Adecco Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adecco Group Bundle

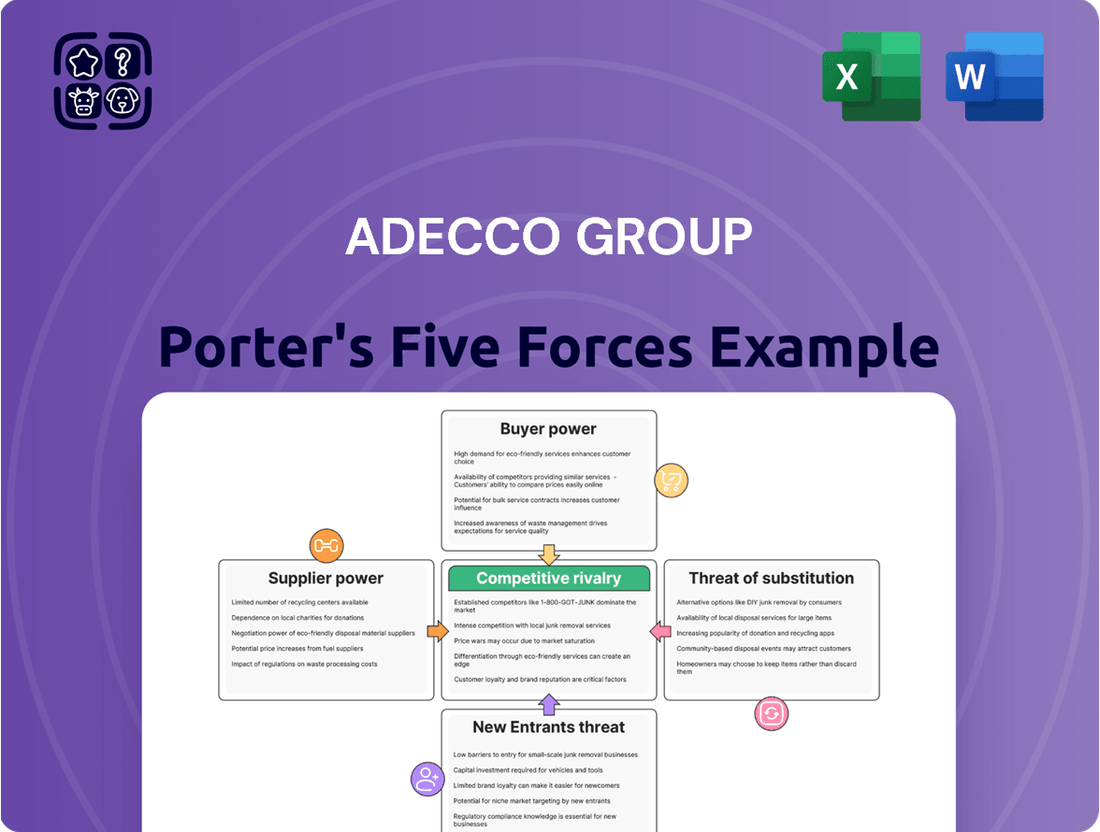

Understanding the Adecco Group's competitive landscape through Porter's Five Forces reveals a dynamic interplay of buyer power, supplier leverage, and the constant threat of new entrants. The intensity of rivalry within the staffing industry significantly shapes Adecco's strategic decisions.

The complete report reveals the real forces shaping Adecco Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Talent pool scarcity significantly bolsters the bargaining power of suppliers, particularly skilled professionals in high-demand fields. For Adecco, this means that when there aren't enough qualified individuals to go around, especially in areas like technology or specialized healthcare roles, those professionals can command higher wages and better benefits. This directly impacts Adecco's recruitment costs and its ability to efficiently meet client staffing needs.

For highly specialized roles within sectors like advanced technology or specialized engineering, the limited availability of qualified professionals grants these individuals significant bargaining power. This means Adecco Group, when sourcing talent for such niche positions, may encounter higher wage demands and increased competition from other firms seeking the same limited talent pool. For instance, in 2024, the demand for AI specialists continued to outstrip supply, with average salaries for experienced AI engineers in leading tech hubs exceeding $200,000 annually.

