Adlink SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adlink Bundle

Adlink's market position is fortified by its strong brand recognition and established distribution networks, but it faces increasing competition and evolving technological landscapes. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities or mitigate risks within this sector.

Want the full story behind Adlink's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ADLINK boasts an extensive product portfolio, featuring a wide array of embedded boards, systems, and modules designed for various industrial applications. This broad offering spans critical sectors like industrial automation, healthcare, transportation, and gaming, effectively diversifying their market exposure and mitigating risks associated with over-reliance on any single segment.

Their comprehensive solutions, which notably include the new Open Standard Modules (OSM) and a variety of processor-based options from leading providers such as Intel, NVIDIA, Arm, AMD, MediaTek, NXP, and Qualcomm, allow ADLINK to adeptly address a wide spectrum of customer requirements and emerging technological demands.

ADLINK is a leader in Edge AI and generative AI, actively developing and demonstrating cutting-edge innovations. Their portfolio includes solutions like AI-ADAS for commercial vehicles and AI smart cameras for industrial automation, showcasing their commitment to practical AI applications.

The company's expandable DLAP Edge AI platforms are designed to meet the growing need for intelligent processing at the edge. As an NVIDIA Elite Partner, ADLINK is strategically positioned to leverage the significant market growth in AI-driven edge computing solutions.

ADLINK's strategic alliances with major technology players like Intel, NVIDIA, Arm, AMD, MediaTek, NXP, and Qualcomm are a significant strength. These collaborations are crucial for powering the high-performance computing required for edge AI applications, allowing ADLINK to offer complete solutions.

The company's 'EdgeOpen Consortium' is another key asset, actively promoting collaboration among distributors, independent software vendors (ISVs), and other partners. This ecosystem approach accelerates both business growth and technological innovation within the edge computing space.

Deep Expertise in High-Growth Vertical Markets

ADLINK's deep expertise in high-growth vertical markets is a significant strength. They have developed specialized knowledge and tailored solutions for rapidly expanding sectors such as industrial automation, healthcare, and transportation, with a particular focus on railway and autonomous driving applications.

This focused approach enables ADLINK to offer application-ready intelligent platforms that precisely meet the demanding and specific requirements of these industries. The embedded computing market and Industrial IoT (IIoT) are seeing substantial growth, and ADLINK's specialization positions them well to capitalize on these trends.

For instance, the global industrial automation market was valued at approximately $200 billion in 2023 and is projected to grow at a CAGR of over 8% through 2030. Similarly, the IIoT market is expected to reach over $1 trillion by 2028, demonstrating the immense potential in these sectors where ADLINK excels.

- Specialized knowledge in industrial automation, healthcare, and transportation.

- Development of application-ready intelligent platforms for specific industry needs.

- Alignment with high-growth embedded computing and Industrial IoT markets.

- Targeting key growth areas like railway and autonomous driving.

Commitment to Green Computing and Sustainability

ADLINK is making significant strides in green computing, championing its 'Greener Tech, Smarter Edge AI' initiative. This focus translates into developing energy-efficient embedded devices and sustainable solutions. For instance, their AI-powered auto-sorting technology for recycling demonstrates a practical application of this commitment, aiming to reduce waste and improve resource management.

This dedication to environmental responsibility is not just a philosophical stance; it directly addresses a growing market demand. As global Environmental, Social, and Governance (ESG) goals gain prominence, customers are increasingly prioritizing technology partners who demonstrate a clear commitment to sustainability. ADLINK's efforts in this area position them favorably in a market where eco-conscious choices are becoming a key differentiator.

The company's product development strategy emphasizes reducing energy consumption and optimizing operational efficiency. This includes hardware designed for lower power draw and software solutions that leverage AI to streamline processes, thereby minimizing their environmental footprint. This approach is crucial for industries looking to cut operational costs and meet their own sustainability targets.

Key aspects of ADLINK's sustainability commitment include:

- Focus on Energy Efficiency: Developing embedded devices with reduced power consumption.

- Sustainable Solutions: Creating products and services that contribute to environmental goals, like AI for recycling.

- Market Alignment: Responding to increasing customer demand for environmentally responsible technology.

- Operational Optimization: Leveraging AI to improve efficiency and reduce resource usage in various applications.

