Advantech Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advantech Bundle

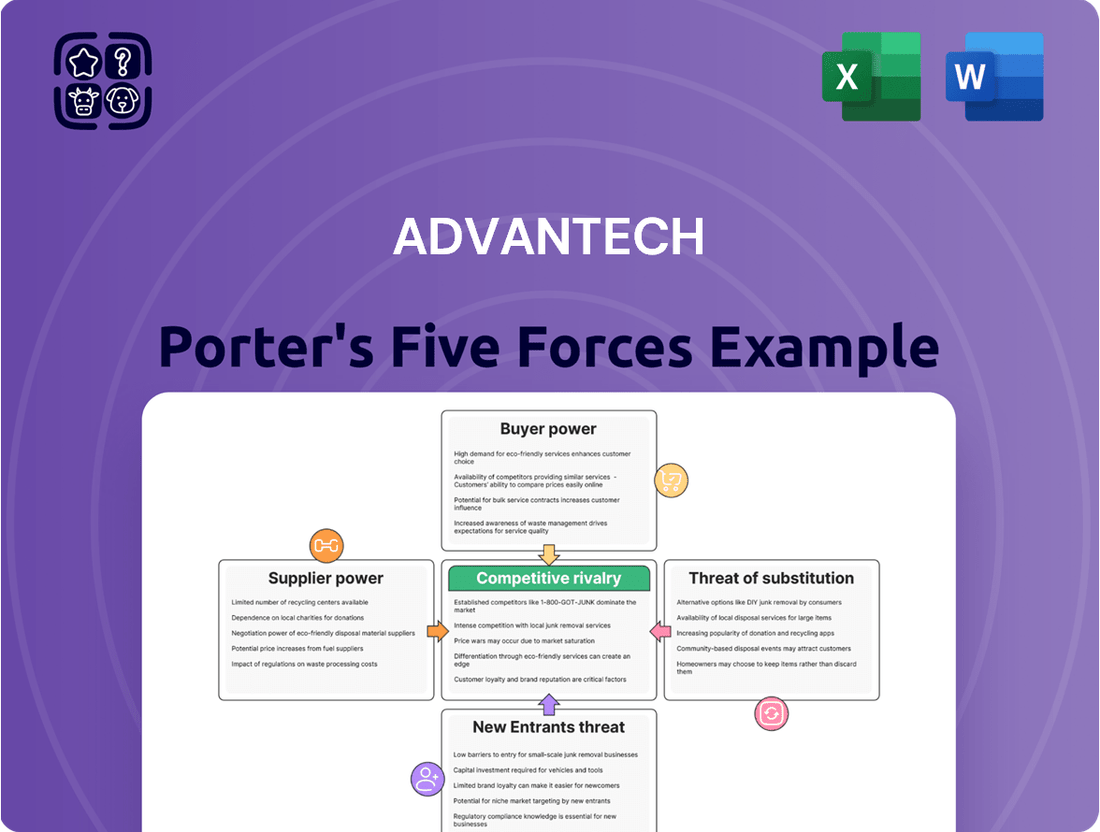

Advantech navigates a landscape shaped by intense competition, the bargaining power of its buyers, and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder.

Our full Porter's Five Forces Analysis delves into each of these forces, providing a comprehensive view of Advantech's competitive environment and strategic positioning.

Ready to gain a deeper understanding of the forces driving Advantech's market? Unlock the complete analysis to reveal actionable insights and inform your strategic decisions.

Suppliers Bargaining Power

Suppliers of specialized components, like high-performance processors and industrial-grade sensors, wield considerable influence over Advantech. Many of these critical parts are proprietary or manufactured by only a few companies, creating a reliance that can drive up costs or disrupt production if alternatives are limited.

The global semiconductor industry's inherent volatility, marked by periods of significant demand and occasional shortages, grants considerable power to chip manufacturers. For instance, in 2023, the average lead time for semiconductors stretched to 27 weeks, highlighting supply chain sensitivities.

