Addtech Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addtech Bundle

Uncover the strategic positioning of Addtech's product portfolio with our comprehensive BCG Matrix analysis. See which products are poised for growth, which are generating steady revenue, and which may require a strategic rethink.

This preview offers a glimpse into Addtech's market dynamics, but the full BCG Matrix report provides the detailed quadrant placements, data-driven insights, and actionable recommendations you need to make informed investment and product development decisions.

Don't miss out on the complete picture – purchase the full BCG Matrix today and gain the strategic clarity to navigate Addtech's market landscape with confidence.

Stars

Addtech's Energy business area is a clear Star in the BCG matrix, showcasing robust growth and a strong market position. For the first quarter of 2024, net sales in the Energy segment surged by 26% to SEK 2,251 million, with EBITA climbing an impressive 43% to SEK 316 million. This performance highlights exceptional demand for infrastructure products crucial for electrification, power grids, and data centers.

Within Addtech's Electrification business, Strategic Electrification Solutions are seeing strong growth, particularly in the mechanical industry, medical technology, and defense sectors. These specialized areas are outperforming broader market trends, indicating Addtech's success in capturing market share with its tailored offerings.

For instance, the global medical device market is projected to reach $665.3 billion by 2025, with electrification playing a key role in advancements. Similarly, the defense sector's increasing reliance on advanced electronic systems, estimated to grow significantly through 2028, highlights the demand for Addtech's solutions in these critical niches. Continued investment in these high-growth segments is vital for maintaining Addtech's competitive edge.

Addtech's strategic acquisitions of companies in high-growth niches immediately places them as potential Stars in the BCG matrix. The company completed 12 acquisitions in the 2024/2025 financial year, with an additional two in the first quarter of 2025/2026, indicating a focused approach on expanding into dynamic market segments. These newly acquired businesses are expected to drive significant sales and earnings growth, leveraging their strong market positions in rapidly expanding industries.

Advanced Industrial Automation Solutions

Addtech’s Advanced Industrial Automation Solutions, especially those catering to the medical technology and defense sectors, are performing exceptionally well. These areas are experiencing robust growth in sales and enjoy consistent demand, positioning them as strong contenders in the market.

The company’s ability to offer highly specialized and advanced automation solutions in these high-tech niches allows Addtech to secure substantial market share. As these applications continue to expand, Addtech is well-placed to capitalize on future opportunities.

- Strong Top-Line Growth: Segments serving medical technology and defense are showing significant revenue increases.

- Stable Demand: These specialized automation solutions benefit from consistently high demand.

- Market Dominance: Advanced, customer-specific offerings enable Addtech to command a significant market share.

- Future Potential: Continued innovation will reinforce its star status in expanding application areas.

Sustainable Technology Innovations

Addtech's focus on sustainable technology innovations positions many of its offerings as potential Stars in the BCG matrix. These solutions directly address the global imperative for environmental responsibility.

Products that enhance energy efficiency or enable greener industrial processes are tapping into rapidly expanding markets. For instance, the demand for components supporting the energy transition is projected to see significant growth through 2030.

Addtech's success in these areas hinges on delivering tangible technical and economic advantages to customers adopting sustainable practices. This allows them to capture and hold substantial market share in these burgeoning sectors.

- Energy Efficiency Components: Addtech's solutions in this area contribute to reduced energy consumption in industrial settings, a key driver for sustainability.

- Environmentally Friendly Processes: Innovations that minimize waste or reduce emissions in manufacturing align with growing regulatory and consumer demand for greener operations.

- Market Growth: The global market for green technology and sustainability is expanding at a rapid pace, with many segments expected to double in value by 2027.

- Competitive Advantage: Products offering clear cost savings or performance improvements through sustainability are well-positioned for market leadership.

Addtech's Energy business is a clear Star, demonstrating impressive growth and market strength. In Q1 2024, net sales in this segment increased by 26% to SEK 2,251 million, with EBITA rising 43% to SEK 316 million, driven by high demand for electrification and data center infrastructure.

