Adcock Ingram Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adcock Ingram Bundle

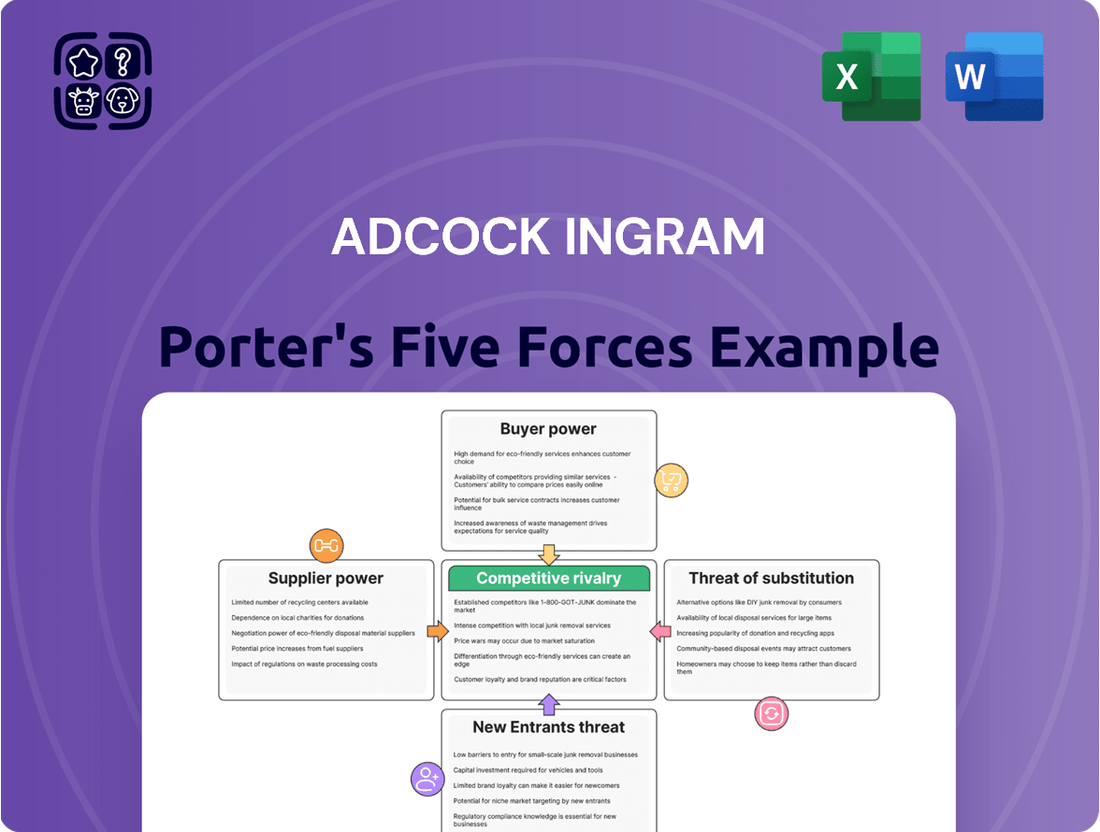

Adcock Ingram operates within a dynamic pharmaceutical landscape, where understanding competitive pressures is crucial for success. A Porter's Five Forces analysis reveals the intricate web of forces shaping its market. From the bargaining power of suppliers and buyers to the threat of new entrants and substitutes, each element plays a significant role in defining Adcock Ingram's strategic positioning.

The complete report reveals the real forces shaping Adcock Ingram’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Adcock Ingram's reliance on imported Active Pharmaceutical Ingredients (APIs) is a significant factor contributing to the bargaining power of its suppliers. The South African pharmaceutical sector, including Adcock Ingram, sources a substantial portion of its APIs from international markets, with estimates ranging from 70% to as high as 98%.

This heavy dependence on countries like India and China for essential API components grants these overseas suppliers considerable leverage. Any instability or price increases in these global supply chains can directly affect Adcock Ingram's manufacturing expenses and operational continuity.

The scarcity of local API production within South Africa further amplifies this reliance, presenting a hurdle for Adcock Ingram when considering swift or economical supplier transitions. This situation inherently strengthens the position of international API providers.

