Adecco Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adecco Group Bundle

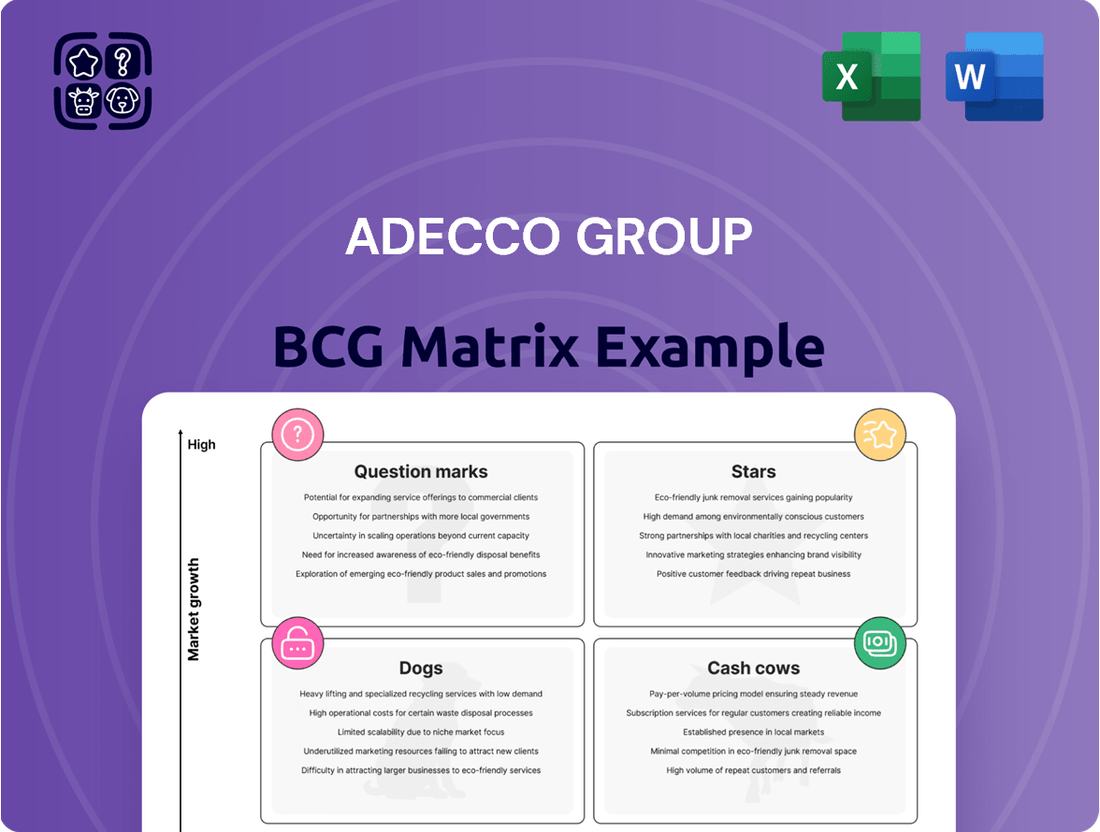

Curious about the Adecco Group's strategic positioning? Our BCG Matrix analysis reveals which of their business units are Stars, Cash Cows, Dogs, or Question Marks, offering a crucial snapshot of their market performance.

Don't miss out on the full picture; purchase the complete BCG Matrix report to gain detailed quadrant insights and actionable strategies that will illuminate your own investment and resource allocation decisions.

Unlock the full potential of your strategic planning by acquiring the comprehensive Adecco Group BCG Matrix, your essential guide to navigating market dynamics and driving growth.

Stars

Adecco Group's AI-powered recruitment solutions, exemplified by their r.Potential platform and collaborations with Bullhorn AI and Salesforce Agentforce, are positioned as Stars in the BCG Matrix. These investments are designed to automate candidate matching and streamline recruitment, targeting significant growth in the tech-driven talent market.

The Adecco Group's performance in the Asia-Pacific (APAC) region has been exceptionally strong, showcasing robust organic revenue growth. In Q1 2025, this growth reached an impressive 11% year-over-year. This upward trend highlights Adecco's successful penetration and expansion within key APAC markets such as Japan, broader Asia, and India.

