Adient Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adient Bundle

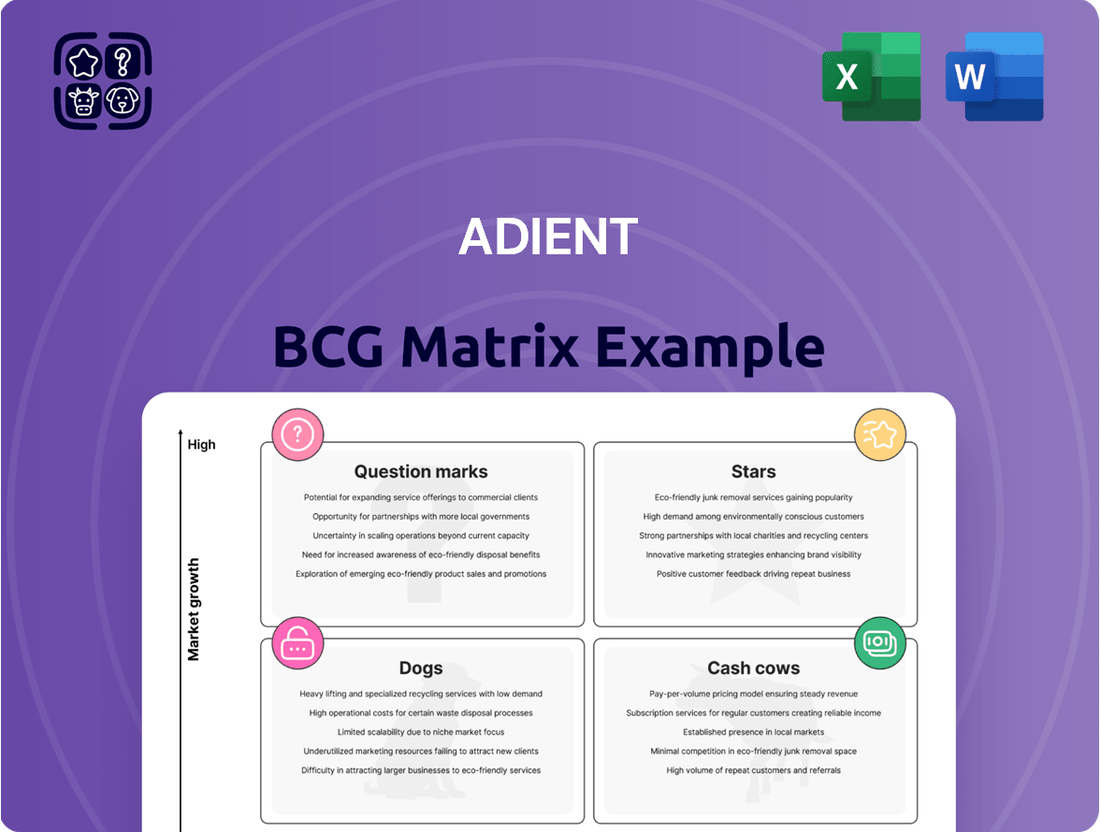

This Adient BCG Matrix preview highlights key product categories, but to truly unlock strategic growth, you need the full picture. Understand which of Adient's offerings are Stars poised for expansion, Cash Cows generating steady revenue, Dogs that may need divestment, or Question Marks requiring careful evaluation.

Don't leave your investment decisions to guesswork. Purchase the complete Adient BCG Matrix for a detailed breakdown of each product's market share and growth rate, empowering you to allocate resources effectively and drive future success.

Gain a competitive edge with the full Adient BCG Matrix, providing actionable insights and a clear roadmap for optimizing your portfolio. Invest in clarity and strategic foresight today!

Stars

Adient's EV seating solutions are a key component of its future growth, aligning with the company's strategic shift towards the burgeoning electric vehicle market. This segment is experiencing significant expansion, with global electric car registrations reaching 14 million in 2023, highlighting a substantial opportunity for market penetration.

The company's proactive engagement in supplying seats for new EV platforms, including its investment in a facility to support Rivian's R2 SUV from 2026, underscores its commitment to this high-growth sector. This forward-looking strategy positions Adient to capture a significant share of the evolving automotive landscape.

Advanced comfort and smart seating technologies, like Adient's new mechanical massage seat, are a significant growth driver in the automotive sector. Consumers are actively seeking these integrated smart features, pushing demand for innovation.

