Advance Auto Parts Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advance Auto Parts Bundle

Advance Auto Parts navigates a complex automotive aftermarket landscape, where intense rivalry and the threat of substitutes significantly shape its competitive environment. Understanding the subtle interplay of buyer power and supplier leverage is crucial for strategic positioning.

The complete report reveals the real forces shaping Advance Auto Parts’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in the automotive aftermarket. If a few major suppliers control essential components, they gain considerable leverage over retailers like Advance Auto Parts. This can lead to pressure on pricing and supply terms, impacting Advance Auto Parts' profitability and operational efficiency.

Switching costs represent the financial and operational hurdles Advance Auto Parts (AAP) would encounter if it needed to change its suppliers. These can range from the expense of retooling manufacturing equipment to the time and resources required for re-certifying new parts and renegotiating complex supply agreements.

For AAP, significant switching costs would empower its suppliers. For instance, if a supplier provides highly specialized components that require unique manufacturing processes, finding an alternative supplier capable of meeting those exact specifications could be both costly and time-consuming. This dependency makes it harder for AAP to switch, even if current terms become less favorable.

In 2024, the automotive aftermarket industry, where AAP operates, continues to grapple with supply chain complexities. The increasing integration of advanced technologies in vehicles means that suppliers of specialized electronic components or advanced materials can command greater leverage due to the high investment required for AAP to qualify and integrate alternative sources, potentially increasing switching costs.

The uniqueness of supplier offerings significantly impacts Advance Auto Parts' bargaining power. If a supplier provides highly specialized or proprietary parts essential for specific vehicle makes or complex repairs, they can command higher prices. For instance, if a particular European luxury car model relies on a unique filtration system only available from one manufacturer, that supplier holds considerable sway.

Conversely, when parts are standardized and easily sourced from numerous vendors, Advance Auto Parts benefits from greater negotiation leverage. In 2024, the automotive aftermarket saw continued consolidation among some component manufacturers, but a vast array of common parts like oil filters, brake pads, and spark plugs remain widely available from multiple competing suppliers, diluting individual supplier power.

Threat of Forward Integration by Suppliers

Suppliers to Advance Auto Parts could threaten its market position by integrating forward into direct sales. This means they might begin selling auto parts directly to professional installers or even do-it-yourself (DIY) customers, effectively cutting out retailers like Advance Auto Parts.

This move would directly challenge Advance Auto Parts' core business model, which relies on distributing parts through its retail network. By bypassing the retailer, suppliers could capture a larger share of the profit margin and gain more control over pricing and customer relationships.

For instance, if a major tire manufacturer or a large automotive component supplier were to establish its own direct-to-consumer sales channels, it could siphon off significant sales volume from Advance Auto Parts. This would not only reduce Advance Auto Parts' revenue but also strengthen the bargaining power of those suppliers who successfully implement such strategies.

- Direct Competition: Suppliers entering the retail space directly compete with Advance Auto Parts.

- Margin Erosion: Forward integration by suppliers can reduce Advance Auto Parts' profit margins.

- Customer Relationship Shift: Suppliers could gain direct access to and loyalty from end customers.

Importance of Advance Auto Parts to Suppliers

Advance Auto Parts' substantial size and consistent purchasing volume can significantly influence the bargaining power it holds over its suppliers. For instance, if a particular supplier relies heavily on Advance Auto Parts for a large percentage of its revenue, that supplier might be more inclined to negotiate favorable pricing or terms to secure continued business, thereby diminishing their own leverage.

In 2023, Advance Auto Parts reported net sales of approximately $11.0 billion. This scale means that for many automotive parts manufacturers, Advance Auto Parts represents a critical customer. The company's ability to place large orders can give it considerable sway in negotiations.

- Significant Customer Base: Advance Auto Parts serves a vast network of customers, enabling large-scale procurement from suppliers.

- Purchasing Volume: The sheer volume of parts Advance Auto Parts buys can make it a key client for many suppliers.

- Negotiating Leverage: A supplier's dependence on Advance Auto Parts' business can reduce the supplier's ability to dictate terms.

