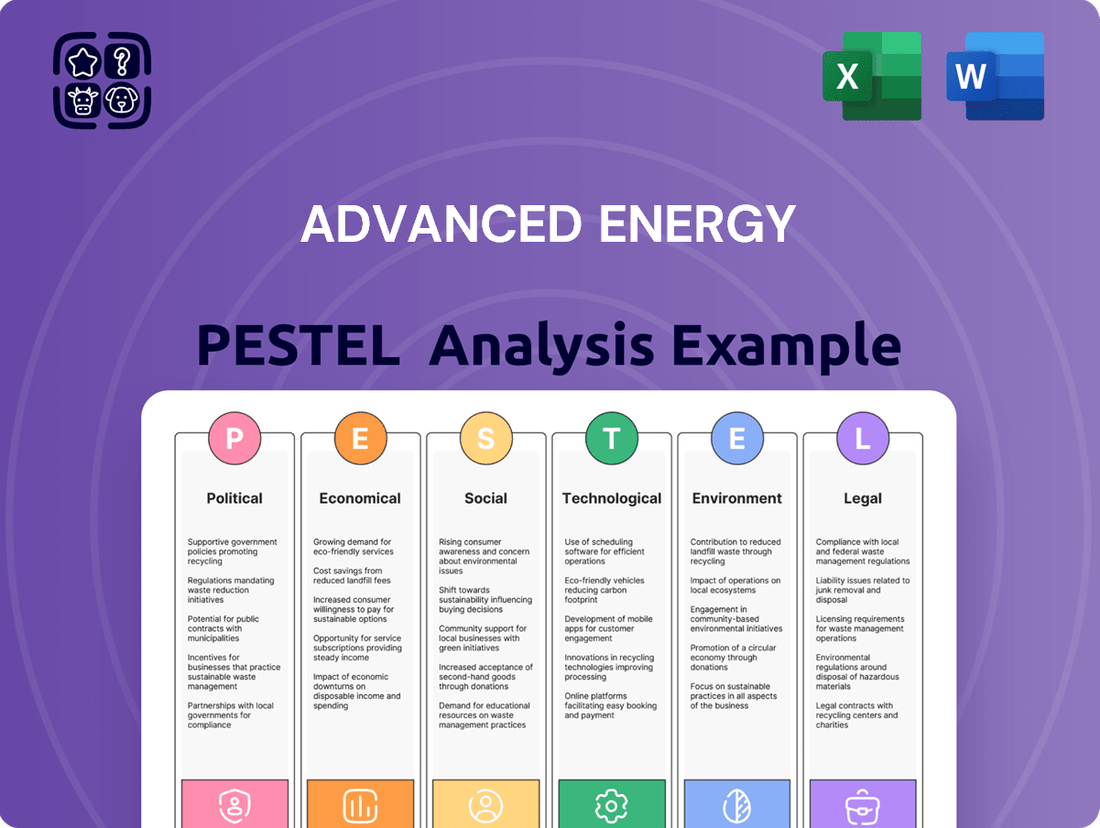

Advanced Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Energy Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Advanced Energy's trajectory. This comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now for actionable insights to drive your business forward.

Political factors

Geopolitical trade tensions are a significant concern for Advanced Energy. Global trade policies, including tariffs and export controls, directly affect the company's ability to source components and access international markets. For instance, in 2023, ongoing trade disputes between the US and China led to increased uncertainty in the semiconductor supply chain, a critical area for Advanced Energy's product development and sales.

Escalating political friction between major economic powers can result in restrictions on technology transfer and higher costs for essential parts. This can impact Advanced Energy's profitability and its standing in the competitive landscape. The semiconductor sector, a vital market for the company, is particularly susceptible to these political shifts, as evidenced by the export control measures implemented in late 2023 impacting advanced chip manufacturing equipment.

Government initiatives like the US CHIPS Act, coupled with similar programs in Europe and Asia, are channeling substantial financial backing into semiconductor manufacturing and advanced technology. These incentives are designed to spur investment in new fabrication facilities and research, directly benefiting companies like Advanced Energy by increasing demand for their precision power solutions and fostering new market avenues.

For instance, the CHIPS and Science Act of 2022 authorized over $280 billion in funding, with a significant portion dedicated to boosting domestic semiconductor research, development, and manufacturing. This influx of capital is expected to drive substantial growth in the sector, creating a more robust and resilient supply chain for critical technologies.

Changes in political leadership or shifts in industrial policy can introduce uncertainty regarding future regulations affecting Advanced Energy's diverse customer base. For instance, the US Inflation Reduction Act of 2022, while generally supportive of clean energy, has seen ongoing discussions and potential adjustments to its implementation, impacting project financing and deployment timelines.