The market for crucial raw materials like codeine can be highly concentrated, meaning a few suppliers control a significant portion of the supply. This concentration gives these suppliers considerable power. Any disruption, such as issues with regulatory renewals or changes in international trade, can directly impact availability and lead to delays for companies like Adcock Ingram.

Adcock Ingram has indeed faced these challenges, experiencing firsthand how concentrated power among key raw material suppliers, or even the regulatory bodies governing them, can affect operations. These delays underscore the significant leverage these suppliers possess in the supply chain.

To counter this supplier influence and ensure operational continuity, Adcock Ingram has proactively begun building buffer inventories. This strategy acknowledges the reality of supplier power and aims to create a cushion against potential supply chain disruptions.

Suppliers of Active Pharmaceutical Ingredients (APIs) face significant hurdles due to strict quality and regulatory standards mandated by the South African Health Products Regulatory Authority (SAHPRA). This regulatory landscape limits the number of compliant suppliers, empowering those already meeting these rigorous demands. For instance, companies such as Multichem Sourcing, which are SAHPRA-licensed for API importation, wholesale, and distribution, highlight the specialized nature and established compliance within this sector, bolstering their negotiating position.

Potential for Supplier Forward Integration

The potential for suppliers to integrate forward into the finished product market, such as Adcock Ingram's operational landscape, presents a nuanced aspect of supplier bargaining power. Large global Active Pharmaceutical Ingredient (API) manufacturers, for instance, could theoretically move into producing finished drugs in South Africa. This would directly challenge local pharmaceutical companies by offering a competing product.

While this forward integration isn't a widespread current phenomenon, it represents a latent threat. The significant capital expenditure and stringent regulatory requirements associated with finished drug manufacturing in South Africa currently act as deterrents. For example, establishing a new manufacturing facility compliant with South African Health Products Regulatory Authority (SAHPRA) standards involves millions in investment and years of validation.

Nevertheless, the long-term possibility of major international API suppliers undertaking such a strategic move grants them a degree of subtle, underlying power. This capability influences negotiations with local players who rely on their API supply.

The bargaining power of suppliers concerning forward integration is therefore not solely about current actions but also about potential future strategic shifts.

Switching Costs Associated with API Changes

The bargaining power of suppliers is significantly influenced by switching costs, particularly when it comes to API (Active Pharmaceutical Ingredient) suppliers for companies like Adcock Ingram. Changing an API supplier isn't a simple swap; it involves substantial investment and time.

These switching costs for Adcock Ingram can be quite high. For instance, a pharmaceutical manufacturer must undertake extensive validation processes for any new API to ensure it meets stringent quality and safety standards. This often necessitates significant laboratory testing and analytical work, which can take months to complete. Furthermore, any change in API supplier typically requires regulatory re-approvals from health authorities like the South African Health Products Regulatory Authority (SAHPRA), adding another layer of complexity and delay.

The financial implications are also considerable. Beyond validation and regulatory fees, there's the potential for production line disruptions. Reconfiguring manufacturing processes to accommodate a new API can lead to downtime and lost output, impacting revenue. In 2023, the average cost for pharmaceutical product revalidation after a supplier change was estimated to be in the range of R5 million to R15 million, depending on the complexity of the product and the regulatory requirements. This financial burden directly enhances the leverage held by incumbent, validated API suppliers.

- High Validation Costs: Rigorous testing and quality assurance protocols for new APIs can cost hundreds of thousands of Rand.

- Regulatory Hurdles: Obtaining re-approval from health authorities can take 6-18 months and incur significant administrative fees.

- Production Line Adjustments: Reconfiguring manufacturing equipment and processes to integrate a new API can lead to costly downtime.

- Impact on Flexibility: These substantial switching costs limit Adcock Ingram's ability to negotiate better terms or readily switch suppliers, thereby strengthening the bargaining power of existing API providers.

Adcock Ingram's significant reliance on imported Active Pharmaceutical Ingredients (APIs), often sourced from international markets like India and China, grants suppliers considerable bargaining power. This dependence is exacerbated by limited local API production, making it difficult and costly to switch suppliers quickly. The concentration of supply for critical raw materials further amplifies this power, with disruptions impacting Adcock Ingram's operations and costs.

Switching API suppliers involves substantial costs for Adcock Ingram, including extensive validation processes, regulatory re-approvals from SAHPRA, and potential production line adjustments. These high switching costs, estimated to cost between R5 million to R15 million for revalidation in 2023, strengthen the negotiating position of incumbent suppliers.

