Adient Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adient Bundle

Adient, a global leader in automotive seating, faces significant competitive pressures. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping Adient’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Adient's reliance on key raw materials like steel, aluminum, and various polymers for seating components places significant bargaining power in the hands of its suppliers. Fluctuations in the global prices of these commodities, such as the average price of hot-rolled coil steel which saw significant volatility in 2024, directly affect Adient's cost of goods sold and its ability to maintain competitive pricing.

The automotive sector, which includes Adient's crucial suppliers, has been grappling with considerable swings in commodity prices. For instance, the price of aluminum, a key material for many automotive components, saw significant upward movement in late 2023 and early 2024, impacting production costs across the board.

This price instability grants suppliers more leverage. They can more easily pass on these heightened expenses to companies like Adient, directly squeezing profit margins. This necessitates that Adient implement stringent cost control measures and explore alternative sourcing strategies to mitigate these impacts.

Global supply chain disruptions and escalating raw material costs remain significant headwinds for automotive suppliers, a situation anticipated to continue through 2025. These persistent challenges can amplify the bargaining power of suppliers, especially when critical components face scarcity or extended lead times. For instance, the automotive industry experienced significant material cost increases in 2024, with some key commodities seeing double-digit percentage hikes, directly impacting production costs and supplier leverage.

Supplier Performance Management

Adient's approach to supplier performance management, including its Global Comprehensive Supplier Scorecard, aims to mitigate supplier power by standardizing evaluations across quality, delivery, and sustainability. This system provides visibility into supplier reliability, allowing Adient to identify and address underperforming partners. However, the inherent nature of specialized or high-value components means certain suppliers can retain considerable leverage, especially if alternatives are scarce or costly to develop.

The bargaining power of suppliers for Adient is influenced by several factors:

- Supplier Concentration: Industries supplying Adient, such as automotive seating components or raw materials like foam and fabric, may have a limited number of key players. For instance, in 2024, the global automotive seating market is dominated by a few major suppliers, giving them a stronger negotiating position.

- Switching Costs: The cost and time required for Adient to switch to a new supplier for critical components can be substantial. This includes retooling, quality validation, and integration into Adient's production lines, which can deter frequent supplier changes.

- Uniqueness of Offering: Suppliers providing proprietary technology, specialized materials, or unique manufacturing processes can command higher prices and more favorable terms. If a supplier's product is essential and difficult to replicate, their bargaining power increases significantly.

- Threat of Forward Integration: While less common in this sector, a powerful supplier could theoretically consider integrating forward into assembly or manufacturing, thereby competing directly with Adient. This potential threat can influence negotiation dynamics.

Technological Specialization of Components

Suppliers who specialize in highly technical or innovative components for automotive seating, like advanced lightweight composites or unique foam technologies, often hold significant bargaining power. This is because their specialized knowledge and proprietary materials are not easily replicated by competitors. For instance, a supplier developing next-generation seating materials that significantly reduce vehicle weight could command higher prices, especially as automakers strive for improved fuel efficiency or electric vehicle range.

The automotive industry's increasing focus on electrification and autonomous driving is a key factor amplifying this supplier power. As vehicle designs evolve to accommodate new powertrains and sensor integration, specialized seating components that support these advancements become critical. For example, seating designed for enhanced passenger interaction in autonomous vehicles or integrated thermal management systems for EV seats represents a new frontier where specialized suppliers can leverage their expertise to negotiate favorable terms. By 2024, the demand for advanced materials in automotive interiors, including seating, was projected to grow substantially, driven by these technological shifts.

- Technological Differentiation: Suppliers offering unique, patented materials or manufacturing processes for automotive seating components can command premium pricing.

- R&D Investment: Companies investing heavily in research and development for next-generation seating technologies, such as those for EVs and autonomous vehicles, are likely to see increased supplier leverage.

- Industry Trends: The automotive sector's push for lightweighting and enhanced passenger experience in new mobility solutions directly benefits suppliers of specialized seating materials and designs.

- Supplier Concentration: In segments where only a few suppliers possess the necessary technological capabilities for advanced seating components, their bargaining power is significantly enhanced.

The bargaining power of Adient's suppliers is substantial, particularly for specialized components and raw materials like steel and aluminum. Commodity price volatility in 2024, with significant increases in materials like aluminum, directly empowers these suppliers to pass on costs, impacting Adient's margins. This leverage is amplified by supplier concentration in certain automotive seating segments and the high switching costs for Adient to change providers for critical, technologically advanced parts.

