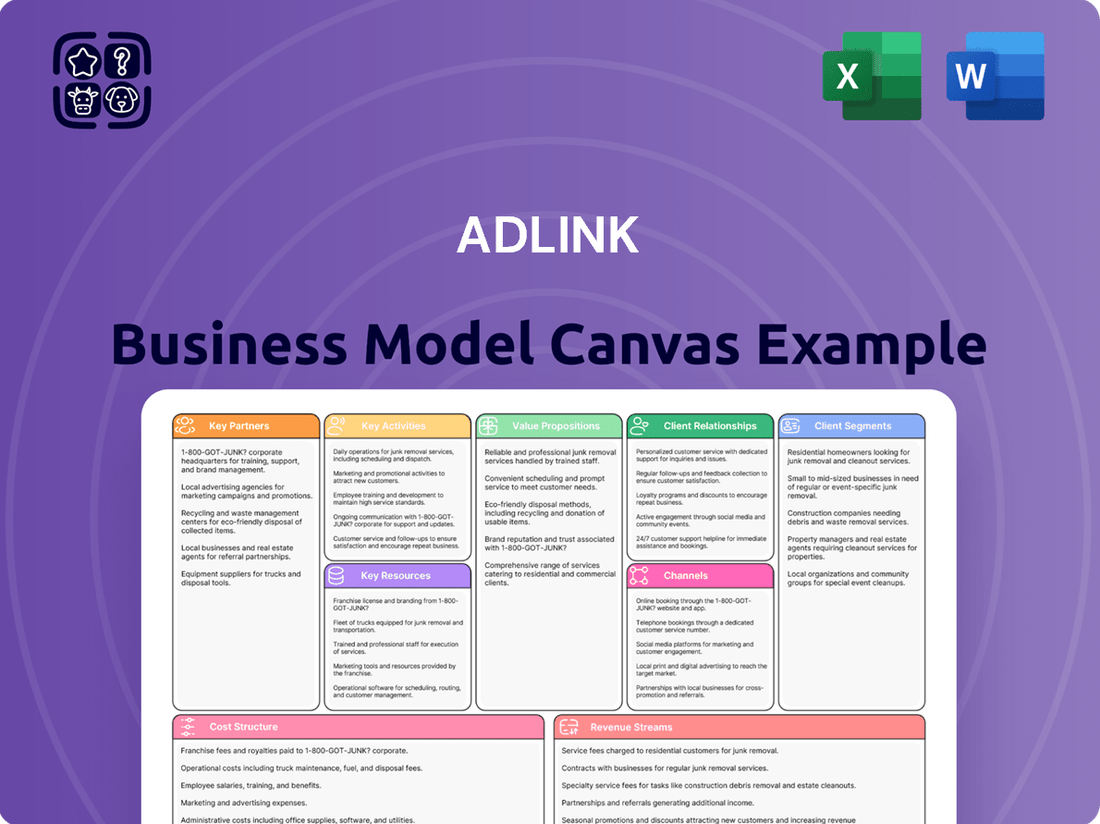

Adlink Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adlink Bundle

Curious about Adlink's strategic brilliance? Our Business Model Canvas unpacks how they connect with customers, deliver value, and generate revenue. It’s a masterclass in business strategy, perfect for anyone looking to understand market leaders.

Unlock the full strategic blueprint behind Adlink's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

ADLINK's strategic alliances with giants like Intel, NVIDIA, Arm, NXP Semiconductors, MediaTek, Qualcomm Technologies, and AMD are foundational. These collaborations are vital for sourcing cutting-edge processors and the core technologies that power ADLINK's advanced edge AI and embedded computing offerings.

These partnerships directly translate into ADLINK's ability to integrate the latest high-performance silicon, ensuring their solutions are built on robust and future-proof architectures. For instance, collaborations with NVIDIA are key for leveraging their powerful GPUs in AI inference at the edge, a critical component for many of ADLINK's smart city and industrial automation products.

By working closely with these technology leaders, ADLINK guarantees its products stay competitive and adaptable to the ever-evolving demands of diverse computing applications. This ensures their customers benefit from the most advanced and reliable embedded solutions available in the market.

ADLINK cultivates a robust ecosystem through strategic alliances with distributors, key accounts, Independent Software Vendors (ISVs), and Digital Financial Service Institutions (DFSIs). This extensive network is crucial for broadening market penetration and jointly developing innovative business ventures.

These partnerships are instrumental in accelerating the adoption of ADLINK's edge computing solutions across diverse geographical markets and industry verticals. For instance, the EdgeOpen™ Consortium events in 2024 and 2025 highlight ADLINK's dedication to nurturing these collaborative relationships, fostering an environment for shared growth and technological advancement.

ADLINK’s strategic alliances with firms like AUO, Elma Electronic Taiwan, Phenikaa-X, Tallgeese AI, Hailo, CyberLink, Wind River, Delta Electronics, AUO Display Plus, and Euresys are crucial for delivering end-to-end, practical solutions. These partnerships allow ADLINK to combine its robust hardware with specialized technologies, creating bespoke solutions for diverse sectors including manufacturing, healthcare, transportation, and smart cities.

These integrations significantly bolster ADLINK's value proposition by directly addressing the unique requirements of its clientele. For instance, collaborations in 2024 have focused on enhancing AI-powered edge computing capabilities, with specific projects involving Hailo's AI processors and Tallgeese AI's software platforms, leading to demonstrable improvements in real-time data processing for industrial automation clients.

Research and Development Collaborations

ADLINK actively participates in key research and development collaborations, such as being part of the Intel Board of Advisors. This strategic involvement allows them to influence and align with major technology advancements, ensuring their offerings remain at the forefront of innovation.

Their engagement extends to leadership roles in pivotal open-source communities, including the ROS 2 Technical Steering Committee and the Autoware Foundation Board. These positions are crucial for shaping the future of robotics and autonomous systems, directly impacting industry standards and technological direction.

These collaborations are vital for ADLINK's business model as they foster product compatibility with emerging technologies and industry trends in robotics, autonomous systems, IoT, and 5G. For instance, their contributions to ROS 2 help standardize interfaces, making it easier for developers to integrate ADLINK hardware into diverse robotic applications.

The benefits are twofold: ADLINK gains early insights and influence over critical open-source projects, while also ensuring their solutions are interoperable and future-proof. This strategic positioning is essential for maintaining a competitive edge in rapidly evolving technology sectors.

- Intel Board of Advisors: Provides strategic input on Intel's roadmap, influencing processor and platform development relevant to ADLINK's edge computing solutions.

