Addtech Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addtech Bundle

Addtech operates within a dynamic market, facing significant pressures from intense rivalry and the constant threat of new entrants. Understanding the nuanced interplay of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Addtech’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Addtech's reliance on specialized, high-tech components means suppliers of these niche products can wield considerable influence. When manufacturers produce proprietary or uniquely designed parts, and few other companies can offer comparable alternatives, they gain leverage. This is particularly true if Addtech's product lines are heavily dependent on these specific components.

For instance, in the semiconductor industry, where Addtech operates, the concentration of advanced chip manufacturers means that suppliers of cutting-edge processors or memory modules can dictate terms. In 2024, the global semiconductor market, valued at over $600 billion, saw continued consolidation among key players, intensifying supplier power in specific segments.

While Addtech's in-house technical expertise allows them to effectively manage supplier relationships and understand the intricacies of these specialized markets, it doesn't negate the fundamental power imbalance. The ability to source critical, hard-to-find components is paramount to Addtech's business model, making supplier dependence a significant factor in their operational landscape.

Addtech cultivates enduring connections with key suppliers, a strategy designed to lessen supplier leverage. These partnerships often include preferential pricing and joint innovation efforts, making abrupt cost hikes or supply interruptions less probable.

For instance, in 2024, Addtech's top 10 suppliers accounted for approximately 65% of its total procurement costs, highlighting the significance of these relationships. The company's commitment to these long-term arrangements, as evidenced by its supplier retention rate of over 90% in the past five years, provides a degree of stability.

However, the inherent costs and complexities associated with severing these established ties mean suppliers retain a degree of influence, particularly concerning contract renewals and potential supply chain adjustments.

Addtech's proactive acquisition strategy significantly shapes supplier bargaining power. By integrating companies with diverse product lines and market access, Addtech can tap into new supply chains, reducing reliance on any single supplier.

For instance, in 2023, Addtech completed several acquisitions, expanding its presence in areas like industrial automation and power electronics. This diversification inherently dilutes the power of individual suppliers by providing alternative sourcing options and increasing Addtech's overall purchasing volume across a wider range of inputs.

This strategic integration allows Addtech to negotiate more favorable terms, as suppliers recognize Addtech's broader market reach and reduced dependence. Consequently, the bargaining power of suppliers is effectively mitigated as Addtech diversifies its supplier base and strengthens its overall procurement position.

Supplier's Ability to Forward Integrate

The bargaining power of Addtech's suppliers is influenced by their potential to forward integrate, meaning they could bypass Addtech and sell directly to end customers. If suppliers possess the capability and motivation to do so, their leverage over Addtech would naturally grow.

However, Addtech's business model, which includes providing significant value-added services, developing tailored solutions for clients, and nurturing strong, long-term customer relationships, presents a barrier to such direct supplier entry. These factors make it difficult for suppliers to simply step in and replicate Addtech's established role in the value chain.

- Supplier Forward Integration Threat: Suppliers' ability to bypass Addtech and reach customers directly increases their bargaining power.

- Addtech's Value Proposition: Addtech's customized solutions and value-added services create a competitive advantage, hindering supplier integration.

- Customer Relationships: Addtech's established customer base and loyalty make it harder for suppliers to replicate its market access.

Cost of Switching Suppliers

The cost of switching suppliers is a crucial factor influencing the bargaining power of suppliers in the Addtech ecosystem. When Addtech relies on highly technical or customized components, the expense and complexity associated with finding and integrating a new supplier can be substantial. These switching costs often include significant investments in re-engineering existing products, rigorous re-qualification processes for new parts, and the potential for considerable disruption to ongoing supply chains.

These substantial switching costs directly empower existing suppliers. For instance, if a key supplier for a specialized electronic component used in Addtech's solutions has a high degree of proprietary technology, Addtech might face millions in development and testing costs to transition to an alternative. This financial and operational barrier makes it less feasible for Addtech to switch, thereby strengthening the supplier's position to dictate terms, including pricing and delivery schedules.

Consider the scenario where Addtech sources a unique sensor technology. The cost to redesign the product around a different sensor, including new tooling, software integration, and extensive validation, could easily run into hundreds of thousands or even millions of euros. This economic reality means suppliers of such specialized items hold considerable leverage.

- High Switching Costs: Re-engineering, re-qualification, and supply chain disruption are significant expenses when changing suppliers for specialized components.

- Supplier Leverage: Substantial switching costs increase the bargaining power of existing suppliers, enabling them to command better terms.

