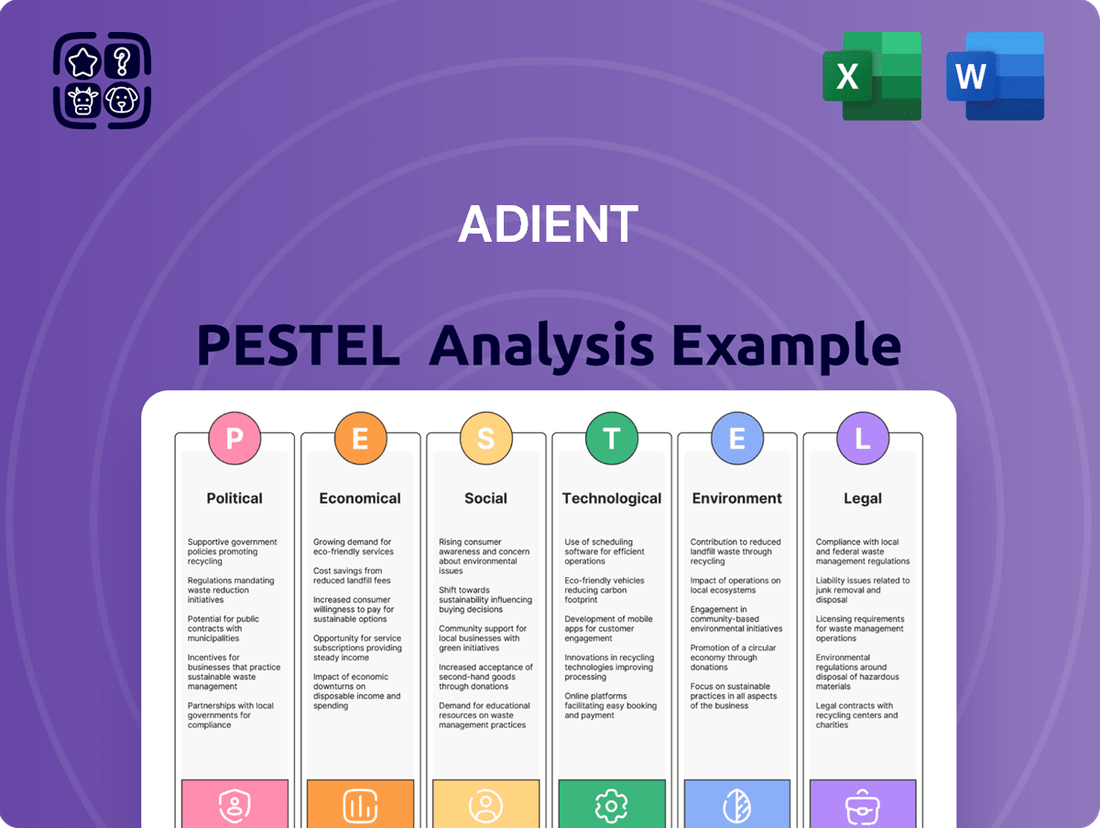

Adient PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adient Bundle

Adient's future is intricately woven with political stability, economic fluctuations, evolving social attitudes, technological advancements, environmental regulations, and legal frameworks. Our PESTLE analysis dives deep into these critical external factors, revealing the hidden opportunities and potential threats that will shape Adient's trajectory. Equip yourself with this essential intelligence to make informed strategic decisions and gain a competitive advantage. Download the full PESTLE analysis now and unlock actionable insights.

Political factors

Changes in global trade policies and the imposition of tariffs directly affect Adient's operational costs and market access. For instance, the U.S. tariffs on imported vehicles and auto parts have a tangible impact on the automotive industry's supply chain dynamics.

The implementation of a 25% U.S. tariff on auto and auto parts has been a significant disruptor, negatively impacting the projected global light vehicle production for 2025. This tariff structure creates uncertainty and can lead to increased manufacturing expenses for companies like Adient, which rely on international sourcing and sales.

Government policies significantly shape the automotive sector, directly impacting component manufacturers like Adient. New emissions standards, such as those finalized by the U.S. EPA for model years 2027 and later, which aim to cut greenhouse gases by approximately 50% over eight years, are a prime example. These regulations compel automakers to increase production of electric and hybrid vehicles.

