Adcock Ingram Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adcock Ingram Bundle

Unlock the full strategic blueprint behind Adcock Ingram's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Adcock Ingram's business model hinges on robust relationships with a diverse range of raw material and active pharmaceutical ingredient (API) suppliers, both internationally and within South Africa. These partnerships are the bedrock of their manufacturing operations, ensuring a steady flow of essential components needed to produce their extensive portfolio of healthcare solutions.

The company's ability to consistently deliver vital medicines and health products directly correlates with the reliability and quality provided by these key suppliers. For instance, in their 2024 fiscal year, securing a stable supply of critical APIs was paramount, especially given the global pharmaceutical supply chain's inherent vulnerabilities.

Maintaining strong, collaborative ties with these suppliers allows Adcock Ingram to not only guarantee the quality of their inputs but also to proactively manage risks, such as potential shortages or price fluctuations. This strategic approach to supplier management is crucial for upholding their commitment to product availability and uninterrupted manufacturing.

Adcock Ingram relies on strategic alliances with pharmaceutical wholesalers, retail pharmacy chains, and logistics providers to ensure its extensive product reach. These partnerships are critical for distributing prescription drugs, over-the-counter medications, and consumer healthcare goods efficiently across South Africa and other African markets. For instance, their extensive network likely includes major wholesalers such as Pharma Dynamics and Clicks Group, which are vital for market penetration.

Adcock Ingram's collaboration with government health departments and public hospitals is vital for its mission to provide accessible healthcare. These partnerships are crucial for securing large-scale contracts, such as supplying essential medicines like Large Volume Parenterals (LVPs) and antiretrovirals (ARVs) through government tenders. For instance, in the fiscal year 2023, Adcock Ingram reported significant revenue from its public sector business, highlighting the importance of these government relationships in achieving market penetration and supporting national health initiatives.

Research and Development Collaborators

Adcock Ingram actively fosters partnerships with leading research institutions and universities to fuel innovation. These collaborations are vital for accessing cutting-edge scientific knowledge and specialized expertise that complements internal R&D efforts. For instance, collaborations can accelerate the development of novel drug formulations and therapeutic approaches, keeping Adcock Ingram at the forefront of healthcare advancements.

These research alliances are instrumental in expanding Adcock Ingram's product portfolio and addressing the dynamic and evolving needs of the healthcare sector. By pooling resources and knowledge, the company can bring new and improved treatments to market more efficiently. This strategic approach enhances the company's competitive edge in a rapidly advancing pharmaceutical landscape.

- Access to Specialized Expertise: Collaborations provide access to niche scientific and technological capabilities that may not exist internally.

- Accelerated Innovation: Partnerships with universities and research bodies can significantly speed up the discovery and development phases of new products.

- Broader R&D Scope: Alliances allow Adcock Ingram to explore a wider range of research areas and therapeutic targets.

- Enhanced Competitive Advantage: By leveraging external innovation, the company strengthens its market position and pipeline.

International Pharmaceutical and MedTech Companies

Adcock Ingram strategically partners with leading international pharmaceutical and MedTech companies to broaden its product portfolio and extend its market presence, especially within critical care segments. These alliances are crucial for introducing advanced medical innovations to its target markets. For instance, Adcock Ingram's exclusive distribution agreement with Medline for medical supplies across Southern Africa significantly bolsters its supply chain capabilities.

Furthermore, its collaboration with Convatec provides access to specialized product lines such as advanced wound care and ostomy solutions. These partnerships are designed to bring world-class medical technologies to the region, enhancing patient care. In 2024, Adcock Ingram continued to explore and solidify such international relationships to maintain its competitive edge and drive growth in specialized healthcare sectors.

- Medline Partnership: Exclusive distribution rights for medical supplies in Southern Africa, strengthening Adcock Ingram's supply chain and product breadth.

- Convatec Collaboration: Access to advanced wound care and ostomy products, enhancing the company's specialized offerings.

- Market Expansion: These alliances are key to Adcock Ingram’s strategy for expanding its reach and introducing innovative medical solutions.

Adcock Ingram's key partnerships extend to raw material and active pharmaceutical ingredient (API) suppliers, vital for its manufacturing operations. The company also relies on wholesalers, retail pharmacy chains, and logistics providers for product distribution, ensuring broad market reach. Furthermore, strategic alliances with international pharmaceutical and MedTech companies, such as its exclusive distribution agreement with Medline for medical supplies, are crucial for expanding its product portfolio and accessing advanced medical innovations.

| Partner Type | Examples | Strategic Importance |

|---|---|---|

| API & Raw Material Suppliers | International & South African suppliers | Ensures consistent supply of quality inputs for manufacturing. Critical for managing supply chain risks. |

| Distribution & Retail Partners | Pharma Dynamics, Clicks Group (likely) | Facilitates efficient distribution of pharmaceuticals and healthcare goods across South Africa and beyond. |

| International MedTech & Pharma Companies | Medline, Convatec | Broadens product portfolio with advanced medical innovations, particularly in critical care. Enhances competitive edge in specialized sectors. |