Suppliers with unique offerings, such as advanced lightweight materials or proprietary seating technologies for electric and autonomous vehicles, hold considerable sway. The automotive industry's rapid evolution towards new mobility solutions in 2024 and beyond necessitates these specialized components, granting suppliers enhanced negotiating positions. For instance, the growing demand for integrated thermal management systems in EV seats highlights areas where supplier expertise translates to greater leverage.

| Factor | Impact on Adient | 2024 Data/Trend |

|---|---|---|

| Raw Material Costs | Increased cost of goods sold, pressure on margins | Significant volatility in steel and aluminum prices, with some commodities up double digits in 2024. |

| Supplier Concentration | Limited alternatives, stronger negotiation position for suppliers | Dominance of a few key players in the global automotive seating market. |

| Switching Costs | Deters supplier changes, maintains supplier leverage | Substantial costs for retooling, quality validation, and production line integration. |

| Technological Differentiation | Premium pricing, favorable terms for suppliers | Growing demand for specialized seating for EVs and autonomous vehicles, increasing supplier R&D investment. |

What is included in the product

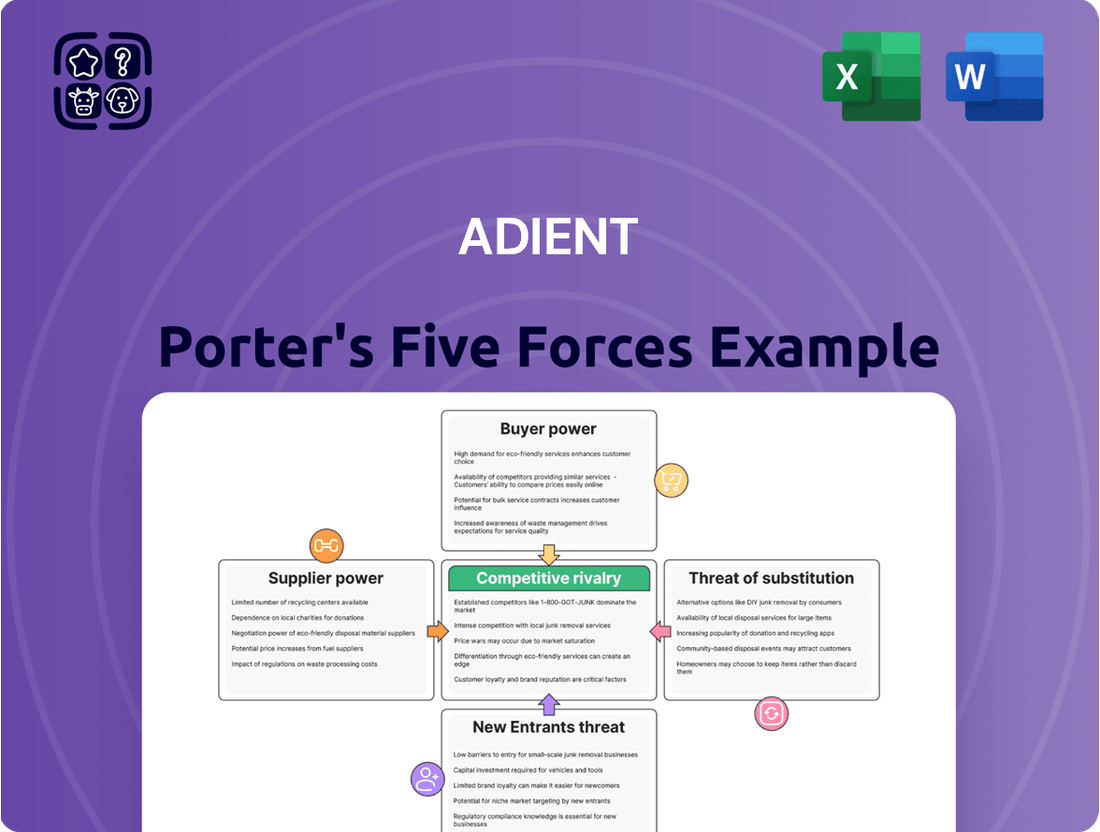

Adient's Porter's Five Forces analysis dissects the industry's competitive intensity, buyer and supplier power, threat of new entrants, and substitutes, providing a strategic framework for understanding its market dynamics.