This shift in vehicle technology directly influences the demand for specific automotive components, including advanced seating systems designed for these new powertrains. For instance, lightweight seating solutions are increasingly crucial for electric vehicles to optimize battery range. Mandates for electric vehicle adoption also create a growing market for specialized seating features that cater to the unique interior designs and user experiences of EVs.

Adient's global footprint means political stability in key automotive markets, such as the US, China, and Germany, is crucial. For instance, the 2024 US election cycle could introduce policy shifts impacting the automotive sector, including potential changes to trade agreements or manufacturing incentives that directly affect Adient's operations and profitability.

Changes in government regulations, particularly concerning emissions standards and electric vehicle (EV) adoption, pose significant political risks. A shift towards stricter internal combustion engine (ICE) vehicle regulations in major markets like the European Union could accelerate demand for EVs, requiring Adient to adapt its product portfolio and manufacturing capabilities more rapidly than anticipated.

Labor Laws and Policies

Labor laws and policies significantly influence Adient's operational landscape. Minimum wage adjustments, such as the ongoing discussions and potential federal increases in the United States, directly impact manufacturing costs. Unionization efforts, a persistent factor in the automotive supply chain, can lead to collective bargaining agreements that affect wages, benefits, and working conditions, potentially increasing labor expenses.

Immigration policies also play a crucial role in workforce availability. For instance, changes in visa programs or border enforcement could reduce the pool of available skilled and semi-skilled labor, particularly in regions where Adient operates manufacturing facilities. In 2024, the automotive sector continued to grapple with labor shortages, exacerbated by demographic shifts and evolving worker expectations.

- Minimum Wage Impact: A hypothetical 10% increase in minimum wage across all Adient's U.S. operations could add tens of millions to annual labor costs.

- Unionization Trends: As of late 2024, union membership in the manufacturing sector remained a key consideration for companies like Adient, influencing wage negotiations.

- Immigration Policy Effects: Stricter immigration controls could limit the influx of foreign workers, potentially increasing competition for domestic talent and driving up wages in specific skill sets.

Government Incentives for Automotive Innovation

Government incentives play a crucial role in driving innovation within the automotive sector, directly impacting companies like Adient. For instance, the US government's Inflation Reduction Act (IRA) offers significant tax credits for electric vehicle (EV) production and battery manufacturing, encouraging suppliers to invest in components for these vehicles. Similarly, the European Union's Green Deal aims to promote sustainable practices, potentially providing subsidies for the development and use of eco-friendly materials in seating systems.

These incentives can directly encourage Adient to allocate more resources towards research and development for advanced seating technologies, such as smart seating features or the incorporation of sustainable materials. For example, as of early 2024, many governments are actively promoting the shift to EVs through purchase subsidies and charging infrastructure investments, which in turn creates demand for specialized automotive components. This creates a favorable environment for Adient to explore and implement innovations that align with these governmental priorities.

Specifically, government programs can offer financial backing for companies transitioning their manufacturing capabilities towards electric vehicle components. This might include grants for retooling factories or tax breaks for producing specific EV parts. The global push for decarbonization, supported by policies like China's New Energy Vehicle (NEV) mandate, which targets a significant percentage of NEV sales, underscores the growing importance of government support for companies like Adient that are adapting to the evolving automotive landscape.

Government policies directly influence Adient's market access and cost structure through trade agreements and tariffs. For example, the ongoing trade tensions and potential for new tariffs in 2024-2025 create uncertainty for global supply chains, impacting Adient's sourcing and sales strategies.

Stricter environmental regulations, such as proposed emissions standards for 2027 and beyond in the U.S., are compelling automakers to accelerate the production of electric vehicles. This regulatory push directly affects Adient by increasing demand for specialized seating components suited for EV architectures, like lightweight designs to enhance battery range.

Political stability in key markets like the U.S., China, and Germany is critical for Adient's operations, as policy shifts, such as those anticipated from the 2024 U.S. election cycle, can alter trade agreements and manufacturing incentives.

Government incentives, like the U.S. Inflation Reduction Act, provide substantial tax credits for EV and battery production, encouraging suppliers like Adient to invest in components for these growing segments. Similarly, global decarbonization efforts and mandates, such as China's NEV targets, further support Adient's strategic focus on EV-related seating solutions.

