Advance Auto Parts PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advance Auto Parts Bundle

Navigate the complex external forces shaping Advance Auto Parts's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the automotive aftermarket. Gain a strategic advantage by uncovering opportunities and mitigating risks. Download the full analysis now and make informed decisions.

Political factors

Federal legislative proposals like the REPAIR Act and SAFE Repair Act are significant for Advance Auto Parts. These bills aim to give independent repair shops and consumers access to vehicle diagnostic tools and information. This is vital for Advance Auto Parts because it ensures a competitive market for aftermarket parts and services, preventing car manufacturers from controlling the entire repair ecosystem.

The U.S. automotive parts sector faces intricate trade regulations and the looming threat of tariffs, especially concerning goods imported from China. For Advance Auto Parts, these tariffs directly translate to higher costs for its inventory, potentially squeezing profit margins and forcing adjustments to its pricing for both retail customers and professional mechanics. Navigating these evolving trade policies is crucial for the company to keep its prices competitive and its supply chain running smoothly.

Federal investments in transportation infrastructure, such as the Bipartisan Infrastructure Law passed in 2021, are projected to infuse billions into roads, bridges, and public transit. This can indirectly boost vehicle usage and, consequently, demand for automotive aftermarket parts and services. For instance, increased road maintenance and new construction could lead to more wear and tear on vehicles.

The significant push for electric vehicle (EV) charging infrastructure, also a component of this infrastructure spending, directly impacts the automotive aftermarket. As more charging stations are deployed, the adoption rate of EVs is expected to accelerate. This necessitates Advance Auto Parts to strategically adjust its product mix and technician training to cater to the evolving needs of EV maintenance and repair, moving beyond traditional internal combustion engine components.

Automotive Emissions and Fuel Economy Standards

Current Environmental Protection Agency (EPA) regulations, such as ambitious carbon emission reduction targets and Corporate Average Fuel Economy (CAFE) standards, are significantly shaping the automotive landscape. For instance, the EPA's proposed 2027 and later model year greenhouse gas emission standards aim to reduce emissions by 50% compared to 2026 levels. These evolving mandates, including increasing requirements for electric vehicle (EV) sales, directly influence vehicle design and the types of maintenance and parts needed.

These stringent standards create a direct impact on the demand for specific automotive parts and services. Advance Auto Parts must ensure its product assortment and service offerings align with these evolving environmental compliance requirements. This includes stocking parts for newer, more fuel-efficient internal combustion engines, as well as components for electric and hybrid vehicles.

- EPA's proposed greenhouse gas emission standards for 2027 and later aim for a 50% reduction compared to 2026 levels.

- CAFE standards continue to push for improved average fuel economy across manufacturers' fleets.

- Mandates for electric vehicle sales are increasing, driving demand for EV-specific parts and maintenance expertise.

- Advance Auto Parts needs to adapt its inventory and service capabilities to meet these regulatory shifts.

Political Stability and Policy Shifts

The broader political climate, including major elections and potential shifts in government policy, can introduce uncertainty for businesses like Advance Auto Parts. For instance, the 2024 US presidential election could lead to changes in economic policies that impact consumer discretionary spending, a key driver for auto parts sales.

Changes in administration could affect regulatory enforcement, trade agreements, and economic stimulus packages. For example, a shift in environmental regulations could influence the demand for certain types of automotive parts or repair services.

- Policy Uncertainty: Upcoming elections in major markets, including the 2024 US Presidential election, introduce potential policy shifts affecting trade, taxation, and consumer spending.

- Regulatory Landscape: Evolving regulations on vehicle emissions and fuel efficiency could impact the types of parts in demand and necessitate adjustments in product offerings.

- Trade Relations: Fluctuations in international trade agreements and tariffs can affect the cost of imported components and the competitiveness of Advance Auto Parts' supply chain.

Government initiatives promoting vehicle repair rights, like the REPAIR Act, are crucial for maintaining a competitive aftermarket for Advance Auto Parts. These regulations ensure access to diagnostic tools, preventing manufacturer monopolies and supporting independent repair shops.

Trade policies, particularly tariffs on goods from China, directly impact Advance Auto Parts by increasing inventory costs. Navigating these evolving trade landscapes is vital for maintaining competitive pricing and supply chain stability.

Investments in infrastructure, including the Bipartisan Infrastructure Law, can indirectly boost vehicle usage and demand for aftermarket parts through increased road maintenance and travel. Furthermore, the expansion of EV charging infrastructure signals a shift in the automotive market, requiring Advance Auto Parts to adapt its product mix and service offerings for electric vehicles.

