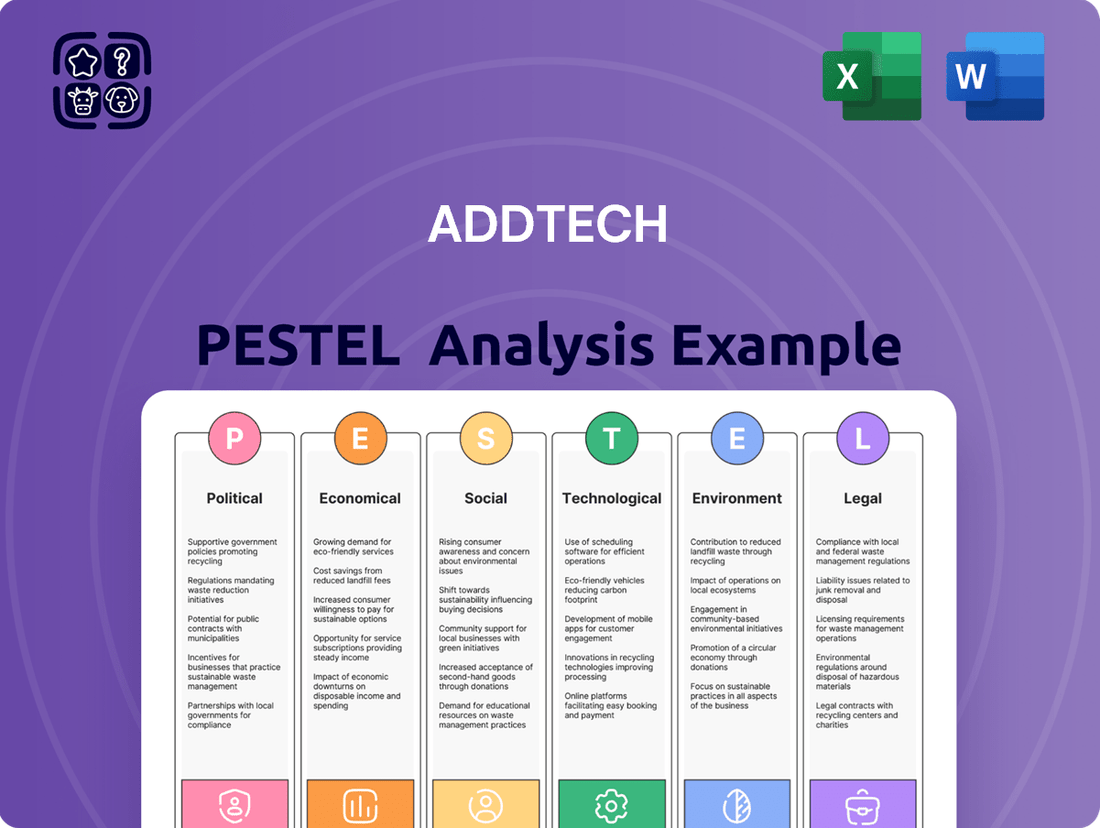

Addtech PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addtech Bundle

Navigate the complex external forces shaping Addtech's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and threats, empowering you to make informed strategic decisions. Download the full report now to unlock actionable intelligence and gain a competitive advantage.

Political factors

Changes in government regulations, particularly concerning industrial standards and product safety, can directly influence Addtech's operational framework and product development cycles. For instance, the European Union's ongoing efforts to harmonize product safety directives, with updates expected throughout 2024 and 2025, require manufacturers to adapt their offerings, impacting Addtech's supplier relationships and product portfolio.

Addtech's position as an intermediary in global markets makes it susceptible to shifts in international trade policies. The United States' imposition of tariffs on certain manufactured goods in 2023, and ongoing trade discussions with various Asian economies throughout 2024, could affect Addtech's supply chain costs and market access, necessitating strategic adjustments to maintain competitive pricing and operational efficiency.

Addtech's global footprint means its performance is directly tied to geopolitical stability. For instance, the ongoing conflicts and trade tensions in Eastern Europe and the Middle East, which intensified in 2024, could impact supply chains for electronic components or create uncertainty in regional demand for Addtech's specialized technical solutions.

Trade disputes, such as those that have surfaced between major economic blocs in recent years, can lead to increased tariffs or import restrictions. This could directly affect Addtech's cost of goods sold or limit market access in key regions, potentially impacting their 2025 revenue projections if not adequately managed through diversified sourcing and market strategies.

While Addtech's strategy of operating in multiple countries offers a degree of risk mitigation against localized political instability, a significant global geopolitical shock could still pose challenges. For example, a widespread economic downturn triggered by international conflict could dampen overall demand for advanced technical products across all of Addtech's operating markets.