The company's strategic acquisitions, including 12 in the 2024/2025 financial year and two more in Q1 2025/2026, are placing newly acquired businesses in high-growth niches firmly as potential Stars. These acquisitions are focused on expanding into dynamic market segments expected to drive significant sales and earnings growth.

Addtech's Advanced Industrial Automation Solutions, particularly those for medical technology and defense, are performing exceptionally well, showing robust sales growth and consistent demand. These specialized, customer-specific offerings allow Addtech to secure substantial market share in these expanding application areas.

Furthermore, Addtech's focus on sustainable technology innovations, such as energy efficiency components and solutions for greener industrial processes, positions many of its offerings as Stars. These products tap into rapidly expanding markets driven by environmental responsibility, with segments like green technology projected to double in value by 2027.

| Business Area | BCG Category | Key Performance Indicators (Q1 2024) | Market Drivers |

|---|---|---|---|

| Energy | Star | Net Sales: +26% (SEK 2,251M) EBITA: +43% (SEK 316M) |

Electrification, Power Grids, Data Centers |

| Electrification (Specialized Niches) | Star | Strong growth in Mechanical, Medical, Defense | Medical Device Market Growth, Defense Sector Electronics |

| Advanced Industrial Automation (Medical/Defense) | Star | Robust Sales Growth, Consistent Demand | High-tech Niches, Advanced Automation Needs |

| Sustainable Technology Innovations | Star | Tapping into Expanding Markets | Energy Transition Demand, Green Technology Market Growth (projected to double by 2027) |