Advantech, a key player in embedded systems and industrial PCs, is heavily reliant on these semiconductor suppliers. This dependence means that any shifts in supply availability or pricing from major chipmakers directly influence Advantech's manufacturing expenses and the timely delivery of its products to market.

Advantech's reliance on specialized, high-reliability components for demanding industrial applications significantly amplifies supplier power. Suppliers who can consistently deliver the ruggedized and durable parts essential for sectors like automation and embedded systems are limited, granting them considerable leverage in negotiations. For instance, in 2024, lead times for certain advanced industrial-grade processors, critical for Advantech's product lines, extended by an average of 20% compared to the previous year, reflecting this concentrated supplier strength.

The effort and expense involved in qualifying and integrating new suppliers capable of meeting Advantech's exacting quality and performance benchmarks are substantial. This process can involve rigorous testing, certification, and supply chain audits, often taking 12-18 months to complete. Consequently, Advantech faces challenges in diversifying its supplier base for these critical components, further solidifying the bargaining power of existing, trusted providers.

Supplier Power 4

The bargaining power of suppliers for Advantech is significant, primarily due to high switching costs. When Advantech needs to change a major component supplier, it often involves substantial expenses. These costs stem from redesigning products, re-certifying new components, and re-validating entire systems to guarantee compatibility and maintain performance standards. This process can be lengthy and resource-intensive, limiting Advantech's ability to easily shift to alternative suppliers.

These high switching costs directly empower incumbent suppliers. They know that Advantech faces considerable hurdles in finding and integrating new sources for critical components. This leverage allows suppliers to potentially command higher prices or dictate more favorable terms, as Advantech has less flexibility to negotiate or walk away. For instance, in the semiconductor industry, where Advantech sources many of its processors and memory chips, lead times for new, qualified components can extend for months, further solidifying supplier power.

- High Switching Costs: Redesign, re-certification, and system re-validation are costly and time-consuming for Advantech when changing component suppliers.

- Supplier Leverage: Incumbent suppliers benefit from Advantech's limited flexibility, potentially leading to less favorable pricing and terms.

- Component Dependency: Advantech's reliance on specialized components, particularly in areas like industrial automation and embedded systems, increases the power of its key suppliers.

- Market Concentration: In certain component categories, a limited number of suppliers may dominate the market, further concentrating power and reducing Advantech's negotiation options.

Supplier Power 5

Suppliers often provide critical intellectual property and technological advancements that are integrated into Advantech's solutions, directly impacting product competitiveness. This deep reliance on supplier innovation for cutting-edge features significantly bolsters their bargaining power.

Advantech must cultivate robust relationships with these technology leaders to guarantee continued access to essential, state-of-the-art components and specialized knowledge. For instance, in 2024, the semiconductor industry, a key supplier base for Advantech's embedded computing solutions, continued to experience supply chain complexities, underscoring the importance of strong supplier partnerships.

- Supplier Dependency: Advantech's reliance on specialized components and intellectual property from a limited number of technology partners increases supplier leverage.

- Innovation Integration: The need to incorporate advanced technologies from suppliers into Advantech's product roadmap directly translates to greater supplier influence.

- Strategic Partnerships: Maintaining strong relationships with key technology providers is crucial for Advantech to secure access to critical innovations and maintain its competitive edge in the rapidly evolving industrial IoT market.

Advantech's suppliers, particularly those providing specialized semiconductors and industrial-grade components, hold significant bargaining power. This is amplified by the high costs and time involved in qualifying new suppliers, often 12-18 months, which limits Advantech's flexibility. For instance, in 2024, lead times for critical industrial processors saw a 20% increase, underscoring supplier leverage.