Stricter environmental regulations, such as EPA emission standards and CAFE mandates, are reshaping vehicle design and parts demand. Advance Auto Parts must align its inventory with these trends, stocking parts for fuel-efficient internal combustion engines and the growing EV segment.

| Political Factor | Description | Impact on Advance Auto Parts | Key Data/Examples (2024-2025) |

| Right to Repair Legislation | Laws granting access to vehicle diagnostics and repair information. | Ensures fair competition for aftermarket parts and services. | REPAIR Act and SAFE Repair Act proposals are active legislative discussions. |

| Trade Policy & Tariffs | Government regulations on imported goods, including potential tariffs. | Increases cost of imported inventory, affecting pricing and margins. | Ongoing trade tensions with China could lead to new tariff implementations or adjustments. |

| Infrastructure Spending | Government investment in roads, bridges, and EV charging. | Boosts vehicle usage and demand for parts; necessitates EV part inventory. | Bipartisan Infrastructure Law allocates significant funds for road and EV infrastructure. |

| Environmental Regulations | Emission standards (EPA) and fuel economy mandates (CAFE). | Drives demand for EV parts and components for fuel-efficient vehicles. | EPA's proposed 2027 standards aim for 50% GHG reduction vs. 2026; increasing EV sales mandates. |

| Political Stability & Elections | Potential shifts in government policy and economic conditions. | Creates uncertainty in consumer spending and regulatory enforcement. | The 2024 US Presidential election could lead to changes in economic and trade policies. |

What is included in the product

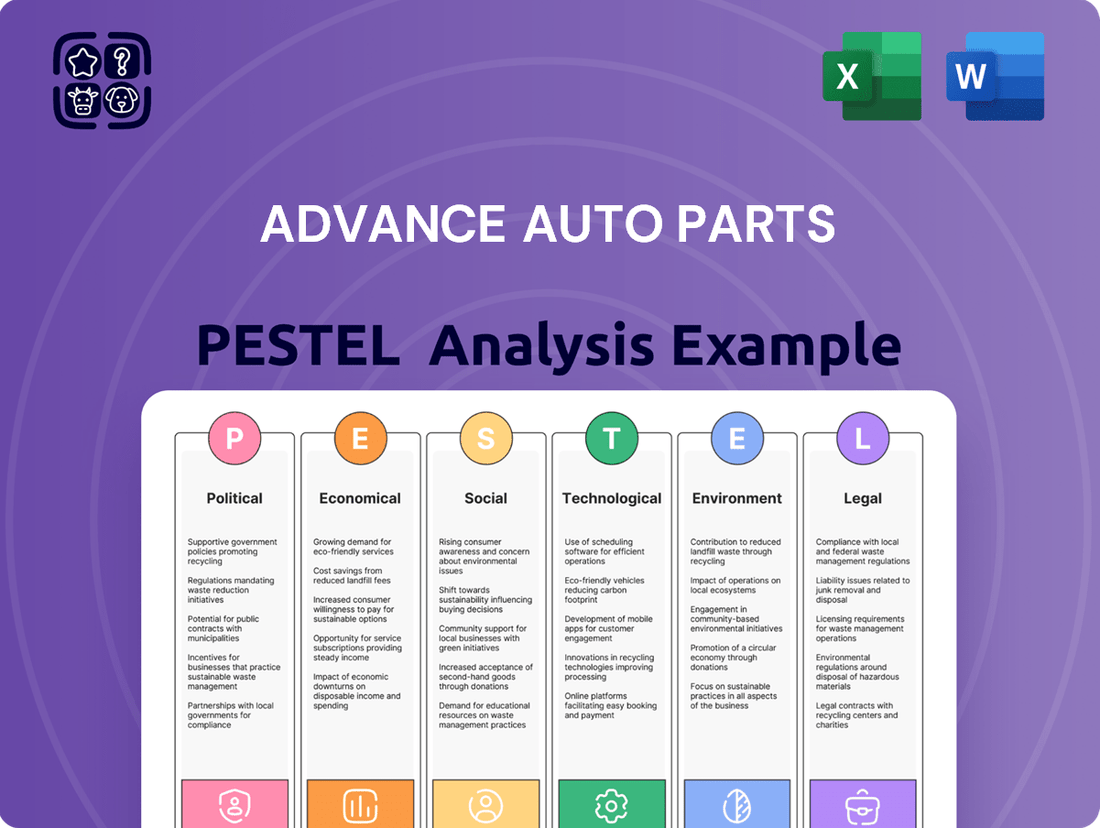

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Advance Auto Parts, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting key trends and their implications for the automotive aftermarket industry.

A clear, actionable PESTLE analysis for Advance Auto Parts that highlights key external factors impacting the automotive aftermarket, enabling proactive strategy development and risk mitigation.