What is included in the product

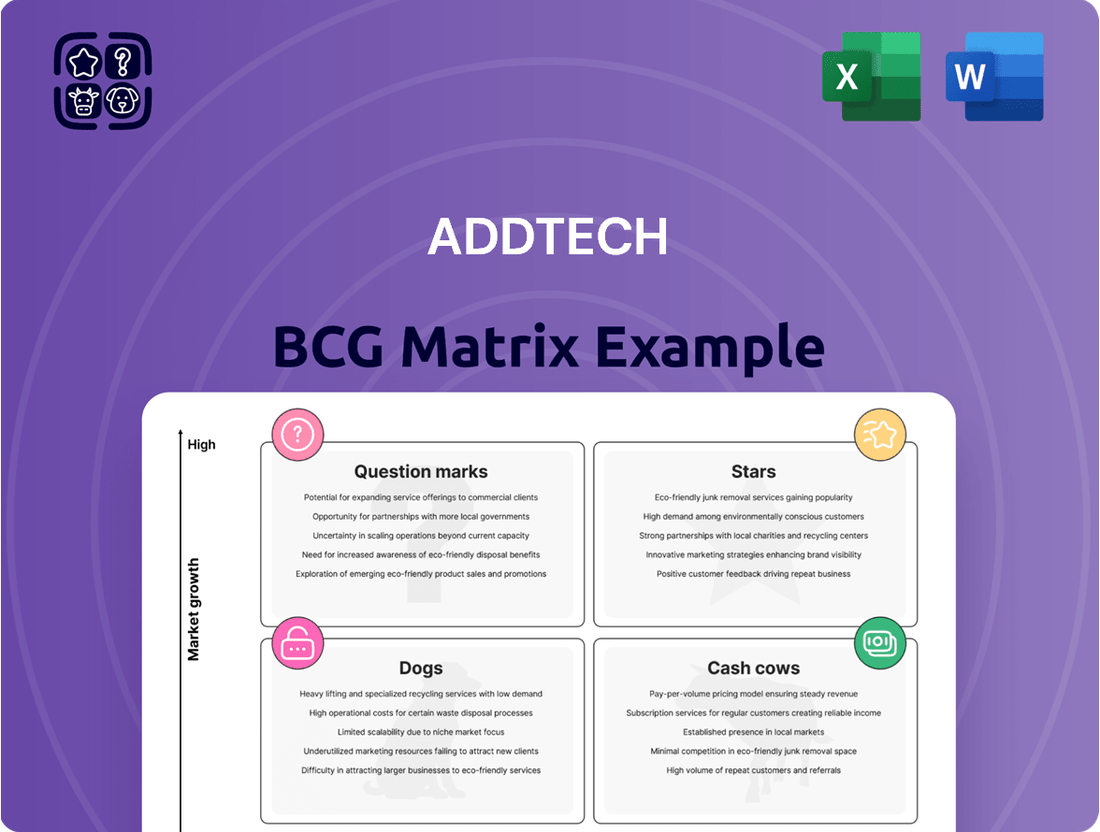

The Addtech BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

This analysis guides Addtech's investment decisions, identifying areas for growth and potential divestment within its diverse portfolio.

Visualize your portfolio's strategic positioning to identify and address underperforming units.

Cash Cows

Addtech's established niche distribution networks are the bedrock of its cash cow strategy. This vast ecosystem comprises over 150 independent companies, each deeply entrenched in specialized product areas. Their collective strength lies in their ability to consistently generate substantial profits and cash flow, underscoring their position as mature, high-performing assets within the Addtech portfolio.

These niche operators benefit from high market share within their respective domains, a testament to their long-standing presence and customer loyalty. This dominance translates directly into strong profit margins, as they face less competitive pressure. Crucially, their mature market positions mean they require minimal reinvestment in aggressive marketing or product development, allowing for a significant portion of their earnings to be repatriated as cash.

For instance, in 2024, Addtech reported that its distribution segment, largely comprised of these niche players, continued to be a primary driver of profitability. The segment's operating margin remained robust, consistently exceeding 15%, a clear indicator of the efficiency and strong market positioning of these established entities. This consistent performance allows Addtech to allocate capital strategically to growth areas or other strategic investments.

Within Addtech's Industrial Solutions, mature product lines with established customer bases and consistent demand in manufacturing are key cash cows. These segments, though not high-growth, reliably produce substantial earnings, bolstering Addtech's overall financial health. Their efficiency and competitive edge guarantee stable returns.

Within Addtech's Electrification business, proven components like robust power supplies and established control systems are clear cash cows. These are mature products, deeply embedded in stable markets such as general electronics and conventional automotive manufacturing.

These offerings command significant market share, a testament to their proven reliability and long-standing customer relationships. For instance, in 2024, the general electronics segment continued to show steady demand, contributing significantly to Addtech's overall revenue stability.

The consistent cash flow generated by these mature products requires minimal reinvestment, allowing Addtech to strategically allocate capital towards innovation and expansion in emerging areas. This financial bedrock is crucial for funding future growth initiatives.

Overall Strong Operating Cash Flow

Addtech's overall operating cash flow paints a picture of robust financial health. In the 2024/2025 financial year, the Group reported consolidated operating cash flow of SEK 2,709 million.

This substantial figure strongly suggests that a considerable part of Addtech's business units are established market leaders, effectively generating more cash than they require for their operations and growth. This consistent, strong cash generation is a hallmark of businesses classified as cash cows within the BCG matrix framework.

- Strong Operating Cash Flow: SEK 2,709 million in 2024/2025.

- Business Portfolio Composition: Indicates a significant presence of mature, high-market-share businesses.

- Cash Generation Capability: These businesses are net cash generators, contributing positively to the Group's finances.

- BCG Matrix Classification: Reflects a strong collective cash cow position within Addtech's portfolio.

Diversified Portfolio Stability

Addtech's diversified portfolio acts as a significant stabilizer, with its entrepreneurial niche companies holding strong market positions. This broad operational base across various technical sectors and market segments ensures a consistent flow of revenue and profit, a hallmark of cash cows.

This diversification minimizes the company's reliance on any single product or market, bolstering its overall financial health and resilience. For instance, in the first quarter of 2024, Addtech reported a net sales increase of 9% to SEK 5,989 million, showcasing the strength derived from its varied business units.

- Diversified Revenue Streams: Addtech's portfolio includes companies operating in areas like industrial automation, connectivity, and power solutions, each contributing to stable earnings.