The concentration of suppliers for advanced technologies and proprietary components further strengthens their position. Advantech's reliance on these key partners for innovation, essential for its competitive edge in industrial IoT, means supplier terms can directly impact Advantech's costs and product development timelines.

| Factor | Impact on Advantech | Supporting Data (2024) |

| Supplier Specialization | High reliance on proprietary, high-performance components | Extended lead times for advanced industrial processors (avg. 20% increase) |

| Switching Costs | Significant expenses for redesign, re-certification, and system re-validation | Qualification and integration of new suppliers can take 12-18 months |

| Supplier Concentration | Limited number of providers for critical technologies | Volatile semiconductor market with periodic shortages impacting availability |

| Innovation Dependence | Need for cutting-edge components from key technology partners | Crucial for maintaining competitive edge in rapidly evolving industrial IoT |

What is included in the product

This analysis meticulously dissects the competitive landscape for Advantech, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly visualize competitive intensity across all five forces with a dynamic, interactive dashboard.

Customers Bargaining Power

Advantech's buyer power is significantly influenced by its diverse customer base, which includes large industrial enterprises and system integrators. These major clients, often purchasing in high volumes, possess considerable leverage. For instance, a large system integrator might account for a substantial portion of Advantech's revenue for specific product lines, giving them a strong hand in price negotiations.

These significant customers frequently require tailored solutions and robust support, which further amplifies their bargaining power. Their ability to demand customized specifications and competitive pricing, backed by their substantial order sizes, allows them to negotiate terms that can impact Advantech's profitability on those deals. In 2023, Advantech reported total revenue of NT$72.3 billion (approximately $2.3 billion USD), highlighting the scale of operations where such customer influence can be felt.

Customers in industries like factory automation and transportation are highly sensitive to price, constantly looking for the most cost-effective solutions. This puts significant pressure on Advantech to offer competitive pricing without compromising on the quality or innovation of its products.

The increasing commoditization of standard industrial computing components, such as basic embedded systems or certain types of industrial monitors, further amplifies buyer power. For instance, in 2024, the global industrial PC market saw a rise in offerings from multiple vendors for more standardized products, giving buyers more choices and leverage.

This dynamic means Advantech must continuously innovate and differentiate its offerings beyond price, focusing on value-added services, superior performance, and robust support to retain its customer base and pricing power.

Advantech faces significant buyer power in the industrial PC and embedded solutions market. The presence of numerous alternative suppliers, even those with smaller market shares or niche specializations, allows customers to easily compare offerings and negotiate terms. This competitive landscape means customers can credibly threaten to switch to a competitor if Advantech's pricing or service levels don't meet their expectations.

For instance, while Advantech is a leader, the market for industrial PCs includes players like Dell, Siemens, and numerous smaller, highly specialized manufacturers. In 2024, the global industrial PC market was valued at approximately USD 5.5 billion, with projections indicating continued growth, underscoring the breadth of competitive options available to buyers. This forces Advantech to constantly innovate and justify its value proposition through performance, reliability, and support to retain its customer base.

Buyer Power 4

Customers' ability to integrate their own solutions or source components from various suppliers significantly diminishes their dependence on a single provider like Advantech. This unbundling capability grants customers greater leverage in negotiations.

While Advantech provides comprehensive integrated solutions, advanced customers might opt to assemble systems from different vendors. This strategy can be employed to optimize costs or to attain highly specific functionalities not readily available from a single source.

- Customer Integration Capability: Sophisticated buyers can piece together systems from multiple vendors, reducing reliance on Advantech's integrated offerings.

- Component Sourcing: The availability of interchangeable components allows customers to switch suppliers, increasing their bargaining power.

- Cost Optimization: Customers may seek to build their own solutions to achieve lower overall costs compared to purchasing a fully integrated package.

- Advantech's Market Position: In 2023, Advantech reported revenue of approximately $2.2 billion USD, indicating a significant market presence but also highlighting the vastness of the electronics components market where alternative sourcing is possible.

Buyer Power 5

Advantech's buyer power is influenced by the long-term nature of industrial projects. Once embedded, their solutions create a lock-in effect, reducing customer power post-purchase. However, during the initial selection process, customers wield significant influence as they compare vendors and assess long-term viability and support.