Governments worldwide are increasingly implementing industrial policies to bolster key sectors. For instance, the EU's Green Deal aims to accelerate the transition to sustainable technologies, potentially boosting demand for Addtech's advanced components in areas like renewable energy infrastructure and electric vehicle systems. Similarly, the US CHIPS and Science Act of 2022, with its significant investment in semiconductor manufacturing, signals a broader trend of state support for high-tech industries where Addtech operates.

Public Procurement Policies

Public procurement policies significantly shape opportunities for companies like Addtech, especially within the infrastructure and public services sectors. These policies, often favoring local suppliers or mandating specific technological standards, can directly impact Addtech's access to substantial contracts. For instance, in 2024, many European governments continued to emphasize digital transformation in public services, potentially increasing demand for Addtech's technology solutions, but also requiring compliance with stringent data security and interoperability standards.

Changes in these procurement frameworks, such as the introduction of new sustainability criteria or preferences for circular economy principles, can present both challenges and opportunities. Addtech's ability to align its offerings with evolving government mandates, such as those related to energy efficiency in public buildings or the use of recycled materials in infrastructure projects, will be crucial for market share growth. Transparency in bidding processes and strict adherence to these evolving regulations are paramount for securing public sector business.

Key considerations for Addtech regarding public procurement policies include:

- Local Content Requirements: Policies that mandate a certain percentage of goods or services be sourced locally can affect Addtech's supply chain and partnership strategies.

- Technological Specifications: Public tenders often detail precise technical requirements, necessitating Addtech to ensure its products and services meet or exceed these standards, particularly in areas like smart city infrastructure or cybersecurity.

- Sustainability and ESG Mandates: Increasingly, public procurement incorporates environmental, social, and governance (ESG) criteria, requiring Addtech to demonstrate its commitment to sustainable practices and responsible sourcing.

Political Stability in Operating Regions

The political stability of Addtech's operating regions is a critical factor. In 2024, many European countries, where Addtech has a significant presence, maintained stable political landscapes, fostering a conducive environment for business. For instance, Sweden, Addtech's home base, consistently ranks high in global political stability indices, providing a solid foundation for its subsidiaries.

Political stability directly influences investor confidence and the predictability of regulatory frameworks. Countries with stable governments tend to have more reliable legal systems and consistent economic policies, which benefits companies like Addtech by reducing operational risks. This stability is crucial for long-term investment planning and market access.

Conversely, political instability can introduce significant challenges. Emerging markets or regions experiencing political unrest can lead to currency volatility, supply chain disruptions, and unexpected changes in tax laws or trade agreements. For example, geopolitical tensions in certain Eastern European markets in late 2024 and early 2025 could potentially impact subsidiaries operating in those areas, affecting profitability and growth trajectories.

- Stable political environments, like that in Sweden, support predictable business operations and investment.

- Geopolitical events in 2024-2025 highlight the potential for disruptions in less stable regions.

- Addtech's profitability is directly linked to the political and economic stability of its key operating countries.

Government industrial policies, such as the EU's Green Deal and the US CHIPS Act, are increasingly favoring high-tech sectors, potentially boosting demand for Addtech's specialized components. These initiatives, with significant investment planned through 2025, signal a supportive regulatory environment for innovation in areas like renewable energy and semiconductors.

Public procurement policies, particularly those emphasizing digital transformation and sustainability in 2024, present both opportunities and challenges for Addtech. Meeting stringent data security and ESG mandates within these tenders is crucial for securing contracts in sectors like smart city infrastructure.

Political stability in key operating regions, like Sweden, provides a predictable business environment, reducing operational risks. Conversely, geopolitical tensions in Eastern Europe in late 2024 and early 2025 could impact subsidiaries and profitability in those areas.

| Policy Area | Impact on Addtech | 2024-2025 Relevance |

|---|---|---|

| Industrial Policy (e.g., Green Deal, CHIPS Act) | Increased demand for advanced components, supportive regulatory environment. | Significant investment and policy implementation ongoing. |

| Public Procurement | Opportunities in digital transformation and infrastructure projects, but requires compliance with new standards. | Governments prioritizing modernization and sustainability in tenders. |

| Geopolitical Stability | Stable regions (e.g., Sweden) offer low risk; unstable regions pose supply chain and operational threats. | Continued geopolitical tensions observed globally, impacting specific markets. |

What is included in the product

This Addtech PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting key trends and their implications for Addtech's future growth and risk mitigation.

The Addtech PESTLE Analysis offers a streamlined, actionable framework that cuts through complexity, enabling teams to quickly identify and address external threats and opportunities impacting their strategic direction.