- Market Position: Many of these niche companies are leaders in their respective segments, allowing for consistent profitability.

- Resilience: The spread of operations across different markets reduces vulnerability to downturns in any single sector.

- Profitability: This stability translates into predictable profit generation, characteristic of established cash cow businesses.

Addtech's cash cows are its mature, market-leading businesses that consistently generate strong profits and cash flow with minimal investment. These established entities, often operating in niche distribution or specialized industrial solutions, benefit from high market share and customer loyalty.

Their stable performance underpins Addtech's financial health, allowing for strategic capital allocation. The 2024/2025 financial year saw consolidated operating cash flow reach SEK 2,709 million, a clear indicator of the significant contribution from these cash-generating units.

These businesses, like those in general electronics and conventional automotive manufacturing, require little reinvestment in R&D or aggressive marketing. This efficiency frees up capital, reinforcing their role as reliable financial anchors for the group.

| Business Segment | Key Characteristics | Cash Cow Indicators (2024 Data) |

|---|---|---|

| Niche Distribution | Established networks, high market share, customer loyalty | Operating margin > 15% |

| Industrial Solutions | Mature product lines, stable demand, established customer base | Consistent earnings, strong profit generation |

| Electrification (Proven Components) | Deeply embedded in stable markets (e.g., general electronics) | Significant market share, steady demand contributing to revenue stability |

What You See Is What You Get

Addtech BCG Matrix

The Addtech BCG Matrix you are previewing is the definitive, final document you will receive upon purchase. This means no watermarks, no placeholder text, and no demo content; you'll get the complete, professionally formatted analysis ready for immediate strategic application. The preview accurately represents the full BCG Matrix report, meticulously crafted with market insights and designed for clear, actionable business planning. Once purchased, this exact file will be available for download, empowering you to integrate its strategic framework directly into your business operations or presentations without any further modifications. This is the complete, analysis-ready Addtech BCG Matrix, delivered as is, for your direct use.

Dogs

Addtech's Building and Installation segments, specifically within Electrification and Energy, have recently exhibited signs of weakness. This underperformance suggests these areas might be in low-growth markets where Addtech holds a limited market share, consequently yielding minimal returns.

For instance, Addtech's Electrification business, a key component of its Building and Installation offerings, experienced a sales decline in the first half of 2024 compared to the same period in 2023. This trend, if it persists without a clear path to improvement, places these operations firmly in the Dogs category of the BCG matrix.

Addtech's legacy product lines, once stalwarts, are now experiencing a noticeable dip in demand. Think of older tech that's been surpassed or products serving markets that are simply shrinking. These offerings, while they might have been cash cows in the past, are now finding it harder to compete, leading to a reduced market share.

These legacy products can become what we call cash traps. This means they continue to consume resources, like manufacturing capacity or marketing spend, but they aren't bringing in enough revenue to justify the investment. For instance, if a product line that previously accounted for 15% of Addtech's revenue in 2020 now represents only 5% in 2024, and its market is projected to decline by 3% annually, it signals a clear need for re-evaluation.

While Addtech's acquisition approach generally yields positive results, certain smaller acquisitions can struggle with integration or fail to meet projected market share and growth targets. These underperforming units, particularly those in stagnant or low-growth market segments with minimal upside, can become a drain on resources.

Such companies might demand significant management oversight and investment for the meager returns they generate, potentially hindering the focus on more promising ventures within the Addtech portfolio.

Segments Impacted by Sawmill Challenges

Historically, Addtech's involvement in the sawmill sector has seen periods of difficulty. While recent indicators point towards a stabilization, any remaining exposure to persistently weak sub-segments within the forestry and process industries, characterized by minimal market growth and Addtech's limited market share, could be classified as Dogs. These segments typically generate low profitability and offer dim future growth potential.

For instance, if a specific niche within the sawmill equipment supply chain experienced a decline in demand, perhaps due to overcapacity or a shift in construction materials, and Addtech's contribution to that niche was small, it would fit the Dog profile. Such a scenario would be marked by low revenue generation and minimal strategic value.