Economic factors

The U.S. automotive aftermarket, a sector covering parts, accessories, maintenance, and repair, is experiencing strong growth. This trend is expected to continue through 2025, creating a positive landscape for companies like Advance Auto Parts to achieve their revenue and market share goals.

Further bolstering this outlook, the light-duty vehicle aftermarket segment alone is projected to see an increase of 5.1% in 2025. This specific growth metric highlights the ongoing demand for services and products within a key area of the automotive aftermarket.

The average age of vehicles on U.S. roads is a significant factor for the automotive aftermarket, reaching a record 12.8 years. This aging trend directly benefits companies like Advance Auto Parts, as older vehicles typically require more frequent repairs and replacement parts. This creates sustained demand across both professional repair shops and individual consumers looking to maintain their vehicles.

Inflation continues to drive up the cost of vehicle maintenance and repairs. For instance, the Consumer Price Index for motor vehicle maintenance and parts saw a significant increase in late 2024, impacting consumers' discretionary spending on their vehicles.

This trend presents a dual effect for companies like Advance Auto Parts. On one hand, higher part costs could translate to increased revenue per sale. On the other, consumers facing these elevated repair expenses may delay non-essential maintenance or seek out more budget-friendly solutions, potentially affecting sales volume.

Consumer Spending and Disposable Income

Consumer spending and disposable income are critical drivers for Advance Auto Parts. When consumers have more money left after essential bills, they are more likely to invest in vehicle maintenance or upgrades, boosting sales for the company.

Economic headwinds can significantly impact this. For instance, during periods of high inflation and rising interest rates, consumers often tighten their belts, prioritizing necessities over discretionary purchases. This cautiousness can lead to delayed non-essential auto repairs or a preference for less expensive parts, directly affecting Advance Auto Parts' revenue streams.

Despite potential cutbacks on non-essential items, essential automotive maintenance and repairs often remain a priority. Even in uncertain economic times, consumers need their vehicles to function for work and daily life. This resilience in essential spending provides a baseline demand for Advance Auto Parts' products.

- Consumer spending on vehicles and parts: In the first quarter of 2024, consumer spending on motor vehicle and parts spending saw a modest increase, reflecting ongoing demand for essential automotive services.

- Disposable income trends: Real disposable personal income continued to show growth through early 2024, though at a pace that suggests consumers are still mindful of overall economic conditions.

- Impact of interest rates: Higher interest rates can increase the cost of financing vehicle purchases and repairs, potentially dampening consumer enthusiasm for larger auto-related expenditures.

- Essential vs. discretionary auto spending: Data from late 2023 and early 2024 indicates that consumers are more likely to defer non-critical aesthetic upgrades while continuing to prioritize necessary maintenance and safety-related repairs.

Impact of Electric Vehicle Adoption

The accelerating adoption of electric vehicles (EVs) is reshaping the automotive aftermarket. As EVs gain traction, their distinct maintenance needs and component requirements diverge significantly from traditional internal combustion engine (ICE) vehicles. This shift presents both challenges and opportunities for companies like Advance Auto Parts.

By 2025, it's projected that EVs will constitute a substantial portion of new vehicle sales, necessitating a strategic pivot in inventory and service offerings. For instance, the global EV market was valued at approximately $200 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, indicating a substantial long-term market transformation.

- EVs require specialized parts such as high-voltage batteries, electric motors, and advanced thermal management systems, differing from ICE components like exhaust systems and fuel injectors.

- Maintenance services for EVs focus on areas like battery diagnostics, software updates, and brake system regeneration, rather than traditional oil changes and engine tune-ups.

- New market opportunities are emerging in EV-specific diagnostics, battery repair and replacement services, and the supply chain for EV components.

- The transition impacts traditional parts suppliers by potentially decreasing demand for ICE-related parts while creating a need for investment in new technologies and training for EV maintenance.

Economic factors present a mixed bag for Advance Auto Parts. While the aging U.S. vehicle fleet, averaging 12.8 years, fuels demand for repairs, rising inflation, as seen in the CPI for motor vehicle maintenance and parts in late 2024, increases costs for consumers. This could lead to delayed non-essential repairs or a shift to cheaper parts, impacting sales volume despite potentially higher revenue per sale.

Consumer spending and disposable income remain crucial, with real disposable personal income showing growth in early 2024, though consumers remain cautious. Higher interest rates also pose a challenge, potentially discouraging larger auto expenditures. However, essential maintenance and safety-related repairs continue to be prioritized even amid economic uncertainty, providing a baseline of demand.