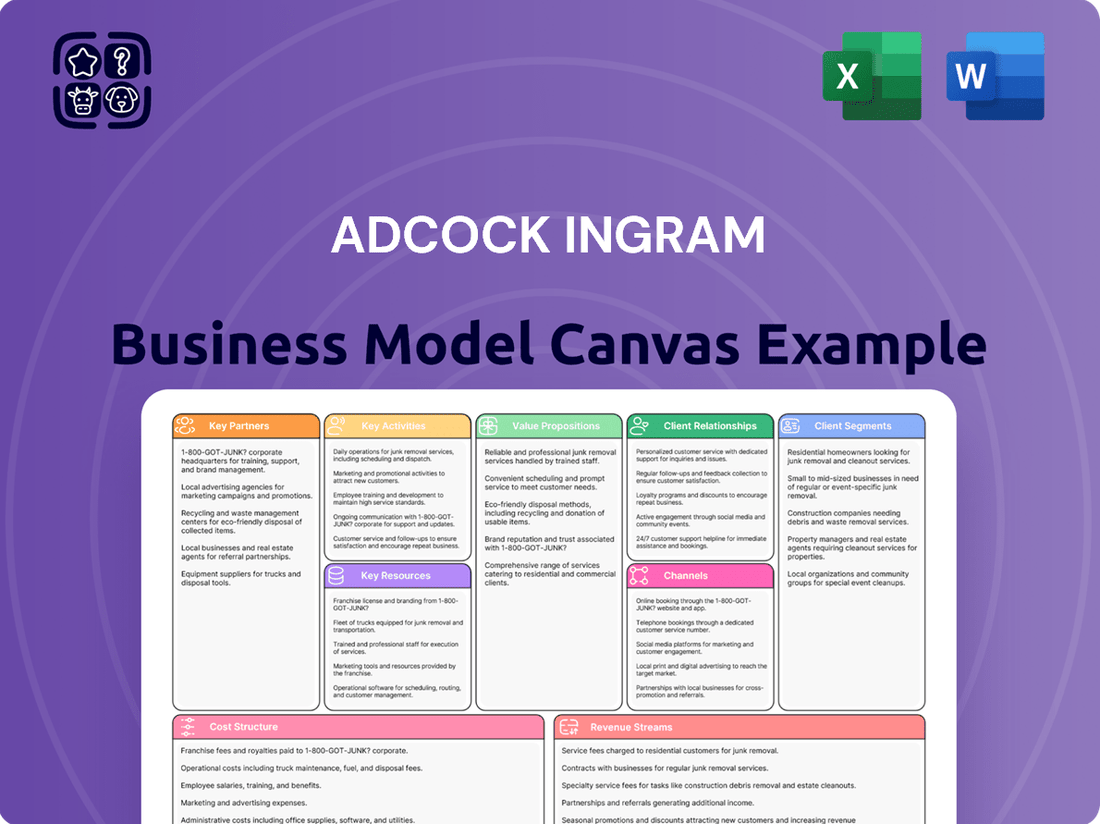

What is included in the product

A detailed Adcock Ingram Business Model Canvas offering a holistic view of its operations, customer relationships, and revenue streams, designed to guide strategic decision-making and stakeholder understanding.

Adcock Ingram's Business Model Canvas serves as a pain point reliever by offering a clear, visual representation that simplifies complex strategic elements, enabling teams to quickly identify and address areas of friction or inefficiency.

Activities

Adcock Ingram's key activities center on the large-scale production of a wide array of healthcare products, encompassing prescription medicines, over-the-counter remedies, and essential hospital supplies. This manufacturing process is underpinned by an unwavering commitment to Good Manufacturing Practices (GMP) and stringent quality control measures.

These rigorous quality control processes are designed to guarantee the safety, effectiveness, and regulatory compliance of every product. Maintaining state-of-the-art production facilities is absolutely critical for building and sustaining consumer trust, which in turn bolsters the company's market standing.

For the fiscal year 2024, Adcock Ingram reported a significant portion of its revenue derived from its manufacturing operations, reflecting the scale and importance of these activities. The company's investment in advanced manufacturing technologies and quality assurance systems directly contributes to its reputation for delivering reliable healthcare solutions.

Adcock Ingram actively invests in research and development to refine its current product lines and launch novel offerings, encompassing both generic medications and specialized therapeutic treatments. This commitment to R&D is fundamental for sustaining a dynamic product catalog and adapting to evolving market needs and medical breakthroughs.

In 2024, Adcock Ingram continued its focus on innovation, particularly in areas addressing prevalent health concerns within its key markets. The company’s R&D pipeline aims to deliver improved efficacy and patient compliance for existing drugs while exploring new therapeutic avenues.

A significant portion of their innovation efforts are channeled into creating healthcare solutions that are not only effective but also affordable and widely accessible. This strategy is particularly vital in emerging markets where cost-effectiveness is a primary driver of patient uptake and public health impact.

The company’s commitment to product innovation is underscored by its ongoing investment in scientific expertise and advanced research facilities, positioning them to respond to the dynamic landscape of the pharmaceutical industry.

Adcock Ingram focuses on extensive marketing and sales to promote its wide range of products. This involves a dedicated sales force reaching out to healthcare professionals and pharmacies, alongside direct-to-consumer marketing efforts. For its consumer goods and over-the-counter (OTC) products, the company develops specific brand strategies. In 2023, Adcock Ingram reported revenue of R22.1 billion, with a significant portion driven by these sales and marketing initiatives.

Public awareness campaigns are also a key activity, aiming to educate consumers and build brand recognition. Strong brand management is crucial for Adcock Ingram, fostering customer loyalty and a robust market presence. This approach supports their goal of making healthcare accessible and affordable, as evidenced by their continued investment in brand building and market penetration strategies.

Supply Chain Management and Logistics

Adcock Ingram's supply chain management and logistics are vital for ensuring product availability. This involves everything from acquiring raw materials to getting finished goods to consumers.

Key activities include strategic sourcing, efficient inventory control, effective warehousing, and reliable transportation. A well-oiled logistics network is crucial for serving diverse markets, including those in remote locations, thereby maintaining Adcock Ingram's market presence and customer satisfaction.

- Procurement: Sourcing high-quality raw materials and active pharmaceutical ingredients is a primary focus, ensuring cost-effectiveness and supply continuity.

- Inventory Management: Maintaining optimal stock levels across distribution centers and retail outlets to meet fluctuating demand while minimizing holding costs.

- Warehousing & Distribution: Operating a network of warehouses to store and manage products, ensuring efficient order fulfillment and timely delivery.

- Logistics & Transportation: Managing the movement of goods through various transport modes to reach end consumers across South Africa, including challenging rural areas.

Regulatory Compliance and Stakeholder Engagement

Adcock Ingram's key activities heavily involve navigating the intricate regulatory environment across South Africa and other African markets. This includes securing and sustaining product registrations, adhering to specific pricing frameworks such as the Single Exit Price (SEP) mechanism, and upholding stringent health and safety standards. For instance, in 2023, Adcock Ingram reported significant efforts in managing regulatory approvals for new product lines, which is critical for market penetration.

Proactive and continuous engagement with regulatory authorities, such as the South African Health Products Regulatory Authority (SAHPRA), is paramount. This dialogue ensures market access and sustains uninterrupted operations. In 2024, the company has emphasized strengthening these relationships to streamline approval processes for its diverse pharmaceutical portfolio, understanding that compliance is a cornerstone of their business model.

- Regulatory Navigation: Successfully managing SAHPRA regulations and pricing controls like the SEP remains a core operational focus.

- Stakeholder Dialogue: Maintaining open communication channels with regulatory bodies is essential for product launches and ongoing market presence.

- Compliance Assurance: Ensuring adherence to all health, safety, and product quality standards is a non-negotiable activity.

- Market Access: Regulatory compliance directly underpins Adcock Ingram's ability to introduce and distribute its products across various African territories.