Adient's recent debut of a 3D massage module in the GAC-Trumpchi M8 PHEV highlights their pioneering spirit. This move positions them to capture a larger share of this expanding market, as evidenced by the growing consumer preference for enhanced in-car experiences.

Adient's robust presence and ambitious expansion plans in the Asia Pacific region, especially within China, clearly position it in the Star quadrant of the BCG matrix. This is driven by the region's automotive seat market, which is anticipated to experience the most rapid expansion globally.

Adient forecasts its volume growth in China to significantly outpace the overall Chinese industry growth rate. The company is actively reorienting its customer portfolio, with a strategic focus on Chinese original equipment manufacturers (OEMs) and the burgeoning electric vehicle (EV) and sport utility vehicle (SUV) segments.

By fiscal year 2027, Adient aims for these strategic customer segments to represent a substantial 60% of its business in the region. This proactive market alignment is crucial for capturing the high growth potential in Asia Pacific.

Lightweight Seating Architectures

Lightweight seating architectures represent a significant growth opportunity within the automotive sector, driven by the industry's focus on efficiency and sustainability. Adient's commitment to this area is evident in innovations like the Pure Essential seat, which incorporates eco-friendly materials such as green steel and recyclable polyester. The company's Smart Efficiency seat further exemplifies this trend with its reduced weight and optimized design.

These advancements are crucial for adapting to evolving vehicle designs, particularly for electric vehicles, where weight reduction directly impacts range and performance. By prioritizing lightweight solutions, Adient is addressing key consumer and regulatory demands.

- Market Growth: The global automotive lightweight materials market was valued at approximately $50 billion in 2023 and is projected to grow significantly, with seating components being a key contributor.

- Adient's Innovations: Adient's focus on lightweight seating aligns with industry trends, aiming to reduce vehicle weight by an average of 10-15% through advanced materials and design.

- EV Integration: Lightweight seating is critical for electric vehicles, where every kilogram saved can translate to extended battery range, a key purchasing factor for consumers.

- Sustainability Focus: The use of recycled and green materials in seating solutions supports the automotive industry's broader sustainability goals, aiming for a circular economy.

High-Complexity Program Launches

Adient's strategic emphasis on high-complexity program launches, exemplified by its involvement with the Infiniti QX80, showcases its capability to secure high-tier business. This segment demands sophisticated design and engineering expertise, positioning Adient for growth in premium and technologically advanced automotive markets.

These complex launches, though requiring significant investment, offer substantial value and are crucial for maintaining market leadership. For instance, Adient's 2024 fiscal year revenue reached $13.1 billion, reflecting its scale in handling such demanding projects.

- Infiniti QX80 Launch: Demonstrates Adient's capability in premium vehicle interiors.

- Market Segment: Targets high-value luxury and technologically advanced vehicle segments.

- Strategic Importance: Solidifies market leadership and drives future growth.

- Financial Impact: High-complexity programs contribute to Adient's substantial revenue base.

Adient's strong performance and strategic focus in the rapidly expanding Asia Pacific region, particularly China, firmly place its automotive seating business in the Stars category of the BCG matrix. This is fueled by China's automotive seat market, projected for the highest global growth, with Adient expecting its China volume growth to significantly surpass overall industry expansion.

The company's strategic pivot towards Chinese OEMs and the booming EV and SUV segments, aiming for these to constitute 60% of its regional business by fiscal year 2027, underscores its commitment to capitalizing on this high-growth area. This proactive market alignment is crucial for capturing the substantial potential within Asia Pacific.

Adient's significant investments in EV seating solutions, including its facility to support Rivian's R2 SUV from 2026, solidify its position in this high-growth sector. Global electric car registrations hit 14 million in 2023, indicating a substantial market opportunity for Adient's advanced seating technologies.

The company's commitment to lightweight seating architectures, utilizing materials like green steel and recyclable polyester in its Pure Essential seat, directly addresses the automotive industry's drive for efficiency and sustainability. This focus is particularly critical for EVs, where weight reduction directly impacts battery range, a key consumer consideration.

| Adient's Star Segments | Market Characteristic | Adient's Strategy | Growth Driver | Key Data Point (2023/2024) |

|---|---|---|---|---|

| Asia Pacific (China) | High Market Growth | Focus on Chinese OEMs, EVs, SUVs | Regional expansion, industry outperformance | China volume growth to significantly outpace industry |

| EV Seating Solutions | High Market Growth | Investment in EV platforms (e.g., Rivian R2) | Global EV adoption | 14 million global EV registrations |

| Lightweight Seating | High Market Growth | Innovation in materials (green steel, recycled polyester) | Efficiency, sustainability, EV range | Global lightweight materials market ~$50 billion |

What is included in the product

The Adient BCG Matrix analyzes business units based on market share and growth, guiding strategic decisions for investment and resource allocation.