The bargaining power of suppliers for Advance Auto Parts (AAP) is influenced by several factors, including supplier concentration and the uniqueness of their offerings. In 2024, the automotive aftermarket continues to see consolidation among some component manufacturers, but many common parts remain widely available from multiple sources, which generally dilutes individual supplier power.

High switching costs for AAP, stemming from specialized components or complex integration processes, empower suppliers. Conversely, AAP's significant scale, with approximately $11.0 billion in net sales reported in 2023, grants it considerable leverage over suppliers who depend on its substantial purchasing volume.

Suppliers can also exert power by threatening forward integration, moving into direct sales channels that bypass AAP and erode its margins. The uniqueness of a supplier's product, such as proprietary parts for luxury vehicles, also increases their leverage.

| Factor | Impact on AAP | 2024 Context |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Some consolidation, but many common parts have multiple suppliers. |

| Switching Costs | High costs empower suppliers. | Increasing for specialized electronic and advanced material components. |

| Uniqueness of Offerings | Unique parts grant suppliers pricing power. | Essential for specific makes or complex repairs. |

| Forward Integration Threat | Direct competition and margin erosion. | Suppliers may bypass retailers for direct sales. |

| AAP's Purchasing Power | Large volume reduces supplier leverage. | $11.0 billion in net sales (2023) makes AAP a critical customer. |

What is included in the product

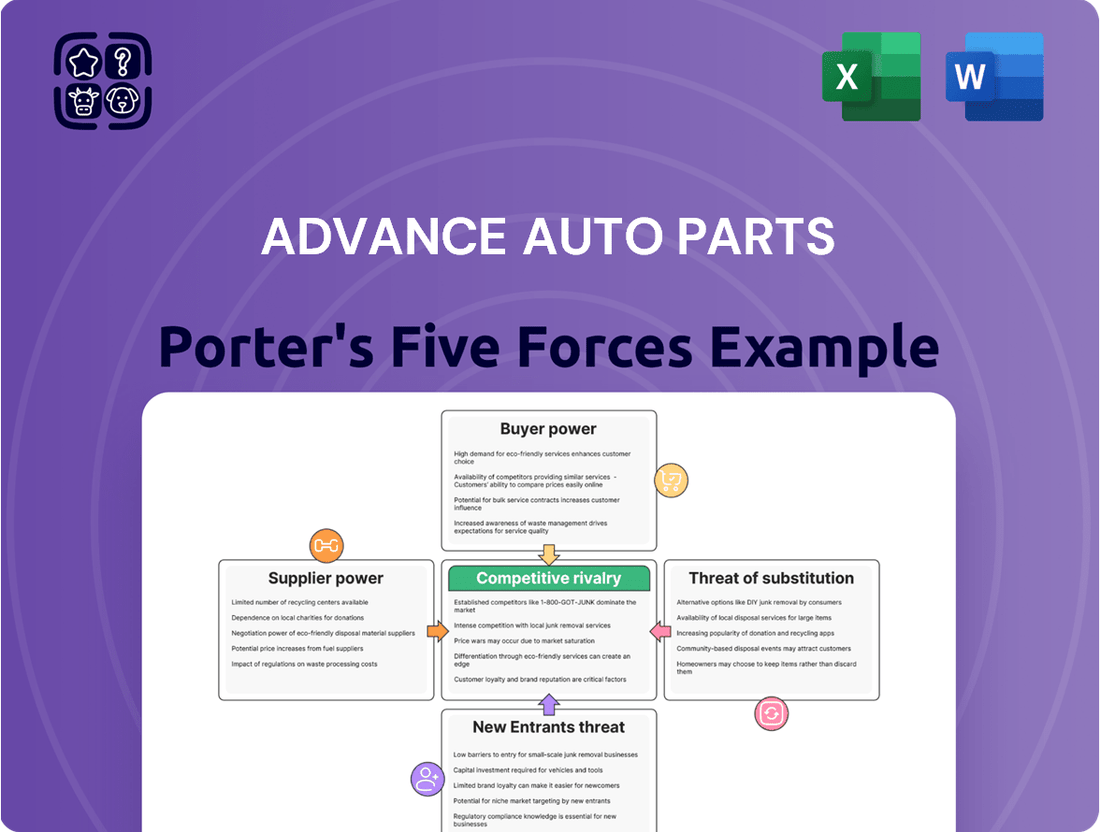

This analysis specifically examines Advance Auto Parts' competitive environment, detailing the intensity of rivalry, buyer and supplier power, threats from new entrants and substitutes. It provides strategic insights into how these forces shape the company's profitability and market positioning.