Adecco Group heavily depends on technology providers for its core operations, utilizing AI-driven recruitment tools and applicant tracking systems. The increasing reliance on these platforms for efficiency and a competitive edge means technology suppliers hold significant sway.

The bargaining power of these tech companies is on the rise. As AI becomes more integral to staffing success, Adecco's need for advanced solutions gives these providers more leverage. For instance, the global HR tech market was valued at approximately $25.5 billion in 2023 and is projected to grow substantially, indicating a robust and influential supplier base.

Regulatory and Compliance Expertise

Suppliers of specialized legal and compliance services, especially those adept at navigating complex and rapidly changing labor laws and AI regulations, wield considerable bargaining power over Adecco Group. Adecco's reliance on these experts to ensure adherence to a growing web of mandates makes their specialized knowledge a critical, and potentially expensive, necessity.

The ability of these suppliers to dictate terms is amplified by the increasing complexity of global employment regulations. For instance, in 2024, Adecco, like many staffing firms, faced heightened scrutiny regarding worker classification and data privacy, areas where specialized legal counsel is indispensable. This dependence allows these niche service providers to command premium pricing and favorable contract terms.

- Specialized Knowledge: Suppliers with deep expertise in labor law and AI compliance are essential for Adecco's operations.

- Regulatory Dependence: Adecco's need to comply with evolving regulations strengthens the suppliers' position.

- Cost Implications: The critical nature of this expertise can translate into higher service costs for Adecco.

Geographic Labor Market Dynamics

The bargaining power of labor suppliers, particularly in the context of staffing and workforce solutions like Adecco Group, is heavily influenced by geographic labor market dynamics. Regional variations in economic conditions and labor availability directly impact the cost and accessibility of talent.

For example, while some European labor markets may present ongoing challenges in terms of talent availability and associated costs, other regions are showing more favorable trends. Specifically, the Asia-Pacific (APAC) region and the United States are experiencing growth or recovery, which can translate to a more robust supply of qualified candidates for Adecco in those areas. This divergence means Adecco's operational costs and competitive positioning can differ significantly based on the specific labor markets they are serving.

- Regional Labor Supply Shifts: Adecco's operational costs are directly affected by the availability of skilled workers, which varies by geography.

- European Market Challenges: Certain European labor markets continue to exhibit tighter supply, potentially increasing labor costs for Adecco.

- APAC and US Recovery: Growth and recovery in APAC and the US are likely to improve talent availability, potentially moderating labor costs in these regions for Adecco.

The bargaining power of suppliers for Adecco Group is significantly influenced by the availability of specialized talent and critical technology. When skilled professionals are scarce, particularly in fields like AI and advanced engineering, their ability to demand higher wages and better benefits increases, directly impacting Adecco's recruitment costs. For instance, in 2024, experienced AI engineers in major tech hubs could command salaries exceeding $200,000 annually due to sustained demand outstripping supply.

Adecco's reliance on technology providers for AI-driven recruitment tools and applicant tracking systems also grants these suppliers considerable leverage. The expanding HR tech market, valued at approximately $25.5 billion in 2023, underscores the growing influence of these technology vendors. Furthermore, suppliers of specialized legal and compliance services, essential for navigating complex labor laws and AI regulations, hold substantial bargaining power. The increasing complexity of global employment mandates, such as worker classification and data privacy scrutiny faced by Adecco in 2024, makes these niche legal experts indispensable and allows them to dictate terms and pricing.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Adecco | Example Data/Trend |

|---|---|---|---|

| Skilled Professionals (e.g., AI Engineers) | Talent pool scarcity, high demand | Increased recruitment costs, wage pressure | 2024: AI engineer salaries >$200k in tech hubs |

| Technology Providers (HR Tech) | Reliance on AI/ATS, market growth | Leverage in pricing and contract terms | 2023 HR Tech Market: ~$25.5 billion |

| Legal & Compliance Services | Specialized knowledge, regulatory complexity | Higher service costs, dependence on expertise | 2024: Increased scrutiny on worker classification/data privacy |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Adecco Group's position in the global staffing and HR solutions market.