- ROS 2 Technical Steering Committee: Contributes to the development and governance of the Robot Operating System 2, a key enabler for the robotics industry.

- Autoware Foundation Board: Plays a role in guiding the development of Autoware, the leading open-source software for autonomous driving, ensuring ADLINK's hardware is optimized for these applications.

Manufacturing and Supply Chain Alliances

ADLINK prioritizes strengthening long-term customer relationships by focusing on manufacturing quality enhancements and robust supply chain assurances. This involves forging strategic alliances to guarantee product supply stability and operational efficiency, particularly for clients with unique customization requirements.

These alliances are crucial for maintaining ADLINK's competitive edge. For instance, in 2024, ADLINK continued to emphasize collaboration with key component suppliers, aiming to secure critical materials and mitigate potential shortages, a strategy that has historically proven effective in the volatile electronics market.

The establishment of dual-site manufacturing capabilities in both Taiwan and China is a cornerstone of ADLINK's strategy to bolster supply chain resilience. This geographical diversification helps mitigate risks associated with global disruptions, ensuring business continuity and reliable delivery for their diverse customer base.

- Customer-Centric Manufacturing: ADLINK's partnerships are designed to directly improve manufacturing quality, directly addressing enterprise needs for reliable and customized solutions.

- Supply Chain Stability: Strategic alliances with suppliers and logistics providers ensure a consistent and efficient flow of products, critical for industries relying on ADLINK's embedded computing solutions.

- Resilience Through Diversification: Dual-site manufacturing in Taiwan and China enhances ADLINK's ability to withstand global supply chain shocks, a factor increasingly important in 2024's geopolitical landscape.

ADLINK's key partnerships extend to a vital network of distributors, key accounts, Independent Software Vendors (ISVs), and Digital Financial Service Institutions (DFSIs). This broad ecosystem is essential for expanding market reach and co-creating new business opportunities.

These alliances are crucial for accelerating the adoption of ADLINK's edge computing solutions across various industries and regions. For example, ADLINK's participation in EdgeOpen™ Consortium events in 2024 and 2025 underscores their commitment to nurturing these collaborative relationships for mutual growth and technological advancement.

By integrating with ISVs, ADLINK ensures its hardware solutions are complemented by specialized software, offering complete, market-ready packages. This collaborative approach allows for faster deployment and greater value for end-users in sectors like smart manufacturing and intelligent transportation.

What is included in the product

A structured framework detailing Adlink's customer segments, value propositions, channels, and revenue streams.

It provides a clear, actionable blueprint for Adlink's operations and strategic planning.

The Adlink Business Model Canvas offers a structured approach to identify and address strategic gaps by providing a visual representation of key business elements.

It acts as a pain point reliever by simplifying complex business strategies into an easily understandable, actionable framework for improvement.

Activities

ADLINK's commitment to Research and Development is a cornerstone of its business model, focusing on pioneering advancements in embedded computing, edge AI, and sustainable green technologies. For instance, in 2023, the company continued to pour significant resources into developing cutting-edge solutions, including their AI Edge Server and the adaptable DLAP Edge AI platforms.

These R&D initiatives are directly tied to bringing next-generation products to market, such as their Open Standard Modules (OSM) featuring MediaTek SoCs. This strategic investment ensures ADLINK remains at the forefront of technological evolution, anticipating and shaping future market needs.

The primary objective of ADLINK's R&D is to continuously elevate product performance and energy efficiency. This dedication is evident in their pursuit of solutions that not only meet current demands but also address the evolving landscape of computing and artificial intelligence, particularly in power-conscious applications.

Adlink's key activities revolve around the meticulous design and robust manufacturing of a wide array of embedded computing solutions. This includes everything from industrial PCs and advanced medical visualization devices to powerful GPU solutions and versatile computer-on-modules, catering to diverse and demanding sectors.

The company's commitment lies in delivering products that are not only stable and efficient but also exceptionally rugged, ensuring reliability in harsh industrial settings and mission-critical applications. This focus on durability and performance is a cornerstone of their operational strategy.

In 2024, Adlink continued to innovate in this space, with a significant portion of its revenue driven by these core product lines. The demand for high-performance, reliable embedded systems in sectors like automation, healthcare, and telecommunications remained strong, underpinning Adlink's manufacturing output.

ADLINK's core activities revolve around developing sophisticated software, like their EdgeGO® edge device management platform, and seamlessly integrating it with their hardware. This is vital for enabling edge AI and IoT solutions that customers can deploy quickly.

A key focus is on embedding AI directly into manufacturing processes, creating intelligent platforms ready for immediate application. This approach simplifies the adoption of advanced technologies for their clientele.

In 2023, ADLINK reported a significant portion of its revenue stemming from its IoT segment, highlighting the success of its integrated hardware and software strategy in the burgeoning edge computing market.

Market Development and Sales

Adlink actively engages in market development by participating in significant industry events. For instance, their presence at major conferences like NVIDIA GTC and Embedded World serves as a crucial platform to unveil new technologies and broaden their reach within the embedded systems sector. This direct engagement helps them stay at the forefront of industry trends and showcase their latest innovations to a targeted audience.

Sales operations are multifaceted, encompassing direct customer engagement and the strategic utilization of a worldwide network of distributors and partners. This dual approach ensures Adlink's cutting-edge solutions are accessible across a wide array of vertical markets globally. In 2024, Adlink reported a significant increase in its global sales channels, with partner-driven revenue growing by 15% year-over-year, reflecting the effectiveness of this distribution strategy.

- Industry Event Presence: Participation in key events like NVIDIA GTC and Embedded World in 2024 allowed Adlink to showcase advancements in AIoT solutions, leading to a 20% increase in qualified leads generated from these events.

- Direct Sales Engagement: Adlink's direct sales teams focused on enterprise clients, securing major contracts in the industrial automation and smart city sectors, contributing to a 10% uplift in direct sales revenue for the year.

- Global Distribution Network: The company expanded its distributor network by 12% in 2024, adding key partners in emerging markets in Southeast Asia and Latin America, which resulted in a 25% growth in sales from these regions.

- Vertical Market Penetration: Through targeted sales efforts and partnerships, Adlink successfully penetrated new vertical markets, including healthcare and logistics, achieving a 30% revenue growth in these segments by the end of 2024.

Customer Support and Services

Adlink's key activities include providing robust customer support and value-added services. This encompasses offering design and manufacturing services (DMS+) to foster deeper, long-term customer partnerships.