ADLINK's extensive product catalog covers a wide range of embedded boards, systems, and modules, serving diverse industrial sectors like automation, healthcare, and transportation. Their commitment to Edge AI and generative AI is evident in solutions like AI-ADAS for vehicles and smart cameras for industry, positioning them as a leader in this rapidly expanding field.

Strategic partnerships with tech giants such as NVIDIA, Intel, and Arm are a core strength, enabling ADLINK to deliver high-performance edge AI solutions. The company's 'EdgeOpen Consortium' further fosters an ecosystem of collaboration, accelerating innovation and business growth in edge computing.

ADLINK demonstrates deep expertise in high-growth markets like industrial automation and transportation, particularly in railway and autonomous driving. Their tailored, application-ready platforms cater to specific industry demands, aligning with the substantial growth in the embedded computing and Industrial IoT sectors. For example, the global industrial automation market reached approximately $200 billion in 2023.

ADLINK's focus on green computing, exemplified by their 'Greener Tech, Smarter Edge AI' initiative, addresses the growing market demand for sustainable solutions. Developing energy-efficient devices and AI applications for recycling showcases their commitment to environmental responsibility, a key differentiator in today's market.

| Strength Category | Key Aspect | Supporting Detail |

|---|---|---|

| Product Portfolio & Innovation | Broad Embedded Solutions | Extensive range of boards, systems, and modules for industrial applications. |

| Market Leadership | Edge AI & Generative AI | Development of cutting-edge AI solutions like AI-ADAS and AI smart cameras. |

| Strategic Alliances | Key Technology Partnerships | Collaborations with NVIDIA, Intel, Arm, etc., to power high-performance edge AI. |

| Ecosystem Development | EdgeOpen Consortium | Fosters collaboration among distributors and ISVs to accelerate edge computing growth. |

| Vertical Market Expertise | Specialized Industry Focus | Deep knowledge in industrial automation, healthcare, and transportation (railway, autonomous driving). |

| Sustainability Focus | Green Computing Initiative | Development of energy-efficient devices and eco-conscious solutions. |