The stringent quality and regulatory standards set by SAHPRA limit the pool of compliant API suppliers, empowering those who meet these demands. This regulatory landscape, coupled with the high costs and time involved in changing suppliers, significantly enhances the bargaining power of existing, compliant API providers for Adcock Ingram.

| Factor | Impact on Adcock Ingram | Supplier Bargaining Power |

|---|---|---|

| API Import Reliance | High dependence on international sources (70%-98%) | Increased leverage for overseas suppliers |

| Limited Local Production | Difficulty in finding local alternatives | Strengthens international supplier position |

| Concentrated Raw Material Supply | Vulnerability to disruptions (e.g., regulatory changes) | Concentrated suppliers have significant leverage |

| High Switching Costs | Validation (months), regulatory re-approvals (6-18 months), production adjustments | Enhances power of incumbent, validated suppliers |

| Regulatory Standards (SAHPRA) | Limits number of compliant suppliers | Empowers compliant suppliers |

What is included in the product

This analysis examines the competitive landscape for Adcock Ingram by evaluating the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products.

Identify and mitigate potential market threats before they impact profitability, providing a proactive strategy for sustained success.

Customers Bargaining Power

Adcock Ingram faces considerable bargaining power from major retail pharmacy chains like Clicks and Dis-Chem. These entities are not just customers but gatekeepers to a vast consumer base in South Africa, controlling a substantial portion of the distribution network.

The sheer volume of purchases made by these large chains grants them significant leverage. Their market share means they can dictate terms and influence pricing structures, potentially squeezing Adcock Ingram's profit margins.

In 2024, Clicks reported a 13.7% increase in group turnover to R45.2 billion, highlighting their expanding reach and the associated purchasing power they wield. This growth further amplifies their ability to negotiate favorable terms with suppliers like Adcock Ingram.

The South African government, especially via its public healthcare system and the upcoming National Health Insurance (NHI) plan, is a massive buyer of pharmaceuticals. This concentrated purchasing power, combined with the Single Exit Price (SEP) system that controls medicine costs, significantly pressures companies like Adcock Ingram to keep prices low.

The SEP policy, which caps annual price increases, directly restricts how much pharmaceutical firms can adjust their pricing. For instance, in 2024, the SEP allowed for a maximum increase of 5.9% for listed medicines, a figure that directly impacts Adcock Ingram's revenue streams.

South African consumers demonstrate significant price sensitivity, a factor heavily influenced by government initiatives encouraging the adoption of more affordable generic medicines. This economic reality means customers actively seek out lower-cost alternatives.

Pharmacists in South Africa are frequently mandated to suggest or dispense generic substitutes for branded prescription drugs. This policy directly empowers consumers by making cost-effective options readily available, thereby increasing their leverage in price negotiations.

The mandatory generic substitution policy directly erodes the sales volume of higher-priced branded pharmaceuticals. This shift in consumer behavior, driven by affordability, strengthens the bargaining power of customers by making them less willing to pay a premium for brand names.

Customer Concentration in the Hospital and Private Healthcare Sectors

Adcock Ingram's position in the South African healthcare market means it caters to both public and private sectors, including major hospital groups and medical aid schemes. This dual focus exposes the company to concentrated customer bases.

When a few large entities, like major hospital chains or national medical aid providers, represent a substantial portion of Adcock Ingram's revenue, their bargaining power intensifies. For instance, if a single large hospital group accounts for over 10% of Adcock Ingram's sales, that group can exert significant influence on pricing and terms.

The bargaining power of these concentrated customers is further amplified by their ability to switch suppliers or negotiate more favorable contracts, potentially impacting Adcock Ingram's profitability. In 2024, the healthcare sector saw increased pressure on pricing due to economic conditions, making these customer negotiations even more critical.

- Customer Concentration: A significant portion of Adcock Ingram's revenue is derived from a limited number of large private hospital groups and medical aid schemes.

- Impact of Large Customers: These major customers, due to their purchasing volume, possess considerable leverage in price negotiations and contract terms.

- Regulatory and Pricing Risks: Adverse regulatory shifts or intense pricing competition affecting these key customers can directly translate into financial pressure for Adcock Ingram.

