Advanced Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Energy Bundle

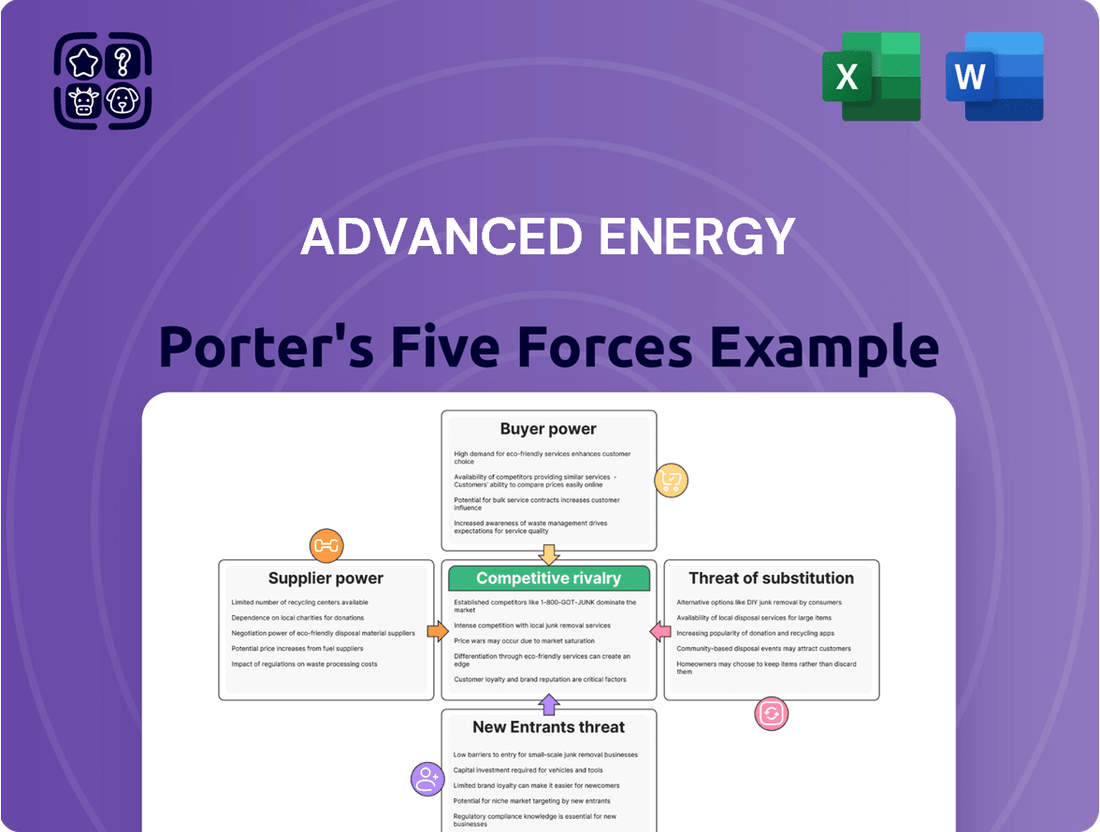

Advanced Energy operates in a dynamic market shaped by intense competition and evolving technological landscapes. Understanding the interplay of buyer power, supplier leverage, the threat of new entrants, substitutes, and rivalry is crucial for navigating this environment.

The complete report reveals the real forces shaping Advanced Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Advanced Energy's reliance on a select group of specialized suppliers for crucial electronic components and raw materials significantly amplifies supplier bargaining power. These suppliers often hold patents or unique manufacturing processes for essential inputs, limiting Advanced Energy's alternatives and giving them considerable pricing leverage. For instance, in 2024, the semiconductor industry, a key supplier sector for Advanced Energy, continued to experience supply chain constraints and price volatility, directly impacting component costs.

Advanced Energy (AEIS) faces significant supplier power due to high switching costs associated with its highly engineered, mission-critical components. These costs encompass rigorous re-qualification, potential design modifications, and extensive validation testing, all crucial for maintaining product reliability and performance standards. This situation inherently limits AEIS's leverage and bolsters the negotiating strength of its existing suppliers, often necessitating long-term agreements and strategic alliances to mitigate the impact.

