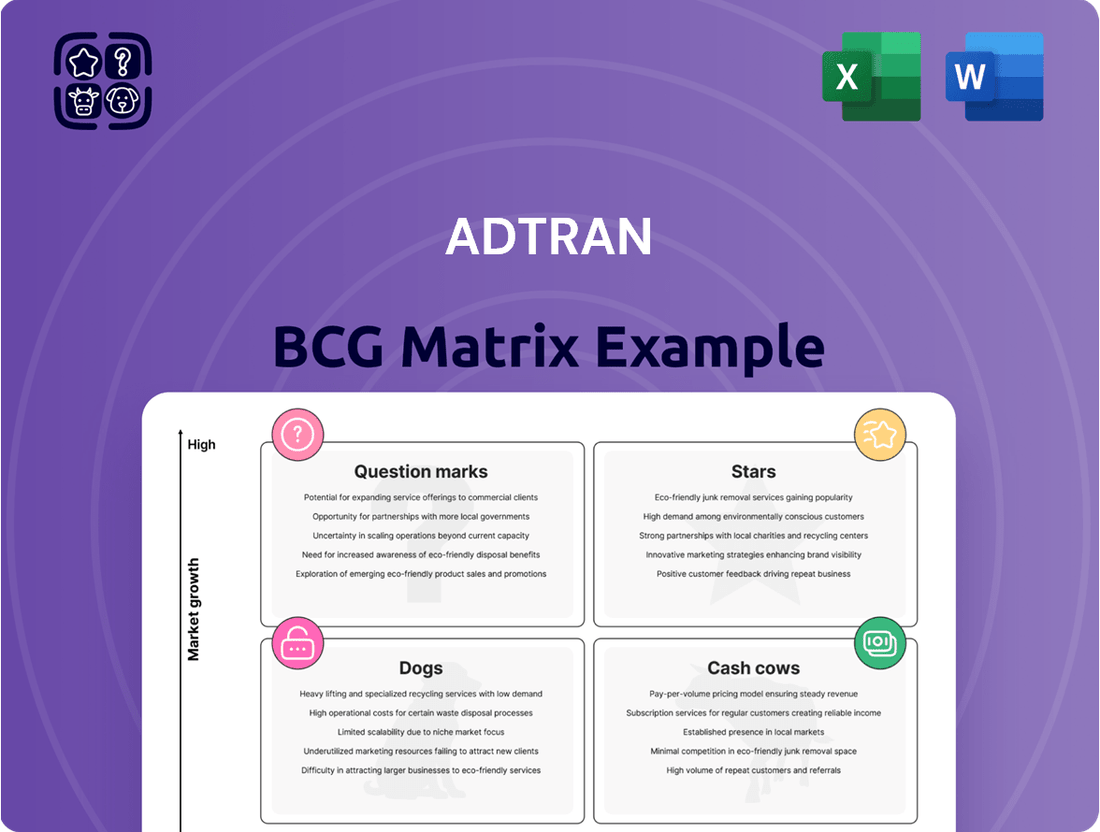

ADTRAN Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADTRAN Bundle

ADTRAN's product portfolio is a dynamic landscape, and understanding its position within the BCG Matrix is crucial for strategic growth. This initial glimpse highlights key areas, but to truly unlock ADTRAN's market potential, a deeper dive is essential.

Are ADTRAN's innovative solutions Stars poised for future dominance, or are its established offerings Cash Cows generating consistent revenue? Perhaps some products are languishing as Dogs, requiring divestment, or are emerging as Question Marks needing further investment to determine their trajectory.

This preview offers a foundational understanding, but for a comprehensive strategic roadmap, you need the full ADTRAN BCG Matrix. Gain clarity on which products are driving growth, which are consuming resources, and where to strategically allocate capital for maximum impact.

Purchase the complete BCG Matrix report to receive detailed quadrant placements, actionable data-driven recommendations, and a clear blueprint for informed investment and product development decisions at ADTRAN.