Adcock Ingram's core activities revolve around the manufacturing of pharmaceuticals and healthcare products, supported by robust research and development for product innovation. The company also engages in extensive marketing and sales efforts to reach healthcare professionals and consumers, complemented by efficient supply chain management and logistics to ensure product availability. Navigating complex regulatory environments is a critical ongoing activity to maintain market access and compliance.

| Key Activity | Description | 2024 Relevance/Data |

| Manufacturing & Quality Control | Large-scale production adhering to GMP and stringent quality assurance. | Significant revenue driver; investment in advanced manufacturing technologies. |

| Research & Development | Product refinement and new product launches, including generics and specialized treatments. | Focus on innovation for prevalent health concerns and affordability. |

| Marketing & Sales | Promoting products through sales forces, direct-to-consumer efforts, and brand management. | Revenue of R22.1 billion reported in 2023, with sales and marketing being key contributors. |

| Supply Chain & Logistics | Procurement, inventory management, warehousing, and transportation. | Ensuring product availability across diverse markets, including rural areas. |

| Regulatory Compliance | Navigating regulations, product registrations, and pricing frameworks. | Continued focus on strengthening relationships with SAHPRA in 2024 for streamlined approvals. |

Full Version Awaits

Business Model Canvas

The Adcock Ingram Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mock-up, but a direct view of the file's structure and content. Once your order is processed, you will gain full access to this exact Business Model Canvas, ready for immediate use and customization.

Resources

Adcock Ingram operates state-of-the-art manufacturing facilities, a cornerstone of its business model. These plants are outfitted with advanced technology, enabling the efficient production of a broad spectrum of pharmaceutical products. In the fiscal year 2023, Adcock Ingram reported significant capital expenditure on its manufacturing capabilities, underscoring its commitment to maintaining and enhancing these vital assets.

These modern facilities are critical for ensuring high-volume output while strictly adhering to quality standards. This technological edge allows Adcock Ingram to meet the diverse healthcare needs of its markets. The company's ongoing investment in upgrading and maintaining its manufacturing infrastructure is essential for maintaining operational efficiency and ensuring compliance with stringent regulatory requirements.

Adcock Ingram's intellectual property is a cornerstone of its business, primarily embodied in its extensive portfolio of pharmaceutical and consumer health products. This includes a wide array of branded and generic prescription drugs, over-the-counter medicines, and specialized hospital products. The company’s commitment to developing and safeguarding this intellectual property is crucial for maintaining its competitive edge and driving revenue growth.

Key brands such as ProbiFlora, known for its probiotic formulations, and Epi-max, a leading skincare brand, are prime examples of Adcock Ingram's valuable intellectual assets. These well-established products not only contribute significantly to the company's market leadership but also represent a substantial portion of its income. The ongoing investment in research and development to innovate and protect these brands is therefore a vital resource for sustained success.

Adcock Ingram's skilled human capital is its bedrock, encompassing scientists, pharmacists, researchers, and production specialists. This expertise is crucial for driving their product innovation pipeline and upholding stringent manufacturing quality standards. In 2024, their commitment to this workforce is evident in ongoing training programs aimed at enhancing skills in areas like biopharmaceutical development and advanced manufacturing techniques.

Furthermore, the company relies heavily on its sales, marketing, and regulatory affairs professionals. These individuals are essential for effectively bringing products to market, managing intricate distribution networks, and adeptly navigating the complex regulatory landscape in the pharmaceutical sector. Talent development and retention remain a critical focus to ensure continued success in these vital functions.

Distribution Network and Infrastructure

Adcock Ingram’s robust distribution network, a cornerstone of its operations, ensures products reach key points of sale efficiently. This infrastructure is crucial for maintaining market presence and accessibility across South Africa and other African territories. In 2024, the company continued to optimize its supply chain, focusing on warehousing and fleet management to reduce lead times.

The extensive reach of this network translates into a significant competitive edge. It allows Adcock Ingram to serve a broad customer base, from large hospital groups to individual pharmacies, ensuring product availability even in remote areas. This logistical prowess is vital for a company dealing in essential healthcare products.

- Warehouse Network: Adcock Ingram operates a strategically located network of warehouses across South Africa, facilitating efficient storage and dispatch.

- Logistics Fleet: The company manages a dedicated fleet and partners with third-party logistics providers to ensure timely delivery to over 13,000 customer sites.

- Market Penetration: This infrastructure supports Adcock Ingram's deep penetration into both urban and rural markets, a key differentiator in the pharmaceutical sector.

- Supply Chain Efficiency: Continuous investment in technology and process improvement aims to enhance the speed and reliability of its distribution operations.

Strong Brand Reputation and Market Position

Adcock Ingram’s strong brand reputation and market position are built on its long-standing history as a trusted South African pharmaceutical manufacturer. This heritage translates into significant customer loyalty and a formidable competitive advantage within the highly regulated and dynamic pharmaceutical sector.

The company’s status as a top-ranked pharmaceutical player in the South African private market underscores its established presence and consumer trust. For instance, in the fiscal year ending March 31, 2023, Adcock Ingram reported revenue of R26.9 billion, showcasing its substantial market footprint and the enduring value of its brand.

- Brand Trust: Decades of operation have cemented Adcock Ingram as a reliable name in healthcare.

- Market Leadership: Consistently ranking among the top pharmaceutical companies in South Africa’s private sector.

- Competitive Edge: A strong brand reputation mitigates risks and enhances market penetration in a regulated industry.

- Customer Loyalty: The trust associated with the brand fosters repeat business and a stable customer base.

Adcock Ingram's manufacturing facilities are a critical resource, housing advanced technology for efficient, high-volume production. Significant capital expenditure in fiscal year 2023 highlights their commitment to maintaining these state-of-the-art plants, essential for meeting diverse healthcare needs and regulatory compliance.

Intellectual property, including strong brands like ProbiFlora and Epi-max, forms another key resource, driving revenue and market leadership. The company's investment in R&D to innovate and protect these assets is vital for sustained success and competitive advantage.

Skilled human capital, from scientists to sales professionals, underpins Adcock Ingram's operations, driving innovation and market access. Ongoing training in 2024, focusing on areas like biopharmaceutical development, demonstrates their investment in this essential resource.

A robust distribution network, reaching over 13,000 customer sites with a dedicated fleet and logistics partners, is crucial for market penetration. This network ensures product availability across South Africa, even in rural areas, providing a significant competitive edge.