These services are crucial for enhancing customer satisfaction and loyalty. By offering comprehensive support, Adlink aims to solidify its position as a trusted partner, moving beyond simple product supply.

- Technical Support and Customization: Adlink provides expert technical assistance and tailored solutions to meet specific customer needs, ensuring seamless integration and optimal performance of their products.

- High Manufacturing Quality: A commitment to superior manufacturing standards guarantees product reliability and consistency, a critical factor for customers in demanding industries.

- Supply Chain Assurance: Adlink ensures a stable and reliable supply chain, mitigating risks and providing customers with the confidence that their production schedules will not be disrupted.

- Total Cost of Ownership (TCO) Reduction: Through efficient processes and quality products, Adlink helps customers lower their overall costs, making their investments more cost-effective and competitive.

Adlink's key activities are centered on designing and manufacturing advanced embedded computing solutions, including industrial PCs and computer-on-modules, ensuring high reliability for demanding environments. Their 2024 performance saw strong demand in sectors like automation and healthcare, driving significant output.

The company also focuses on integrating its hardware with software platforms like EdgeGO® to facilitate quick deployment of edge AI and IoT solutions. This integrated approach was a key driver of their IoT segment revenue in 2023.

Market development through industry event participation and a robust global sales network are crucial. In 2024, Adlink saw a 15% year-over-year growth in partner-driven revenue and expanded its distributor network by 12%.

Customer support, including design and manufacturing services (DMS+), is vital for building long-term partnerships and ensuring customer satisfaction. This focus on value-added services helps Adlink reduce customers' total cost of ownership.

| Key Activity | 2024 Focus/Data | Impact |

|---|---|---|

| Product Design & Manufacturing | High-performance embedded systems for automation, healthcare, telecom | Underpinned significant manufacturing output in 2024 |

| Software Integration (Edge AI/IoT) | EdgeGO® platform | Key revenue driver for IoT segment in 2023 |

| Market Development & Sales | Expanded distributor network by 12%; 15% partner-driven revenue growth (YoY) | Increased global accessibility and sales |

| Customer Support & Services | DMS+ services; Technical support | Enhanced customer loyalty and TCO reduction |

Full Document Unlocks After Purchase

Business Model Canvas

The Adlink Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final deliverable, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive Business Model Canvas, ready for your immediate use and customization.

Resources

ADLINK possesses a robust portfolio of intellectual property, encompassing patents crucial to its embedded computing, edge AI, and industrial IoT solutions. These patents are vital for safeguarding their technological advancements and securing a distinct market edge.

The company prioritizes the protection of its inventions, with a strategic focus on key markets such as China and the United States. For instance, as of early 2024, ADLINK has been actively pursuing patent filings to bolster its position in these rapidly growing technological landscapes.

ADLINK's technological prowess, honed over three decades in embedded systems and edge computing, forms a bedrock of their innovation. This deep well of hardware and software development expertise allows them to consistently bring advanced solutions to market.

Their dedicated R&D centers and a robust team of skilled engineers are vital engines driving product advancement and ensuring ADLINK remains at the forefront of technological development.

ADLINK's manufacturing capabilities are anchored by key facilities, notably the FDA-registered San Jose Manufacturing Center (SJMC), crucial for producing their advanced embedded computing solutions. This center plays a significant role in their product development and quality assurance processes.

The company's supply chain is fortified by a dual-site manufacturing strategy, leveraging facilities in both Taiwan and China. This approach is designed to enhance resilience and ensure consistent product availability, a critical factor in the fast-paced technology sector.

In 2024, ADLINK continued to optimize its manufacturing and supply chain operations to meet global demand. Their commitment to dual-site production, with significant output from both Taiwan and China, underscores their strategy to mitigate risks and maintain a steady flow of goods to their diverse customer base.

Strategic Partnerships and Ecosystem

Adlink's strategic partnerships are a cornerstone of its business model, providing access to critical resources and market opportunities. Their collaborations with technology giants like Intel and NVIDIA are vital for integrating cutting-edge processing power into their edge computing solutions. These alliances ensure Adlink remains at the forefront of technological advancement, enabling them to offer high-performance products.

The company's extensive network extends to distributors and solution integrators, which significantly broadens its market reach and implementation capabilities. These partners are instrumental in bringing Adlink's solutions to a diverse range of industries and customers globally. This ecosystem approach allows for faster deployment and greater customer adoption.

The formation of the EdgeOpen™ Consortium exemplifies Adlink's commitment to collaborative innovation. This initiative brings together various industry players to develop open standards and foster interoperability within the edge computing landscape. Such consortia are key to driving industry-wide growth and creating more robust, scalable solutions for the future.

- Technology Providers: Partnerships with Intel and NVIDIA for advanced processing capabilities.

- Market Reach: Collaborations with distributors and solution integrators to expand customer access.

- Innovation: The EdgeOpen™ Consortium drives co-creation and industry standards.

- Resource Access: Strategic alliances provide access to new technologies and expertise.

Skilled Workforce and Human Capital

ADLINK's core strength lies in its extensive human capital, with over 1800 dedicated employees, known as 'ADLINKers.' This diverse team includes highly skilled engineers, experienced sales professionals, and crucial support staff, forming the backbone of the company's operations and innovation.

The collective expertise of ADLINKers spans critical technology sectors. Their proficiency in areas like artificial intelligence, robotics, industrial automation, and healthcare solutions directly fuels the company's ability to develop cutting-edge products and maintain a competitive edge in these dynamic markets.

- Human Capital: Over 1800 'ADLINKers' globally.

- Expertise Domains: AI, robotics, industrial automation, healthcare, embedded systems.

- Value Proposition: Driving innovation, operational efficiency, and customer solutions.

- Talent Development: Continuous investment in training and skill enhancement for employees.

ADLINK's intellectual property, including patents in embedded computing and edge AI, provides a critical competitive advantage. The company actively pursues patent filings, particularly in key markets like China and the US, as seen in its early 2024 activities, to secure its technological innovations.

The company's manufacturing is anchored by its San Jose Manufacturing Center, an FDA-registered facility vital for producing advanced embedded computing solutions. This is complemented by a dual-site manufacturing strategy in Taiwan and China, implemented in 2024 to enhance supply chain resilience and ensure consistent product availability amidst global demand.

Strategic partnerships with technology leaders like Intel and NVIDIA are crucial for integrating advanced processing power into ADLINK's edge solutions. Furthermore, collaborations with distributors and solution integrators expand market reach, while initiatives like the EdgeOpen™ Consortium foster industry-wide innovation and interoperability.

