ACP Holding GmbH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACP Holding GmbH Bundle

ACP Holding GmbH possesses significant strengths in its established market presence and diverse portfolio, but faces potential threats from evolving industry regulations and competitive pressures. Understanding these dynamics is crucial for strategic planning and anticipating future challenges. Our comprehensive SWOT analysis delves deeper into these elements, offering a clearer picture of the company's operational landscape.

Unlock the full story behind ACP Holding GmbH's market position. Our complete SWOT analysis provides actionable insights, financial context, and strategic takeaways, making it an indispensable tool for entrepreneurs, analysts, and investors seeking to navigate this complex market.

Strengths

ACP Holding GmbH experienced a landmark fiscal year 2024/2025, posting a record revenue of €1.05 billion. This represents a substantial 12% jump compared to the previous year, underscoring robust financial health and effective strategic implementation. Such impressive growth, especially within their core markets of Germany and Austria, signals a strong competitive positioning and adaptability.

ACP Holding GmbH boasts a comprehensive and vendor-independent IT portfolio, encompassing Hybrid Cloud & Datacenter, Network & Security, Modern Workplace, Digital Solutions, and Managed Services. This '360° IT portfolio' allows ACP to address a vast range of client requirements, establishing them as a versatile provider for intricate IT infrastructure needs. For instance, in 2024, ACP reported strong growth across its managed services segment, indicating client trust in their end-to-end IT management capabilities.

ACP Holding GmbH has demonstrated a strong commitment to growth through strategic acquisitions and new business establishments. A significant move was the acquisition of network specialist Xnet Systems GmbH in July 2024, a deal that bolstered its technical capabilities.

Further expanding its market footprint, ACP launched ACP IT Consulting GmbH in Aachen in January 2025, specifically to drive digitalization efforts for clients. This strategic placement aims to capture emerging opportunities in the German IT landscape.

The company also enhanced its 'Modern Workplace' offering by opening a new location in Münster in August 2024. This expansion directly addresses the growing demand for integrated IT solutions and improved workplace functionalities.

These carefully timed acquisitions and new establishments in 2024 and early 2025 underscore ACP's proactive approach to strengthening its expertise and broadening its market reach across Germany, positioning it for sustained competitive advantage.

Strong Market Position in DACH Region

ACP Holding GmbH commands a formidable market position within the DACH region, solidifying its status as a premier IT service provider. The company is a recognized leader in Austria and holds a strong standing among the top ten IT service providers in Germany, also maintaining a presence in Switzerland.

This robust market penetration is evidenced by significant recent financial performance. For the fiscal year 2024/2025, ACP Holding GmbH achieved an impressive 17% growth in Germany and a healthy 10% growth in Austria. These figures highlight the company's sustained competitive advantage and increasing market share in its key operational territories.

- Leading IT Service Provider: Dominant player in Austria and a top ten contender in Germany.

- Geographic Reach: Established operations across Austria, Germany, and Switzerland.

- Strong Growth Metrics (FY 2024/2025): 17% revenue increase in Germany, 10% revenue increase in Austria.

- Competitive Advantage: Demonstrated ability to gain market share and outperform competitors in core markets.

Customer-Centric Approach and Long-Term Partnerships

ACP Holding GmbH distinguishes itself through a deeply customer-centric philosophy, prioritizing the understanding and fulfillment of each client's distinct requirements. This is achieved via customized solutions and specialized consulting services.

The company actively cultivates enduring client relationships, a testament to its success in managed services, where customer satisfaction rates consistently surpassed 90% throughout 2024. This focus on partnership builds loyalty and repeat business.

- Customer-Centricity: Tailored solutions and expert consulting address unique client needs.

- Long-Term Partnerships: Commitment to fostering lasting client relationships.

- High Satisfaction: Managed services achieved over 90% customer satisfaction in 2024.