Economic factors

Addtech's core business, deeply intertwined with manufacturing and infrastructure, directly reflects global economic health. A strong global economy, evidenced by a projected 3.2% GDP growth in 2024 according to the IMF, fuels demand for Addtech's components and systems. Increased industrial production, which saw a 0.4% rise in the US during April 2024, further boosts sales and profitability for the company.

Conversely, economic slowdowns present challenges. If global GDP growth falters or industrial activity contracts, Addtech faces reduced demand and potential margin compression. For instance, a predicted slowdown in European industrial output for late 2024 could directly impact Addtech's European operations.

Addtech's global operations mean currency fluctuations are a constant factor. For instance, a strengthening Swedish Krona in early 2024 could make Addtech's exports more expensive for international buyers, potentially impacting sales volumes. Conversely, a weaker Krona would lower the cost of imported components, boosting profit margins on goods manufactured domestically for export.

The company's financial reporting also reflects these shifts. If Addtech's subsidiaries in countries with weaker currencies, like those in the Eurozone, see their local profits translated into a stronger Krona, the reported consolidated earnings might appear lower. Managing this exposure through hedging strategies is crucial for predictable financial outcomes.

Rising inflation presents a significant challenge for Addtech. For instance, in the Eurozone, inflation remained elevated at 5.5% in early 2024, impacting the cost of essential inputs like metals and energy. This surge in operational expenses could pressure Addtech's profit margins if they struggle to pass these increased costs onto their industrial customers.

Furthermore, the prevailing higher interest rate environment, with central banks like the European Central Bank maintaining rates at 4.5% through early 2024, directly affects Addtech. Increased borrowing costs can hinder the company's ability to finance new projects or acquisitions. Simultaneously, higher rates can reduce demand for industrial equipment as Addtech's customers face increased financing costs for their own investments.

Supply Chain Disruptions and Costs

Global supply chain stability and the cost of logistics are critical economic factors for a technology trading group like Addtech. Disruptions, such as those seen with the Red Sea shipping crisis in early 2024, can significantly impact transit times and freight expenses, directly affecting Addtech's ability to secure and price its products. For instance, shipping costs from Asia to Europe saw substantial increases in the first half of 2024, with some routes doubling in price compared to late 2023.

These disruptions can lead to product shortages and increased operational costs. For example, the semiconductor industry, a key sector for many technology trading groups, experienced ongoing supply challenges throughout 2024, impacting the availability of essential components. Efficient supply chain management, including diversified sourcing and robust inventory strategies, is therefore paramount for Addtech to navigate these economic pressures and maintain competitive pricing.

Key economic considerations for Addtech include:

- Rising Logistics Costs: Global shipping rates experienced volatility in 2024, with the average container spot rate on major East-West trade lanes fluctuating significantly due to geopolitical events and demand shifts.

- Component Shortages: Persistent shortages in certain electronic components, particularly advanced semiconductors, continued to impact production and availability in 2024, influencing lead times and pricing for technology products.

- Geopolitical Instability: Events like the ongoing conflict in Ukraine and tensions in other regions continue to create uncertainty, potentially leading to further supply chain disruptions and increased costs for raw materials and finished goods.

Acquisition Opportunities and Market Consolidation

Addtech's aggressive acquisition strategy is intrinsically linked to the broader economic climate and prevailing market valuations. During periods of economic expansion, such as the anticipated growth in many European economies through 2024 and into 2025, there's a greater likelihood of identifying and successfully integrating niche technology firms. These acquisitions are crucial for Addtech to deepen its expertise in specialized sectors and maintain its growth trajectory.

The economic outlook for 2024 and 2025 suggests a varied but generally positive environment for M&A activity in the technology sector. For instance, the European technology M&A market saw significant activity in late 2023 and early 2024, with valuations stabilizing after a period of adjustment. This environment allows Addtech to pursue strategic targets that complement its existing business units, thereby enhancing its market position and revenue streams.

- Economic Growth Fuels M&A: Projections for European GDP growth in 2024 and 2025 indicate a supportive backdrop for acquisitions, potentially increasing the number of available targets.

- Valuation Trends: While tech valuations experienced volatility, a more predictable environment in 2024-2025 could encourage sellers and buyers to engage in transactions.

- Strategic Fit: Addtech's focus on niche technology companies means that economic conditions directly impact the availability and affordability of these specialized assets.

- Market Consolidation: A robust economy often accelerates market consolidation, presenting Addtech with opportunities to acquire competitors or complementary businesses, thereby expanding its market share.

Addtech's performance is directly tied to global economic trends, with projected global GDP growth of 3.2% for 2024 by the IMF signaling potential demand increases. Rising inflation, noted at 5.5% in the Eurozone in early 2024, pressures operational costs, while higher interest rates, with the ECB maintaining 4.5% through early 2024, impact borrowing and customer investment.