Adient's BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Adient's Global Core Automotive Seating Systems represents its foundational business, positioning the company as a leading provider of complete seating solutions to major original equipment manufacturers (OEMs) globally. This segment operates within a mature yet stable automotive market, consistently delivering substantial cash flow thanks to Adient's high market share and deeply entrenched customer relationships.

Despite the moderate growth characteristic of the automotive seating industry, Adient's extensive global footprint, spanning 29 countries and over 200 manufacturing facilities, underpins a reliable and steady revenue generation. For instance, in fiscal year 2023, Adient reported net sales of $13.5 billion, with its seating segment being a primary contributor to this figure, highlighting its role as a significant cash cow.

Adient's deep and long-standing relationships with global Original Equipment Manufacturers (OEMs), particularly those in Japan and Asia, are a clear indicator of its Cash Cow status. These enduring partnerships ensure a consistent and predictable demand for Adient's seating solutions. For instance, in fiscal year 2023, Adient reported that its top five customers accounted for approximately 47% of its net sales, highlighting the critical role of these OEM relationships.

Adient's complete seating systems for high-volume passenger cars and light trucks are significant cash generators. This segment benefits from a stable market, with passenger car seats projected to grow at a 2.7% CAGR. Adient's strong market share in this area guarantees steady demand, solidifying its position as a cash cow.

These mature product lines demand less investment in marketing and distribution compared to newer offerings, leading to higher profit margins. For instance, in fiscal year 2023, Adient reported a substantial contribution from its seating segment, reflecting the profitability of these established systems.

Traditional Seating Component Manufacturing

The manufacturing of core automotive seating components, including frames, mechanisms, foam, trim, and fabric, functions as a stable Cash Cow for Adient. This segment benefits from consistent demand as these parts are indispensable across all vehicle types, ensuring a reliable revenue stream. Adient's established global manufacturing network enables cost-effective, large-scale production, which underpins healthy profit margins in this mature but vital business area.

In 2024, Adient's traditional seating component manufacturing segment continued to be a bedrock of its financial performance. This segment, characterized by its mature market position and consistent demand, generated significant operating cash flow, supporting investments in other business units. For instance, Adient reported that its seating components division consistently delivered strong EBITDA margins, often exceeding 10%, reflecting the efficiency and scale of its operations.

- Stable Demand: Essential seating components are required for every vehicle manufactured, creating a predictable and ongoing revenue base.

- Economies of Scale: Adient's vast global manufacturing presence allows for efficient, high-volume production, driving down per-unit costs.

- Profitability: The mature nature of this segment, combined with operational efficiencies, typically results in strong and consistent profit margins for Adient.

- Cash Generation: This segment acts as a primary generator of cash flow, which Adient can then reinvest in growth areas or return to shareholders.

Established Manufacturing Footprint and Supply Chain

Adient's extensive global manufacturing and assembly operations, spread across 29 countries, serve as a significant Cash Cow. This vast network, a cornerstone of their business, allows for highly efficient production and timely delivery of automotive seating solutions worldwide. In fiscal year 2023, Adient reported net sales of $13.7 billion, underscoring the scale of their operations and their ability to generate substantial revenue from these established facilities.

This robust operational footprint is crucial for cost optimization and ensuring a dependable supply chain for their automotive customers. The company's ability to manage this complex network effectively minimizes production disruptions, directly contributing to consistent cash flow generation through high-volume output.

- Global Reach: Operates manufacturing and assembly plants in 29 countries.

- Efficiency Driver: Enables optimized production costs and reliable customer supply.

- Supply Chain Resilience: Minimizes disruptions, supporting consistent cash generation.

- Revenue Generation: Contributes significantly to Adient's overall financial performance, with $13.7 billion in net sales reported for FY2023.

Adient's core automotive seating business, particularly its complete seating systems for high-volume vehicles, functions as a robust Cash Cow. This segment benefits from the mature automotive market and Adient's significant market share, ensuring consistent demand and predictable revenue streams. In fiscal year 2023, Adient's seating segment was a primary driver of its $13.5 billion in net sales, demonstrating its foundational role in cash generation.

