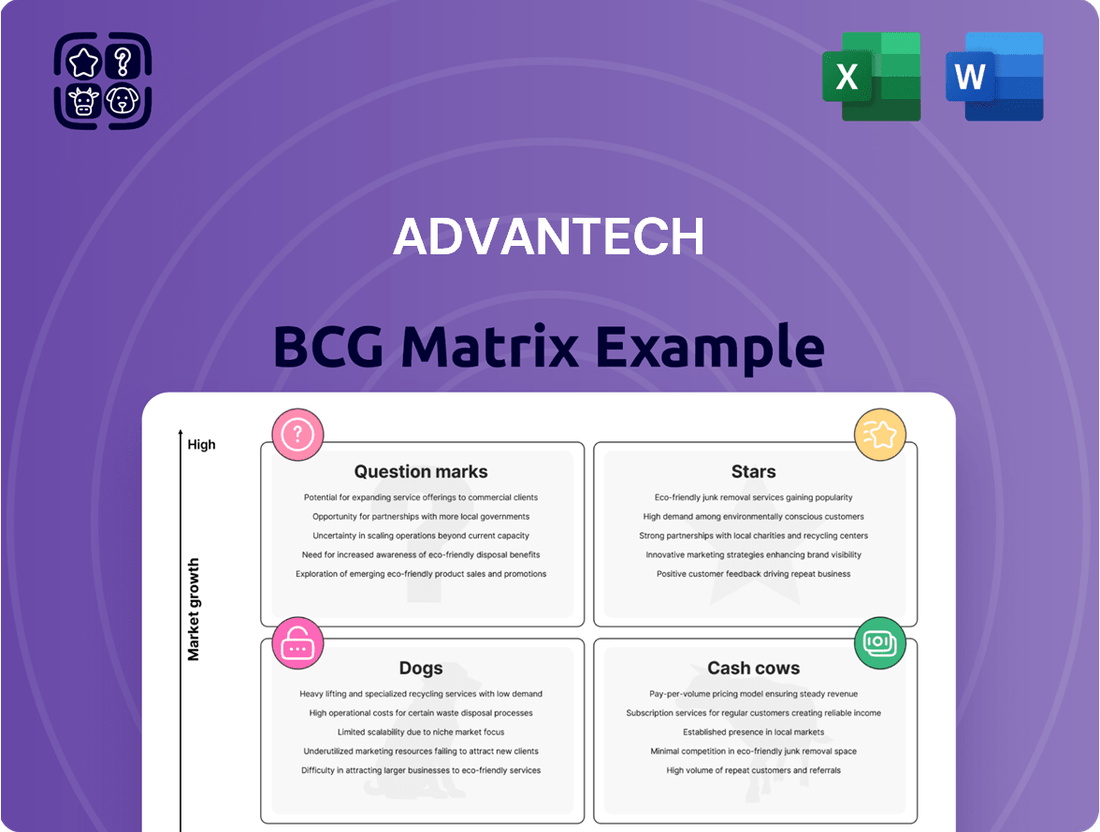

Advantech's BCG Matrix offers strategic guidance by categorizing products into Stars, Cash Cows, Question Marks, and Dogs to inform investment decisions.

The Advantech BCG Matrix offers a clear, one-page overview, relieving the pain of complex business unit analysis by placing each in its strategic quadrant.

Cash Cows

Advantech's Industrial PCs (IPCs) are a cornerstone of their business, historically positioning them as a global leader in this mature market. This segment consistently generates significant cash flow, demonstrating its enduring strength even as the company expands into new areas like Edge AI.

Advantech's embedded computing platforms are firmly positioned as Cash Cows within their BCG matrix. This segment benefits from the steady, albeit slower, growth of the broader embedded market, fueled by the ongoing expansion of the Internet of Things (IoT) and the increasing demand for edge computing solutions. Advantech's significant market share in these foundational, reliable systems ensures a consistent and predictable revenue stream.

In 2024, the global embedded computing market was valued at approximately $11.5 billion and is projected to grow at a compound annual growth rate (CAGR) of around 5.5% through 2029. Advantech's established presence and strong brand recognition in this mature yet expanding sector allow them to capitalize on this stable demand, generating substantial and reliable profits that support other business units.

Advantech's Industrial Automation & I/O Products segment is a strong Cash Cow within its BCG Matrix. This division provides essential solutions for Industry 4.0, data acquisition, and facility monitoring, serving a mature market where Advantech holds a significant competitive edge.

The company's extensive portfolio of automation and I/O products, including PLCs, PACs, and industrial communication devices, consistently generates high profit margins. In 2023, Advantech reported a robust performance in its industrial sector, with revenue growth driven by demand for smart manufacturing and IoT solutions.