The shift towards electric vehicles (EVs) is a significant economic consideration, with the global EV market valued at around $200 billion in 2023 and projected for strong growth. This necessitates investment in new technologies and training for EV maintenance, impacting the demand for traditional internal combustion engine (ICE) parts.

| Economic Factor | 2024/2025 Impact | Data Point |

|---|---|---|

| Vehicle Fleet Age | Increased demand for repairs | Average U.S. vehicle age: 12.8 years |

| Inflation | Higher part costs, potential consumer pullback | CPI for motor vehicle maintenance and parts increased late 2024 |

| Consumer Spending/Disposable Income | Supports discretionary spending on vehicles | Real disposable personal income grew early 2024 |

| Interest Rates | May dampen larger auto expenditures | Higher rates increase financing costs |

| EV Adoption | Shift in parts and service demand | Global EV market valued at ~$200 billion in 2023 |

Full Version Awaits

Advance Auto Parts PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Advance Auto Parts PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market dynamics, competitive landscapes, and strategic considerations. The content and structure shown in the preview is the same document you’ll download after payment.

No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase, equipping you with a thorough understanding of the forces shaping Advance Auto Parts' business environment.

Sociological factors

Consumer preferences in the automotive aftermarket are evolving, creating a dynamic split between those who prefer to perform their own repairs (DIY) and those who opt for professional services (DIFM). The rise of online resources, like YouTube tutorials, has empowered more car owners to tackle basic maintenance and repairs themselves. For example, a 2024 survey indicated that over 60% of vehicle owners now research repair solutions online before making a decision.

However, the increasing complexity of modern vehicles, with advanced electronics and intricate engine systems, often pushes consumers towards professional repair. This trend is supported by data showing a steady increase in the average age of vehicles on the road, as older cars may require more specialized knowledge and tools. Advance Auto Parts must strategically balance its inventory and support for both DIY enthusiasts and those seeking DIFM solutions to capture market share.

Changes in how much people drive directly affect how quickly cars wear out, which in turn shapes the demand for car maintenance and replacement parts. More miles driven means more parts will need to be replaced sooner.

American drivers significantly increased their travel throughout 2024 and are expected to continue this trend into early 2025. This sustained increase in vehicle miles traveled (VMT) signals a robust and ongoing need for the products offered by companies like Advance Auto Parts.

The automotive repair sector is grappling with a significant shortage of skilled technicians, a trend exacerbated by an aging workforce. Many experienced mechanics are retiring, and fewer young people are entering the trade, creating a widening gap between demand and supply for certified professionals. This labor crunch directly affects the capacity and efficiency of auto repair shops.

This shortage translates into longer wait times for vehicle servicing and potentially higher labor costs for professional installers. Consequently, these businesses become even more reliant on reliable and prompt parts delivery from retailers like Advance Auto Parts to maintain their operational flow and customer satisfaction. In 2024, industry reports indicated a deficit of over 70,000 qualified automotive technicians in the United States alone.

Digital Literacy and Online Shopping Habits

Consumers are increasingly comfortable with technology, and this digital fluency directly impacts how they shop for automotive parts. In 2024, a significant portion of auto parts purchases are expected to occur online, with customers demanding comprehensive product details, a seamless checkout process, and prompt delivery. This trend means companies like Advance Auto Parts must invest heavily in their e-commerce platforms and supply chains to keep pace with evolving consumer preferences.

The growing preference for online shopping for auto parts is evident in market growth. For instance, the global automotive aftermarket e-commerce market was valued at approximately $25 billion in 2023 and is projected to grow substantially in the coming years, with a compound annual growth rate (CAGR) of around 7-8% expected through 2028. This highlights the critical need for Advance Auto Parts to enhance its digital presence and fulfillment capabilities.

- Digital Savvy Consumers: A growing segment of the population is highly proficient in using digital tools for research and purchasing.

- Online Preference for Auto Parts: Consumers are increasingly turning to online channels for convenience, selection, and competitive pricing when buying auto parts and accessories.

- E-commerce Imperative: Companies must offer robust online platforms with detailed product information, user-friendly interfaces, and efficient order processing.

- Logistics and Delivery Expectations: Fast and reliable shipping is a key factor in customer satisfaction and retention in the online auto parts market.

Trust and Transparency in Auto Repair

Consumer trust is a major hurdle in the automotive repair industry, with many individuals feeling apprehensive about pricing and the necessity of recommended services. A 2024 survey indicated that over 60% of car owners worry about being overcharged or sold unnecessary repairs. This sentiment directly impacts how businesses like Advance Auto Parts are perceived and patronized.

For Advance Auto Parts, building and maintaining trust is paramount. This involves not only offering high-quality parts but also actively supporting professional installers who demonstrably prioritize transparency and fair dealing with their customers. When consumers perceive a repair shop as honest and reliable, they are more likely to return and recommend it, influencing their choice of parts suppliers as well.