These established product lines, requiring less investment in innovation and marketing compared to newer technologies, yield strong profit margins. The stable demand for essential seating components, which are integral to every vehicle, further solidifies this segment's Cash Cow status. For instance, Adient's consistent EBITDA margins, often exceeding 10% in its components division in 2024, highlight the profitability of these mature operations.

Adient's global manufacturing footprint, spanning 29 countries, supports efficient, large-scale production of these core seating systems. This operational scale drives down costs and ensures a reliable supply chain, directly contributing to the segment's ability to generate substantial and consistent cash flow. The company's deep relationships with major OEMs, with its top five customers accounting for approximately 47% of net sales in FY2023, further reinforce this predictable revenue generation.

| Metric | FY2023 Value | Significance for Cash Cow |

| Net Sales | $13.5 billion | Demonstrates scale and revenue generation from core business. |

| Top 5 Customer Sales % | 47% | Indicates strong, predictable demand from key OEM partners. |

| EBITDA Margins (Components) | >10% (reported for 2024) | Highlights profitability and operational efficiency of mature segments. |

| Global Manufacturing Sites | Over 200 (in 29 countries) | Enables economies of scale and cost-effective production. |

Delivered as Shown

Adient BCG Matrix

The Adient BCG Matrix preview you're examining is the identical, fully completed report you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no hidden surprises – just a professionally designed, analysis-ready document ready for your strategic application. You can confidently use this preview to assess the comprehensive insights and actionable strategies contained within the Adient BCG Matrix, knowing the final version will be exactly as presented. This ensures you're investing in a tangible, high-quality strategic tool that’s prepared for immediate integration into your business planning and decision-making processes.

Dogs

Legacy Metal Seating Programs are categorized as Dogs within Adient's BCG Matrix. Adient's strategic plan to phase out most of these programs by fiscal year 2027 highlights their position in declining or low-growth market segments, offering minimal future profit potential.

Adient's European operations are currently positioned as a Dog in the BCG Matrix. This segment has been grappling with a downturn in volumes and an increase in customers bringing production in-house, which directly impacts Adient's business.

Furthermore, the mix of customer programs in Europe has not been favorable, leading to reduced profitability. These headwinds have resulted in a net loss for the region and a decrease in overall sales for Adient.

Despite significant restructuring initiatives aimed at improving performance, the European segment continues to consume resources without yielding substantial returns. This situation is characteristic of a Dog in a low-growth market, highlighting the need for strategic evaluation.

Certain traditional internal combustion engine (ICE) vehicle programs at Adient, despite serving major original equipment manufacturers (OEMs), are positioned as Dogs in the BCG matrix. These programs are characterized by declining production volumes and a less favorable customer mix, directly impacted by the broader industry shift towards electric vehicles and general softness in vehicle production. For instance, in 2024, the global automotive production forecast saw continued pressure on traditional ICE segments, with some legacy models experiencing year-over-year declines exceeding 10% in key markets.

These ICE programs can become cash traps for Adient, generating minimal cash flow or even consuming resources. The decreasing relevance of these older platforms, coupled with potentially high associated costs for tooling, maintenance, and specialized labor relative to their diminishing revenue streams, makes them unattractive. This situation is exacerbated by the increasing investment required to support a diverse product portfolio while simultaneously pivoting towards EV-focused technologies.

High-Cost, Low-Efficiency Manufacturing Sites

High-cost, low-efficiency manufacturing sites within Adient, particularly those in regions experiencing economic challenges, would fall into this category. These operations likely drag down overall profitability by increasing production expenses without a commensurate output. Adient's focus on operational excellence, including its continuous improvement initiatives, aims to identify and rectify such inefficiencies.

For instance, if a specific plant in a high-cost labor market or one with outdated machinery consistently underperforms on key efficiency metrics, it would be flagged. Such underperforming sites directly erode gross profit margins, making them candidates for strategic review, including potential restructuring, investment in modernization, or even divestiture.

- Negative Margin Impact: Sites with high operational costs and low output directly reduce Adient's gross profit margins.

- Restructuring/Divestiture Need: Persistent inefficiency at these locations necessitates significant strategic intervention.

- Continuous Improvement Focus: Adient's ongoing efforts are designed to identify and eliminate these costly, inefficient operations.