In specialized segments of power electronics, Advanced Energy might encounter a limited number of suppliers possessing the unique technical expertise and proprietary manufacturing capabilities required for its high-precision products. This scarcity, coupled with the specialized nature of the components, significantly amplifies supplier leverage. For instance, if a critical component for a new semiconductor manufacturing tool is only available from two or three highly specialized firms, these suppliers hold considerable sway.

Forward Integration Potential of Suppliers

While less common for highly specialized components, some large, technologically advanced suppliers could theoretically consider forward integration into producing complete power solutions. This would necessitate substantial investment and deep market expertise, making it a less probable scenario for most. For instance, a key component supplier to the semiconductor industry might explore offering integrated chip manufacturing equipment, but the capital expenditure and operational complexity are immense.

The threat, however minor, highlights Advanced Energy's need to cultivate robust, collaborative supplier relationships and clearly articulate the value of its own integration capabilities. This strategic imperative influences supplier negotiations by subtly reminding them of potential competitive responses.

This potential for forward integration by suppliers acts as a subtle but persistent factor in bargaining power dynamics. It encourages Advanced Energy to maintain strong partnerships and demonstrate its own value proposition.

- Forward Integration Threat: Suppliers might integrate forward into producing complete power solutions, though this is challenging for specialized component makers.

- Investment and Expertise: Such a move requires significant capital and market knowledge, limiting its feasibility for many suppliers.

- Advanced Energy's Strategy: Maintaining strong supplier relationships and showcasing integration value are crucial to mitigate this subtle threat.

Impact of Input Costs on Profitability

Fluctuations in the cost of critical raw materials, such as silicon wafers or specialized semiconductor components, directly impact Advanced Energy's cost of goods sold and, consequently, its profitability margins. For instance, a significant increase in polysilicon prices, a key input for solar wafer manufacturing, could squeeze margins if not effectively managed.

Suppliers with strong bargaining power can pass on cost increases, forcing Advanced Energy to either absorb these costs or attempt to pass them on to customers. This is particularly challenging in competitive markets where price sensitivity is high. In 2024, many technology companies faced similar pressures as global supply chains continued to experience volatility.

- Rising Input Costs: Advanced Energy's profitability is sensitive to the price of key components like advanced semiconductors and specialized materials.

- Supplier Leverage: Suppliers who dominate specific niche markets or control essential intellectual property can command higher prices, impacting Advanced Energy's cost structure.

- 2024 Market Impact: Persistent supply chain disruptions and inflationary pressures in 2024 meant that Advanced Energy, like many in the electronics sector, had to navigate increased procurement costs.

- Mitigation Strategies: Effective cost management and supplier diversification are crucial for Advanced Energy to maintain healthy profit margins amidst potential supplier power.

Advanced Energy's bargaining power with suppliers is constrained by the specialized nature of its components and the limited number of qualified manufacturers. This scarcity, particularly for highly engineered electronic inputs, grants suppliers significant pricing leverage. For example, in 2024, the semiconductor industry, a critical supplier for Advanced Energy, continued to face supply chain challenges, leading to price increases for essential chips.

| Supplier Characteristic | Impact on Advanced Energy | 2024 Relevance |

| Limited number of specialized suppliers | Increased supplier pricing power | Persistent in advanced semiconductor components |

| High switching costs (re-qualification, design changes) | Reduced flexibility, reliance on existing suppliers | Critical for maintaining product reliability |

| Proprietary technology/patents | Suppliers dictate terms, control pricing | Common for unique power management ICs |

| Potential for supplier forward integration | Minor threat, but influences relationship management | Unlikely for most component suppliers due to capital intensity |

What is included in the product

This analysis meticulously dissects the competitive forces impacting Advanced Energy, assessing the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Easily identify and mitigate competitive threats by visualizing the intensity of each force, enabling proactive strategic adjustments.

Pinpoint key areas of supplier or buyer power to negotiate more favorable terms and reduce cost pressures.

Customers Bargaining Power

Advanced Energy's highly engineered, precision components are often critical to the performance and reliability of their customers' complex manufacturing processes. This inherent criticality means customers are less likely to push for significant price reductions, as performance and uptime are paramount. For instance, in the semiconductor manufacturing sector, where AEIS is a key player, unplanned downtime can cost millions per hour, making component reliability a far greater concern than minor price variations.

For Advanced Energy's customers in sectors such as semiconductor manufacturing, medical equipment, and data centers, the cost of switching from an existing precision power solution is substantial. These expenses include re-designing systems, re-validating performance, obtaining new certifications, and the potential for costly production downtime. This financial and operational burden makes it difficult for customers to switch, even for minor price advantages.

