ADTRAN SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADTRAN Bundle

ADTRAN's robust product portfolio and strong customer relationships represent significant strengths in the telecommunications infrastructure market. However, the company faces challenges from intense competition and the rapid pace of technological change, impacting its opportunities for expansion. Understanding these dynamics is crucial for navigating the evolving landscape.

Discover the complete picture behind ADTRAN’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking to leverage ADTRAN's potential.

Strengths

ADTRAN Holdings kicked off 2025 with a powerful financial showing. Preliminary figures for the first quarter revealed a healthy 10% year-over-year revenue jump, reaching $247.7 million and surpassing earlier forecasts. This growth wasn't just on the top line; the company also saw improvements in its gross and operating margins, signaling better efficiency in its operations.

The positive financial momentum extended to cash flow, with ADTRAN generating robust cash from its operations. This indicates a well-functioning business model and effective management of its resources, setting a strong foundation for the year ahead.

ADTRAN boasts a remarkably comprehensive and forward-thinking product lineup, a key strength amplified by its strategic integration of ADVA. This extensive suite covers critical areas like fiber broadband, the latest Wi-Fi 7 technology, and sophisticated optical transport solutions, directly addressing the dynamic needs of the telecommunications sector.

The company's dedication to staying ahead is clearly demonstrated through its consistent and substantial investment in research and development. This focus fuels the creation of next-generation technologies, such as advanced 10G/25G fiber access platforms and innovative software-defined networking capabilities, ensuring ADTRAN remains at the technological forefront.

ADTRAN is strategically positioned to benefit from the robust demand for advanced broadband technologies. The company is a key player in the ongoing global push for fiber optic infrastructure and multi-gigabit Wi-Fi solutions, essential for modern digital connectivity. This focus aligns perfectly with the increasing need for faster and more reliable internet services worldwide.

The company's success is evident in its significant customer acquisition and expansion, particularly within European markets. Furthermore, ADTRAN is experiencing notable growth with Tier 2 service providers in the United States. This expansion is driven by the continuous build-out of fiber networks and crucial infrastructure upgrades by these providers.

By aligning its product and service offerings with these strong market trends, ADTRAN has built a solid foundation for sustained growth. The ongoing investment in network expansion and modernization by telecommunications companies globally directly translates into increased demand for ADTRAN's solutions, reinforcing its market position.

Operational Flexibility and Global Supply Chain

ADTRAN leverages its operational flexibility and a globally diversified supply chain to effectively navigate evolving trade policies and maintain robust customer connections. This strategic advantage allows the company to proactively address potential geopolitical shifts and supply chain disruptions, thereby ensuring operational continuity and stability.

The company's adaptability in its operations is a key strength, particularly in managing the complexities of global logistics. For instance, in 2023, ADTRAN reported that its strategic sourcing initiatives helped mitigate the impact of global component shortages, allowing for timely delivery of its network solutions.

- Global Sourcing Network: ADTRAN’s access to a wide range of suppliers across different regions reduces reliance on any single source, enhancing resilience.

- Agile Manufacturing: The company’s ability to adjust production based on demand and component availability ensures it can respond quickly to market needs.

- Supply Chain Diversification: By spreading its supply chain across multiple countries, ADTRAN minimizes risks associated with localized disruptions or trade disputes.

- Customer Focus: This operational agility directly translates into better service and reliability for customers, strengthening relationships and market position.

Growing Demand for Optical Networking and Network Automation

ADTRAN is capitalizing on a surging market for optical networking and network automation. The company's Mosaic One platform, designed for network insights and intelligence, is seeing increasing adoption. This growth is further fueled by robust demand for ADTRAN's optical network automation solutions, a key area for modern network infrastructure.

The company's optical networking products have demonstrated consistent growth across all geographical regions. This broad market penetration is attracting a diverse customer base, including major service providers, internet content providers, and enterprise clients. This widespread acceptance highlights the competitive strength of ADTRAN's offerings in a vital and expanding market segment.

- Growing Optical Networking Demand: ADTRAN's optical solutions are experiencing strong uptake globally.

- Mosaic One Adoption: The Mosaic One platform for network intelligence is gaining traction.

- Diverse Customer Acquisition: New clients include service providers, ICPs, and enterprises.

- Market Competitiveness: Strong regional growth underscores ADTRAN's powerful market position.