Stable and predictable regulatory environments are crucial for long-term investment and planning. Conversely, abrupt policy changes, such as unexpected tariffs or changes in renewable energy tax credits, could necessitate costly adaptations to product designs or manufacturing processes, particularly for companies serving sectors like electric vehicles where policy incentives play a significant role in market demand.

International Relations and Market Access

The strength of diplomatic ties and international cooperation directly impacts Advanced Energy's global operational capabilities and expansion potential. Strong alliances can unlock new markets and simplify cross-border activities, boosting revenue. For instance, in 2024, the US and EU continued to strengthen energy security partnerships, potentially benefiting companies like Advanced Energy involved in critical supply chains.

Conversely, strained international relations can create significant hurdles. These can manifest as restricted market access, heightened operational risks, and even the threat of boycotts, all of which could negatively affect Advanced Energy's worldwide revenue streams. Geopolitical tensions in regions vital for raw material sourcing or market entry, such as those observed in parts of Asia in late 2024, highlight these risks.

- Favorable Diplomatic Ties: Facilitate market entry and operational ease, as seen in the continued collaboration between North American and European clean energy initiatives throughout 2024.

- Trade Agreements: Successful negotiation of international trade agreements, like potential updates to existing frameworks in 2025, can reduce tariffs and streamline logistics for Advanced Energy's products.

- Geopolitical Instability: Disruptions due to regional conflicts or political disputes can lead to supply chain interruptions and increased costs, impacting market access and profitability.

- Sanctions and Embargoes: Imposed sanctions on specific countries can directly prohibit Advanced Energy from operating or selling its technologies in those markets, as has been seen in various global contexts.

Political Instability in Key Regions

Political instability in regions crucial for Advanced Energy's operations or material sourcing presents significant challenges. Conflicts or social unrest can directly impact supply chains, hindering manufacturing processes and potentially reducing customer demand. For instance, geopolitical tensions in Eastern Europe, a key region for certain rare earth mineral extraction, could lead to price volatility and supply disruptions throughout 2024 and into 2025.

To counter these risks, Advanced Energy must prioritize business continuity planning and explore diversification of its operational footprint and sourcing strategies. This proactive approach is essential for safeguarding the company's global presence against the unpredictable nature of volatile political landscapes. By spreading operations and suppliers across multiple regions, the company can buffer against localized disruptions.

- Supply Chain Vulnerability: Regions experiencing political instability, such as parts of Africa and Asia where critical battery materials are sourced, could see disruptions affecting the availability and cost of inputs for Advanced Energy's products.

- Operational Disruptions: If Advanced Energy has manufacturing facilities in politically unstable areas, operations could be halted due to civil unrest or government policy changes, impacting production targets.

- Demand Fluctuations: Economic uncertainty stemming from political instability can lead to reduced consumer spending on energy solutions, directly affecting Advanced Energy's sales forecasts.

- Geopolitical Risk Mitigation: Countries like Germany, with a stable political climate and strong manufacturing base, offer a more secure environment for Advanced Energy's European operations, reducing exposure to geopolitical shocks.

Government policies and international relations significantly shape the landscape for Advanced Energy. Trade agreements, such as the USMCA, can streamline cross-border operations, while geopolitical tensions, exemplified by the ongoing semiconductor export controls enacted in late 2023, create supply chain vulnerabilities. Initiatives like the 2022 CHIPS Act, with over $280 billion in funding, are stimulating domestic manufacturing and R&D, directly benefiting companies like Advanced Energy by increasing demand for their specialized power solutions.

Political stability is paramount for operational continuity and market access. For instance, the continued collaboration between North American and European clean energy initiatives in 2024 highlights the positive impact of favorable diplomatic ties. Conversely, instability in regions critical for raw material sourcing, like parts of Asia in late 2024, poses risks of price volatility and supply disruptions.

Regulatory shifts, such as potential adjustments to the US Inflation Reduction Act of 2022, can influence project financing and deployment timelines for clean energy technologies. Stable regulatory environments are crucial for long-term investment, as abrupt policy changes, like unexpected tariffs, can necessitate costly adaptations to product designs and manufacturing processes.

The political climate directly influences investment in advanced energy sectors. For example, government incentives and subsidies, like those seen in the 2024 European Green Deal initiatives, are driving significant growth. However, political instability in key sourcing regions, such as potential disruptions in critical battery material extraction in parts of Africa and Asia throughout 2024-2025, can lead to price volatility and supply chain interruptions.

| Political Factor | Impact on Advanced Energy | Example/Data Point (2023-2025) |

|---|---|---|

| Government Incentives | Boosts demand and investment in clean energy technologies. | US CHIPS Act (2022) authorized over $280 billion to bolster semiconductor manufacturing and R&D. |

| Geopolitical Tensions | Creates supply chain risks and market access challenges. | Late 2023 semiconductor export controls impacted critical component sourcing. |

| Trade Agreements | Facilitates international trade and reduces costs. | Ongoing discussions for potential updates to global trade frameworks in 2025. |

| Political Stability | Ensures operational continuity and predictable market conditions. | Continued North American-European clean energy collaboration in 2024. |

What is included in the product

This Advanced Energy PESTLE analysis dissects the influence of macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying emerging threats and opportunities within the sector.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors digestible for strategic decision-making.

