Advance Auto Parts Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advance Auto Parts Bundle

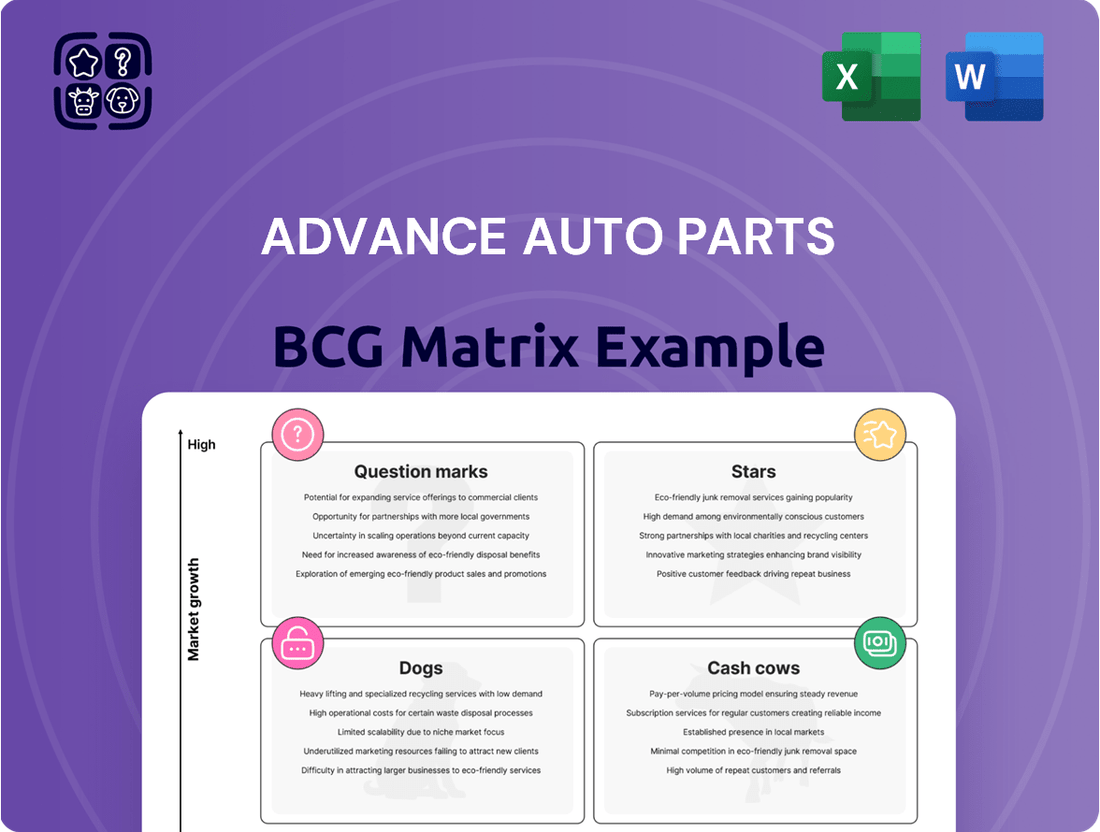

Curious about Advance Auto Parts' strategic positioning? Our BCG Matrix analysis reveals which of their product lines are market leaders (Stars), consistent revenue generators (Cash Cows), underperforming assets (Dogs), or potential growth opportunities (Question Marks).

This initial glimpse is just the tip of the iceberg. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Advance Auto Parts.

Don't miss out on the complete picture; gain a clear view of where Advance Auto Parts' products stand and unlock actionable insights to drive your own business strategy forward.

Stars

Advance Auto Parts is heavily investing in its e-commerce platforms, recognizing them as a critical driver for future revenue. Online sales are outperforming traditional brick-and-mortar channels, attracting a broad customer base. This strategic push into digital is a clear indicator of the company's ambition to capture a larger share of the rapidly expanding online automotive aftermarket. For example, in the first quarter of 2024, Advance Auto Parts reported a significant uptick in digital sales, contributing to overall revenue growth.

