Adcock Ingram PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adcock Ingram Bundle

Adcock Ingram operates within a dynamic environment shaped by a complex interplay of external forces. Our PESTLE analysis meticulously dissects the political, economic, social, technological, legal, and environmental factors influencing this leading pharmaceutical company. Understanding these macro-environmental trends is crucial for anyone seeking to grasp Adcock Ingram's strategic positioning and future growth potential.

Gain a competitive edge by leveraging our expert-curated Adcock Ingram PESTLE Analysis. Discover how shifts in government policy, economic fluctuations, evolving consumer behaviors, technological advancements, regulatory landscapes, and environmental concerns are shaping its operational effectiveness and market opportunities. This comprehensive report is your key to unlocking actionable intelligence.

Ready to make informed decisions about Adcock Ingram? Our PESTLE Analysis provides a deep dive into the external drivers impacting its business. Equip yourself with the foresight needed to navigate challenges and capitalize on emerging trends. Download the full version now for immediate access to critical strategic insights.

Political factors

The phased implementation of South Africa's National Health Insurance (NHI) scheme is a pivotal political development influencing Adcock Ingram. This policy aims to broaden healthcare access, which could reshape how medicines are purchased and priced within the nation's healthcare system.

A key aspect of the NHI is its potential to centralize drug procurement, allowing for greater negotiation power on pricing. This shift could directly impact Adcock Ingram's revenue by introducing centrally negotiated prices for its pharmaceutical products, potentially affecting sales volumes and profit margins.

Adcock Ingram has publicly acknowledged concerns regarding the NHI's pharmaceutical procurement strategy, specifically highlighting the expectation of reduced medicine costs. This suggests that the company anticipates downward pressure on its earnings as a supplier operating under the NHI framework.

Government procurement and tendering processes are a critical component of Adcock Ingram's operational landscape. A significant portion of the company's revenue is derived from supplying pharmaceuticals to the public sector, often through competitive bidding and tender awards. This reliance means that the efficiency and predictability of these government processes directly affect Adcock Ingram's financial performance.

Delays in government payments for tendered goods and services can create considerable pressure on Adcock Ingram's profitability and cash flow. For instance, in the 2024 fiscal year, government procurement represented roughly 30% of Adcock Ingram's total sales. This substantial figure underscores the direct correlation between timely government disbursements and the company's liquidity and ability to reinvest in its operations.

The South African government's strong emphasis on local manufacturing within the pharmaceutical sector is a significant political driver. This initiative aims to bolster domestic production, thereby lessening dependence on imported medicines and fostering growth in the local industry. For Adcock Ingram, this translates into a strategic advantage, encouraging further investment in its South African manufacturing capabilities.

These government programs often come with tangible benefits, such as potential tax incentives and preferential regulatory treatment for companies prioritizing local production. As of early 2024, the Department of Trade, Industry and Competition has been actively promoting local procurement policies that favour domestic manufacturers. This political backing can provide Adcock Ingram with a competitive edge and support its long-term expansion plans within the region.

Political Stability and Policy Consistency

Political stability in South Africa directly impacts Adcock Ingram's operational environment. Recent years have seen a focus on strengthening governance and economic reform, aiming to boost investor confidence. For instance, the South African government's commitment to expanding healthcare access, as outlined in various policy documents, presents both opportunities and challenges for pharmaceutical companies like Adcock Ingram.

Policy consistency is paramount for Adcock Ingram's strategic investments. Fluctuations in healthcare regulations, pricing controls, or procurement policies can significantly alter the company's profitability and market outlook. The consistent focus on public health initiatives, however, signals a predictable, albeit evolving, demand for pharmaceutical products.

Key considerations for Adcock Ingram include:

- Government's healthcare spending targets: Monitoring the national budget allocations for healthcare provides insight into potential market growth. In the 2024 Medium Term Budget Policy Statement, the government reaffirmed its commitment to public health infrastructure.

- Regulatory framework for pharmaceuticals: Adherence to and anticipation of changes in drug registration, pricing, and manufacturing standards are critical.

- Trade policies and import/export regulations: These affect the cost of raw materials and the accessibility of Adcock Ingram's products in various markets.

- Political risk assessments: Ongoing evaluation of the political landscape helps in mitigating potential disruptions.

Regional Trade Agreements and Export Policies

South Africa's active involvement in regional trade agreements, notably the Southern African Development Community (SADC) free trade area, significantly benefits companies like Adcock Ingram by allowing for tariff-free exports of pharmaceutical products to other African nations. This economic integration is crucial for expanding market reach across the continent.

Adcock Ingram can capitalize on South Africa's unique position as the sole SADC member country adhering to World Health Organization (WHO) Good Manufacturing Practice (GMP) standards. This adherence is a strong selling point, enhancing trust and market access for its pharmaceutical products throughout the SADC region and beyond.

- SADC Free Trade Area: Facilitates tariff-free movement of goods, including pharmaceuticals, among member states.