During the critical procurement phase, customers have substantial bargaining power. They meticulously evaluate Advantech's offerings against competitors, focusing on total cost of ownership, technological integration, and the assurance of ongoing support. This initial stage is where Advantech must demonstrate its value proposition to overcome price sensitivity and secure foundational business.

- Customer Influence: Buyers can exert considerable pressure during the initial vendor selection process for large-scale industrial projects.

- Lock-in Effect: Advantech's embedded solutions in critical infrastructure create a switching cost barrier for customers once implemented.

- Value Demonstration: Advantech must prove long-term reliability and robust support to win initial contracts and mitigate customer bargaining power.

- Procurement Leverage: Customers leverage their purchasing power by comparing Advantech's offerings on price, technology, and service before commitment.

Advantech faces considerable bargaining power from its customers, particularly large enterprises and system integrators who purchase in high volumes. These major clients can negotiate favorable pricing and terms due to their significant order sizes, impacting Advantech's profitability. The global industrial PC market, valued at approximately USD 5.5 billion in 2024, offers a wide array of vendors, allowing buyers to easily switch suppliers if Advantech's offerings are not competitive.

| Customer Segment | Leverage Factors | Impact on Advantech |

|---|---|---|

| Large Industrial Enterprises | High volume purchases, demand for customization | Price negotiation, potential for tailored solutions |

| System Integrators | Significant order contribution, integration capabilities | Strong influence on pricing and product specifications |

| Price-Sensitive Industries (e.g., Automation) | Focus on cost-effectiveness | Pressure on pricing, need for competitive solutions |

Preview the Actual Deliverable

Advantech Porter's Five Forces Analysis

This preview showcases the comprehensive Advantech Porter's Five Forces Analysis you will receive immediately after purchase. The document you see here details the competitive landscape for Advantech, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Rest assured, this is the exact, professionally formatted analysis you'll get, ready for your strategic decision-making.

Rivalry Among Competitors

Advantech faces fierce competition in the industrial IoT and automation sector. The market is crowded with established industrial PC makers, specialized embedded system providers, and large automation companies, all competing for a slice of the market. This intense rivalry fuels constant innovation and keeps pricing under pressure.

Competitive rivalry in the industrial computing sector is intense, with players like Advantech differentiating through product innovation, customization, global presence, and specialized industry knowledge. For instance, Advantech's commitment to R&D, which saw significant investment in 2024, is crucial for maintaining a technological lead and addressing the dynamic needs of sectors like smart manufacturing and intelligent transportation.

The industrial Internet of Things (IoT) and smart applications market is experiencing robust growth, drawing significant new investment and consequently intensifying competition for established players like Advantech. This expansion in sectors like smart manufacturing and intelligent transportation presents a fertile ground for new entrants and existing companies looking to broaden their reach.

As more industries embrace IoT solutions, the opportunity for market expansion is substantial, but this also translates to an increased number of companies vying for market share in Advantech's key segments. For instance, the global industrial IoT market was valued at approximately $247.6 billion in 2023 and is projected to reach over $1.1 trillion by 2030, according to various market research reports. This rapid growth naturally fuels more aggressive competitive actions as companies strive to capture emerging opportunities.

Competitive Rivalry 4

The industrial computing market, while consolidated at the top with players like Advantech, exhibits significant fragmentation in specialized segments. This creates intense rivalry as numerous smaller, agile companies focus on specific applications or regional demands, offering tailored solutions that can challenge larger, more diversified players. For instance, in 2023, the global industrial PC market saw a robust growth, with numerous smaller vendors carving out niches in areas like embedded systems and IoT solutions, contributing to a dynamic competitive landscape.

Advantech, despite its leading position, must contend with these specialized competitors. These smaller firms often possess greater flexibility to adapt quickly to evolving technological trends or specific customer needs within their chosen niches. This necessitates that Advantech not only maintain its broad product offerings but also demonstrate a keen ability to address these niche requirements effectively to retain its competitive edge.