Adient's Five Forces Analysis provides a clear, one-sheet summary of all competitive forces—perfect for quick strategic decision-making.

Customers Bargaining Power

Adient's customer base is heavily concentrated among a few major Original Equipment Manufacturers (OEMs) globally. This concentration means that large automakers, such as Ford, General Motors, and Toyota, are significant buyers of Adient's seating systems, often purchasing in very high volumes.

The substantial purchasing power of these OEMs grants them considerable leverage in negotiations. They can exert pressure on Adient regarding pricing, demanding lower costs, and also dictate stringent quality standards and specific delivery schedules, directly impacting Adient's profitability and operational efficiency.

For instance, in fiscal year 2023, Adient's top five customers accounted for approximately 42% of its net sales, highlighting the significant dependency on a limited number of large automotive manufacturers.

Adient's reliance on just-in-time and in-sequence delivery for Original Equipment Manufacturers (OEMs) significantly amplifies customer bargaining power. OEMs dictate precise delivery schedules, forcing suppliers like Adient to maintain extreme operational flexibility and minimize inventory.

This stringent demand means OEMs can exert considerable pressure on pricing and terms, as any disruption to Adient's supply chain directly impacts their production lines. For instance, in 2023, the automotive industry experienced significant disruptions, highlighting the critical nature of reliable, albeit demanding, supply chains.

Long-standing relationships between original equipment manufacturers (OEMs) and their Tier-1 suppliers, such as Adient, are built on consistency, predictability, and shared strategic goals. These deep ties are crucial for maintaining stability in the automotive supply chain.

OEMs that cultivate robust supplier partnerships often gain preferential treatment, becoming 'customers of choice.' This status grants them significant leverage, influencing suppliers' strategic decisions and investment priorities, as seen in the automotive sector where major players like Volkswagen and Toyota often dictate terms due to their sheer volume and long-term commitment.

Impact of OEM Production Volumes and Mix

Adient's revenue is highly sensitive to the production volumes and the specific mix of vehicles its automotive customers produce. When automakers reduce their output or shift towards models with fewer Adient components, the company experiences a direct hit to its top line. For example, in fiscal year 2023, Adient noted that lower vehicle production, particularly in key markets like EMEA and China, contributed to revenue challenges.

This customer power is evident in how shifts in demand directly affect Adient's financial performance. An unfavorable product mix, meaning fewer high-content vehicles or a greater proportion of lower-margin models, can significantly impact Adient's profitability. This was a factor contributing to revenue pressures Adient faced in its fiscal 2023 results.

- Customer Production Volumes: Fluctuations in global vehicle production directly impact Adient's sales volume.

- Product Mix Influence: The types of vehicles produced by customers dictate the demand for Adient's specific seating components.

- Regional Impact: Lower production or unfavorable mix in regions like EMEA and China have demonstrably affected Adient's revenue performance.

- 2023 Revenue Sensitivity: Adient's fiscal year 2023 financial reports highlighted the impact of these customer-driven volume and mix changes on its revenue.

OEM Demand for Innovation and Cost Efficiency

Automotive original equipment manufacturers (OEMs) exert significant bargaining power on suppliers like Adient, driven by their relentless pursuit of innovation and cost efficiency. In 2024, OEMs are pushing for advanced seating solutions that cater to evolving vehicle trends, such as lightweighting for electric vehicles (EVs) and enhanced passenger comfort features. This demand necessitates substantial investment in research and development by Adient to meet OEM specifications and stay competitive.

Adient's ability to meet these stringent OEM requirements directly influences its pricing power and profitability. For instance, the development of novel seating materials or integrated technology, such as advanced lumbar support systems, can command higher margins but requires upfront R&D expenditure. The competitive landscape among automotive seating suppliers further amplifies OEM leverage, as manufacturers can often source similar components from multiple providers.

- OEMs demand continuous innovation in seating technology and design.

- Cost efficiency is a primary driver of OEM purchasing decisions.

- Adient must invest in R&D to meet evolving needs like lightweighting for EVs.

- The competitive supplier market strengthens OEM bargaining power.