LHH's career transition and talent development services are a key growth area for Adecco Group. Their career transition and mobility services saw a substantial 46% revenue increase in Q4 2023. This strong performance is fueled by strategic digital investments, such as EZRA, which experienced 45% organic growth in Q2 2024.

Further solidifying its leadership, LHH Recruitment Solutions was named a Leader in the Everest Group's PEAK Matrix Assessment 2025 for US Contingent Talent and Strategic Solutions, especially for white-collar positions. These achievements highlight LHH's ability to meet the escalating demand for reskilling and upskilling in today's dynamic job market.

Specialized Consulting & Solutions (Akkodis)

Akkodis's Specialized Consulting & Solutions segment demonstrated resilience in 2024, achieving a 1% revenue increase despite broader challenges in the tech staffing market. This segment is well-positioned within the technology sector due to persistent high demand for specialized skills.

The demand is particularly strong for expertise in cutting-edge fields such as artificial intelligence, machine learning, cloud computing, and high-performance computing. This focus on high-growth niches highlights Akkodis's strategic alignment with key technological advancements.

- 2024 Revenue Growth: Akkodis's Consulting & Solutions segment saw a 1% revenue increase for the full year 2024.

- Q1 2025 Performance: Consulting revenue in Q1 2025 experienced a decline of less than 1%, outperforming the staffing segment.

- Key Skill Demand: High demand exists for AI, machine learning, cloud computing, and high-performance computing skill-sets.

- Market Position: The segment is positioned in a high-growth niche within the digital engineering and technology sector.

Americas Region Recovery

The Adecco GBU in the Americas is demonstrating a robust recovery, with revenues climbing 4% year-over-year in the first quarter of 2025. This growth is particularly driven by positive momentum in the US market, which is showing a strong exit rate and clear signs of improvement.

This rebound in North America, coupled with solid performance in Latin America, indicates a successful regaining of market share and a favorable growth trajectory for the Adecco Group in this vital region.

- Americas Region Recovery: Revenues up 4% year-over-year in Q1 2025.

- US Market Strength: Encouraging signs of improvement and a solid exit rate observed.

- Latin America Performance: Strong results contribute to the overall positive regional trend.

- Market Share Gains: Recovery suggests a successful regaining of competitive position.

Adecco Group's AI-powered recruitment solutions, including r.Potential and collaborations with Bullhorn AI, are positioned as Stars due to their significant growth potential in the tech-driven talent market. LHH's career transition services, boosted by digital investments like EZRA which saw 45% organic growth in Q2 2024, are also strong Stars. These initiatives are capitalizing on the increasing demand for reskilling and upskilling.

| Business Unit | BCG Category | Key Growth Drivers | Recent Performance Data |

| AI Recruitment Solutions (r.Potential, Bullhorn AI) | Stars | Automation of candidate matching, streamlining recruitment, tech-driven talent market expansion | Targeting significant growth |

| LHH Career Transition & Talent Development | Stars | Digital investments (EZRA), reskilling/upskilling demand, strong revenue growth in career transition services | 46% revenue increase in Q4 2023 for career transition; EZRA 45% organic growth in Q2 2024 |

What is included in the product

This BCG Matrix overview highlights strategic recommendations for Adecco's business units, guiding investment and divestment decisions.

A clear Adecco Group BCG Matrix visualizes business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Adecco's core flexible staffing business unit is the Group's largest revenue generator and a significant cash cow. This segment has demonstrated resilience, even gaining 130 basis points of market share in Q1 2025 despite challenging market conditions that have led to overall revenue declines.

The substantial cash flow from this unit is driven by its established presence and leading positions in key markets, such as France and Germany. Firm pricing power and effective capacity management within these operations contribute to its reliability as a funding source for the Adecco Group.

Adecco Group commands substantial positions in both the Managed Services Provider (MSP) and Recruitment Process Outsourcing (RPO) sectors, holding 19% and 22.1% market shares respectively in 2022. These segments are known for their predictable, long-term contracts and stable revenue, making them reliable cash generators for the company.