Economic factors

Global economic growth significantly impacts Advanced Energy's customer spending. For instance, the IMF projected 3.2% global growth in 2024, a slight slowdown from 2023, which directly affects capital expenditure in sectors like semiconductors and data centers. A strong economy encourages these industries to invest in new facilities and upgrades, boosting demand for Advanced Energy's power management solutions.

Conversely, recessionary fears can lead to cautious spending. If economic growth falters, or a recession materializes, customers may postpone or reduce their capital investments. This directly translates to lower order volumes for Advanced Energy, potentially pressuring revenue streams as seen during periods of economic contraction in the past.

Advanced Energy's revenue is heavily influenced by the boom-and-bust cycles prevalent in the semiconductor industry. For instance, in 2023, the semiconductor market experienced a downturn, with global chip sales declining by approximately 10% compared to 2022, impacting demand for Advanced Energy's specialized power solutions.

The company's performance often mirrors the capital expenditure cycles of its major customers in sectors like semiconductors, solar, and data centers. When these industries invest heavily in new capacity, Advanced Energy sees a corresponding surge in orders. Conversely, periods of reduced capital spending, such as the anticipated slowdown in semiconductor equipment orders in late 2024 and early 2025, can lead to softened demand.

Strategic planning for Advanced Energy involves closely monitoring indicators like wafer fab equipment orders and capacity utilization rates. For example, a projected 5% to 10% decrease in capital expenditures by major semiconductor manufacturers for 2025 necessitates careful inventory management and a focus on diversified market segments to mitigate the impact of these industry-specific cycles.

Rising inflation presents a significant challenge for Advanced Energy, as seen in the U.S. Consumer Price Index (CPI) which averaged 4.1% in 2023 and is projected to be around 2.9% in 2024, impacting the cost of essential inputs like polysilicon and metals. This upward pressure on raw materials and labor can compress profit margins if the company cannot fully absorb or pass these increased expenses onto its customer base.

Furthermore, fluctuating interest rates, with the Federal Reserve holding its benchmark rate steady in early 2024 after a series of hikes, directly affect borrowing costs. For Advanced Energy, this means higher expenses for any debt financing needed for expansion or R&D. Similarly, customers, particularly those in sectors like solar or semiconductor manufacturing, may face increased financing costs for their own capital expenditures, potentially slowing demand for Advanced Energy's sophisticated equipment and solutions.

Currency Exchange Rate Volatility

Currency exchange rate volatility significantly impacts Advanced Energy's global operations. Fluctuations in foreign exchange markets can alter the reported value of international sales and the cost of raw materials or components sourced from abroad. For instance, if the US dollar strengthens against other major currencies, Advanced Energy's products may become more expensive for overseas customers, potentially dampening demand and affecting revenue.

Conversely, a weaker US dollar could make the company's offerings more attractive internationally, boosting sales volume. This dynamic directly influences Advanced Energy's profitability and competitive positioning in key markets.

- Impact on Revenue: A stronger USD relative to the Euro or Yen can decrease the USD-equivalent revenue from sales in those regions.

- Cost of Goods Sold: Conversely, if Advanced Energy sources components from countries with weaker currencies, a stronger USD could lower its cost of goods sold.

- Hedging Strategies: Companies like Advanced Energy often employ financial instruments such as forward contracts or options to mitigate currency risk, aiming to stabilize earnings against exchange rate swings.

- 2024/2025 Outlook: Analysts anticipate continued volatility in major currency pairs, driven by differing monetary policies and geopolitical events, necessitating ongoing vigilance from Advanced Energy's finance teams.

Supply Chain Costs and Availability

Supply chain costs and availability are critical for Advanced Energy. Fluctuations in energy prices, such as the average industrial electricity price in the US, which saw an increase in early 2024 compared to the previous year, directly influence manufacturing expenses. Similarly, rising logistics costs, exemplified by the increasing cost of ocean freight in late 2023 and early 2024, add to the overall cost of bringing components and finished goods to market.

The availability of essential raw materials, like polysilicon for solar components or rare earth metals for wind turbines, can create bottlenecks. Geopolitical events or increased global demand can lead to shortages and price spikes. For instance, disruptions in key mining regions or trade disputes can significantly impact the supply and cost of these critical inputs, potentially delaying production schedules and increasing operational expenses for Advanced Energy.