- Market Dynamics: In 2024, the healthcare industry faced ongoing cost-containment measures, heightening the bargaining power of large buyers seeking to reduce their expenditure.

Availability of Information and Increased Health Awareness

Customers today have unprecedented access to health information. This allows them to research various treatment options, compare prices, and understand the efficacy of different products, significantly increasing their ability to negotiate or switch providers if unsatisfied.

The growing awareness about generic medications and over-the-counter (OTC) alternatives directly impacts pharmaceutical companies like Adcock Ingram. For instance, in 2023, the global generic drugs market was valued at approximately $430 billion, indicating a substantial consumer base actively seeking cost-effective solutions. This trend empowers consumers by providing viable alternatives to branded products.

This enhanced transparency and the demand for accessible healthcare solutions bolster the bargaining power of not only individual consumers but also large institutional buyers, such as hospitals and pharmacies. These entities can leverage their purchasing volume to secure more favorable terms and pricing, putting pressure on manufacturers to remain competitive.

- Information Access: Consumers can easily find data on drug efficacy, side effects, and pricing from numerous online sources and health portals.

- Generic Preference: A significant portion of the pharmaceutical market is now driven by generics, which offer lower prices and empower consumers to manage healthcare costs.

- Institutional Power: Bulk purchasing by healthcare institutions allows them to negotiate substantial discounts, impacting manufacturer revenue.

- Consumer Advocacy: Growing patient advocacy groups further amplify consumer voices, demanding transparency and affordability in healthcare.

The bargaining power of customers is substantial for Adcock Ingram, primarily driven by powerful retail pharmacy chains and the government's role in healthcare procurement. Major players like Clicks and Dis-Chem, with their extensive reach, can dictate terms, impacting Adcock Ingram's pricing and margins. In 2024, Clicks' turnover reached R45.2 billion, underscoring their considerable purchasing might.

The South African government, through its public healthcare system and the upcoming NHI, acts as a major buyer. The Single Exit Price (SEP) system, which capped price increases at 5.9% in 2024, directly limits pharmaceutical companies' pricing flexibility, intensifying customer pressure for affordability.

Consumers exhibit high price sensitivity, further amplified by policies encouraging generic medicine adoption. The mandatory generic substitution policy empowers customers by making cheaper alternatives readily available, diminishing the appeal of higher-priced branded products and strengthening buyer leverage.

| Customer Type | Key Leverage Points | 2024 Data/Trend Impact |

|---|---|---|

| Retail Pharmacy Chains (e.g., Clicks) | High purchase volume, extensive distribution network | Clicks' R45.2 billion turnover indicates significant negotiating power. |

| Government (Public Healthcare/NHI) | Concentrated purchasing, regulatory pricing (SEP) | 2024 SEP cap of 5.9% limits price adjustments for suppliers. |

| Consumers | Price sensitivity, preference for generics, information access | Growing generic market (valued at ~$430 billion globally in 2023) empowers consumers seeking cost savings. |

| Large Private Hospitals/Medical Aids | Bulk purchasing, ability to switch suppliers | Increased cost-containment measures in 2024 heightened their leverage. |

Full Version Awaits

Adcock Ingram Porter's Five Forces Analysis

This preview showcases the complete Adcock Ingram Porter's Five Forces Analysis you will receive immediately after purchase, offering a thorough examination of competitive pressures within the pharmaceutical industry. The document details the intensity of rivalry among existing firms, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitute products, providing actionable insights for strategic decision-making. You're looking at the actual document, a professionally formatted and ready-to-use analysis that accurately reflects the competitive landscape for Adcock Ingram. Once you complete your purchase, you’ll get instant access to this exact file, enabling you to leverage its comprehensive strategic assessment without delay.

Rivalry Among Competitors

The South African pharmaceutical landscape is a battleground, featuring formidable domestic giants like Aspen Pharmacare alongside powerful multinational corporations such as Pfizer, Novartis, and GlaxoSmithKline. This dual presence creates a highly competitive environment.

Aspen and Adcock Ingram themselves command a significant portion of the local market share. However, the sheer number of over 200 pharmaceutical companies operating in South Africa amplifies the rivalry across nearly all therapeutic segments, driving innovation and price pressures.

The South African pharmaceutical market, while featuring numerous participants, is significantly shaped by a high concentration of market share among a few key players. Adcock Ingram and Aspen Pharmacare stand out as the dominant domestic forces, setting a competitive tone across various product categories.