The mature nature of these corporate solutions markets, coupled with Adecco's established client base, allows for consistent cash flow generation. This stability means that investment needs for growth in these areas are typically lower when compared to more dynamic, high-growth business units.

Adecco's global permanent placement operations are a classic cash cow. Despite a 7% dip in Q4 2024, this segment is known for its high margins. Adecco commanded a substantial 27.7% share of the professional staffing market in 2022, underscoring its strong global presence.

As economic uncertainty lingers, businesses are likely to lean more on permanent hiring. This trend plays directly into Adecco's strengths, allowing them to capitalize on their established expertise and market leadership to drive robust profits.

The company's capacity to maintain stable pricing for its permanent placement services further cements its cash cow status. Even with short-term market volatility, this segment consistently provides a reliable stream of earnings for Adecco.

Established European Markets

Established European Markets, such as France and Germany, are considered Cash Cows for Adecco Group. Despite facing macroeconomic headwinds, these mature regions continue to hold significant market positions, with France at 24% and Germany at 22% market share in 2021.

These markets, while potentially showing short-term revenue dips, are characterized by their deep client penetration and robust operational frameworks. This stability allows Adecco to focus on optimizing efficiency and nurturing existing client relationships.

- Leading Market Shares: Adecco maintains strong positions in key European markets like France and Germany.

- Mature Market Stability: Despite economic challenges, these markets provide a stable revenue base.

- Operational Efficiency Focus: The strategy centers on maximizing profitability through streamlined operations.

- Client Relationship Management: Continued emphasis on strong, long-term client partnerships is crucial.

Training, Up-skilling & Re-skilling Programs (General Assembly)

Adecco Group's General Assembly offers vital training, up-skilling, and re-skilling programs designed to equip individuals and businesses with essential digital competencies. These services are crucial for adapting to the evolving job market, ensuring both organizational relevance and individual career longevity.

The established training portfolio, a cornerstone of Adecco's offerings, acts as a significant cash cow. This segment, while mature, continues to generate consistent revenue due to the ongoing need for workforce development. In 2022, Adecco held a substantial 14.1% market share within the global Training & Career Transition sector, underscoring the stability and demand for these services.

- Stable Revenue Stream: The consistent demand for digital skills training provides a reliable cash flow for Adecco.

- Market Position: Adecco's 14.1% market share in Training & Career Transition in 2022 highlights its strong presence in this segment.

- Future-Proofing: These programs address the critical need for workforce adaptation in a rapidly changing digital landscape.

- Client Collaboration: Partnerships with clients for tailored upskilling programs further solidify this offering as a dependable revenue source.

Adecco's flexible staffing operations, particularly within its core markets like France and Germany, represent significant cash cows. These segments benefit from established market positions and resilient pricing power, even when facing broader economic challenges.

The company's global permanent placement business also functions as a cash cow, characterized by high margins and a substantial market share in professional staffing, which was 27.7% in 2022. This segment is poised to benefit from businesses increasingly focusing on permanent hiring amidst economic uncertainty.

Furthermore, Adecco's Managed Services Provider (MSP) and Recruitment Process Outsourcing (RPO) divisions, holding 19% and 22.1% market shares respectively in 2022, are stable revenue generators due to long-term contracts.

The Training & Career Transition sector, where Adecco held a 14.1% market share in 2022, also contributes consistently to cash flow, addressing the ongoing demand for workforce development and digital upskilling.

| Business Segment | Market Share (2022) | Key Characteristics | Cash Cow Status Driver |

|---|---|---|---|

| Flexible Staffing (France/Germany) | High in key European markets | Resilient pricing, established presence | Consistent revenue and market share |

| Global Permanent Placement | 27.7% (Professional Staffing) | High margins, increasing demand | Profitability and market leadership |

| MSP & RPO | 19% (MSP), 22.1% (RPO) | Long-term contracts, stable revenue | Predictable income streams |

| Training & Career Transition | 14.1% | Ongoing demand for upskilling | Reliable cash flow from workforce development |

Preview = Final Product

Adecco Group BCG Matrix

The Adecco Group BCG Matrix preview you are currently viewing is the complete and final document you will receive upon purchase. This means you'll get the exact same professionally formatted analysis, ready for immediate strategic application, without any watermarks or demo content. The insights and structure presented here are precisely what you'll unlock, allowing you to directly integrate this valuable market intelligence into your business planning and decision-making processes.