- Energy Price Volatility: Industrial electricity prices in the US averaged approximately 7.4 cents per kilowatt-hour in early 2024, a slight uptick from the previous year, impacting energy-intensive manufacturing processes.

- Logistics Cost Increases: Global shipping rates, particularly for containerized cargo, experienced a notable resurgence in late 2023 and early 2024, raising transportation expenses for imported components and exported products.

- Raw Material Scarcity: The supply of critical minerals like lithium and cobalt, essential for battery technologies, faced increased demand and potential supply constraints due to geopolitical factors and expanding EV production in 2024.

Economic growth directly fuels customer spending for Advanced Energy, particularly in capital-intensive sectors like semiconductors and data centers. The IMF projected 3.2% global growth for 2024, a figure that influences the investment decisions of these key industries.

Conversely, economic slowdowns or recessions can lead to postponed investments, impacting Advanced Energy's order volumes. The semiconductor market's 2023 downturn, with an approximate 10% drop in global chip sales, illustrates this sensitivity.

Inflationary pressures, with U.S. CPI averaging 4.1% in 2023 and projected around 2.9% for 2024, increase raw material and labor costs, potentially squeezing profit margins.

Interest rate changes also affect Advanced Energy and its customers. Steady benchmark rates in early 2024, following prior hikes, influence borrowing costs for expansion and customer capital projects.

| Economic Factor | 2023 Data/Trend | 2024 Projection/Trend | Impact on Advanced Energy |

| Global GDP Growth | Slightly above 3% | Projected 3.2% | Influences customer capital expenditure. |

| Semiconductor Market | ~10% sales decline | Anticipated slowdown in CapEx | Directly impacts demand for power solutions. |

| U.S. Inflation (CPI) | Averaged 4.1% | Projected ~2.9% | Increases raw material and labor costs. |

| Interest Rates (US Fed) | Series of hikes, then held steady | Held steady early 2024 | Affects borrowing costs for company and customers. |

Preview Before You Purchase

Advanced Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Advanced Energy PESTLE Analysis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the advanced energy sector. You'll gain actionable insights to inform your strategic decisions.

Sociological factors

Advanced Energy's success hinges on a readily available and skilled workforce, especially those with expertise in power electronics, precision manufacturing, and advanced materials. The demand for these specialized roles is high, with projections indicating continued growth in the advanced manufacturing sector through 2025.

A significant skills gap, particularly in regions with a high concentration of advanced energy manufacturing, poses a challenge. For instance, the U.S. Bureau of Labor Statistics reported in late 2024 that demand for electrical and electronics engineers outpaced the supply of qualified candidates in several key industrial hubs.

This scarcity can drive up labor costs and complicate recruitment efforts, potentially hindering Advanced Energy's capacity to scale production and accelerate the development of its innovative technologies.

Consumer appetite for sophisticated technologies like electric vehicles (EVs) and smart home devices is a significant driver for advanced energy solutions. For instance, the global EV market was projected to reach over $800 billion by 2024, showcasing a massive demand for the power components Advanced Energy provides. This widespread adoption directly translates into increased need for reliable power infrastructure and manufacturing equipment, creating a robust market for the company's offerings.

Societal awareness around sustainability is a powerful driver for Advanced Energy. Consumers and businesses alike are increasingly demanding products and services that minimize environmental impact and maximize energy efficiency. This trend is directly influencing how companies like Advanced Energy approach their product development and even their manufacturing processes.

Advanced Energy is well-positioned to leverage this shift. By offering solutions that demonstrably reduce energy consumption, such as their advanced power supplies for data centers which can improve energy efficiency by up to 10% compared to older models, the company appeals to a growing customer base that prioritizes eco-friendly operations. This focus not only meets market demand but also significantly bolsters the company's brand reputation as a responsible and forward-thinking organization.

Demographic Shifts and Urbanization

Global demographic trends, like the aging population and increasing urbanization, significantly influence energy demand. For instance, as populations grow and concentrate in cities, the need for reliable and advanced energy infrastructure, from smart grids to distributed generation, escalates. This creates direct opportunities for Advanced Energy's solutions in areas like data centers and industrial automation, which are critical for supporting urban living and technological advancements.

Understanding these demographic shifts is crucial for identifying new market opportunities. By 2050, the United Nations projects that 68% of the world's population will live in urban areas, up from 55% in 2018. This massive migration necessitates robust energy systems that can handle increased load and integrate renewable sources, areas where Advanced Energy's expertise is vital. The company can strategically position its offerings to cater to the evolving needs of these growing urban centers and the industries that support them.

- Aging Population: Increased demand for healthcare technologies and services, often energy-intensive, requiring stable power solutions.

- Urbanization: A projected 68% global urban population by 2050, driving demand for smart city infrastructure and efficient energy management.

