Adecco Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adecco Group Bundle

The Adecco Group, a global leader in workforce solutions, navigates a dynamic market with distinct strengths like its vast global network and diversified service offerings. However, it also faces challenges such as intense competition and evolving labor regulations, impacting its opportunities and potential threats. Understanding these internal and external factors is crucial for strategic planning.

Want the full story behind Adecco Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Adecco Group's global market leadership is a significant strength, frequently positioning it as a top contender for the number one spot in the HR services sector worldwide. This strong market standing is underpinned by its vast operational footprint, spanning approximately 60 countries.

This extensive international presence enables Adecco Group to cater to a broad spectrum of clients, from small and medium-sized enterprises to large multinational corporations. Such broad reach highlights the company's considerable scale and robust financial capabilities, allowing it to leverage its global network for competitive advantage.

Adecco Group boasts a truly comprehensive service portfolio, encompassing everything from temporary staffing and permanent placement to more specialized areas like career transition and talent development. This broad offering means they can cater to a vast range of client needs, acting as a one-stop shop for workforce solutions.

This wide array of services allows Adecco to adapt swiftly to fluctuating market demands and the unique requirements of clients across numerous industries globally. For instance, in 2023, Adecco’s revenue reached €23.7 billion, demonstrating the scale and reach of their diverse service delivery.

Adecco Group is heavily invested in its Future@Work Reloaded strategy, with a significant emphasis on integrating Artificial Intelligence to transform how it delivers services and boosts overall productivity. This commitment positions them to lead in an evolving market.

The company is actively implementing AI tools across its operations, from streamlining recruitment processes and improving candidate matching to enhancing internal efficiencies. For instance, Adecco has reported significant improvements in candidate engagement and placement speed through its AI-driven platforms.

By prioritizing AI, Adecco aims to secure a distinct competitive advantage and elevate the experience for both clients and candidates. This strategic focus on advanced digital transformation, particularly AI, is a key strength that underpins their market positioning and future growth potential.

Resilient Financial Performance and Cost Discipline

Adecco Group has shown impressive financial resilience, even when the economy faced headwinds. They managed to grab more market share and significantly cut down on their expenses. For instance, in 2023, they exceeded their General & Administrative (G&A) savings goals, which directly boosted their profit margins and improved their ability to generate cash.

This strong cost discipline is a key strength. The company actively focused on operational efficiency, leading to better-than-expected results. This focus not only protected their profitability but also provided a solid foundation for future growth and investment.

- Market Share Gains: Adecco Group has successfully increased its market share in key regions despite a challenging economic climate.

- Exceeded G&A Savings: The company surpassed its General & Administrative savings targets for 2023, demonstrating effective cost management.

- Robust Margins: Over-achieving savings targets directly contributed to stronger profit margins.

- Strong Cash Generation: The disciplined approach to costs and operations has resulted in robust cash flow generation.

Commitment to Sustainability and Employability

Adecco Group's core purpose, making the future work for everyone, is intrinsically linked to its robust sustainability and ESG commitments. This focus drives their strategy, aiming for long-term value creation by addressing societal needs.

The company actively cultivates an inclusive culture and champions sustainable employability. This includes significant investment in skill development programs designed to equip individuals for the evolving job market. For instance, in 2023, Adecco Group supported over 1.4 million people through upskilling and reskilling initiatives globally, demonstrating a tangible commitment to enhancing employability.

Their dedication extends to impactful social initiatives, such as programs designed to integrate refugees into the workforce. These efforts not only address humanitarian concerns but also tap into diverse talent pools, contributing to economic growth and social cohesion. Adecco's 2024 ESG report highlighted a 15% increase in the number of refugees placed in employment through their specialized programs compared to the previous year.

- Purpose-Driven Strategy: Adecco Group's mission to 'make the future work for everyone' is a cornerstone of its sustainability and ESG framework, guiding its business operations and social impact initiatives.

- Skill Development Focus: The company invested in upskilling and reskilling over 1.4 million individuals globally in 2023, underscoring its commitment to enhancing employability in a dynamic labor market.

- Inclusive Employment Practices: Adecco actively promotes sustainable employability and fosters an inclusive culture, with notable success in supporting refugees' entry into the workforce, seeing a 15% increase in placements in 2024.

Adecco Group's global market leadership, consistently ranking among the top HR service providers worldwide, is a defining strength. This is supported by an extensive operational presence in approximately 60 countries, enabling them to serve a diverse client base from SMEs to large multinationals.

