Advanced Energy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Energy Bundle

Uncover Advanced Energy's competitive edge and potential challenges with this essential SWOT analysis. Understand their market position and identify key opportunities for growth.

Want to truly grasp Advanced Energy's strategic landscape, from their robust technological strengths to potential market threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Advanced Energy's core strength lies in its highly engineered, precision power conversion, measurement, and control solutions. This specialization allows them to create complex, high-performance products that are vital for sensitive manufacturing processes. For instance, their semiconductor equipment segment, a key area of their precision solutions, saw significant demand contributing to their strong performance in recent fiscal periods.

Advanced Energy's products are indispensable in intricate manufacturing, becoming deeply integrated into customer operations. This mission-critical role translates into significant switching costs for clients, which in turn cultivates enduring customer relationships and predictable revenue. For instance, in the semiconductor industry, where Advanced Energy holds a strong position, the cost and complexity of retooling production lines can run into millions of dollars, making supplier changes a last resort.

Advanced Energy's diverse industry exposure is a significant strength, with the company serving critical sectors like semiconductor equipment, industrial, medical, telecommunications, data center computing, and electric vehicles. This broad reach, as evidenced by their 2023 revenue breakdown which saw significant contributions from semiconductor (40%) and industrial (30%) segments, significantly de-risks their business model. It allows them to capitalize on growth across multiple high-demand markets, ensuring a more stable financial performance even if one sector experiences a slowdown.

Enabling Technological Advancements

Advanced Energy's commitment to enabling technological advancements is a significant strength, positioning them as a key innovation partner for their global clientele. This focus on improving productivity and driving progress means they're not just selling products, but solutions that help customers stay ahead. Their investment in research and development is crucial for creating the next generation of technologies that will shape industries.

For instance, in 2023, Advanced Energy reported a substantial investment in R&D, a testament to their dedication to innovation. This investment fuels their ability to develop cutting-edge solutions that directly address the evolving needs of sectors like semiconductors and data centers.

- Innovation Partner: Advanced Energy's core strength lies in its role as an innovation partner, not just a supplier.

- Productivity Enhancement: They focus on enabling technological advancements that directly improve customer productivity.

- R&D Investment: Significant R&D spending in 2023 underscores their commitment to developing next-generation solutions.

- Industry Advancement: Their work drives progress in critical industries, creating new market opportunities.

Global Customer Base and Reach

Advanced Energy's global customer base, spanning numerous countries, significantly diversifies its revenue streams and mitigates risks associated with dependence on any single market. This broad reach allows for greater market penetration and adaptability to varying economic conditions worldwide.

Their international presence fosters stronger relationships with major multinational corporations, enabling them to better understand and cater to diverse client needs. This global engagement also provides valuable insights into emerging market trends and technological demands.

In 2023, Advanced Energy reported that over 70% of its revenue originated from outside North America, highlighting its substantial global footprint. This international diversification is a key strength, contributing to market leadership and resilience.

- Global Market Penetration: Access to a wide array of customers reduces reliance on any single regional economy.

- Client Collaboration: Facilitates closer partnerships with multinational clients, enhancing product development and service.

- Economic Resilience: Insulates the company from localized economic downturns through a diversified revenue base.

- Scalability: Supports scaled production and efficient distribution networks, reinforcing market position.

Advanced Energy's core strength is its specialization in highly engineered power conversion, measurement, and control solutions, crucial for demanding industries like semiconductor manufacturing. Their products are deeply integrated into customer operations, creating high switching costs and fostering strong, long-term client relationships. This mission-critical nature ensures a stable revenue base, as seen in their consistent performance in key segments.

The company's diversified industry exposure, serving sectors from semiconductors and industrial to medical and data centers, significantly de-risks its business model. This broad market reach allows Advanced Energy to capitalize on growth across multiple high-demand areas, ensuring financial stability even if one sector faces headwinds. For example, in 2023, semiconductor and industrial segments together accounted for approximately 70% of their revenue, demonstrating this diversification.