What is included in the product

This Adient PESTLE analysis comprehensively examines the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying current trends and future implications for Adient's global operations.

The Adient PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliver by providing easy referencing during meetings and strategic planning.

Economic factors

The global automotive market's trajectory is a critical determinant of Adient's performance. For 2025, projections indicate a modest 0.6% uptick in global light vehicle production, reaching an estimated 91.0 million units. However, it's important to note that this forecast carries notable downside risks, suggesting potential for softer demand.

Adient's profitability is directly influenced by the price swings of essential inputs such as steel, foam chemicals, and fabrics. For instance, during 2024, global steel prices saw considerable volatility, with benchmarks fluctuating by as much as 15% in certain quarters due to supply chain disruptions and shifts in industrial demand.

These raw material cost fluctuations directly impact Adient's cost of goods sold. Furthermore, new federal regulations implemented in late 2023 and continuing into 2024 have added to the overall cost structure for automotive manufacturers, indirectly affecting the pricing and demand for components like seating systems.

Higher interest rates on auto loans directly impact consumer purchasing power, potentially slowing new vehicle sales. This slowdown can translate to reduced demand for Adient's seating components. For instance, if average auto loan rates climb to 7.5% in early 2025, as some projections suggest, a car buyer might face significantly higher monthly payments, discouraging a purchase.

However, there's a positive outlook for 2025, with forecasts indicating a moderation in auto loan interest rates. If rates ease back towards 6.5% by mid-2025, this could provide much-needed relief. Such a decrease would make vehicle financing more accessible for consumers, potentially boosting sales volumes and, in turn, benefiting suppliers like Adient.

Inflation and Economic Growth

Inflationary pressures are a significant concern for Adient, as they directly impact operational costs. For instance, rising material and labor costs can squeeze margins. Adient's reported gross margin of 6.18% in the first quarter of 2024 indicates a tight operating environment where increased expenses can quickly erode profitability.

Economic growth, or the lack thereof, in key automotive markets also plays a crucial role. A slowdown in economic activity can lead to reduced consumer spending on new vehicles, directly affecting Adient's sales volume. The company's negative net profit margin, which was -1.2% for the same period, highlights its vulnerability to these demand fluctuations and its limited capacity to absorb rising costs without impacting overall business performance.

- Inflationary Impact: Rising input costs, such as raw materials and energy, directly challenge Adient's profitability, especially given its thin gross margin of 6.18% as of Q1 2024.

- Economic Growth Sensitivity: Adient's performance is closely tied to the health of the global automotive market; economic contractions in major regions can significantly reduce demand for new vehicles.

- Profitability Challenges: A negative net profit margin of -1.2% (Q1 2024) limits Adient's ability to weather economic downturns or absorb cost increases, making it susceptible to market volatility.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Adient, a global automotive seating supplier. As earnings are translated from local currencies into its reporting currency, a strengthening US dollar, for instance, can diminish the reported value of foreign profits. This volatility directly impacts Adient's financial performance.

The company's own financial reporting underscores this vulnerability. For its fiscal year 2025 (FY25) outlook, Adient maintained the lower end of its Adjusted-EBITDA guidance. This adjustment was specifically attributed to reduced sales guidance, with foreign exchange headwinds and lower customer volumes in key regions like EMEA and China playing a substantial role.

- Impact on Reported Earnings: Fluctuations in exchange rates can distort the reported revenue and profitability of Adient's international operations when converted to USD.

- FY25 Guidance Adjustment: Adient cited foreign exchange as a contributing factor to its reduced sales guidance, leading to the retention of the lower end of its FY25 Adjusted-EBITDA outlook.

- Regional Exposure: The company's performance is particularly sensitive to currency movements in regions like EMEA and China, where it experienced lower customer volumes alongside FX challenges.

Global economic growth directly influences vehicle demand, impacting Adient's sales volumes. For 2025, while global light vehicle production is projected to reach 91.0 million units, a modest 0.6% increase, downside risks remain, suggesting softer consumer spending could temper this growth.

Adient's profitability is sensitive to input cost volatility, with steel prices in 2024 showing up to a 15% quarterly fluctuation due to supply chain issues. Furthermore, new regulations implemented in late 2023 and into 2024 have increased automotive manufacturers' costs, indirectly affecting component pricing and demand.