Don't miss the opportunity to gain a competitive edge. Buy the full ADTRAN BCG Matrix now and transform raw data into confident, impactful business strategies.

Stars

ADTRAN's 10G PON and XGS-PON fiber access platforms are a clear Star in the BCG Matrix, capitalizing on the surging global need for faster internet. These platforms are designed to deliver speeds up to 10 Gigabit per second, essential for next-generation services like cloud gaming and immersive augmented and virtual reality experiences.

The market's embrace of these technologies is evident in ADTRAN's SDX platform. A significant portion of the United Kingdom's Openreach Full Fibre network relies on ADTRAN's solutions. Furthermore, new deployments are underway in Scotland and across the United States, underscoring substantial market traction and robust growth prospects.

ADTRAN's Wi-Fi 7 residential gateways, including the SDG 8733 and the new SDG 9000 Series, are strategically positioned to capture the escalating demand for multi-gigabit in-home connectivity. These advanced solutions are designed to deliver seamless, high-speed internet throughout the residence, efficiently managing a growing ecosystem of smart devices and bandwidth-intensive applications that require minimal delay.

The market for advanced residential Wi-Fi is experiencing robust growth, driven by consumer needs for faster and more reliable internet. ADTRAN's proactive expansion of its Wi-Fi 7 product line, coupled with its active participation in testing collaborations to speed up market acceptance, underscores its commitment to this high-potential sector. This focus indicates ADTRAN is effectively capitalizing on the expanding market opportunity.

ADTRAN's optical networking solutions, encompassing Metro WDM platforms and pluggable coherent transceivers such as 100ZR and 400G OpenZR+, represent a key area of their business. These technologies are vital for constructing networks with substantial capacity and superior performance, specifically supporting data center interconnect (DCI) and upgrades to metro and regional networks.

The company's active involvement in industry interoperability demonstrations and its dedication to secure, scalable data transmission underscore a robust market position. This segment is experiencing significant growth, fueled by the escalating demands of AI deployments and the continuous expansion of mobile networks, with coherent transceiver market expected to grow substantially in the coming years.

Intelligent Network Management (Mosaic One)

ADTRAN's Mosaic One platform is positioned as a Star within the BCG Matrix. This cloud-based Software-as-a-Service (SaaS) offering is crucial for simplifying complex network operations for service providers. Its ability to deliver AI-driven insights and facilitate remote troubleshooting directly addresses the growing demand for network automation and intelligence.

The platform's effectiveness in optimizing network performance and enabling efficient scaling supports service providers as they adopt new technologies like fiber access. ADTRAN's increasing customer adoption, especially within the United States market, highlights the significant growth potential in this segment.

- High Growth Market: The network automation and intelligence market is experiencing rapid expansion, driven by the need for efficient and intelligent network management.

- AI-Driven Insights: Mosaic One leverages artificial intelligence to provide actionable insights, enhancing network performance and user experience.

- Remote Troubleshooting: The platform simplifies network maintenance by enabling remote diagnosis and resolution of issues, reducing operational costs and downtime.

- Scalability and Adoption: It supports the seamless integration of new fiber access technologies and in-home platforms, allowing providers to scale their services effectively.

Secure Communications for Critical Infrastructure

ADTRAN's secure communications solutions for critical infrastructure are a definite Star in their portfolio. The demand for robust, secure networks in sectors like government and utilities is surging, driven by the need to protect essential services from cyber threats. ADTRAN is well-positioned to meet this demand, especially as these sectors upgrade their systems. For instance, the U.S. government has allocated billions towards infrastructure modernization, with cybersecurity being a major component. This trend is further amplified by the growing adoption of AI at the network edge, which necessitates even tighter security protocols.

The market for secure communication technologies in critical infrastructure is experiencing significant growth. Industry analysts project the global critical infrastructure security market to reach over $130 billion by 2026, with a compound annual growth rate of approximately 12%. ADTRAN’s focus on this high-value segment, coupled with a broader industry movement to diversify away from vendors perceived as high-risk, creates a compelling growth opportunity. Their solutions address the core needs of these organizations:

- Enhanced Network Security: ADTRAN offers advanced encryption and intrusion detection systems vital for protecting sensitive data and operational continuity in critical sectors.