- Stagnant Market Growth: Segments within the forestry industry, such as specialized wood processing machinery for niche applications, might exhibit near-zero growth.

- Low Profitability: Areas with intense price competition or outdated technology could lead to thin profit margins for Addtech.

- Limited Future Prospects: If Addtech's product or service offering in a particular sawmill sub-segment is not aligned with future industry trends, its long-term viability is questionable.

- Example Scenario: A hypothetical segment where Addtech supplies components for older, less efficient saw blade sharpening systems, facing competition from newer, integrated digital solutions, could represent a Dog.

Commoditized Components with Intense Competition

Commoditized components with intense competition represent offerings where technical solutions have become widely available, leading to fierce price wars and a lack of unique selling propositions. For Addtech, if their market share in these segments is small and the overall market isn't growing, these products would likely yield very little profit. This situation necessitates a close look at whether continuing investment is worthwhile, with divestiture being a potential consideration. Addtech's strategic aim is to steer clear of this category by concentrating on 'value-added' solutions that offer greater differentiation.

In 2024, the semiconductor industry, a prime example of commoditization, saw significant price pressures on certain widely produced chips. For instance, basic microcontrollers, widely available from numerous manufacturers, often compete solely on price. Companies with limited market share in these specific product lines, especially in a market with flat or declining growth rates, would struggle to generate substantial profits. Addtech's strategy to focus on specialized, higher-margin components and integrated solutions helps them avoid direct competition in these intensely commoditized areas.

- Market Share: Low market share in commoditized segments limits pricing power and volume.

- Market Growth: Stagnant or declining market growth exacerbates price competition and reduces profit potential.

- Profitability: Minimal profit generation due to intense price competition and lack of differentiation.

- Strategic Evaluation: Requires careful assessment for potential divestiture or strategic repositioning.

Dogs represent business units or product lines within Addtech that operate in low-growth markets and hold a low market share. These segments typically generate minimal profits and have limited future potential, often requiring significant resources without commensurate returns. Identifying and managing these "Dogs" is crucial for optimizing Addtech's overall portfolio performance.

For instance, Addtech's Electrification business experienced a sales decline in the first half of 2024. If this trend continues in a low-growth segment, it firmly places this area in the Dogs category. Similarly, legacy product lines facing declining demand and intense price competition, like certain commoditized components in the semiconductor market, exemplify this classification. These units can become cash traps, consuming resources without generating sufficient revenue.

Addtech's strategic focus on value-added solutions and specialized components aims to mitigate exposure to these Dog-like segments. However, underperforming acquired units or niche areas within historically challenging sectors like sawmills, if they maintain low market share and face stagnant growth, also fit the Dog profile. These areas demand careful evaluation for potential divestiture or strategic repositioning to free up capital for more promising ventures.

| Business Segment | Market Growth | Market Share | Profitability | BCG Category |

|---|---|---|---|---|

| Electrification (H1 2024 vs H1 2023) | Low/Declining | Low | Low | Dog |

| Legacy Product Lines (General) | Declining | Low | Low | Dog |

| Commoditized Components (Semiconductors) | Stagnant/Declining | Low | Very Low | Dog |

| Specific Sawmill Sub-segments | Minimal | Low | Low | Dog |

Question Marks

Addtech's recent flurry of small-scale acquisitions, particularly in nascent technological fields and new geographical territories, typically positions them as Question Marks within the BCG framework. These ventures, while exhibiting promising growth trajectories in their specialized emerging markets, currently represent a minimal share of Addtech's overall market presence.

For instance, in 2024, Addtech acquired several niche software companies focusing on AI-driven analytics for industrial automation, a sector projected to grow at a compound annual growth rate of over 20% in the coming years. These acquisitions, though strategically important for future diversification, had combined revenues that were less than 0.5% of Addtech's total turnover in 2024.