Traditional IoT Intelligent Systems

Advantech's Traditional IoT Intelligent Systems are firmly established as Cash Cows within their business portfolio. Their long-standing expertise and global leadership in general IoT intelligent systems and embedded platforms consistently generate substantial and stable cash inflows. These mature systems are integral to numerous sectors, forming a bedrock of Advantech's revenue generation.

These systems are critical across various industries, including industrial automation, healthcare, and transportation, demonstrating their widespread applicability and established market presence. For instance, in 2023, Advantech reported revenue of approximately $2.07 billion USD, with their embedded computing and IoT segments contributing significantly to this figure, reflecting the ongoing demand for their foundational intelligent systems.

- Stable Revenue Streams: The established nature of these systems ensures predictable and consistent cash flow, supporting other business initiatives.

- Market Dominance: Advantech's leadership in embedded platforms provides a strong competitive advantage and a loyal customer base.

- Diversified Sectoral Application: Their intelligent systems are deployed across a wide array of industries, mitigating sector-specific risks.

- Foundation for Innovation: The cash generated fuels investment in newer, high-growth areas like AI-driven IoT solutions.

Design & Manufacturing Services (DMS)

Advantech's Design & Manufacturing Services (DMS) likely represent a significant Cash Cow within its portfolio. These services, focusing on customized product designs and deep technology expertise, particularly in embedded solutions and applied computing, cater to major clients. This maturity in offerings suggests a consistent generation of high-value, recurring revenue streams, a hallmark of a Cash Cow.

In 2024, Advantech's commitment to these specialized services is evident in its continued investment in R&D and client partnerships. The company's ability to deliver tailored embedded solutions for sectors like industrial automation and healthcare ensures a stable demand. This steady revenue generation allows Advantech to fund growth in other areas of its business.

- High Recurring Revenue: DMS services provide predictable, ongoing income from long-term client contracts.

- Mature Market Position: Advantech's established expertise in embedded and applied computing solidifies its market standing.

- Client Dependency: Major clients rely on Advantech for critical, customized technology solutions.

- Profitability Driver: The stable cash flow from DMS supports overall company profitability and investment capacity.

Advantech's Industrial PCs (IPCs) and embedded computing platforms are quintessential Cash Cows, leveraging their established market presence and consistent demand. These mature product lines, critical for sectors like industrial automation and IoT, generate substantial and stable cash flow, underpinning Advantech's financial stability.

The global embedded computing market, valued at approximately $11.5 billion in 2024 and projected for steady growth, provides a fertile ground for these offerings. Advantech's significant market share ensures a reliable revenue stream, enabling strategic investments in emerging technologies.

Advantech's Industrial Automation & I/O Products and Traditional IoT Intelligent Systems also function as strong Cash Cows. Their deep integration into Industry 4.0 and diverse applications across healthcare and transportation solidify their position as consistent profit generators.

These segments benefit from high profit margins and recurring revenue, exemplified by Advantech's reported revenue of approximately $2.07 billion USD in 2023, with these areas contributing significantly.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | Market Growth (CAGR) |

|---|---|---|---|---|

| Industrial PCs (IPCs) | Cash Cow | Mature market, high market share, stable demand | Significant | Moderate (part of embedded) |

| Embedded Computing Platforms | Cash Cow | IoT expansion, edge computing, consistent revenue | Significant | ~5.5% (through 2029) |

| Industrial Automation & I/O Products | Cash Cow | Industry 4.0, smart manufacturing, high margins | Strong | Steady |

| Traditional IoT Intelligent Systems | Cash Cow | Diverse applications, established leadership, stable cash inflow | Significant | Steady |

Full Transparency, Always

Advantech BCG Matrix

The Advantech BCG Matrix preview you are currently viewing is the definitive version that will be delivered to you upon purchase. This means you'll receive the complete, unwatermarked report, ready for immediate integration into your strategic planning processes without any modifications or additional content.

Dogs

Undifferentiated legacy hardware, often older industrial components without advanced AI or IoT features, can become 'dogs' in the BCG matrix. These products typically face fierce price wars and shrinking demand, resulting in a low market share and profitability. For instance, if a company's 2024 sales for a specific line of older industrial PCs dropped by 15% compared to 2023, and its market share in that segment is only 3%, it would likely be classified here.

Advantech's performance in 2024 revealed significant regional challenges, with North America, Europe, and Japan all seeing sales drop by more than 10%. This persistent double-digit decline in key markets signals potential 'dog' status for specific product lines within these geographies if they fail to show a turnaround.