ADTRAN's strengths lie in its comprehensive and advanced product portfolio, significantly enhanced by the ADVA integration. This includes leading solutions in fiber broadband, Wi-Fi 7, and optical transport, directly addressing the telecommunications industry's evolving demands. The company's commitment to R&D fuels the development of next-generation technologies like 10G/25G fiber access and SDN, positioning it at the technological forefront.

ADTRAN is well-positioned to capitalize on the global surge in demand for advanced broadband technologies, particularly fiber optic infrastructure and multi-gigabit Wi-Fi. This strategic alignment with essential digital connectivity needs is a major advantage. The company's success is further evidenced by strong customer acquisition and expansion, especially in Europe and with US Tier 2 service providers undertaking network upgrades.

The company's operational flexibility and diversified global supply chain are key strengths, enabling it to effectively manage trade policies and supply chain disruptions. For example, ADTRAN's strategic sourcing in 2023 helped mitigate component shortages. This agility ensures operational continuity and customer reliability.

ADTRAN is also excelling in the growing optical networking and network automation markets, driven by the increasing adoption of its Mosaic One platform. Consistent growth in optical networking products across all regions, serving a diverse customer base including major service providers and enterprises, highlights its competitive edge and strong market position.

| Metric | Q1 2025 (Preliminary) | Year-over-Year Change |

|---|---|---|

| Revenue | $247.7 million | +10% |

| Gross Margin | Improved | N/A |

| Operating Margin | Improved | N/A |

What is included in the product

Analyzes ADTRAN’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex market positioning, allowing ADTRAN to quickly identify and leverage competitive advantages while mitigating potential threats.

Weaknesses

ADTRAN Holdings faced significant challenges as it announced that its financial statements for fiscal years ending December 31, 2023, and 2024, require restatement due to errors, particularly affecting inventory and cost of revenue recognition. This situation has triggered heightened regulatory scrutiny, potentially impacting investor confidence and leading to increased legal and compliance expenses.

The need for restatement has directly resulted in the postponement of the company's 2025 annual stockholder meeting. Such delays and the underlying accounting issues can create uncertainty for investors, making it harder to assess the company's true financial health and future prospects.

This scrutiny and the need for restatements can also impose substantial costs on ADTRAN, not only for the investigation and correction of accounting errors but also for potential fines or penalties from regulatory bodies. These financial and operational disruptions can divert management attention from strategic growth initiatives.

ADTRAN faced a significant challenge in 2024 with a pronounced slowdown in customer demand, largely attributed to high existing inventory levels. This overhang directly impacted the company, resulting in a notable revenue decline for the year.

While ADTRAN's management anticipates a stabilization in 2025, projecting that service providers will begin to replenish their depleted stockpiles, a degree of uncertainty remains. Persistent caution in service provider spending habits could continue to suppress order volumes and dampen revenue growth prospects.

ADTRAN operates in highly competitive markets, facing formidable rivals like Calix, Nokia, Huawei, and Ciena. This intense rivalry often leads to price pressures, potentially impacting profit margins and market share. To stay ahead, ADTRAN must consistently innovate and optimize its operations, a challenge amplified by the rapid pace of technological advancements in the telecommunications sector.

Customer Concentration Risk

ADTRAN's business model carries a notable weakness in customer concentration risk. This means a significant portion of its revenue could be tied to a small number of major clients. If any of these key customers reduce their orders or shift their business elsewhere, ADTRAN could experience a substantial hit to its top line. For instance, in recent financial reporting, a few large telecommunications providers have consistently accounted for a substantial percentage of ADTRAN's total revenue. This dependency makes ADTRAN susceptible to the financial performance and strategic decisions of these few entities.

This concentration exposes ADTRAN to potential volatility. The company's financial health is, to an extent, at the mercy of its largest clients' purchasing patterns and overall business success. This can create uncertainty in revenue forecasting and overall business planning.

- Revenue Dependence: A few major customers represent a disproportionately large share of ADTRAN's sales, increasing vulnerability.

- Client Strategy Impact: Changes in a key customer's investment in network upgrades or shift in vendor strategy can directly impact ADTRAN's revenue.

- Financial Health Link: The financial stability of major clients directly correlates with the security of ADTRAN's revenue streams.

- Reduced Negotiating Power: High reliance on a few customers can weaken ADTRAN's negotiating position on pricing and contract terms.

Exposure to Foreign Exchange and Tariff Volatility

ADTRAN's global footprint means it's susceptible to fluctuations in foreign exchange rates. For instance, a strengthening US dollar could make its products more expensive in international markets, potentially impacting sales volumes. This currency exposure can directly affect reported earnings and requires careful hedging strategies.