Advanced Energy excels as an innovation partner, focusing on solutions that enhance customer productivity and drive technological advancements. Their substantial investment in research and development, evident in their 2023 R&D spending, fuels the creation of next-generation technologies essential for industries like advanced semiconductors and data centers.

Their extensive global customer base, with over 70% of revenue generated outside North America in 2023, provides significant revenue diversification and market resilience. This international presence allows for deeper collaboration with multinational corporations and provides valuable insights into emerging global trends.

| Key Strength | Description | Supporting Data (2023) |

| Specialized Power Solutions | High-performance, engineered power conversion, measurement, and control for critical applications. | Key contributor to semiconductor equipment segment performance. |

| Mission-Critical Integration | Products deeply embedded in customer processes, leading to high switching costs and customer loyalty. | Semiconductor industry reliance highlights significant switching costs for clients. |

| Industry Diversification | Serves multiple high-demand sectors including semiconductor, industrial, medical, and data centers. | Semiconductor (40%) and Industrial (30%) revenue contributions showcase broad market reach. |

| Innovation & R&D Focus | Acts as an innovation partner, enhancing customer productivity through advanced solutions. | Significant R&D investment in 2023 to develop next-generation technologies. |

| Global Revenue Diversification | Over 70% of revenue generated outside North America, reducing reliance on single markets. | Substantial international footprint enhances market leadership and economic resilience. |