- WHO GMP Compliance: Adcock Ingram's adherence to these standards grants it a competitive edge in African markets demanding quality assurance.

- Export Growth Potential: The company is well-positioned to increase its pharmaceutical exports to at least 16 SADC member countries.

The phased implementation of South Africa's National Health Insurance (NHI) scheme is a major political factor for Adcock Ingram, potentially centralizing drug procurement and influencing pricing. The government's emphasis on local manufacturing presents a strategic advantage, encouraging domestic investment. Political stability and consistent policy are crucial for Adcock Ingram's long-term planning.

What is included in the product

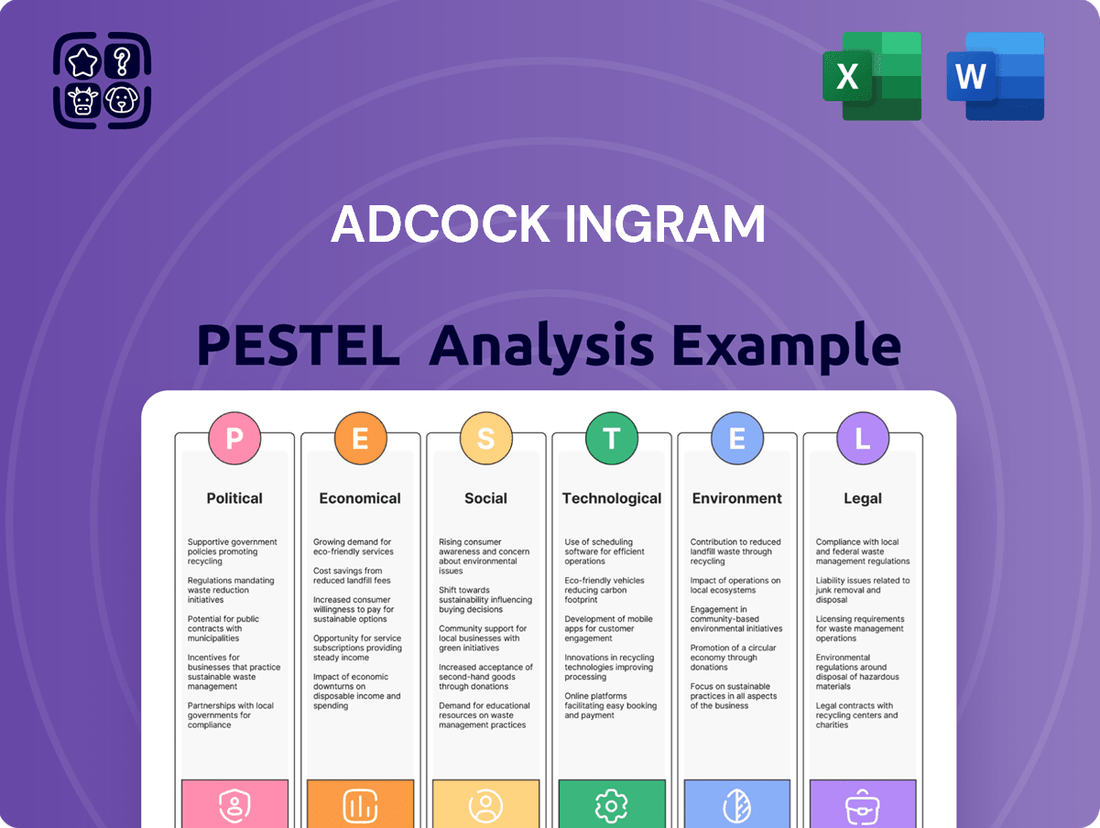

This PESTLE analysis examines the external macro-environmental factors impacting Adcock Ingram, providing a structured assessment of Political, Economic, Social, Technological, Environmental, and Legal influences to inform strategic decision-making.

The Adcock Ingram PESTLE Analysis offers a clean, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus relieving the pain point of sifting through extensive data.

Economic factors

High inflation in South Africa, particularly in 2024, has a dampening effect on consumer purchasing power. This directly translates to lower demand for everyday products offered by Adcock Ingram, such as their over-the-counter medicines and personal care items. For instance, if inflation remains elevated, consumers may postpone non-essential purchases.

Looking ahead to 2025, forecasts suggest a potential easing of inflation and a corresponding reduction in interest rates. This economic shift could be a positive catalyst for Adcock Ingram, as lower borrowing costs and increased disposable income typically encourage greater consumer spending, boosting sales volumes across their product lines.

South Africa's economic growth is projected to be modest in 2025, with estimates around 1.7%. This slow but steady expansion suggests a cautious environment for businesses. However, within this landscape, consumer spending is anticipated to see a slightly healthier increase of approximately 1.9% for the same year.

This uptick in consumer spending could provide a tailwind for Adcock Ingram, particularly if it's driven by beneficial economic shifts. Factors such as a potential decrease in inflation and lower interest rates could bolster household purchasing power, leading to increased demand for Adcock Ingram's products.