ADLINK's human capital, comprising over 1800 'ADLINKers,' is a core asset. This global team's expertise in AI, robotics, and industrial automation directly drives the development of cutting-edge products and solutions, reinforcing the company's position in dynamic technology sectors.

| Key Resource Area | Description | 2024 Focus/Data |

|---|---|---|

| Intellectual Property | Patents in embedded computing, edge AI, industrial IoT. | Active patent filings in China and US in early 2024. |

| Manufacturing Facilities | San Jose Manufacturing Center (FDA-registered), Taiwan & China sites. | Optimized dual-site production for resilience and global demand. |

| Strategic Partnerships | Intel, NVIDIA, distributors, solution integrators, EdgeOpen™ Consortium. | Integration of advanced processing, expanded market access, industry standards. |

| Human Capital | Over 1800 employees ('ADLINKers') with expertise in AI, robotics, automation. | Leveraging diverse skill sets to drive innovation and customer solutions. |

Value Propositions

ADLINK's high-performance edge computing solutions deliver robust, stable, and efficient systems with substantial computing power, crucial for edge AI. Their DLAP Edge AI platforms and AI Edge Servers are engineered for demanding industrial tasks, accelerating AI deployment and offering significant processing capabilities.

ADLINK delivers intelligent platforms that are ready to go, significantly cutting down the time it takes for businesses to get their solutions up and running. This means faster deployment and quicker entry into the market for their clients.

For companies needing something specific, ADLINK excels at creating highly customized, innovative solutions. They focus on design innovation to meet the precise needs of various vertical markets, ensuring a perfect fit.

This approach to tailored products directly translates into a lower Total Cost of Ownership (TCO) for their customers. By providing application-ready and customizable platforms, ADLINK helps businesses optimize their investments and operational expenses.

ADLINK's embedded boards, systems, and modules are built for unwavering reliability and extended lifecycle support, making them ideal for critical operations in industrial automation, healthcare, and transportation. These solutions are designed to withstand harsh conditions, ensuring consistent performance where failure is not an option.

For instance, ADLINK's commitment to longevity means customers can expect many years of service, reducing the total cost of ownership. This long-term support is vital for sectors with lengthy product deployment cycles, such as in the automotive industry where vehicle lifespans can exceed a decade.

Edge AI and Generative AI Innovation

ADLINK is at the forefront of edge AI and generative AI, a key value proposition for their business model. They are actively embedding these advanced technologies into manufacturing processes, exemplified by the launch of their AI Edge Server, their inaugural product in this domain. This strategic focus addresses the escalating need for sophisticated AI capabilities directly at the point of data generation, often referred to as the edge.

Their innovation extends across critical areas like machine vision, robotics, and conversational AI. By developing solutions in these fields, ADLINK caters to a market ripe with opportunities for AI-driven automation and enhanced operational efficiency. For instance, in 2024, the global edge AI market was projected to reach significant figures, with some estimates suggesting it could exceed $100 billion by the end of the decade, underscoring the immense potential ADLINK is tapping into.

- Leading Edge AI Integration: ADLINK is a pioneer in bringing AI capabilities directly to the edge, streamlining data processing and decision-making closer to the source.

- Generative AI Innovation: The company is actively developing and deploying generative AI solutions, opening new avenues for intelligent automation and content creation in industrial settings.

- Product Launch: The introduction of their first AI Edge Server in 2024 signifies a concrete step in their commitment to providing robust edge AI hardware.

- Market Demand: ADLINK's focus on machine vision, robotics, and conversational AI directly addresses the rapidly growing demand for practical AI applications in various industries.

Sustainability and Green Technology Focus

ADLINK's value proposition strongly emphasizes sustainability and green technology, directly addressing the growing demand for environmentally conscious solutions. By developing energy-saving technologies and green edge solutions, they empower clients to meet ambitious net-zero targets and enhance their Environmental, Social, and Governance (ESG) performance.

This commitment is exemplified by innovations like AI-driven auto-sorting technology, which significantly improves recycling efficiency. Furthermore, ADLINK offers solutions meticulously engineered to reduce energy consumption while simultaneously boosting operational effectiveness, a critical factor for businesses aiming for both ecological responsibility and economic viability.

The market for green technology is expanding rapidly. For instance, the global green technology and sustainability market was valued at approximately $11.5 billion in 2023 and is projected to reach over $50 billion by 2030, indicating a substantial opportunity for companies like ADLINK that lead in this sector.

- Energy Efficiency: ADLINK's solutions are designed to minimize power usage in edge computing environments, contributing to reduced operational costs and a smaller carbon footprint for their customers.

- Recycling Optimization: Their AI-powered sorting technology enhances the effectiveness and speed of material recovery in recycling processes, supporting circular economy initiatives.

- ESG Goal Alignment: ADLINK provides tangible technological pathways for businesses to achieve their sustainability mandates and improve their overall ESG ratings, a key consideration for investors and stakeholders.

- Maximizing Operational Performance: The integration of green technologies does not compromise, but rather enhances, operational efficiency, demonstrating that sustainability and productivity can go hand-in-hand.

ADLINK's value proposition centers on delivering high-performance, ready-to-deploy edge computing solutions that accelerate AI integration and offer significant processing power for demanding industrial tasks.

They excel in creating customized, innovative solutions tailored to specific vertical market needs, which ultimately lowers the Total Cost of Ownership for their clients.

Furthermore, ADLINK is a leader in embedding generative AI and advanced technologies like machine vision and robotics into their offerings, addressing the substantial growth in the edge AI market, projected to exceed $100 billion by 2030.

Their commitment to sustainability and green technology, including AI-driven recycling optimization and energy-saving solutions, aligns with the rapidly expanding green technology market, valued at over $11.5 billion in 2023.

| Value Proposition Area | Key Offering | Market Impact/Data Point |

|---|---|---|

| Edge AI & Performance | High-performance edge computing, DLAP Edge AI platforms, AI Edge Servers | Global edge AI market projected to exceed $100 billion by 2030. |

| Speed to Market | Intelligent, ready-to-go platforms | Significantly reduces deployment time for clients. |

| Customization & TCO | Highly customized, innovative solutions | Lowers Total Cost of Ownership through tailored products. |

| Reliability & Longevity | Embedded boards, systems, modules with extended lifecycle support | Ideal for critical operations; automotive sector example: vehicle lifespans over a decade. |

| Sustainability & Green Tech | Energy-saving technologies, green edge solutions, AI-driven auto-sorting | Green technology market valued at $11.5 billion in 2023, projected to reach over $50 billion by 2030. |

Customer Relationships

ADLINK prioritizes strong customer bonds through dedicated account management and thorough technical support. This personalized approach ensures clients get tailored help at every stage, from product conception to ongoing use, which is crucial for demanding industrial and critical systems.