Advantech's product lines that have become highly commoditized, facing intense competition and minimal differentiation, could be classified as 'dogs' within the BCG matrix. These offerings likely yield low returns and consume valuable resources without substantial growth potential. For instance, if Advantech's basic industrial PC hardware has not been effectively bundled with higher-value software or services, it might fall into this category.

Non-Strategic or Stagnant Niche Products

Products that don't fit Advantech's focus on Edge Computing and AI, and cater to small, slow-growing markets, might be considered for sale. These items could be using up valuable resources without adding much to the company's main objectives.

For instance, if Advantech had a product line in legacy industrial automation components that saw only a 2% year-over-year growth in 2024, and this segment represented less than 1% of the company's total revenue, it would likely fall into this category. Such products might be draining R&D and marketing budgets that could be better allocated to their AIoT solutions, which are projected to grow at a much faster pace.

- Non-Strategic Alignment: Products failing to support Advantech's core strategy in Edge AI and IoT.

- Limited Growth Potential: Niche markets with minimal expansion prospects, hindering overall company growth.

- Resource Drain: Products consuming R&D, marketing, or operational resources without generating significant returns or strategic value.

- Divestiture Consideration: Potential candidates for sale or discontinuation to reallocate capital and focus.

Products with High Inventory & Slow Turnover

Products languishing with high inventory and sluggish sales, particularly those lacking a clear strategic future for Advantech, can be categorized as Dogs within the BCG Matrix. These items consume valuable working capital without generating significant returns, potentially acting as cash traps.

For instance, if Advantech's 2024 sales data reveals certain legacy industrial automation components experiencing a year-over-year decline in unit sales by over 15% while inventory levels remain stubbornly high, these would be prime candidates for the Dog quadrant. This situation could indicate a market shift away from these older technologies or intense competition that Advantech is not effectively addressing.

- High Inventory Levels: Products with stock exceeding typical demand by a substantial margin.

- Slow Turnover: Items remaining in inventory for extended periods, indicating weak customer interest.

- Lack of Strategic Focus: Product lines not aligned with Advantech's future growth initiatives or technological advancements.

- Capital Tie-up: These products immobilize funds that could be reinvested in more promising areas of the business.

Products that are not aligning with Advantech's strategic focus on Edge AI and IoT, especially those in niche, slow-growing markets, are prime candidates for the Dog quadrant. These offerings often consume valuable resources like R&D and marketing budgets without contributing significantly to overall growth or future objectives. For example, if a legacy product line saw only 2% growth in 2024 and represented less than 1% of total revenue, it would likely be classified as a Dog, potentially hindering resource allocation to more promising AIoT solutions.

Advantech's 2024 performance showed significant sales drops exceeding 10% in key markets like North America, Europe, and Japan. If specific product lines within these regions continue to experience such declines without a clear turnaround strategy, they risk being categorized as Dogs. These products often face intense price competition and have low market share, leading to reduced profitability.

Highly commoditized products within Advantech, facing stiff competition and lacking differentiation, can also be considered Dogs. These items typically generate low returns and tie up capital that could be better utilized in growth areas. For instance, basic industrial PC hardware not enhanced with advanced software or services might fall into this category, especially if unit sales decline by over 15% year-over-year with high inventory levels, as seen in some legacy components in 2024.

| Product Category Example | 2024 Market Share | 2024 Year-over-Year Sales Growth | Strategic Alignment | BCG Classification |

|---|---|---|---|---|

| Legacy Industrial Automation Components | 3% | -15% | Low (Not AIoT focused) | Dog |

| Basic Industrial PCs (Undifferentiated) | 5% | -5% | Moderate (Potential for upgrade) | Dog/Cash Cow (depending on cash flow) |

| AIoT Edge Solutions | 25% | +20% | High (Core Strategy) | Star |

Question Marks

Advantech's WISE-IoT Andon AI-Powered Digital Solution and LEO-L50 Outdoor Asset Management Device exemplify their push into new, rapidly expanding sectors like smart manufacturing and sustainable logistics. These offerings, recognized with awards in 2025, signal strong market potential but are currently in a phase where significant investment is crucial for scaling adoption and solidifying market share.

The Advantech AOM-2521 OSM module, featuring the NXP i.MX 95 processor, is positioned for engineering evaluations in Q4 2025. This positions it as a potential star product within Advantech's portfolio, targeting the burgeoning machine vision and industrial IoT markets. Its advanced capabilities for edge AI suggest a high growth trajectory, though its market share is still unestablished.

Advantech is actively developing AI Agent and Small Language Models (SLMs) across diverse sectors, spurred by the widespread adoption of cloud-based large language models. This strategic focus positions them in a developing, high-potential market where they are establishing their presence and market share.