The bargaining power of Adient's customers, primarily major automotive OEMs, remains substantial due to their concentrated purchasing volume and the critical nature of seating systems in vehicle assembly. In 2024, this power is amplified by OEMs' drive for cost reduction and technological advancements, forcing suppliers like Adient to absorb significant R&D costs and maintain competitive pricing. The industry's reliance on just-in-time delivery further empowers OEMs, as any supply disruption directly halts their production lines.

| Customer Concentration (Top 5) | FY2023 Sales Contribution | Impact on Adient |

| Major Automotive OEMs | ~42% | Significant pricing and terms leverage |

| Just-in-Time Delivery Demands | Constant | Operational flexibility required, vulnerability to disruption |

| Innovation & Cost Efficiency Drive | Ongoing in 2024 | Pressure on R&D investment and margins |

Preview the Actual Deliverable

Adient Porter's Five Forces Analysis

This preview showcases the complete Adient Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within the automotive seating industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

Adient stands as a titan in the automotive seating industry, commanding roughly one-third of the global market share. This leadership position means the competitive landscape is fiercely contested by a handful of major players vying for lucrative contracts with original equipment manufacturers (OEMs).

The intense rivalry among these dominant companies, including competitors like Lear Corporation and Faurecia, shapes Adient's strategic decisions. For instance, in fiscal year 2023, Adient reported net sales of $13.5 billion, underscoring the scale of operations and the financial stakes involved in maintaining and expanding market presence.

Adient operates in a highly competitive arena, contending with formidable global rivals like Lear Corporation, Magna International, and Forvia. These established players, along with numerous niche specialists, intensify the pressure on Adient to excel.

This intense rivalry means Adient must constantly push for innovation in seating technology and design, while also maintaining rigorous cost controls. Building and sustaining strong relationships with automotive manufacturers is paramount to securing and retaining business in this dynamic market.

For instance, in 2023, Lear Corporation reported net sales of approximately $22.7 billion, showcasing the scale of operations and the financial muscle of key competitors Adient must contend with.

The automotive seating market is experiencing robust expansion, with projections indicating continued growth fueled by consumer demand for superior comfort, premium features, and cutting-edge technology. This upward trend is a significant factor in competitive rivalry.

Companies are actively distinguishing their offerings through innovations such as integrated massage systems, sophisticated climate control within seats, and the increasing use of eco-friendly materials. This drive for differentiation intensifies competition as firms vie for greater market share.

For instance, in 2024, the global automotive seating market was valued at approximately $60 billion, with an anticipated compound annual growth rate (CAGR) of over 5% through 2030. This expanding market size naturally attracts more players and encourages aggressive competition.

Regional Market Dynamics

Competitive rivalry within the automotive seating industry, as analyzed through Adient's Porter's Five Forces framework, is significantly shaped by regional market dynamics. The intensity of competition varies considerably across different geographical areas, directly impacting Adient's strategic positioning and operational focus.

The Asia Pacific region, for instance, presents a landscape of robust growth, driven by expanding automotive production and increasing consumer demand. However, this dynamism also translates to heightened competitive pressure from both established global automotive suppliers and increasingly capable regional manufacturers who often possess a deep understanding of local market nuances and cost structures. In contrast, Europe is experiencing a more challenging environment. Economic uncertainties and persistent production headwinds, such as supply chain disruptions and evolving regulatory landscapes, are intensifying competitive pressures. This forces companies like Adient to navigate a more complex and less predictable market, where maintaining market share and profitability requires agile strategies and efficient operations.

- Asia Pacific Growth vs. European Challenges: While Asia Pacific automotive seating markets are experiencing significant expansion, Europe faces economic uncertainties and production headwinds, leading to varied competitive intensity across regions.

- Global vs. Regional Competitors: Adient must contend with a dual competitive threat, facing off against established global automotive suppliers as well as strong, localized regional manufacturers in key markets.

- Impact on Strategy: Navigating these divergent regional dynamics necessitates tailored competitive strategies, balancing growth opportunities in Asia with resilience-building in more mature or challenged European markets.

Strategic Investments and Technology Race

Adient, a major player in automotive seating, is heavily investing in R&D to stay ahead in the technology race. This includes developing advanced seating systems for electric and autonomous vehicles, crucial for future market share. For instance, Adient's commitment to innovation is reflected in its continuous pursuit of lighter, more sustainable, and technologically integrated seating solutions.