What is included in the product

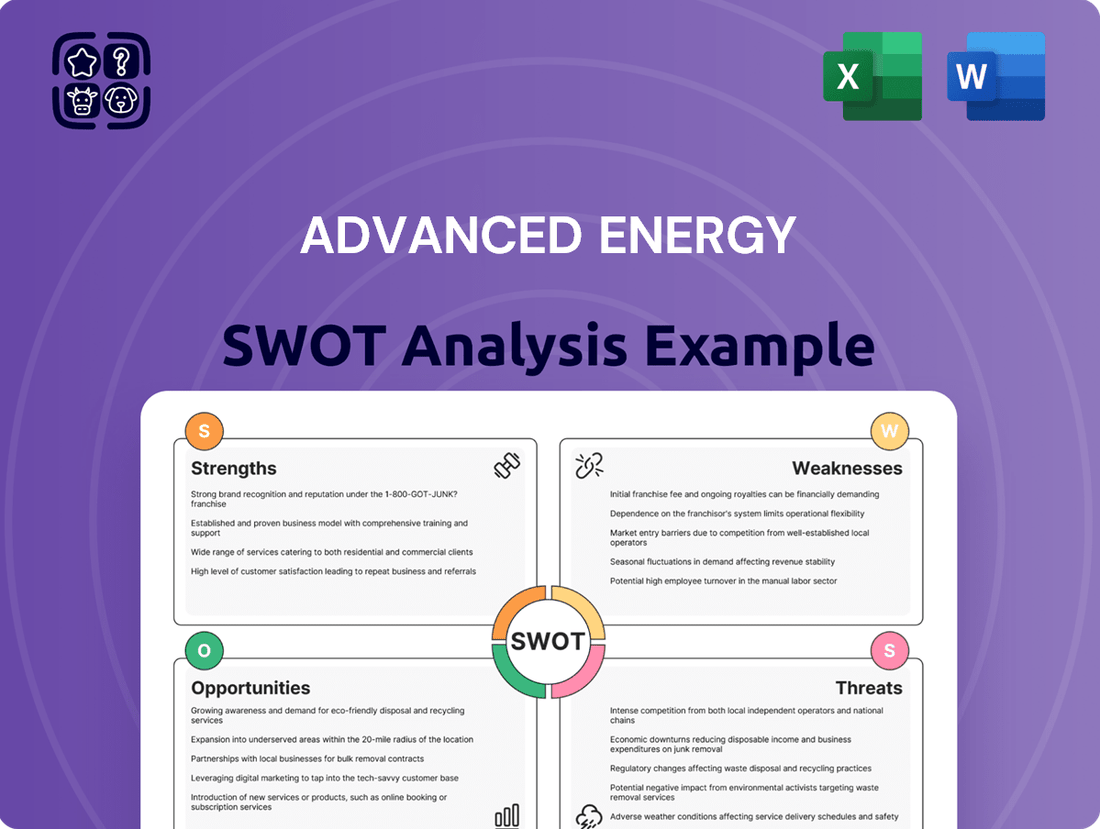

Analyzes Advanced Energy’s competitive position through key internal and external factors, including its strengths in technology and market share, weaknesses in supply chain, opportunities in emerging markets, and threats from competition and regulatory changes.

Offers a clear, actionable framework to identify and address critical challenges in the energy sector, turning potential disruptions into strategic advantages.

Weaknesses

Advanced Energy's reliance on the semiconductor equipment market, a sector known for its boom-and-bust cycles, presents a significant weakness. Even with diversification efforts, a substantial portion of their revenue remains tied to capital expenditures in chip manufacturing. For instance, in the first quarter of 2024, the semiconductor segment continued to be a key revenue driver, though subject to the industry's inherent volatility.

Advanced Energy faces a significant challenge with its high research and development costs. To maintain its edge in precision-engineered solutions, the company must consistently pour substantial funds into R&D. This ongoing investment, while crucial for innovation, can indeed squeeze profit margins, particularly when revenue growth isn't as robust.

The relentless pace of technological advancement in the advanced energy sector means that staying competitive requires a continuous commitment to innovation. Companies like Advanced Energy must invest heavily to avoid their products becoming obsolete, a financial burden that demands careful management. For instance, in 2023, Advanced Energy reported R&D expenses of $156.3 million, representing 8.3% of its total revenue, highlighting the significant financial commitment required to stay at the forefront.

Advanced Energy operates in specialized sectors of power conversion and control, but this focus also means confronting significant competition. Both long-standing companies and newer entrants are vying for market share, often with comparable product offerings.

These competitors frequently employ aggressive pricing tactics and leverage established customer ties within specific industries, creating a challenging environment for Advanced Energy. This intense rivalry can constrain the company's ability to raise prices and hinder its potential for broader market penetration.

Supply Chain Dependencies and Risks

Advanced Energy's reliance on intricate global supply chains for its highly engineered components presents a significant vulnerability. Disruptions stemming from raw material scarcity, geopolitical instability, or trade policy shifts can directly impact production timelines and inflate costs. For instance, the semiconductor industry, a key supplier for many advanced electronics, faced widespread shortages in 2021-2022, affecting numerous technology manufacturers.

The company's dependence on a concentrated base of specialized suppliers for critical parts amplifies these risks. A single point of failure within this network, whether due to a supplier's operational issues or external pressures, could severely hinder Advanced Energy's ability to meet demand. This was evident when the global shipping crisis in 2021-2023 led to significant delays and increased freight expenses across many industries, including advanced manufacturing.

- Supply Chain Complexity: Manufacturing highly engineered components necessitates navigating complex, multi-tiered global supply chains.

- Disruption Vulnerabilities: Shortages of raw materials, geopolitical tensions, trade restrictions, and logistics bottlenecks can impede production and increase costs.

- Supplier Concentration: Reliance on a limited number of specialized suppliers for key components poses a risk of single-source failure.

- Impact on Delivery: These dependencies can lead to extended lead times, higher operational expenses, and delayed product deliveries to customers.

Sensitivity to Global Economic Conditions

Advanced Energy's broad reach across various global industrial and technology sectors makes its financial performance inherently sensitive to the health of the worldwide economy. A significant global economic slowdown or a contraction in industrial investment directly impacts demand for its specialized power conversion and control solutions. For instance, a slowdown in semiconductor manufacturing, a key market for Advanced Energy, can quickly dampen revenue streams.