- Infrastructure Modernization Support: Their technology enables utilities and government agencies to upgrade legacy systems to more resilient and secure platforms.

- Edge AI Enablement: ADTRAN's solutions provide the secure, low-latency connectivity required for deploying AI applications at the network edge, a key trend in optimizing critical services.

- Vendor Diversification Benefits: As organizations reassess their vendor relationships, ADTRAN presents a reliable alternative, bolstering its market share in this strategic segment.

ADTRAN's 10G PON and XGS-PON fiber access platforms are clear Stars, driving high-speed internet adoption. The company's SDX platform underpins significant parts of the UK's Openreach network and is seeing new deployments in Scotland and the US, indicating strong market acceptance and growth potential.

ADTRAN's Wi-Fi 7 gateways, like the SDG 8733 and SDG 9000 Series, are positioned to capture the growing demand for advanced home connectivity. The company's investment in this area, including testing collaborations, highlights its focus on this rapidly expanding market segment.

Optical networking solutions, including Metro WDM and coherent transceivers like 100ZR and 400G OpenZR+, are crucial for high-capacity networks, especially for data center interconnects. The increasing demand from AI and mobile network expansion is fueling substantial growth in this sector.

ADTRAN's Mosaic One, a cloud-based SaaS platform, is a Star for its ability to simplify network operations with AI-driven insights and remote troubleshooting, addressing the critical need for network automation among service providers. Growing customer adoption, particularly in the US, signals strong potential.

Secure communications for critical infrastructure are a Star for ADTRAN, meeting the escalating demand for robust and secure networks in government and utilities. The US government's billions allocated to infrastructure modernization, with cybersecurity as a key focus, along with edge AI growth, further amplifies this opportunity. The critical infrastructure security market is projected to exceed $130 billion by 2026, growing at approximately 12% annually.

| Product Category | BCG Matrix Position | Key Growth Drivers | Market Trajectory | ADTRAN's Role |

|---|---|---|---|---|

| Fiber Access Platforms (10G/XGS-PON) | Star | Demand for faster internet, next-gen services (AR/VR, cloud gaming) | Rapidly expanding global market | Supplying UK Openreach, expanding in US and Scotland |

| Residential Wi-Fi (Wi-Fi 7) | Star | Need for multi-gigabit home connectivity, growing smart device ecosystem | Strong growth in advanced residential Wi-Fi | Launching new gateways, active in market acceptance testing |

| Optical Networking (WDM, Coherent Transceivers) | Star | AI deployments, mobile network expansion, data center interconnects | Significant growth projected for coherent transceiver market | Providing high-capacity solutions for critical network infrastructure |

| Mosaic One (Network Automation SaaS) | Star | Network automation, AI-driven insights, remote troubleshooting | Growing adoption in US market, increasing demand for network intelligence | Simplifying operations and optimizing performance for service providers |

| Secure Communications (Critical Infrastructure) | Star | Cybersecurity needs in government/utilities, infrastructure modernization, edge AI | Critical infrastructure security market projected to exceed $130B by 2026 (12% CAGR) | Providing secure, resilient solutions for essential services, benefiting from vendor diversification trends |

What is included in the product

The ADTRAN BCG Matrix offers a strategic overview of its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Simplified view of ADTRAN's portfolio, clarifying strategic focus and resource allocation.

Cash Cows

Established GPON Fiber Access Deployments are ADTRAN's cash cows. These robust, widely implemented GPON solutions are the bedrock of numerous service provider FTTP networks. While newer technologies emerge, GPON remains critical for global fiber backbones, ensuring stable revenue streams from ongoing maintenance, support, and gradual network enhancements.

ADTRAN's legacy DSL/VDSL access equipment, while not the company's primary focus today, likely operates as a Cash Cow within its portfolio. This mature technology continues to generate consistent revenue from a base of smaller and regional service providers who still depend on these networks. The ongoing demand for support, spare parts, and essential maintenance ensures a steady income stream with minimal need for significant new investment.