- Consumer Distrust: A significant segment of consumers harbors skepticism regarding the fairness of pricing and the quality of work at auto repair shops.

- Transparency is Key: Clear communication about costs, necessary repairs, and the quality of parts used is crucial for building customer confidence.

- Advance Auto Parts' Role: The company can enhance its market position by supporting and highlighting professional installers who demonstrate a commitment to transparency and customer satisfaction.

- Perceived Value: Ultimately, purchasing decisions are often swayed by a customer's perception of honesty and the overall value offered, not just the price of parts.

Consumer reliance on digital platforms for research and purchasing auto parts is a defining sociological trend. In 2024, over 60% of vehicle owners utilized online resources for repair solutions, indicating a strong shift towards e-commerce. This digital fluency necessitates robust online offerings from companies like Advance Auto Parts, including detailed product information and seamless checkout experiences.

The automotive aftermarket is experiencing a pronounced split between DIY enthusiasts and those opting for professional services (DIFM). While online tutorials empower DIYers, the increasing complexity of modern vehicles, with advanced electronics, favors professional repair. This is underscored by the rising average age of vehicles, often requiring specialized knowledge and tools, a trend expected to continue into 2025.

Consumer trust remains a critical factor, with many expressing skepticism about auto repair pricing and recommended services, as evidenced by a 2024 survey where over 60% of car owners feared overcharging. Advance Auto Parts can leverage this by supporting and highlighting professional installers who prioritize transparency, directly influencing customer loyalty and parts purchasing decisions.

Technological factors

The automotive aftermarket is rapidly shifting towards digital channels, with consumers increasingly favoring online purchases. Advance Auto Parts has strategically invested in its digital infrastructure, seeing significant growth in its e-commerce platform. This digital focus is essential for maintaining a competitive edge in the evolving market landscape.

In 2023, Advance Auto Parts reported that a substantial portion of its total parts orders were processed through its e-commerce channels, highlighting the growing importance of online sales. This digital expansion allows the company to reach a wider customer base and streamline the purchasing process, directly impacting revenue and market share.

The automotive aftermarket is rapidly evolving with the surge in electric vehicle (EV) adoption. This technological shift necessitates specialized parts, advanced diagnostic equipment, and sophisticated software capabilities for maintenance and repair. For instance, by the end of 2024, it's projected that over 3 million EVs will be on US roads, a significant increase from previous years, demanding a new suite of aftermarket solutions.

Advance Auto Parts needs to strategically adjust its inventory to include EV-specific components like battery cooling systems, electric motor parts, and charging equipment. Furthermore, the company must invest in training its workforce to handle the unique diagnostic procedures and repair techniques required for EVs, which differ substantially from internal combustion engine vehicles. This adaptation is crucial as EVs, while having fewer mechanical parts, require different expertise, particularly in areas like high-voltage systems and software integration.

The integration of artificial intelligence (AI) and advanced data analytics is revolutionizing the automotive aftermarket. These technologies offer practical solutions for real-time demand forecasting, leading to more efficient inventory management and data-driven decision-making. For Advance Auto Parts, this translates into a significant competitive advantage, enhancing both operational efficiency and profitability through precisely targeted product assortments and marketing campaigns.

Advanced Diagnostics and Telematics

Modern vehicles are packed with advanced driver-assistance systems (ADAS), telematics, and complex software for diagnostics. This means independent repair shops and even car owners need specialized information and tools to fix them. For parts providers like Advance Auto Parts, this drives a significant need for robust data access solutions.

The increasing complexity of vehicle technology directly impacts the aftermarket. For instance, ADAS calibration, a common requirement after repairs like windshield replacement, can cost anywhere from $150 to $1,000 or more, depending on the system and labor rates. This highlights the demand for accurate diagnostic data and specialized parts that Advance Auto Parts can supply.

- Technological Shift: Vehicles are becoming more like computers on wheels, demanding new repair approaches.

- Data Dependency: Independent repairers and DIYers rely on accurate, up-to-date technical information.

- Market Opportunity: Advance Auto Parts can capitalize by providing essential diagnostic tools and data services.

- Consumer Impact: Access to this information empowers consumers with more repair choices and transparency.

Supply Chain Automation and Optimization

Technological advancements are fundamentally reshaping the automotive aftermarket supply chain, with a strong emphasis on automation and real-time data analytics to optimize logistics. This modernization aims to create more efficient, responsive, and cost-effective operations.

Advance Auto Parts is actively investing in these areas, as evidenced by their ongoing efforts to streamline operations and expand last-mile delivery capabilities. For instance, by the end of fiscal year 2023, the company had made significant progress in optimizing its distribution network, leading to a projected improvement in delivery times for a substantial portion of their customer base.