- Market Fragmentation: The industrial computing sector includes many smaller companies specializing in niche areas, intensifying competition.

- Agile Competitors: Advantech faces rivalry from nimble players focusing on specific applications or geographic markets.

- Portfolio Breadth vs. Niche Focus: Advantech's challenge lies in balancing its extensive product range with the need to cater to specialized, niche demands.

Competitive Rivalry 5

Competitive rivalry is intense in the industrial computing sector, with price competition being a major driver, especially for standardized products like industrial PCs and embedded boards. Advantech faces pressure from rivals who may employ aggressive pricing to gain market share, necessitating a careful balance between maintaining profitability and staying competitive.

For instance, in 2024, the industrial PC market saw continued price sensitivity, with some reports indicating an average selling price (ASP) decline in certain segments due to increased competition from Asian manufacturers. Advantech's strategy to counter this involves focusing on value-added services and integrated solutions, moving beyond basic hardware to offer comprehensive packages that differentiate them from competitors solely focused on price.

- Price Pressure: Competitors frequently use aggressive pricing, particularly for commoditized industrial PC and embedded board offerings, impacting Advantech's margins.

- Market Share Focus: Some rivals prioritize market share acquisition through lower prices, creating a challenging environment for Advantech to maintain its pricing power.

- Differentiation Strategy: Advantech counters by emphasizing value-added services, customization, and complete solutions, aiming to justify higher price points based on total offering value.

- 2024 Market Dynamics: The industrial PC market in 2024 continued to experience price competition, with some segments seeing downward pressure on average selling prices.

Advantech navigates a highly competitive landscape within the industrial IoT and automation sector. The market is populated by numerous established industrial PC manufacturers, specialized embedded system providers, and large automation conglomerates, all vying for market share. This intense rivalry drives continuous innovation and exerts downward pressure on pricing. For example, in 2024, the industrial PC market continued to see price sensitivity, with some segments experiencing declining average selling prices due to increased competition, particularly from Asian manufacturers.

The industrial Internet of Things (IoT) and smart applications market is experiencing substantial growth, attracting significant new investment and thereby intensifying competition for established players like Advantech. This expansion in sectors such as smart manufacturing and intelligent transportation creates fertile ground for both new entrants and existing companies aiming to broaden their market reach. The global industrial IoT market was valued at approximately $247.6 billion in 2023 and is projected to exceed $1.1 trillion by 2030, underscoring the dynamic and growing competitive environment.

Advantech faces significant price pressure, especially for standardized products like industrial PCs and embedded boards. Rivals often employ aggressive pricing strategies to capture market share, forcing Advantech to balance profitability with competitiveness. To counter this, Advantech emphasizes value-added services, customization, and integrated solutions, aiming to justify higher price points through the overall value proposition rather than just hardware. For instance, in 2024, Advantech's R&D investments were crucial for maintaining a technological edge and addressing evolving market needs, a strategy vital in a market where price competition is a major driver.

| Competitive Factor | Advantech's Position | Market Impact | 2024 Data/Trend |

|---|---|---|---|

| Number of Competitors | High | Intense rivalry, price pressure | Continued growth in market entrants |

| Competitor Strategies | Innovation, customization, value-added services | Differentiation is key to market share | Focus on integrated solutions over basic hardware |

| Pricing Power | Moderate to High (for specialized solutions) | Pressure on commoditized products | ASP decline in certain segments of industrial PCs |

| Market Growth | High | Attracts new competitors, opportunities for expansion | Global industrial IoT market projected to exceed $1.1 trillion by 2030 |

SSubstitutes Threaten

General-purpose computing hardware presents a viable threat to Advantech, particularly for less demanding industrial applications. Standard commercial PCs and servers, while lacking the ruggedization and specific certifications of industrial-grade solutions, can be adapted for certain tasks. This offers a lower initial cost, potentially diverting customers who prioritize budget over extreme durability.