Advanced Energy operates across a wide array of industries, catering to sophisticated global manufacturers. These clients, such as those in the semiconductor sector, often possess significant technical knowledge and substantial purchasing clout, which can amplify their bargaining power.

However, the company's presence in diverse markets like industrial, medical, telecommunications, and electric vehicles (EV) acts as a crucial buffer. This broad customer segmentation means Advanced Energy isn't overly dependent on any single industry or a small group of dominant buyers, thereby diffusing concentrated customer power.

For instance, in 2024, the semiconductor industry, a key market for Advanced Energy, saw continued robust demand, but also increasing price pressures from major chip manufacturers. Conversely, the burgeoning EV sector, while also demanding, presents a more fragmented customer base with varying levels of purchasing power, offering a more balanced dynamic.

Backward Integration by Customers

The likelihood of Advanced Energy's customers pursuing backward integration, meaning they would start producing their own highly specialized power conversion, measurement, and control solutions, is generally quite low.

This is because developing and manufacturing these complex components demands substantial capital investment, extensive research and development, robust intellectual property, and deep technical expertise. For instance, the semiconductor manufacturing equipment sector, a key market for Advanced Energy, requires billions in R&D and manufacturing infrastructure. Customers typically prefer to concentrate on their core business activities, leaving the specialized engineering and production to experts like Advanced Energy.

- High Capital Requirements: Building the necessary manufacturing facilities and R&D capabilities for precision power solutions can cost hundreds of millions, if not billions, of dollars.

- Specialized Expertise: The intricate nature of power conversion and control technology requires highly specialized engineering talent that is not readily available.

- Intellectual Property: Advanced Energy holds significant patents and proprietary knowledge in its field, creating a barrier to entry for potential integrators.

- Focus on Core Competencies: Customers in sectors like semiconductor manufacturing or industrial automation are focused on their own product innovation and market presence, not on becoming power electronics manufacturers.

Price Sensitivity vs. Performance Needs

While customers are always mindful of cost, for critical components from Advanced Energy, performance, reliability, and technological superiority often take precedence over price. In sectors like semiconductor manufacturing, where even minor disruptions can lead to significant financial losses, customers prioritize solutions that ensure maximum uptime, precision, and yield. This inherent need for high-value, dependable technology lessens their ability to drive down prices through sheer bargaining power.

For instance, in the semiconductor industry, the cost of a single wafer can be thousands of dollars, and production downtime can cost millions per hour. Therefore, the cost of the equipment that ensures consistent, high-quality output becomes a secondary concern compared to its performance. Advanced Energy's focus on these critical performance metrics allows them to maintain a stronger position against price-based demands.

- Performance Over Price: In high-stakes industries like semiconductor fabrication, the cost of equipment failure or subpar performance far outweighs the initial purchase price.

- Reliability and Uptime: Customers in these sectors demand robust solutions that guarantee continuous operation, making reliability a key purchasing driver.

- Technological Advancement: Advanced Energy's commitment to innovation provides cutting-edge solutions that are essential for maintaining a competitive edge, further reducing customer price sensitivity.

Advanced Energy's customers, particularly in critical sectors like semiconductor manufacturing, often have substantial bargaining power due to their significant purchasing volume and technical expertise. However, the high cost of switching and the paramount importance of component reliability in these industries significantly mitigate this power. For instance, in 2024, while major semiconductor manufacturers sought cost efficiencies, the need for uninterrupted production lines meant that performance and dependability from suppliers like Advanced Energy remained top priorities.

What You See Is What You Get

Advanced Energy Porter's Five Forces Analysis

This preview displays the complete Advanced Energy Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the sector. The document you see is precisely what you will receive immediately upon purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

The precision power conversion and control market is a battleground for several global giants. Companies like Siemens, ABB, and Schneider Electric, with their vast resources and established reputations, are significant players. These diversified electronics manufacturers and specialized power solution providers bring deep R&D expertise and a history of customer trust to the table, directly challenging Advanced Energy.

Advanced Energy’s competitive advantage stems from its highly specialized, application-specific solutions, offering enhanced precision and reliability. This strong product differentiation lessens direct price competition, as customers value the unique performance benefits. For instance, in 2023, Advanced Energy reported revenue of $1.3 billion, with a significant portion attributed to its differentiated product lines in semiconductor manufacturing equipment.