Non-Strategic or Outdated Component Offerings

Non-strategic or outdated component offerings within Adient's portfolio, particularly those not aligning with the automotive industry's shift towards lightweighting, smart features, and sustainability, would be classified as Dogs in the BCG matrix. These might include legacy seating components or technologies that have seen declining demand and hold minimal market share in niche, stagnant segments.

Such offerings often face significant price pressure from competitors and require substantial investment to modernize, making their future growth prospects dim. For instance, Adient's strategic emphasis on advanced seating solutions for electric vehicles (EVs) and connected car technologies suggests a deliberate divestment or phasing out of older product lines that do not contribute to these forward-looking trends. In 2023, Adient reported a focus on its seating systems for SUVs and trucks, indicating a strategic reallocation of resources away from segments less aligned with current market demand.

- Outdated Technologies: Components lacking integration capabilities for advanced driver-assistance systems (ADAS) or infotainment.

- Low Growth Segments: Seating solutions for vehicle types experiencing declining sales, such as certain compact car segments.

- Intense Price Competition: Basic seating components facing commoditization and aggressive pricing from low-cost manufacturers.

- Lack of Differentiation: Offerings that do not incorporate innovative materials or ergonomic advancements crucial for modern vehicle interiors.

Legacy metal seating programs at Adient are considered Dogs. These are older product lines in markets with little to no growth, offering minimal future profit. Adient plans to phase out many of these by fiscal year 2027, reflecting their low strategic value and resource drain.

Adient's European operations are currently a Dog. This segment faces declining sales volumes and increased customer insourcing, impacting profitability. Despite restructuring, the region struggles to generate significant returns, consuming resources without substantial gains.

Certain traditional internal combustion engine (ICE) vehicle programs are also Dogs. These legacy models are experiencing reduced production volumes, especially as the industry shifts to electric vehicles. For example, in 2024, global automotive production forecasts showed continued pressure on ICE segments, with some legacy models seeing over 10% year-over-year declines in key markets.

These ICE programs can be cash traps, consuming resources without generating significant cash flow. Their diminishing relevance, coupled with high associated costs for tooling and labor compared to their revenue, makes them unattractive. This is compounded by the need to invest in EV technologies while supporting these older platforms.

High-cost, low-efficiency manufacturing sites are also classified as Dogs. These operations increase production expenses without a proportional output, directly impacting profitability. Adient's continuous improvement initiatives aim to identify and address such inefficiencies, which can erode gross profit margins and necessitate strategic review, including potential divestiture.

Question Marks

Adient is actively innovating safety solutions for the unique seating arrangements required in autonomous vehicles, even showcasing concepts like their Autonomous Elegance seat. This forward-thinking approach positions them to capture a share of a rapidly expanding market.

The autonomous vehicle sector is poised for substantial growth, with projections indicating millions of such vehicles on roadways by 2025. Despite this promising outlook, Adient's current market penetration in this emerging, specialized area is likely modest, classifying it as a Question Mark.

Significant investment will be crucial for Adient to solidify its position and capitalize on the future potential within the autonomous vehicle seating segment. This strategic focus is essential for transforming this Question Mark into a future market leader.

Adient's new mechanical massage seating solution, a novel offering in the premium comfort segment, is currently positioned as a Question Mark in the BCG matrix. While it has seen a strong debut in China, with initial adoption in select models, its overall market share remains modest due to its recent introduction.

This innovative product targets a high-growth market, and its potential to transition into a Star is significant. Industry analysts project the premium automotive seating market to grow at a CAGR of 5.8% through 2028, reaching an estimated $25.5 billion. Heavy investment in marketing and expanding its availability across more mid- to high-end vehicle platforms will be crucial for increasing its market penetration and future success.

Adient's decision to invest in a new facility in Normal, Illinois, specifically to support Rivian's R2 SUV production, positions them within a burgeoning electric vehicle (EV) market. This strategic move targets a segment experiencing substantial growth, reflecting Adient's ambition to capture future demand.

While the potential for this partnership is considerable, Adient's current market share derived from this specific new venture is minimal. This classification as a Question Mark in the BCG matrix highlights its high growth potential, contingent on the successful scaling of Rivian's R2 production, which is projected to reach tens of thousands of units annually by 2026.

Advanced Sustainable Seating Materials

Adient's commitment to sustainability is evident in its development of advanced seating materials, such as green steel and recyclable polyester utilized in their Pure Essential seat. This focus aligns with a significant market trend towards eco-friendly automotive components, fueled by both manufacturer mandates and growing consumer demand for greener vehicles.