Advance Auto Parts is strategically investing in larger 'market hub' stores, with a significant rollout planned. The company intends to open 30 new U.S. locations in 2025, followed by an additional 100 by 2027. This expansion is a key component of their strategy to enhance market presence.

These new hubs are designed to dramatically increase parts availability, aiming to stock between 75,000 and 85,000 Stock Keeping Units (SKUs). This increased inventory will be positioned closer to customers and existing Advance stores, facilitating quicker access to a wider range of products.

The core objective of this initiative is to improve service speed, particularly through same-day delivery. By concentrating inventory in these strategic hubs, Advance Auto Parts aims to capture a larger market share in key communities where they already have a strong foothold, thereby boosting efficiency and customer satisfaction.

Advance Auto Parts is actively cultivating its Professional (PRO) customer segment as a core component of its blended-box strategy. This focus is yielding tangible results, with the company reporting consistent U.S. PRO comparable sales growth, demonstrating effective engagement with this vital customer group.

The company's commitment to this segment is underscored by significant investments in supply chain enhancements and improved service offerings specifically tailored for PRO customers. These initiatives aim to capture a larger share of a market characterized by higher-value transactions and strong potential for repeat business, solidifying Advance Auto Parts' position as a preferred partner for professional installers.

High-Demand Performance and Specialty Parts

The market for performance and specialty parts is booming, driven by an aging vehicle fleet and a consumer preference for upgrades over new car purchases. This trend is particularly strong in 2024, with segments like suspension, exhaust, and engine control experiencing notable growth. Advance Auto Parts can leverage this by broadening its product lines in these high-demand areas.

This strategic focus on performance and specialty parts allows Advance Auto Parts to tap into a niche but highly profitable market. These parts often command higher margins compared to standard replacement parts, appealing to a dedicated customer base that values vehicle enhancement and personalization.

- Sustained Demand: An aging vehicle population (average age of vehicles on U.S. roads reached a record 12.5 years in 2022, a trend continuing into 2024) fuels demand for parts that maintain or enhance vehicle performance.

- Consumer Trends: Consumers are increasingly investing in vehicle customization and upgrades, rather than purchasing new vehicles, boosting the specialty parts segment.

- Growth Areas: Key growth categories in 2024 for Advance Auto Parts include suspension, exhaust systems, and engine control components.

- Profitability: This segment offers higher profit margins, driven by specialized product offerings and a dedicated customer base willing to pay a premium for performance and customization.

Supply Chain Optimization for Faster Delivery

Advance Auto Parts' strategic plan heavily emphasizes supply chain optimization to achieve faster delivery. This includes consolidating its distribution center network and implementing strategic sourcing initiatives. The goal is to significantly reduce the time it takes to get parts to market, thereby improving overall availability and service speed.

A key objective of this optimization is to enable same-day delivery for an expanded selection of parts. This enhanced speed and availability are critical for capturing market share, especially within the professional installer segment. For these customers, rapid access to necessary components directly impacts their own operational efficiency and profitability.

- Distribution Center Consolidation: In 2023, Advance Auto Parts continued its efforts to streamline its distribution network, aiming to reduce operational costs and improve delivery times.

- Strategic Sourcing: The company is focusing on building stronger relationships with key suppliers to ensure a consistent and timely flow of inventory.

- Same-Day Delivery Expansion: The initiative aims to increase the number of markets and parts available for same-day delivery, a key differentiator in the automotive aftermarket.

- Impact on Professional Segment: Faster delivery directly addresses the needs of professional installers, where downtime due to part unavailability can be very costly.