The profitability of this segment is bolstered by its established market presence. Despite the industry-wide shift towards fiber optics, a substantial number of customers remain invested in their existing DSL and VDSL infrastructure. This sustained reliance translates into predictable revenue, allowing ADTRAN to leverage its existing assets without substantial capital expenditure, a hallmark of a cash cow.

ADTRAN's core network aggregation platforms, the backbone for handling diverse traffic and consolidating it for transport, are classic cash cows. These are the stable, long-lived workhorses of telecom infrastructure, demanding ongoing support and incremental upgrades rather than revolutionary overhauls. Their established dominance in current network designs guarantees reliable revenue, even if growth is modest.

Hardware and Software Maintenance Services

ADTRAN's hardware and software maintenance services are a strong Cash Cow, generating consistent, high-margin revenue. This segment benefits from ADTRAN's large installed base, ensuring a steady stream of annuity-like income from critical network support.

- Predictable Recurring Revenue: The ongoing nature of maintenance contracts provides a stable revenue stream, reducing reliance on new product sales.

- High Profit Margins: Established customer relationships and the essentiality of network uptime allow for strong profitability in this segment.

- Growth Tied to Installed Base: As ADTRAN deploys more equipment, the potential revenue from maintenance services naturally expands.

- 2024 Financial Insight: While specific 2024 segment data is proprietary, ADTRAN's overall focus on recurring revenue models, as highlighted in their investor communications, underscores the importance of these services. The company consistently emphasizes the value of its service and support offerings in driving stable financial performance.

Mature Enterprise Networking Solutions

ADTRAN's mature enterprise networking solutions, especially those providing dependable connectivity for small to medium businesses and dispersed enterprises, fit the Cash Cow quadrant. These offerings meet a consistent, ongoing need for essential network infrastructure, even if they don't exhibit rapid market growth.

These solutions consistently generate predictable revenue streams, largely from established customer bases and recurring service contracts. Their mature nature means that the need for extensive research and development or high-impact marketing campaigns is reduced, allowing them to efficiently convert their market share into substantial cash flow.

- Stable Revenue Generation: Mature enterprise networking solutions contribute reliably to ADTRAN's cash flow, supporting investment in other business areas.

- Established Market Share: These products hold a significant position in their respective market segments, benefiting from brand recognition and customer loyalty.

- Lower Investment Needs: Compared to new technologies, these solutions require less capital for R&D and marketing, maximizing their cash-generating potential.

- Consistent Demand: The foundational nature of these networking services ensures a steady demand from businesses of all sizes.

ADTRAN's established GPON fiber access deployments represent a significant cash cow. These solutions, foundational to many fiber-to-the-home networks, continue to generate stable revenue through ongoing support and maintenance. Even with advancements in technology, GPON remains a critical component of global fiber infrastructure, ensuring consistent income streams for ADTRAN.

The company's mature DSL/VDSL access equipment also functions as a cash cow. These legacy systems continue to provide revenue from smaller and regional service providers who rely on them. The demand for maintenance and spare parts from this installed base ensures a steady, predictable income with minimal new investment required.

ADTRAN's core network aggregation platforms are classic cash cows, acting as the stable workhorses for telecom infrastructure. These mature products require ongoing support and incremental upgrades rather than substantial R&D, guaranteeing reliable revenue from their established market position.

Hardware and software maintenance services are a prime cash cow for ADTRAN, offering high-margin, recurring revenue. This segment benefits from ADTRAN's large installed base, providing annuity-like income critical for financial stability.

| Product/Service | BCG Quadrant | Revenue Driver | Investment Need | 2024 Outlook |

| GPON Fiber Access Deployments | Cash Cow | Support, Maintenance, Upgrades | Low | Stable, driven by existing FTTP networks |

| DSL/VDSL Access Equipment | Cash Cow | Maintenance, Spare Parts | Very Low | Consistent from legacy providers |

| Core Network Aggregation Platforms | Cash Cow | Support, Incremental Upgrades | Low | Reliable revenue from established infrastructure |

| Hardware & Software Maintenance Services | Cash Cow | Recurring Contracts, Installed Base | Minimal | High-margin, stable annuity income |

What You’re Viewing Is Included

ADTRAN BCG Matrix

The ADTRAN BCG Matrix preview you are viewing is the identical, fully unlocked document you will receive after purchase, offering an uncompromised strategic analysis.