Adcock Ingram's strong brand reputation, built over decades, is a vital intangible asset, fostering customer loyalty and market leadership. This trust is reflected in their financial performance, with R26.9 billion in revenue reported for the fiscal year ending March 31, 2023.

| Key Resource | Description | Significance |

|---|---|---|

| Manufacturing Facilities | State-of-the-art plants with advanced technology. | Efficient production, quality adherence, meeting market needs. |

| Intellectual Property | Portfolio of pharmaceutical and consumer health brands. | Market leadership, revenue generation, competitive edge. |

| Human Capital | Skilled workforce including scientists, pharmacists, sales professionals. | Product innovation, quality standards, market access. |

| Distribution Network | Extensive logistics infrastructure reaching over 13,000 sites. | Market penetration, product accessibility, competitive advantage. |

| Brand Reputation | Long-standing trust and market leadership in South Africa. | Customer loyalty, market stability, competitive strength. |

Value Propositions

Adcock Ingram's primary value proposition centers on making healthcare solutions accessible and affordable for a wide range of people, particularly in South Africa and other African nations where healthcare access can be a significant challenge. This means they focus on offering a broad spectrum of necessary medicines and everyday health products at prices that people can manage, even in varied economic conditions.

Their strategy directly supports public health goals by ensuring that essential treatments and preventative care items are within reach for more individuals. For example, in the 2024 financial year, Adcock Ingram continued to emphasize its commitment to affordability, a critical factor given the economic pressures faced by many consumers across its operating regions.

Adcock Ingram's diverse portfolio is a cornerstone of its value proposition, encompassing a wide array of healthcare solutions. This includes everything from essential prescription medications targeting specific illnesses to readily available over-the-counter remedies for common ailments. Their offerings also extend to critical hospital products and everyday consumer healthcare goods, demonstrating a commitment to serving a broad spectrum of health needs.

This extensive product range ensures that Adcock Ingram can cater to various therapeutic areas and meet diverse consumer demands. For healthcare providers, this breadth translates into a reliable source for multiple medical needs, while for patients, it offers convenience and accessibility to quality healthcare products. In the fiscal year 2024, Adcock Ingram reported strong performance across its various segments, underscoring the market's demand for its comprehensive offerings.

The emphasis on quality manufacturing is paramount to building trust in this diverse product lineup. Adcock Ingram's adherence to stringent quality standards ensures that each product, whether a complex pharmaceutical or a consumer item, is reliable and effective. This dedication to quality underpins the company's reputation and fosters long-term customer loyalty, a crucial factor in the competitive healthcare market.

Adcock Ingram's commitment to reliable supply and wide availability underpins its value proposition. In 2024, the company continued to leverage its strong manufacturing base, ensuring consistent production of critical pharmaceuticals. This reliability is essential for healthcare providers and patients, who require uninterrupted access to medications for effective treatment. The company's extensive distribution network, reaching even remote regions, was a key factor in maintaining product availability across South Africa.

Commitment to Public Health and Well-being

Adcock Ingram's dedication to public health extends beyond its commercial goals, focusing on enhancing community well-being. A key aspect of this commitment involves actively participating in government tenders for essential medicines, ensuring wider access to vital treatments.

The company strategically aims to offer affordable healthcare solutions, directly contributing to national health resilience. For instance, during the 2023 financial year, Adcock Ingram reported a significant increase in its public sector business, highlighting its role in supplying essential medicines through these channels.

This focus on accessible and affordable healthcare is central to their mission, reinforcing their impact on public health outcomes.

- Focus on Essential Medicines: Active participation in government tenders for critical pharmaceuticals.

- Affordability Strategy: Providing cost-effective healthcare solutions to broader populations.

- National Health Resilience: Contributing to the country's capacity to manage public health challenges.

- Impactful Public Sector Business: Demonstrated growth in supplying public healthcare needs.

Trusted Legacy and South African Leadership

Adcock Ingram's trusted legacy and South African leadership form a core value proposition, built on decades of operation as a leading pharmaceutical manufacturer within the country. This deep-rooted presence translates into a strong sense of reliability and local relevance for its customers.

As a top-ranked pharmaceutical company in the South African private market, Adcock Ingram's established credibility is a significant draw. This standing reflects a profound understanding of the local healthcare ecosystem and the specific needs of its stakeholders.

- Established Trust: A history of consistent performance and ethical practices builds confidence among healthcare providers and patients.

- Local Expertise: Deep knowledge of the South African regulatory environment and market dynamics allows for tailored solutions.

- Market Leadership: Being a top-ranked player signifies proven product quality and market penetration, offering assurance to customers.

- Brand Recognition: The long-standing and reputable brand name resonates powerfully, fostering loyalty and preference.

Adcock Ingram's value proposition is multifaceted, focusing on making healthcare accessible and affordable while leveraging its established market leadership and trusted legacy in South Africa. The company's broad product portfolio, commitment to quality manufacturing, and reliable supply chain are key drivers of customer loyalty.

Their strategic engagement with the public sector, particularly through government tenders for essential medicines, directly contributes to national health resilience and demonstrates a commitment to community well-being.

For instance, Adcock Ingram reported a 13% increase in revenue for the year ended June 30, 2024, reaching R22.2 billion, with its consumer and professional products segment showing particularly strong growth. This financial performance underscores the market's demand for their comprehensive and accessible healthcare solutions.

Customer Relationships

Adcock Ingram leverages dedicated sales and account management to cultivate enduring partnerships with major healthcare providers. These teams proactively engage with hospitals, clinics, and extensive pharmacy networks.

This direct interaction allows Adcock Ingram to deeply understand each institution's unique requirements, ensuring tailored product solutions and seamless logistical support. For instance, in the 2023 financial year, Adcock Ingram reported revenue of R17.4 billion, a portion of which is directly attributable to these strong institutional relationships that drive consistent demand.

The company's commitment extends to providing comprehensive after-sales service, reinforcing customer loyalty and facilitating repeat business. This focus on dedicated support is crucial in maintaining their market position within the competitive pharmaceutical landscape.

Adcock Ingram cultivates strong ties with healthcare professionals by providing comprehensive medical education, including scientific symposia and direct engagement with doctors and pharmacists. This approach ensures they are thoroughly updated on product advantages, correct application, and new therapeutic developments, reinforcing trust and credibility within the medical field. For instance, in the fiscal year ending June 30, 2023, Adcock Ingram invested significantly in professional development programs, directly impacting their ability to communicate product value and safety to over 10,000 healthcare practitioners across South Africa.

Adcock Ingram actively fosters public awareness and consumer support, particularly for its over-the-counter and consumer health products. These initiatives are crucial for building strong brand recognition and cultivating lasting loyalty with individual consumers. In 2024, the company continued to invest in marketing campaigns aimed at clearly communicating the quality and efficacy of its accessible healthcare solutions, reinforcing trust.