The performance and specialty parts segment represents a significant growth opportunity for Advance Auto Parts. With the average age of vehicles on U.S. roads reaching a record 12.5 years in 2022 and continuing this trend into 2024, demand for parts that maintain or enhance vehicle performance is robust. Consumers are increasingly opting for vehicle upgrades over new car purchases, a trend that directly benefits this niche market. Advance Auto Parts is well-positioned to capitalize on this by expanding its offerings in high-demand areas like suspension, exhaust systems, and engine control components, which are experiencing notable growth in 2024.

| Category | Growth Drivers | Advance Auto Parts' Strategy |

| Performance & Specialty Parts | Aging vehicle fleet (avg. 12.5 years in 2022, continuing trend) | Broaden product lines in suspension, exhaust, engine control |

| Consumer preference for upgrades over new vehicles | Tap into profitable niche market with higher margins | |

| Key growth areas in 2024: suspension, exhaust, engine control | Cater to dedicated customer base valuing customization |

What is included in the product

This BCG Matrix analysis categorizes Advance Auto Parts' business units, detailing strategic recommendations for Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Advance Auto Parts' portfolio, easing strategic decisions by highlighting high-growth, high-share Stars and cash-generating Cash Cows.

Cash Cows

Traditional internal combustion engine (ICE) wear-and-tear parts remain a significant cash cow for Advance Auto Parts. Despite the growing EV market, ICE vehicles still make up the vast majority of the global automotive fleet, and their average age is increasing, leading to sustained demand for routine maintenance items. For instance, in 2024, it's estimated that over 90% of vehicles on the road globally are still ICE-powered, and the average age of vehicles in the US surpassed 12 years, a trend continuing from previous years.

These components, like brake pads, oil filters, and spark plugs, represent a mature market where Advance Auto Parts holds a strong market share. This allows the company to generate consistent and substantial cash flow with minimal need for heavy investment in marketing or product innovation, as the demand is largely predictable and driven by the existing vehicle parc.

Advance Auto Parts boasts an extensive store network, with over 75% of its locations strategically placed in markets where it ranks as the number one or two player by store density. This strong physical presence ensures consistent customer access and a stable revenue stream, especially for immediate automotive needs.

This established footprint in mature, high-density markets acts as a significant cash generator for Advance Auto Parts. The company's ability to capture substantial market share in these areas translates directly into reliable cash flow, solidifying its position as a cash cow within its portfolio.

The DIY auto maintenance market continues to show strength, with consumers increasingly opting for self-service to save money and foster independence. This trend is particularly noticeable among younger car owners.

Advance Auto Parts' foundational DIY product lines, including essential replacement parts and routine maintenance supplies, are well-positioned to capitalize on this steady demand. These items represent a significant portion of the company's market share within the DIY sector.

These core products are reliable cash generators for Advance Auto Parts, thanks to their consistent need and relatively short repurchase cycles. For instance, in 2024, the automotive aftermarket industry, which heavily includes DIY, was projected to reach over $490 billion globally, underscoring the enduring consumer commitment to vehicle upkeep.

Basic Automotive Fluids and Chemicals

Basic automotive fluids and chemicals, such as motor oil, coolants, and transmission fluids, represent a core "Cash Cow" for Advance Auto Parts. These are fundamental to vehicle maintenance and see consistent demand across all vehicle types and ages. Advance Auto Parts enjoys a robust market share in these essential, albeit low-growth, product segments.

Their status as Cash Cows stems from their high sales volume and the fact that they require relatively low investment in marketing. This consistent demand ensures a stable revenue stream and healthy profit margins, making them a reliable contributor to the company's overall financial health.

- High Demand: Products like motor oil and coolant are necessities for all vehicle owners, driving consistent sales.

- Low Growth Market: While essential, the market for basic fluids is mature, with growth tied mainly to vehicle parc expansion.

- Profitability: Advance Auto Parts' strong market position allows for stable profit margins on these high-volume items.

- Minimal Investment: Due to their essential nature, these products generate revenue with less need for extensive promotional spending.

Batteries and Essential Electrical Components

Batteries and essential electrical components like spark plugs and alternators are critical for vehicle operation and experience consistent demand. Advance Auto Parts holds a strong position in these mature market segments.

These non-discretionary items, essential for keeping vehicles running, contribute significantly to Advance Auto Parts' revenue. In 2024, the automotive aftermarket continued to show resilience, with battery replacement remaining a core service need.

- High Replacement Frequency: Automotive batteries are replaced every 3-5 years on average, creating a predictable demand.

- Climate Influence: Extreme temperatures, both hot and cold, accelerate battery degradation, boosting replacement sales, particularly in regions like the Sun Belt and Northern states.