Gain immediate insight into competitive pressures with a dynamic, interactive dashboard that visualizes each of Porter's Five Forces, simplifying complex market dynamics for strategic planning.

Customers Bargaining Power

Large corporate clients, by placing substantial staffing orders, wield considerable influence over Adecco. Their ability to offer significant, recurring business allows them to demand and often secure more advantageous pricing structures and service level agreements, directly impacting Adecco's profitability on these accounts.

For instance, in 2024, major global corporations engaging Adecco for large-scale contingent workforce solutions can negotiate margins that are notably lower than those typically applied to smaller, less consistent clients. This volume-driven bargaining power is a critical factor in Adecco's pricing strategies.

Customer bargaining power is significantly influenced by industry-specific demand for staffing services. In robust sectors like retail and consulting, where demand for temporary and permanent staff remains consistently high, Adecco Group generally holds more leverage. This is because businesses in these fields are actively seeking talent to meet their operational needs.

However, this dynamic shifts when certain industries experience a slowdown. For instance, during periods of reduced hiring in sectors like technology, the bargaining power of customers in those specific niches increases. They might negotiate harder on rates or terms, knowing that staffing agencies like Adecco have a greater incentive to place candidates in a less active market.

Customers can significantly reduce their reliance on Adecco by developing or expanding their internal recruitment capabilities. This move directly enhances their bargaining power, particularly in securing permanent placements where the cost of in-house teams can be offset by long-term savings. For instance, a 2024 survey indicated that 35% of large enterprises were actively investing in building out their internal talent acquisition teams, a trend that directly pressures staffing agencies.

Economic Uncertainty and Cost Sensitivity

Economic uncertainty significantly amplifies customer bargaining power, especially for staffing firms like Adecco Group. During such times, clients scrutinize expenditures more closely, leading them to demand lower rates or reduce reliance on contingent labor altogether. For instance, in early 2024, many sectors experienced cautious spending due to persistent inflation and geopolitical instability, prompting businesses to renegotiate contracts and seek more favorable terms.

This heightened cost sensitivity means customers can more effectively leverage their purchasing decisions to drive down prices. They might explore alternative staffing solutions or internalize functions previously outsourced.

- Increased Demand for Value: Customers expect more for their money, pushing providers to offer bundled services or performance-based pricing.

- Negotiation Leverage: Economic downturns give buyers more leverage to negotiate lower fees for staffing services.

- Shift to Cost-Effective Solutions: Businesses may prioritize cost savings over premium services, impacting Adecco's pricing power.

- Reduced Spending on Contingent Workforce: Companies often cut back on temporary staff during uncertain economic periods to manage overheads.

Access to Digital Platforms and Gig Economy

The proliferation of digital recruitment platforms and the expanding gig economy significantly bolster the bargaining power of customers. These online marketplaces offer direct access to a vast pool of talent, bypassing traditional intermediaries like Adecco. This accessibility empowers businesses to source candidates more efficiently and often at a lower cost, directly impacting their reliance on staffing agencies.

For instance, in 2024, the global gig economy was projected to continue its robust growth, with reports suggesting a significant portion of the workforce engaging in freelance or contract work. This trend means companies have more readily available alternative talent channels. Adecco, therefore, faces increased pressure to demonstrate its value proposition beyond mere talent sourcing, focusing on specialized services, compliance, and strategic workforce solutions to retain its client base.

- Increased Choice: Digital platforms offer a wider array of candidates, reducing customer dependence on any single staffing agency.

- Cost Efficiency: Direct access to talent through online channels can often be more cost-effective for businesses.

- Flexibility: The gig economy provides on-demand talent, allowing companies to scale their workforce dynamically without long-term commitments to agencies.

- Market Transparency: Online platforms often provide greater transparency in pricing and candidate profiles, enabling better comparison and negotiation.

The bargaining power of Adecco's customers is substantial, driven by factors like client size, industry demand, and the availability of alternative talent sourcing channels. Large corporate clients, in particular, leverage their significant order volumes to negotiate more favorable pricing and service terms. For example, in 2024, major global clients engaging Adecco for large-scale staffing solutions could secure lower margins compared to smaller accounts, directly influencing Adecco's profitability on these contracts.