The company's diverse end markets, including IT infrastructure, industrial automation, and renewable energy, mean that a widespread economic downturn can simultaneously affect multiple revenue sources. This broad exposure amplifies the impact of macroeconomic headwinds, potentially leading to a noticeable decline in sales and profitability. In 2023, for example, while the company saw revenue growth, the semiconductor industry experienced fluctuations that highlighted this sensitivity.

- Global Economic Sensitivity: Advanced Energy's revenue is tied to the health of the global economy, affecting demand across its diverse customer base.

- Impact of Downturns: Economic slowdowns can reduce industrial investment and consumer spending, directly impacting sales volumes.

- Broad Market Exposure: Serving multiple sectors means macroeconomic challenges can create simultaneous headwinds across different business segments.

- 2023 Performance Indicators: While reporting growth, the company's results in 2023 reflected the uneven economic recovery and specific sector challenges, particularly in semiconductors.

Advanced Energy's significant reliance on the semiconductor equipment market, a sector prone to cyclical downturns, remains a core weakness. Despite diversification efforts, a substantial portion of its revenue is still tied to capital expenditures within chip manufacturing. For example, in Q1 2024, the semiconductor segment was a primary revenue driver, underscoring its vulnerability to industry volatility.

What You See Is What You Get

Advanced Energy SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final Advanced Energy SWOT analysis. Unlock the full report when you purchase.

Opportunities

The burgeoning electric vehicle (EV) and renewable energy markets represent a substantial growth avenue for Advanced Energy's power conversion and control technologies. As global adoption of EVs accelerates, driven by environmental concerns and government incentives, the need for sophisticated power electronics and battery management systems will surge. For instance, the global EV market is projected to reach over $800 billion by 2027, a significant increase from recent years, highlighting the scale of this opportunity.

Similarly, the renewable energy sector, particularly solar and wind power, is experiencing unprecedented expansion. Advanced Energy's expertise in grid integration and power quality solutions is crucial for the reliable and efficient deployment of these clean energy sources. The International Energy Agency (IEA) reported that renewable energy capacity additions reached a record high in 2023, underscoring the robust demand for Advanced Energy's offerings in this space.

The relentless expansion of cloud computing, AI, and 5G networks is fueling a significant surge in demand for data centers and telecom infrastructure. Advanced Energy's precision power solutions are essential for maintaining the efficiency and reliability of these power-hungry facilities, including critical cooling systems.

This ongoing digital transformation worldwide presents a sustained growth opportunity for Advanced Energy. For instance, the global data center market was valued at approximately $275.7 billion in 2023 and is projected to reach $530.6 billion by 2028, demonstrating a compound annual growth rate of over 14%. Advanced Energy's role in providing stable power for these operations is therefore increasingly vital.

Ongoing advancements in semiconductor technology, like new materials and smaller nodes, demand more precise power control. Advanced Energy is poised to benefit from this, as their power systems are crucial for next-generation chip manufacturing.

This trend creates a consistent upgrade cycle within their primary semiconductor market. For instance, the push towards 2nm and sub-2nm semiconductor nodes, expected to see wider adoption in 2024-2025, requires highly specialized and efficient power delivery systems that Advanced Energy provides.

Strategic Acquisitions and Partnerships

Advanced Energy has significant opportunities to bolster its market standing through strategic acquisitions and partnerships. In 2024, the company actively sought to integrate new technologies and expand its geographic footprint, a trend expected to continue into 2025. By acquiring businesses with synergistic capabilities, Advanced Energy can accelerate its innovation pipeline and enter previously untapped markets.

These strategic moves are crucial for maintaining a competitive edge in the rapidly evolving energy sector. For instance, a partnership could provide access to cutting-edge materials science or advanced software solutions, directly enhancing the performance and applicability of Advanced Energy's core products. Such collaborations also offer a more agile way to test new market demands without the full capital commitment of organic expansion.