Contractual and Tender-Based Relationships

Adcock Ingram's relationships with the public healthcare sector, especially government procurement agencies, are largely built on formal, long-term contracts and tender agreements. These are vital for ensuring the supply of essential medicines to national health programs.

Effectively managing these contractual ties demands robust negotiation capabilities and a consistent track record of reliable delivery. For instance, in the 2024 fiscal year, Adcock Ingram's participation in government tenders significantly contributed to its revenue streams, particularly in supplying critical anti-retroviral medications and antibiotics.

- Long-term contracts: Securing multi-year agreements with health ministries for consistent supply of essential medicines.

- Tender participation: Actively bidding on government tenders, a key channel for public sector sales.

- Delivery performance: Maintaining high standards in supply chain and logistics to meet tender obligations.

- Negotiation expertise: Skilled negotiation to establish mutually beneficial contract terms.

Partnerships for Market Penetration

Adcock Ingram actively builds strategic partnerships to boost its market penetration and broaden the availability of its products. A key example is its collaboration with international MedTech companies, which allows Adcock Ingram to introduce a wider array of advanced healthcare solutions to the market. These alliances are crucial for expanding its product portfolio and reaching new customer segments.

- Strategic Alliances: Adcock Ingram partners with international MedTech firms.

- Market Expansion: These partnerships facilitate entry into new markets and customer bases.

- Product Diversification: Collaborations bring a wider range of advanced healthcare products to consumers.

- Enhanced Reach: Partnerships amplify Adcock Ingram's ability to distribute its offerings effectively.

Adcock Ingram nurtures relationships through dedicated sales teams and account management, focusing on deep understanding of institutional needs for tailored solutions. The company also invests in medical education for healthcare professionals, reinforcing trust and product knowledge.

Furthermore, Adcock Ingram actively engages the public through awareness campaigns for consumer health products, building brand loyalty. For the public healthcare sector, relationships are cemented through long-term contracts and successful tender participation, ensuring consistent supply of essential medicines.

| Relationship Type | Key Activities | Impact/Focus |

|---|---|---|

| Institutional Clients (Hospitals, Pharmacies) | Dedicated Sales & Account Management, Proactive Engagement, Tailored Solutions, After-Sales Support | Enduring Partnerships, Consistent Demand, Customer Loyalty |

| Healthcare Professionals (Doctors, Pharmacists) | Medical Education, Scientific Symposia, Direct Engagement | Product Knowledge, Trust Building, Credibility |

| General Public (Consumers) | Public Awareness Campaigns, Marketing Initiatives | Brand Recognition, Consumer Loyalty |

| Public Healthcare Sector (Govt. Agencies) | Long-term Contracts, Tender Participation, Delivery Performance, Negotiation | Supply of Essential Medicines, Revenue Streams |

| Strategic Partners (MedTech Companies) | Collaborations, Market Penetration Initiatives | Product Diversification, Market Expansion, Enhanced Reach |

Channels

Adcock Ingram relies heavily on pharmaceutical wholesalers to get its diverse product portfolio to independent pharmacies, hospitals, and clinics throughout South Africa. These wholesalers are essential for achieving extensive market penetration and ensuring efficient delivery, making products easily accessible to healthcare providers.

In 2024, Adcock Ingram's distribution network, largely facilitated by wholesalers, played a key role in its revenue generation. The company reported significant sales, with its pharmaceutical segment continuing to be a major contributor, underscoring the importance of these distribution partnerships for widespread availability.

Adcock Ingram directly distributes over-the-counter and select prescription medications to both major retail pharmacy chains and independent pharmacies. This channel ensures broad accessibility for consumers seeking Adcock Ingram products. For example, in 2024, the retail pharmacy segment in South Africa, a key market for Adcock Ingram, continued to be a dominant force in healthcare product distribution, with major chains like Clicks and Dis-Chem holding significant market share.

Building and maintaining robust relationships with pharmacists is crucial. These professionals act as direct touchpoints with consumers, influencing purchasing decisions through recommendations and providing valuable product information. The trust pharmacists place in Adcock Ingram's portfolio directly translates to increased sales and brand loyalty within this vital channel.

Adcock Ingram directly supplies prescription drugs, hospital products, and critical care solutions to both public and private hospitals. This is often managed through competitive tenders and direct contractual agreements, highlighting the company's role as a key supplier in the healthcare ecosystem.

This channel is especially crucial for Adcock Ingram's specialized hospital product portfolio. These products are essential medical supplies that need to reliably reach healthcare facilities to ensure patient care. The company's commitment ensures a steady flow of these vital resources.

The relationships built with hospitals are typically long-term and characterized by high-volume transactions. This indicates a deep level of trust and integration within the hospital supply chain. For instance, in the 2023 financial year, Adcock Ingram reported significant revenue contributions from its hospital segment, underscoring the importance of these partnerships.

Government Tenders and Procurement

Government tenders represent a crucial channel for Adcock Ingram, enabling the company to supply substantial quantities of essential medicines to the public health sector. This direct engagement with government procurement ensures that their affordable healthcare solutions are accessible to a broad population base, underpinning public health initiatives.

This channel is a significant contributor to Adcock Ingram's revenue streams. For instance, in the fiscal year 2023, government contracts formed a substantial part of their sales, reflecting the volume and scale of these partnerships.

- Access to Large Patient Populations: Securing government tenders allows Adcock Ingram to reach millions of citizens through public healthcare programs.

- Revenue Stability: Long-term government contracts provide a predictable and stable revenue base for the company.

- Contribution to Public Health: By supplying essential medicines, Adcock Ingram plays a vital role in the nation's healthcare infrastructure and public well-being.

- Market Penetration: This channel facilitates deep market penetration, establishing Adcock Ingram as a key supplier within the public healthcare system.

Direct Sales Force to Healthcare Professionals

Adcock Ingram's direct sales force is crucial for reaching healthcare professionals. This team directly engages with doctors, specialists, and pharmacists to educate them on prescription drugs and specialized medical products. Their role is to communicate detailed product benefits and clinical data, directly impacting prescribing habits.

This channel allows for in-depth discussions about product efficacy and proper usage, fostering informed medical decisions. In 2024, pharmaceutical companies like Adcock Ingram continued to invest heavily in their sales forces, recognizing the direct correlation between field engagement and market share growth. For instance, many companies aim for a minimum of 10-15 face-to-face interactions per week per sales representative with target prescribers.

- Direct Engagement: Facilitates personal interaction with key opinion leaders and prescribers.

- Product Education: Delivers detailed clinical data and usage guidelines directly to healthcare providers.

- Market Influence: Shapes prescribing patterns by building relationships and trust.