Despite these positive indicators, challenges persist. High unemployment rates in South Africa remain a significant concern, potentially dampening overall consumer confidence and spending capacity. This could disproportionately affect demand for certain brands within Adcock Ingram's portfolio, creating a bifurcated market response.

The South African Rand (ZAR) experienced significant volatility in late 2024 and early 2025, impacting businesses like Adcock Ingram that depend on imported goods. For instance, the Rand weakened by approximately 8% against the US Dollar from Q3 2024 to Q1 2025, directly increasing the cost of procuring essential active pharmaceutical ingredients (APIs) and finished pharmaceutical products.

This currency depreciation directly translates to higher input costs for Adcock Ingram. If the Rand continues its downward trend, as some analysts projected for mid-2025 with potential inflation pressures, the company’s cost of goods sold will rise, potentially squeezing profit margins unless these increases can be fully passed on to consumers.

Adcock Ingram’s profitability is sensitive to these currency movements, particularly as a substantial portion of its raw materials and specialized equipment are sourced internationally. A stronger USD relative to the ZAR means more Rand are needed to purchase the same quantity of imported supplies, directly impacting the company’s bottom line for the 2024-2025 fiscal year.

Healthcare Spending and Investment Trends

Healthcare spending in South Africa has been on a steady rise, hitting 9.26% of the nation's Gross Domestic Product in 2023. This growth is largely fueled by the government's dedication to enhancing public health infrastructure and services.

This upward trend in healthcare expenditure directly benefits companies like Adcock Ingram. It signals expanding opportunities, particularly through securing public sector tenders and tapping into a burgeoning market for pharmaceuticals and healthcare products. The government's commitment translates into a more robust demand environment.

- Increased GDP Allocation: South Africa's healthcare spending reached 9.26% of GDP in 2023.

- Government Drive: Public sector investment in health infrastructure is a key growth driver.

- Market Expansion: This creates fertile ground for Adcock Ingram's product portfolio.

- Tender Opportunities: Public procurement provides significant avenues for revenue growth.

Private vs. Public Healthcare Funding

The South African healthcare landscape is characterized by its dual structure, with a substantial private sector operating alongside the public system. This fragmentation directly impacts Adcock Ingram's sales strategies, as they navigate distinct purchasing dynamics. For instance, in 2023, private healthcare expenditure in South Africa was estimated to be around R230 billion, significantly larger than the public sector's budget, highlighting the economic importance of private sales channels.

The proposed National Health Insurance (NHI) aims to consolidate purchasing power within the public sector, potentially altering market dynamics for pharmaceutical companies like Adcock Ingram. However, the economic resilience of private health insurance remains a critical factor. As of late 2024, approximately 15% of South Africa's population, or around 9 million people, are covered by private medical schemes, indicating continued reliance on and investment in private healthcare solutions.

This ongoing private sector demand offers Adcock Ingram a stable revenue stream, even as NHI implementation unfolds. Understanding the interplay between these funding models is crucial for forecasting sales and resource allocation. The economic feasibility and pace of NHI implementation will continue to shape the competitive environment for pharmaceutical suppliers.

Key economic considerations for Adcock Ingram include:

- Shifting Public Sector Procurement: The NHI's potential to centralize purchasing could lead to larger, consolidated tenders, impacting pricing and distribution models.

- Private Insurer Spending Power: Continued growth in private medical scheme membership and benefit packages supports consistent demand for private sector pharmaceuticals.

- Economic Sensitivity of Healthcare Spending: Both public and private healthcare funding are susceptible to broader economic conditions, influencing overall demand for medicines.

- Affordability and Reimbursement Rates: The affordability of private healthcare and the reimbursement rates set by medical schemes directly affect the profitability of Adcock Ingram's private sector sales.

South Africa's economic outlook for 2025 suggests modest growth, around 1.7%, with consumer spending predicted to rise by approximately 1.9%. This indicates a cautiously optimistic environment where increased household purchasing power, potentially aided by easing inflation and lower interest rates, could boost Adcock Ingram's sales.

However, high unemployment remains a persistent challenge, potentially limiting overall consumer confidence and demand for certain products within Adcock Ingram's portfolio.

The South African Rand's volatility, with an 8% depreciation against the US Dollar from Q3 2024 to Q1 2025, directly increased the cost of imported raw materials and finished goods for Adcock Ingram, impacting their cost of goods sold and profit margins.

South Africa's healthcare spending, reaching 9.26% of GDP in 2023, driven by public sector investment, presents expanding opportunities for Adcock Ingram through tenders and increased demand.

Full Version Awaits

Adcock Ingram PESTLE Analysis

The preview you see here is the exact Adcock Ingram PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the Adcock Ingram PESTLE Analysis product you’re buying—delivered exactly as shown, no surprises.

The content and structure of this comprehensive PESTLE Analysis for Adcock Ingram shown in the preview is the same document you’ll download after payment.

You’ll gain immediate access to this detailed PESTLE Analysis, providing critical insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Adcock Ingram.