- Automation in Warehousing: Implementing robotic process automation (RPA) for inventory management and order fulfillment to reduce manual errors and speed up processing.

- Real-time Visibility: Utilizing advanced tracking and telematics to provide live updates on inventory levels and shipment status, improving predictability.

- Optimized Logistics: Leveraging AI-powered route optimization software for delivery fleets, aiming to cut down on fuel costs and delivery lead times.

- Last-Mile Delivery Expansion: Forging new partnerships with third-party logistics (3PL) providers to extend delivery reach and offer faster fulfillment options, a strategy that saw a 15% increase in same-day delivery availability in key markets during 2024.

The increasing complexity of modern vehicles, particularly with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), presents a significant technological shift for the automotive aftermarket. By the close of 2024, it's estimated that over 3 million EVs will be operating on U.S. roads, each requiring specialized parts and diagnostic expertise distinct from traditional internal combustion engine vehicles. This trend necessitates substantial investment in new inventory, such as battery cooling systems and electric motor components, and a commitment to upskilling the workforce in areas like high-voltage system diagnostics and software integration. Advance Auto Parts' strategic focus on digital channels, with a substantial portion of parts orders processed online in 2023, further underscores the industry's move towards tech-enabled accessibility and sales.

| Technological Factor | Impact on Automotive Aftermarket | Advance Auto Parts' Response/Opportunity | Relevant Data/Projections |

| Electric Vehicle (EV) Adoption | Demand for specialized EV parts and expertise; shift from mechanical to electrical/software focus. | Need to expand EV-specific inventory (e.g., battery cooling systems) and invest in technician training for EV diagnostics. | Over 3 million EVs projected on U.S. roads by end of 2024. |

| Advanced Driver-Assistance Systems (ADAS) & Telematics | Increased vehicle complexity requiring specialized diagnostic tools and data access for repairs. | Opportunity to provide robust data solutions and calibration services, supporting independent repair shops. | ADAS calibration can range from $150 to $1,000+ per instance. |

| Digitalization & E-commerce | Growing consumer preference for online purchasing and digital service interactions. | Continued investment in e-commerce platform and digital infrastructure to reach a wider customer base. | Substantial portion of Advance Auto Parts' total parts orders processed via e-commerce in 2023. |

| Automation & Data Analytics | Optimization of supply chain, inventory management, and logistics through AI and automation. | Implementing RPA for warehousing, leveraging AI for route optimization, and expanding last-mile delivery capabilities. | 15% increase in same-day delivery availability in key markets during 2024. |

Legal factors

Right-to-Repair legislation, like the federal REPAIR Act and state-level SAFE Repair Act, is a significant legal factor for Advance Auto Parts. These laws mandate that manufacturers provide independent repair shops and vehicle owners with access to diagnostic tools, software, and repair information. This levels the playing field, preventing original equipment manufacturers (OEMs) from monopolizing vehicle servicing and parts sales.

This legal push ensures a more competitive aftermarket for parts and labor, directly benefiting Advance Auto Parts by supporting its customer base of independent repair shops. For instance, by 2024, an estimated 85% of vehicles on the road in the US will be equipped with advanced driver-assistance systems (ADAS), requiring specialized diagnostic tools and data that right-to-repair laws aim to make accessible.

Advance Auto Parts navigates a complex web of automotive emissions and environmental regulations, primarily driven by agencies like the Environmental Protection Agency (EPA). These rules directly impact the product catalog, influencing the types of parts and fluids the company can offer to consumers and repair shops. For instance, stringent standards on volatile organic compounds (VOCs) in automotive paints and coatings, or mandates for specific refrigerant types in air conditioning systems, necessitate careful product selection and sourcing.

The company must ensure its extensive product lines, from engine components to maintenance fluids, comply with evolving environmental mandates. This includes adhering to fuel efficiency standards and emissions control requirements that shape vehicle design and, consequently, the aftermarket parts needed for repairs and maintenance. Failure to comply can result in significant fines and reputational damage, making proactive adaptation crucial for business continuity and market positioning.

Looking ahead, the push towards electric vehicles (EVs) presents both challenges and opportunities. As the automotive landscape shifts, Advance Auto Parts will need to adapt its inventory and services to support EV maintenance and repair, while continuing to meet the environmental compliance needs of the existing internal combustion engine (ICE) vehicle fleet. The EPA's ongoing efforts to strengthen emissions standards for new vehicles, for example, signal a continued regulatory focus that will ripple through the aftermarket sector.

Advance Auto Parts operates within a stringent legal framework mandating adherence to product safety and quality regulations for all automotive replacement parts and accessories. This includes compliance with standards set by bodies like the National Highway Traffic Safety Administration (NHTSA) and various state-specific consumer protection laws. For instance, in 2024, the automotive aftermarket industry continued to see increased scrutiny on the safety and performance of components, impacting everything from brake pads to engine parts.