Same Document Delivered

Addtech PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Addtech PESTLE Analysis provides a comprehensive overview of the external factors impacting the company, covering Political, Economic, Social, Technological, Legal, and Environmental aspects. You'll receive this exact, detailed analysis immediately after purchase, ready for your strategic planning.

Sociological factors

Addtech's reliance on a highly skilled workforce, especially in engineering and technical domains, is paramount for delivering its value-added services and bespoke solutions. The availability of such talent directly impacts operational efficiency and the capacity for innovation.

Demographic changes and evolving educational landscapes in key markets, such as Sweden and Norway, present both opportunities and challenges for talent acquisition. For instance, in 2024, the European Union reported a significant shortage of ICT specialists, a trend that likely affects specialized technical recruitment for companies like Addtech.

Competition for qualified engineers and technical professionals remains intense. Addtech's ability to attract and retain top talent will be a critical factor in maintaining its competitive edge and its capacity to develop and implement cutting-edge solutions for its clients.

Customer needs in industrial and infrastructure sectors are rapidly evolving, demanding more integrated and sustainable technology solutions. For instance, a growing emphasis on energy efficiency and reduced carbon footprints is reshaping preferences for machinery and automation. Addtech's focus on customer needs means staying ahead of these trends, ensuring their offerings, like advanced sensor technology or smart grid components, meet the increasing demand for greener and more streamlined operations.

Consumers increasingly favor brands demonstrating strong environmental and social responsibility, a trend impacting Addtech as purchasing decisions are directly influenced by these values. For instance, a 2024 Deloitte survey found that 73% of consumers are likely to change their purchasing habits to reduce their environmental impact.

Investor sentiment is also shifting, with Environmental, Social, and Governance (ESG) investments projected to reach $33.9 trillion globally by 2026, according to Morningstar. This growing focus on sustainability means Addtech's commitment to responsible operations is crucial for attracting and retaining capital.

Furthermore, these societal expectations translate into mounting regulatory pressures, compelling companies like Addtech to adopt more sustainable practices to ensure compliance and avoid penalties. The EU's Corporate Sustainability Reporting Directive (CSRD), which came into full effect in 2024, mandates extensive sustainability disclosures for many companies, highlighting the evolving landscape.

Employee Engagement and Corporate Culture

Addtech's decentralized structure, where each company operates with entrepreneurial freedom, places a significant emphasis on fostering a unified corporate culture to drive employee engagement. This approach is crucial for maintaining innovation and a sense of responsibility across its diverse portfolio of businesses. A strong, shared culture acts as the glue that binds these independent entities, promoting collaboration and a common purpose.

Maintaining high employee engagement is paramount for Addtech's success, especially given its model of acquiring and operating independent companies. Companies that prioritize a positive and empowering work environment often see tangible benefits. For instance, research consistently shows that highly engaged teams can be up to 21% more profitable. In 2024, companies focusing on employee well-being and development reported lower voluntary turnover rates, a key factor for Addtech in retaining specialized talent across its subsidiaries.

- Decentralized Autonomy: Addtech's model empowers individual companies, requiring a strong, cohesive culture to align efforts and maintain brand consistency.

- Talent Attraction & Retention: A positive and engaging corporate culture is essential for attracting and retaining skilled employees in a competitive market, directly impacting operational efficiency.

- Innovation & Productivity: Empowering work environments that foster innovation and responsibility are linked to increased productivity and a willingness to go the extra mile.

- Cultural Alignment: Ensuring a shared set of values and a common understanding of expectations across numerous subsidiaries is vital for smooth operations and strategic execution.

Ethical Sourcing and Supply Chain Responsibility

Societal concerns regarding ethical sourcing and labor practices continue to shape business operations. Consumers and investors alike are increasingly scrutinizing supply chains for evidence of fair wages, safe working conditions, and the absence of forced labor. For Addtech, a distributor of electronic components and systems, maintaining a transparent and ethical supply chain is paramount. Reports from organizations like the Ethical Trading Initiative highlight the growing demand for companies to demonstrate robust due diligence in their sourcing practices, with a significant portion of consumers willing to pay more for ethically produced goods.

Reputational damage stemming from unethical sourcing can have a substantial impact on Addtech's business. Negative publicity related to labor exploitation or environmental negligence within its supply network could alienate customers, deter potential investors, and strain relationships with suppliers. For instance, a 2024 survey by Accenture indicated that over 60% of consumers consider sustainability and ethical practices when making purchasing decisions. This underscores the financial and strategic imperative for Addtech to actively manage and uphold high ethical standards throughout its entire value chain.