- Stable Revenue: Advance Auto Parts' substantial market share in batteries and electrical components ensures a reliable and consistent cash flow, underpinning its Cash Cow status.

Advance Auto Parts' established product lines, particularly those related to traditional internal combustion engine (ICE) vehicles, function as its primary Cash Cows. These items, such as oil filters, brake pads, and basic maintenance fluids, benefit from the enduring prevalence of ICE vehicles, which still constitute the vast majority of the global fleet. The increasing average age of vehicles, exceeding 12 years in the US by 2024, further fuels consistent demand for these wear-and-tear parts.

The company's strong market share in these mature segments, coupled with its extensive store network where it holds a top-two position in most markets, ensures a steady and predictable revenue stream. This allows Advance Auto Parts to generate substantial cash flow with minimal incremental investment, solidifying these products as reliable profit drivers.

The DIY auto maintenance sector also contributes significantly to the Cash Cow portfolio. Core DIY products, including essential replacement parts and routine maintenance supplies, continue to see robust consumer demand as individuals opt for self-service. The global automotive aftermarket industry, projected to exceed $490 billion in 2024, highlights the sustained consumer commitment to vehicle upkeep, with Advance Auto Parts well-positioned to capture this market.

| Product Category | Market Characteristic | Advance Auto Parts Position | Cash Flow Contribution |

| ICE Wear-and-Tear Parts | Mature, High Demand (Avg. vehicle age >12 years in US) | Strong Market Share, Extensive Store Network | High, Stable |

| Basic Fluids & Chemicals | Essential, Consistent Demand (Global aftermarket >$490B in 2024) | Robust Market Share | High, Stable |

| Batteries & Electrical Components | Non-Discretionary, Predictable Replacement (3-5 year cycle) | Substantial Market Share | High, Stable |

Preview = Final Product

Advance Auto Parts BCG Matrix

The Advance Auto Parts BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after your purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and actionable document ready for immediate use in your business planning.

Dogs

Underperforming physical store locations represent the "Dogs" in Advance Auto Parts' strategic assessment. The company's announcement to close over 700 locations, with more than 500 of those being corporate stores by mid-2025, directly addresses these underperformers. These closures signal a clear divestiture of assets that were likely situated in markets with limited growth potential or held a weak competitive position, thereby failing to deliver adequate returns.

These underperforming stores acted as cash traps, immobilizing capital that could be better deployed elsewhere in the business. By shedding these locations, Advance Auto Parts aims to improve its overall financial health and focus resources on more promising avenues for growth and profitability, aligning with their broader strategic transformation.

Advance Auto Parts' decision to sell its Worldpac wholesale distribution business for approximately $1.5 billion in late 2024 strongly indicates Worldpac's status as a 'Dog' in its BCG Matrix. This divestiture highlights that Worldpac was viewed as a non-core asset, not fitting with Advance Auto Parts' strategic pivot towards its 'blended-box' model.

While Worldpac may have generated revenue, its classification as a Dog suggests it possessed lower strategic growth potential or a less dominant market position within Advance Auto Parts' overall business. This aligns with the typical characteristics of a Dog in the BCG Matrix, which often represents businesses with low market share in low-growth industries.

Legacy inventory for obsolete vehicle models often falls into the Dogs category for Advance Auto Parts. As vehicles age, the demand for their specific parts dwindles, leading to low market share for these items. For instance, parts for models produced before 2010 might see a significant drop in sales volume, impacting their profitability.

Holding onto these slow-moving, obsolete parts ties up crucial warehouse space and capital that could be better utilized. In 2024, the cost of inventory carrying for automotive parts can range from 15% to 30% of the inventory's value annually, making these 'Dogs' a financial drain.

The potential for infrequent sales rarely justifies the holding costs, pushing these items towards clearance sales or outright write-offs to recover some capital and free up resources.

Declining Mobile Electronics Category

The market for standalone mobile electronics, like GPS devices and car stereos, has shrunk as new cars now come with these features built-in. For Advance Auto Parts, this means the demand for these specific items is low and likely shrinking further.