High interest rates, potentially reaching 7.5% for auto loans in early 2025, can reduce consumer purchasing power and slow new vehicle sales, directly impacting Adient's seating component demand. Conversely, a projected easing of rates to 6.5% by mid-2025 could boost financing accessibility and sales volumes.

Inflationary pressures, evident in Adient's Q1 2024 gross margin of 6.18%, squeeze profitability. The company's negative net profit margin of -1.2% in the same period highlights its vulnerability to rising material and labor costs and economic downturns in key markets.

| Economic Factor | 2024/2025 Data/Projection | Impact on Adient |

| Global Light Vehicle Production | 91.0 million units (projected 2025, +0.6%) | Influences Adient's sales volume; downside risks noted. |

| Steel Price Volatility | Up to 15% quarterly fluctuation (2024) | Directly impacts Adient's cost of goods sold. |

| Auto Loan Interest Rates | Projected 7.5% (early 2025), potential easing to 6.5% (mid-2025) | Affects consumer purchasing power and vehicle demand. |

| Inflationary Pressures | Q1 2024 Gross Margin: 6.18% | Squeezes profitability, increases operational costs. |

| Net Profit Margin | -1.2% (Q1 2024) | Indicates vulnerability to demand fluctuations and cost increases. |

Preview the Actual Deliverable

Adient PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Adient PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Adient's strategic landscape.

Sociological factors

Consumer desires for vehicle interiors are shifting dramatically, with a growing emphasis on comfort, luxury, and personalization. Features like smart seats offering massage and temperature control are no longer niche; they are becoming key differentiators that directly shape Adient's product innovation pipeline.

By 2025, expect car buyers to prioritize integrated smart technology, sustainable materials, and highly customizable interior elements. This trend is supported by market research indicating that over 60% of consumers are willing to pay a premium for advanced comfort and connectivity features in their vehicles.

Demographic shifts, like the aging populations in many developed nations, can influence vehicle preferences, potentially increasing demand for more accessible seating and features. Urbanization trends also play a role, as denser populations might favor smaller, more efficient vehicles or shared mobility solutions, impacting seating needs.

The growing adoption of semi-autonomous and autonomous driving technologies, projected to see significant market growth through 2025, necessitates new seating arrangements and interior designs to accommodate passenger comfort and interaction during transit.

Consumer demand for healthier and more comfortable vehicle interiors is a significant sociological driver. This translates into a strong push for ergonomic seating, advanced air filtration systems, and features designed to reduce driver stress. For instance, a 2024 survey indicated that over 60% of new car buyers consider advanced comfort features, such as heated and ventilated seats, as a key purchasing factor.

The integration of smart technology into automotive seating is directly addressing these evolving wellness expectations. Seats offering automatic adjustments, built-in massage functions, and personalized climate control are becoming increasingly sought after, particularly for long-distance journeys. By 2025, it's projected that the market for advanced automotive seating technologies, including these comfort-enhancing features, will reach an estimated $15 billion globally.

Sustainability and Ethical Consumerism

Growing consumer awareness about environmental impact and ethical sourcing is significantly shaping purchasing habits. This trend directly affects automotive seating manufacturers like Adient, as Original Equipment Manufacturers (OEMs) face mounting pressure to incorporate sustainable materials and processes into their vehicles. For instance, by 2025, a significant portion of new car buyers express a willingness to pay a premium for vehicles with demonstrably sustainable features.

This societal shift translates into tangible demands on the automotive supply chain:

- Demand for Recycled and Bio-based Materials: Consumers are actively seeking seating solutions that utilize recycled plastics, plant-based fibers, and other eco-friendly alternatives, pushing suppliers to innovate in material science.

- Transparency in Supply Chains: Buyers expect clear information about the ethical treatment of workers and the environmental footprint of manufacturing processes, requiring suppliers to ensure responsible sourcing and production.

- Circular Economy Principles: There's an increasing expectation for products to be designed for longevity, repairability, and recyclability, influencing how seating components are conceived and manufactured.