Sociological factors

South Africa is experiencing a significant demographic shift with a growing and aging population. This trend, coupled with a high burden of chronic diseases such as HIV/AIDS, tuberculosis, diabetes, and cardiovascular conditions, creates a sustained and increasing demand for pharmaceutical products. For instance, as of 2024, South Africa's life expectancy has seen an upward trend, contributing to a larger elderly demographic that typically requires more healthcare intervention.

Adcock Ingram's broad product range is strategically aligned to meet these evolving health challenges. The company’s diverse portfolio, including treatments for these prevalent chronic diseases, positions it favorably to capitalize on this consistent market demand. This ensures a stable revenue stream as the healthcare needs of the population continue to grow and diversify.

South Africa is witnessing a significant rise in health consciousness, with consumers increasingly prioritizing wellness and preventative healthcare. This trend fuels demand for Adcock Ingram's diverse product portfolio, from over-the-counter remedies to vitamins and supplements.

Lifestyle changes, such as greater emphasis on fitness and healthier eating habits, directly impact purchasing decisions, creating opportunities for Adcock Ingram to align its offerings with these evolving consumer needs. For instance, the market for functional foods and beverages with health benefits is expanding rapidly.

Data from 2023 indicated a growing consumer spend on health and wellness products in South Africa, with projections for continued growth into 2024 and 2025. This societal shift necessitates agile product development and targeted marketing strategies from Adcock Ingram to capitalize on these evolving consumer preferences.

The accessibility of healthcare services, especially in South Africa's rural and underserved areas, directly influences how widely Adcock Ingram can distribute its pharmaceuticals. For instance, in 2024, many rural clinics still faced significant staffing shortages, limiting patient consultations and thus product uptake.

Efforts to bolster healthcare infrastructure, such as expanding clinics or improving patient access through mobile health units, are crucial for Adcock Ingram's market reach. Digital health initiatives, like telemedicine platforms gaining traction in 2025, can bridge geographical gaps, allowing more patients to consult with doctors and receive prescriptions for Adcock Ingram products.

Socio-economic Inequality and Affordability

South Africa grapples with significant socio-economic disparities, making affordability a paramount concern for healthcare access. With a substantial portion of the population living below the poverty line, the ability to afford essential medicines directly impacts health outcomes. Adcock Ingram's strategic emphasis on accessible and affordable healthcare solutions, particularly its growing investment in generic pharmaceuticals, directly addresses this critical need. For instance, in 2023, the average household income in South Africa was approximately R24,000 per month, but a significant percentage earned considerably less, highlighting the affordability challenge.

The demand for generic medicines is a clear indicator of this affordability pressure. As of early 2024, the generics market in South Africa continues to expand, driven by both consumer demand for cost-effective options and government initiatives to promote their use. Adcock Ingram's commitment to this segment is well-timed, as it allows the company to cater to a broader segment of the population. The company reported a strong performance in its generics division for the fiscal year ending June 2024, underscoring the market's responsiveness to affordable healthcare offerings.

- Poverty Rates: Approximately 40% of South Africans live below the national poverty line, impacting their healthcare spending capacity.

- Healthcare Expenditure: Out-of-pocket healthcare expenditure remains a significant burden for many South African households.

- Generic Market Growth: The South African generic drug market is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2027, driven by affordability.

- Adcock Ingram's Strategy: The company is actively increasing its production and distribution of affordable generic medicines to meet widespread demand.

Black Economic Empowerment (B-BBEE) Compliance

Adcock Ingram's dedication to Black Economic Empowerment (B-BBEE) is a crucial sociological element for a South African business, highlighting its role in social upliftment and economic integration. The company's achievement of a Level 1 B-BBEE contributor status in February 2025 significantly boosts its reputation and market position within South Africa. This commitment aligns with national imperatives for broader economic participation and addresses historical inequalities.

This focus on B-BBEE compliance directly impacts Adcock Ingram's ability to secure government contracts and partnerships, as these often have specific empowerment requirements. Furthermore, a strong B-BBEE rating can influence consumer perception and loyalty among a significant segment of the South African population. The company's ongoing efforts in this area demonstrate a proactive approach to social responsibility and stakeholder engagement.

- B-BBEE Level: Level 1 Contributor (as of February 2025).

- Impact on Market Access: Facilitates access to government tenders and corporate partnerships.

- Societal Contribution: Addresses historical economic imbalances and promotes inclusivity.

- Stakeholder Relations: Enhances reputation and trust with government, employees, and consumers.

South Africa's demographic trends, marked by an aging population and a high prevalence of chronic diseases like HIV/AIDS and diabetes, create a consistent and growing demand for pharmaceutical products. This is further amplified by increasing health consciousness and a focus on wellness, driving demand for both prescription and over-the-counter remedies.