Beyond currency, ADTRAN faces risks from evolving trade policies and tariffs. Changes in international trade agreements or the imposition of new tariffs can increase the cost of goods sold or disrupt supply chains. For example, a sudden tariff on electronic components imported into a key manufacturing region could elevate operating expenses. These uncertainties necessitate continuous monitoring and adaptation of global business operations to mitigate financial impacts.

- Foreign Exchange Risk: Fluctuations in currency values can impact ADTRAN's reported revenue and profitability from international sales.

- Tariff Uncertainty: Evolving trade policies and potential tariffs on imported components or finished goods can increase costs and affect supply chain stability.

- Operational Adjustments: The company must continually adapt its global operations and pricing strategies to navigate these external economic and political factors.

- Profitability Impact: Both currency volatility and tariff changes can directly influence ADTRAN's overall financial performance and profit margins.

ADTRAN's financial reporting for fiscal years 2023 and 2024 required restatements due to errors in inventory and cost of revenue recognition. This has led to increased regulatory scrutiny and a postponement of its 2025 annual stockholder meeting, creating investor uncertainty. The company incurred substantial costs related to these accounting issues and potential penalties, diverting management focus from strategic growth.

The company experienced a significant revenue decline in 2024 due to a slowdown in customer demand, driven by high existing inventory levels among service providers. While ADTRAN anticipates stabilization in 2025 as service providers replenish stocks, cautious spending habits could continue to limit order volumes and revenue growth.

ADTRAN faces intense competition from major players like Calix, Nokia, Huawei, and Ciena, leading to price pressures that can impact profit margins and market share. The rapid pace of technological change in the telecommunications sector necessitates continuous innovation and operational optimization, which is a considerable challenge.

A key weakness for ADTRAN is its customer concentration risk, with a substantial portion of revenue tied to a few major clients. For instance, in recent reporting periods, a small number of large telecommunications providers consistently accounted for a significant percentage of ADTRAN's total revenue. This dependency makes the company vulnerable to the financial performance and strategic decisions of these key entities, creating revenue forecasting uncertainty.