Instantly identify and address competitive threats with a visual breakdown of the industry's five forces, enabling proactive strategy adjustments for Advance Auto Parts.

Customers Bargaining Power

Customers in the automotive aftermarket, encompassing both professional mechanics and do-it-yourselfers, exhibit a notable sensitivity to price. This means they actively seek the best deals and are willing to switch providers if a competitor offers a lower price for the same product.

The automotive aftermarket landscape is characterized by a high degree of competition, with numerous retailers and online marketplaces readily available. This accessibility empowers customers to effortlessly compare prices across different vendors, creating significant downward pressure on the profit margins of companies like Advance Auto Parts.

For instance, in 2024, the average consumer spent an estimated $1,000 annually on car maintenance and parts, a figure that can fluctuate based on vehicle age and model. This spending habit reinforces the importance of competitive pricing for Advance Auto Parts to attract and retain its customer base.

Customers for auto parts have a significant number of alternatives available, which directly impacts Advance Auto Parts' bargaining power. They can easily turn to other large retail chains like AutoZone or O'Reilly Auto Parts, each offering a similar product range and often competitive pricing. This abundance of choice means customers aren't locked into a single supplier.

Furthermore, independent repair shops often source their own parts, bypassing direct retail purchases and presenting another substitute channel. Online marketplaces, such as Amazon or specialized automotive parts websites, also provide a vast selection, often with the convenience of home delivery and price comparison tools. This broad accessibility to substitutes empowers customers to seek out the best deals and service, putting pressure on Advance Auto Parts to remain competitive.

The internet has significantly boosted customer information and transparency, a key factor in their bargaining power. Customers can now easily access detailed product specifications, compare prices across numerous retailers, and read reviews from other buyers. This readily available information allows them to make much more informed decisions, diminishing their dependence on any single seller.

For Advance Auto Parts, this means customers can readily compare pricing for parts like brake pads or oil filters with competitors, both online and in brick-and-mortar stores. For instance, in 2024, the automotive aftermarket industry saw continued growth, with online sales becoming increasingly significant, giving consumers more leverage through readily available price comparisons.

Volume of Purchases by Professional Customers

Professional installers, a significant segment making up about half of Advance Auto Parts' revenue, tend to buy in larger quantities. This substantial purchasing power allows them to negotiate for better pricing and more favorable business terms.

For instance, in 2023, Advance Auto Parts reported that its professional segment accounted for a substantial portion of its sales, highlighting the importance of this customer group. The ability of these larger buyers to consolidate their purchases gives them considerable leverage.

- Professional installers represent approximately 50% of Advance Auto Parts' sales.

- Larger purchase volumes empower professional customers to negotiate discounts.

- This negotiation power can directly impact Advance Auto Parts' profit margins.

Low Switching Costs for Customers

Customers generally face low switching costs when purchasing auto parts. They can readily shift between various retail locations, online marketplaces, or even explore different service providers for their vehicle maintenance needs. This accessibility significantly amplifies customer bargaining power.

For instance, in 2024, the average consumer spent approximately $1,500 annually on vehicle maintenance and repairs, according to industry estimates. This recurring expenditure incentivizes shoppers to seek the best value, making price and convenience paramount factors in their purchasing decisions. Advance Auto Parts, like its competitors, must therefore remain competitive on both fronts.

- Low Switching Costs: Customers can easily move between Advance Auto Parts, AutoZone, O'Reilly Auto Parts, and online retailers like Amazon or RockAuto without incurring significant penalties or complications.

- Price Sensitivity: With an average annual spend on auto parts and maintenance, consumers are often motivated to compare prices across multiple vendors.

- Information Availability: Online reviews and price comparison tools further reduce the effort required for customers to find the best deals, increasing their leverage.