Specific Vertical Market Sub-segments for Edge AI

Advantech's focus on broad markets like healthcare and smart cities for Edge AI is strategic, but within highly specialized niches, their market share might be nascent. For instance, in advanced AI-driven diagnostics for rare diseases or highly specific traffic flow optimization in complex urban environments, Advantech may still be building its presence. This presents an opportunity for significant growth, albeit with the need for targeted R&D and market penetration efforts.

Consider the burgeoning field of AI in personalized medicine, specifically for analyzing genomic data in real-time at the edge for early cancer detection. While the overall healthcare AI market is expanding rapidly, with projections suggesting it could reach over $100 billion by 2028, sub-segments like edge-based genomic analysis are still in their early stages. Advantech's potential market share here could be relatively small, making it a prime candidate for investment to capture future growth.

- Niche Medical Imaging: AI for analyzing specific types of medical scans, like early-stage diabetic retinopathy detection from retinal images, where specialized algorithms and datasets are crucial.

- Smart City Infrastructure Monitoring: Edge AI applications for predictive maintenance of critical infrastructure, such as bridge structural integrity monitoring or AI-powered leak detection in water distribution systems.

- Industrial IoT Anomaly Detection: AI models trained to identify subtle anomalies in manufacturing processes for highly specialized machinery, preventing costly downtime.

- Autonomous Vehicle Sensor Fusion: Edge AI solutions for integrating and processing data from multiple sensors in autonomous vehicles for specific driving scenarios, like navigating complex intersections in adverse weather.

New Strategic Partnerships for Emerging Technologies

Advantech’s strategic alliances with industry leaders like Qualcomm for cutting-edge Edge AI compute and mimik for streamlined AI deployment are prime examples of its ‘Question Marks’ strategy. These collaborations target nascent, high-potential markets where Advantech is investing to build future dominance.

These partnerships are crucial for Advantech to establish a foothold in rapidly expanding sectors. For instance, the collaboration with Qualcomm aims to capitalize on the projected growth of the Edge AI market, which is expected to reach hundreds of billions of dollars by the late 2020s. Similarly, the mimik partnership facilitates easier AI integration, addressing a key bottleneck in cloud and edge computing adoption, a sector seeing exponential growth in data processing and analytics.

- Edge AI Growth: The global Edge AI market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 25% in the coming years, reaching over $200 billion by 2028.

- Qualcomm Collaboration: Advantech's work with Qualcomm focuses on developing next-generation AI solutions for edge devices, leveraging Qualcomm’s advanced chipsets to power complex AI tasks directly on hardware.

- Mimik Partnership: This alliance simplifies the deployment of AI models across distributed environments, enabling faster innovation and broader application of AI technologies for Advantech’s customers.

- Market Entry Strategy: By forming these partnerships, Advantech is actively positioning itself in emerging technological landscapes, accepting lower initial market share for the promise of substantial future returns.

Question Marks represent Advantech's investments in emerging technologies with high growth potential but currently low market share. These are areas where the company is establishing a presence, requiring significant R&D and strategic partnerships to capture future market dominance.

Advantech's focus on AI Agent and Small Language Models (SLMs) exemplifies this, targeting a developing market where they are building their share. Similarly, their edge AI initiatives in specialized healthcare niches, like early cancer detection through edge-based genomic analysis, position them in rapidly expanding sub-sectors where their current market penetration is nascent.

Strategic collaborations, such as those with Qualcomm for Edge AI compute and mimik for AI deployment, underscore Advantech's 'Question Mark' strategy. These alliances are crucial for navigating the high-growth Edge AI market, projected to exceed $200 billion by 2028, by simplifying AI integration and leveraging advanced hardware.

Advantech's commitment to these nascent, high-potential markets, accepting lower initial market share for substantial future returns, is evident in their targeted investments. This approach is vital for establishing a foothold in rapidly evolving technological landscapes.

| Technology Area | Current Market Share (Advantech) | Projected Market Growth | Strategic Focus | Investment Rationale |

|---|---|---|---|---|

| Edge AI Solutions | Nascent | CAGR > 25% (est. > $200B by 2028) | Smart Manufacturing, Logistics, Healthcare | Capture high-growth potential in distributed intelligence |

| AI Agent/SLMs | Developing | Rapid expansion driven by LLM adoption | Cross-sector applications | Establish presence in evolving AI software landscape |

| Niche Medical Imaging AI | Low | Significant growth in specialized diagnostics | Diabetic retinopathy detection, etc. | Target specialized, high-value healthcare segments |

| Autonomous Vehicle Sensor Fusion | Low | Growing demand for advanced automotive AI | Specific driving scenario solutions | Address critical needs in the autonomous driving sector |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of proprietary market research, financial statements, and industry-specific growth projections to deliver actionable strategic insights.