- Financial Impact: For Addtech, the potential millions in costs associated with switching can make it economically unviable to change, reinforcing supplier influence.

The bargaining power of suppliers for Addtech is significant due to the specialized nature of many components and the concentration of key manufacturers in high-tech industries. This leverage is amplified when suppliers offer proprietary or uniquely designed parts with few comparable alternatives, particularly for critical inputs like advanced semiconductors. The global semiconductor market's value exceeding $600 billion in 2024, coupled with ongoing consolidation, underscores the intensified power of suppliers in specific segments.

Addtech's strategy of fostering long-term supplier relationships, including preferential pricing and joint innovation, aims to mitigate this power. However, the substantial costs and complexities involved in switching suppliers, especially for highly technical or customized components, mean suppliers retain considerable influence. These switching costs can involve millions in re-engineering and re-qualification, making it economically challenging for Addtech to change partners.

Acquisitions by Addtech, such as those in industrial automation and power electronics in 2023, help diversify its supply base and reduce reliance on individual suppliers. While this dilutes supplier power by offering alternatives and increasing Addtech's overall purchasing volume, the threat of supplier forward integration remains. Addtech's value-added services and strong customer relationships act as a barrier, making it difficult for suppliers to bypass Addtech and sell directly to end customers.

| Factor | Impact on Addtech | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | High leverage for key component providers | Semiconductor market over $600 billion, with ongoing consolidation |

| Switching Costs | Significant barrier to changing suppliers, empowering existing ones | Potential millions in re-engineering and re-qualification costs for specialized parts |

| Addtech's Mitigation Strategies | Long-term partnerships, acquisitions, value-added services | Acquisitions in industrial automation and power electronics in 2023 |

| Supplier Forward Integration Threat | Potential to bypass Addtech and reach end customers directly | Hindered by Addtech's tailored solutions and strong customer relationships |

What is included in the product

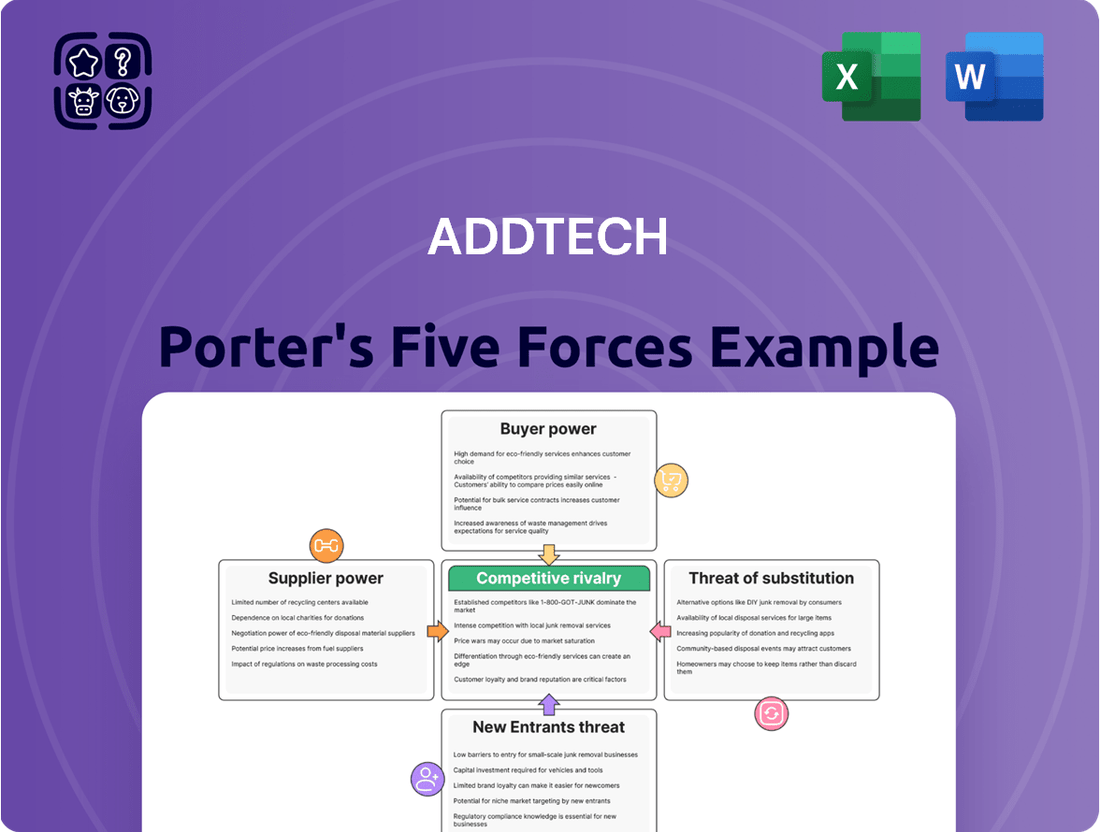

This analysis delves into the five forces shaping Addtech's competitive environment, assessing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its markets.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, allowing for proactive strategic adjustments.