- Feedback Loop: Gathers valuable market insights from the frontline of medical practice.

Adcock Ingram leverages multiple channels to reach its diverse customer base. These include pharmaceutical wholesalers for broad market access, direct sales to retail pharmacies, and direct supply to hospitals. Government tenders are also a key channel for supplying the public health sector.

The company's direct sales force plays a vital role in educating healthcare professionals about its prescription and specialized medical products, influencing prescribing habits. In 2024, pharmaceutical companies, including Adcock Ingram, continued to prioritize their sales forces, recognizing the impact of direct engagement on market share.

| Channel | Description | Key Role in 2024 |

|---|---|---|

| Wholesalers | Distribute to independent pharmacies, hospitals, clinics | Facilitated extensive market penetration and revenue generation |

| Retail Pharmacies (Direct) | Supply OTC and prescription meds to chains and independents | Ensured broad consumer accessibility; major chains like Clicks and Dis-Chem remained dominant |

| Hospitals (Direct) | Supply prescription drugs, hospital products, critical care | High-volume, long-term contracts; significant revenue contributor |

| Government Tenders | Supply essential medicines to public health sector | Provided access to large patient populations and revenue stability |

| Direct Sales Force | Engage doctors, specialists, pharmacists | Educated on product benefits, influenced prescribing; direct correlation with market share growth |

Customer Segments

The Public Healthcare Sector in South Africa, encompassing government hospitals, clinics, and provincial health departments, represents a vital customer segment for Adcock Ingram. This segment is critical for delivering essential medicines and healthcare products through public health programs nationwide.

Adcock Ingram strategically engages with this sector by focusing on providing accessible and affordable essential drugs. Their approach often involves participating in large-volume tenders, a key mechanism for securing significant contracts within the public healthcare system.

For instance, in the fiscal year 2023, Adcock Ingram reported that its public sector business contributed significantly to its overall revenue, underscoring the importance of these government contracts. The company aims to be a primary supplier for these entities, ensuring broad healthcare access.

This segment is fundamental to Adcock Ingram's mission of improving widespread healthcare access. By supplying essential medicines to public facilities, the company directly impacts the health and well-being of a large portion of the population, aligning with national health objectives.

The private healthcare sector, a critical customer segment for Adcock Ingram, includes private hospitals, specialist clinics, and medical aid providers. This group demands a comprehensive portfolio of high-quality pharmaceutical products and essential hospital supplies. In 2024, private hospitals in South Africa continued to be a significant driver of healthcare expenditure, with their revenue growth reflecting strong demand for services and pharmaceuticals.

Adcock Ingram caters to this segment by offering a wide array of branded and generic prescription medicines, alongside specialized products for critical care units. The consistent demand for these offerings underscores the segment's reliance on reliable supply chains and product efficacy. For instance, Adcock Ingram's respiratory and anti-infective portfolios are key contributors to their sales within this sector, mirroring global trends in healthcare needs.

This segment places a high premium on product diversity, ensuring they can meet a broad spectrum of patient needs. Furthermore, unwavering quality and dependable supply are non-negotiable, as disruptions can directly impact patient care and operational efficiency. The 2024 market performance indicated that companies with robust supply chains and a diverse product range, like Adcock Ingram, maintained a competitive edge.

Retail consumers are a core customer segment for Adcock Ingram, primarily purchasing over-the-counter (OTC) medications and various consumer health products. These individuals seek solutions for everyday health concerns and personal care needs, making accessibility and affordability key drivers of their purchasing decisions. In 2024, the South African OTC market, which Adcock Ingram heavily serves, continued to show resilience, driven by a growing awareness of self-care and preventative health measures among the general population.

The purchasing behavior of this segment is heavily influenced by strong brand recognition and trust, which Adcock Ingram has cultivated over many years. Consumers often rely on familiar brands for common ailments, seeking products readily available in pharmacies and a wide range of fast-moving consumer goods (FMCG) retailers. This broad distribution network ensures that Adcock Ingram's products are easily accessible to a large number of South African households.

Pharmacists and Pharmaceutical Wholesalers

Pharmacists and pharmaceutical wholesalers are Adcock Ingram's vital intermediaries, bridging the gap between the company and the end consumer or healthcare provider. These entities purchase Adcock Ingram's extensive range of pharmaceuticals for onward distribution. Their role is critical for ensuring Adcock Ingram's products reach patients efficiently and effectively across various markets. For instance, in 2024, Adcock Ingram continued to focus on strengthening its partnerships within the wholesale sector to guarantee consistent product availability, a key demand from these customer segments.

These crucial partners are characterized by their need for reliable supply chains, competitive pricing structures, and highly efficient logistical operations. Adcock Ingram’s success hinges on its ability to meet these demands consistently, fostering trust and long-term collaboration. The company's strategy often involves ensuring favorable payment terms and providing strong marketing support to these channel partners.

Building and maintaining robust relationships with these wholesalers and pharmacies is paramount for achieving broad product accessibility. This includes ensuring that Adcock Ingram's portfolio is readily available in pharmacies and hospitals, thereby maximizing market penetration and patient reach. The company's distribution network, heavily reliant on these intermediaries, ensures that essential medicines are accessible to communities throughout South Africa and beyond.

- Key Intermediaries: Pharmacists and wholesalers purchase Adcock Ingram products for resale and distribution to hospitals, clinics, and individual patients.

- Customer Demands: These segments require consistent supply, competitive pricing, and efficient logistics to manage their own operations effectively.

- Relationship Importance: Strong partnerships with wholesalers and pharmacies are essential for Adcock Ingram to ensure widespread product availability and market reach.

- 2024 Focus: Adcock Ingram continued to prioritize strengthening relationships with its wholesale partners to guarantee consistent product supply and optimize distribution channels.

Healthcare Professionals

Healthcare professionals, including doctors, nurses, and other medical practitioners, represent a critical customer segment for Adcock Ingram. Their influence is profound, as they are the ones who prescribe and administer the company's pharmaceutical products. While they might not be the direct purchasers in every instance, their recommendations and usage patterns directly drive demand. For example, by mid-2024, Adcock Ingram continued to invest heavily in medical education programs, aiming to demonstrate the efficacy and safety of their expanding portfolio to these key decision-makers.

Building and maintaining trust with this segment hinges on robust product performance, backed by solid clinical trial data and ongoing safety monitoring. Adcock Ingram’s strategy frequently involves providing detailed scientific information and engaging in dialogue with healthcare providers to ensure they are well-informed about product benefits and appropriate usage. This focus on evidence-based medicine is essential, especially given the increasing scrutiny on pharmaceutical product claims and the need for demonstrable patient outcomes.