This category is a classic example of a 'Dog' in the BCG Matrix. Continued investment here wouldn't make sense, as the returns are expected to be minimal. Advance Auto Parts should consider reducing its focus on these products.

- Market Decline: The global market for automotive aftermarket infotainment systems, which includes navigation and audio, has seen a slowdown, with some segments contracting.

- Vehicle Integration: Over 80% of new vehicles sold in 2024 now offer integrated navigation systems as standard or optional equipment, reducing the need for aftermarket solutions.

- Low Growth Potential: This segment represents a low-growth area for Advance Auto Parts, with sales in this specific category potentially declining year-over-year.

- Strategic Review: Advance Auto Parts should evaluate its inventory and marketing efforts for these declining mobile electronics to optimize resource allocation.

Parts for Significantly Declining Vehicle Segments

Parts for declining vehicle segments, such as sedans and coupes, represent a potential 'Dog' category for Advance Auto Parts within the BCG Matrix. These segments are seeing reduced consumer interest, with a notable shift towards SUVs and trucks. For instance, in 2023, the market share of sedans in new vehicle sales continued its downward trend, while SUV sales saw continued growth.

Advance Auto Parts' market share in parts for these specific, shrinking segments might be low, further solidifying their 'Dog' status. Demand for these components is expected to keep falling, presenting minimal opportunities for expansion. Effective inventory management is crucial to prevent these parts from becoming costly burdens.

- Declining Segments: Sedans and coupes are experiencing a significant drop in popularity and sales volume.

- Market Share: Advance Auto Parts may hold a minor position in supplying parts for these less popular vehicle types.

- Growth Prospects: The future outlook for these parts is dim, with continued decreases in demand anticipated.

- Cash Trap Risk: Without careful inventory control, these parts could tie up capital with little return.

Underperforming physical store locations are the 'Dogs' for Advance Auto Parts, with over 700 closures planned by mid-2025. These represent assets in low-growth markets or with weak competitive positions, failing to generate adequate returns.

The sale of the Worldpac wholesale distribution business in late 2024 for approximately $1.5 billion also signals its 'Dog' status, indicating it was a non-core asset not aligning with the company's strategic pivot.

Legacy inventory for obsolete vehicle models, such as parts for models produced before 2010, are also 'Dogs'. Holding these slow-moving parts ties up capital, with inventory carrying costs potentially reaching 15-30% annually.

Standalone mobile electronics like GPS devices, with over 80% of new vehicles in 2024 offering integrated systems, are another 'Dog' category. Advance Auto Parts should reduce focus on these declining products.

| Category | Description | Strategic Implication | Example Data Point |

| Underperforming Stores | Physical locations with low sales and profitability. | Divestiture and closure to free up capital. | Over 500 corporate stores to close by mid-2025. |

| Worldpac Wholesale | Wholesale distribution business. | Sale to focus on core retail strategy. | Sold for approximately $1.5 billion (late 2024). |

| Obsolete Inventory | Parts for older vehicle models with low demand. | Inventory reduction and clearance. | Inventory carrying costs can be 15-30% annually. |

| Standalone Mobile Electronics | Aftermarket GPS, car stereos. | Reduced focus and inventory optimization. | Over 80% of new vehicles in 2024 have integrated systems. |

Question Marks

The electric vehicle (EV) aftermarket is a burgeoning area, with projections indicating substantial growth. From 2025 through 2033/2034, this sector is expected to see compound annual growth rates (CAGRs) between 14.5% and over 20%. Despite this impressive growth trajectory, EVs currently constitute a modest 4% of the total automotive aftermarket.

For Advance Auto Parts, the EV aftermarket is categorized as a Question Mark within the BCG Matrix. This classification stems from the significant capital required for investment in specialized EV parts inventory, technician training programs, and necessary charging infrastructure. The potential for market share capture is high, but the return on these substantial investments remains uncertain, necessitating careful strategic consideration.

The automotive aftermarket is witnessing a surge in demand for Advanced Driver-Assistance Systems (ADAS) components, a trend fueled by increasing vehicle integration of these safety features and evolving regulations. This burgeoning sector represents a significant growth opportunity, driven by ongoing technological innovation and a heightened focus on vehicle safety. For instance, the global ADAS market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a compound annual growth rate exceeding 15%.