Customers Bargaining Power

Addtech's diverse and stable customer base significantly tempers the bargaining power of individual customers. With operations spanning numerous subsidiaries, the company serves a wide array of clients primarily within the manufacturing and infrastructure industries. This broad reach means Addtech is not overly reliant on any single client, a crucial factor in mitigating demands from large buyers.

Addtech strategically positions itself by offering more than just component distribution; it provides deep technological and industrial expertise, along with customized solutions. This focus on value-added services means customers aren't just buying parts, but also specialized support and tailored integration.

This specialization significantly increases switching costs for Addtech's clients. Moving to another supplier would mean losing the specific technical know-how and bespoke support that Addtech delivers, thereby diminishing the bargaining power of customers who rely on this integrated expertise.

Addtech's strategy of focusing on niche markets for advanced technology products significantly impacts customer bargaining power. By concentrating on these specialized areas, the company seeks to establish dominant market positions.

In these select niches, customers often find a limited number of suppliers capable of providing the same highly specialized products and comprehensive solutions. This scarcity of alternatives inherently reduces the customers' leverage to demand lower prices or more favorable terms, thereby weakening their bargaining power.

Customer's Price Sensitivity and Volume

Addtech's customers exhibit varying degrees of price sensitivity, particularly large industrial or infrastructure clients who, due to high purchase volumes, can exert greater influence in demanding more favorable pricing. This leverage is a key factor in assessing customer bargaining power.

However, Addtech strategically mitigates this by emphasizing the economic value-added services and solutions it provides, moving beyond a purely price-driven negotiation. This focus on the total value proposition, which includes expertise and integrated offerings, helps to lessen the impact of raw price comparisons.

- High-volume clients, such as those in infrastructure projects, represent a significant segment where price sensitivity can be more pronounced.

- Value-added services, including technical support and customized solutions, are crucial in differentiating Addtech and reducing reliance on price alone.

- Addtech's strategy aims to anchor customer relationships on performance and total cost of ownership rather than just the initial purchase price.

Customer's Ability to Vertically Integrate

Customers' ability to vertically integrate poses a potential threat. If customers could easily produce components or systems themselves, or bypass Addtech to deal directly with manufacturers, it would weaken Addtech's position. This backward integration is a key aspect of customer bargaining power.

However, for most of Addtech's diverse customer base, this is a significant hurdle. Addtech's value proposition lies in its extensive product portfolio sourced from numerous suppliers, coupled with specialized expertise and efficient logistics. For a customer to replicate this, they would need to invest heavily in managing a complex web of supplier relationships, inventory, and technical support, which is often impractical and cost-prohibitive.

- Customer Integration Challenge: Replicating Addtech's broad product access and logistical efficiency through in-house production or direct sourcing is complex and expensive for most customers.

- Addtech's Value Proposition: Addtech provides a consolidated, expert-driven solution, simplifying procurement and technical challenges for its clients.

- Cost-Benefit Analysis: The high cost and complexity of vertical integration often outweigh the potential benefits for customers, reinforcing Addtech's role as a crucial intermediary.

The bargaining power of Addtech's customers is generally moderate, influenced by factors like customer size, product specialization, and the availability of alternatives. While large, high-volume clients can exert pressure on pricing, Addtech mitigates this through its value-added services and focus on total cost of ownership. The complexity and cost of vertical integration for customers further limit their leverage.

| Customer Segment | Price Sensitivity | Influence on Addtech | Mitigation Strategy |

|---|---|---|---|

| High-volume industrial clients | High | Significant | Value-added services, total cost of ownership focus |

| Niche technology adopters | Moderate | Limited | Specialized solutions, high switching costs |

| Small to medium enterprises | Moderate to High | Low to Moderate | Efficient logistics, broad product access |

Preview Before You Purchase

Addtech Porter's Five Forces Analysis

This preview showcases the complete Addtech Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document displayed here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises. You're looking at the actual document, ready for immediate download and use the moment you buy, providing you with actionable insights.