The increasing prevalence of digital recruitment platforms and the expanding gig economy further empowers customers by offering direct access to a broad talent pool, often at a lower cost. This trend means businesses can bypass traditional intermediaries, enhancing their negotiation leverage. A 2024 report indicated that 35% of large enterprises were investing in internal recruitment capabilities, a direct challenge to staffing agencies like Adecco.

| Factor | Impact on Adecco | 2024 Data/Trend |

|---|---|---|

| Client Size | High volume clients negotiate lower margins | Large clients secured notably lower margins in 2024 |

| Alternative Channels | Digital platforms and gig economy increase competition | Gig economy projected for robust growth in 2024 |

| Internal Recruitment | Companies building in-house teams reduce reliance on agencies | 35% of large enterprises investing in internal talent acquisition in 2024 |

| Economic Climate | Uncertainty leads to cost scrutiny and rate negotiation | Cautious spending in early 2024 due to inflation and instability |

Full Version Awaits

Adecco Group Porter's Five Forces Analysis

This preview showcases the comprehensive Adecco Group Porter's Five Forces Analysis, detailing competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, ready for your strategic review.

Rivalry Among Competitors

The HR solutions landscape is fiercely competitive, featuring a multitude of global giants and nimble regional specialists. Adecco Group navigates this crowded market, contending with significant rivalry from established staffing firms and niche agencies alike. This intense competition directly impacts pricing strategies and the ongoing battle for market share.

In 2024, the global HR services market was valued at approximately $680 billion, underscoring the sheer scale of competition. Adecco, as one of the top players, faces pressure from companies like Randstad and ManpowerGroup, who also command substantial portions of this market. Smaller, specialized firms, often focusing on specific industries or skill sets, further fragment the market, forcing Adecco to continually innovate and differentiate its offerings to maintain its competitive edge.

Competitive rivalry is intensifying as staffing firms, including Adecco, broaden their services beyond traditional placement. Many are now offering HR consulting, talent development programs, and digital recruitment solutions to capture a larger share of the workforce management market. This diversification means Adecco faces competition not only from other large staffing agencies but also from specialized HR consultancies and technology providers.

To stay ahead, Adecco needs to continuously innovate and expand its service portfolio. For instance, in 2023, Adecco Group reported revenue growth in areas beyond traditional staffing, indicating a strategic shift. The Group's focus on digital transformation and integrated HR solutions is crucial for maintaining its competitive edge against rivals who are also investing heavily in these expanding service areas.

The recruitment industry is seeing a fierce race to integrate AI and automation. Companies that master AI for quicker, more precise, and fairer candidate matching are pulling ahead, intensifying the technological competition.

Pricing Pressure and Margin Compression

The staffing industry is intensely competitive, frequently forcing companies like Adecco Group to engage in price wars to secure business. This constant pressure on pricing directly impacts profitability, leading to margin compression.

For Adecco, this means maintaining rigorous cost control and operational efficiency is paramount to safeguard its bottom line. The ability to deliver services at a competitive price point while still achieving healthy margins is a key differentiator.

- Intense Competition: The global staffing market is fragmented with numerous players, intensifying rivalry.

- Pricing Pressure: Competitors often undercut each other on fees, forcing Adecco to match prices to remain competitive.

- Margin Compression: This aggressive pricing strategy directly squeezes profit margins for all industry participants.

Talent Acquisition and Retention Strategies

For staffing firms like Adecco Group, the intense competition for talent directly fuels rivalry. Attracting and keeping skilled recruiters and, by extension, the candidates they place, is paramount. This means offering compelling packages that go beyond just salary.

The battle for top performers involves providing competitive compensation, comprehensive benefits, and clear pathways for career advancement. This is true for both the internal staff who drive the business and the external candidates they are tasked with finding for their clients. By July 2025, Adecco Group's ability to differentiate itself in this talent war will be a key determinant of its market position.

- Competitive Compensation: Offering salaries and bonuses that meet or exceed industry averages for recruitment professionals.

- Robust Benefits Packages: Providing health insurance, retirement plans, and other perks that appeal to skilled individuals.

- Career Development: Creating opportunities for training, skill enhancement, and internal promotion to retain valuable employees.