The intense competition in the automotive seating sector is driven by a relentless pursuit of technological superiority. Companies are pouring resources into developing next-generation seating that caters to evolving vehicle trends, such as enhanced comfort, integrated connectivity, and advanced safety features. This technological arms race directly impacts market positioning and the ability to secure contracts with major automakers.

- Strategic Investments: Leading automotive seating manufacturers are channeling significant capital into R&D, focusing on lightweight materials and smart seating technologies.

- Electric & Autonomous Vehicle Focus: The shift towards EVs and AVs necessitates specialized seating designs, creating a competitive arena for innovation in these areas.

- Technological Leadership: Companies vie for dominance by developing proprietary technologies that offer superior performance, comfort, and integration capabilities, influencing supplier selection by OEMs.

- R&D Spending: While specific figures vary, industry reports indicate substantial year-over-year increases in R&D expenditures by major seating suppliers to maintain a competitive edge.

Competitive rivalry in the automotive seating sector is intense, with Adient facing strong competition from global giants like Lear Corporation and Forvia. This rivalry is fueled by the need for innovation in areas like electric and autonomous vehicle seating, with companies investing heavily in R&D. For instance, in 2024, the global automotive seating market was valued at approximately $60 billion, a figure that encourages aggressive competition among major players vying for market share.

| Competitor | Approx. 2023 Net Sales (USD Billions) | Key Focus Areas |

|---|---|---|

| Adient | 13.5 | Lightweight materials, EV/AV seating, sustainability |

| Lear Corporation | 22.7 | Seating systems, E-Systems, innovation |

| Forvia (Faurecia) | 27.0 (combined with Hella) | Sustainable mobility, advanced seating, interiors |

SSubstitutes Threaten

The threat of substitutes in the automotive seating industry is primarily driven by the evolving nature of vehicle interiors themselves, rather than entirely different product categories. As electric and autonomous vehicles gain traction, interior designs are being reimagined, fundamentally changing the role and functionality of seats.

Seats are no longer just passive seating. They're becoming dynamic, integrated systems. Think about seats that can recline significantly, swivel to face passengers, or even incorporate advanced entertainment and connectivity features. This shift means that a traditional, static seat is becoming a less attractive substitute for these more advanced, multi-functional interior solutions.

For instance, the push for lounge-like cabin experiences in autonomous vehicles directly challenges the traditional seating paradigm. Companies are investing heavily in these new interior concepts, with projections suggesting a significant portion of new vehicle sales could be electric by the late 2020s, further accelerating this trend. This evolution presents a substantial substitute threat to conventional automotive seating suppliers not adapting to these new demands.

The increasing adoption of lightweight and sustainable materials by automotive manufacturers presents a significant threat of substitution for Adient. Companies are actively integrating materials like carbon-fiber-reinforced plastics, magnesium, and natural-fiber composites to boost fuel efficiency and extend electric vehicle range. For instance, by 2024, the global market for lightweight automotive materials was projected to reach over $20 billion, indicating a strong industry trend.

This shift directly impacts Adient's traditional material offerings, potentially decreasing demand for conventional seating components if not adapted. The push for sustainability also means a greater use of recycled fabrics and bio-based materials, creating new opportunities but also requiring Adient to innovate its supply chain and product development to remain competitive.

The rising consumer desire for advanced comfort and wellness in vehicles, including sophisticated climate control, massage functions, and biometric integration, presents a significant threat. While Adient is investing in these areas, a lag in innovation could see customers opting for competitors who more readily adopt these features. For instance, in 2024, the automotive interiors market saw a notable increase in demand for personalized cabin experiences, a trend that could be exploited by agile competitors.

Modular and Flexible Seating Solutions

The rise of modular and flexible seating solutions, particularly for electric and autonomous vehicles, acts as a significant substitute threat to traditional automotive seating. These innovative designs offer enhanced configurability and space optimization, allowing for multiple vehicle interior arrangements. For instance, by 2024, the global automotive seating market, which Adient is a major player in, was valued at approximately $65 billion, with a growing segment dedicated to these advanced, adaptable systems.

This trend necessitates that seating manufacturers like Adient develop highly adaptable designs capable of serving diverse functions within a single vehicle. The ability to reconfigure seating layouts quickly can reduce the need for specialized seating for different vehicle types or purposes. Reports from 2024 indicated that consumer demand for customizable and multi-functional vehicle interiors was increasing, directly impacting the perceived value of static seating arrangements.