ACP Holding GmbH's strengths lie in its commanding market position within the DACH region, recognized as a leading IT service provider in Austria and a top ten player in Germany. This is supported by impressive growth figures, with a 17% revenue increase in Germany and 10% in Austria during fiscal year 2024/2025, highlighting their competitive edge and expanding market share. Furthermore, their customer-centric approach, evidenced by over 90% satisfaction in managed services for 2024, fosters strong, lasting client relationships and repeat business.

| Metric | FY 2024/2025 Value | Previous Year Value | Growth |

|---|---|---|---|

| Total Revenue | €1.05 billion | €0.94 billion | 12% |

| German Revenue Growth | N/A | N/A | 17% |

| Austrian Revenue Growth | N/A | N/A | 10% |

| Managed Services Satisfaction | >90% | >90% | Stable |

What is included in the product

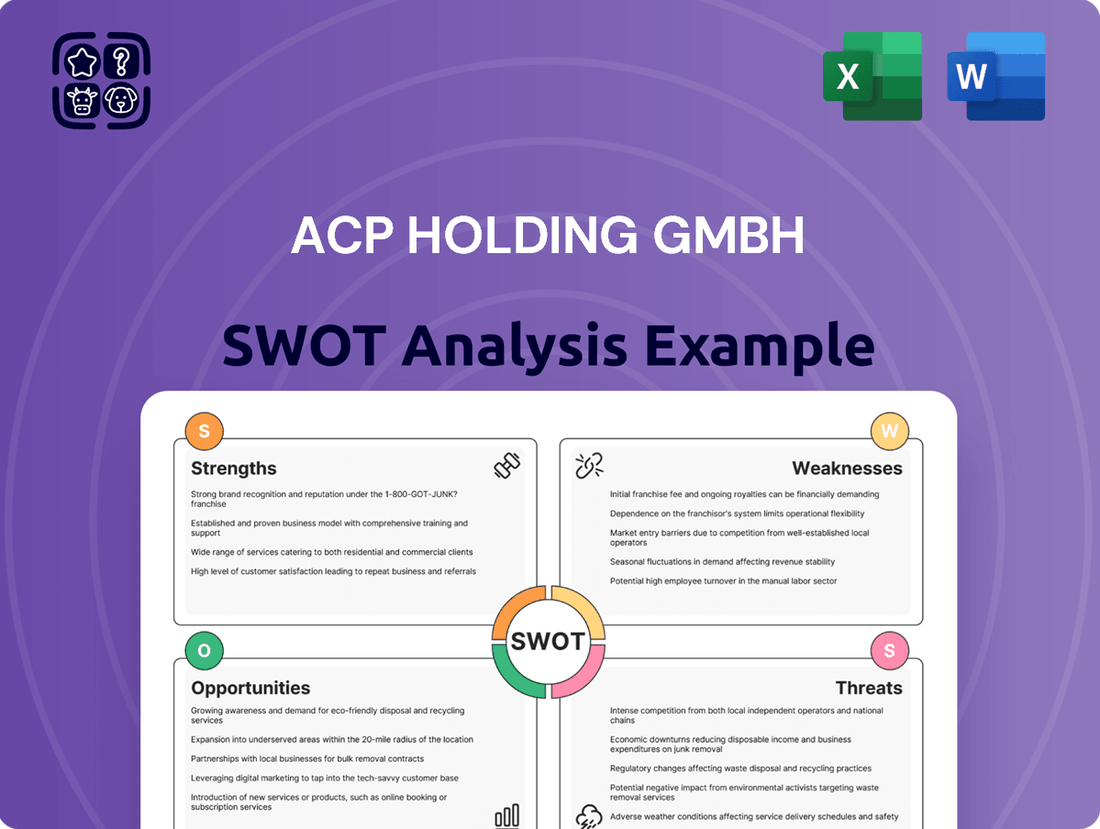

Delivers a strategic overview of ACP Holding GmbH’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis of ACP Holding GmbH to pinpoint and address strategic weaknesses and threats.

Weaknesses

ACP Holding GmbH's deliberate focus on the DACH region, encompassing Germany, Austria, and Switzerland, presents a notable weakness. This strategic decision, which led to divestments in markets such as Poland and Romania, concentrates the company's operations and revenue streams.

While this concentration allows for deep market penetration and specialized expertise within these core territories, it simultaneously heightens vulnerability to region-specific economic shocks or shifts in regulatory landscapes. For instance, a significant economic downturn in Germany, which represents a substantial portion of the DACH economic output, could disproportionately impact ACP Holding's overall financial performance in 2024 and beyond. The lack of geographical diversification means the company cannot leverage the performance of other markets to offset potential regional weaknesses.