This concentration means that intense rivalry exists, particularly in lucrative segments such as generics, over-the-counter (OTC) medications, and essential hospital products. These leading companies are locked in a continuous battle for market dominance, driving innovation and strategic pricing.

For instance, in the 2023 fiscal year, Adcock Ingram reported revenue growth, underscoring its strong position. Aspen Pharmacare, similarly, holds a substantial share in several therapeutic areas, showcasing the impact of market leadership.

Sustaining or expanding market share in this environment necessitates ongoing strategic initiatives, including robust product development pipelines, effective marketing campaigns, and a keen understanding of evolving healthcare needs.

Competitive rivalry within the pharmaceutical sector, including for companies like Adcock Ingram, is intensified by government pricing regulations and the increasing prevalence of generic medications. South Africa's Single Exit Price (SEP) mechanism directly impacts how medicines can be priced, fostering a more price-sensitive market. This regulatory framework, coupled with a policy encouraging the use of generic drugs, forces pharmaceutical companies to vie for market share through competitive pricing, especially in the generic segment which is expected to grow significantly.

The drive towards affordability means that companies must carefully manage their cost structures to remain competitive. For instance, as of early 2024, the South African government continues to emphasize the importance of generic substitution, aiming to reduce healthcare costs for consumers. This trend puts considerable pressure on the profit margins of both originator and generic drug manufacturers, as they are compelled to offer lower prices to capture or maintain market presence. The market's trajectory suggests that this pricing pressure will likely persist and even escalate.

Diverse Product Portfolios and Therapeutic Area Overlap

Competitors in the pharmaceutical sector frequently boast diverse product portfolios that significantly overlap across numerous therapeutic areas. This overlap fuels direct competition for market share, whether it's in prescription drugs, over-the-counter remedies, or essential hospital products. For instance, in 2024, major global pharmaceutical companies reported substantial revenue streams from multiple therapeutic classes, indicating this widespread competitive dynamic.

Adcock Ingram, while possessing a broad product range, faces rivals who also excel in similar specialized areas. This necessitates a constant drive for innovation, robust marketing strategies, and efficient distribution networks to stay ahead. Companies are investing heavily in R&D; in 2023, global pharmaceutical R&D spending reached over $240 billion, highlighting the intense focus on bringing new products to market.

- Market Share Competition: Competitors vie for patient and physician preference across various therapeutic segments.

- Portfolio Overlap: Many companies offer treatments for similar conditions, intensifying rivalry.

- Innovation Imperative: Continuous investment in new drug development and product improvements is crucial.

- Operational Efficiency: Streamlined marketing and distribution are key differentiators in a crowded market.

Focus on Local Manufacturing and Distribution Capabilities

The push for local pharmaceutical manufacturing and distribution, bolstered by government incentives, is significantly heating up competition. Companies are channeling substantial investments into domestic production facilities. For instance, South Africa's Department of Trade, Industry and Competition (DTIC) has been actively promoting local production through various initiatives, aiming to reduce reliance on imported Active Pharmaceutical Ingredients (APIs). This focus creates a competitive arena where not just product pipelines, but also supply chain robustness and contributions to the local economy, become key differentiators.

This strategic shift means that rivalry is now deeply intertwined with operational efficiency and local integration. Companies are not merely competing on who has the best medicines, but also on who can manufacture and distribute them most reliably within the country. This is evident in the increasing number of companies announcing expansions or new builds of local manufacturing plants. For example, in 2024, several major pharmaceutical players in emerging markets announced plans to increase their local production capacity by 15-20% to capitalize on these government-backed opportunities.

- Increased Investment in Local Facilities: Companies are pouring capital into building or expanding manufacturing plants within their home countries to meet growing demand and benefit from government support.

- Supply Chain Resilience as a Competitive Edge: The ability to maintain a robust and localized supply chain is becoming a critical factor in outperforming rivals, especially in the face of global supply chain disruptions.

- Government Incentives Driving Localisation: Policies that encourage domestic pharmaceutical production create a more intense competitive landscape as firms vie for these advantages.

- Broader Definition of Competition: Rivalry now encompasses not only product innovation but also a company's commitment to and capabilities in local manufacturing, distribution, and economic participation.