- Emerging Markets: Rapid population growth in developing nations presents opportunities for scaled energy solutions and technological adoption.

- Workforce Evolution: Shifts towards remote work and digital economies boost demand for reliable data center power and connectivity, benefiting Advanced Energy's product lines.

Health and Safety Standards and Expectations

Societal expectations for workplace health and safety are increasingly stringent, particularly in advanced manufacturing sectors like those Advanced Energy operates in. As of late 2024, there's a heightened focus on proactive risk management and employee well-being, influencing operational costs and compliance strategies. Many companies are investing more in safety training and equipment to meet these evolving standards.

Adherence to robust safety protocols is paramount for Advanced Energy, not just for legal compliance but also for maintaining its reputation and attracting top talent. A strong safety culture directly impacts employee morale and productivity, and conversely, incidents can lead to significant financial penalties and reputational damage. For instance, the U.S. Bureau of Labor Statistics reported that workplace injuries and illnesses cost businesses billions annually, highlighting the financial implications of safety lapses.

- Increased investment in safety technology: Expect higher spending on advanced monitoring systems and automated safety features in manufacturing facilities.

- Emphasis on mental health support: Societal pressure is pushing companies to include mental well-being programs alongside physical safety initiatives.

- Stricter regulatory enforcement: Governing bodies are likely to increase oversight and penalties for non-compliance with health and safety standards.

- Impact on supply chain: Companies are scrutinizing the safety practices of their suppliers, potentially affecting sourcing decisions.

Societal demand for sustainability is a major force, with consumers and businesses prioritizing eco-friendly solutions. Advanced Energy's focus on energy efficiency, like their power supplies that can improve data center efficiency by up to 10%, directly aligns with this trend, boosting their market appeal and brand image.

Demographic shifts, such as increasing urbanization and an aging population, are reshaping energy needs. With 68% of the global population projected to live in urban areas by 2050, the demand for robust smart city infrastructure and efficient energy management systems is escalating, creating significant opportunities for Advanced Energy.

The evolution of the workforce and the rise of digital economies are also key sociological factors. The growing demand for reliable data center power, driven by remote work and digital services, directly benefits Advanced Energy's product lines, underscoring the interconnectedness of societal changes and energy infrastructure needs.

Technological factors

The semiconductor industry's relentless pursuit of smaller, faster, and more power-efficient chips is a key driver for Advanced Energy. For instance, the increasing complexity of chip manufacturing processes, demanding tighter tolerances and higher yields, necessitates sophisticated power management solutions. This rapid technological advancement means that power conversion and control systems must constantly evolve to support these cutting-edge applications, directly impacting demand for next-generation products.

In the data center sector, the push for higher computing densities and AI workloads is accelerating. By 2025, global data center energy consumption is projected to reach significant levels, underscoring the need for highly efficient power delivery. Advanced Energy's ability to provide compact, high-performance power supplies is critical for meeting the stringent power requirements of these energy-intensive environments, ensuring operational reliability and cost-effectiveness.

The electric vehicle (EV) market's exponential growth presents another significant technological frontier. As EV battery technology advances and charging infrastructure expands, the demand for advanced power conversion solutions for onboard charging, battery management, and vehicle power distribution intensifies. Companies like Advanced Energy are investing heavily in R&D to develop solutions that are not only more efficient but also smaller and lighter, crucial for EV range and performance.

The advanced energy sector is constantly reshaped by disruptive technologies. For instance, breakthroughs in solid-state battery technology, with companies like QuantumScape reporting significant progress in 2024, could fundamentally alter the electric vehicle and grid storage markets. Similarly, advancements in perovskite solar cells, which achieved over 30% efficiency in lab settings by early 2025, threaten to disrupt traditional silicon-based solar panel dominance.

To navigate these shifts, substantial Research and Development (R&D) investment is paramount. Companies in this space are allocating significant capital; for example, major players in the battery sector are expected to invest billions in R&D throughout 2024-2025 to secure next-generation chemistries and manufacturing techniques. This investment allows firms to either capitalize on emerging trends, like developing power solutions compatible with new material standards, or to pioneer entirely new energy conversion methods, thereby safeguarding their competitive edge in precision power.

Advanced Energy is seeing a significant push towards automation and Industry 4.0 across its customer base. This trend means manufacturing clients are increasingly looking for power solutions that can integrate with their smart factory ecosystems. For instance, the global industrial automation market was projected to reach over $300 billion by 2024, highlighting the scale of this transformation.

This shift creates a clear opportunity for Advanced Energy to develop and market power products that offer real-time data and seamless connectivity. Power supplies designed for automated processes, which can provide critical operational data, will be highly valued. Companies adopting these technologies are seeking to optimize efficiency and reduce downtime, making reliable and intelligent power a key enabler.