Failure to meet these rigorous standards can result in significant legal repercussions, including substantial fines, product recalls, and damage to brand reputation. In 2025, regulatory bodies are expected to further emphasize supply chain transparency and product traceability, making it imperative for Advance Auto Parts to maintain robust quality control and compliance processes throughout its operations to safeguard consumer trust and avoid costly litigation.

Consumer Protection Laws

Consumer protection laws are a critical legal factor for Advance Auto Parts, dictating how they interact with customers. These regulations cover everything from the accuracy of product descriptions and pricing to the fairness of warranties and how customer data is handled. Ensuring compliance means Advance Auto Parts must maintain transparency and have robust systems for resolving customer complaints. For instance, in 2023, the Federal Trade Commission (FTC) continued to emphasize data privacy and security, with potential fines for non-compliance impacting businesses across sectors.

Adherence to these laws directly impacts customer trust and loyalty. Advance Auto Parts needs to be particularly mindful of:

- Truthful Advertising: Ensuring all product claims and advertised prices are accurate and not misleading to consumers.

- Data Privacy: Complying with regulations like the California Consumer Privacy Act (CCPA) and similar state-level laws regarding the collection and use of customer information.

- Warranty Enforcement: Clearly outlining warranty terms and honoring them as promised to build customer confidence.

- Fair Trade Practices: Avoiding deceptive or unfair business practices that could harm consumers or create an uneven playing field.

Labor Laws and Employment Regulations

As a significant employer, Advance Auto Parts must navigate a complex web of federal, state, and local labor laws. These regulations dictate crucial aspects of its operations, including minimum wage standards, workplace safety protocols, and non-discrimination policies. For instance, the federal minimum wage remains at $7.25 per hour, though many states and cities have established higher rates, impacting Advance Auto Parts' payroll expenses across its numerous locations.

Adherence to these legal frameworks directly influences Advance Auto Parts' operational costs and its approach to human resource management. Ensuring compliance with worker safety regulations, such as those enforced by the Occupational Safety and Health Administration (OSHA), is paramount to preventing accidents and potential litigation. In 2023, OSHA reported that workplace injuries and illnesses cost employers billions annually, highlighting the financial imperative of robust safety programs.

- Minimum Wage Compliance: Advance Auto Parts must track and comply with varying federal, state, and local minimum wage laws, which can significantly impact labor costs, especially in regions with higher mandated rates.

- Worker Safety Regulations: Adherence to OSHA standards and other safety legislation is critical to preventing workplace accidents, reducing insurance premiums, and avoiding substantial fines.

- Non-Discrimination Laws: Compliance with equal employment opportunity laws ensures fair hiring and promotion practices, mitigating legal risks and fostering a diverse workforce.

The automotive industry faces evolving regulations concerning vehicle repair accessibility and environmental impact. Legislation like the REPAIR Act and state-level initiatives aim to ensure independent repair shops and consumers have access to necessary diagnostic tools and information, fostering a more competitive aftermarket. Advance Auto Parts benefits from this by supporting its independent repair shop customer base, especially as complex vehicle systems like ADAS become more prevalent, with an estimated 85% of US vehicles featuring them by 2024.

Environmental regulations, particularly from the EPA, directly influence Advance Auto Parts' product offerings, impacting everything from automotive fluids to parts that must meet emissions and fuel efficiency standards. The company must also adapt to the growing electric vehicle market and stricter emissions controls for traditional vehicles, as highlighted by the EPA's ongoing efforts to strengthen standards.

Product safety and consumer protection laws are paramount, with bodies like NHTSA setting standards for automotive replacement parts. In 2024, increased scrutiny on component safety affects the entire aftermarket. Furthermore, consumer protection laws dictate transparent advertising, data privacy, and fair trade practices, with the FTC’s focus on data security in 2023 underscoring the need for robust compliance to maintain customer trust.

Labor laws, including minimum wage and workplace safety (OSHA), significantly impact operational costs and HR management. With many states and cities having higher minimum wages than the federal $7.25, Advance Auto Parts faces varied payroll expenses. Adhering to safety regulations is crucial, as workplace injuries cost billions annually, making robust safety programs a financial imperative.

Environmental factors

Advance Auto Parts is actively working to shrink its environmental impact, focusing on reducing energy use and evaluating its Scope 3 emissions, which represent indirect emissions from its entire value chain. This commitment aligns with widespread industry goals and government mandates aimed at tackling climate change and fostering more sustainable business practices.