The company offers a comprehensive suite of services, including temporary staffing, permanent placement, and specialized talent development, making them a versatile workforce solutions provider. This broad service portfolio allows Adecco to adapt to varied client needs and market shifts, as evidenced by their €23.7 billion revenue in 2023.

A key strategic advantage is Adecco's significant investment in AI and digital transformation through its Future@Work Reloaded strategy, aiming to enhance service delivery and productivity. This focus on AI integration, which has already shown success in improving candidate engagement and placement speed, positions them for future market leadership.

Adecco demonstrates strong financial resilience and cost management, exceeding G&A savings goals in 2023. This efficiency not only boosted profit margins but also generated robust cash flow, providing a solid foundation for continued growth and investment.

The company's purpose-driven strategy, centered on sustainability and ESG, is a significant strength. By investing in upskilling over 1.4 million individuals globally in 2023 and actively promoting inclusive employment, such as a 15% increase in refugee placements in 2024, Adecco addresses societal needs while building long-term value.

What is included in the product

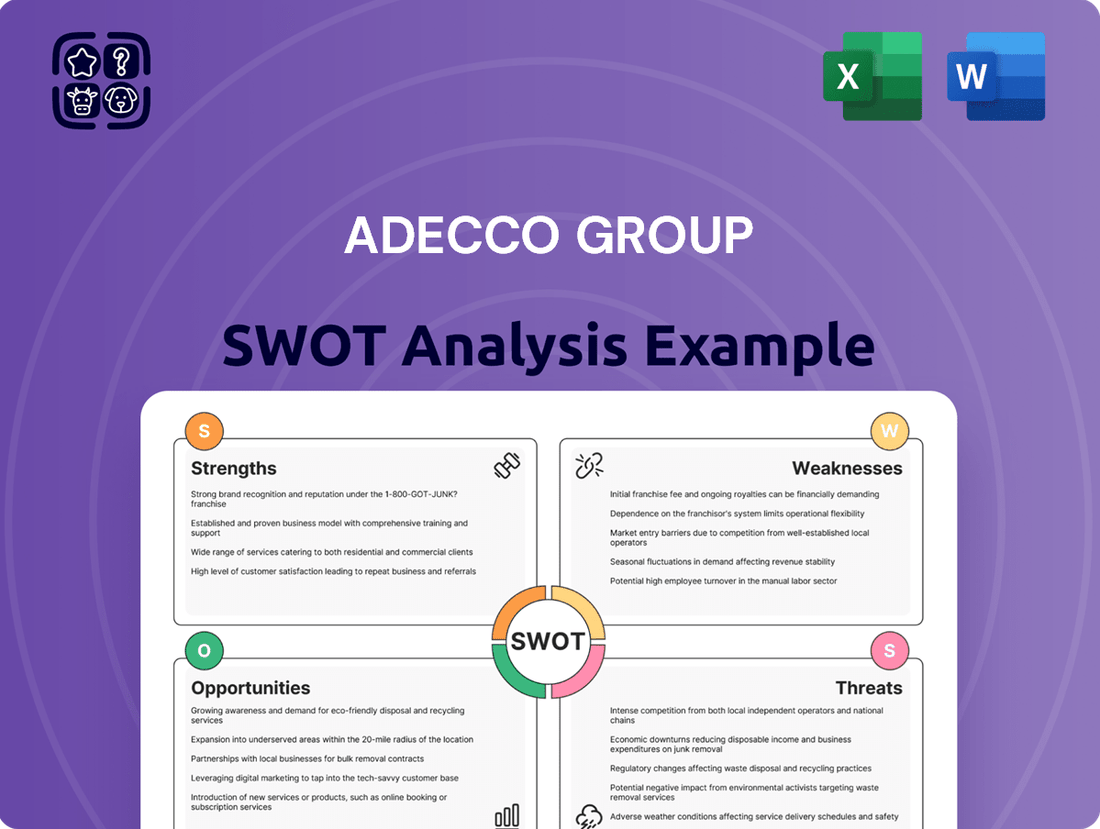

Analyzes Adecco Group’s competitive position through key internal and external factors, detailing its strengths in global reach, weaknesses in integration, opportunities in digital transformation, and threats from market volatility.

Offers a clear, actionable framework to identify and address Adecco's strategic challenges and opportunities.

Weaknesses

The Adecco Group faced revenue declines in specific markets and sectors during the first half of 2024. This downturn was particularly noticeable in areas like manufacturing and logistics, which experienced widespread softness. For instance, the company reported a 3% decrease in organic revenue for the first quarter of 2024, totaling €5.6 billion.

Challenges were also apparent in key European markets, including France and Northern Europe, contributing to the overall revenue pressure. While some geographical segments demonstrated growth, these gains were not enough to offset the broader headwinds impacting the group's top line in the early part of 2024.