Rivalry Among Competitors

Addtech's focus on specialized niche markets for advanced technology products means competition can be particularly sharp within these segments. While the overall market might seem less crowded, the battle for dominance among a few key players in these specific niches is often intense.

Addtech's decentralized structure, with over 150 independent subsidiaries, fuels intense internal competition as each unit strives for market leadership under its own brand. This fosters an entrepreneurial spirit, driving innovation and localized strategies. For instance, in 2023, Addtech's revenue grew by 18% to SEK 53.2 billion, demonstrating the success of this distributed approach in achieving overall group growth.

Addtech's strategy of continuous acquisitions, evidenced by its consistent deal-making, actively fuels competitive rivalry. This rapid expansion through mergers and acquisitions suggests a dynamic market where companies are constantly seeking to strengthen their positions and consolidate market share, leading to intensified competition for both customers and promising acquisition targets.

Differentiation Through Value-Add

Addtech distinguishes itself by offering more than just products; it provides technological and industrial expertise. This value-added approach includes customized solutions and services that competitors find difficult to match, thereby mitigating direct price wars.

This strategy creates a more robust competitive advantage by focusing on unique benefits rather than solely competing on cost. For instance, in 2024, Addtech's focus on integrated solutions for the manufacturing sector, which often involves significant technical support and bespoke engineering, allowed them to maintain strong margins even amidst broader economic pressures.

- Value-Added Services: Addtech's commitment to providing technical support, training, and after-sales service differentiates its offerings.

- Customized Solutions: The company's ability to tailor products and services to specific client needs reduces direct competition based purely on price.

- Technological Expertise: Addtech leverages its deep understanding of industrial processes and technologies to offer solutions that enhance efficiency and performance for its customers.

- Reduced Price Sensitivity: By emphasizing unique benefits and expertise, Addtech fosters customer loyalty that is less susceptible to price fluctuations in the market.

Organic Growth and Market Position

Addtech's consistent organic growth across its diverse business segments, a trend evident in its sustained revenue increases, highlights its capacity to outpace competitors and expand market share organically. For instance, the company reported a significant increase in net sales for the fiscal year ending April 30, 2024, reaching SEK 21,943 million, up from SEK 18,269 million in the prior year.

This robust growth trajectory, coupled with Addtech's strategic focus on achieving leading positions within specialized niche markets, directly intensifies rivalry. By effectively leveraging its technological expertise and market understanding, Addtech presents a formidable challenge to incumbents who may rely on broader, less specialized strategies.

- Sustained Organic Growth: Addtech's ability to grow without relying on acquisitions underscores its competitive strength in existing markets.

- Niche Market Leadership: The company's ambition to dominate specific niches creates direct competitive pressure on rivals operating in those same areas.

- Market Share Capture: Addtech's continuous expansion into market potential means it is actively taking business from competitors.

- Financial Performance Indicator: The reported net sales increase to SEK 21,943 million for FY24 demonstrates tangible market success against rivals.

Addtech faces intense rivalry within its specialized technology niches, where a few dominant players often vie for market share. This is amplified by Addtech's decentralized structure, fostering internal competition among its numerous subsidiaries, each aiming for leadership. For example, Addtech's revenue growth of 18% to SEK 53.2 billion in 2023 illustrates the success of this competitive model.

The company's active acquisition strategy further escalates competition, as it consolidates market positions and targets promising businesses. Addtech's emphasis on value-added services, such as technical expertise and customized solutions, helps it differentiate from competitors and reduces direct price-based rivalry. This focus on unique benefits, exemplified by their 2024 integrated solutions for manufacturing, allows them to maintain strong margins.

| Metric | Value (SEK Billion) | Year |

|---|---|---|

| Total Revenue | 53.2 | 2023 |

| Net Sales | 21.9 | FY24 (ending April 30) |

| Net Sales (Previous Year) | 18.3 | FY23 (ending April 30) |

SSubstitutes Threaten

Customers might bypass Addtech's distributor model by sourcing components directly from manufacturers or exploring alternative distribution channels. This threat is somewhat mitigated by Addtech's value proposition, which extends beyond mere product delivery.

Addtech differentiates itself by providing crucial value-added services, including expert technical support and tailored solutions, making direct procurement less appealing for many clients. For instance, in 2023, Addtech reported that its technical support services were utilized by over 70% of its key accounts, highlighting the importance of this offering in retaining customers.