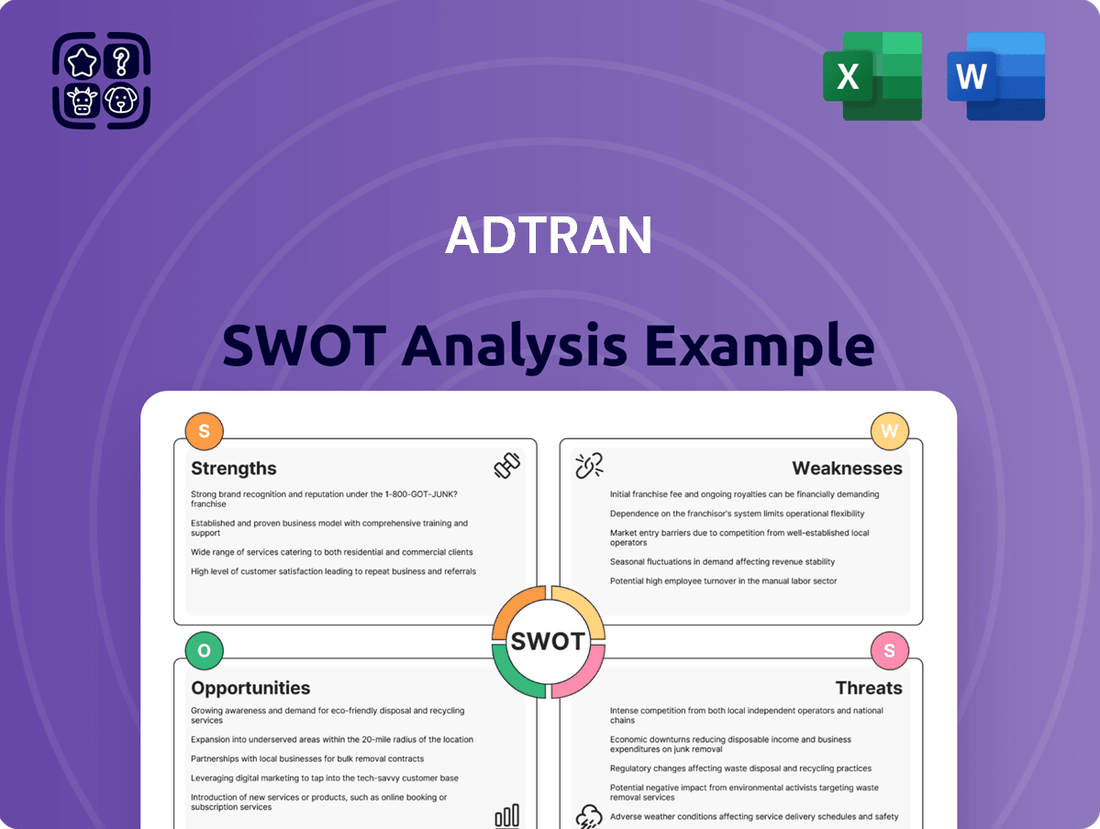

What You See Is What You Get

ADTRAN SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, revealing ADTRAN's strategic advantages, potential weaknesses, market opportunities, and competitive threats.

This is a real excerpt from the complete document, showcasing the comprehensive nature of the ADTRAN SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual SWOT analysis file for ADTRAN. The complete version, detailing all aspects of their business environment, becomes available after checkout.

Opportunities

The global fiber broadband market is experiencing a significant upswing, with projections indicating robust growth through 2033. This expansion is fueled by a surging demand for faster, more reliable internet connections, crucial for everything from remote work to immersive entertainment.

Key drivers include the ongoing rollout of 5G networks, which rely heavily on fiber backhaul, and the continuous expansion of cloud computing and the Internet of Things (IoT). These trends collectively create a vast and growing addressable market for ADTRAN's specialized fiber access and services solutions.

For instance, the fiber optic cable market alone was valued at approximately USD 22.4 billion in 2023 and is expected to reach USD 46.7 billion by 2033, growing at a CAGR of 7.7% during this period. This presents a substantial opportunity for ADTRAN to capitalize on increasing infrastructure investments worldwide.

Governments globally are channeling significant resources into expanding fiber optic networks, aiming to close the digital divide and foster smart city development. Programs like the US Broadband Equity, Access and Deployment (BEAD) Program, with its substantial allocation of $42.45 billion, are prime examples of this commitment. These substantial public investments create a fertile ground for companies like ADTRAN, directly stimulating demand for their networking solutions.

Such government funding not only fuels current deployment projects but also provides a stable environment for ADTRAN's future research and development efforts in advanced networking technologies. The increased availability of high-speed internet infrastructure, a direct result of these initiatives, will naturally drive greater adoption of digital services and applications, further boosting the need for ADTRAN's equipment.

The ongoing geopolitical climate is prompting a significant move away from high-risk vendors, particularly those based in China, within the optical transport and fiber access sectors. This trend presents a substantial opportunity for ADTRAN.

ADTRAN is strategically positioned to capitalize on this market shift. Their robust portfolio of solutions and extensive global reach make them a compelling alternative for businesses seeking to diversify their supply chains and reduce reliance on potentially volatile sources.

As of early 2024, many telecommunications providers are actively reviewing and re-evaluating their vendor relationships, with a clear preference emerging for companies like ADTRAN that offer a blend of advanced technology and geopolitical stability. This is driving increased interest and potential for market share gains.

ADTRAN's ability to provide reliable, high-performance networking equipment, coupled with a strong commitment to customer support across various regions, directly addresses the concerns driving this vendor diversification. The company's ongoing investment in research and development further solidifies its appeal as a long-term partner.

Advancements in 5G and Edge Computing

The continued rollout and sophistication of 5G networks, hand-in-hand with the growing importance of edge computing, present significant avenues for growth for ADTRAN. These technological shifts necessitate more robust network infrastructure, reduced latency, and greater bandwidth, areas where ADTRAN's established strengths in fiber, access, and aggregation solutions are directly applicable.

The demand for enhanced network performance driven by 5G and edge computing translates into a need for more advanced networking hardware and software. ADTRAN is well-positioned to capitalize on this by providing solutions that support the increased data traffic and real-time processing required by these emerging technologies. For instance, by 2027, the global edge computing market is projected to reach $80.6 billion, up from $23.5 billion in 2022, showcasing the substantial growth potential.

- 5G Expansion: The increasing global adoption of 5G, with subscriber numbers expected to surpass 1.5 billion by the end of 2024, drives demand for the high-capacity, low-latency solutions ADTRAN offers.

- Edge Computing Growth: The burgeoning edge computing market, anticipated to grow at a CAGR of over 30% through 2027, creates opportunities for ADTRAN's network solutions that enable localized data processing and reduced latency for applications like IoT and AI.