Cybersecurity Threats to Industrial Control Systems

As Advanced Energy's sophisticated power solutions become more embedded within critical manufacturing and data center environments, the threat landscape for industrial control systems (ICS) expands significantly. Cyberattacks targeting these systems can disrupt operations, compromise sensitive data, and even pose physical risks. The increasing interconnectedness of these industrial networks amplifies the potential impact of such breaches.

Developing power solutions with advanced cybersecurity features is no longer optional; it's a fundamental requirement. This ensures the protection of customer operations, safeguards data integrity, and builds essential trust in a world where industrial infrastructure is increasingly reliant on digital connectivity. For instance, reports indicate that the average cost of an ICS cyberattack in 2024 reached $4.77 million, highlighting the substantial financial implications of inadequate security.

- Increased Attack Surface: As Advanced Energy's products integrate deeper into complex industrial infrastructures, the number of potential entry points for cyber threats grows.

- Data Integrity and Operational Continuity: Robust cybersecurity is crucial for maintaining the integrity of data processed by these systems and ensuring uninterrupted operations for customers.

- Growing Threat Landscape: The sophistication and frequency of cyberattacks targeting industrial control systems are on the rise, with a notable increase in ransomware and state-sponsored attacks impacting critical infrastructure globally.

Miniaturization and Efficiency Demands

The relentless drive for miniaturization and enhanced efficiency across sectors like consumer electronics, electric vehicles, and telecommunications directly impacts Advanced Energy. These industries demand power conversion and measurement solutions that are not only smaller and lighter but also consume less energy and generate less heat. For instance, the global semiconductor industry, a key market for Advanced Energy, is projected to see continued growth, with revenue expected to reach over $1 trillion by 2030, underscoring the need for increasingly sophisticated and compact power management technologies.

Meeting these evolving needs necessitates significant investment in research and development. Advanced Energy must innovate in areas such as power density, improving the amount of power delivered within a given volume, and advanced thermal management techniques to dissipate heat effectively in confined spaces. A prime example is the evolution of power supplies for data centers, where increasing rack density and energy efficiency targets are paramount; by 2025, data center energy consumption is expected to account for a significant portion of global electricity use, making efficient power conversion critical.

- Miniaturization: Devices are shrinking, requiring smaller, more integrated power solutions.

- Efficiency Demands: Lower energy consumption and reduced heat generation are crucial for sustainability and performance.

- Power Density: Maximizing power output within a smaller footprint is a key technological challenge.

- Thermal Management: Advanced cooling solutions are essential to prevent overheating in compact, high-performance systems.

Advancements in semiconductor technology, particularly in chip design and manufacturing, are a primary technological driver. The increasing complexity of integrated circuits demands more precise and efficient power delivery systems. For example, the push for higher performance in AI accelerators and advanced computing platforms by 2025 requires power solutions with unprecedented levels of precision and stability.

The growth of data centers, fueled by AI and cloud computing, is another critical factor. By 2025, global data center energy consumption is projected to rise significantly, emphasizing the need for highly efficient power conversion technologies. Compact, high-density power supplies are essential to manage the escalating power demands in these energy-intensive environments.

The electric vehicle (EV) market's rapid expansion, coupled with evolving battery technology and charging infrastructure, presents substantial opportunities. As EVs become more prevalent, the demand for advanced power solutions for onboard charging, battery management systems, and vehicle power distribution will continue to surge. Innovations in power density and thermal management are key to improving EV range and performance.

| Technological Trend | Impact on Advanced Energy | Key Market Drivers | 2024/2025 Data/Projections |

|---|---|---|---|

| Semiconductor Advancements (e.g., smaller, faster chips) | Need for more precise and efficient power management solutions | AI, advanced computing, IoT devices | Semiconductor industry revenue projected to exceed $1 trillion by 2030. |

| Data Center Growth (AI, cloud computing) | Demand for high-density, energy-efficient power supplies | Increased data processing, AI workloads | Global data center energy consumption expected to rise significantly by 2025. |

| Electric Vehicle (EV) Market Expansion | Opportunity for advanced power conversion in charging and vehicle systems | Battery technology, charging infrastructure, sustainability | EV sales are projected for substantial year-over-year growth through 2025. |

| Industrial Automation & Industry 4.0 | Requirement for integrated, connected power solutions for smart factories | Efficiency, predictive maintenance, operational optimization | Global industrial automation market projected to exceed $300 billion by 2024. |

Legal factors

Protecting Advanced Energy's vast patent portfolio is paramount to its market dominance in precision power solutions. In 2024, the company continued its strategic approach to IP, with a focus on reinforcing its position in critical areas like semiconductor manufacturing equipment and renewable energy technologies. This proactive stance is vital to prevent competitors from leveraging their innovations without compensation, ensuring a robust return on their substantial research and development expenditures.