The threat of substitutes for Advantech's industrial computing hardware is growing, particularly from cloud-based and software-defined solutions. As more processing power moves to the cloud, the demand for powerful, on-premise industrial PCs might decrease for certain applications.

For instance, the increasing adoption of edge AI services delivered via the cloud means businesses may opt for less specialized hardware at the edge, relying instead on remote processing. This trend necessitates that Advantech continues to innovate by integrating its hardware with cloud platforms and offering hybrid computing models to remain competitive.

Large enterprises with robust R&D capabilities may develop their own specialized hardware or software, acting as a substitute for Advantech's offerings. This in-house development is often driven by unique requirements, security concerns, or the desire to protect intellectual property. For instance, a major automotive manufacturer might develop its own embedded systems for autonomous driving, bypassing external providers.

4

The threat of substitutes for Advantech's industrial IoT solutions is a significant consideration. Alternative connectivity technologies or data acquisition methods that bypass the need for traditional industrial IoT gateways or embedded systems could emerge. For instance, advancements in wireless communication, such as enhanced LoRaWAN or 5G private networks, or even direct sensor-to-cloud connections, might reduce the necessity for intermediary hardware like Advantech's gateways.

These substitutes could offer a more streamlined and potentially cost-effective approach for certain applications, especially those with simpler data requirements or where edge processing is less critical. For example, a smart agriculture sensor directly transmitting data via a cellular network to a cloud platform would bypass the need for a local industrial gateway. This trend is growing as connectivity becomes more ubiquitous and affordable.

Advantech must actively monitor these technological shifts and be prepared to integrate new approaches into its offerings to remain competitive. This could involve developing solutions that leverage direct-to-cloud connectivity or offering gateways with enhanced, more flexible communication capabilities.

- Emerging Connectivity: Direct sensor-to-cloud solutions via advanced cellular or satellite networks pose a threat by eliminating the need for intermediary gateways.

- Wireless Advancements: Enhanced LoRaWAN and other low-power wide-area network (LPWAN) technologies may allow for direct device-to-network communication in certain scenarios.

- Edge Computing Evolution: As edge computing capabilities become more integrated into end devices themselves, the role of a separate industrial gateway could diminish for some applications.

- Cost-Benefit Analysis: For less complex IoT deployments, the total cost of ownership for a direct connection might become more attractive than a gateway-based system.

5

The threat of substitutes for Advantech's industrial computing solutions is generally considered moderate. While direct substitutes offering the same level of industrial-grade reliability and integration are few, the broader trend of accessible computing power presents a nuanced challenge.

The rise of the do-it-yourself (DIY) movement, particularly among smaller businesses and hobbyists, utilizing open-source hardware platforms like Raspberry Pi and Arduino for simpler automation tasks, represents a low-end substitute. These platforms, often costing under $100, can perform basic control and monitoring functions, potentially displacing more complex, and thus more expensive, industrial systems in very niche applications. For instance, a small workshop might use an Arduino to automate a single machine process, bypassing the need for a full Advantech industrial PC.

However, Advantech's core strength lies in its enterprise-grade solutions, which are designed for high reliability, scalability, and seamless integration within complex industrial environments. These solutions are built to withstand harsh conditions, offer advanced processing capabilities, and provide robust security features that DIY alternatives typically lack. For example, Advantech's industrial IoT gateways are crucial for managing vast networks of sensors and devices in sectors like manufacturing and transportation, where system failure is not an option. In 2023, the industrial embedded computing market, a key segment for Advantech, was valued at approximately $6.5 billion, with strong growth projected due to increasing automation and IoT adoption, underscoring the demand for specialized, high-performance solutions.

Key considerations regarding substitutes include:

- Low-end competition: Open-source platforms offer cost-effective alternatives for basic automation, impacting very simple, non-critical applications.

- Performance gap: Advantech's products significantly outperform DIY solutions in terms of durability, processing power, and integration capabilities for demanding industrial use cases.

- Industry focus: Advantech targets sectors requiring high reliability and specialized features, where DIY solutions are generally not viable substitutes.