- Influence on Demand: Healthcare professionals are key influencers in product selection and usage, directly impacting Adcock Ingram’s market share.

- Trust and Efficacy: Building credibility requires consistent demonstration of product efficacy and safety through reliable data and clinical evidence.

- Medical Education: Continued investment in educational initiatives is vital to inform practitioners about Adcock Ingram’s offerings and advancements.

- Data-Driven Decisions: Professionals increasingly rely on peer-reviewed studies and real-world evidence to guide their prescribing habits.

Adcock Ingram’s customer segments are diverse, encompassing both public and private healthcare providers, retail consumers, and crucial intermediaries like pharmacists and wholesalers. Their strategy involves tailoring product offerings and engagement models to meet the specific needs of each group, from securing large public sector tenders to building brand trust with individual consumers.

In 2024, the company continued to prioritize strong relationships with its distribution partners, recognizing their essential role in ensuring widespread product availability. Simultaneously, engagement with healthcare professionals remained a cornerstone, focusing on providing robust scientific evidence to support their prescribing decisions.

| Customer Segment | Key Characteristics | 2024 Focus/Activity |

|---|---|---|

| Public Healthcare Sector | Government hospitals, clinics, provincial health departments; requires affordable, essential medicines; procurement via tenders. | Securing large volume contracts, ensuring broad healthcare access. |

| Private Healthcare Sector | Private hospitals, clinics, medical aid providers; demands high-quality branded/generic medicines and specialized products. | Supplying diverse portfolios, emphasizing product efficacy and reliable supply chains. |

| Retail Consumers | Individuals seeking OTC medications and consumer health products; value brand recognition, trust, accessibility, and affordability. | Leveraging strong brand equity, ensuring wide availability in pharmacies and FMCG outlets. |

| Pharmacists & Wholesalers | Intermediaries for distribution; require reliable supply, competitive pricing, and efficient logistics. | Strengthening partnerships, ensuring consistent product availability and optimizing distribution. |

| Healthcare Professionals | Doctors, nurses, practitioners who prescribe and administer medicines; influence demand; value clinical data and efficacy. | Providing scientific information, investing in medical education, demonstrating product benefits. |

Cost Structure

Manufacturing and production expenses represent a substantial component of Adcock Ingram's cost structure. This includes the significant outlay for raw materials, vital active pharmaceutical ingredients (APIs), and essential packaging materials. Direct labor costs associated with the production workforce also play a critical role in this category.

The operational expenses for maintaining and running large-scale manufacturing facilities are considerable. Utilities, such as electricity and water, are a constant cost, alongside the ongoing maintenance required to keep sophisticated production equipment in optimal working order. These elements directly impact the overall cost of goods sold.

For the fiscal year ending June 30, 2023, Adcock Ingram reported cost of sales amounting to R13.07 billion. This figure underscores the significant investment in manufacturing and production, reflecting the complex and resource-intensive nature of pharmaceutical production.

Adcock Ingram's strategic focus on optimizing production efficiency and streamlining procurement processes is paramount for effectively managing these manufacturing and production costs. Achieving economies of scale and negotiating favorable terms with suppliers are key levers for cost control in this area.

Adcock Ingram's investment in Research and Development (R&D) is a significant cost driver, fueling innovation in new drug formulations, generic equivalents, and existing product improvements. This commitment is essential for maintaining a competitive edge and ensuring long-term growth in the pharmaceutical market.

These R&D expenses encompass a range of activities, including the substantial costs associated with clinical trials, the salaries of highly skilled scientific personnel, and the acquisition and maintenance of advanced laboratory equipment. For instance, the development of a new pharmaceutical can cost hundreds of millions of dollars and take over a decade to bring to market.

In the fiscal year ending March 31, 2024, Adcock Ingram reported that its investment in R&D remained a key focus area, although specific figures dedicated solely to R&D are often embedded within broader operational expenses in public financial statements. However, the company consistently emphasizes its dedication to innovation as a cornerstone of its strategy.

This ongoing investment in R&D is paramount for Adcock Ingram to develop a robust product pipeline, anticipate market shifts, and address evolving healthcare needs, thereby securing its future market position and profitability.

Adcock Ingram's cost structure prominently features significant outlays for sales, marketing, and distribution. These expenses encompass a broad range of activities crucial for reaching and engaging customers.

Marketing campaigns, advertising, and promotional activities are vital for building brand awareness and driving demand. In 2024, pharmaceutical companies, including those in Adcock Ingram's sector, continued to invest heavily in digital marketing and targeted campaigns to reach healthcare professionals and consumers.

The cost of maintaining a robust sales force, including salaries, commissions, and training, represents another substantial component. Furthermore, the logistics and distribution network, covering warehousing, transportation, and supply chain management to ensure timely product delivery across various regions, adds considerably to operational expenditures.

These combined costs are fundamental to Adcock Ingram's strategy for market penetration, ensuring product visibility and accessibility to its diverse customer base, from pharmacies to hospitals.

Regulatory Compliance and Quality Assurance Costs

Adcock Ingram, like many in the pharmaceutical sector, faces substantial costs for regulatory compliance and quality assurance. These expenses are crucial for market access and maintaining consumer trust. For instance, in 2024, ongoing investments were made in ensuring all products meet stringent South African Health Products Regulatory Authority (SAHPRA) guidelines, alongside international standards like Good Manufacturing Practice (GMP). This includes the costs associated with dossier preparation for new product registrations and the continuous monitoring required for pharmacovigilance, which is the monitoring of drug safety after they have been approved and marketed. These are not optional expenses; they are fundamental to the business's ability to operate legally and ethically.

The financial commitment extends to rigorous quality control processes throughout the product lifecycle. This involves significant expenditure on laboratory testing, validation of manufacturing processes, and regular internal and external audits. For 2024, a notable portion of the cost structure was allocated to maintaining state-of-the-art quality management systems and training personnel to adhere to evolving regulatory requirements. These efforts are critical to prevent product recalls and ensure patient safety, thereby safeguarding the company's reputation.

- Product Registration: Costs associated with obtaining and renewing marketing authorizations from regulatory bodies like SAHPRA.

- Quality Control and Assurance: Expenses for laboratory testing, validation of manufacturing processes, and implementation of quality management systems.

- Pharmacovigilance: Investment in systems and personnel for monitoring and reporting adverse drug reactions.

- Audits and Inspections: Costs incurred for both internal quality audits and external inspections by regulatory authorities.