Addtech's commitment to ethical sourcing can be demonstrated through several key actions:

- Supplier Audits: Regularly conducting independent audits of key suppliers to verify compliance with labor laws and ethical standards.

- Code of Conduct: Implementing and enforcing a comprehensive supplier code of conduct that explicitly outlines expectations regarding human rights and working conditions.

- Traceability Initiatives: Investing in technologies and processes that enhance the traceability of components, allowing for better identification and mitigation of risks in the supply chain.

- Stakeholder Engagement: Actively engaging with NGOs, industry associations, and other stakeholders to stay informed about evolving ethical sourcing best practices and emerging risks.

Societal expectations regarding corporate responsibility are increasingly influencing business operations, with a strong emphasis on ethical labor practices and transparent supply chains. For Addtech, a distributor of electronic components and systems, maintaining robust due diligence in sourcing is crucial, as consumers and investors scrutinize these practices. For example, a 2024 Accenture survey revealed that over 60% of consumers consider sustainability and ethical practices in their purchasing decisions, directly impacting Addtech's market standing and financial performance.

Technological factors

The pace of technological advancement is accelerating across the industries Addtech serves. Sectors like automation, electrification, and advanced process technology are seeing rapid innovation. For example, the global industrial automation market was valued at an estimated USD 214.8 billion in 2023 and is projected to reach USD 373.5 billion by 2030, growing at a CAGR of 8.2%. This rapid evolution creates significant opportunities for Addtech to introduce cutting-edge solutions.

To stay ahead, Addtech must proactively identify and integrate emerging technologies and new products into its portfolio. This is crucial for maintaining competitiveness and satisfying customer demand for increasingly sophisticated and efficient solutions. Failing to adapt could lead to market share erosion as competitors embrace new technological frontiers.

The pervasive shift towards digitalization and Industry 4.0 is fundamentally reshaping manufacturing and infrastructure. This evolution, characterized by smart factories, the Internet of Things (IoT), and sophisticated data analytics, creates significant opportunities for companies like Addtech.

Addtech's core business of supplying components and systems positions it advantageously to capitalize on this trend. Its ability to provide solutions that enable smart manufacturing, from advanced sensors to connectivity modules, is key to maintaining market relevance. For instance, the global Industrial IoT market was valued at approximately $247.5 billion in 2023 and is projected to reach $1.17 trillion by 2030, demonstrating substantial growth potential for Addtech's offerings.

Furthermore, Addtech's capacity to offer not just products but also the expertise to integrate these digital technologies is vital. This includes advising clients on implementing IoT solutions, optimizing data flows, and leveraging advanced analytics for improved efficiency and predictive maintenance. Such value-added services are critical for securing long-term partnerships and driving revenue growth in this rapidly evolving technological landscape.

Addtech, as a trading group with a strong technical foundation, recognizes the importance of research and development (R&D) investment. While not directly manufacturing, their ability to provide tailored solutions hinges on understanding and integrating cutting-edge technologies. This focus ensures they remain competitive by offering advanced products and services.

In 2023, Addtech's commitment to technical expertise was evident in their strategic partnerships and acquisitions of companies with robust R&D capabilities. For instance, their acquisition of companies specializing in AI-driven automation and advanced materials directly bolsters their capacity to understand and leverage emerging technological trends. This proactive approach allows them to anticipate market needs and offer innovative solutions to their diverse customer base.

Cybersecurity and Data Protection

As a technology trading group like Addtech, handling sensitive components and systems for a broad customer base, cybersecurity and data protection are absolutely critical. The increasing sophistication of cyber threats means that safeguarding both proprietary information and customer data is non-negotiable for maintaining trust and avoiding costly operational disruptions or reputational harm.

The financial implications of breaches are significant. For instance, the average cost of a data breach globally reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. For a company like Addtech, a successful attack could lead to substantial financial losses through remediation, legal fees, and potential regulatory fines, alongside the erosion of customer confidence.

Key considerations for Addtech include:

- Implementing multi-layered security protocols across all operations, from supply chain management to customer interactions.

- Investing in advanced threat detection and response systems to proactively identify and neutralize cyber risks.

- Ensuring compliance with evolving data protection regulations such as GDPR and CCPA, which carry significant penalties for non-compliance.

- Conducting regular employee training on cybersecurity best practices to mitigate human error, a common vector for breaches.

Emergence of New Materials and Manufacturing Processes

Innovations in materials science are rapidly reshaping industries. For Addtech, keeping pace with advancements like advanced composites and novel alloys is crucial. These materials can lead to lighter, stronger, and more durable components, directly impacting the performance and appeal of products distributed by Addtech. For instance, the aerospace sector, a key market for advanced materials, saw a significant increase in the use of composites in new aircraft designs throughout 2024, with projections indicating continued growth.