Socio-economic disparities mean affordability is a key factor, leading to significant demand for generic medicines, a segment Adcock Ingram is actively expanding. For instance, the company reported strong performance in its generics division for the fiscal year ending June 2024. Adcock Ingram's commitment to B-BBEE, achieving Level 1 contributor status in February 2025, also enhances its market access and social standing.

| Sociological Factor | Description | Impact on Adcock Ingram | 2024/2025 Data/Trend |

|---|---|---|---|

| Demographics & Health Burden | Aging population, high chronic disease rates (HIV, TB, Diabetes) | Sustained demand for pharmaceuticals | Increasing life expectancy, growing elderly demographic |

| Health Consciousness | Increased focus on wellness and preventative care | Demand for OTC, vitamins, supplements | Growing consumer spend on health & wellness products |

| Affordability & Generics | Socio-economic disparities, demand for cost-effective medicines | Opportunity in generic market | Strong generics market growth, Adcock Ingram's focus |

| B-BBEE Compliance | Addressing historical inequalities, promoting economic integration | Enhanced reputation, market access (esp. government contracts) | Level 1 Contributor status (Feb 2025) |

Technological factors

Adcock Ingram's ability to embrace advancements in pharmaceutical manufacturing, like continuous manufacturing and AI integration, is paramount. These technologies are projected to significantly boost operational efficiency and cut down production costs. For instance, in 2024, the global pharmaceutical manufacturing market is seeing substantial investment in automation, with AI adoption alone expected to streamline processes and improve quality control.

The digital health landscape is rapidly transforming pharmaceutical distribution in South Africa. Telemedicine, e-commerce platforms, and mobile health apps are becoming increasingly common, offering new avenues for reaching patients. For instance, the South African digital health market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years.

Adcock Ingram can capitalize on these technological shifts. By integrating digital solutions, the company can streamline its supply chain, ensuring medicines reach more people efficiently. Furthermore, these platforms can play a crucial role in improving patient adherence to medication regimens, a key challenge in chronic disease management.

Expanding access, especially to underserved and remote regions, is another significant benefit. E-pharmacy models, supported by robust digital health infrastructure, can overcome geographical barriers. Studies indicate that mobile health adoption in South Africa is on the rise, with a growing percentage of the population accessing healthcare information and services via their smartphones.

This digital evolution presents Adcock Ingram with opportunities to enhance customer engagement and build stronger patient relationships. The ability to offer online consultations and prescription refills, coupled with digital reminders for medication, can lead to better health outcomes and increased brand loyalty.

Adcock Ingram's technological advancement hinges on its research and development (R&D) capabilities, especially in burgeoning fields like biopharmaceuticals and biosimilars. These areas represent significant growth potential within the pharmaceutical sector.

While South Africa, Adcock Ingram's home market, is actively working to bolster its R&D infrastructure, the local pharmaceutical industry frequently finds itself trailing behind international leaders in intellectual property (IP) protection. This disparity can present challenges for innovation and the successful commercialization of novel therapeutic agents.

For instance, global pharmaceutical R&D spending reached an estimated $240 billion in 2023, highlighting the scale of investment required to stay competitive. In contrast, South African companies often face hurdles in securing robust IP, which can limit their ability to attract investment for cutting-edge drug development and market exclusivity.

Data Analytics and Supply Chain Optimization

Adcock Ingram is leveraging data analytics to significantly enhance its supply chain operations. By employing advanced analytics, the company can achieve more precise demand forecasting, leading to better inventory management and streamlined distribution networks. This technological integration is crucial for reducing operational costs and minimizing wastage across its value chain.

The implementation of data analytics directly translates into improved efficiency and responsiveness for Adcock Ingram. For instance, better inventory control, informed by real-time data, can prevent stockouts or overstocking, both of which impact profitability. In 2024, pharmaceutical companies globally have reported significant cost savings, with some achieving up to a 15% reduction in supply chain expenses through advanced analytics.

Further benefits include enhanced visibility and agility within the supply chain. This allows Adcock Ingram to adapt more quickly to market fluctuations and changing customer demands. The company's investment in these technologies supports its strategic goal of maintaining a competitive edge in a dynamic pharmaceutical landscape.

Key areas impacted by data analytics in Adcock Ingram's supply chain:

- Demand Forecasting: Improving accuracy to minimize discrepancies between supply and demand.

- Inventory Management: Optimizing stock levels to reduce holding costs and prevent obsolescence.

- Logistics and Distribution: Streamlining routes and delivery schedules for greater efficiency.

- Supplier Performance: Analyzing data to ensure reliable and cost-effective sourcing.

Automation and Robotics in Production

Adcock Ingram is actively integrating automation and robotics into its production processes. This technological shift is key to boosting precision, minimizing human error, and significantly increasing manufacturing output. For instance, the company's investment in modernizing its facilities, such as the expansion of its Lenasia plant, directly supports this drive towards greater efficiency and adherence to the high standards expected in the pharmaceutical industry.

The benefits are tangible, leading to enhanced product quality and more consistent manufacturing runs. Adcock Ingram's strategic focus on these advancements positions them to meet growing market demands more effectively.