Dogs

Traditional staffing in key European markets like France, Germany, and the UK is facing considerable headwinds. For instance, France saw a revenue drop of 9% in Q1 2025, while Germany experienced a 14% decline in Q4 2024.

These downturns stem from a confluence of factors including economic instability, political uncertainties, reduced client demand, and an overall contracting market. These challenging conditions place these traditional staffing segments in a precarious position within the BCG matrix.

Without a substantial recovery or strategic pivot, these segments risk being classified as Dogs, characterized by low growth prospects and a potential erosion of market share in specific areas.

Akkodis's tech staffing segments are currently facing significant headwinds, placing them in a challenging market position. Revenues for Akkodis's tech staffing specifically declined by 11% in Q4 2024. This downturn is largely attributed to the ongoing slump in the US tech staffing market and growing difficulties in Germany.

The broader Akkodis Global Business Unit (GBU) also saw its revenue decrease by 8% in Q1 2025. These figures suggest that Akkodis may be operating in low-growth, low-market-share areas within the tech staffing landscape. Such a situation often classifies these segments as Dogs in a BCG matrix, potentially necessitating divestment or substantial strategic adjustments if market conditions fail to rebound.

Adecco Group's legacy IT systems, particularly in front and middle office operations, represent a significant challenge. These outdated platforms, slated for replacement by the end of 2024 with solutions from Microsoft and Salesforce, demonstrably underperform in efficiency and cost-effectiveness. The substantial investment in new technology underscores the diminishing value and operational drag of the legacy infrastructure.

Segments with Weak Enterprise Client Demand

In the fourth quarter of 2024, Adecco Group observed a noticeable dip in demand from its larger enterprise clients, particularly within the automotive and IT technology sectors. This weakness was partially cushioned by continued strong demand from small and medium-sized enterprises (SMEs).

While Adecco’s overarching strategy involves capturing greater market share, certain specific sub-segments or client portfolios within the subdued automotive and IT Tech areas are showing consistent low demand coupled with low market share. Without clearly defined strategies for recovery or growth in these particular niches, they could be categorized as Dogs within the Adecco Group's BCG Matrix.

- Automotive Sector Weakness: The automotive industry experienced a slowdown in hiring needs during Q4 2024, impacting Adecco's enterprise client demand in this segment.

- IT Tech Subdued Demand: Similarly, specific areas within IT Tech reported reduced demand from larger clients, contributing to the overall subdued enterprise client sentiment.

- SME Resilience: In contrast, demand from SMEs remained robust, providing a positive counterpoint to the enterprise client weakness.

- Low Market Share/Low Demand Identification: Sub-segments within autos and IT Tech consistently exhibiting low demand and low market share, without clear turnaround plans, are flagged for potential re-evaluation.

Underperforming Specific Geographies within Americas

Within the Adecco Group's Americas Global Business Unit (GBU), certain segments are exhibiting characteristics of 'Dogs' in the BCG Matrix. While the Americas GBU as a whole saw improvement in Q1 2025, North America's revenue experienced a significant 12% decline in Q4 2024. This downturn is attributed to persistent weakness in demand for flexible staffing solutions and the impact of specific client issues.

Despite ongoing turnaround efforts in the US market, some localized areas or client groups within North America are proving resistant to these initiatives. These persistently underperforming sub-regions or client segments, failing to respond to recovery strategies, align with the 'Dog' profile in the BCG matrix. For instance, if a specific state or a major client contract within North America continues to show declining revenue and market share despite targeted interventions, it would be classified as a 'Dog'.

- North America Revenue Decline: 12% lower in Q4 2024.

- Underlying Cause: Continued downturn in flexible placement demand and specific client impacts.

- 'Dog' Identification: Sub-regions or client segments within North America consistently underperforming and unresponsive to turnaround efforts.

- Strategic Implication: Potential need for divestment or significant restructuring for these specific areas.