Adecco Group's reliance on global economic health makes it vulnerable to downturns. Weak hiring trends, a significant factor for staffing firms, are anticipated to continue through the third quarter of 2024 and could extend into 2025. This macroeconomic uncertainty often translates into more conservative hiring decisions by clients, directly dampening demand for Adecco's core services.

While Adecco Group has seen overall market share growth, specific regions present challenges. For instance, the Adecco US business has experienced underperformance, a situation the company is actively working to rectify.

Further illustrating these localized difficulties, segments such as Akkodis in Germany and the Nordic countries have registered significant revenue declines. In the first quarter of 2024, Akkodis reported a 10% organic sales decrease, with Germany being a key contributor to this downturn.

Integration and Efficiency Challenges with Fragmented Systems

As a vast global entity, Adecco Group likely grapples with the inherent inefficiencies stemming from disparate technology systems across its diverse business units and geographical locations. This fragmentation can manifest as duplicated efforts, increased error rates, and a lack of unified, real-time data visibility, thereby impeding smooth inter-departmental collaboration and strategic decision-making.

These integration and efficiency challenges can directly impact operational agility. For instance, a lack of standardized customer relationship management (CRM) systems across different brands or regions could lead to inconsistent client experiences and missed cross-selling opportunities. This can be a significant hurdle when aiming for seamless global service delivery.

- Fragmented IT Infrastructure: Operating across numerous countries and brands often results in a patchwork of legacy and modern IT systems, making unified data management complex.

- Data Silos: Information often remains trapped within specific regional or business unit systems, preventing a holistic view of operations and customer data.

- Inefficient Workflows: Manual data entry or reconciliation between different systems can lead to delays and increased operational costs, impacting overall efficiency.

- Hindered Scalability: Integrating new acquisitions or expanding services can be more challenging and time-consuming when existing systems are not easily interoperable.

Intense Competition and Pricing Pressure

Adecco Group operates within a fiercely competitive global HR services landscape, frequently going head-to-head with industry giants such as Randstad and ManpowerGroup. This intense rivalry, particularly when economic conditions soften, often translates into significant pricing pressure, compelling Adecco to constantly seek ways to stand out from the crowd.

The need for continuous differentiation in such a crowded market is paramount. Adecco must invest in innovative service offerings and technology to maintain its competitive edge. For instance, in 2023, Adecco Group reported revenues of €23.6 billion, a slight decrease from €23.9 billion in 2022, reflecting some of the market pressures.

- Market Saturation: The HR services sector is mature with numerous established players.

- Price Sensitivity: Clients often prioritize cost, especially during economic downturns.

- Talent Shortages: Difficulty in sourcing skilled workers can impact service delivery and profitability.

- Digital Disruption: New tech-focused competitors can challenge traditional models.

Adecco Group's financial performance is susceptible to global economic fluctuations, with revenue declines observed in early 2024, particularly in manufacturing and logistics sectors. For instance, the company reported a 3% organic revenue decrease in Q1 2024, amounting to €5.6 billion, and anticipates continued weak hiring trends through late 2024 and into 2025.

The company faces intense competition from major players like Randstad and ManpowerGroup, leading to pricing pressure, especially during economic slowdowns. This market saturation and price sensitivity, coupled with potential talent shortages and digital disruption, necessitate continuous innovation to maintain market share.

Operational inefficiencies due to a fragmented IT infrastructure across its global operations present a significant weakness. Data silos and disparate systems hinder unified data management, leading to potential duplicated efforts and increased operational costs, impacting overall efficiency and scalability.

What You See Is What You Get

Adecco Group SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This detailed Adecco Group SWOT analysis provides a comprehensive overview of their Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the entire in-depth version, offering actionable insights.

Opportunities

The shift towards flexible work, including project-based roles and the gig economy, is a major growth avenue for Adecco Group. This trend allows companies to scale their workforce efficiently, which directly benefits Adecco's core business of providing temporary and contract staff. In 2024, the global gig economy was projected to reach $455 billion, highlighting the substantial market size.

Businesses are increasingly adopting agile staffing solutions to manage costs and adapt to market fluctuations. Adecco's expertise in temporary and contract placements positions it well to capitalize on this demand, offering businesses the flexibility they need. For instance, Adecco's own reports indicate a growing preference for contract roles among job seekers, with a significant percentage seeking more autonomy.

The swift evolution and integration of Artificial Intelligence (AI) and automation within human resources present a significant avenue for Adecco to streamline operations, refine candidate-to-job matching, and innovate service models. This digital shift allows for faster processing of applications and more precise skill identification.