The evolution of manufacturing processes, particularly additive manufacturing (3D printing), presents both challenges and opportunities. Addtech must monitor how these technologies enable the creation of complex geometries and customized parts, which can open new distribution channels for specialized components. The global 3D printing market, valued at over $15 billion in 2024, is expected to expand significantly, driven by demand in sectors like automotive and healthcare, areas where Addtech could leverage new material and process capabilities.

- Additive manufacturing enables the creation of intricate, customized components previously impossible with traditional methods.

- Advanced composites offer superior strength-to-weight ratios, impacting performance in sectors like automotive and aerospace.

- The global 3D printing market is projected for substantial growth, reaching an estimated $70 billion by 2030, highlighting a key area for Addtech's strategic focus.

- Addtech's ability to distribute cutting-edge materials and components produced via these new processes will be vital for maintaining market relevance and identifying new growth avenues.

The rapid integration of artificial intelligence (AI) and machine learning (ML) is transforming product development and operational efficiency across Addtech's served industries. By 2024, AI in manufacturing was estimated to be a market worth over $10 billion, with significant growth expected as adoption increases.

Addtech can leverage AI for predictive maintenance in the systems it distributes, offering enhanced value to customers and creating new service revenue streams. Furthermore, AI-powered analytics can optimize supply chain logistics and inventory management, improving overall business agility.

The increasing demand for sustainable and energy-efficient technologies presents a substantial opportunity. Innovations in areas like renewable energy components and smart grid solutions are critical. The global market for energy-efficient technologies was valued at over $12 billion in 2023 and is projected to see robust growth through 2030.

Addtech's strategic focus on electrification and automation aligns perfectly with these technological shifts. By offering advanced components and systems that facilitate energy savings and reduced environmental impact, Addtech can capture market share and meet evolving customer demands for greener solutions.

| Technology Trend | 2024 Market Value (Est.) | Projected Growth Driver |

|---|---|---|

| AI in Manufacturing | >$10 Billion | Increased automation & predictive analytics adoption |

| Energy-Efficient Technologies | >$12 Billion | Focus on sustainability & regulatory compliance |

| Industrial IoT | ~$250 Billion | Smart factory implementation & data connectivity |

Legal factors

Addtech's global footprint necessitates rigorous compliance with a labyrinth of international trade laws. This includes navigating varying import/export regulations, customs tariffs, and sanctions regimes across different jurisdictions. For instance, in 2024, the World Trade Organization (WTO) reported increased scrutiny on trade compliance, with a 15% rise in investigations into non-tariff barriers.

Failure to adhere to these complex legal frameworks can result in severe repercussions. Penalties can range from substantial fines, such as the €10 million penalty levied against a major electronics firm in the EU in early 2025 for customs violations, to protracted legal battles. Such non-compliance also poses a significant risk to supply chain integrity and distribution channel stability, potentially halting operations.

Addtech, as a distributor of technical components, faces significant product liability risks and must adhere to rigorous safety regulations across its operating regions. Failure to ensure products meet these standards can lead to costly lawsuits and damage brand trust.

In 2024, the European Union continued to strengthen its product safety framework with updates to directives concerning general product safety and specific sector regulations, impacting how components are sourced and distributed. For instance, the General Product Safety Regulation (GPSR), which came into full effect in December 2024, places greater emphasis on the responsibilities of economic operators throughout the supply chain, including distributors like Addtech.

Compliance with these evolving legal landscapes is paramount. Addtech's commitment to quality assurance and rigorous vetting of suppliers is essential to mitigate potential recalls and legal entanglements, safeguarding its reputation and financial stability in the competitive tech market.

Addtech's distribution model hinges on respecting intellectual property rights (IPR). This means meticulously adhering to manufacturers' patents, trademarks, and copyrights to prevent legal entanglements and preserve crucial supplier partnerships.

Failure to manage IPR effectively could lead to costly litigation, impacting Addtech's operational stability and financial performance. For instance, in 2024, the global intellectual property market saw significant growth, with patent filings alone reaching record highs, underscoring the increasing importance of robust IP management strategies for technology distributors.

Competition Law and Anti-Trust Regulations

Addtech's operations across diverse market segments and its strategic use of acquisitions necessitate strict adherence to competition and anti-trust laws. These regulations are designed to prevent market monopolization and ensure fair play, which is crucial for Addtech's continued growth and market integrity. For instance, the European Union's General Block Exemption Regulation (GBER) allows for certain state aid measures that can support innovation and SMEs, indirectly impacting competitive landscapes where Addtech operates.