The bargaining power of customers within the automotive aftermarket is substantial, driven by price sensitivity and the abundance of readily available alternatives. In 2024, consumers demonstrated a clear inclination to seek out the best value for their estimated annual spending on car parts and maintenance, which industry figures suggest hovers around $1,000 to $1,500 depending on vehicle specifics. This environment forces companies like Advance Auto Parts to maintain competitive pricing and convenient access to products.

| Factor | Impact on Advance Auto Parts | 2024 Data/Context |

|---|---|---|

| Price Sensitivity | Customers actively seek lower prices, pressuring margins. | Average annual spend on auto parts incentivizes comparison shopping. |

| Availability of Substitutes | Numerous competitors (AutoZone, O'Reilly, online) offer similar products. | Online sales continue to grow, increasing customer leverage. |

| Information Transparency | Easy access to product specs, prices, and reviews empowers informed decisions. | Online comparison tools are widely used by consumers. |

| Switching Costs | Minimal costs to switch between retailers or service providers. | Customers can easily change vendors without penalty. |

| Professional Buyer Volume | Professional installers, ~50% of sales, negotiate larger discounts. | Significant purchasing power allows for favorable terms. |

Preview the Actual Deliverable

Advance Auto Parts Porter's Five Forces Analysis

This preview showcases the complete Advance Auto Parts Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the automotive aftermarket industry. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, offering actionable insights without any placeholders or surprises. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this comprehensive analysis, ready for your strategic planning needs.

Rivalry Among Competitors

The automotive aftermarket is a crowded space. Major players like AutoZone, O'Reilly Auto Parts, and Genuine Parts Company (NAPA Auto Parts) dominate, but they face competition from thousands of smaller regional and independent stores. This fragmented yet concentrated market means Advance Auto Parts is constantly battling for customer attention and market share.

The automotive aftermarket is expected to see a healthy 5.1% growth rate in 2025. This expansion, while positive, means companies like Advance Auto Parts must still fight hard for their piece of the pie. A growing market doesn't automatically translate to easy gains; it often fuels more intense competition as players strive to outmaneuver rivals and capture market share.

Product differentiation in the auto parts retail sector is tough because many items are pretty much the same. This means companies often battle it out on things like having parts in stock, how quickly they can get them to you, the quality of customer service, and special deals for loyal customers.

Advance Auto Parts is actively working to stand out. For instance, their 'market hub' store concept is designed to improve how quickly customers can get the parts they need, a key differentiator in a fast-paced market.

High Fixed Costs and Inventory Management

Auto parts retailers like Advance Auto Parts face intense competition, partly due to significant fixed costs. These costs stem from maintaining a wide network of physical stores, large distribution centers, and substantial inventory levels. For instance, in 2023, Advance Auto Parts reported operating expenses of $9.7 billion, highlighting the scale of their fixed cost base.

The necessity of stocking a vast array of parts to cater to both DIY customers and professional installers, who demand immediate availability, puts considerable pressure on retailers. This need for high sales volumes to offset these substantial fixed costs directly intensifies the rivalry among players in the market.

- High Fixed Costs: Significant investments in brick-and-mortar stores and logistics infrastructure.

- Inventory Burden: Maintaining a broad selection of parts to meet diverse customer demands, especially for professionals.

- Sales Volume Pressure: The need for high sales to cover fixed costs fuels aggressive competition.

- 2023 Operating Expenses: Advance Auto Parts' $9.7 billion in operating expenses underscores the cost structure.

Exit Barriers

Advance Auto Parts faces significant exit barriers. The company has substantial investments in its physical store network and distribution centers, making it costly to divest these assets. For instance, as of early 2024, Advance Auto Parts operated over 4,600 stores across North America, each representing a considerable capital outlay.

Long-term lease agreements for these retail locations further lock the company into its current operational footprint. These commitments make it financially challenging to simply close down underperforming stores or exit the market altogether. This reluctance to exit, even when profitability is low, can perpetuate intense competition among existing players.

- High Capital Investment: Significant funds are tied up in physical infrastructure like stores and distribution centers.

- Long-Term Lease Obligations: Commitments to property leases make exiting costly and complex.

- Reluctance to Exit: High exit barriers force companies to stay in the market, potentially prolonging competitive pressures.