However, rivals are also heavily investing in research and development to create their own proprietary technologies and specialized offerings. Companies like Applied Materials and Lam Research, major competitors in the semiconductor equipment space, consistently allocate substantial capital to innovation. Applied Materials, for example, invested over $1.5 billion in R&D in their fiscal year 2023, aiming to match or surpass Advanced Energy's technological advancements.

Maintaining this edge requires Advanced Energy to continuously innovate. The rapid pace of technological change, particularly in sectors like semiconductor manufacturing where Advanced Energy is a key player, means that product lifecycles can be short. Staying ahead necessitates ongoing investment in R&D to ensure its specialized products remain superior and meet the evolving demands of sophisticated end-users.

Advanced Energy operates in segments like semiconductor equipment, data center computing, and electric vehicles, all experiencing robust growth. This makes the market highly attractive, drawing in both established companies and new players eager to capture market share.

The significant expansion within these sectors, such as the projected 12.1% compound annual growth rate for the global semiconductor equipment market through 2027, fuels intense competition. Companies are investing heavily in research and development and manufacturing capacity to stay ahead.

While this growth can escalate rivalry, it also provides ample room for multiple companies to thrive. For instance, the data center market is expected to reach $332.1 billion by 2028, indicating substantial opportunity for various providers of power and thermal management solutions.

Customer Switching Costs and Loyalty

Customers generally face high switching costs when changing precision power solution providers. This is because the components are critical to operations, and extensive validation processes are required before a new supplier can be integrated, fostering significant customer stickiness and loyalty for established companies like Advanced Energy.

For instance, the semiconductor manufacturing industry, a key market for Advanced Energy, involves rigorous qualification periods that can extend for months, making it costly and time-consuming for a customer to switch. This inherent barrier reinforces the loyalty of existing clients.

Despite these high costs, competitors actively work to attract customers. They do this by offering more attractive value propositions, superior performance metrics, or a lower total cost of ownership, aiming to overcome the inertia of existing relationships.

- High Validation Requirements: Semiconductor and advanced manufacturing processes demand lengthy and complex validation for new power components, often taking 6-12 months.

- Integration Complexity: Replacing existing power solutions requires re-engineering and re-testing of entire systems, adding significant time and expense.

- Supplier Reliability: Established suppliers like Advanced Energy have proven track records, reducing perceived risk for customers compared to new entrants.

- Competitive Differentiation: Competitors focus on innovation, cost reduction, and enhanced support to incentivize customers to undertake the switching process.

Intensity of R&D and Innovation Race

The advanced energy sector is characterized by a fierce rivalry fueled by an unrelenting innovation race. Companies are pouring resources into research and development, aiming to launch novel products and enhance existing technologies for greater precision and efficiency.

This dynamic necessitates substantial capital investment and a deep pool of skilled talent, compelling firms like Advanced Energy to maintain a leading edge in technological progress to secure their competitive position. For instance, in 2024, global R&D spending in the renewable energy sector alone was projected to exceed $100 billion, underscoring the scale of this innovation drive.

- High R&D Investment: Companies are dedicating significant portions of their revenue to R&D to stay ahead.

- Talent Acquisition: The need for specialized engineering and scientific expertise drives competition for top talent.

- Product Lifecycles: Rapid technological advancements lead to shorter product lifecycles, demanding continuous innovation.

- Capital Expenditure: Developing and scaling new energy technologies requires substantial financial backing.

Competitive rivalry in the precision power conversion and control market is intense, driven by innovation and significant R&D investments from major players like Siemens, ABB, and Schneider Electric. Advanced Energy differentiates itself through specialized, high-performance solutions, though competitors like Applied Materials are also investing heavily, with Applied Materials dedicating over $1.5 billion to R&D in fiscal year 2023. This dynamic necessitates continuous innovation from Advanced Energy to maintain its technological edge in rapidly evolving sectors.

| Competitor | 2023 Revenue (Approx.) | Key Focus Areas | R&D Investment (2023) |

| Siemens | $76 billion (Digital Industries) | Industrial automation, power management | Significant, part of overall corporate spend |

| ABB | $30 billion | Electrification, robotics, motion | Significant, part of overall corporate spend |

| Schneider Electric | $36 billion | Energy management, automation | Significant, part of overall corporate spend |

| Applied Materials | $26.5 billion | Semiconductor manufacturing equipment | >$1.5 billion |

SSubstitutes Threaten

The threat of substitutes for Advanced Energy's offerings is notably low, especially in their core markets. For highly specialized applications like semiconductor manufacturing equipment or advanced medical imaging devices, finding a product that matches the precision and reliability of Advanced Energy's power conversion and control solutions is extremely difficult.