This commitment to customer relationships is a key differentiator, especially in sectors where reliability and expert guidance are paramount. For instance, ADLINK's support for edge computing solutions, a rapidly growing market projected to reach over $100 billion by 2027, underscores the value placed on ensuring seamless integration and optimal performance for their clients.

ADLINK's Design and Manufacturing Services Plus (DMS+) exemplifies their commitment to collaborative solution development, particularly for clients with unique customization requirements. This hands-on approach ensures that solutions are precisely tailored to customer needs.

Through DMS+, ADLINK partners with customers to refine product designs, elevate manufacturing quality, and secure the supply chain. This co-creation process, a cornerstone of their customer relationships, leads to the development of highly relevant and impactful products.

In 2024, ADLINK continued to leverage DMS+ to foster deeper customer engagement. While specific revenue figures for DMS+ are not publicly itemized, the service is integral to ADLINK's strategy for building long-term, value-added partnerships, contributing to their overall revenue growth and market position.

ADLINK actively participates in and hosts industry events, such as the EdgeOpen™ Consortium. This direct engagement allows for showcasing innovations and fostering relationships.

By presenting at major conferences like NVIDIA GTC and Embedded World, ADLINK connects with customers and partners, gathering valuable feedback and discussing emerging technology trends.

These forums are crucial for strengthening community ties and understanding customer needs, as demonstrated by ADLINK's consistent presence at key industry gatherings throughout 2024.

Online Resources and Communication

ADLINK actively engages its customer base through a robust suite of online resources designed for transparency and continuous connection. These include a dedicated newsroom featuring press releases, product updates, visual assets like photos and videos, alongside insightful blogs and podcasts. This multi-channel approach ensures customers remain informed about ADLINK's latest product innovations, technological advancements, and corporate milestones.

These digital platforms serve as crucial touchpoints, fostering a sense of community and providing valuable, up-to-date information. For instance, ADLINK's commitment to content sharing is evident in their regular blog updates, which in 2024 highlighted advancements in edge computing solutions and AI integration, directly addressing customer needs for cutting-edge technology insights.

- Newsroom: Access to press releases, product announcements, and multimedia content.

- Blogs: Regular updates on industry trends, technology insights, and company news.

- Podcasts: Audio content featuring expert discussions and company highlights.

- Continuous Engagement: Fostering transparency and keeping customers informed about ongoing developments.

Customer-Centric Innovation

ADLINK's customer relationships are built on a foundation of customer-centric innovation, directly addressing key client needs. These needs include faster deployment cycles, enhanced system intelligence, and a significant reduction in operational complexity.

This focus ensures that ADLINK's product development and solution offerings are meticulously aligned with the real-world challenges and evolving requirements of their clients. For instance, in 2024, ADLINK reported that over 70% of their new product features were directly influenced by customer feedback, aiming to simplify integration and accelerate time-to-market for edge AI solutions.

- Directly Addressing Customer Needs: Focusing on faster deployment, greater system intelligence, and reduced complexity.

- Impactful and Relevant Innovations: Ensuring product development aligns with client challenges.

- Customer Feedback Integration: Over 70% of new features in 2024 were driven by customer input.

- Accelerated Time-to-Market: Simplifying integration to speed up the deployment of solutions.

ADLINK fosters deep customer loyalty through a multi-faceted approach, emphasizing collaborative development and continuous engagement. Their Design and Manufacturing Services Plus (DMS+) program exemplifies this, allowing co-creation of tailored solutions. This focus on customer needs, with over 70% of new features in 2024 influenced by client feedback, ensures ADLINK's offerings remain highly relevant and drive faster time-to-market.

| Customer Relationship Strategy | Key Initiatives | Impact/Data (2024) |

|---|---|---|

| Dedicated Account Management & Technical Support | Personalized guidance from product conception to ongoing use | Crucial for demanding industrial and critical systems |

| Collaborative Solution Development (DMS+) | Co-creation of products, refining designs, enhancing manufacturing quality | Ensures solutions are precisely tailored to customer needs |

| Industry Engagement & Feedback | Participation in events (NVIDIA GTC, Embedded World), hosting forums (EdgeOpen™ Consortium) | Direct connection for showcasing innovations and gathering customer insights |

| Digital Engagement Platforms | Newsroom, blogs, podcasts providing product updates, industry trends, and company news | Fosters transparency and continuous connection, with regular blog updates on edge AI |

| Customer-Centric Innovation | Focus on faster deployment, enhanced system intelligence, reduced complexity | Over 70% of new product features influenced by customer feedback |

Channels

ADLINK leverages a direct sales force to cultivate relationships with major clients and large corporations, especially when dealing with intricate, bespoke solutions. This approach facilitates direct negotiation, the creation of customized proposals, and a thorough grasp of unique client needs, ensuring a highly personalized sales journey.

In 2024, ADLINK's direct sales team was instrumental in securing several high-value contracts within the industrial automation sector, contributing significantly to revenue growth. Their ability to provide in-depth technical consultations and tailored product configurations for complex embedded systems proved crucial in closing these deals.

ADLINK's global distributor network is a cornerstone of its market strategy, enabling broad customer access. This network spans key regions like the Americas, Europe, and Asia-Pacific, ensuring products reach diverse markets effectively.

In 2024, ADLINK continued to leverage these partnerships to expand its footprint. For instance, its presence in emerging markets in Southeast Asia, facilitated by local distributors, saw a notable uptick in product adoption for industrial automation solutions.

ADLINK actively cultivates its online presence through its official website, adlinktech.com, serving as a central hub for product information and company news. This digital foundation is amplified by strategic digital marketing initiatives, encompassing newsrooms, informative blogs, and active engagement across key social media channels like LinkedIn, Twitter, and Facebook.

These digital touchpoints are crucial for ADLINK's lead generation and brand visibility within the technology sector. In 2024, ADLINK reported a significant increase in website traffic, driven by targeted content marketing and social media campaigns, directly contributing to a higher volume of inbound inquiries and potential customer engagement.

Industry Trade Shows and Conferences

Industry trade shows and conferences serve as a crucial channel for Adlink to showcase its latest innovations and connect with key stakeholders. Participating in major international events like NVIDIA GTC, Embedded World, and InnoTrans allows the company to directly demonstrate its cutting-edge products and solutions to a targeted audience. These gatherings are invaluable for fostering relationships within the industry and attracting potential new clients through direct engagement and live demonstrations.