- Market segmentation: The threat is largely confined to the lower end of the market, leaving Advantech's core, high-value segments relatively protected.

The threat of substitutes for Advantech's industrial computing solutions is moderate, primarily driven by the increasing availability of general-purpose computing hardware and evolving cloud-based services. While standard PCs and servers can be adapted for less demanding tasks, they often lack the ruggedization and certifications crucial for industrial environments. Cloud and software-defined solutions also present a growing challenge, as more processing power shifts to the cloud, potentially reducing the need for on-premise industrial PCs in certain applications.

The DIY movement, utilizing platforms like Raspberry Pi and Arduino, offers a low-end substitute for simpler automation tasks, impacting very niche, non-critical applications. However, Advantech's core strength lies in its enterprise-grade solutions, designed for high reliability, scalability, and integration in complex industrial settings, features typically absent in DIY alternatives. For instance, the industrial embedded computing market, a key segment for Advantech, was valued at approximately $6.5 billion in 2023, demonstrating continued demand for specialized, high-performance solutions.

| Substitute Type | Key Characteristics | Advantech's Counter | Impact on Advantech |

|---|---|---|---|

| General-Purpose Computing | Lower initial cost, adaptable for less demanding tasks. | Industrial-grade ruggedization, certifications, advanced processing, security. | Moderate threat for lower-end applications. |

| Cloud/Software-Defined Solutions | Remote processing, potential reduction in on-premise hardware needs. | Hybrid computing models, integration with cloud platforms. | Growing threat for specific applications, necessitating innovation. |

| DIY Platforms (e.g., Raspberry Pi) | Cost-effective for basic automation, hobbyist use. | High reliability, scalability, seamless integration in complex environments. | Low threat, limited to very simple, non-critical applications. |

Entrants Threaten

The industrial IoT and automation market presents a formidable threat of new entrants due to the immense capital required. Advantech, like its peers, needs substantial investment for cutting-edge R&D, sophisticated manufacturing, and establishing a worldwide distribution system. For instance, developing a new industrial-grade gateway with advanced AI capabilities can easily cost millions in research and development alone.

High upfront costs act as a significant barrier. Creating robust industrial hardware and complex software solutions demands considerable financial outlay before any revenue is generated. This financial hurdle deters many potential competitors from even entering the market, protecting established players like Advantech.

Developing the specialized technical expertise and intellectual property needed for industrial-grade systems presents a significant hurdle for new entrants. This includes acquiring deep knowledge in embedded systems design, industrial protocols, cybersecurity for operational technology, and ruggedized hardware engineering.

Advantech's decades of accumulated expertise in these critical areas create a formidable barrier, giving them a strong competitive advantage. For instance, in 2024, industrial IoT solutions are increasingly complex, demanding highly integrated hardware and software, a space where established players like Advantech have already invested heavily in R&D and talent.

The threat of new entrants for Advantech is moderate, primarily due to the significant barriers to entry in the industrial computing and IoT solutions market. Building trust and strong relationships with industrial customers and system integrators is a lengthy and resource-intensive process. Newcomers struggle to replicate the established credibility and brand reputation that Advantech has cultivated over decades, which is vital in sectors demanding unwavering reliability and long-term support.

Gaining customer confidence, especially for mission-critical applications, is a journey that typically spans years, if not longer. Advantech's extensive history and proven track record provide a substantial advantage, making it difficult for new players to quickly establish a foothold. For instance, in 2024, the average sales cycle for complex industrial automation solutions often exceeded 12 months, highlighting the time investment required to secure key accounts.

Threat of New Entrants 4

The threat of new entrants for Advantech is moderated by the significant hurdles in navigating complex regulatory compliance and industry-specific certifications. Sectors like transportation, healthcare, and energy demand adherence to stringent safety, environmental, and performance standards. New players must commit substantial capital and time to obtain these essential approvals, effectively slowing their market entry and providing Advantech with a competitive buffer.