The competitive rivalry within South Africa's pharmaceutical market is exceptionally high, driven by the presence of both strong domestic players like Adcock Ingram and multinational giants. This intense competition forces companies to constantly innovate and manage pricing effectively, especially with government regulations like the Single Exit Price mechanism. As of early 2024, the government's continued emphasis on generic substitution further amplifies price pressures, impacting profit margins across the board.

Many competitors offer overlapping product portfolios across numerous therapeutic areas, leading to direct battles for market share. For example, in 2024, global pharmaceutical companies reported significant revenues from multiple drug classes, demonstrating this widespread competitive dynamic. Adcock Ingram must therefore focus on continuous R&D and strong marketing to maintain its edge, a trend mirrored globally where R&D spending exceeded $240 billion in 2023.

The recent push for local pharmaceutical manufacturing, supported by government initiatives, is intensifying competition further. Companies are making substantial investments in domestic production facilities, with some major players in emerging markets planning 15-20% increases in local capacity by 2024. This means rivalry now includes not just product innovation but also supply chain resilience and local economic contributions.

| Key Competitors | Market Share Influence | Key Competitive Factors |

| Aspen Pharmacare | Significant domestic market share | Product innovation, pricing, distribution |

| Pfizer, Novartis, GlaxoSmithKline (Multinationals) | Strong presence across therapeutic segments | Global R&D, marketing, established brands |

| Over 200 Pharmaceutical Companies | Fragmented but amplifies overall rivalry | Specialization, price competitiveness, generics |

SSubstitutes Threaten

The most significant threat of substitution for Adcock Ingram stems from the increasing prevalence and promotion of generic drugs. South Africa actively supports generic substitution policies, aiming to enhance affordability and accessibility of medicines. Pharmacists are often encouraged, and sometimes legally required, to offer generic alternatives to branded medications.

This policy environment is a key driver for generic drug market share growth. By 2024, it's projected that generics will continue to capture a larger portion of the pharmaceutical market, directly displacing established branded products. This trend poses a direct challenge to Adcock Ingram's revenue streams derived from its patented and higher-margin drugs.

The increasing prominence of biologics and biosimilars poses a significant long-term threat to Adcock Ingram's conventional drug portfolio. These advanced therapies, often targeting chronic and complex conditions, represent a direct alternative to traditional small-molecule pharmaceuticals. For instance, the global biosimilar market was valued at approximately $20.2 billion in 2023 and is projected to grow substantially, indicating a growing preference for these innovative treatments.

While Adcock Ingram's core business remains in established pharmaceuticals, the biopharmaceutical sector is rapidly evolving. Advancements in biotechnology are leading to the development of highly effective biologics, and the subsequent emergence of biosimilars offers more affordable versions of these complex drugs. This trend could gradually shift treatment paradigms away from Adcock Ingram's existing product lines.

Strategic investments and the development of local production capabilities within the biopharmaceutical space by competitors could accelerate this substitution effect. Companies focusing on biologics and biosimilars are well-positioned to capture market share as healthcare systems and patient preferences increasingly embrace these newer therapeutic modalities. This dynamic necessitates a careful watch on evolving treatment protocols and market penetration of these advanced alternatives.

The growing emphasis on preventative healthcare and wellness products presents a significant indirect substitution threat. Consumers are increasingly investing in immunity-building vitamins, tonics, minerals, and supplements as a proactive measure against illness, potentially reducing their reliance on traditional pharmaceuticals, especially for managing lifestyle-related conditions. This societal shift is evident in market growth figures; for instance, the global dietary supplements market was valued at approximately USD 176.7 billion in 2023 and is projected to grow substantially, indicating a strong consumer preference for wellness solutions.

Alternative Therapies and Traditional Medicine

In South Africa, traditional medicine and alternative therapies present a nuanced threat of substitutes for conventional pharmaceuticals. These practices often cater to specific health needs and cultural preferences, potentially diverting demand from traditional drug manufacturers like Adcock Ingram.

While not always a direct replacement, these alternatives represent a significant portion of healthcare expenditure. For instance, in 2024, the global complementary and alternative medicine market was valued at an estimated USD 132.1 billion, indicating substantial consumer spending outside of conventional channels.

- Market Share: While precise figures for the substitution effect on Adcock Ingram are not publicly available, the broad acceptance of traditional remedies in South Africa suggests a tangible, albeit difficult to quantify, impact on demand for certain over-the-counter and even prescription medications.