Certain segments within Adecco Group, particularly in traditional staffing and specific tech niches, are showing 'Dog' characteristics. These areas face low growth and declining market share, exemplified by France's 9% revenue drop in Q1 2025 and Germany's 14% decline in Q4 2024 for traditional staffing. Akkodis's tech staffing also saw an 11% revenue drop in Q4 2024.

These underperforming areas, like subdued automotive and IT tech sub-segments, coupled with persistent weakness in North America's flexible staffing (down 12% in Q4 2024), highlight the 'Dog' profile. Without strategic pivots, these segments risk further erosion.

The legacy IT systems, slated for replacement by end-2024, also represent a drag, underscoring the challenges in optimizing operations for these low-performing units.

The strategic implication for these 'Dog' segments is a potential need for divestment or significant restructuring to reallocate resources effectively.

| Segment | Performance Metric | Trend | BCG Classification |

|---|---|---|---|

| Traditional Staffing (France) | Revenue | -9% (Q1 2025) | Dog |

| Traditional Staffing (Germany) | Revenue | -14% (Q4 2024) | Dog |

| Akkodis Tech Staffing | Revenue | -11% (Q4 2024) | Dog |

| North America Flexible Staffing | Revenue | -12% (Q4 2024) | Dog |

Question Marks

Adecco's r.potential platform, a new AI-powered initiative, along with the accelerated expansion of its digital delivery engine, represent significant growth opportunities. These ventures, while promising, are in their nascent stages, meaning their current market share is likely minimal. Significant investment is required to achieve broad adoption and prove their profitability.

Adecco's strategic partnerships, like its collaboration with Salesforce to develop AI-powered recruitment agents, are positioned to tap into high-growth areas driven by technological advancements. These ventures, while promising for future workforce solutions, are still in their nascent stages of market penetration. For instance, the integration of AI in recruitment is a rapidly evolving sector, with the global AI in recruitment market projected to reach USD 3.5 billion by 2027, growing at a CAGR of 23.5%.

Similarly, partnerships focused on diverse talent development, such as those aligning with initiatives like OneTen, address significant societal shifts towards inclusivity. These collaborations, while targeting robust growth potential by tapping into underrepresented talent pools, are currently building their market share. The focus here is on long-term development, demanding continued investment to scale and achieve significant market impact.

Adecco is strategically targeting niche, high-skilled industrial segments like advanced manufacturing, renewable energy, and electric vehicles (EVs). These sectors are poised for significant growth, indicating a strong future demand for specialized industrial staffing. For instance, the global renewable energy market was valued at approximately $1.5 trillion in 2023 and is projected to grow substantially, creating a need for skilled workers in areas like solar panel installation and wind turbine maintenance.

While these areas represent high-growth opportunities, Adecco's current market penetration in these highly specialized niches may be relatively modest. This presents a clear opportunity for Adecco to invest and develop targeted strategies to capture a larger share, aiming to elevate these segments to 'Star' status within the BCG matrix. The EV market alone is expected to reach over $1.5 trillion by 2030, highlighting the immense potential for staffing providers who can supply specialized talent for battery manufacturing and vehicle assembly.

Emerging Digital Skills Training Programs

Emerging digital skills training programs, focusing on areas like advanced AI and machine learning, represent potential Stars within Adecco Group's portfolio. While the overall training and development sector is a Cash Cow, these specific, high-demand programs are experiencing rapid market growth. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to reach over $1.8 trillion by 2030, indicating a substantial growth trajectory for related training services.

These programs require significant and ongoing investment in updating curricula and securing specialized instructors to keep pace with technological advancements. This investment is crucial for Adecco to gain a larger foothold in this dynamic and expanding market. By 2024, the demand for cloud computing skills alone saw an estimated 30% increase year-over-year, highlighting the urgency and opportunity.

- High Growth Demand: Programs in AI, machine learning, and advanced cloud computing are experiencing rapid market expansion.

- Investment Needs: Continuous investment in curriculum development and expert trainers is essential for success.

- Market Potential: The global AI market's projected growth to over $1.8 trillion by 2030 underscores the significant revenue potential.

- Skill Gap: The increasing demand for skills like cloud computing, with a 30% year-over-year rise in 2024, signifies a critical market need.