What is included in the product

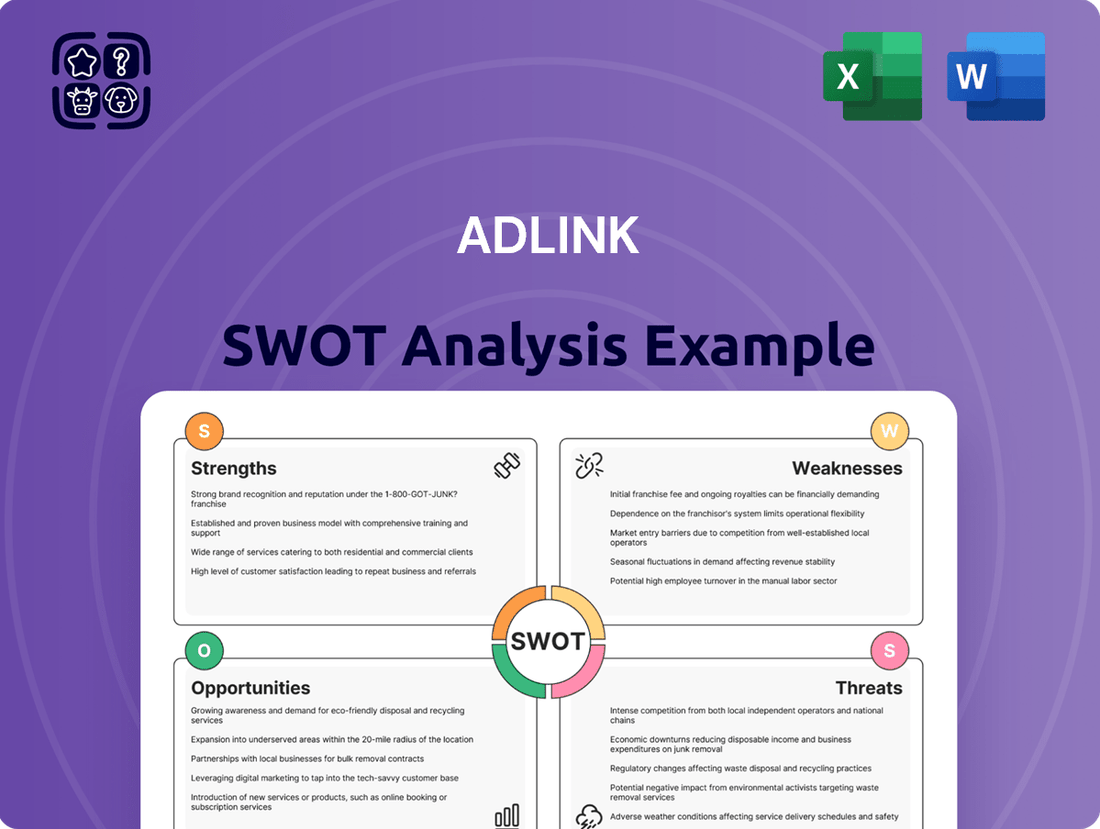

Delivers a strategic overview of Adlink’s internal strengths, weaknesses, external opportunities, and threats.

Adlink's SWOT analysis offers a clear, actionable roadmap by identifying key internal strengths and weaknesses alongside external opportunities and threats, thereby alleviating strategic uncertainty and guiding focused decision-making.

Weaknesses

ADLINK operates in the embedded computing and Edge AI sectors, which are characterized by a high degree of competition and fragmentation. This crowded landscape means many companies are vying for the same customers, creating significant pressure on pricing. For example, the global edge computing market, valued at approximately $11.7 billion in 2023, is projected to grow substantially, attracting more entrants.

This intense rivalry makes it difficult for ADLINK to stand out. Differentiating its products and services becomes a constant challenge, potentially squeezing profit margins. Companies must invest heavily in research and development to stay ahead, a costly endeavor that can impact financial performance if new innovations don't gain traction quickly enough.

ADLINK's core products are heavily dependent on chip architectures provided by external technology giants such as Intel, NVIDIA, and AMD. This fundamental reliance means ADLINK is susceptible to disruptions in the global supply chain for these critical components. For instance, the semiconductor shortages experienced in 2021-2022 significantly impacted many tech companies, and ADLINK would likely face similar challenges if such events recur.

Furthermore, ADLINK's pricing strategy and product development timelines are intrinsically linked to the pricing and future roadmaps of these third-party chip providers. Any unexpected price increases or shifts in the strategic direction of Intel, NVIDIA, or AMD could directly affect ADLINK's cost of goods sold and its ability to innovate and bring new products to market effectively.

ADLINK's Edge AI solutions, while promising, can encounter significant integration hurdles as clients scale from initial trials to full operational deployment. This complexity in merging with diverse existing IT systems and varied operational settings presents a notable weakness, potentially leading to extended project durations and escalating implementation expenses for customers.

Vulnerability to Cybersecurity Threats

ADLINK's embedded computing and AI solutions, vital for sectors like industrial automation, healthcare, and transportation, face heightened cybersecurity risks. The interconnectedness of IoT and edge devices creates numerous entry points for cyberattacks, potentially leading to significant data breaches and operational downtime. For instance, in 2024, the industrial IoT sector experienced a notable increase in ransomware attacks targeting operational technology (OT) systems, highlighting the real-world threat landscape.

The potential for cyberattacks to disrupt critical infrastructure, such as smart grids or autonomous vehicle systems, poses a serious threat to ADLINK's reputation and customer trust. Maintaining state-of-the-art security protocols across a diverse product portfolio, especially with the rapid evolution of cyber threats, remains a continuous and substantial challenge for the company. Reports from 2024 indicated that the average cost of a data breach in the industrial sector exceeded $4 million, underscoring the financial implications of security failures.

- Exposure of critical infrastructure to cyber threats.

- Risk of data breaches and operational disruptions.

- Reputational damage from security incidents.

- Ongoing challenge of maintaining robust security measures.

Fluctuations in Financial Performance

ADLINK's financial performance has shown notable fluctuations, presenting a key weakness. For example, while Q1 2025 indicated a net income recovery, the company experienced a net loss in Q1 2024. This inconsistency suggests potential difficulties in achieving predictable earnings.

Further illustrating this weakness, ADLINK reported a revenue decline in fiscal year 2024, contrasting with broader market growth trends. This dip in revenue, even amidst a growing market, highlights challenges in capitalizing on market opportunities and maintaining sales momentum.

Consequently, ADLINK may struggle to consistently meet financial projections. The volatility observed in its recent earnings and revenue reports indicates an underlying vulnerability to market shifts and operational execution, impacting investor confidence and strategic planning.

- Revenue Decline in FY 2024: ADLINK experienced a downturn in revenue for the fiscal year 2024.