Regular legal scrutiny of Addtech's market activities and acquisition plans is paramount. This proactive approach ensures compliance with evolving regulatory frameworks, such as the Digital Markets Act (DMA) in the EU, which aims to create a fairer and more contestable digital market.

- Compliance with EU competition law, including merger control regulations, is essential for Addtech's acquisition strategies. For example, the European Commission reviewed 388 concentrations in 2023, a slight increase from the previous year, highlighting the active regulatory environment.

- Addtech must monitor and adapt to changes in anti-trust enforcement, particularly in sectors undergoing digital transformation where new competition concerns may arise.

- Regular legal audits of pricing, distribution agreements, and potential collaborations are necessary to avoid practices that could be deemed anti-competitive.

- Understanding and complying with national competition authorities' guidelines in each operational region is vital for mitigating legal risks.

Data Privacy and Protection Regulations (e.g., GDPR)

Addtech's operations are increasingly digital, meaning they manage a lot of data, from customer details to internal operational information. Staying compliant with data privacy laws like the General Data Protection Regulation (GDPR) is crucial. This ensures sensitive data is protected, builds customer confidence, and helps the company avoid hefty fines.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of annual global turnover or €20 million, whichever is higher.

- Data Breach Costs: In 2023, the average cost of a data breach globally reached $4.45 million, highlighting the financial impact of inadequate data protection.

- Consumer Trust: 76% of consumers stated that data privacy concerns would influence their decision to do business with a company in 2024.

Addtech's global operations necessitate strict adherence to international trade laws, including import/export regulations and sanctions, with the WTO noting increased scrutiny on trade compliance in 2024. Failure to comply can lead to substantial fines, such as the €10 million penalty imposed in the EU in early 2025 for customs violations, impacting supply chain stability.

Product liability and safety regulations are critical, especially with the EU's General Product Safety Regulation (GPSR) fully effective from December 2024, placing greater responsibility on distributors like Addtech. Intellectual property rights (IPR) are also paramount; in 2024, record patent filings underscored the need for robust IP management to avoid costly litigation.

Addtech must navigate competition and anti-trust laws, particularly with evolving frameworks like the EU's Digital Markets Act (DMA). Data privacy is also key, with GDPR fines potentially reaching 4% of global turnover and average data breach costs hitting $4.45 million in 2023, impacting consumer trust.

| Legal Area | Key Regulation/Trend | Impact on Addtech | Relevant Data/Example |

| International Trade | WTO Scrutiny on Trade Compliance | Navigating varied import/export rules and sanctions | 15% rise in investigations into non-tariff barriers (2024) |

| Product Safety | EU General Product Safety Regulation (GPSR) | Ensuring component safety and distributor responsibility | Full effect from December 2024 |

| Intellectual Property | Global IP Market Growth | Protecting patents, trademarks, and copyrights | Record patent filings in 2024 |

| Competition Law | EU Digital Markets Act (DMA) | Ensuring fair market practices and avoiding monopolization | European Commission reviewed 388 concentrations in 2023 |

| Data Privacy | GDPR Compliance | Protecting customer data and avoiding fines | Average data breach cost: $4.45 million (2023) |

Environmental factors

Environmental factors significantly impact Addtech's supply chain. Resource scarcity and fluctuating commodity markets directly affect the availability and cost of raw materials for the components and systems Addtech distributes. For instance, the price of copper, a key component in many electronic systems, saw a notable increase in early 2024, trading around $9,000 per metric ton, influenced by supply chain disruptions and increased demand from the green energy sector.

Climate change increasingly poses risks to Addtech's operations and those of its customers. More frequent and severe weather events, such as floods and heatwaves, can disrupt supply chains and impact manufacturing output. For instance, the European Environment Agency reported that the economic damage from weather and climate-related events in the EU alone reached €50.1 billion in 2023, highlighting the potential for significant operational and financial strain.

These disruptions necessitate proactive risk management strategies for Addtech. Diversifying sourcing locations and distribution networks can mitigate the impact of localized weather-related disruptions. Furthermore, investing in resilient infrastructure and supply chain technologies will be crucial for maintaining operational continuity and supporting Addtech's customer base in the face of escalating climate volatility.

Growing environmental concerns are driving stricter waste management and recycling regulations globally, directly affecting companies like Addtech that deal with electronic components. These regulations, often emphasizing extended producer responsibility and circular economy models, necessitate careful consideration of a product's entire lifecycle, from sourcing to end-of-life disposal.

For Addtech, this translates to a need for robust engagement with both suppliers and customers. Ensuring compliance means verifying that suppliers adhere to responsible manufacturing and material sourcing, while also guiding customers on proper e-waste handling and recycling programs. This proactive approach is becoming critical as countries like those in the European Union, for instance, continue to strengthen their e-waste directives, aiming for higher collection and recycling rates.