Cultural Perceptions of Vehicle Ownership and Mobility

Cultural perceptions of vehicle ownership are evolving. In 2024, the global ride-sharing market is projected to reach over $200 billion, indicating a significant shift away from traditional car ownership, especially in urban centers. This trend directly impacts the automotive industry, influencing demand for new vehicles and, by extension, automotive seating.

Furthermore, there's a growing cultural interest in personalizing and adapting products to individual needs. This translates to a demand for vehicles with modular and customizable seating solutions. For instance, by 2025, consumer demand for flexible interior configurations in vehicles is expected to rise by 15% year-over-year, driven by a desire for multi-functional and adaptable mobility.

- Shifting ownership models: The increasing adoption of ride-sharing and car-sharing services is altering the traditional view of personal vehicle ownership.

- Demand for adaptability: Consumers are increasingly seeking vehicles with modular and customizable interior designs to suit evolving lifestyle needs.

- Environmental consciousness: Cultural emphasis on sustainability is also driving interest in shared mobility and potentially reducing the perceived need for individual car ownership.

Societal expectations for vehicle interiors are increasingly focused on wellness and personalized comfort, driving demand for features like advanced ergonomics and integrated smart technology. By 2025, over 60% of new car buyers consider comfort features a key purchasing factor, with the global market for advanced automotive seating technologies projected to reach $15 billion.

Growing environmental consciousness is pushing for sustainable materials and transparent supply chains, influencing consumer willingness to pay a premium for eco-friendly vehicles. This trend encourages manufacturers to adopt circular economy principles in seating design and production.

Evolving cultural perceptions of vehicle ownership, influenced by the rise of ride-sharing and car-sharing services, are shifting demand towards adaptable and customizable interior solutions. By 2025, consumer demand for flexible vehicle interior configurations is expected to increase by 15% annually.

| Sociological Factor | Trend Description | Impact on Adient | Supporting Data (2024/2025 Projections) |

| Wellness & Comfort | Demand for ergonomic, smart, and personalized seating. | Drives innovation in advanced seating features. | 60%+ of new car buyers prioritize comfort; $15B global market for advanced seating tech. |

| Sustainability & Ethics | Preference for recycled/bio-based materials and transparent supply chains. | Requires investment in sustainable materials and ethical sourcing. | Increasing consumer willingness to pay premium for sustainable vehicles. |

| Ownership Models & Adaptability | Shift towards shared mobility and demand for modular interiors. | Necessitates flexible seating designs and consideration of shared vehicle needs. | 15% annual growth in demand for flexible vehicle interiors; $200B+ global ride-sharing market. |

Technological factors

Adient's competitive advantage hinges on integrating smart features into its seating systems, including advanced ergonomics, connectivity, biometric sensors, and automated adjustments. These innovations are becoming standard expectations for consumers seeking superior comfort and functionality.

The global automotive smart seating market is projected to reach approximately $10.5 billion by 2027, growing at a compound annual growth rate of around 7.2%, according to recent market analyses. This expansion is fueled by a clear consumer preference for enhanced in-vehicle experiences, directly impacting Adient's product development and market strategy.

The automotive sector's push for lighter vehicles to boost fuel economy and extend electric vehicle range directly impacts Adient. This trend requires Adient to integrate advanced lightweight materials and sophisticated manufacturing techniques into its seating solutions. For instance, the demand for improved EV range, with many manufacturers targeting 300-400 miles on a single charge by 2025, fuels the need for weight reduction across all vehicle components.

Automakers are increasingly specifying advanced composites like carbon fiber and high-strength aluminum alloys for critical seating parts, including frames and structural elements. Companies like Ford have already showcased significant weight savings in their F-150 models using aluminum, demonstrating the material's potential. This shift means Adient must invest in technologies capable of working with these new materials to maintain its competitive edge.

The automotive industry's shift towards autonomous and electric vehicles (EVs) is fundamentally reshaping interior design. This evolution creates significant opportunities for seating manufacturers like Adient to innovate beyond traditional driver-centric layouts. Expect to see more modular, reconfigurable seating arrangements that prioritize passenger comfort and productivity during transit, as the focus shifts from active driving to passive experience.