These unique performance attributes are often critical for the functionality of the end products, making direct functional substitutes scarce. This indispensability in critical systems significantly dampens the pressure from alternative technologies or solutions.

The industries Advanced Energy serves, such as semiconductors and data centers, have incredibly demanding performance and reliability needs. Even small errors in power delivery can cause major disruptions, leading to substantial financial losses and safety concerns. For instance, a semiconductor fabrication plant can lose millions of dollars per hour due to an unplanned shutdown.

Because of these critical requirements, standard or less advanced power solutions are simply not viable alternatives. They lack the precision, stability, and fault tolerance necessary for these high-stakes environments. Customers in these sectors prioritize guaranteed uptime and flawless operation above all else, making them highly resistant to accepting substitutes that could jeopardize their processes.

While direct product substitutes for Advanced Energy's offerings are scarce, a significant threat could emerge from customers adopting entirely new system architectures. These shifts might bypass the need for Advanced Energy's specialized power and control solutions altogether.

However, such fundamental architectural changes are infrequent, demanding substantial research and development investment from customers and typically involving lengthy implementation periods. For instance, the transition to fully integrated smart grid systems, while a long-term trend, doesn't immediately eliminate the need for advanced power conversion components that Advanced Energy provides.

Advanced Energy proactively addresses this by focusing on enabling emerging technologies, ensuring its solutions evolve alongside customer requirements. This forward-looking approach helps mitigate the risk of obsolescence due to architectural shifts.

In-house Development by Customers

Very large enterprises with substantial engineering resources might explore developing their own power conversion and control systems. This could be driven by a desire for greater control over their technology or to reduce reliance on external suppliers.

However, the significant hurdles of specialized expertise, substantial capital outlay, and the time needed to replicate Advanced Energy's advanced, proprietary technologies and efficient production scales are major deterrents. These factors often make in-house development economically unfeasible for most.

For instance, the semiconductor manufacturing sector, a key market for Advanced Energy, often requires highly specialized power solutions. Developing these internally would demand significant R&D investment, potentially diverting resources from core manufacturing operations. In 2024, the global semiconductor equipment market was valued at approximately $133 billion, highlighting the scale of investment required for such specialized components.

- High R&D Costs: Developing proprietary power conversion technology requires extensive research and development, often running into millions of dollars annually.

- Capital Investment: Building manufacturing facilities and acquiring specialized equipment for power electronics can cost tens to hundreds of millions of dollars.

- Time to Market: Bringing a complex, reliable power solution from concept to production can take several years, a significant delay for many businesses.

- Focus on Core Competencies: Most customers, particularly in high-tech industries, find it more strategic to concentrate on their primary business functions rather than investing in specialized component manufacturing.

Cost-Performance Trade-offs of Alternatives

Any potential substitute for Advanced Energy's specialized semiconductor manufacturing equipment, whether it's a less precise alternative or an in-house developed solution, typically demands substantial compromises. These compromises often manifest as reduced performance, lower reliability, increased integration complexity, or a higher overall cost of ownership over time.

For Advanced Energy's core customer base, which operates in sectors where precision, consistency, and minimal downtime are absolutely critical, these trade-offs are generally unacceptable. This significantly curtails the appeal of substitutes that cannot replicate the highly specialized capabilities offered by Advanced Energy's advanced process control and thin-film deposition systems.

The value proposition of Advanced Energy's solutions, which focus on enhancing yield, improving wafer quality, and ensuring process stability, frequently outweighs the consideration of the lowest upfront cost. For instance, in 2024, the semiconductor industry continued to emphasize advanced node manufacturing, where even minor deviations in process control can lead to billions in lost revenue due to lower yields.

- Performance Degradation: Substitutes may offer lower throughput or less precise control, impacting wafer output and quality.

- Reliability Concerns: Non-specialized equipment often has higher failure rates, leading to costly unplanned downtime.