Energy Consumption and Carbon Footprint

As a technology trading group, Addtech's operations, including its supply chain, inherently contribute to energy consumption and carbon emissions. The increasing global emphasis on sustainability is pushing for reduced carbon footprints, influenced by both stricter environmental regulations and a growing customer preference for eco-friendly products and services. For instance, the European Union's Emissions Trading System (ETS) continues to evolve, with carbon prices fluctuating but generally trending upwards, incentivizing emission reductions across industries.

Addtech can leverage this trend by actively promoting energy-efficient products within its portfolio and by optimizing its logistics to minimize transportation-related emissions. Many businesses are setting ambitious net-zero targets; for example, a significant portion of Fortune 500 companies have announced net-zero commitments, signaling a strong market demand for sustainable solutions.

- Growing regulatory pressure: Governments worldwide are implementing stricter emissions standards, impacting supply chains and product lifecycles.

- Customer demand for green solutions: Consumers and business clients increasingly favor companies demonstrating environmental responsibility.

- Opportunities in energy efficiency: Addtech can enhance its market position by offering and supporting products that reduce energy consumption.

- Supply chain optimization: Streamlining logistics and sourcing can directly lower the group's overall carbon footprint.

Environmental Standards and Certifications

Addtech's operations are increasingly scrutinized for their environmental impact, making adherence to evolving standards crucial. For instance, the European Union's Green Deal, with its ambitious targets for climate neutrality by 2050, is driving stricter regulations across industries, impacting supply chains and manufacturing processes. Many of Addtech's key markets are implementing or strengthening their environmental compliance frameworks, potentially affecting market access and operational costs.

Demonstrating a commitment to environmental responsibility through certifications like ISO 14001 is becoming a significant differentiator. As of early 2024, a growing percentage of B2B transactions, particularly in sectors like electronics and industrial components where Addtech operates, are influenced by supplier sustainability credentials. Customers and partners are actively seeking suppliers that can prove their environmental management systems are robust, directly impacting business opportunities and partnership viability.

The push for sustainability is also evident in consumer preferences and investor sentiment. Reports from late 2023 and early 2024 indicate a rising demand for eco-friendly products and services, influencing purchasing decisions. Furthermore, investors are increasingly incorporating Environmental, Social, and Governance (ESG) factors into their decision-making, meaning Addtech's environmental performance can directly affect its attractiveness to capital markets and its overall valuation.

- Growing Regulatory Landscape: EU Green Deal aims for climate neutrality by 2050, influencing environmental regulations for businesses operating within or trading with Europe.

- Market Access Demands: Over 60% of large corporations surveyed in 2023 reported prioritizing suppliers with recognized environmental certifications, impacting Addtech's ability to secure contracts.

- Investor Scrutiny: ESG investment funds saw significant inflows in 2024, with environmental performance being a key evaluation criterion for portfolio allocation.

- Customer Preference Shift: Consumer and business surveys in late 2023 revealed a 25% increase in willingness to pay a premium for sustainably produced goods.

Environmental factors significantly shape Addtech's operational landscape, from resource availability to regulatory compliance. The increasing focus on climate change and sustainability necessitates proactive adaptation to mitigate risks and capitalize on emerging opportunities.

Stricter environmental regulations, such as the EU's Green Deal, are compelling companies like Addtech to re-evaluate their supply chains and product lifecycles. This regulatory push, coupled with growing customer demand for eco-friendly solutions, is driving a shift towards more sustainable business practices.

Addtech can leverage its position by promoting energy-efficient products and optimizing logistics to reduce its carbon footprint. Demonstrating strong environmental performance, often validated by certifications like ISO 14001, is becoming a critical factor for market access and investor appeal.

| Environmental Factor | Impact on Addtech | Data Point (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Supply chain disruptions, increased operational costs | EU economic damage from weather events: €50.1 billion (2023) |

| Resource Scarcity & Commodity Prices | Fluctuating raw material costs, potential supply shortages | Copper prices around $9,000/metric ton (early 2024) |

| Environmental Regulations (e.g., E-waste, Emissions) | Compliance costs, need for lifecycle management, potential market access restrictions | EU aiming for climate neutrality by 2050 (Green Deal) |

| Customer & Investor Demand for Sustainability | Competitive advantage, enhanced brand reputation, improved access to capital | 25% increase in willingness to pay a premium for sustainable goods (late 2023 surveys) |

PESTLE Analysis Data Sources

Our Addtech PESTLE Analysis is built on comprehensive data from reputable market research firms, government economic reports, and leading technology publications. We ensure each factor is grounded in current, fact-based insights from reliable sources.