Large customers, particularly those with significant technical needs, might explore developing their own in-house capabilities for the specialized technical solutions and system integration services that Addtech offers. This would necessitate considerable investment in research and development, acquiring highly skilled personnel, and building robust infrastructure.

However, the substantial upfront investment and the ongoing operational costs associated with creating and maintaining these internal capabilities act as significant deterrents. For instance, a company looking to replicate Addtech's expertise in industrial automation would need to invest millions in specialized engineering talent and advanced testing equipment, making it a financially unviable substitute for most.

Furthermore, the high switching costs already embedded in Addtech's existing customer relationships, often tied to long-term contracts and integrated systems, further diminish the attractiveness of developing in-house alternatives. These factors collectively reduce the threat of substitutes stemming from in-house development capabilities for Addtech.

The threat of substitutes for Addtech is significant due to the rapid pace of technological advancement. New technologies can emerge that fulfill similar customer needs using different underlying components or systems, potentially disrupting Addtech's existing markets. For instance, advancements in AI-driven automation could offer alternatives to some of the industrial technology solutions Addtech provides.

Addtech actively addresses this threat by prioritizing sustainable development and maintaining a high degree of adaptability to new innovations. This forward-thinking approach ensures their continued relevance in a dynamic market. By continuously evolving their product and service offerings, Addtech aims to stay ahead of emerging substitute technologies and maintain its competitive edge.

Standardized Product Availability

For highly standardized components, the threat of substitutes can be significant as customers can easily switch to alternative suppliers or online marketplaces. However, Addtech's strategic emphasis on advanced technology products and solutions within selected niches significantly mitigates this threat. This specialization means that many of Addtech's offerings are not easily interchangeable with generic alternatives.

Addtech's business model, which centers on providing specialized and often proprietary technological solutions, inherently limits the availability of direct substitutes. This focus on niche markets means that customers seeking these advanced capabilities are less likely to find readily available, lower-quality alternatives that can fulfill their specific needs. For instance, in the industrial automation sector where Addtech operates, specialized sensors or control systems often require specific integration and expertise, making direct substitution difficult.

- Niche Specialization: Addtech's focus on advanced technology in specific niches reduces the threat from easily substitutable commoditized products.

- Proprietary Solutions: Many of Addtech's offerings are likely proprietary or require specialized knowledge, making direct substitution challenging for customers.

- Limited Interchangeability: The nature of advanced technology products means they are often not directly interchangeable with simpler or generic alternatives.

Cost-Benefit of Integrated Solutions

Addtech's strategy of bundling products with specialized expertise and services creates a significant barrier for substitutes. Customers often find the total cost and complexity of sourcing, integrating, and managing individual components from various suppliers to be higher than opting for Addtech's all-inclusive approach.

For instance, in the industrial automation sector, where Addtech is active, the integration of disparate systems can lead to significant downtime and require specialized engineering knowledge. A 2024 industry survey indicated that over 60% of businesses consider system integration a major challenge, making integrated solutions highly attractive.

- Integrated Solutions vs. Piece-Meal Approach: Addtech's offering reduces the perceived risk and effort for customers.

- Expertise as a Differentiator: The value of Addtech's technical support and application knowledge is hard for standalone product suppliers to replicate.

- Total Cost of Ownership: While individual components might seem cheaper, the hidden costs of integration often favor bundled solutions.

- Complex Industrial Applications: The higher the complexity of the need, the greater the deterrent effect of substitutes that lack integration capabilities.

The threat of substitutes for Addtech is moderated by its focus on specialized, high-value technology solutions rather than commoditized products. While customers could theoretically source components directly or explore alternative distribution channels, Addtech's integrated approach, encompassing technical support and tailored solutions, makes this less appealing. For example, in 2023, Addtech noted that over 70% of its key accounts utilized its technical support, underscoring its importance in customer retention.

Entrants Threaten

The technology trading and distribution sector, especially in Addtech's specialized areas, presents a formidable barrier to new entrants due to substantial capital needs. Companies looking to break in must invest heavily in stocking diverse product lines, establishing efficient logistics, and hiring highly skilled technical staff, a significant hurdle for newcomers.

Furthermore, replicating Addtech's established competitive advantages is incredibly challenging. The company boasts deep technical expertise accumulated over years, coupled with an expansive network of over 150 subsidiaries and deeply entrenched, long-standing relationships with both suppliers and customers, making it difficult for new players to gain traction.

Addtech benefits from a broad and stable customer base, cultivated through years of providing customized solutions and a deep understanding of their specific needs. This established trust makes it difficult for newcomers to gain a foothold.