- Fiber Infrastructure Needs: The foundational requirement for 5G and edge computing is robust fiber optic networks, a core area of ADTRAN's expertise, supporting the need for faster and more reliable connectivity.

Growth in In-Home Multi-Gig Wi-Fi Upgrades

As fiber optic networks continue to expand, delivering multi-gigabit internet speeds directly into homes, a significant demand is emerging for in-home Wi-Fi systems capable of supporting these faster connections. This creates a substantial opportunity for ADTRAN.

ADTRAN's Wi-Fi 7 portfolio and its comprehensive subscriber solutions are strategically positioned to address this growing need. The company is well-equipped to benefit from the increasing number of connected devices within households and the escalating consumption of data-intensive applications, such as high-definition streaming and immersive gaming.

- Demand for Multi-Gig Wi-Fi: The rollout of fiber to the home (FTTH) is accelerating, with projections indicating continued strong growth through 2025, pushing the need for in-home network upgrades.

- ADTRAN's Wi-Fi 7 Advantage: Wi-Fi 7 offers significantly higher speeds and lower latency compared to previous generations, making it essential for realizing the full potential of multi-gigabit internet.

- Connected Device Growth: The average number of connected devices per household is steadily increasing, with many homes now exceeding 10-15 devices, all vying for bandwidth.

- Data-Intensive Applications: The rise of 8K video streaming, cloud gaming, and virtual reality experiences necessitates robust home network infrastructure that ADTRAN's solutions can provide.

The escalating global demand for faster internet fuels ADTRAN's growth, with the fiber broadband market projected for substantial expansion through 2033. This is further amplified by government initiatives like the US BEAD program, injecting billions into fiber deployment and directly stimulating demand for ADTRAN's solutions.

Geopolitical shifts are driving telecommunications providers to seek alternatives to high-risk vendors, positioning ADTRAN as a stable, technologically advanced option. This trend is evident as companies re-evaluate their supply chains, favoring reliable partners like ADTRAN.

The rapid advancement of 5G networks and the rise of edge computing necessitate robust network infrastructure, a core strength of ADTRAN's fiber and access solutions. The edge computing market alone is expected to surge, reaching $80.6 billion by 2027.

The increasing adoption of multi-gigabit internet services is creating a strong demand for advanced in-home Wi-Fi systems. ADTRAN's Wi-Fi 7 offerings are well-suited to meet this need, catering to the growing number of connected devices per household and the consumption of data-intensive applications.

Threats

ADTRAN is navigating significant regulatory and legal headwinds. The company has been subject to ongoing scrutiny stemming from its financial statement restatements, which can create uncertainty for investors.

These challenges include potential class-action lawsuits, which, if pursued, could lead to substantial legal expenses and settlements for ADTRAN. For instance, during the period leading up to and following the restatements, the company's stock price experienced volatility, reflecting market concerns.

While ADTRAN is actively addressing these compliance issues, the diversion of management focus and financial resources to legal and regulatory matters presents a significant operational threat. This can impede the company's ability to pursue strategic growth initiatives and innovation in a competitive market.

The reputational damage associated with financial reporting issues and legal entanglements could also deter customers and partners, further impacting ADTRAN's market position and long-term financial performance.

Service provider spending patterns are showing signs of cautious fluctuation, even with expectations for a broader market stabilization. This uncertainty can directly impact ADTRAN's order and billing volumes, making revenue predictability a challenge. For instance, if major telecommunications companies decide to hold back on capital expenditures for an extended period, it could significantly slow down ADTRAN's anticipated revenue growth for 2024 and into 2025. Such a slowdown would represent a considerable threat to the company's financial performance, especially if these spending cuts are widespread across the industry.

ADTRAN faces significant threats from ongoing global supply chain volatility. Disruptions in the availability and pricing of essential electronic components, a common issue in 2024, directly impact manufacturing schedules and the cost of goods sold for ADTRAN's networking solutions. This can lead to extended lead times for customers and increased operational expenses.

Geopolitical risks further compound these supply chain challenges. Tensions in key manufacturing regions or trade policy shifts can disrupt the flow of materials and finished products. For instance, heightened international trade disputes in 2024 have created uncertainty, potentially affecting ADTRAN's ability to source components reliably and deliver products on time across its global customer base.

Operating in multiple international markets exposes ADTRAN to the inherent risks of political instability and fluctuating economic policies. Changes in regulations, tariffs, or currency exchange rates in countries where ADTRAN has a presence or sells its products can negatively impact profitability and strategic planning. The company's reliance on international markets means that adverse political or economic developments in any single region could have a cascading effect on its overall performance.