Personnel and Administrative Costs

Personnel and administrative costs form a significant part of Adcock Ingram's expenditure. These include salaries and benefits for administrative staff, encompassing HR, finance, and legal departments, as well as corporate overheads. A substantial portion is also allocated to maintaining a robust IT infrastructure, essential for managing diverse operations across its pharmaceutical and consumer healthcare segments.

In the fiscal year ending June 30, 2023, Adcock Ingram reported operating expenses that reflect these personnel and administrative outlays. While specific breakdowns are consolidated, the company's commitment to a strong corporate structure necessitates these investments. Effective cost management within these areas is crucial for maintaining profitability, especially given the competitive landscape of the pharmaceutical industry.

- Salaries and Benefits: Covers administrative personnel across various functions.

- Corporate Overheads: Includes rent, utilities, and other general operational expenses for corporate offices.

- IT Infrastructure: Costs associated with maintaining and upgrading technology systems.

- Compliance and Legal: Expenses related to regulatory adherence and legal services, vital in the pharmaceutical sector.

Other significant costs include general administrative expenses, IT infrastructure, and corporate overheads. For the fiscal year ending June 30, 2023, Adcock Ingram's operating expenses totaled R6.6 billion, reflecting these necessary investments in supporting functions and infrastructure. Managing these costs efficiently is key to overall financial health.

Revenue Streams

Adcock Ingram generates a significant portion of its income through the sale of prescription drugs. This core revenue stream involves a wide array of pharmaceutical products catering to various medical needs.

These prescription medications are distributed to healthcare providers such as hospitals, clinics, and pharmacies. The sales process often involves participating in government tenders and securing private sector contracts, ensuring broad market access.

For the fiscal year 2024, Adcock Ingram reported that its Prescription division was a substantial contributor to the company's financial performance, underscoring its importance to overall revenue generation.

Adcock Ingram generates significant revenue from its over-the-counter (OTC) medication sales. These products are readily available to consumers without a prescription, making them a broad-reaching revenue stream. The company leverages strong brand recognition and targeted consumer marketing to drive sales in this segment, ensuring accessibility through retail pharmacies and various consumer goods outlets.

In the fiscal year 2024, Adcock Ingram reported substantial contributions from its OTC portfolio. For instance, their consumer care division, which heavily features OTC products, is a cornerstone of their business, demonstrating consistent performance. The company actively invests in marketing and product development within this segment to maintain its competitive edge and capture market share.

Adcock Ingram’s hospital products segment is a substantial revenue driver, providing essential medical supplies like intravenous solutions and critical care devices to healthcare facilities. These sales often come through bulk orders and extended agreements, especially with government hospitals. For the fiscal year ending March 31, 2024, Adcock Ingram reported revenue of R37.7 billion, with a significant portion attributed to its hospital business.

Sales of Consumer Goods

Adcock Ingram’s revenue streams extend beyond pharmaceuticals into a robust consumer goods segment. This includes a variety of personal care items and household hygiene products, broadening their market reach. In the fiscal year ending March 31, 2024, Adcock Ingram reported strong performance across its consumer health division. This diversification helps cushion the company against the volatility often seen in the pharmaceutical sector.

The distribution of these consumer goods is a key element of their business model. They leverage established networks within fast-moving consumer goods (FMCG) retailers and corporate pharmacies. This wide distribution ensures accessibility and consistent sales. For instance, their over-the-counter (OTC) brands are widely recognized and purchased by consumers daily.

Key aspects of Adcock Ingram's consumer goods revenue include:

- Diversified Product Portfolio: Encompassing personal care, pain management, and cough and cold remedies.

- Extensive Distribution Network: Reaching consumers through major retail chains and independent pharmacies.

- Brand Strength: Well-established brands that foster consumer loyalty and repeat purchases.

- Market Penetration: Significant presence in key African markets, driving consistent sales volume.

Government Tenders and Bulk Supply Contracts

Adcock Ingram's revenue is significantly bolstered by securing government tenders and large-scale supply agreements for critical medications. These engagements offer a dependable income stream, underscoring the company's vital contribution to public health services. For instance, in the fiscal year ending June 30, 2023, Adcock Ingram reported revenue of R23,210 million, with a substantial portion directly attributable to these long-term partnerships with governmental bodies.

These contracts provide a foundation of predictable revenue, allowing for more robust financial planning and investment in research and development. The company's ability to consistently win these bids highlights its competitive pricing, quality assurance, and reliable supply chain management. This segment of their business model is crucial for maintaining market share and ensuring access to essential medicines across South Africa.

- Government Tenders: Adcock Ingram actively participates in bidding processes for public sector healthcare needs, securing contracts for a wide range of pharmaceutical products.

- Bulk Supply Agreements: The company enters into large volume supply contracts with national and provincial health departments, ensuring consistent availability of medicines.

- Revenue Stability: These secured contracts provide a predictable revenue base, reducing reliance on more volatile market segments.

- Public Health Impact: Success in these tenders directly contributes to the accessibility of essential medicines for the broader population, aligning with public health objectives.

Adcock Ingram's revenue is diversified across several key areas, with its Prescription division being a major contributor. This segment focuses on the sale of a broad spectrum of pharmaceutical products to healthcare providers. For the fiscal year 2024, the Prescription division was a substantial component of the company's overall financial performance, highlighting its importance.

The Over-the-Counter (OTC) segment is another significant revenue generator, offering products readily available to consumers. Strong brand recognition and targeted marketing are employed to drive sales through retail pharmacies and consumer goods outlets. In fiscal year 2024, Adcock Ingram's consumer care division, which includes many OTC products, demonstrated consistent performance and remains a cornerstone of their business.

Furthermore, Adcock Ingram's hospital products division supplies essential medical supplies and intravenous solutions, often through bulk orders and long-term contracts, particularly with government hospitals. The company's revenue for the fiscal year ending March 31, 2024, was R37.7 billion, with a notable portion stemming from this hospital business.

| Revenue Stream | Description | Fiscal Year 2024 Performance Highlight |

|---|---|---|

| Prescription Drugs | Sale of a wide array of pharmaceutical products to healthcare providers. | Substantial contributor to overall financial performance. |

| Over-the-Counter (OTC) Medications | Readily available products for consumers without a prescription. | Consumer care division shows consistent performance. |

| Hospital Products | Essential medical supplies and IV solutions sold to healthcare facilities. | Significant portion of R37.7 billion revenue reported. |

Business Model Canvas Data Sources

The Adcock Ingram Business Model Canvas is built upon a foundation of internal financial reports, market research data, and operational performance metrics. These diverse sources ensure each component of the canvas is informed by accurate, up-to-date information relevant to the company's strategic direction.