- Consumer Behavior: Many South Africans utilize traditional healers and herbal remedies alongside or in lieu of Western medicine, particularly for chronic conditions or ailments where conventional treatments are perceived as slow or ineffective.

- Regulatory Landscape: The evolving regulatory framework for traditional and complementary medicine in South Africa could further legitimize and expand the market for these substitutes, potentially increasing their competitive pressure on pharmaceutical companies.

- Economic Factors: Cost can also be a driver, with some traditional remedies being more affordable than patented pharmaceuticals, especially for lower-income segments of the population.

Non-Pharmacological Interventions and Lifestyle Changes

For certain health conditions, alternatives to traditional drug treatments are gaining traction. These include lifestyle changes like improved diet, regular exercise, and physical therapy. For instance, a growing body of evidence supports the efficacy of lifestyle interventions in managing type 2 diabetes, potentially reducing reliance on oral hypoglycemic agents.

As public health awareness regarding preventative care and holistic wellness continues to rise, these non-pharmacological approaches may chip away at the demand for certain pharmaceutical products. This is particularly relevant for chronic diseases where lifestyle modifications can play a significant role in management. For example, in 2024, global spending on wellness tourism, a sector often driven by lifestyle changes, was projected to reach hundreds of billions of dollars, indicating a strong consumer interest in these alternatives.

This presents a subtle but persistent threat of substitution for Adcock Ingram. While not always a direct one-to-one replacement, the increasing acceptance and perceived effectiveness of these lifestyle-driven interventions could gradually erode the market share for some of their drug offerings, especially those targeting conditions with strong lifestyle components.

- Growing consumer focus on preventative health and wellness.

- Evidence supporting lifestyle changes in managing chronic conditions.

- Increased availability and promotion of non-pharmacological therapies.

The threat of substitutes for Adcock Ingram is multi-faceted, with generic drugs being a primary concern due to South Africa's supportive policies for affordability and accessibility. This trend is projected to continue, with generics capturing a larger market share by 2024, directly impacting Adcock Ingram's revenue from branded products.

Biologics and biosimilars also pose a significant long-term threat, offering advanced alternatives to traditional pharmaceuticals. The global biosimilar market was valued around $20.2 billion in 2023, highlighting a growing preference for these innovative and often more affordable treatments.

Furthermore, preventative healthcare and wellness products, including vitamins and supplements, represent an indirect substitution threat as consumers increasingly opt for proactive health measures. The global dietary supplements market was valued at approximately USD 176.7 billion in 2023, underscoring this shift.

Lifestyle changes, such as improved diet and exercise, are also emerging as substitutes, particularly for chronic conditions, potentially reducing reliance on certain pharmaceuticals. This growing consumer interest in wellness is reflected in the projected hundreds of billions of dollars in global wellness tourism spending for 2024.

Entrants Threaten

The pharmaceutical industry, particularly in South Africa, demands significant upfront investment. Establishing modern manufacturing plants that adhere to stringent Good Manufacturing Practices (GMP) and investing in robust research and development capabilities represent substantial capital outlays. For instance, setting up a new pharmaceutical production line can easily cost tens of millions of dollars, a figure that immediately deters many smaller players.

These high capital requirements serve as a formidable barrier to entry for potential competitors looking to challenge established firms like Adcock Ingram. Companies must not only fund the physical infrastructure but also the ongoing costs associated with regulatory compliance, quality assurance, and innovation. In 2024, the global pharmaceutical market saw continued investment in advanced manufacturing technologies, further raising the bar for new entrants.

The South African Health Products Regulatory Authority (SAHPRA) imposes demanding licensing and product registration requirements. These processes are notoriously time-consuming and intricate, presenting a substantial obstacle for any new company looking to enter the pharmaceutical market.

Successfully navigating SAHPRA's stringent regulations is crucial for ensuring product safety, efficacy, and overall compliance. This regulatory framework significantly deters potential entrants by increasing both the time and financial investment needed for market entry.

For instance, the average time for registering a new pharmaceutical product in South Africa can extend to several years, with costs potentially running into hundreds of thousands of dollars, a significant barrier to entry.