- Increased Configurability: Modular seating allows users to change the interior layout, a direct substitute for fixed seating arrangements.

- Space Optimization: Flexible designs can maximize interior space, particularly critical in smaller EVs, offering an alternative to traditional, less adaptable seat structures.

- Multi-Purpose Functionality: Seating that can transform for different uses (e.g., lounge, workspace) substitutes for vehicles requiring separate configurations.

- Technological Integration: The integration of technology within flexible seating systems further enhances their appeal as a substitute for simpler seating options.

Alternative Transportation Modes

While not a direct substitute for automotive seating itself, broader trends in transportation can indirectly impact Adient's market. For instance, the rise of ride-sharing services and the eventual widespread adoption of autonomous vehicle fleets might shift consumer preferences. In these scenarios, the primary user may not be the vehicle owner, potentially leading to a prioritization of durability and ease of maintenance over the highly personalized comfort and features often sought by individual car buyers. This could subtly alter the demand for certain types of seating solutions.

Consider the evolving landscape of urban mobility. In 2024, ride-sharing platforms like Uber and Lyft continued to see significant usage, particularly in major metropolitan areas. While specific data on seating attribute preferences in these services is proprietary, the focus is generally on maximizing vehicle utilization and passenger throughput. This contrasts with the traditional automotive market where individual consumers often prioritize comfort, aesthetics, and advanced features in their seating choices. The long-term implications for seating manufacturers like Adient hinge on how these shared mobility models evolve and whether they lead to a significant reduction in private vehicle ownership or a change in the specifications for vehicles used in these services.

- Ride-Sharing Dominance: Continued growth in ride-sharing services may reduce demand for privately owned vehicles, indirectly affecting seating sales.

- Autonomous Vehicle Impact: Future autonomous fleets could prioritize different seating functionalities, such as enhanced durability or modularity, over traditional luxury features.

- Shifting Consumer Priorities: In shared mobility, the focus might shift from individual comfort to cost-effectiveness and maintenance, influencing seating design.

- Urban Mobility Trends: Increased reliance on public transport and micro-mobility solutions in cities could further diminish the need for traditional automotive seating.

The threat of substitutes for automotive seating, particularly for a company like Adient, is evolving rapidly. New interior concepts for electric and autonomous vehicles are emerging, offering multi-functional and dynamic seating arrangements that challenge traditional, static designs. For instance, by 2024, the automotive interiors market saw a notable increase in demand for personalized cabin experiences, a trend that agile competitors could exploit.

Lightweight and sustainable materials are also gaining significant traction, with the global market for these materials projected to exceed $20 billion by 2024. This shift necessitates that seating manufacturers innovate their material usage and supply chains to remain competitive against these evolving substitutes.

Furthermore, the rise of modular and flexible seating solutions, designed for enhanced configurability and space optimization, presents a direct substitute threat. These adaptable systems are becoming increasingly desirable, especially in smaller electric vehicles, as consumer demand for customizable interiors continues to grow.

| Substitute Type | Key Characteristics | Impact on Traditional Seating | Market Trend Example (2024) |

|---|---|---|---|

| Dynamic/Integrated Seating | Swiveling, reclining, integrated tech | Reduces demand for static, basic seats | Growth in lounge-like autonomous vehicle interiors |

| Lightweight Materials | Carbon fiber, composites, bio-based | Decreases reliance on traditional materials | Global lightweight automotive materials market over $20 billion |

| Modular/Flexible Seating | Configurable, space-optimizing | Offers alternative to fixed seating layouts | Increased consumer demand for customizable interiors |

Entrants Threaten

The automotive seating industry demands significant upfront capital for research, design, and engineering, along with the establishment of a global manufacturing and supply chain network. For instance, Adient's extensive operational footprint, comprising over 200 manufacturing facilities worldwide, underscores the immense scale required to compete effectively. This high capital barrier makes it exceedingly difficult for new players to enter and achieve the necessary economies of scale to challenge established incumbents.

New entrants face significant hurdles due to established Original Equipment Manufacturer (OEM) relationships and rigorous qualification processes. These relationships are built on trust, consistent quality, and reliable delivery, often taking years to cultivate. For instance, in the automotive sector, a new supplier might need to undergo multiple rounds of testing and validation, a process that can extend for several model years before full production approval is granted.