The market for these specific advanced sustainable materials, while experiencing high growth, still represents a relatively small portion of Adient's overall offerings. This indicates a need for continued market penetration and strategic investment to fully capitalize on this burgeoning sector.

- Market Growth: The global automotive lightweight materials market, which includes sustainable options, was valued at approximately $20 billion in 2023 and is projected to reach over $35 billion by 2030, demonstrating a strong compound annual growth rate (CAGR) of over 8%.

- Adient's Innovation: Adient's Pure Essential seat, incorporating materials like recyclable polyester, exemplifies their proactive approach to meeting evolving industry standards.

- Market Share Potential: While precise figures for advanced sustainable seating materials as a distinct market segment are still emerging, their share is expected to grow substantially as automakers prioritize ESG (Environmental, Social, and Governance) goals.

- Investment Focus: Continued investment in R&D and production capacity for these materials will be crucial for Adient to maintain its leadership position and capture a larger share of this high-growth segment.

Expansion into New Emerging Markets

Adient's strategy involves expanding into new emerging markets, like Southeast Asia, to capitalize on growing automotive sectors. This aligns with the 'Question Marks' quadrant of the BCG matrix, signifying high market growth potential but currently low market share for Adient in these regions.

These markets offer substantial opportunities driven by rising vehicle production and favorable economic trends. For instance, the Association of Southeast Asian Nations (ASEAN) automotive market is projected to see significant growth, with vehicle sales expected to increase steadily in the coming years, creating fertile ground for Adient's expansion efforts.

- High Growth Potential: Emerging markets in Southeast Asia exhibit robust economic development and increasing consumer demand for vehicles, indicating a strong growth trajectory for the automotive industry.

- Low Market Share: Adient currently holds a relatively small market share in these nascent territories, necessitating strategic investments to build brand presence and capture market share.

- Strategic Investment Required: To succeed, Adient must allocate resources for market penetration, product development tailored to local needs, and establishing strong distribution networks.

- Future Potential: Successful expansion into these 'Question Marks' could transform them into future 'Stars' for Adient, contributing significantly to overall revenue and profitability.

Adient's focus on advanced seating for autonomous vehicles, like their Autonomous Elegance concept, addresses a high-growth sector with significant future potential. While the market for autonomous vehicle seating is projected to expand rapidly, Adient's current market share in this nascent area is likely modest, classifying it as a Question Mark. Substantial investment will be necessary to solidify their position and transform this into a leading segment.

The company's new mechanical massage seating solution, which debuted strongly in China, also falls into the Question Mark category. This innovative product targets the premium automotive seating market, which is expected to grow at a CAGR of 5.8% through 2028, reaching $25.5 billion. Increased marketing and broader availability are key to boosting its market penetration.

Adient's new facility for Rivian's R2 SUV production places them in the high-growth electric vehicle market. Although the potential is considerable, their current market share from this specific venture is minimal, marking it as a Question Mark. Success hinges on Rivian scaling R2 production, which is anticipated to reach tens of thousands of units annually by 2026.

The company's development of sustainable seating materials, such as those in the Pure Essential seat, aligns with the growing demand for eco-friendly automotive components. The market for these materials, while growing at over 8% CAGR (projected to exceed $35 billion by 2030), still represents a smaller portion of Adient's overall offerings, requiring further investment for market capture.

Expansion into emerging markets like Southeast Asia also positions Adient as a Question Mark. These regions offer substantial automotive sector growth, with increasing vehicle production and consumer demand. Adient's current market share in these territories is low, necessitating strategic investment to build brand presence and secure a stronger foothold.

| Area of Focus | Market Growth Potential | Current Market Share | BCG Classification | Strategic Imperative |

| Autonomous Vehicle Seating | Very High | Low | Question Mark | Significant Investment for Market Penetration |

| Premium Massage Seating | High (5.8% CAGR projected) | Low | Question Mark | Expand Distribution and Marketing |

| EV Seating (Rivian R2) | Very High | Minimal | Question Mark | Support Production Scaling, Secure Future Orders |

| Sustainable Materials | High (8%+ CAGR projected) | Modest | Question Mark | Increase R&D and Production Capacity |

| Emerging Markets (e.g., SE Asia) | High | Low | Question Mark | Invest in Market Entry and Localization |

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary market research, financial statements, and industry growth forecasts to provide a comprehensive view of Adient's product portfolio.