For instance, the increasing prevalence of EVs, projected to capture over 20% of global car sales by 2025, necessitates lighter and more space-efficient seating solutions. Autonomous vehicle technology further liberates interior space, allowing for lounge-like seating configurations. Adient's focus on developing advanced seating systems that can swivel, recline extensively, and even face each other reflects this technological push, aiming to enhance the passenger experience in these new mobility paradigms.

Manufacturing Process Innovations

Adient is actively integrating advanced manufacturing techniques to boost its operational effectiveness. The adoption of technologies such as additive manufacturing, commonly known as 3D printing, and sophisticated robotics allows for enhanced production efficiency, cost reductions, and the creation of more intricate product designs.

These innovations are crucial for staying competitive in the automotive seating industry. In fiscal year 2024, Adient successfully implemented over 1,500 continuous improvement projects. This significant undertaking yielded substantial annual savings, underscoring the tangible financial benefits derived from process enhancements.

- Additive Manufacturing: Enables the production of complex seating components with reduced material waste.

- Advanced Robotics: Streamlines assembly processes, improving speed and precision.

- Continuous Improvement: Over 1,500 projects completed in FY2024 led to significant cost savings.

- Efficiency Gains: Innovations directly contribute to lower manufacturing costs and higher output quality.

Data Analytics and AI in Design and Production

Adient is increasingly leveraging data analytics and AI to refine its design and production processes. These technologies are crucial for predictive maintenance, ensuring equipment uptime and minimizing costly disruptions in manufacturing. For example, AI algorithms can analyze sensor data from machinery to anticipate potential failures before they occur, allowing for proactive servicing. This not only boosts operational efficiency but also contributes to a more reliable supply chain.

Optimizing production through data analytics allows Adient to fine-tune manufacturing workflows, reduce waste, and improve throughput. By analyzing production data, the company can identify bottlenecks and implement data-driven solutions. This focus on efficiency is particularly important in the competitive automotive seating market, where cost control is paramount. Furthermore, the insights gained from data can inform inventory management, ensuring that materials are available precisely when needed.

The application of AI extends to enhancing the customer experience through personalized seating. Adient is prioritizing AI integration in luxury vehicle models, aiming to deliver advanced features such as sophisticated ambient lighting systems and intuitive voice-controlled climate controls. This personalization caters to evolving consumer expectations for smart and responsive vehicle interiors. For instance, AI can learn driver preferences and automatically adjust seating positions, lighting, and climate settings for an optimal environment. By 2024, the global market for AI in automotive was projected to reach tens of billions of dollars, highlighting the significant investment and potential in this area.

- Predictive Maintenance: AI-powered systems analyze machine health data to forecast potential breakdowns, reducing unplanned downtime.

- Production Optimization: Data analytics identify inefficiencies in manufacturing lines, leading to improved output and reduced waste.

- Personalized Experiences: AI enables advanced features like adaptive ambient lighting and voice-controlled climate systems, particularly in premium vehicles.

- Market Growth: The automotive AI market is experiencing rapid expansion, with significant investments expected in the coming years, driving innovation in areas like smart seating.

Technological advancements are reshaping automotive interiors, with smart seating features like advanced ergonomics, connectivity, and biometrics becoming standard consumer expectations. The global smart seating market is anticipated to exceed $10.5 billion by 2027, underscoring Adient's strategic focus on innovation.

The drive for lighter vehicles, crucial for EV range, necessitates Adient's adoption of advanced materials and manufacturing techniques, as evidenced by the automotive sector's increasing use of composites and alloys. Furthermore, the rise of autonomous and electric vehicles is spurring a shift towards reconfigurable, passenger-centric seating designs, with EVs projected to represent over 20% of global car sales by 2025.

Adient is enhancing production efficiency through additive manufacturing and advanced robotics, aiming for cost reductions and intricate designs. In fiscal year 2024, over 1,500 continuous improvement projects were completed, demonstrating a commitment to operational effectiveness and cost savings.

Leveraging data analytics and AI, Adient is improving predictive maintenance and production optimization, crucial for cost control in the competitive automotive seating market. AI is also central to delivering personalized in-cabin experiences, with AI in automotive projected for significant market growth by 2024.

Legal factors

Automotive safety standards are a major legal consideration for Adient. Strict regulations governing vehicle components like seat belts, airbags, and overall crashworthiness directly influence how Adient designs, engineers, and tests its seating systems. These requirements ensure passenger protection and dictate material choices, structural integrity, and the integration of advanced safety features.