New players entering the pharmaceutical market in South Africa, for instance, face a significant hurdle in replicating Adcock Ingram's established distribution networks. Building the necessary infrastructure to reach diverse markets, including both urban centers and remote areas, requires substantial investment and time. This is particularly true for specialized logistics like cold chain management, crucial for many pharmaceutical products.

Adcock Ingram's extensive reach across South Africa and into other African nations means they possess a deep understanding of local regulatory landscapes and logistical challenges. For a new entrant, securing reliable suppliers and ensuring consistent product availability across a broad geographic area, as Adcock Ingram does, presents a formidable barrier. The company reported revenues of R17.0 billion for the year ended June 30, 2024, underscoring the scale of its operations and market penetration.

Intellectual Property Protection and Patent Landscape

The existing intellectual property (IP) landscape, particularly the patents held by established pharmaceutical players like Adcock Ingram, acts as a significant barrier to entry. These patents protect their innovative drugs, making it challenging for new companies to develop and market similar products without infringing on existing rights.

While South Africa's patent legislation has faced scrutiny for not fully embracing public health flexibilities compared to other emerging markets, the strength of current IP protections still presents a substantial hurdle for new entrants aiming to introduce novel pharmaceuticals. For instance, as of early 2024, the pharmaceutical sector continues to grapple with balancing IP rights with access to medicines, a dynamic that inherently favors incumbents with established patent portfolios.

- Existing patent protection by companies like Adcock Ingram deters new entrants from launching similar innovative products.

- South Africa's patent law, though criticized for public health flexibilities, still provides a barrier to entry for novel drugs.

- The cost and complexity of navigating IP further increase the threat for potential new market participants.

Government Incentives and Localisation Efforts

Government incentives aimed at boosting local manufacturing, such as tax breaks and subsidies for domestic production, can inadvertently lower entry barriers for new companies, particularly those focusing on generic pharmaceuticals or specific therapeutic areas. For instance, South Africa's focus on growing its local pharmaceutical manufacturing base through initiatives like the Department of Trade, Industry and Competition's (DTIC) master plan could attract new players looking to capitalize on these supportive policies. While intended to foster domestic industry, these measures can intensify competition among existing and new local firms, making it challenging for any single new entrant to gain a significant foothold without substantial investment or a highly differentiated offering.

These localization efforts, while beneficial for the broader industry, create a more crowded marketplace. New entrants must contend not only with established players like Adcock Ingram but also with other companies drawn by the same incentives. This dynamic means that while the *threat* of new entrants might seem reduced due to established competition, the specific nature of government support can create niche opportunities. For example, if incentives are tied to specific types of manufacturing or export targets, companies positioned to meet those criteria might find the barriers to entry lower than in a completely open market.

The competitive landscape is further shaped by the fact that these incentives often lead to increased domestic production capacity. By 2024, South Africa's pharmaceutical sector was seeing increased investment in local manufacturing, driven by government policy. This growth means that any new entrant faces an already expanding supply base.

- Government initiatives can lower entry barriers for generic producers.

- Localization efforts increase competition among domestic players.

- New entrants must navigate an expanding local production capacity.

- Incentives create niche opportunities for strategically aligned new companies.

High capital investment for manufacturing and R&D, coupled with complex regulatory approval processes from bodies like SAHPRA, significantly deters new pharmaceutical companies. Established distribution networks and intellectual property rights further solidify the position of incumbents like Adcock Ingram, making market entry challenging.

While government incentives can foster local production, they also intensify competition by attracting new players, particularly in the generic segment. New entrants must overcome substantial hurdles in infrastructure, regulatory navigation, and IP protection to effectively challenge established market leaders.

The pharmaceutical sector's inherent barriers, such as R&D costs and stringent quality controls, remain high. In 2024, continued investment in advanced manufacturing practices globally has further elevated these requirements for potential new entrants.

New companies face considerable challenges in replicating Adcock Ingram's established distribution capabilities, especially for specialized logistics like cold chain management. The company's reported revenue of R17.0 billion for the year ended June 30, 2024, highlights its significant market presence and operational scale.

Porter's Five Forces Analysis Data Sources

Our Adcock Ingram Porter's Five Forces analysis is built upon a foundation of robust data, incorporating financial reports, investor presentations, and market research from reputable firms. We also leverage industry-specific publications and regulatory filings to capture a comprehensive view of the competitive landscape.