- Net Income Volatility: The company reported a net loss in Q1 2024, followed by a net income recovery in Q1 2025.

- Inconsistent Performance: These financial swings suggest ADLINK faces challenges in achieving stable and predictable financial results.

- Market Growth Disconnect: The fluctuations occurred despite an overall growth trend in the relevant market sectors.

ADLINK's reliance on a few key chip suppliers, like Intel and NVIDIA, creates a significant vulnerability. Any disruptions in their supply chains or changes in their product roadmaps directly impact ADLINK's ability to produce and price its own offerings. For instance, the global semiconductor shortage in 2021-2022 demonstrated how dependent companies can be on these component providers.

The complex integration of ADLINK's Edge AI solutions with diverse client IT systems presents a hurdle. This can lead to longer project timelines and increased implementation costs for customers, potentially slowing adoption. Furthermore, the company's embedded computing and AI products are increasingly targeted by cyber threats. In 2024, industrial IoT systems saw a rise in ransomware attacks, with average data breach costs in the industrial sector exceeding $4 million, highlighting the substantial risks ADLINK faces in protecting its clients' critical operations and its own reputation.

ADLINK's financial performance exhibits notable instability. The company reported a net loss in Q1 2024, followed by a recovery in Q1 2025, indicating inconsistent earnings. This volatility is compounded by a revenue decline in fiscal year 2024, even as the broader market for its solutions expanded. Such fluctuations suggest difficulties in consistently capitalizing on market opportunities and achieving predictable financial results, which can impact investor confidence.

What You See Is What You Get

Adlink SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final Adlink SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering comprehensive insights into Adlink's strategic position.

Opportunities

The Edge AI market is poised for substantial expansion, with projections indicating a significant surge in enterprise adoption by 2025. This growth is fueled by the increasing need for real-time data processing and decision-making at the source, bypassing the latency of cloud-based solutions.

Concurrently, the Industrial IoT (IIoT) sector is experiencing rapid growth, driven by the global push for automation, predictive maintenance, and digital transformation across manufacturing, logistics, and energy sectors. The IIoT market was valued at over $200 billion in 2023 and is expected to grow at a CAGR of over 20% through 2028.

ADLINK is strategically positioned to capitalize on these converging trends. Its robust portfolio of advanced edge AI hardware and comprehensive IIoT platforms enables businesses to deploy intelligent solutions that enhance operational efficiency, improve product quality, and unlock new revenue streams.

The embedded computing market is experiencing robust growth, largely driven by the expanding use cases for edge computing. This trend is evident in the increasing incorporation of embedded systems within critical sectors like medical devices, the ongoing development and deployment of autonomous vehicles, and the growing need for smarter, more connected infrastructure.

ADLINK's strategic alignment with these burgeoning edge computing applications offers substantial opportunities for market penetration and growth. For instance, the global edge computing market was projected to reach $11.4 billion in 2024 and is expected to grow to $39.5 billion by 2029, demonstrating a compound annual growth rate of 28.2% according to some market analyses.

The healthcare industry's digital shift is accelerating, creating a significant opportunity for AI solutions. This growing demand for AI in medical technology, aimed at better diagnostics, efficient operations, and improved patient outcomes, presents a fertile ground for growth. For instance, the global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to reach over $190 billion by 2030, showcasing a compound annual growth rate of over 36%.

ADLINK's medically certified devices and its advancements in AI-powered medical innovations are perfectly aligned to capitalize on this trend. The company is well-positioned to secure a more substantial portion of this expanding market by offering solutions that address critical needs in healthcare's technological evolution.

Rise of Autonomous Systems and Robotics

The accelerating adoption of autonomous systems, from self-driving cars to sophisticated industrial robots, presents a significant growth avenue. This trend is fueling demand for high-performance, low-power embedded computing, a core strength for ADLINK.

ADLINK's portfolio, encompassing autonomous driving platforms, robotics control systems, and AI-powered vision solutions, is strategically positioned to capitalize on this expansion. For instance, the global market for autonomous mobile robots (AMRs) was projected to reach approximately $5.5 billion in 2024, with significant growth expected in the coming years.

- Growing Demand for AI-Enabled Robotics: The industrial robotics market alone is anticipated to exceed $100 billion by 2030, with AI integration being a key driver.