The automotive seating industry, including Adient, is characterized by significant technological complexity. Developing advanced seating solutions requires expertise in engineering, materials science, and the integration of sophisticated electronics and safety features. For instance, the development of smart seating technologies, which can monitor occupant health or adjust dynamically for comfort, demands substantial upfront investment in research and development.

New entrants face a considerable hurdle due to the high R&D intensity required to stay competitive. Trends like lightweighting for fuel efficiency and the integration of advanced features for autonomous vehicles necessitate continuous innovation. Companies like Adient invest heavily in R&D; in fiscal year 2023, Adient reported R&D expenses of $327 million. This level of ongoing investment makes it difficult for new players to enter and compete on technological parity.

Stringent Regulatory and Safety Standards

The automotive industry is heavily regulated, with stringent safety and emissions standards that vary significantly by region. For instance, in 2024, the European Union's Euro 7 emissions standards continue to push manufacturers towards cleaner technologies, requiring substantial investment in research and development. New entrants face the daunting task of meeting these evolving requirements, which can add years and millions of dollars to their product development cycles. This regulatory hurdle acts as a significant barrier, making it difficult for less-established companies to compete with incumbents who have already invested in compliant technologies and processes.

Navigating these complex compliance landscapes is a major deterrent. For example, the U.S. National Highway Traffic Safety Administration (NHTSA) mandates numerous safety standards, such as Federal Motor Vehicle Safety Standards (FMVSS), which require rigorous testing and validation. A new entrant must not only design vehicles that meet these standards but also establish the infrastructure and expertise to ensure ongoing compliance. This can involve significant capital expenditure on testing facilities and specialized personnel, effectively raising the cost of entry and favoring well-capitalized players.

- High Compliance Costs: Meeting global safety and emissions regulations, such as Euro 7 in Europe and FMVSS in the US, requires substantial investment in R&D and testing.

- Extended Development Timelines: Adhering to these standards can add years to the product development process for new entrants.

- Capital Expenditure: Establishing compliant manufacturing and testing facilities demands significant upfront capital, favoring established players.

- Regional Variations: The need to comply with diverse regulations across different markets further complicates market entry for new automotive companies.

Supply Chain Integration and Logistics Expertise

The threat of new entrants in the automotive seating industry is significantly mitigated by the intricate demands of supply chain integration and logistics expertise. Operating on a just-in-time and in-sequence basis for Original Equipment Manufacturers (OEMs) necessitates highly sophisticated supply chain management and logistics capabilities. For instance, in 2023, the automotive industry’s reliance on precise delivery schedules meant that disruptions, even minor ones, could halt production lines, costing billions. New entrants would need to invest heavily and build robust, reliable supply networks globally, which presents a substantial operational hurdle and barrier to entry.

Establishing the necessary infrastructure and relationships to meet OEM demands for timely and accurate delivery is a monumental task. This includes not only physical logistics but also the technological integration required for seamless communication and inventory management. The capital expenditure for such systems, coupled with the time needed to prove reliability to major automotive manufacturers, acts as a strong deterrent. For example, building out a global logistics network comparable to established players like Adient, which handles millions of components annually, would require billions in upfront investment and years of operational refinement.

- Sophisticated Supply Chain Management: OEMs demand 'just-in-time' and 'in-sequence' delivery, requiring advanced planning and execution.

- Global Logistics Network: New entrants must establish and manage complex, reliable supply networks across multiple continents.

- High Capital Investment: Building the necessary infrastructure and technology for global logistics is extremely costly.

- Operational Hurdles: Proving reliability and efficiency to major automotive manufacturers takes considerable time and resources.

The threat of new entrants into the automotive seating market, where Adient operates, is significantly constrained by the immense capital required for research, development, and establishing global manufacturing and supply chain networks. For instance, Adient's vast operational footprint, with over 200 facilities worldwide, highlights the scale needed to compete effectively. This substantial capital barrier makes it exceedingly challenging for new companies to enter and achieve the necessary economies of scale to challenge established players.

Porter's Five Forces Analysis Data Sources

Our Adient Porter's Five Forces analysis is built upon a foundation of robust data, including Adient's annual reports and SEC filings, alongside industry-specific market research from sources like IHS Markit and PwC.