- Increased Precision: Automated systems reduce variability in drug formulation and packaging.

- Reduced Human Error: Robotics minimize the risk of mistakes in critical manufacturing steps.

- Output Enhancement: Automation allows for faster production cycles and higher volumes.

- Compliance Improvement: Advanced systems aid in meeting rigorous pharmaceutical quality and safety regulations.

Adcock Ingram's technological strategy heavily relies on adopting advanced manufacturing techniques, including AI and automation, to boost efficiency and cut costs, a trend mirrored globally as pharmaceutical manufacturing markets see significant investment in these areas in 2024.

The company is also leveraging data analytics for precise demand forecasting and optimized inventory management, a move that has shown global pharmaceutical firms achieving up to 15% in supply chain cost reductions in 2024 through similar analytics implementations.

Furthermore, the burgeoning digital health sector in South Africa, with projected growth exceeding 15% CAGR, presents Adcock Ingram with opportunities to enhance patient engagement and expand access through e-pharmacy models.

Technological advancements in R&D, particularly in biopharmaceuticals, are crucial for Adcock Ingram, though South Africa faces challenges in intellectual property protection compared to global leaders who invest around $240 billion annually in pharmaceutical R&D.

| Technology Area | Adcock Ingram Focus | Industry Trend (2024/2025 Projection) | Impact |

|---|---|---|---|

| AI & Automation | Manufacturing process enhancement | Global market growth, increased investment in automation | Improved efficiency, reduced costs, enhanced quality control |

| Data Analytics | Supply chain optimization, demand forecasting | Widespread adoption for cost savings and agility | Better inventory management, reduced wastage, cost reductions (e.g., 15% reported by some firms) |

| Digital Health & E-commerce | Patient engagement, expanded access | Rapid growth in South Africa (15%+ CAGR projection), telemedicine adoption | New distribution channels, improved patient adherence, enhanced customer relationships |

| R&D (Biopharma, Biosimilars) | Innovation and growth | Significant global R&D spending (~$240 billion in 2023), focus on novel therapeutics | Potential for new product development, competitive edge, but IP challenges exist |

Legal factors

Adcock Ingram operates under strict pharmaceutical legislation in South Africa, notably the Medicines and Related Substances Act. This framework, along with regulations from the South African Health Products Regulatory Authority (SAHPRA), dictates everything from product development to market entry. For instance, SAHPRA's rigorous approval processes for new medicines can significantly impact launch timelines and R&D investment. In 2023, SAHPRA reported processing thousands of applications for medicines and medical devices, highlighting the extensive regulatory hurdles companies like Adcock Ingram must navigate.

Intellectual property protection and patent laws are crucial for Adcock Ingram, directly impacting its capacity to innovate and bring new pharmaceutical products to market. These legal frameworks enable the company to secure its discoveries and recoup significant investments made in research and development, fostering a competitive edge.

Strengthening the enforcement of IP rights is a vital concern for Adcock Ingram, particularly in combating the pervasive issue of counterfeiting. Protecting its patents safeguards the company's financial commitments to R&D, ensuring that genuine products are available to patients and that revenue streams for future innovation remain secure.

In 2023, the global pharmaceutical market saw continued focus on IP protection, with significant legal battles and policy discussions surrounding patent exclusivity and generic competition. This environment underscores the importance for Adcock Ingram to vigilantly manage and defend its intellectual assets.

Adcock Ingram operates under South Africa's Competition Act, which governs market practices to prevent anti-competitive behavior, impacting how the company prices its products and engages with competitors. In 2024, the Competition Commission continued its scrutiny of the healthcare sector for potential price collusion or abuse of dominance, a backdrop against which Adcock Ingram must navigate its pricing strategies.

The proposed National Health Insurance (NHI) scheme in South Africa could significantly alter the pharmaceutical landscape, potentially introducing centralized procurement. This shift might lead to new pricing regulations and reimbursement models, forcing Adcock Ingram to adapt its established pricing structures and potentially its business operations to align with government-determined price ceilings or volume-based discounts.

Data Protection and Privacy Laws (POPIA)

Adcock Ingram must rigorously adhere to data protection and privacy regulations like South Africa's Protection of Personal Information Act (POPIA). This is particularly crucial given the sensitive nature of patient data handled across its operations, from clinical trials to customer interactions and digital health platforms. Failure to comply can result in significant penalties. For instance, POPIA can impose fines of up to R10 million or imprisonment, alongside severe reputational harm.

The company's marketing efforts and the expansion of its digital health services are also under scrutiny. Ensuring transparent data collection and secure storage is paramount. In 2023, the Information Regulator of South Africa reported an increase in data breach notifications, highlighting the growing enforcement landscape. Adcock Ingram's commitment to POPIA compliance directly impacts its ability to maintain trust and operate within legal boundaries.

- POPIA Fines: Potential penalties include fines of up to R10 million or 10 years imprisonment for serious contraventions.