However, Advance Auto Parts may face challenges in capturing substantial market share within this specialized segment. The complexity of ADAS components, often requiring specific diagnostic tools and deep technical expertise, along with the prevalent control of these parts by original equipment manufacturers (OEMs), necessitates considerable investment. This includes building up specialized technician training, acquiring advanced diagnostic equipment, and managing a precise inventory of highly technical parts to effectively compete and capitalize on this expanding market.

Modern vehicles, especially electric vehicles (EVs) and those packed with advanced electronics, demand specialized diagnostic and repair tools. These are a far cry from the traditional equipment mechanics have used for years. Think of complex software interfaces and specific hardware for battery diagnostics or advanced driver-assistance systems (ADAS) calibration.

The market for these specialized tools is expanding rapidly, mirroring the growth of new vehicle technologies. However, Advance Auto Parts might currently hold a relatively small slice of this niche market. While the overall aftermarket is robust, this specialized segment requires a different approach and product offering.

To stay competitive in servicing newer vehicles, significant investment is crucial. This means equipping both their own stores and their professional customers with these often high-cost, cutting-edge tools. For instance, a comprehensive EV diagnostic system can easily cost tens of thousands of dollars, a substantial outlay for any auto parts retailer aiming to serve this evolving segment.

Connected Car Service Offerings

The connected car revolution, driven by telematics and advanced software, presents a significant opportunity for aftermarket service providers like Advance Auto Parts. This evolving landscape focuses on digital enhancements, data-driven diagnostics, and over-the-air software updates, creating new revenue streams beyond traditional parts sales.

While the market for these digital services is experiencing rapid growth, current penetration among traditional aftermarket retailers remains low. This presents a strategic imperative for Advance Auto Parts to actively explore and invest in developing or partnering for these digital service offerings to secure a foothold in this burgeoning segment.

- Market Growth: The global connected car market was valued at approximately $23.5 billion in 2023 and is projected to reach over $100 billion by 2030, indicating substantial growth potential.

- Service Opportunities: Key service areas include predictive maintenance alerts, remote diagnostics, in-car infotainment upgrades, and personalized driving experience enhancements.

- Investment Needs: Capturing this market requires investment in software development capabilities, data analytics infrastructure, and strategic partnerships with technology providers.

- Competitive Landscape: Traditional players face competition from tech companies and specialized automotive software firms entering the aftermarket space.

Expansion into New, Specialized Service Offerings

Advance Auto Parts can consider expanding into specialized services beyond traditional parts sales, tapping into the growing demand for expertise in areas like electric vehicle (EV) battery diagnostics and Advanced Driver-Assistance Systems (ADAS) calibration. This strategic move aligns with the evolving automotive aftermarket, which increasingly requires specialized technical skills for complex vehicle systems and emerging technologies.

Leveraging its existing PRO installer network, Advance Auto Parts could offer these advanced services. For instance, the company might invest in training and equipment to support EV battery health checks or ADAS recalibration, areas experiencing significant growth. This diversification positions Advance Auto Parts to capture a larger share of the aftermarket revenue stream.

- EV Battery Diagnostics: The global EV battery diagnostics market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years, reaching billions in value by 2030.

- ADAS Calibration: The ADAS market itself is expanding rapidly, and the need for recalibration services after windshield replacements or sensor repairs is a direct consequence, creating a substantial service opportunity.

- PRO Installer Network: Advance Auto Parts’ existing network of professional installers provides a ready-made channel to introduce and deliver these specialized services, potentially reducing the initial investment and time to market.

The EV aftermarket, despite its rapid expansion, represents a significant investment for Advance Auto Parts. The company faces a strategic dilemma: invest heavily in specialized EV parts, training, and infrastructure for uncertain returns, or risk falling behind in a high-growth sector. This positions the EV aftermarket as a classic Question Mark in the BCG Matrix, demanding careful consideration of capital allocation and market penetration strategies.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.