- Integration Challenges: Adapting generic solutions to complex semiconductor manufacturing workflows can be time-consuming and expensive.

- Total Cost of Ownership: While a substitute might have a lower initial price, the long-term costs associated with maintenance, lower yields, and potential quality issues can be substantially higher.

The threat of substitutes for Advanced Energy's highly specialized power and control solutions is generally low. Customers in demanding sectors like semiconductor manufacturing and data centers require unparalleled precision and reliability, making direct functional substitutes scarce. For example, the semiconductor industry's focus on advanced node manufacturing in 2024 means even minor process deviations, which less specialized power solutions might introduce, can result in billions in lost revenue due to lower yields.

While entirely new system architectures could emerge, these are infrequent and require substantial customer investment and long development cycles. Advanced Energy mitigates this by aligning its offerings with emerging technologies. Furthermore, the significant R&D costs, capital investment, and time to market make in-house development by large enterprises economically unfeasible, especially given the specialized expertise required to replicate Advanced Energy's proprietary technologies.

Substitutes, whether less precise alternatives or in-house solutions, often demand significant compromises in performance, reliability, or integration complexity. For Advanced Energy's core clientele, where minimal downtime and process stability are paramount, these trade-offs are typically unacceptable, making the value proposition of their advanced solutions highly compelling.

| Factor | Impact on Advanced Energy | Example/Data Point (2024) |

|---|---|---|

| Performance Requirements | Very High | Semiconductor manufacturing demands precision; process deviations can cost billions in lost yield. |

| Reliability Needs | Very High | Unplanned downtime in data centers or fabrication plants incurs massive financial losses. |

| Switching Costs | High | Redesigning complex power systems is costly and time-consuming for customers. |

| Customer Propensity to Substitute | Low | Customers prioritize guaranteed uptime and flawless operation over lower upfront costs. |

Entrants Threaten

Entering the advanced energy sector, particularly in highly engineered power conversion, measurement, and control solutions, demands significant upfront capital. Companies need to invest heavily in state-of-the-art manufacturing plants and advanced testing machinery. For instance, establishing a cutting-edge semiconductor fabrication facility, crucial for many advanced energy components, can easily run into billions of dollars.

Continuous research and development (R&D) is not optional but essential for survival and growth in this dynamic field. Companies must allocate substantial budgets to innovation, often representing 10-20% of revenue, to stay ahead of technological advancements. This ongoing investment in R&D, coupled with the initial capital expenditure, creates a formidable barrier, deterring all but the most financially robust and strategically committed new entrants.

Advanced Energy, like many in the advanced energy sector, relies heavily on its substantial portfolio of intellectual property, including patents and trade secrets. This deep well of technological expertise, cultivated through years of dedicated research and development, creates a significant barrier for newcomers. For instance, many companies in this space invest millions annually in R&D; in 2023, leading players saw R&D spending range from 5% to 15% of their revenue, a figure that underscores the resource commitment needed to build comparable technological capabilities.

Developing and defending a robust intellectual property position is a time-consuming and capital-intensive endeavor. New entrants would need to invest heavily not only in replicating existing technologies but also in navigating and potentially challenging the established IP landscape. The cost of patent litigation alone can be prohibitive, deterring many potential competitors from entering markets dominated by firms with strong IP protection.

The threat of new entrants in the advanced energy sector is significantly mitigated by long customer qualification cycles, particularly in demanding industries like semiconductor manufacturing, medical device production, and aerospace. These sectors require extensive testing and validation for new components due to their mission-critical applications and rigorous regulatory oversight. For instance, a new advanced energy component might need to pass years of performance and safety evaluations before being approved for use in a commercial aircraft or a life-support medical system.

New companies entering this space face a substantial barrier in establishing the credibility, trust, and proven reliability that these sophisticated customers demand. Building this reputation takes considerable time and investment, often requiring a track record of successful deployments and unwavering quality. Established players benefit from pre-existing relationships and a history of dependable performance, making it difficult for newcomers to penetrate these markets.

In 2024, the semiconductor industry alone saw billions invested in new fabrication facilities, yet the qualification of new power management solutions or energy storage systems for these fabs can still extend over 18-24 months. This lengthy process, coupled with the high stakes involved, effectively deters many potential new entrants who lack the resources and patience to navigate such a demanding market entry.