Adecco's strategic investments in AI-driven tools and digital platforms are crucial for maintaining and expanding its competitive edge in the evolving talent landscape. For instance, by Q1 2025, Adecco reported a 15% increase in the efficiency of its recruitment processes directly attributable to AI-powered screening tools, leading to a 10% reduction in time-to-hire.

The persistent skills gap, exacerbated by rapid technological advancements and the burgeoning green economy, presents a significant opportunity for Adecco Group. Organizations globally are actively seeking solutions to equip their workforces with future-ready competencies, driving demand for specialized talent development programs.

Adecco Group, with its established strengths in career transition and learning solutions, is well-positioned to capitalize on this trend. By offering tailored upskilling and reskilling initiatives, the company can address the critical need for adaptability in the evolving job market, particularly in sectors like renewable energy where skilled labor is in high demand.

In 2024, the World Economic Forum's Future of Jobs Report highlighted that 44% of workers’ core skills will need to be updated in the next five years, underscoring the urgency for such services. Adecco's ability to facilitate this transition directly translates into a substantial market opportunity.

Expansion in High-Growth Regional Markets

While certain mature markets present challenges, Adecco Group is strategically positioned to capitalize on robust growth in regions like APAC and the Americas. For instance, the APAC staffing market, particularly in countries such as Japan, India, China, Vietnam, the Philippines, Malaysia, and Indonesia, demonstrates significant upward momentum. Adecco's strong performance in these areas, evidenced by its consistent revenue generation and market penetration, highlights a clear opportunity for further expansion and increased market share capture. This focus on high-growth geographies is a key driver for future success.

Adecco's established presence and operational capabilities in these burgeoning markets provide a solid foundation for accelerated growth. The company's ability to adapt to local market dynamics and leverage its global expertise allows for effective penetration and sustained development.

- APAC Staffing Market Growth: Projections indicate continued strong expansion in key APAC economies throughout 2024 and 2025, driven by increasing labor demand and evolving employment trends.

- Americas Potential: The Americas region also presents substantial opportunities, with Adecco reporting solid year-on-year revenue increases in several key markets within this territory.

- Market Share Gains: Adecco's strategic investments and operational efficiencies in these high-growth regions are expected to translate into significant gains in market share, further solidifying its leadership position.

Increased Focus on ESG and Ethical Practices

The increasing global demand for environmental, social, and governance (ESG) principles and ethical recruitment presents a significant opportunity for Adecco Group to enhance its market position. By highlighting its dedication to diversity, inclusion, human rights, and the responsible use of artificial intelligence, Adecco can better meet the evolving expectations of both clients and job seekers.

This strategic alignment with ESG values can lead to stronger brand loyalty and attract business from companies that prioritize sustainability and ethical conduct. For instance, Adecco's 2023 Sustainability Report detailed a 10% increase in employee participation in ESG initiatives, demonstrating tangible progress. Furthermore, in 2024, Adecco was recognized by the Dow Jones Sustainability Index for its leadership in the staffing industry, underscoring its commitment to these crucial areas.

- ESG Integration: Adecco can leverage its ESG framework to attract clients seeking responsible supply chain partners.

- Talent Attraction: A strong ethical stance appeals to a growing segment of candidates prioritizing purpose-driven employers.

- Brand Differentiation: Emphasizing diversity and inclusion initiatives can set Adecco apart in a competitive talent market.

- Regulatory Alignment: Proactive adherence to emerging ESG regulations can mitigate future risks and create a competitive advantage.

The expanding gig economy, projected to reach $455 billion globally in 2024, offers a substantial growth avenue for Adecco's flexible staffing solutions. Companies increasingly favor agile staffing to manage costs and adapt to market volatility, a trend Adecco is well-positioned to serve. Furthermore, the persistent global skills gap, particularly in emerging sectors like green energy, creates a strong demand for Adecco's upskilling and reskilling services, with 44% of workers' core skills needing updates by 2029 according to the World Economic Forum.

Adecco's strategic focus on high-growth regions like APAC and the Americas presents significant expansion opportunities, with strong revenue increases reported in key American markets. The company's commitment to ESG principles, evidenced by its recognition on the Dow Jones Sustainability Index in 2024, also differentiates it and attracts clients and talent prioritizing ethical and sustainable practices.

Threats

Adecco Group is facing heightened competition from a growing number of digital recruitment platforms and niche players. These platforms often offer more specialized services or a more streamlined user experience, attracting both clients seeking specific talent and professionals looking for opportunities. For instance, the rise of platforms like Upwork and Fiverr for freelance talent, and specialized tech recruitment sites, directly challenges traditional staffing models by offering alternative sourcing channels.