New safety standards, particularly for safety belt and restraint systems, are set to be implemented in phases starting April 2025. This phased approach means Adient must continually adapt its product development to meet evolving legal mandates, ensuring compliance and maintaining its competitive edge in the automotive seating market.

Environmental regulations, particularly those concerning manufacturing emissions and waste disposal, directly shape Adient's operational strategies and material choices. The U.S. Environmental Protection Agency (EPA) has indeed implemented new emissions standards for vehicles starting with model year 2027, targeting a significant reduction in greenhouse gas emissions. These evolving standards necessitate ongoing investment in cleaner production processes and potentially influence the types of materials Adient can utilize in its seating solutions to meet compliance.

Adient, operating as a critical component supplier in the automotive industry, faces significant exposure to product liability laws. These regulations mandate stringent quality control and thorough testing protocols to mitigate the risks inherent in supplying potentially defective automotive parts. For instance, in 2024, the automotive sector continued to grapple with recalls, with the NHTSA reporting millions of vehicles affected by safety-related defects, underscoring the financial and reputational stakes involved.

Consequently, Adient must maintain exceptionally robust internal processes and adhere strictly to evolving industry standards, such as ISO/TS 16949 (now IATF 16949), to ensure product safety and compliance. Failure to do so can result in costly lawsuits, recalls, and damage to its brand reputation, impacting its financial performance and market position.

Supply Chain Due Diligence Regulations

New regulations are placing greater emphasis on supply chain oversight. For instance, the EU Corporate Sustainability Due Diligence Directive (CSDDD), finalized in June 2024, compels large businesses to implement robust due diligence processes. This means actively identifying, preventing, and mitigating potential human rights and environmental harms within their entire supply networks.

This directive impacts companies by requiring them to demonstrate responsible practices across their value chains. Failure to comply could result in significant penalties and reputational damage. Adient, like other global manufacturers, must adapt its operations to meet these evolving legal standards, ensuring ethical sourcing and environmental responsibility are embedded in its supply chain management.

- CSDDD Adoption: The EU Corporate Sustainability Due Diligence Directive was adopted in June 2024.

- Scope: It requires large companies to conduct due diligence on human rights and environmental impacts in their supply chains.

- Mitigation Mandate: Companies must identify, prevent, and mitigate adverse impacts.

Intellectual Property Laws

Intellectual property laws are a cornerstone for Adient's competitive edge. Protecting its unique automotive seating designs, advanced engineering innovations, and specialized manufacturing processes through patents and trademarks is vital in the highly competitive automotive supply sector. For instance, in 2023, companies in the automotive sector saw a significant increase in patent filings related to sustainable materials and advanced seating technologies, underscoring the importance of IP protection.

Navigating the complexities of licensing agreements for its technologies and actively managing potential infringement issues with rivals are ongoing challenges. Adient's ability to secure and defend its intellectual property directly impacts its market position and revenue streams, especially as the industry moves towards new mobility solutions.

- Patent Protection: Safeguarding Adient's innovative seating designs and manufacturing techniques.

- Trademark Enforcement: Protecting Adient's brand identity and product recognition.

- Licensing Agreements: Managing the use of Adient's IP by third parties.

- Infringement Monitoring: Vigilantly watching for and addressing potential misuse of its intellectual property by competitors.

Adient must navigate a complex web of automotive safety regulations, with new standards for safety belt and restraint systems phased in from April 2025. Product liability laws also impose strict quality control, underscored by millions of vehicles recalled in 2024 due to safety defects, highlighting the financial and reputational risks. Furthermore, the EU Corporate Sustainability Due Diligence Directive, adopted in June 2024, mandates robust supply chain oversight, requiring Adient to identify and mitigate human rights and environmental risks across its operations.

Environmental factors

Adient faces significant pressure from regulators, customers like original equipment manufacturers (OEMs), and investors to curb its carbon footprint. This demand directly influences how Adient designs its manufacturing processes and manages its energy usage throughout its operations.

In response, Adient has made substantial progress, achieving a 38% reduction in its global scope 1 and 2 absolute greenhouse gas emissions. This is a notable accomplishment when measured against their 2019 baseline year.