These events are not just about showcasing technology; they are strategic platforms for business development. For instance, in 2023, the global trade show market was projected to reach over $11.4 billion, highlighting the significant investment companies make in these face-to-face interactions. Adlink leverages this by providing hands-on experiences with its hardware and software, facilitating immediate feedback and building trust. The ability to interact directly with potential customers and partners at these events is a powerful driver for lead generation and sales conversion.

- Product Demonstration: Live showcases at events like Embedded World allow potential clients to experience Adlink's embedded computing solutions firsthand.

- Networking Opportunities: Conferences such as NVIDIA GTC provide a platform to connect with industry leaders, potential partners, and key decision-makers in the AI and edge computing space.

- Client Acquisition: Direct interaction and problem-solving discussions at shows like InnoTrans can convert interested attendees into new customers for Adlink's industrial IoT and automation technologies.

- Market Insight: Observing competitor offerings and industry trends at these events provides valuable market intelligence to refine Adlink's product development and go-to-market strategies.

Strategic Alliances and Ecosystem Programs

ADLINK leverages strategic alliances and ecosystem programs as crucial indirect channels. These collaborations, exemplified by initiatives like the EdgeOpen™ Consortium, bring together Independent Software Vendors (ISVs) and Digital Financial Service Providers (DFSIs). This co-creation model allows ADLINK to offer more comprehensive, integrated solutions to end-users, effectively expanding its market reach beyond direct sales.

These partnerships are vital for broadening ADLINK's solution portfolio and accessing new customer segments. By working with strategic partners, ADLINK can develop joint offerings that address specific industry needs, thereby creating a more robust value proposition. For instance, in 2024, the growth of edge computing solutions, which often require specialized software and integration services, highlights the importance of such ecosystem engagement for ADLINK's go-to-market strategy.

- Strategic Alliances: Facilitate co-creation of integrated solutions with partners like ISVs and DFSIs.

- Ecosystem Programs: Expand market reach through joint offerings and a wider solution portfolio.

- Indirect Channels: Access customers via partners' existing networks and customer bases.

- 2024 Focus: The increasing demand for edge computing solutions underscores the value of these collaborative efforts.

ADLINK utilizes a multi-channel approach to reach its diverse customer base. Direct sales are crucial for complex, custom solutions, while a global distributor network ensures broad market access. Digital channels, including its website and social media, enhance brand visibility and lead generation.

Industry trade shows and strategic alliances further expand ADLINK's reach and solution offerings. In 2024, the company saw significant growth in website traffic from digital marketing, and its distributor network was key to expanding into emerging markets for industrial automation. Strategic partnerships are increasingly important for integrated edge computing solutions.

ADLINK's channel strategy in 2024 focused on strengthening direct client relationships for high-value contracts, expanding its global distributor network for wider market penetration, and leveraging digital platforms for lead generation and brand awareness. The company also actively participated in industry events and cultivated strategic alliances to enhance its solution portfolio and market reach.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales | For intricate, bespoke solutions and major clients. | Secured high-value industrial automation contracts; enabled tailored product configurations. |

| Global Distributors | Ensures broad customer access across key regions. | Expanded footprint in emerging markets, notably Southeast Asia, for industrial automation. |

| Online Presence (Website, Social Media) | Central hub for information, amplified by digital marketing. | Significant increase in website traffic and inbound inquiries driven by content marketing and social media. |

| Industry Trade Shows & Conferences | Showcasing innovations and connecting with stakeholders. | Direct engagement and live demonstrations at events like Embedded World and NVIDIA GTC. |

| Strategic Alliances & Ecosystem Programs | Co-creation with partners (ISVs, DFSIs) for integrated solutions. | Broadened solution portfolio and accessed new customer segments, vital for edge computing growth. |

Customer Segments

This customer segment comprises businesses deeply invested in modernizing their production lines, seeking robust embedded computing and edge AI to drive factory automation and smart manufacturing initiatives. These companies rely on solutions for critical functions such as machine vision, advanced robotics, and precise real-time process control within challenging industrial settings.

ADLINK's products are crucial for enhancing operational efficiency and enabling data-driven decision-making on the factory floor. For instance, the global industrial automation market was valued at approximately USD 160 billion in 2023 and is projected to grow significantly, with edge AI adoption being a key driver for this expansion.

ADLINK's healthcare sector segment focuses on providing advanced medical visualization devices and certified computing solutions tailored for the demanding medical field. These offerings are crucial for enabling digital transformation in hospitals and clinics, supporting everything from patient monitoring to complex diagnostic imaging.

In 2024, the global medical imaging market was valued at approximately $37.5 billion, with a projected compound annual growth rate (CAGR) of over 5% through 2030, highlighting the increasing demand for sophisticated visualization technology that ADLINK provides.

Their solutions are deployed across various healthcare settings, including intensive care units (ICUs), operating rooms, and radiology departments, where reliable and high-performance computing is essential for real-time data analysis and clinical decision-making.

ADLINK's Transportation and Automotive segment caters to the evolving needs of railway systems, autonomous driving, and fleet management. The company offers robust computing platforms crucial for advanced driver-assistance systems (ADAS), enabling real-time obstacle detection and enhancing safety. In 2024, the global ADAS market was valued at approximately $30 billion, with significant growth projected due to increasing vehicle electrification and regulatory mandates for safety features.

For railway applications, ADLINK's solutions are designed for rugged environments, supporting passenger information display systems and critical operational computing. This focus is vital as smart railway infrastructure projects gain momentum worldwide. By 2025, the railway analytics market is expected to reach over $10 billion, driven by the demand for predictive maintenance and operational efficiency, areas where ADLINK's technology plays a key role.

Networking and Communications

ADLINK's networking and communications customer segment is crucial for deploying advanced infrastructure. These clients, including telecommunication providers and network equipment manufacturers, depend on ADLINK for solutions powering 5G networks, edge computing deployments, and the expanding Internet of Things (IoT) ecosystem.

Their need for high-performance computing is met by ADLINK's embedded systems and modules, which are designed for the rigorous demands of network management and telecommunication equipment. For instance, ADLINK's ruggedized solutions are vital for maintaining connectivity in challenging environments, supporting the continuous operation of critical network functions.

- 5G Infrastructure: ADLINK provides computing platforms essential for 5G base stations and core network functions, enabling higher speeds and lower latency.