New entrants would face a significant challenge in replicating these deep-seated relationships and overcoming the loyalty Addtech has fostered. The high switching costs associated with integrated solutions further solidify this barrier.

Addtech's aggressive acquisition strategy is a powerful deterrent to new market entrants. By continuously acquiring promising companies, Addtech not only expands its own capabilities but also effectively removes potential future competitors from the landscape. This consolidation makes it significantly harder for new players to establish a foothold.

In 2023, Addtech completed 17 acquisitions, a testament to its proactive approach. This high volume of M&A activity means that many innovative startups, which could have otherwise emerged as disruptive forces, are absorbed into Addtech's existing structure, thereby raising the barrier to entry considerably.

Economies of Scale and Scope

Addtech's substantial size, with annual sales approaching SEK 22 billion and a presence across diverse technology segments, creates significant economies of scale. This scale translates into cost advantages in areas like purchasing, supply chain management, and overhead, making it difficult for newcomers to match their efficiency without a similar initial footprint.

New entrants would struggle to replicate Addtech's cost structure. Achieving comparable procurement power or spreading administrative costs across a broad operational base requires substantial upfront investment and market penetration, which is a considerable barrier.

- Economies of Scale: Addtech's SEK 22 billion in annual sales allows for bulk purchasing discounts and optimized logistics, driving down per-unit costs.

- Economies of Scope: Operating across multiple technology sectors enables Addtech to leverage shared resources and expertise, further reducing operational expenses.

- High Entry Costs: New entrants would need to invest heavily to achieve a similar scale and scope, making it economically prohibitive to compete effectively from the start.

- Procurement Power: Addtech's large order volumes grant them superior negotiating power with suppliers compared to smaller, emerging companies.

Regulatory and Certification Hurdles

The threat of new entrants in the technology sector, particularly for a company like Addtech, is significantly influenced by regulatory and certification hurdles. Navigating complex compliance landscapes, such as those in industrial automation or advanced materials, requires substantial investment in time and resources. For instance, in 2024, the average time to obtain key certifications for new electronic components could extend to over six months, coupled with costs ranging from thousands to tens of thousands of dollars.

These stringent requirements act as a formidable barrier. New players must not only develop innovative products but also demonstrate adherence to a multitude of standards, which can be a daunting and costly undertaking. This process often involves rigorous testing, documentation, and audits, making it difficult for smaller or less-resourced companies to enter the market effectively.

- Regulatory Compliance Costs: New entrants may face significant upfront costs for legal counsel, compliance officers, and the testing required to meet industry-specific regulations.

- Certification Lead Times: Obtaining necessary certifications can take several months, delaying market entry and product launch for new competitors.

- Quality and Safety Standards: Adherence to high quality and safety standards, often mandated by industry bodies, requires robust internal processes and investments in quality control, which new entrants may struggle to establish quickly.

The threat of new entrants for Addtech is considerably low due to the significant capital investment required to establish operations, including inventory, logistics, and skilled personnel. Furthermore, Addtech's deeply entrenched relationships with over 150 subsidiaries and its extensive customer base, built on years of trust and customized solutions, create formidable barriers that new players struggle to overcome.

Addtech's aggressive acquisition strategy, evidenced by 17 acquisitions in 2023, actively removes potential competitors, raising entry barriers. The company's substantial annual sales, approaching SEK 22 billion, generate economies of scale and procurement power that smaller entrants cannot easily match.

Navigating complex regulatory and certification landscapes, which can take over six months and cost tens of thousands of dollars in 2024, presents another significant hurdle for new entrants in Addtech's specialized technology sectors.

| Factor | Addtech's Advantage | Impact on New Entrants |

| Capital Investment | Established infrastructure and scale | High initial costs for inventory, logistics, and talent |

| Relationships & Expertise | Extensive network, deep technical knowledge, long-term customer loyalty | Difficulty gaining market access and customer trust |

| Acquisition Strategy | Proactive market consolidation | Reduced opportunities for organic growth or acquisition by newcomers |

| Economies of Scale | SEK 22 billion annual sales, bulk purchasing power | Inability to match cost efficiencies and pricing |

| Regulatory Hurdles | Experience navigating compliance | Significant time and financial investment for certifications (e.g., 6+ months in 2024) |

Porter's Five Forces Analysis Data Sources

Our Addtech Porter's Five Forces analysis is built upon a foundation of data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from reputable financial news outlets and trade publications to capture current market dynamics and competitive pressures.