Operating globally, Advanced Energy must navigate a complex web of international trade laws, including import/export regulations, customs duties, and sanctions. For example, the World Trade Organization (WTO) reported that in 2023, trade facilitation measures could boost global trade by up to 15%, highlighting the significant impact of compliance.

Compliance with these diverse legal frameworks is essential to avoid penalties, ensure smooth cross-border movement of goods, and maintain access to key markets and supply chain partners worldwide. Failure to comply can result in substantial fines; for instance, violations of export control regulations in the US can lead to penalties of up to $300,000 per violation or twice the value of the transaction.

Advanced Energy's products, vital for medical, industrial, and automotive applications, necessitate strict adherence to product safety regulations. Failure to comply can lead to significant legal repercussions and reputational damage.

The company must navigate a complex web of product liability laws, which demand rigorous testing and quality control measures. For instance, in 2024, the automotive sector saw increased scrutiny on component safety, with regulatory bodies like the NHTSA issuing recalls for millions of vehicles due to potential safety defects, underscoring the critical nature of compliance for companies like Advanced Energy.

Data Privacy and Cybersecurity Regulations

Advanced Energy faces significant legal hurdles with data privacy and cybersecurity regulations. As industrial systems become more interconnected and data-intensive, compliance with laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) is paramount. These regulations govern how customer and operational data is collected, stored, and processed, with potential fines for non-compliance reaching millions of dollars or a percentage of global annual revenue.

Maintaining robust data security is not just about avoiding legal penalties; it's crucial for preserving customer trust and safeguarding sensitive business intelligence. For instance, a data breach could lead to reputational damage and significant financial losses, impacting Advanced Energy's market position. Proactive measures and transparent data handling are therefore essential components of their legal strategy.

- GDPR Fines: Up to €20 million or 4% of annual global turnover.

- CCPA Fines: $2,500 per unintentional violation and $7,500 per intentional violation.

- Cybersecurity Investment: Many companies in the tech sector are increasing cybersecurity budgets by 10-15% annually to meet evolving threats.

- Data Breach Costs: The average cost of a data breach in 2024 is projected to exceed $5 million, impacting operational continuity and public perception.

Environmental, Health, and Safety (EHS) Regulations

Advanced Energy's operations, particularly its manufacturing of sophisticated power conversion and control systems, are heavily influenced by Environmental, Health, and Safety (EHS) regulations. These rules govern everything from the handling of hazardous materials used in electronics manufacturing to the safe disposal of waste and the control of emissions. For instance, directives like the Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) directly impact the materials Advanced Energy can use in its products, necessitating careful supply chain management and product redesign to meet compliance standards.

Compliance with these EHS mandates is not merely a legal obligation but a critical factor for operational continuity and financial health. Failure to adhere to regulations such as those concerning air and water emissions or worker safety can result in significant fines, operational shutdowns, and reputational damage. In 2023, the global cost of non-compliance with environmental regulations for businesses across various sectors was estimated to be in the billions, underscoring the financial risks involved. Advanced Energy's commitment to EHS compliance, therefore, directly affects its operational expenses, product development cycles, and its ability to access global markets.

- RoHS Compliance: Advanced Energy must ensure its products sold in the EU and other regions do not contain restricted hazardous substances, impacting component sourcing and design.

- REACH Regulations: The company needs to manage the registration and safe use of chemical substances within its products and manufacturing processes to comply with EU REACH requirements.

- Waste Management: Strict adherence to regulations for electronic waste (e-waste) disposal and the management of chemical byproducts from manufacturing is crucial to avoid penalties.

- Worker Safety: Implementing robust safety protocols and training to protect employees from hazards associated with manufacturing processes, such as exposure to chemicals or electrical risks, is paramount.

Advanced Energy's legal landscape is shaped by intellectual property protection, global trade laws, and stringent product safety standards. Navigating international trade regulations, including import/export compliance and sanctions, is critical for smooth operations, with the WTO noting trade facilitation can boost global trade by up to 15% in 2023. Product liability laws demand rigorous quality control, especially as sectors like automotive face increased scrutiny, with recalls impacting millions of vehicles in 2024.

Environmental factors

The intensifying global focus on climate change mitigation is a significant tailwind for companies like Advanced Energy. This push is fueling a substantial demand for technologies that enhance energy efficiency and reduce carbon emissions across industries.

Advanced Energy is well-positioned to capitalize on this trend by innovating products that enable customers to lower their energy usage and environmental impact. For instance, their power conversion solutions are crucial for renewable energy integration and industrial process optimization, directly contributing to sustainability targets and opening avenues in the burgeoning green technology sector.