Geographic Expansion into Untapped or Rapidly Developing Markets

Adecco Group's strategic focus on geographic expansion into rapidly developing or untapped markets positions these ventures as potential Stars or Question Marks, depending on their current penetration and investment levels. These markets, while demanding significant upfront investment in localized solutions and talent, offer substantial long-term growth opportunities. For instance, targeting specific high-growth regions within Africa or Latin America, where Adecco's current footprint is minimal but economic development is accelerating, aligns with this strategy.

Such expansion requires careful market entry planning and execution. Adecco’s approach would involve understanding local labor dynamics, regulatory environments, and skill shortages to tailor staffing and HR solutions effectively. For example, investing in digital infrastructure and training programs in regions experiencing a digital skills gap could unlock significant potential.

- Emerging Market Focus: Adecco may identify specific countries in Southeast Asia (excluding established Star markets like Singapore) or parts of Eastern Europe experiencing rapid industrialization and a growing need for skilled labor.

- Investment Requirements: Entry into these markets necessitates substantial capital for establishing local offices, developing customized recruitment platforms, and building a robust talent pipeline, potentially requiring tens of millions of dollars in initial investment per significant market.

- Growth Potential: These markets often exhibit double-digit GDP growth and a burgeoning young workforce, presenting a fertile ground for Adecco to capture market share and establish itself as a leading HR solutions provider.

- Risk Mitigation: Adecco would need to navigate political and economic volatility, currency fluctuations, and varying labor laws, employing agile strategies and strong local partnerships to mitigate risks.

Adecco's ventures into new geographic markets or highly specialized industrial niches, like those in renewable energy or electric vehicles, can be classified as Question Marks. These areas exhibit strong growth potential but currently hold a low market share for Adecco. Significant investment is required to build brand recognition, establish operations, and develop a skilled talent pool in these emerging segments. For instance, while the global renewable energy market is projected to grow significantly, Adecco's current penetration in specialized roles within this sector might be limited, necessitating substantial investment to capture market share.

The success of these Question Marks hinges on Adecco's ability to effectively allocate resources and execute targeted strategies. For example, in the burgeoning EV market, which is expected to exceed $1.5 trillion by 2030, Adecco needs to invest in specialized recruitment capabilities to supply talent for battery manufacturing and vehicle assembly. Similarly, expanding into developing economies with high GDP growth requires tailored approaches to navigate local labor dynamics and regulatory landscapes, demanding considerable upfront capital for market entry.

These initiatives represent opportunities to transform into Stars if market share can be increased through strategic investment and successful execution. The key challenge lies in the uncertainty of achieving dominant market positions amidst competition and evolving market demands. Adecco's investment in digital delivery engines and AI-powered recruitment agents, while promising, also falls into this category due to their nascent stage and the need for substantial capital to scale and prove profitability.

Adecco's expansion into emerging markets, such as certain regions in Southeast Asia or Eastern Europe, presents classic Question Mark scenarios. These markets offer high growth potential due to industrialization and a growing need for skilled labor, with some exhibiting double-digit GDP growth. However, entry requires substantial capital for local infrastructure, customized platforms, and talent pipelines, potentially in the tens of millions of dollars per market. Adecco must also navigate political and economic volatility, currency fluctuations, and varying labor laws to mitigate risks and establish a strong foothold.

| Initiative/Market Segment | Current Market Share | Market Growth Rate | Investment Required | Potential Classification |

|---|---|---|---|---|

| r.potential platform (AI) | Low | High | High | Question Mark |

| AI in Recruitment (Salesforce Partnership) | Low | High (Global market projected to reach USD 3.5 billion by 2027) | High | Question Mark |

| Niche Industrial Segments (EVs, Renewables) | Modest | High (EV market > $1.5 trillion by 2030, Renewables ~$1.5 trillion in 2023) | High | Question Mark |

| Emerging Geographic Markets (e.g., parts of SE Asia, Eastern Europe) | Minimal | High (Double-digit GDP growth in some) | Very High (Tens of millions per market) | Question Mark |

BCG Matrix Data Sources

Our Adecco Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.