The automotive industry is increasingly prioritizing sustainability, pushing companies like Advance Auto Parts to embed eco-friendly practices across their entire supply chain. This includes everything from how parts are made to how they reach customers.

Advance Auto Parts is actively working on making its logistics greener. By optimizing delivery routes and managing its vehicle fleet more efficiently, the company aims to cut down on its environmental footprint while simultaneously boosting operational performance. For instance, in 2024, many logistics companies reported significant fuel savings and emissions reductions by implementing advanced route optimization software, a trend Advance Auto Parts is likely following.

The growing environmental awareness and global efforts to curb greenhouse gas emissions are fueling a significant increase in electric vehicle (EV) adoption. By the end of 2023, global EV sales surpassed 13 million units, a substantial leap from previous years, highlighting a clear market shift.

The automotive aftermarket is integral to this evolving EV landscape. Companies are increasingly offering environmentally friendly products and are actively developing sophisticated recycling solutions for critical EV components, particularly the high-voltage batteries. This focus on sustainability is not just a trend but a necessity as the EV fleet expands.

Waste Management and Resource Efficiency

Advance Auto Parts faces environmental scrutiny regarding waste management and resource efficiency, particularly concerning automotive parts and fluids. The company's sustainability initiatives focus on reducing waste and optimizing resource use throughout its extensive retail and distribution network.

The company's environmental sustainability program is designed to conserve energy and promote recycling. For instance, in 2023, Advance Auto Parts reported progress in its waste reduction efforts, aiming to divert a significant portion of operational waste from landfills through enhanced recycling programs for materials like cardboard, plastic, and scrap metal.

- Energy Conservation: Efforts include optimizing lighting and HVAC systems in stores and distribution centers to reduce electricity consumption.

- Recycling Programs: Implementation of comprehensive recycling for packaging materials, batteries, and other automotive components.

- Hazardous Waste Management: Strict protocols for the safe handling and disposal of hazardous materials like used oils and chemicals.

- Resource Efficiency: Focus on reducing water usage and promoting the use of recycled content in packaging and operational supplies.

Renewable Energy Adoption

Advance Auto Parts is actively integrating renewable energy into its operations, aiming to shrink its environmental impact. This strategic shift is not only about sustainability but also about long-term financial prudence, as optimizing energy procurement can lead to reduced operational expenses.

The company's commitment to renewable energy aligns with broader industry trends and consumer demand for environmentally conscious businesses. For instance, by 2024, the U.S. renewable energy sector saw significant growth, with solar and wind power continuing to expand their market share, making such investments increasingly viable.

- Renewable Energy Integration: Advance Auto Parts is increasing its use of renewable energy sources to power its facilities.

- Cost Optimization: The company is optimizing energy procurement strategies to reduce long-term operational costs.

- Sustainability Goals: These initiatives directly support Advance Auto Parts' broader environmental, social, and governance (ESG) objectives.

- Carbon Footprint Reduction: Investing in renewables is a key strategy for lowering the company's overall carbon footprint.

Environmental factors significantly influence Advance Auto Parts' operations, from waste management to energy consumption. The company is actively pursuing greener logistics, optimizing routes and fleets to reduce emissions. By 2024, efficient logistics were a key focus for many companies, leading to notable fuel savings.

The automotive aftermarket is adapting to the rise of electric vehicles, with a growing emphasis on sustainable products and battery recycling. Global EV sales surpassed 13 million units by the end of 2023, indicating a major market shift. Advance Auto Parts is addressing waste and resource efficiency, particularly with automotive parts and fluids, aiming to divert more waste from landfills through enhanced recycling programs.

Advance Auto Parts is also integrating renewable energy to lower its environmental impact and operational costs, aligning with the growth seen in the U.S. renewable energy sector by 2024. These efforts support the company's ESG goals and carbon footprint reduction strategies.

| Sustainability Initiative | Focus Area | Impact | 2023/2024 Data Point |

|---|---|---|---|

| Logistics Optimization | Route Planning & Fleet Efficiency | Reduced Fuel Consumption & Emissions | Reported fuel savings and emissions reductions by logistics companies using advanced software. |

| Waste Management | Recycling Programs | Reduced Landfill Waste | Progress reported in diverting operational waste through enhanced recycling. |

| Renewable Energy | Energy Procurement | Lower Operational Costs & Carbon Footprint | Increased viability of solar and wind power investments in the U.S. |

| EV Aftermarket | Sustainable Products & Battery Recycling | Market Adaptation & Environmental Responsibility | Global EV sales exceeded 13 million units by end of 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Advance Auto Parts is built on a robust foundation of data from government agencies, reputable industry associations, and leading market research firms. We meticulously gather information on regulatory changes, economic indicators, technological advancements, and social trends to ensure comprehensive insights.