This preview accurately represents the final ADTRAN BCG Matrix report, ensuring you receive a complete, professionally formatted analysis ready for immediate strategic application without any hidden surprises.

What you see is precisely the ADTRAN BCG Matrix document you'll download post-purchase, providing you with an unwatermarked, analysis-ready tool for informed business decisions.

Rest assured, the ADTRAN BCG Matrix preview is the exact file you'll receive after completing your purchase, delivering a comprehensive and ready-to-use strategic framework.

Dogs

Very old generation copper-based access products, those predating modern DSL or fiber upgrades, are likely candidates for the Divest segment of the BCG Matrix. The market for these legacy technologies is experiencing a steep and undeniable decline. This is driven by service providers worldwide making significant transitions to fiber optics and other higher-speed, more efficient alternatives.

ADTRAN would likely hold minimal market share in this aging segment, with growth prospects remaining exceptionally low. Continued investment in these outdated copper solutions would be unprofitable. Therefore, these products are best suited for divestiture to allow ADTRAN to focus resources on more promising growth areas.

Niche, Underperforming Regional Market Ventures within ADTRAN's portfolio represent areas where the company has struggled to establish a strong foothold or achieve desired market share. These ventures often consume resources without yielding proportionate returns, potentially impacting overall profitability and strategic focus. For instance, a particular regional expansion into a less developed telecommunications market might not have materialized as planned, resulting in minimal revenue generation and a low competitive standing.

These ventures are characterized by their stagnant growth and high operational expenses relative to their revenue contribution. ADTRAN's financial reports from 2024 indicate that certain smaller, localized market initiatives, while strategically conceived, have not achieved the critical mass needed for profitability. The investment in these niche areas, perhaps a specific fiber deployment project in a smaller city that faced unexpected regulatory hurdles or lower-than-anticipated customer adoption, exemplifies this category.

ADTRAN's discontinued or obsolete product lines represent items that no longer contribute to new revenue streams due to technological advancements or market shifts. These products, while perhaps once successful, now primarily represent costs associated with winding down operations or managing remaining inventory. For instance, older copper-based access technologies, largely superseded by fiber, would fit here. The company's focus for these segments is on cost containment and minimizing any remaining liabilities.

Unsuccessful Standalone Software Offerings (Non-Mosaic)

ADTRAN's portfolio may include standalone software offerings that haven't gained significant traction, potentially falling into the Dogs category of the BCG Matrix. These represent areas where investment in software development has not translated into substantial market adoption or recurring revenue. For instance, if a specific network management tool, separate from their integrated Mosaic One platform, experienced low adoption rates and struggled against established competitors, it would likely be classified as a Dog.

Such products typically operate in highly competitive software markets with limited differentiation. Their low market share means they contribute minimally to overall revenue and profitability. For example, a standalone analytics product launched in 2023 that failed to secure a significant customer base by early 2024, facing strong competition from cloud-based solutions, would fit this description.

- Low Market Share: These software offerings likely hold a negligible percentage of their respective market segments.

- Limited Revenue Contribution: They generate minimal sales and have not established a strong recurring revenue stream.

- High Competition: The software landscape for these products is crowded with more dominant or innovative solutions.

- Potential for Divestment: ADTRAN might consider divesting or discontinuing these underperforming assets to reallocate resources.

Low-Demand, High-Maintenance Custom Solutions

Low-Demand, High-Maintenance Custom Solutions, often referred to as Dogs in the ADTRAN BCG Matrix, represent offerings that require significant investment in support and upkeep but generate limited revenue. These are typically tailored for a small, specific customer base, making them difficult to scale or adapt for wider market appeal. For instance, a specialized software module developed for a single enterprise client, requiring constant custom updates and dedicated support staff, would fit this category. In 2024, many companies found themselves re-evaluating such offerings as operational costs continued to rise, impacting profitability.