Advantech’s established position in embedded computing and IoT solutions means new entrants face high upfront costs for research and development, manufacturing infrastructure, and securing necessary certifications. For instance, achieving certifications like ISO 13485 for medical devices or specific automotive standards can take years and millions of dollars. This investment requirement acts as a formidable barrier, protecting Advantech's market share.

- High Capital Investment: New entrants require significant capital for R&D, manufacturing, and obtaining certifications, potentially running into millions of dollars for specialized sectors.

- Regulatory Hurdles: Navigating complex and sector-specific regulations (e.g., FDA, CE marking, automotive safety standards) is time-consuming and costly for new companies.

- Brand Reputation and Trust: Advantech benefits from a strong reputation built over decades, particularly in critical applications where reliability and trust are paramount.

- Economies of Scale: Advantech’s existing production volumes allow for cost efficiencies that new, smaller entrants would struggle to match initially.

Threat of New Entrants 5

New entrants face significant hurdles in replicating Advantech's established supply chain and global sales infrastructure. Access to a well-established and efficient supply chain for industrial components, as well as a robust global sales and support infrastructure, is difficult for new entrants to replicate. Advantech benefits from long-standing relationships with suppliers and a worldwide network of sales offices and service centers.

Building such an extensive operational backbone from scratch is a formidable challenge, requiring substantial capital investment and time to cultivate. For instance, establishing a comparable global footprint in sales and support, akin to Advantech's presence across numerous countries, would necessitate years of development and considerable financial commitment, making it a high barrier to entry.

The threat of new entrants is therefore moderated by these high setup costs and the time required to build comparable operational capabilities. New players would struggle to match Advantech's economies of scale and established market penetration, which are critical for competing effectively in the industrial IoT and embedded systems markets.

- High Capital Requirements: Replicating Advantech's global supply chain and sales network demands massive upfront investment.

- Long-Term Supplier Relationships: Advantech's established ties with component suppliers are hard for newcomers to forge quickly.

- Global Service Network: The cost and complexity of building a worldwide sales and support infrastructure are substantial deterrents.

The threat of new entrants for Advantech is generally considered moderate. While the industrial IoT and automation market is attractive, significant barriers exist. These include substantial capital requirements for R&D and manufacturing, the need for specialized technical expertise, and the lengthy process of building customer trust and regulatory compliance.

For instance, in 2024, the development of advanced industrial AI solutions can cost millions in R&D alone, a cost that deters many potential competitors. Furthermore, Advantech's established reputation for reliability, built over decades, is a crucial differentiator that new entrants struggle to replicate quickly, especially in mission-critical applications where sales cycles can exceed 12 months.

The complexity of regulatory compliance and the need for industry-specific certifications, such as ISO 13485 for medical devices, also present considerable challenges. New entrants must invest heavily in time and resources to obtain these approvals, which Advantech has already achieved, thereby solidifying its market position.

| Barrier Type | Description | Impact on New Entrants | Advantech's Advantage |

| Capital Investment | High costs for R&D, manufacturing, and global distribution. | Significant deterrent; millions needed for advanced solutions. | Established infrastructure and economies of scale. |

| Technical Expertise | Deep knowledge in embedded systems, industrial protocols, and cybersecurity. | Difficult to acquire; requires years of specialized experience. | Decades of accumulated R&D and talent. |

| Brand Reputation & Trust | Customer confidence in reliability and long-term support. | Challenging to build; long sales cycles (e.g., 12+ months in 2024). | Proven track record and established customer relationships. |

| Regulatory Compliance | Adherence to stringent industry standards and certifications. | Time-consuming and costly to obtain necessary approvals. | Existing certifications and expertise in navigating regulations. |

Porter's Five Forces Analysis Data Sources

Our Advantech Porter's Five Forces analysis leverages data from Advantech's official investor relations website, annual reports, and SEC filings. We also incorporate insights from reputable industry research firms and financial news outlets to provide a comprehensive view.