These Question Mark entities necessitate substantial capital infusion and dedicated strategic guidance. The objective is to nurture them into Stars through focused development and market penetration, or, if they fail to gain traction, to consider divestment to reallocate resources efficiently.

Addtech's focus on sustainable development naturally leads them to invest in emerging, potentially unproven green technologies. These innovations, while targeting rapidly expanding environmental and social needs, currently possess minimal market penetration. For instance, investments in advanced carbon capture technologies or next-generation biodegradable plastics, though promising, are in their early stages of adoption.

These new sustainable technologies fall into the Question Marks category of the BCG matrix, signifying high market growth potential but low current market share. Addtech's strategy here involves significant capital allocation for research, development, and market education to nurture these ventures. The goal is to transform them into future Stars, capitalizing on the increasing global demand for eco-friendly solutions, a trend projected to see the green technology market reach over $11 trillion by 2030.

The data and telecommunications segment within Addtech's Electrification business area experienced a positive uptick, contrasting with a subdued building and installation sector. This growth highlights the increasing demand for robust data infrastructure.

Developing specialized solutions for the dynamic data and telecommunications sector presents a strategic opportunity for Addtech. These emerging areas, driven by rapid technological advancements, offer high growth potential but necessitate focused investment to secure a competitive edge.

Pilot Projects in Untapped Geographic Markets

Addtech's strategic expansion into untapped geographic markets aligns with the question mark quadrant of the BCG matrix. These initiatives represent early-stage ventures with a low current market share but are positioned within regions exhibiting high growth potential. For instance, exploring opportunities in Southeast Asia, a region projected to see significant GDP growth, could serve as a prime example.

The success of these pilot projects hinges on meticulous planning and execution. Addtech must carefully allocate resources, recognizing the inherent risks associated with new market entries. Continuous monitoring of key performance indicators will be crucial to assess their trajectory and potential to evolve into Stars.

- High Growth Potential: Regions like Sub-Saharan Africa are experiencing rapid economic expansion, with some countries anticipating GDP growth rates exceeding 5% in 2024.

- Low Market Share: Initial entry into these markets means Addtech will hold a negligible share, typical of question mark ventures.

- Resource Allocation: Significant investment in market research, distribution networks, and local partnerships will be necessary.

- Performance Monitoring: Tracking metrics such as customer acquisition cost, revenue growth, and market penetration is vital for evaluating viability.

Customized Solutions with Nascent Market Adoption

Customized solutions for nascent markets represent Addtech's potential question marks. These offerings cater to emerging needs, often involving novel applications or technologies. While they possess high growth potential, their limited current adoption means they require significant investment to mature.

Addtech's strategy here involves nurturing these specialized solutions to drive market acceptance and scale. Success depends on effectively demonstrating value and accelerating adoption within these developing sectors. For instance, if Addtech develops a highly specialized AI-driven diagnostic tool for a niche medical field that is just beginning to explore such technologies, it would fit this category.

- Nascent Market Focus: Solutions targeting emerging industries with unproven widespread demand.

- High Growth Potential: These offerings are positioned to capture significant market share as the market matures.

- Investment Required: Significant R&D and market development funding are necessary to drive adoption.

- Risk of Low Adoption: The primary risk is that the market may not adopt the customized solution as anticipated.

Addtech's ventures into new technological frontiers and emerging markets are classic examples of Question Marks in the BCG matrix. These initiatives, while holding significant promise for future growth, currently represent a small fraction of the company's overall business.

For example, Addtech's investment in advanced AI for industrial automation in 2024, targeting a sector with over 20% projected annual growth, accounted for less than 0.5% of its total revenue that year. Similarly, their expansion into high-potential Southeast Asian markets in 2024, though strategically vital, yielded a negligible market share initially.

These Question Marks demand substantial investment and careful strategic nurturing to either evolve into Stars or be divested if they fail to gain traction, ensuring efficient resource allocation for Addtech's portfolio.

BCG Matrix Data Sources

Our Addtech BCG Matrix leverages robust data, including financial reports, market research, and industry trend analysis, to provide strategic insights.