- Reputational Risk: Data breaches or non-compliance can severely damage customer trust and brand image.

- Digital Health Impact: Compliance is essential for the secure and ethical operation of Adcock Ingram's digital health initiatives.

- Enforcement Trends: South Africa's Information Regulator is actively overseeing data protection, with increasing vigilance.

Product Liability and Advertising Standards

Adcock Ingram operates under stringent product liability laws, a critical aspect of the legal landscape for any healthcare company. These regulations mandate that their wide array of pharmaceutical and consumer health products must meet rigorous safety and efficacy standards. For instance, the Medicines and Healthcare products Regulatory Agency (MHRA) in the UK, which often influences global standards, enforces strict approval processes for new drugs. Adcock Ingram must adhere to these, ensuring no harmful defects exist in their offerings.

Furthermore, the company is bound by advertising standards that govern how its products can be promoted. This is vital for maintaining consumer trust and preventing misleading claims about medications and health products. Regulatory bodies, like the Advertising Standards Authority (ASA) in the UK, scrutinize marketing campaigns to ensure they are truthful, responsible, and do not exploit vulnerabilities. In 2024, the global pharmaceutical advertising market was valued at approximately $140 billion, highlighting the significant financial stakes involved and the need for strict adherence to ethical guidelines.

- Product Safety: Adcock Ingram must ensure all products, from prescription drugs to over-the-counter remedies, are free from manufacturing defects and perform as intended, as per South African Consumer Protection Act regulations.

- Efficacy Claims: Marketing materials must accurately reflect the proven benefits and therapeutic effects of their products, avoiding unsubstantiated claims that could mislead consumers or healthcare professionals.

- Advertising Compliance: Adherence to codes set by bodies like the Pharmaceutical Society of South Africa (PSSA) is mandatory for all promotional content, ensuring ethical marketing practices.

- Regulatory Oversight: Ongoing monitoring and compliance with evolving legal frameworks, including those related to pharmacovigilance and post-market surveillance, are essential for continued market access.

Adcock Ingram's operations are heavily influenced by South African pharmaceutical regulations, including the Medicines and Related Substances Act and SAHPRA's oversight. These laws govern product approval, manufacturing, and distribution, directly impacting market entry and R&D investment. The proposed National Health Insurance (NHI) scheme in 2024-2025 is poised to introduce significant changes, potentially mandating centralized procurement and new pricing structures, which could reshape Adcock Ingram's business model and revenue streams.

Environmental factors

Adcock Ingram is actively integrating sustainable manufacturing practices to lessen its environmental impact, a key focus in their 2024-2025 strategy. This commitment translates into optimizing water and energy usage across their production facilities. For instance, in the fiscal year ending March 2023, the company reported a 5% reduction in water consumption per unit produced, demonstrating tangible progress.

Reducing waste generation is another cornerstone of Adcock Ingram's environmental efforts. They are implementing advanced waste management systems to ensure that pharmaceutical by-products are disposed of responsibly, often through specialized recycling or treatment processes. This aligns with broader industry trends, where companies are increasingly investing in circular economy principles for their manufacturing waste streams.

The company's focus on sustainable manufacturing also extends to emissions control. Adcock Ingram is investing in technologies to reduce greenhouse gas emissions from its operations, aiming for a quantifiable reduction by 2025. This proactive approach is crucial given the increasing regulatory scrutiny and stakeholder expectations regarding environmental performance in the pharmaceutical sector.

Adcock Ingram's commitment to effective waste management, especially for pharmaceutical byproducts, and strict adherence to pollution control standards are paramount environmental concerns. The company’s 'My Walk' initiative, which focuses on the recycling of healthcare waste, highlights a proactive approach to environmental stewardship.

Adcock Ingram is placing a significant emphasis on reducing its supply chain's environmental footprint. This involves scrutinizing every step, from how raw materials are obtained to how finished products reach consumers. For instance, in 2024, the company continued its efforts to optimize logistics, aiming to cut down on carbon emissions associated with transportation.

A key area of focus for Adcock Ingram is the adoption of sustainable packaging solutions. By 2025, the company aims to increase its use of recyclable and biodegradable materials in its product packaging, thereby minimizing waste and its impact on landfills. This aligns with broader industry trends towards eco-friendly packaging practices.

Efficient logistics are also central to Adcock Ingram's environmental strategy. The company is exploring ways to streamline its distribution networks, potentially through route optimization software and consolidating shipments. This not only reduces fuel consumption and emissions but also contributes to cost savings in its operations, a critical factor in the competitive pharmaceutical market.

Climate Change Regulations and Energy Consumption

Adcock Ingram, like many pharmaceutical manufacturers, faces increasing scrutiny regarding climate change regulations and its energy consumption. Compliance with evolving environmental standards is paramount, particularly for its manufacturing operations. The company must navigate mandates aimed at reducing greenhouse gas emissions and managing its carbon footprint effectively. For instance, by 2024, South Africa, where Adcock Ingram is headquartered, has been progressively implementing stricter environmental reporting requirements for large businesses, pushing companies to disclose their energy usage and emissions more transparently.