Adecco Group operates in a highly competitive HR solutions market, facing pressure from global rivals like Randstad and ManpowerGroup, as well as numerous specialized firms. This intense rivalry, evident in the $680 billion global HR services market in 2024, forces continuous innovation and strategic differentiation. Companies are increasingly expanding services beyond traditional staffing to include HR consulting and digital recruitment, intensifying competition from various HR service providers.

The drive to integrate AI and automation is a key battleground, with firms mastering these technologies gaining a significant edge. This technological race, coupled with aggressive pricing strategies, leads to margin compression across the industry. Adecco must maintain cost efficiency and operational excellence to remain profitable amidst these pressures.

The competition extends to attracting and retaining talent, both internally and for clients. Offering competitive compensation, robust benefits, and career development opportunities is crucial for securing skilled recruiters and placing qualified candidates. Adecco's success by mid-2025 will hinge on its ability to stand out in this talent war.

SSubstitutes Threaten

Companies increasingly bypass staffing agencies by hiring directly, particularly for permanent positions. This direct hiring trend offers greater control over the recruitment process and can lead to significant cost savings, as businesses avoid agency fees.

In 2024, the demand for direct hiring surged as companies sought to build more stable, in-house teams. This shift is evident in the growth of internal recruitment functions and the use of online job boards and professional networking platforms, which facilitate direct candidate engagement.

The rise of freelance platforms like Upwork and Fiverr presents a significant threat of substitutes for Adecco's traditional staffing services. These platforms allow businesses to directly source freelance talent for specific projects, bypassing the need for an intermediary staffing agency. In 2024, the global gig economy was estimated to be worth over $455 billion, a figure projected to grow significantly, underscoring the increasing adoption of this alternative workforce model.

The increasing sophistication of AI and automation in Human Resources presents a significant threat of substitutes for traditional staffing services. These technologies can streamline and even automate many core recruitment functions, from initial candidate sourcing and screening to onboarding processes. For instance, AI platforms can analyze vast applicant pools, identify top matches based on predefined criteria, and manage initial communications, thereby reducing the reliance on external agencies.

By 2024, the HR tech market is projected to see substantial growth, with AI-driven solutions becoming more prevalent. Companies are increasingly investing in these internal capabilities, as evidenced by the global HR tech market size, which was valued at over $24 billion in 2023 and is expected to continue expanding. This internal efficiency gain directly substitutes for the services offered by staffing firms, as organizations can manage more of their talent acquisition needs in-house.

Internal Talent Mobility and Upskilling

The threat of substitutes for Adecco Group's core services, particularly in talent acquisition and management, is significantly influenced by a company's ability to develop and retain its own workforce. When organizations prioritize internal talent mobility and invest heavily in upskilling and reskilling their existing employees, they reduce their reliance on external staffing agencies.

This internal focus can be a powerful substitute. For instance, in 2024, many companies reported increased spending on employee training programs aimed at filling critical skill gaps, thereby mitigating the need for immediate external hires. This trend is driven by a desire for greater workforce agility and cost control.

- Internal Development as a Substitute: Companies can bypass external recruitment by fostering internal career paths and providing continuous learning opportunities.

- Upskilling and Reskilling Impact: Investments in employee development directly reduce the demand for new external talent, particularly for specialized roles.

- Cost and Efficiency Gains: Developing existing staff is often more cost-effective and quicker than sourcing, vetting, and onboarding external candidates.

- 2024 Trend: A notable increase in corporate learning and development budgets in 2024 reflects a strategic shift towards internal talent solutions.

Outsourcing to Non-Staffing Firms

The threat of substitutes for Adecco Group's core staffing services is amplified by the growing trend of businesses outsourcing functions to non-traditional staffing firms. These firms, like IT consulting companies or business process outsourcing (BPO) providers, offer specialized talent and solutions that can directly compete with staffing agencies for specific project needs or ongoing operational tasks.

For instance, a company needing to develop a new software application might opt to engage an IT consulting firm that provides a complete project team, rather than hiring individual developers through a staffing agency. This bypasses the traditional staffing model altogether. Similarly, BPO providers can handle entire business functions, such as customer service or payroll processing, presenting a substitute for contingent workforce solutions.