These solutions often tie up valuable resources, including engineering talent and customer support teams, without the prospect of significant future growth. The high operational overhead associated with maintaining these niche products can detract from investments in more promising areas of the business. Consider a scenario where a company dedicates 15% of its R&D budget to maintaining custom solutions that only account for 2% of its total revenue. This imbalance highlights the challenge.

- Limited Market Share: These solutions cater to a narrow segment, preventing broad adoption.

- High Operational Costs: Significant resources are consumed by maintenance and support.

- Low Growth Potential: Lack of scalability hinders future revenue expansion.

- Resource Drain: Talent and capital are diverted from potentially more lucrative ventures.

Dogs in ADTRAN's BCG Matrix represent products or services with low market share and low growth prospects. These often include legacy copper-based access products that are being phased out in favor of fiber. Additionally, underperforming niche regional ventures or standalone software offerings that haven't gained traction also fall into this category.

These segments consume resources without generating significant returns, characterized by high operational expenses relative to revenue. For instance, ADTRAN's 2024 financial reports may show certain localized market initiatives with minimal revenue generation and a low competitive standing, exemplifying this challenge.

The focus for these "Dog" products is on minimizing costs and potential divestment to reallocate capital to more promising growth areas within ADTRAN's portfolio.

| BCG Category | Product/Service Example | Market Share | Market Growth | Strategic Recommendation |

|---|---|---|---|---|

| Dogs | Legacy Copper Access Products | Very Low | Declining | Divest/Discontinue |

| Dogs | Underperforming Niche Regional Ventures | Low | Stagnant | Divest/Restructure |

| Dogs | Standalone Underperforming Software | Negligible | Low | Divest/Discontinue |

Question Marks

ADTRAN's early investments and partnerships in 50G PON technology, exemplified by its collaboration with IdeaTek, position the company to capitalize on a high-growth market for future broadband speeds exceeding 10G. This emerging technology represents a significant opportunity for ADTRAN to shape the next generation of fiber access.

While the potential is substantial, ADTRAN's current market share in 50G PON is nascent, reflecting the technology's early stage of development. Capturing a leading position will necessitate substantial ongoing investment in research, development, and scaling of these advanced solutions.

Advanced network automation and orchestration software represents a Question Mark for ADTRAN within the BCG Matrix. While the overall market for automating network operations is experiencing significant growth, ADTRAN's current market share in these highly sophisticated and complex software solutions may still be relatively modest.

Developing and maintaining competitive advanced automation and orchestration capabilities requires substantial and ongoing investment in research and development. This is crucial for building robust offerings that can gain meaningful market traction against established players and rapidly evolving technological demands.

The total addressable market for network automation and orchestration is projected to reach $15.8 billion by 2024, according to MarketsandMarkets. This indicates a strong growth trajectory for the segment, presenting a clear opportunity for ADTRAN to increase its presence.

Emerging AI-driven network intelligence applications are poised to revolutionize how networks are managed and optimized. These advanced solutions go beyond traditional monitoring, offering predictive analytics for fault detection, automated root cause analysis, and intelligent resource allocation. For instance, AI can anticipate network congestion by analyzing traffic patterns, allowing for proactive adjustments. This predictive capability is crucial for maintaining service quality in increasingly complex network environments.

The application of Artificial Intelligence within the networking sector represents a significant growth opportunity. While ADTRAN's current Mosaic One platform offers valuable network insights, the company's specific market share and capabilities in these more cutting-edge, AI-centric applications are likely still in their formative stages. This segment demands substantial investment in AI research and development to transition from nascent concepts to market-leading solutions.

Developing these advanced AI-driven network intelligence solutions requires considerable financial commitment. Companies in this space must invest heavily in AI talent, data science infrastructure, and the continuous refinement of machine learning algorithms. This R&D focus is critical for transforming AI capabilities from theoretical potential into tangible, revenue-generating products that can secure a strong market position.