- Expansion in Autonomous Vehicle Technology: The automotive sector's push towards Level 4 and Level 5 autonomy necessitates robust edge computing solutions that ADLINK provides.

- Increased Investment in Smart Factory Automation: As factories become more automated, the need for integrated control and vision systems, ADLINK's specialty, will surge.

Advancements in Complementary Technologies (5G, Generative AI)

The widespread rollout of 5G networks is a significant opportunity for ADLINK. By mid-2024, 5G coverage was expanding rapidly, with over 1.5 billion 5G connections globally, enabling much faster data speeds and lower latency. This allows ADLINK's edge computing solutions to process and transmit data more efficiently, unlocking new possibilities for real-time analytics and control in sectors like industrial automation and smart cities.

Generative AI's rapid advancements, particularly in creating and processing complex data, offer another avenue for growth. As of early 2025, the generative AI market is projected to reach hundreds of billions of dollars, indicating strong demand for AI-powered solutions. ADLINK can leverage these AI breakthroughs to develop more intelligent edge devices capable of sophisticated pattern recognition, predictive maintenance, and automated decision-making, thereby enhancing the value proposition of its product portfolio.

These complementary technologies create synergistic opportunities:

- Enhanced Edge AI Capabilities: ADLINK can integrate advanced generative AI models into its edge AI platforms, enabling more powerful on-device intelligence for applications like autonomous systems and advanced video analytics.

- New Application Development: The combination of 5G's connectivity and AI's processing power opens doors for entirely new applications, such as immersive AR/VR experiences in industrial settings or highly responsive robotic systems.

- Improved Data Processing: Faster data transfer via 5G combined with AI-driven data pre-processing at the edge can significantly reduce the burden on cloud infrastructure and accelerate insights generation for ADLINK's clients.

The expanding market for AI-enabled robotics, projected to exceed $100 billion by 2030, presents a significant opportunity for ADLINK, especially with AI integration being a key growth driver. The company's expertise in embedded computing is also crucial for the automotive sector's advancement towards higher levels of autonomous vehicle technology, a market segment expecting substantial growth. Furthermore, the increasing investment in smart factory automation, a sector where ADLINK specializes in integrated control and vision systems, is set to drive demand for its solutions.

| Opportunity Area | Market Projection/Growth Factor | ADLINK's Relevance |

| AI-Enabled Robotics | Industrial robotics market > $100 billion by 2030 | Leverages AI and embedded computing strengths |

| Autonomous Vehicle Technology | Increasing demand for advanced edge solutions | Core competency in high-performance, low-power embedded computing |

| Smart Factory Automation | Surging need for integrated control and vision systems | Specializes in these critical system components |

Threats

The embedded computing and Edge AI sectors are seeing a surge in competition, with both seasoned companies and new entrants vying for market share. This crowded field naturally drives down prices, squeezing profit margins for all players. For Adlink, this means a constant need to innovate and offer unique value to stand out.

For instance, the global edge computing market was valued at approximately $10.45 billion in 2023 and is projected to reach $100.70 billion by 2030, growing at a CAGR of 38.4% during this period. This rapid expansion attracts numerous companies, intensifying the pressure on pricing and demanding continuous product development to maintain a competitive edge.

The relentless pace of technological advancement, particularly in areas like embedded computing, AI, and the Internet of Things (IoT), presents a significant threat of rapid product obsolescence for ADLINK. This means their current offerings could quickly become outdated if they don't keep up.

To counter this, ADLINK faces the necessity of substantial, ongoing investment in research and development. For instance, in 2023, ADLINK reported R&D expenses of approximately NT$1.4 billion (around $45 million USD), a figure that will likely need to remain robust or increase to maintain competitiveness and ensure their products stay relevant in these fast-moving sectors.

ADLINK's reliance on a global network of semiconductor suppliers and intricate supply chains makes it susceptible to disruptions. For instance, the ongoing semiconductor shortage, which significantly impacted the tech industry throughout 2023 and into early 2024, directly affects ADLINK's ability to secure critical components. This can lead to extended lead times and higher material costs, potentially squeezing profit margins and delaying product launches.

Escalating Cybersecurity Risks and Data Privacy Regulations

The increasing sophistication of cyberattacks poses a significant threat as ADLINK's embedded systems handle more sensitive data. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the financial ramifications. This escalating risk demands continuous investment in robust security measures to protect both ADLINK's intellectual property and its customers' data.