The competitive rivalry within the automotive aftermarket is fierce, driven by a fragmented market with dominant players like AutoZone and O'Reilly Auto Parts, alongside numerous smaller competitors. Advance Auto Parts, operating over 4,600 stores as of early 2024, must contend with this intense landscape where differentiation relies heavily on inventory availability, speed of service, and customer loyalty programs, rather than distinct product features.

High fixed costs, exemplified by Advance Auto Parts' $9.7 billion in operating expenses in 2023, necessitate high sales volumes, intensifying the battle for market share. Furthermore, significant exit barriers, including substantial investments in physical infrastructure and long-term lease agreements, compel companies to remain in the market, perpetuating competitive pressures.

| Competitor | Number of Stores (Approx. Early 2024) | Key Competitive Factor |

|---|---|---|

| Advance Auto Parts | 4,600+ | Market Hub concept for faster parts acquisition |

| AutoZone | 7,000+ | Strong brand recognition, extensive product selection |

| O'Reilly Auto Parts | 6,000+ | Focus on professional installers, robust inventory |

| Genuine Parts Company (NAPA) | 6,000+ (NAPA stores) | Extensive network, strong relationships with independent repair shops |

SSubstitutes Threaten

The increasing popularity of public transportation and ride-sharing services presents a significant threat to Advance Auto Parts. As more individuals opt for these alternatives, the overall need for personal vehicle ownership declines. This shift directly impacts the demand for automotive replacement parts, as fewer cars are on the road and accumulating mileage that necessitates maintenance and repairs.

By 2024, ride-sharing services like Uber and Lyft have become deeply integrated into urban transportation networks, with millions of daily rides facilitated globally. This trend, coupled with expanding public transit options in many cities, reduces the incentive for consumers to own and maintain their own vehicles, thereby diminishing the market for aftermarket auto parts.

Longer-lasting vehicle components, a direct result of advancements in automotive technology and manufacturing, present a significant threat of substitutes for companies like Advance Auto Parts. These improvements mean vehicles require fewer replacement parts over their extended lifespans. For instance, the average age of vehicles on U.S. roads reached a record 12.5 years in 2022, up from 12.1 years in 2020, indicating a trend towards greater vehicle longevity and potentially less frequent aftermarket purchases.

The increasing adoption of electric vehicles (EVs) poses a significant long-term substitute threat to traditional automotive aftermarket businesses. EVs, by design, have fewer mechanical components than internal combustion engine (ICE) vehicles, meaning fewer oil changes, exhaust system repairs, and spark plug replacements. This shift could lead to a reduction in demand for a substantial portion of the existing aftermarket parts and services. For instance, by the end of 2023, global EV sales surpassed 13.5 million units, a substantial increase from previous years, indicating a growing market segment less reliant on traditional ICE maintenance.

Manufacturer-Supplied Parts and Dealership Services

Consumers and professional installers have the option to buy original equipment (OE) parts directly from vehicle manufacturers or opt for servicing at dealerships. This direct channel, often marketed with a strong emphasis on guaranteed fit and superior quality, presents a significant substitute for the aftermarket parts and services offered by retailers like Advance Auto Parts.

For instance, in 2024, the automotive aftermarket industry continued to see a portion of its business diverted to dealerships, particularly for newer vehicles where warranty concerns or a desire for OE-certified repairs are paramount. While specific market share data for this substitution is dynamic, industry reports from late 2023 indicated that dealership service revenue remained a substantial segment of the overall automotive repair market, underscoring the ongoing competitive pressure from manufacturer-controlled channels.

- Direct Manufacturer Sales: Vehicle owners can bypass aftermarket retailers and purchase OE parts directly from automakers, ensuring compatibility and manufacturer backing.

- Dealership Service Centers: Dealerships offer a comprehensive service option, often leveraging OE parts and manufacturer-trained technicians, acting as a direct competitor to independent repair shops and aftermarket parts suppliers.

- Perceived Quality and Warranty: The emphasis on guaranteed fit, quality assurance, and maintaining vehicle warranties often draws consumers and professional installers to dealership services, even at a potentially higher cost.

DIY vs. Professional Repair Shifts

A notable trend is the growing consumer inclination towards either undertaking repairs themselves, leveraging readily available online tutorials and direct-to-consumer parts sales, or conversely, opting for complete professional service where repair shops might source parts through alternative channels. This bifurcation directly challenges Advance Auto Parts' strategy of serving both the do-it-yourself (DIY) and professional installer markets.