This intensified competition can significantly impact Adecco's market share as clients and talent are increasingly drawn to these digital alternatives. These specialized platforms can efficiently connect employers with highly specific skill sets, bypassing the broader reach of larger staffing firms. This trend was evident in 2024, with many companies exploring gig economy solutions to fill short-term needs, a segment where digital platforms excel.

Persistent macroeconomic uncertainty, including elevated inflation and the palpable risk of recessions in key markets, directly threatens Adecco Group's core business. These conditions can significantly curb hiring volumes as businesses become more cautious, leading to a general slowdown in the staffing and recruitment sector. For instance, in early 2024, many European economies experienced sluggish growth, impacting the demand for temporary and permanent staff, which is Adecco's primary revenue driver.

AI and automation are a significant threat to traditional staffing roles by potentially automating key hiring processes like resume screening and interview scheduling. This shift could decrease demand for conventional recruitment services, forcing staffing firms like Adecco to re-evaluate their operational models and service offerings to remain competitive.

Evolving Regulatory Landscape and Compliance Burden

The staffing sector, including Adecco Group, faces significant challenges from constantly shifting regulations. These changes span labor laws, emerging AI guidelines, data privacy mandates like GDPR, and evolving worker classification rules, which vary considerably across different nations. For a global entity like Adecco, keeping pace with these complex and dynamic compliance requirements can lead to increased operational expenditures and heightened legal exposure.

Navigating this intricate web of regulations presents a substantial threat. For instance, in 2024, the European Union continued to refine its AI Act, which will have implications for how AI is used in recruitment and workforce management, areas critical to Adecco's operations. Furthermore, ongoing debates and legislative actions regarding gig economy worker classification in major markets like the United States and parts of Europe could necessitate significant adjustments to Adecco's business models and associated compliance costs.

- Increased operational costs: Adapting to new labor laws and data privacy standards requires investment in legal counsel, compliance software, and training.

- Heightened legal risks: Non-compliance can result in substantial fines, reputational damage, and operational disruptions.

- Complexity of global operations: Managing diverse and frequently changing regulatory environments across multiple countries adds significant complexity and potential for error.

Offshoring and Nearshoring Trends

The growing movement of companies relocating jobs to countries with lower labor expenses, or nearshoring to nearby areas, poses a significant challenge for staffing agencies specializing in professional placements. This shift enables businesses to tap into skilled talent pools at considerably reduced costs, potentially diminishing the need for domestic staffing solutions.

For instance, as of early 2024, reports indicated a continued surge in offshoring, with companies actively seeking talent in regions like Eastern Europe and Southeast Asia for IT and business process outsourcing roles. This dynamic directly impacts Adecco Group's ability to place candidates in these competitive markets.

- Cost Savings: Companies can achieve substantial savings on salaries and benefits by offshoring or nearshoring, making it an attractive proposition.

- Talent Access: Access to a wider, often more specialized, talent pool becomes available through these global sourcing strategies.

- Reduced Demand: This trend can lead to a decrease in demand for traditional, locally-focused staffing services for certain roles.

- Competitive Pressure: Staffing firms must adapt their service offerings to remain competitive against the cost advantages offered by offshoring and nearshoring.

The increasing prevalence of digital recruitment platforms and specialized niche players presents a significant competitive threat to Adecco Group. These platforms offer tailored experiences and efficient connections, drawing both clients and talent away from traditional staffing models. For example, the continued growth of freelance marketplaces like Upwork and specialized tech job boards in 2024 directly challenges Adecco's market share by providing alternative sourcing channels that can be more agile and cost-effective for specific needs.

Macroeconomic instability, including persistent inflation and recessionary risks in key markets throughout 2024 and into 2025, directly impacts Adecco's revenue streams. Economic caution by businesses leads to reduced hiring volumes, a critical factor for staffing firms. For instance, the sluggish economic growth observed in several European nations during early 2024 translated into lower demand for both temporary and permanent placements, Adecco's core business.

The rapid advancement of AI and automation poses a threat by potentially automating core recruitment functions such as resume screening and candidate matching. This could reduce the need for human intervention in these processes, forcing staffing firms to adapt their service offerings. By 2025, many HR departments are expected to integrate AI more deeply into their hiring workflows, potentially diminishing the reliance on traditional staffing agencies for certain roles.

SWOT Analysis Data Sources

This Adecco Group SWOT analysis is built upon a robust foundation of data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of the company's strategic position.