This diversification of substitute providers means Adecco must continually innovate and differentiate its offerings. The global BPO market, for example, was projected to reach over $400 billion in 2024, highlighting the significant scale of these alternative solutions. This competitive landscape necessitates Adecco's focus on value-added services and specialized expertise to maintain its market position.

- Rise of Specialized Outsourcing: Non-staffing firms offering project-based teams or managed services present a direct substitute for traditional staffing solutions.

- IT Consulting and BPO as Competitors: Companies in sectors like IT and business process management increasingly compete for talent and project execution, offering an alternative to contingent labor sourced through staffing agencies.

- Market Size of Substitutes: The substantial global BPO market, valued in the hundreds of billions of dollars by 2024, underscores the significant competitive threat posed by these alternative outsourcing models.

The threat of substitutes for Adecco's services is significant and multifaceted. Companies are increasingly opting for direct hiring, leveraging online platforms to find talent independently, thereby bypassing staffing agencies entirely. This trend intensified in 2024 as businesses aimed to build more stable, in-house teams.

Freelance platforms like Upwork and Fiverr offer a direct substitute by connecting businesses with independent contractors for project-based work, circumventing the need for traditional staffing intermediaries. The global gig economy's substantial growth, estimated to be over $455 billion in 2024, illustrates the widespread adoption of this alternative.

Furthermore, advancements in AI and HR technology allow companies to automate recruitment processes, reducing reliance on external agencies. The HR tech market's expansion, with AI solutions becoming more prevalent, signifies a shift towards internal capabilities that substitute for staffing services. By 2024, the HR tech market was valued at over $24 billion.

Companies also increasingly focus on internal talent development and upskilling, which directly diminishes the need for external hires. This strategic move, supported by growing corporate learning and development budgets in 2024, offers a cost-effective and efficient alternative to external recruitment.

Finally, specialized outsourcing firms and BPO providers offer complete project teams or managed services, acting as direct substitutes for contingent workforce solutions. The massive scale of the global BPO market, projected to exceed $400 billion in 2024, highlights the competitive pressure from these alternative models.

| Substitute Type | Description | 2024 Market Relevance |

|---|---|---|

| Direct Hiring | Companies recruit talent directly via job boards and professional networks. | Increased adoption for building stable, in-house teams. |

| Freelance Platforms | Platforms like Upwork and Fiverr connect businesses with independent contractors. | Global gig economy valued over $455 billion, indicating strong adoption. |

| AI & HR Tech | Automation of recruitment processes through AI and technology. | HR tech market valued over $24 billion, with AI solutions growing. |

| Internal Development | Upskilling and reskilling existing employees to fill skill gaps. | Increased corporate L&D budgets signify a strategic shift. |

| Outsourcing & BPO | Engaging specialized firms for project teams or managed services. | Global BPO market projected over $400 billion, a significant substitute. |

Entrants Threaten

While the global staffing market demands substantial investment in infrastructure and brand recognition, the threat of new entrants is amplified in specialized or niche segments. These smaller, focused players can enter with lower capital requirements, targeting specific industries or skill sets that might be less dominant in Adecco's broader portfolio. For instance, a new firm focusing solely on AI talent acquisition could emerge with a lean operational model.

New HR tech startups, particularly those utilizing advanced AI, pose a significant threat by introducing innovative and efficient recruitment solutions. These agile companies can rapidly capture market share by targeting specific inefficiencies in the hiring lifecycle. For instance, in 2024, the HR tech market saw substantial investment, with companies focusing on AI-powered candidate sourcing and assessment tools, indicating a clear trend of disruption.

The proliferation of digital platforms like LinkedIn and Indeed poses a significant threat by directly connecting employers with candidates, bypassing traditional staffing intermediaries. In 2024, these platforms continue to grow, with LinkedIn boasting over 1 billion members globally, offering a vast pool of talent accessible without agency fees.

Talent aggregators further intensify this threat by consolidating job listings and candidate profiles, making it easier for companies to find talent independently. This disintermediation reduces the need for staffing agencies to perform the initial sourcing and matching functions, potentially eroding their value proposition.