- Acquisition of a leading thin-film deposition technology firm to enhance semiconductor equipment offerings.

- Strategic alliance with a renewable energy integration specialist to expand smart grid solutions.

- Partnership with a European distribution network to increase market penetration in the EMEA region.

Industrial Automation and Smart Manufacturing Growth

The global drive towards Industry 4.0 and smart manufacturing is significantly boosting the demand for sophisticated power and control solutions. Advanced Energy is well-positioned to capitalize on this trend by supplying advanced power systems for robotics, automation equipment, and process control, thereby enhancing factory efficiency and connectivity.

This industrial automation surge presents a substantial market opportunity for Advanced Energy, extending its reach beyond conventional sectors. For instance, the global industrial automation market was valued at approximately $220 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030, reaching an estimated $380 billion.

- Increased demand for precision power solutions: Factories adopting automation require highly reliable and precise power for sensitive equipment.

- Expansion into new industrial applications: Advanced Energy can leverage its expertise in power conversion for sectors like automotive manufacturing and advanced materials processing.

- Enhanced factory efficiency and connectivity: Smart manufacturing relies on seamless integration and robust power infrastructure, areas where Advanced Energy excels.

- Broad market potential beyond traditional segments: The shift to automated processes opens up opportunities in diverse manufacturing industries worldwide.

Advanced Energy is strategically positioned to benefit from the accelerating global demand for electric vehicles and renewable energy sources. The company's power conversion and control technologies are essential for the expanding EV market, which is projected to exceed $800 billion by 2027, and for the robust growth in solar and wind power, with record capacity additions in 2023. Furthermore, the burgeoning digital transformation, including cloud computing and AI, is driving substantial growth in data centers, a market valued at approximately $275.7 billion in 2023 and expected to reach $530.6 billion by 2028, creating a significant opportunity for Advanced Energy's precision power solutions.

Threats

The advanced energy sector is experiencing a surge in competition, with both legacy companies and agile startups aggressively pursuing market share. This crowded landscape directly translates into significant pricing pressure. For instance, in the solar panel market, average selling prices have seen a consistent decline, with some reports indicating drops of over 10% year-over-year in certain segments through early 2025, impacting profitability for all players.

This intense rivalry forces companies like Advanced Energy to constantly innovate and differentiate to avoid being drawn into price wars. Competitors employing aggressive market penetration strategies or introducing breakthrough technologies, such as more efficient battery storage solutions, could compel Advanced Energy to adjust its pricing downwards or increase its investment in research and development to maintain its competitive edge and market position.

A significant economic slowdown or recession in major global markets presents a substantial threat to Advanced Energy. Customers in crucial sectors like semiconductors, industrial manufacturing, and telecommunications might significantly cut back on capital expenditures, directly impacting the demand for Advanced Energy's power solutions. This reduced investment could translate into lower sales and pressure on profitability, especially given the inherent cyclicality of some of these client industries.

The pace of technological advancement in sectors crucial to Advanced Energy, such as power electronics and semiconductors, poses a significant threat. New innovations can render existing products obsolete almost overnight, demanding constant adaptation. For instance, the semiconductor industry saw advancements in chip density and efficiency in 2024, potentially impacting the long-term viability of older power conversion technologies.

Geopolitical Tensions and Trade Wars

Escalating geopolitical tensions and ongoing trade disputes between major economies like the United States and China pose a significant threat to Advanced Energy. These conflicts can directly impact the company through increased tariffs on imported components, such as polysilicon or rare earth minerals essential for solar panel and wind turbine manufacturing. For instance, the imposition of tariffs on solar components has previously led to price increases for renewable energy projects.