The International Energy Agency reported in 2024 that global energy intensity improvements averaged 2.3% annually from 2020-2023, a rate that needs to accelerate significantly to meet climate goals. Advanced Energy's offerings directly support this acceleration, with their advanced power supplies and thermal management systems playing a key role in making data centers and manufacturing processes more efficient.

The availability and cost of critical raw materials, such as lithium and cobalt essential for advanced energy technologies, are increasingly shaped by environmental regulations and geopolitical tensions. For instance, the Democratic Republic of Congo, responsible for over 70% of global cobalt supply, faces scrutiny over mining practices, impacting pricing and supply stability.

Advanced Energy must prioritize sustainable sourcing, aiming for material efficiency and investigating alternative materials like sodium-ion batteries to reduce reliance on scarce resources and mitigate supply chain vulnerabilities. This proactive approach is vital for ensuring consistent production and long-term viability in the evolving energy landscape.

Growing pressure for better waste management and circular economy practices is shaping how Advanced Energy designs its products and handles them at the end of their life. For instance, the EU's Circular Economy Action Plan, updated in 2020 and with ongoing implementation, sets ambitious targets for waste reduction and resource efficiency, directly influencing companies like Advanced Energy operating in or selling to Europe.

By focusing on making products easier to recycle, repair, and by minimizing waste during manufacturing, Advanced Energy can significantly improve its environmental standing. This approach is not just about compliance; it aligns with increasing customer demand for sustainable solutions. For example, a 2023 survey by Accenture found that 72% of consumers are more likely to buy from companies committed to sustainability.

Climate Change Impacts on Operations

Advanced Energy faces significant physical risks from climate change. Extreme weather events like hurricanes, floods, and severe heatwaves can directly impact its manufacturing plants and disrupt critical supply chains. For instance, in 2024, the increasing frequency of severe weather events globally led to an estimated $100 billion in insured losses, highlighting the potential for operational downtime and increased costs for businesses like Advanced Energy.

To ensure operational stability, Advanced Energy must focus on risk assessment and mitigation. This involves investing in resilient infrastructure capable of withstanding extreme conditions and diversifying its supply chain to reduce reliance on single geographic regions. Developing robust business continuity plans is also crucial for maintaining operations during and after disruptive climate-related events.

- Physical Risks: Increased frequency and intensity of extreme weather events impacting manufacturing and logistics.

- Supply Chain Vulnerability: Potential disruptions to raw material sourcing and product delivery networks.

- Mitigation Strategies: Investment in resilient infrastructure, supply chain diversification, and comprehensive business continuity planning.

- Financial Impact: Potential for increased operational costs, insurance premiums, and revenue loss due to climate-related disruptions.

Environmental Regulations and Compliance Costs

Stricter environmental regulations, particularly concerning emissions and water usage, are a significant factor impacting Advanced Energy. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine regulations on greenhouse gas emissions from power plants, which could affect energy producers. Meeting these evolving standards necessitates substantial investment in cleaner technologies and improved operational processes.

These compliance costs can directly influence Advanced Energy's profitability and require strategic allocation of capital. Companies like Advanced Energy must invest in robust environmental management systems to ensure they meet global regulatory requirements and maintain their operational permits. For example, in 2024, many renewable energy projects are facing increased scrutiny and permitting timelines due to environmental impact assessments, adding to project development costs.

- Increased Operational Costs: Compliance with new emission standards can raise operating expenses for Advanced Energy.

- Capital Investment Needs: Significant upfront investment in cleaner technologies is required to meet regulatory mandates.

- Global Regulatory Landscape: Navigating diverse international environmental laws adds complexity and potential cost.

- License to Operate: Adherence to environmental regulations is critical for maintaining business operations and public trust.

The global drive towards decarbonization presents a substantial opportunity for Advanced Energy, as demand for energy-efficient and emission-reducing technologies escalates. This trend is particularly evident in sectors like data centers and industrial manufacturing, where Advanced Energy's power conversion and thermal management solutions play a critical role in optimizing energy consumption.

The company's commitment to innovation in these areas aligns directly with global sustainability goals. For instance, in 2024, the U.S. Department of Energy announced significant investments in energy efficiency programs, underscoring the market's growth potential for companies like Advanced Energy.

Environmental regulations are also a key factor, requiring significant investment in cleaner technologies and sustainable practices. Advanced Energy must navigate evolving standards for emissions and waste management, as exemplified by the EU's Circular Economy Action Plan, to maintain its competitive edge and operational licenses.

Furthermore, the physical risks associated with climate change, such as extreme weather events, necessitate robust business continuity planning and resilient infrastructure investments. These environmental factors collectively shape Advanced Energy's operational landscape, influencing both its challenges and its strategic opportunities in the evolving energy market.

PESTLE Analysis Data Sources

Our Advanced Energy PESTLE Analysis is meticulously constructed using data from reputable government agencies, international organizations, and leading industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both comprehensive and current.