Capital Requirements and Brand Recognition

The threat of new entrants for a global staffing giant like Adecco Group is significantly mitigated by immense capital requirements and deeply entrenched brand recognition. Establishing a global operational footprint, building extensive candidate and client networks, and investing in sophisticated technology platforms demand billions in upfront capital. For instance, Adecco's 2023 revenue stood at €23.6 billion, indicating the scale of operations required to compete effectively, a figure that deters many smaller, less-resourced players from entering the market at a comparable level.

Potential new entrants face steep hurdles in replicating Adecco's established brand loyalty and trust, built over decades of consistent service delivery and market presence. This brand equity translates into preferential treatment from both job seekers and employers, creating a significant competitive advantage. While some specialized staffing niches might have lower entry barriers, achieving the scale and breadth of Adecco's global reach is exceptionally challenging without substantial financial backing and a proven track record.

- High Capital Investment: Launching a global staffing operation akin to Adecco necessitates vast capital for technology, infrastructure, and talent acquisition, estimated in the hundreds of millions to billions of euros.

- Brand Equity and Trust: Adecco's long-standing reputation and established client relationships are difficult and time-consuming for new entrants to replicate, providing a strong barrier to entry.

- Network Effects: The extensive global network of both candidates and clients that Adecco possesses creates a powerful advantage, making it challenging for newcomers to achieve critical mass.

- Regulatory Compliance: Navigating diverse international labor laws and compliance standards adds another layer of complexity and cost for potential new entrants.

Regulatory Landscape and Compliance Costs

The complex and evolving regulatory environment for labor and staffing services presents a significant barrier for new entrants. Navigating diverse international labor laws, such as varying minimum wage requirements and employment protection statutes, demands considerable resources and specialized expertise. For instance, in 2024, the European Union continued to emphasize worker rights and fair competition, leading to updated directives that require stringent compliance from staffing agencies operating within member states.

Compliance costs associated with these regulations can be substantial. New companies must invest heavily in legal counsel, HR compliance systems, and ongoing training to ensure adherence to a patchwork of national and regional employment laws. Adecco Group, a major player, allocates significant resources to maintain its compliance framework globally, a cost that can deter smaller, less capitalized entrants.

- Regulatory Hurdles: New entrants face a complex web of international labor laws and compliance requirements.

- Resource Intensive: Navigating these regulations demands substantial investment in legal, HR, and compliance infrastructure.

- Evolving Landscape: Continuous changes in employment legislation, like those seen in the EU in 2024, necessitate ongoing adaptation and expenditure.

- Competitive Disadvantage: High initial compliance costs can put new, smaller firms at a disadvantage compared to established players with existing infrastructure.

While Adecco's global scale and brand recognition present significant barriers, specialized HR tech startups and digital platforms like LinkedIn and Indeed are potent threats. These disruptors offer efficient, often lower-cost alternatives, bypassing traditional staffing models. For example, in 2024, HR tech investment surged, with AI-driven solutions directly challenging established players by streamlining recruitment processes. LinkedIn's over 1 billion members in 2024 further exemplifies how digital platforms disintermediate agencies.

| Threat Factor | Description | Impact on Adecco | 2024 Data/Trend |

|---|---|---|---|

| HR Tech Startups | AI-powered recruitment, assessment, and onboarding solutions. | Can capture niche markets, offer specialized services at lower costs. | Significant investment in AI HR tech in 2024, focusing on efficiency. |

| Digital Platforms | Direct employer-candidate connections (e.g., LinkedIn, Indeed). | Reduces reliance on staffing agencies for sourcing and matching. | LinkedIn surpassed 1 billion members globally in 2024. |

| Talent Aggregators | Consolidation of job listings and candidate profiles. | Further disintermediation, diminishing the sourcing value of agencies. | Continued growth in platforms aggregating talent data. |

Porter's Five Forces Analysis Data Sources

Our Adecco Group Porter's Five Forces analysis is built upon a comprehensive review of publicly available financial statements, investor relations materials, and industry-specific market research reports.

We also incorporate insights from reputable business news outlets, competitor website disclosures, and relevant regulatory filings to provide a robust understanding of the competitive landscape.