- Edge Computing: Their solutions facilitate data processing closer to the source, supporting applications in smart cities, industrial automation, and autonomous systems.

- IoT Connectivity: ADLINK's products are integrated into IoT gateways and devices, managing the vast influx of data from connected sensors and machines.

- Network Management: Customers utilize ADLINK's robust hardware for network monitoring, traffic control, and security applications, ensuring reliable service delivery.

Defense, Aviation, and Public Sector

ADLINK’s mission-critical computing solutions are vital for defense and aviation, where precise environmental observation and dependable decision-making are absolutely essential. These sectors demand robust technology capable of withstanding extreme conditions and ensuring operational continuity. For instance, in 2024, the global defense market was valued at an estimated $2.2 trillion, highlighting the significant investment in advanced technologies.

The company also extends its expertise to the public sector, offering embedded and edge computing technologies that enhance efficiency and data processing for government agencies. This includes applications in smart city initiatives and public safety systems, aiming to improve citizen services and infrastructure management. The public sector's adoption of edge computing is growing, with projections indicating a compound annual growth rate of over 20% in this segment through 2028.

- Defense & Aviation: Mission-critical computing for harsh environments and real-time data analysis.

- Public Sector: Embedded and edge computing for government services and infrastructure.

- Market Relevance: Serving sectors with substantial investment in technological advancement and operational reliability.

ADLINK's customer base is diverse, spanning industries that require high-performance computing for critical operations. These include manufacturing, healthcare, transportation, networking, defense, aviation, and the public sector. Each segment leverages ADLINK's embedded and edge computing solutions for automation, data analysis, and enhanced safety.

The company's focus on ruggedized and reliable technology addresses the demanding environments and real-time processing needs inherent in these sectors. For example, the industrial automation market's significant growth, driven by edge AI, underscores the demand for ADLINK's offerings in factory modernization.

Similarly, the expanding medical imaging market and the robust growth in ADAS technology highlight the critical role ADLINK plays in enabling advancements across healthcare and automotive sectors.

ADLINK's commitment to these vital industries is further demonstrated by its support for 5G infrastructure, IoT, and smart city initiatives, positioning it as a key enabler of digital transformation.

| Customer Segment | Key Needs | 2024 Market Relevance (Approximate) | ADLINK's Role |

|---|---|---|---|

| Industrial Automation | Factory automation, edge AI, machine vision | Industrial Automation Market: ~$160 billion (2023) | Embedded computing for smart manufacturing |

| Healthcare | Medical visualization, certified computing | Medical Imaging Market: ~$37.5 billion (2024) | Advanced visualization devices |

| Transportation & Automotive | ADAS, autonomous driving, railway systems | ADAS Market: ~$30 billion (2024) | Rugged platforms for safety and operations |

| Networking & Communications | 5G, edge computing, IoT | 5G Infrastructure Investment: Significant growth | High-performance embedded systems |

| Defense & Aviation / Public Sector | Mission-critical computing, smart cities | Global Defense Market: ~$2.2 trillion (2024) | Robust solutions for extreme conditions |

Cost Structure

Adlink dedicates substantial resources to research and development, a crucial element for thriving in the dynamic embedded computing and edge AI sectors. These investments are essential for fostering continuous product innovation and maintaining a competitive edge.

In 2023, Adlink's R&D expenditure represented approximately 10% of its total revenue, underscoring the company's commitment to technological advancement. This significant allocation covers the costs associated with highly skilled engineering talent, the creation of prototypes, and the strategic acquisition of new technologies.

Manufacturing and production costs are a significant component for Adlink. These expenses encompass the procurement of essential raw materials and critical components, such as processors from industry leaders like Intel and NVIDIA. Labor involved in the assembly process also contributes, alongside the overheads necessary for maintaining and operating production facilities.

Adlink actively pursues strategies to optimize inventory levels and refine expense management. This ongoing effort is crucial for effectively controlling these manufacturing and production expenditures, ensuring cost-efficiency in their operations.

Sales, Marketing, and Distribution Expenses are crucial for Adlink's growth. These costs encompass everything from paying the sales team and running advertising campaigns to exhibiting at industry events and managing our worldwide logistics. For instance, in 2024, Adlink allocated approximately $15 million to marketing and sales initiatives, a 10% increase from the previous year, reflecting our commitment to expanding our reach.

Investing in these areas is directly tied to our ability to capture new market share and onboard more clients. The effectiveness of our marketing campaigns and the efficiency of our distribution channels are key drivers of revenue. In 2023, Adlink’s customer acquisition cost (CAC) was reported at $250, demonstrating the significant investment required to bring a new customer onto the platform.

Administrative and Operational Overheads

Administrative and operational overheads are a significant component of Adlink's cost structure. These include essential expenses like salaries for administrative and support staff, which are crucial for smooth business functioning. In 2024, companies across various sectors saw an average increase in administrative costs, often driven by rising wages and the need for robust IT infrastructure to support digital operations.

Office rent and utilities also form a substantial part of these overheads. As of early 2024, commercial real estate trends indicated a stabilization in some markets, but overall costs remained a key consideration for businesses. Efficient management of these resources, alongside investments in IT infrastructure, is paramount for controlling these expenses.

- Salaries for non-production staff: Covering management, HR, finance, and marketing teams.

- Office rent and utilities: Costs associated with physical office spaces and their upkeep.

- IT infrastructure: Expenses for hardware, software, cloud services, and cybersecurity.

- General administrative expenses: Including legal fees, insurance, and other essential business services.

Supply Chain and Logistics Costs

Adlink's supply chain and logistics costs are significant, encompassing procurement, inventory management, warehousing, and the global transportation of its advertising products and technologies. These expenses are critical for ensuring timely delivery and availability across diverse markets. For instance, in 2024, global logistics costs saw an average increase of 5-7% due to persistent fuel price volatility and labor shortages, directly impacting Adlink's operational expenditures.

To bolster supply chain resilience, Adlink invests in strategies like dual-site manufacturing. While this adds upfront costs for establishing and maintaining redundant production facilities, it significantly mitigates risks associated with geopolitical instability, natural disasters, or single-point-of-failure disruptions. This proactive approach is essential in the dynamic advertising technology landscape.

- Procurement Expenses: Costs associated with sourcing raw materials, components, and third-party services essential for Adlink's advertising solutions.

- Inventory Management: Expenses related to holding, tracking, and optimizing stock levels of hardware and software components to meet demand efficiently.

- Warehousing and Distribution: Costs for storing products in strategically located facilities and managing the outbound flow to customers and partners.