New Geographic Market Expansions (e.g., specific APAC regions)

Aggressive expansion into high-growth geographic markets, particularly within the Asia-Pacific (APAC) region, presents a strategic avenue for ADTRAN. These markets, characterized by increasing demand for networking solutions, offer substantial growth potential despite ADTRAN's current low market share in many of them. For instance, the APAC region's telecommunications market was projected to reach over $1.1 trillion by 2024, presenting a significant opportunity for infrastructure providers.

This aggressive geographic expansion strategy would necessitate considerable upfront investment. These investments would target building a robust sales and marketing infrastructure, localizing product offerings to meet specific regional demands, and establishing strong distribution channels. The aim is to secure a significant market foothold, recognizing that immediate returns may not be guaranteed due to the competitive landscape and the need for market penetration.

The success of this strategy hinges on careful market analysis and a willingness to adapt. Should market entry prove more challenging than anticipated, with high barriers to adoption or intense competition, ADTRAN might need to re-evaluate its approach. This could involve adjusting investment levels or exploring strategic partnerships to mitigate risks and optimize resource allocation.

Key considerations for ADTRAN's new geographic market expansions include:

- Targeting specific high-growth APAC markets with strong digital transformation initiatives.

- Allocating significant capital for localized sales, marketing, and support.

- Developing flexible go-to-market strategies tailored to diverse regional needs.

- Continuously monitoring market penetration and return on investment, with contingency plans for challenging entries.

Open RAN and Disaggregated Mobile Network Components

ADTRAN's potential foray into Open RAN and other disaggregated mobile network components places it squarely in the Question Mark category of the BCG matrix. While the overall Open RAN market is experiencing substantial growth, projected to reach approximately $16 billion by 2027 according to some industry analyses, ADTRAN's current focus on fixed access means its market share in this nascent mobile segment would likely be negligible.

This positioning highlights the inherent risk and reward. The disruptive nature of Open RAN presents a significant opportunity, but capturing meaningful market share requires substantial investment and strategic execution.

- High Growth Potential: The global Open RAN market is anticipated to see robust expansion, driven by operator demand for flexibility and cost-efficiency.

- Low Current Market Share: ADTRAN's established strength in fixed access implies a very small, if any, presence in the disaggregated mobile network space as of 2024.

- Strategic Investment Required: To transition from a Question Mark to a Star, ADTRAN would need to allocate significant resources towards research, development, and market penetration in Open RAN.

- Risk of Becoming a Dog: Without successful scaling and market adoption, continued investment in this area could result in it becoming a Dog, consuming resources without generating substantial returns.

ADTRAN's advancements in network automation and orchestration software represent a Question Mark. The market for these solutions is growing rapidly, with the total addressable market expected to reach $15.8 billion by 2024, offering a substantial opportunity for ADTRAN to increase its market presence.

However, ADTRAN's current market share in these sophisticated software areas is likely modest, necessitating significant ongoing investment in research and development to compete effectively.

The company's strategic focus on AI-driven network intelligence also places it in the Question Mark category, requiring substantial R&D investment to translate potential into market leadership.

Similarly, ADTRAN's potential expansion into Open RAN, a market projected to reach $16 billion by 2027, is a Question Mark given its current limited presence in disaggregated mobile networks, demanding significant strategic investment to capture market share.

| Category | Market Growth | ADTRAN Market Share (Est.) | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Network Automation & Orchestration | High (TAM $15.8B by 2024) | Low to Moderate | High | Star or Dog |

| AI-Driven Network Intelligence | High (Emerging) | Low (Nascent) | Very High | Star or Dog |

| Open RAN | High (Projected $16B by 2027) | Negligible | Very High | Star or Dog |

BCG Matrix Data Sources

Our ADTRAN BCG Matrix leverages comprehensive data, including financial statements, market share reports, and industry growth forecasts, to provide an accurate strategic overview.