Looking ahead, Adient has set an ambitious target to further reduce these emissions by 75% by the year 2030, demonstrating a strong commitment to environmental sustainability.

The availability and cost of raw materials are critical for Adient. As global supply chains continue to face volatility, securing consistent and affordable access to essential components directly impacts production costs and profitability. This scarcity is pushing companies like Adient to actively seek out and integrate more sustainable material options.

A significant trend is the growing emphasis on circular economy principles. This means moving away from a linear take-make-dispose model towards one where materials are reused and recycled. Adient is responding by innovating with recycled, renewable, and bio-based materials for its automotive seating products. By 2025, expect to see wider adoption of materials such as recyclable leather, bamboo fiber, and recycled plastic fabrics in car interiors, reflecting this shift.

Regulations and corporate responsibility initiatives concerning waste reduction, recycling, and product end-of-life management directly impact Adient's manufacturing processes and product design. These evolving standards push for more sustainable material sourcing and disposal methods.

Adient's commitment to environmental stewardship is evident in its operational achievements. In fiscal year 2024, the company successfully implemented over 1,500 continuous improvement projects, which notably led to the diversion of 5,308 metric tons of waste from landfills, demonstrating a tangible reduction in its environmental footprint.

Water Usage and Management

Water scarcity and tightening regulations around industrial water discharge are significant environmental concerns for Adient. These factors drive the need for highly efficient water management across its manufacturing operations. Adient is actively addressing this by implementing new strategies.

In fiscal year 2024, Adient made notable progress in its water management efforts. The company successfully reduced its total water withdrawals by a substantial 7% compared to the previous year. This demonstrates a commitment to more sustainable water usage.

- Water Scarcity: Increasing global water stress impacts manufacturing sectors.

- Regulatory Compliance: Stricter rules on industrial wastewater discharge require advanced treatment.

- FY2024 Water Reduction: Adient achieved a 7% year-over-year decrease in total water withdrawals.

- Efficiency Initiatives: The company is investing in technologies and processes for better water stewardship.

Climate Change Adaptation and Resilience

Adient faces significant physical risks from climate change, including extreme weather events that could disrupt its global supply chain and manufacturing. For instance, increased frequency of hurricanes in regions where Adient operates could impact production and raw material availability. This necessitates robust resilience planning and adaptation strategies, such as diversifying manufacturing locations and strengthening logistics networks to mitigate potential disruptions.

The company must consider how changing climate patterns affect its facility locations and operational continuity. For example, rising sea levels or increased flooding in coastal areas could pose a threat to manufacturing plants. Adient's adaptation efforts may involve investing in flood defenses or relocating vulnerable facilities. By 2024, many automotive suppliers were already reassessing their supply chain vulnerabilities due to climate-related events, with some reporting increased insurance costs.

- Supply Chain Disruption: Extreme weather events like floods and storms can halt production and delay shipments, impacting Adient's ability to meet customer demand.

- Operational Continuity: Facility locations in climate-vulnerable areas require adaptation strategies to ensure uninterrupted operations.

- Logistics Impact: Climate change can affect transportation routes and costs, adding complexity to Adient's global logistics operations.

Adient's environmental strategy is deeply intertwined with regulatory demands and customer expectations for reduced carbon footprints. The company has demonstrated progress by cutting its global scope 1 and 2 greenhouse gas emissions by 38% from a 2019 baseline, with a goal to achieve a 75% reduction by 2030.

The push for circular economy principles is driving Adient to innovate with sustainable materials, aiming for wider adoption of options like recycled plastics and bamboo fiber by 2025.

Adient's commitment to sustainability is further evidenced by its FY2024 waste diversion efforts, successfully diverting over 5,300 metric tons of waste from landfills through continuous improvement projects.

Water management is also a key focus, with Adient reducing its total water withdrawals by 7% in FY2024, implementing strategies to address water scarcity and comply with stricter discharge regulations.

Climate change presents physical risks, such as extreme weather impacting supply chains, prompting Adient to enhance resilience through diversified manufacturing and logistics, a trend observed across the automotive supply sector by 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Adient is meticulously constructed using data from reputable sources including automotive industry reports, economic forecasting agencies like IHS Markit, and governmental regulatory bodies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the automotive seating industry.