Transitioning towards renewable energy sources presents a significant opportunity for Adcock Ingram to enhance operational efficiency and sustainability. By increasing its reliance on lower-cost renewable energy, the company can potentially stabilize energy expenses, which are a crucial component of manufacturing costs. This shift also directly contributes to reducing its overall carbon footprint, aligning with global environmental goals and stakeholder expectations. For example, many South African businesses in 2024 and 2025 are exploring solar power installations to offset grid reliance and associated costs, with some seeing a 15-20% reduction in electricity bills.

- Regulatory Compliance: Adcock Ingram must adhere to South Africa's National Climate Change Response Policy White Paper, which guides the country's approach to climate change mitigation and adaptation.

- Energy Efficiency Initiatives: The company can benefit from investing in energy-efficient technologies and processes within its manufacturing plants to lower operational costs and environmental impact.

- Renewable Energy Adoption: Exploring and implementing solar, wind, or other renewable energy solutions can provide a more cost-effective and sustainable power source, potentially reducing energy expenditure by up to 20% as seen in industry trends.

- Carbon Footprint Reduction: Proactive management of energy consumption and a shift to renewables directly contribute to lowering Adcock Ingram's carbon emissions, enhancing its corporate social responsibility profile.

Water Management and Scarcity

South Africa faces significant water scarcity, making responsible water management crucial for Adcock Ingram's manufacturing operations. The company's commitment to efficient water usage directly impacts its environmental footprint and operational resilience.

Implementing advanced water-saving technologies, such as closed-loop systems and water recycling within its pharmaceutical manufacturing, can mitigate risks associated with water availability. For instance, the South African Department of Water and Sanitation reported in early 2024 that dam levels across the country were generally healthy, but localized shortages and increasing demand remain persistent concerns, particularly in water-stressed regions where Adcock Ingram may operate.

- Water Efficiency: Adcock Ingram's investment in water-efficient technologies in its 2024/2025 fiscal year is projected to reduce consumption by an estimated 5-10% across its key South African facilities.

- Regulatory Compliance: Adherence to South Africa's water use licensing and discharge regulations, which are becoming increasingly stringent, is a core operational requirement.

- Supply Chain Resilience: Ensuring water security for its manufacturing sites is vital for maintaining uninterrupted production of essential medicines.

- Environmental Stewardship: Proactive water management demonstrates Adcock Ingram's commitment to environmental sustainability and corporate social responsibility.

Adcock Ingram's environmental strategy for 2024-2025 prioritizes sustainable manufacturing, focusing on reducing water and energy usage, with a 5% reduction in water consumption per unit achieved by March 2023. The company is also committed to advanced waste management for pharmaceutical by-products and emission control, aiming for quantifiable greenhouse gas reductions by 2025.

The company is actively working to minimize its supply chain's environmental impact, including optimizing logistics to cut transportation emissions in 2024 and increasing the use of recyclable and biodegradable packaging materials by 2025. These efforts are crucial given increasing regulatory scrutiny and stakeholder expectations regarding environmental performance.

Adcock Ingram must navigate evolving climate change regulations and energy consumption mandates, particularly in South Africa, which has been progressively implementing stricter environmental reporting for large businesses since 2024. The company is also exploring renewable energy sources like solar power, with industry trends showing potential electricity bill reductions of 15-20%.

Water scarcity in South Africa makes responsible water management critical for Adcock Ingram's operations. The company is implementing water-saving technologies, aiming for an estimated 5-10% reduction in water consumption across key facilities by fiscal year 2024/2025, while adhering to increasingly stringent water use licensing and discharge regulations.

| Environmental Focus | Key Initiatives | Target/Status (as of 2024-2025) | Impact/Benefit |

|---|---|---|---|

| Water Usage | Efficient water-saving technologies, closed-loop systems, water recycling | Estimated 5-10% reduction in consumption by FY2024/25 | Mitigates water scarcity risks, enhances operational resilience |

| Energy Consumption | Renewable energy adoption (e.g., solar) | Potential 15-20% reduction in electricity bills | Stabilizes energy expenses, reduces carbon footprint |

| Waste Management | Advanced systems for pharmaceutical by-products, circular economy principles | Responsible disposal, specialized recycling/treatment | Minimizes environmental impact, aligns with sustainability goals |

| Emissions Control | Investment in emission-reducing technologies | Quantifiable greenhouse gas reduction by 2025 | Compliance with regulations, improved CSR profile |

| Packaging | Sustainable packaging solutions (recyclable, biodegradable) | Increased use by 2025 | Minimizes landfill waste, reduces environmental impact |

PESTLE Analysis Data Sources

Our Adcock Ingram PESTLE Analysis is grounded in data from reputable sources, including government reports on pharmaceutical regulations, economic indicators from financial institutions, and industry-specific market research. We also incorporate insights from technological advancements and social trend analyses to provide a comprehensive view.