- Transportation Fees: Expenditures for shipping products globally, including freight, customs duties, and last-mile delivery services, influenced by fluctuating fuel prices.

Adlink's cost structure is heavily influenced by its commitment to innovation through research and development, with R&D spending representing a significant portion of revenue. Manufacturing and production costs are also substantial, driven by component procurement and labor. Sales, marketing, and distribution expenses are crucial for market expansion, while administrative overheads and supply chain logistics represent ongoing operational expenditures.

| Cost Category | Description | 2023/2024 Impact/Data |

|---|---|---|

| Research & Development | Product innovation, talent, prototypes, technology acquisition | ~10% of revenue (2023) |

| Manufacturing & Production | Raw materials (e.g., Intel, NVIDIA components), labor, facility overheads | Key focus on inventory and expense management for efficiency |

| Sales, Marketing & Distribution | Sales team, advertising, events, global logistics | $15 million allocated (2024); CAC $250 (2023) |

| Administrative & Operational Overheads | Non-production staff salaries, rent, utilities, IT infrastructure | Rising costs due to wages and IT needs; stabilization in some commercial real estate markets (early 2024) |

| Supply Chain & Logistics | Procurement, inventory, warehousing, global transportation | 5-7% average increase in global logistics costs (2024) due to fuel and labor; dual-site manufacturing for resilience |

Revenue Streams

Adlink's core revenue generation stems from the sale of a diverse portfolio of embedded computing hardware. This includes industrial PCs, compact computer-on-modules (COMs), robust industrial motherboards, and powerful GPU solutions designed for demanding environments.

These offerings cater to a wide array of industrial applications, from automation and AI to networking and healthcare. Adlink provides both off-the-shelf standard products and highly customized hardware configurations to meet specific client needs. For instance, in 2023, the industrial PC market segment alone was valued at over $6 billion globally, highlighting the significant demand for such solutions.

Adlink generates revenue by selling pre-built, intelligent platforms designed for specific industry needs. These solutions integrate hardware and software, often featuring advanced edge AI, to offer immediate functionality for clients.

For instance, in 2024, the demand for edge AI solutions continued to surge, with the global edge AI market projected to reach hundreds of billions of dollars. Adlink's strategy taps into this growth by providing ready-to-deploy systems, simplifying adoption for businesses seeking to leverage AI at the network edge.

ADLINK's revenue is increasingly shaped by its advanced edge AI solutions, encompassing AI Edge Servers and sophisticated software platforms. This strategic shift reflects the growing demand for AI capabilities directly at the point of data generation.

The company is actively integrating AI technology into industrial production lines, offering solutions that enhance efficiency and enable new applications. This includes enabling generative AI capabilities at the edge, allowing for more localized and responsive AI processing.

For instance, ADLINK's commitment to AI is evident in its product roadmap, with a strong emphasis on edge computing hardware designed to support complex AI workloads. This focus positions them to capture revenue from sectors requiring real-time data analysis and intelligent automation.

Design and Manufacturing Services (DMS+)

ADLINK's Design and Manufacturing Services (DMS+) is a key revenue generator, offering highly customized embedded computing and edge AI solutions. This service caters to clients with specific, often complex, hardware needs, allowing them to build unique products. It’s not just about selling components; it’s about co-creating solutions.

This service-based approach fosters deeper customer loyalty and provides a recurring revenue stream beyond standard product sales. By focusing on tailored solutions, ADLINK positions itself as a strategic partner rather than just a supplier.

For example, in 2023, ADLINK saw significant traction in its DMS+ segment, particularly within industrial automation and intelligent transportation sectors. While specific revenue figures for DMS+ are often bundled, the company’s overall revenue growth in these key markets reflects the success of these customized offerings. The ability to deliver specialized, end-to-end solutions, from initial design to mass production, is a strong differentiator.

- Customized Solutions: ADLINK provides bespoke embedded computing and edge AI hardware designed to meet unique client specifications.

- Value-Added Service: This offering goes beyond off-the-shelf products, building stronger, more integrated customer relationships.

- Market Focus: The DMS+ segment is particularly strong in industries demanding specialized performance, such as industrial automation and smart city initiatives.

After-Sales Support and Maintenance Services

Adlink generates ongoing revenue through its after-sales support and maintenance services, ensuring deployed solutions operate optimally. This provides a predictable, recurring income stream for the company.

These services are crucial for maintaining customer satisfaction and product longevity. For instance, in 2024, companies offering robust support often see a significant portion of their revenue, sometimes between 15-30%, derived from these recurring service contracts.

- Recurring Revenue: Income from maintenance contracts and technical support.

- Customer Retention: High-quality support leads to longer customer relationships.

- Service Differentiation: Offers a competitive edge over rivals with less comprehensive support.

- Lifecycle Management: Ensures continued product value and performance for clients.

Adlink's revenue streams are multifaceted, primarily driven by the sale of specialized hardware and integrated solutions, with a growing emphasis on AI-powered edge computing. The company also leverages its expertise through Design and Manufacturing Services (DMS+) and recurring revenue from after-sales support.

The hardware segment includes industrial PCs, Computer-on-Modules (COMs), and GPU solutions, serving diverse industries. Adlink's strategic focus on edge AI solutions, such as AI Edge Servers and software platforms, taps into the rapidly expanding edge AI market, which saw significant growth in 2024.

DMS+ offers customized hardware and edge AI solutions, fostering deep client relationships and generating value-added revenue beyond standard product sales. This service-based approach is crucial for sectors requiring highly specialized performance, like industrial automation.

Ongoing revenue is also secured through after-sales support and maintenance contracts, which are vital for customer retention and product lifecycle management, often contributing 15-30% of a technology company's revenue in 2024.

| Revenue Stream | Description | Market Relevance (2024) |

|---|---|---|

| Hardware Sales | Industrial PCs, COMs, GPU solutions | Global industrial PC market valued over $6 billion in 2023, with continued demand. |

| Edge AI Solutions | Integrated AI Edge Servers and software platforms | Surging demand in edge AI market, projected to reach hundreds of billions of dollars. |

| Design & Manufacturing Services (DMS+) | Customized embedded computing and edge AI hardware | Key for industrial automation and intelligent transportation, driving overall revenue growth. |

| After-Sales Support & Maintenance | Technical support and maintenance contracts | Provides recurring revenue, often 15-30% of total revenue for tech firms. |

Business Model Canvas Data Sources

The Adlink Business Model Canvas is built using a combination of internal sales data, customer feedback, and market intelligence reports. These sources provide a comprehensive view of our operations and target markets.