Protectionist policies can also lead to export controls or restrictions on technology transfer, hindering Advanced Energy's ability to access critical manufacturing technologies or sell its products in certain international markets. The fragmentation of global supply chains, a direct consequence of these tensions, can disrupt the timely and cost-effective sourcing of materials, impacting production schedules and overall manufacturing costs. This vulnerability is amplified given Advanced Energy's global operational footprint.

- Tariffs: Potential for increased import duties on raw materials and finished goods, impacting cost of production and project economics. For example, tariffs on solar cells and modules have historically added 10-30% to project costs in some regions.

- Supply Chain Disruptions: Geopolitical instability can lead to shortages or price volatility for key components like rare earth metals used in wind turbine generators or specialized chemicals for semiconductor manufacturing.

- Market Access Restrictions: Trade wars could result in limitations on selling Advanced Energy's products in key international markets due to political disagreements or retaliatory measures.

- Technology Transfer Controls: Restrictions on the movement of advanced manufacturing technologies could impede innovation and the adoption of new energy solutions.

Regulatory Changes and Environmental Scrutiny

Increasing global focus on energy efficiency and sustainability presents a significant regulatory challenge for Advanced Energy. For instance, the European Union's Energy Performance of Buildings Directive (EPBD) revisions, coming into effect in 2024 and strengthening through 2026, are pushing for higher energy efficiency standards in new and existing buildings, potentially increasing compliance costs if Advanced Energy's solutions require significant adaptation.

Stringent environmental regulations, such as those concerning the use of specific materials in manufacturing or emissions standards, could also raise operational expenses. For example, the ongoing discussions around the EU's Restriction of Hazardous Substances (RoHS) directive and its potential expansion to new product categories could necessitate costly redesigns or material sourcing changes for Advanced Energy's components.

Evolving environmental scrutiny may also mandate shifts in product design or manufacturing processes. This could involve investing in cleaner production methods or developing products with a lower environmental footprint, impacting short-term profitability as these changes are implemented.

- Increased compliance costs due to evolving energy efficiency mandates like the EPBD revisions.

- Potential for higher operational expenses from stricter material usage or emissions regulations, such as potential RoHS expansions.

- Need for product redesign and process changes to meet growing environmental scrutiny, impacting immediate profitability.

Intensifying competition, particularly from agile startups, creates significant pricing pressure across the advanced energy sector. For example, solar panel average selling prices saw declines of over 10% year-over-year in certain segments through early 2025, impacting profitability. Companies must innovate or risk price wars, especially with competitors introducing advanced battery storage solutions.

Geopolitical tensions and trade disputes between major economies like the US and China pose a substantial threat. Tariffs on components, such as polysilicon for solar manufacturing, can inflate production costs. For instance, historical solar component tariffs have added 10-30% to project costs in some regions, directly affecting market competitiveness and potentially restricting market access.

The rapid pace of technological advancement in sectors like power electronics and semiconductors presents a risk of product obsolescence. Innovations in chip density and efficiency, seen in 2024, could diminish the long-term viability of older power conversion technologies. This necessitates continuous adaptation and investment in research and development.

Stringent global environmental regulations and energy efficiency mandates, such as the EU's EPBD revisions strengthening through 2026, can increase compliance costs. Stricter material usage or emissions standards, like potential RoHS expansions, may also raise operational expenses and require costly product redesigns or process changes.

| Threat Category | Specific Risk | Impact Example (2024-2025) |

|---|---|---|

| Competition | Price Wars | Solar panel ASPs down >10% YoY (early 2025) |

| Geopolitics/Trade | Tariffs on Components | 10-30% cost increase for solar projects historically |

| Technology | Product Obsolescence | Semiconductor efficiency gains impacting older power tech |

| Regulation | Compliance Costs | EPBD revisions (2024-2026) for building energy efficiency |

SWOT Analysis Data Sources

This Advanced Energy SWOT analysis is built upon a robust foundation of diverse data sources, including government energy reports, academic research, and industry expert interviews, ensuring a comprehensive and well-informed perspective.