For instance, the DIY segment saw a surge in engagement in 2024, with online automotive repair content platforms reporting record user traffic. This indicates a potential decrease in demand for over-the-counter parts from traditional retailers like Advance Auto Parts as consumers become more self-sufficient.

Conversely, the professional repair sector's purchasing habits are also evolving. Many independent repair shops, especially those focused on efficiency and volume, are increasingly consolidating their parts sourcing through larger distributors or original equipment manufacturers (OEMs). This can bypass traditional aftermarket suppliers.

- DIY Empowerment: Increased access to online repair guides and video tutorials in 2024 empowers consumers to tackle more complex vehicle maintenance, potentially reducing reliance on professional services and aftermarket parts retailers.

- Professional Sourcing Shifts: A growing number of repair shops are exploring direct partnerships with parts manufacturers or larger wholesale distributors, potentially diverting business away from traditional auto parts stores.

- Impact on Dual Customer Base: Advance Auto Parts faces a threat if a significant portion of its customer base either moves entirely to DIY or relies on professional channels that bypass its retail network.

The threat of substitutes for Advance Auto Parts is multifaceted, encompassing shifts in transportation, vehicle technology, and consumer purchasing habits. The rise of ride-sharing and public transit reduces the overall need for personal vehicle maintenance. Furthermore, advancements leading to longer-lasting vehicle components and the increasing adoption of electric vehicles, which have fewer mechanical parts, directly impact demand for traditional aftermarket items.

Consumers also have the option to purchase original equipment (OE) parts directly from manufacturers or service their vehicles at dealerships. This direct channel, often perceived as offering superior quality and warranty assurance, presents a significant substitute for the aftermarket parts and services offered by retailers like Advance Auto Parts. For instance, dealership service revenue remained a substantial segment of the overall automotive repair market in 2024.

The DIY segment is also evolving, with consumers increasingly empowered by online tutorials to perform their own repairs. Conversely, professional repair shops are consolidating parts sourcing through larger distributors or OEMs, potentially bypassing traditional aftermarket suppliers. This dual shift challenges Advance Auto Parts' strategy across both its DIY and professional customer bases.

| Substitute Category | Description | Impact on Advance Auto Parts | Relevant Data/Trend |

| Alternative Transportation | Ride-sharing services, public transit | Reduces overall vehicle usage and maintenance needs | Millions of daily rides facilitated by services like Uber and Lyft in 2024. |

| Vehicle Technology | Longer-lasting parts, Electric Vehicles (EVs) | Decreases frequency of part replacements; EVs have fewer mechanical components | Average age of U.S. vehicles reached 12.5 years in 2022; Global EV sales surpassed 13.5 million units by end of 2023. |

| Direct Manufacturer/Dealership Channels | OE parts sales, dealership service centers | Bypasses aftermarket retailers; leverages perceived quality and warranty | Dealership service revenue remains a substantial segment of the automotive repair market. |

| DIY & Professional Sourcing Shifts | Consumer self-repair, consolidated professional sourcing | Reduces reliance on retail parts stores; shifts purchasing power | Record user traffic on online automotive repair content platforms in 2024. |

Entrants Threaten

The automotive aftermarket retail sector demands significant upfront capital. Newcomers need substantial funds to build a broad store network, establish efficient distribution centers, and stock a wide array of parts. For instance, in 2024, the cost to open a single, well-equipped auto parts store can easily range from $250,000 to over $1 million, depending on location and scale.

This high barrier to entry, driven by the need for extensive physical infrastructure and inventory, deters many potential competitors. Companies like Advance Auto Parts have already invested billions over decades to achieve their current scale, making it incredibly challenging for new players to compete on breadth of product and geographic reach without similar massive investment.

Established players like Advance Auto Parts leverage significant economies of scale in their operations. This includes bulk purchasing power for inventory, optimizing logistics across a vast network of stores, and spreading marketing costs over a larger revenue base. For instance, in 2023, Advance Auto Parts reported net sales of $9.1 billion, allowing for substantial cost efficiencies that new entrants would find challenging to replicate.