Rapid Technological Obsolescence

The telecommunications sector is a hotbed of innovation, where yesterday's cutting-edge technology can become obsolete almost overnight. This rapid pace of change presents a significant challenge for companies like ADTRAN, requiring constant adaptation to stay ahead of the curve.

To maintain its competitive edge, ADTRAN faces the necessity of substantial and ongoing investment in research and development. Without a commitment to continuous innovation, the company risks losing its footing in the market and falling behind competitors who are quicker to adopt new technologies.

For instance, the shift towards 5G and the increasing demand for higher bandwidth services necessitate new product development. ADTRAN's ability to successfully navigate these technological shifts directly impacts its market share and future revenue streams. The company’s R&D spending for the fiscal year ending December 31, 2023, was reported at $125.9 million, a critical figure in this fast-evolving landscape.

Failure to innovate at the required speed can result in a loss of market relevance, impacting ADTRAN's ability to secure new contracts and retain existing customers. This threat is particularly acute as newer, more agile competitors emerge with disruptive technologies.

Key considerations for ADTRAN include:

- Pace of 5G Deployment: The speed at which global 5G networks are rolled out directly influences the demand for next-generation network equipment.

- Emergence of New Standards: The development and adoption of future communication standards, such as Wi-Fi 7 or beyond, require proactive R&D.

- Competitive R&D Investment: Benchmarking ADTRAN's R&D expenditure against key competitors is crucial for assessing its innovation capacity.

- Product Lifecycle Management: Effectively managing the transition from older technologies to newer ones to minimize revenue disruption.

Economic Downturns and Market Saturation in Developed Regions

Economic downturns pose a significant threat by potentially curtailing enterprise and service provider spending on crucial networking infrastructure upgrades. This hesitancy directly impacts ADTRAN's sales pipeline for new equipment and services. For instance, if major economies experience a contraction, as some analysts projected for parts of Europe in late 2023 and early 2024, capital expenditures in telecommunications are often among the first to be re-evaluated.

Furthermore, market saturation in developed regions presents a challenge. While growth opportunities persist in emerging markets, some established markets, particularly in Western Europe and North America, may see slower adoption rates for certain broadband technologies or experience intense competition in already well-covered areas. This saturation can limit ADTRAN's ability to secure substantial new market share or drive volume growth in these mature geographies.

The impact of these economic headwinds is evident when considering broader industry trends. For example, a slowdown in global GDP growth, projected by the IMF to be around 2.9% for 2024, can translate into reduced IT and telecom budgets. This macro-economic pressure directly affects demand for ADTRAN's solutions, as businesses and service providers become more cautious with their investments.

Specific threats include:

- Reduced Capital Expenditure: Economic slowdowns can lead to delayed or canceled infrastructure projects by telecom operators and enterprises.

- Market Saturation: Developed markets may offer limited upside for new broadband deployments, increasing reliance on upgrades and maintenance.

- Intensified Competition: In saturated markets, price wars and aggressive bundling can erode profit margins for equipment vendors like ADTRAN.

- Currency Fluctuations: Global economic instability can also lead to unfavorable currency exchange rates, impacting international revenue.

ADTRAN faces substantial threats from rapid technological evolution in the telecommunications sector, demanding continuous, significant investment in research and development to avoid obsolescence. The company's R&D expenditure of $125.9 million for the fiscal year ending December 31, 2023, underscores the ongoing need for innovation to keep pace with trends like 5G deployment and the emergence of new communication standards. Failure to innovate quickly enough risks market share erosion and declining revenue streams as agile competitors introduce disruptive technologies.

Global supply chain volatility and geopolitical risks also present significant challenges, affecting component availability, pricing, and delivery timelines for ADTRAN's networking solutions. For instance, trade disputes in 2024 have created uncertainty, potentially impacting the reliable sourcing of materials and timely product delivery to international customers. Operating in diverse international markets further exposes ADTRAN to risks from political instability and fluctuating economic policies, which can negatively impact profitability.

Economic downturns and market saturation in developed regions pose another threat, potentially reducing capital expenditure on networking infrastructure and limiting growth opportunities. A projected global GDP growth of 2.9% for 2024, as estimated by the IMF, can translate into tighter IT and telecom budgets, directly affecting demand for ADTRAN's offerings. This economic pressure, combined with intense competition in mature markets, could lead to price wars and reduced profit margins.

SWOT Analysis Data Sources

This ADTRAN SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and informed assessment.