Economies of Scale and Scope

Existing players in the advanced energy sector, such as Advanced Energy, leverage significant economies of scale. This means they can produce components at a lower cost per unit due to high-volume manufacturing, bulk purchasing of raw materials, and shared research and development expenses. For instance, in 2023, Advanced Energy reported revenues of $1.76 billion, indicating a substantial operational scale that new entrants would find challenging to replicate quickly.

New companies entering the market would face considerable hurdles in achieving comparable cost efficiencies. Without the established volume of operations, they would likely incur higher per-unit costs for manufacturing, procurement, and R&D. This cost disadvantage makes it difficult for new entrants to compete effectively on price against established firms that benefit from years of investment in building out their scaled operations.

- Economies of Scale: Advanced Energy's substantial revenue in 2023 ($1.76 billion) highlights its operational scale, enabling cost advantages in production and procurement.

- R&D Investment: Established companies can spread high research and development costs over a larger product portfolio and sales volume, a luxury new entrants may not initially afford.

- Competitive Pricing: The cost efficiencies gained through scale allow incumbents to offer more competitive pricing, creating a barrier for new, smaller-scale competitors.

- Broader Offerings: Economies of scope allow larger firms to offer a wider range of products and services, further differentiating them from specialized new entrants.

Access to Specialized Talent and Supply Chains

The advanced energy sector demands highly specialized engineering talent, a resource that is not easily replicated. For instance, in 2024, the global shortage of skilled electrical engineers was a significant concern, with reports indicating a deficit of over 500,000 professionals in critical areas like power systems and renewable energy integration.

New entrants would struggle to attract and retain the necessary expertise, as established companies often offer competitive compensation and long-term career development. This talent acquisition hurdle is compounded by the need for access to sophisticated global supply chains for unique components and materials essential for advanced energy solutions.

Building reliable relationships with niche suppliers, who often have limited production capacity and long lead times, is a multi-year process. For example, securing a consistent supply of rare earth elements, crucial for high-performance magnets in wind turbines and electric vehicle motors, can involve complex geopolitical and logistical considerations.

- Talent Scarcity: A projected global deficit of over 500,000 skilled electrical engineers in 2024 highlights the difficulty new entrants face in acquiring specialized talent.

- Supply Chain Complexity: Access to niche suppliers for critical components, such as rare earth elements for advanced magnets, requires years to establish reliable relationships.

- Established Relationships: Incumbent firms benefit from long-standing supplier partnerships, creating a barrier for newcomers seeking consistent and quality material sourcing.

The threat of new entrants in the advanced energy sector is significantly constrained by the immense capital required for establishing operations, particularly for manufacturing and R&D. High R&D spending, often 10-20% of revenue, and the need for billions in capital for facilities like semiconductor fabrication plants create substantial entry barriers.

Furthermore, the sector's reliance on extensive intellectual property, built over years of investment, makes it difficult for newcomers to compete. The cost of replicating and defending IP, including potential litigation, deters many potential entrants.

Long customer qualification cycles, especially in critical industries, coupled with the need to build trust and a proven track record, extend the time and investment needed for market entry. For instance, qualifying new components in aerospace can take years.

Established players also benefit from economies of scale, allowing for lower production costs and competitive pricing, which new entrants struggle to match. The scarcity of specialized engineering talent and the difficulty in establishing reliable supply chain relationships for critical components further solidify the position of incumbent firms.

| Barrier Type | Description | Example Data/Impact |

|---|---|---|

| Capital Requirements | High upfront investment in manufacturing and R&D. | Billions for semiconductor fabrication; 10-20% of revenue for R&D. |

| Intellectual Property | Extensive patent portfolios and technological expertise. | Millions spent annually on R&D to build IP; litigation costs are prohibitive. |

| Customer Qualification | Long validation periods for mission-critical applications. | 18-24 months for semiconductor industry components; years for aerospace. |

| Economies of Scale | Cost advantages from high-volume production and procurement. | Advanced Energy's $1.76 billion revenue in 2023 indicates significant scale. |

| Talent & Supply Chain | Scarcity of specialized engineers and difficulty in securing niche suppliers. | Global deficit of over 500,000 skilled electrical engineers in 2024; complex sourcing for rare earth elements. |

Porter's Five Forces Analysis Data Sources

Our Advanced Energy Porter's Five Forces analysis is built upon a foundation of robust data, drawing from government energy statistics, industry association reports, and financial filings of key market players.