New companies entering the automotive aftermarket sector would find it difficult to match the cost advantages enjoyed by incumbents. Without a comparable scale, they would likely face higher per-unit costs for goods, less efficient distribution, and a greater burden in building brand recognition through marketing. This cost disadvantage can make it incredibly hard for new entrants to compete effectively on price against established brands like Advance Auto Parts.

Advance Auto Parts, like other established players in the automotive aftermarket, benefits from strong brand loyalty and deep customer relationships, particularly with professional installers. These customers value reliability and consistent service, making it difficult for new entrants to gain traction. For instance, in 2023, Advance Auto Parts reported approximately 1,700 company-operated stores, each representing a touchpoint for building and maintaining these crucial relationships.

Access to Distribution Channels and Supplier Networks

New entrants face significant hurdles in securing reliable access to a wide range of suppliers and establishing efficient distribution networks. Established players like Advance Auto Parts have cultivated long-standing relationships and optimized their supply chains over years, creating a formidable barrier for newcomers seeking to build comparable capabilities quickly. In 2023, Advance Auto Parts reported operating 4,766 stores across the United States, Canada, and Puerto Rico, underscoring the extensive distribution infrastructure that new entrants would need to replicate.

The capital investment required to build out a comparable network of suppliers and distribution centers is substantial, making it difficult for smaller or less-funded new entrants to compete effectively. Furthermore, established companies often benefit from bulk purchasing power, which allows them to negotiate more favorable terms with suppliers, a cost advantage that new entrants will struggle to match initially.

- Supplier Relationships: Existing retailers have deep, often exclusive, ties with key automotive parts manufacturers and distributors.

- Distribution Efficiency: Years of operational refinement have led to optimized logistics and warehousing for incumbents.

- Capital Intensity: Building a comparable supply chain and distribution network requires massive upfront investment, estimated in the hundreds of millions for national reach.

- Economies of Scale: Incumbents leverage purchasing volume for better pricing, a challenge for new entrants.

Regulatory Hurdles and Technical Expertise

While the automotive aftermarket isn't as strictly regulated as, say, pharmaceuticals, there are still specific standards and certifications for parts quality and safety that new entrants must navigate. For instance, adherence to SAE (Society of Automotive Engineers) standards or specific DOT (Department of Transportation) regulations can add complexity and cost. This means new companies need to invest in ensuring their products meet established benchmarks.

Furthermore, the automotive aftermarket demands a significant level of technical expertise. This is especially true when serving the professional segment, which relies on precise parts identification and application knowledge. New entrants often struggle to build this specialized knowledge base quickly, making it challenging to compete with established players who have years of experience and trained staff. In 2024, the complexity of vehicle systems continues to grow, amplifying this need for specialized knowledge.

- Regulatory Compliance: New entrants must meet industry standards for parts quality and safety, such as SAE or DOT certifications.

- Technical Knowledge Gap: The need for specialized expertise in parts identification and application presents a barrier, particularly for serving professional customers.

- Investment in Training: Overcoming the technical expertise hurdle requires significant investment in training for new staff.

The threat of new entrants for Advance Auto Parts is moderate. Significant capital is required to establish a physical presence and inventory, with opening a single store costing upwards of $250,000 in 2024. Furthermore, replicating the economies of scale enjoyed by incumbents, such as Advance Auto Parts' $9.1 billion in net sales in 2023, presents a substantial cost disadvantage for newcomers.

| Barrier to Entry | Estimated Cost/Challenge for New Entrants (2024) | Impact on Advance Auto Parts |

|---|---|---|

| Capital Investment (Store Network) | $250,000 - $1M+ per store | High initial cost deters new players. |

| Economies of Scale (Purchasing & Logistics) | Challenging to match incumbents' cost efficiencies | Incumbents have significant cost advantages. |

| Brand Loyalty & Customer Relationships | Difficult to build trust quickly, especially with professionals | Established customer base provides a competitive moat. |

| Supplier & Distribution Network Development | Requires extensive time and capital investment | Incumbents have optimized, entrenched networks. |

| Technical Expertise & Training | Requires investment in specialized knowledge | Incumbents possess deep expertise and trained staff. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Advance Auto Parts is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and data from reputable financial databases such as S&P Capital IQ.