Furthermore, the evolving landscape of global data privacy regulations, such as the GDPR and similar frameworks enacted in various regions, introduces complex compliance burdens. Non-compliance can result in substantial fines; for example, under GDPR, penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. These regulations necessitate rigorous data handling protocols and could increase operational costs for ADLINK and its clients, impacting profitability and market access.

- Growing threat of sophisticated cyberattacks targeting interconnected embedded systems.

- Increased operational costs due to evolving global data privacy regulations like GDPR.

- Potential for significant financial penalties and legal risks stemming from data breaches and non-compliance.

Economic Downturns and Sector-Specific Slowdowns

Economic downturns pose a significant threat to ADLINK. A slowdown in key sectors like manufacturing or transportation, which rely heavily on embedded computing, can directly reduce capital expenditure and demand for ADLINK's solutions. For instance, a projected global GDP growth deceleration in 2024-2025, potentially below 2.5% due to persistent inflation and geopolitical tensions, could severely impact ADLINK’s order volumes.

Sector-specific slowdowns are also a concern. If the industrial automation market, a core area for ADLINK, experiences a contraction due to oversupply or reduced consumer spending on manufactured goods, ADLINK's revenue growth could be stunted. The semiconductor industry, which ADLINK is closely tied to, has already seen cyclical downturns, and a repeat could affect component availability and pricing, further pressuring ADLINK's margins.

Historical data supports this vulnerability. During the 2008 financial crisis, many technology companies, including those in embedded systems, experienced sharp declines in sales as businesses cut back on investments. Similarly, the COVID-19 pandemic's initial economic shock led to supply chain disruptions and a temporary dip in demand across various industries ADLINK serves, highlighting the company's sensitivity to broader economic instability.

- Economic Instability: Global economic slowdowns projected for 2024-2025 could reduce ADLINK's customer spending.

- Sector Contraction: Downturns in manufacturing or transportation directly decrease demand for ADLINK's core products.

- Historical Precedent: Past economic crises have shown significant negative impacts on technology and embedded systems companies.

Intense competition in the embedded computing and Edge AI markets pressures ADLINK's pricing and profit margins. The rapid pace of technological advancement also poses a threat of product obsolescence, requiring substantial and continuous R&D investment. For example, ADLINK's 2023 R&D spending was approximately NT$1.4 billion (around $45 million USD), a figure that needs to remain high to stay competitive.

ADLINK's reliance on global supply chains makes it vulnerable to disruptions, such as the semiconductor shortages experienced through 2023 and early 2024, which can delay products and increase costs. Furthermore, sophisticated cyberattacks are a growing concern, with the global average cost of a data breach reaching $4.45 million in 2024, necessitating robust security investments.

Evolving data privacy regulations, like GDPR, add complexity and compliance costs, with potential fines up to 4% of global turnover for non-compliance. Economic downturns and sector-specific slowdowns, particularly in manufacturing and transportation, can significantly reduce demand for ADLINK's solutions, as seen in past economic crises.

| Threat Category | Specific Threat | Impact on ADLINK | Example Data/Context |

|---|---|---|---|

| Market Competition | Intensified competition in Edge AI and embedded computing | Price pressure, reduced profit margins | Global edge computing market projected to reach $100.70 billion by 2030 (CAGR 38.4%) |

| Technological Obsolescence | Rapid advancements in AI, IoT, and embedded systems | Need for continuous R&D, risk of outdated products | ADLINK's 2023 R&D expenses: ~NT$1.4 billion (~$45 million USD) |

| Supply Chain Disruptions | Reliance on global semiconductor suppliers | Component shortages, increased lead times, higher costs | Ongoing semiconductor shortages impacting tech industry (2023-early 2024) |

| Cybersecurity Risks | Increasing sophistication of cyberattacks | Data breach costs, IP protection, customer data security | Global average cost of data breach: $4.45 million (2024) |

| Regulatory Compliance | Evolving data privacy laws (e.g., GDPR) | Increased operational costs, potential for fines | GDPR fines up to 4% of global turnover or €20 million |

| Economic Downturns | Global economic slowdowns, sector-specific contractions | Reduced capital expenditure, lower demand for solutions | Projected global GDP growth deceleration in 2024-2025 |

SWOT Analysis Data Sources

This Adlink SWOT analysis is built upon a foundation of robust data, drawing from Adlink's official financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded and actionable strategic overview.