ACP Holding GmbH faces a significantly challenging environment due to intense market competition within the IT services sector. The company must contend with a broad spectrum of rivals, ranging from large, established international IT corporations to smaller, highly specialized niche providers. This crowded marketplace demands constant strategic adaptation and substantial resource allocation.

Maintaining a competitive edge requires ACP to continuously innovate its service offerings and adopt aggressive sales tactics. For instance, in 2024, IT service market growth was projected to be around 5-7%, but the presence of major players like Bechtle, which reported €6.2 billion in revenue for 2023, and global giants such as Wipro, with its extensive service portfolio, puts pressure on ACP's pricing power and market share. Significant ongoing investment is crucial to keep pace with technological advancements and client expectations.

ACP Holding GmbH, despite its growth to over 2,600 employees, operates within an IT sector that continues to grapple with talent shortages. This difficulty in finding and keeping skilled individuals, especially in high-demand fields like cybersecurity, AI, and cloud computing, could directly impact ACP's ability to innovate and expand its operations effectively.

Potential for Integration Challenges

ACP Holding GmbH's strategy of expanding through acquisitions, including entities like Xnet Systems GmbH and ACP IT Consulting GmbH, presents a significant weakness in potential integration challenges. Merging diverse corporate cultures, IT systems, and operational workflows can be complex and time-consuming. For instance, if a newly acquired company has vastly different customer relationship management (CRM) software, synchronizing data and ensuring smooth client transitions becomes a hurdle. Failure to manage these integrations effectively could lead to inefficiencies and impact service continuity.

Successfully combining different business units requires robust change management. ACP Holding GmbH needs to ensure that acquired companies' employees are adequately onboarded and that their operational processes are harmonized with the parent company's standards to avoid disruptions. For example, the swift and efficient integration of Xnet Systems GmbH into ACP's service delivery framework is crucial for realizing anticipated synergies. Such integrations often involve substantial upfront investment in IT infrastructure and training, which can strain resources if not meticulously planned.

- Cultural Clashes: Differences in organizational culture between acquired firms and ACP Holding can hinder collaboration and productivity.

- System Incompatibility: Integrating disparate IT systems, from ERP to cybersecurity protocols, poses a technical challenge.

- Operational Disruptions: Poorly managed integration can lead to service interruptions for clients of both ACP and the acquired entities.

- Scalability Issues: Rapid growth through acquisitions may outpace the company's ability to scale its support and management infrastructure effectively.

Dependency on Vendor Partnerships

ACP Holding GmbH's reliance on vendor partnerships, while enabling a broad IT solutions portfolio, presents a notable weakness. Their ability to offer cutting-edge solutions is directly tied to the product roadmaps and pricing strategies of key partners like Microsoft, Fortinet, Dell, and HP. This dependency means ACP's service offerings are susceptible to external changes in vendor technology advancements, cost structures, or even the financial stability of these third-party providers. For instance, a significant price increase from a major software vendor could directly impact ACP's profitability and client pricing without direct control.

ACP Holding GmbH's concentrated focus on the DACH region leaves it vulnerable to localized economic downturns or regulatory changes, lacking the buffer of diversified geographical revenue streams. Intense competition in the IT services sector, evidenced by major players like Bechtle with €6.2 billion in 2023 revenue, necessitates continuous innovation and can pressure ACP's pricing power. Furthermore, the ongoing talent shortage in critical IT areas like AI and cloud computing poses a risk to ACP's expansion and innovation capabilities.

Full Version Awaits

ACP Holding GmbH SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual ACP Holding GmbH SWOT analysis, giving you a clear understanding of its strengths, weaknesses, opportunities, and threats. The full, detailed report is identical to this preview, ensuring no surprises upon purchase. Unlock the comprehensive analysis immediately after completing your transaction.

Opportunities

The global digital transformation market is set to reach an impressive $1.009 trillion by 2025. This growth is fueled by the increasing adoption of artificial intelligence, the Internet of Things, and automation across various business operations.

ACP Holding GmbH's existing strengths in delivering digital solutions, particularly its expertise in AI and data analytics, are perfectly aligned with this expanding market. The company is well-positioned to leverage these capabilities to meet the growing demand for digital innovation.

The global cybersecurity market is on a significant growth trajectory, expected to reach an impressive $345.7 billion in 2024. This expansion is fueled by a constant barrage of cyber threats and a growing imperative for robust data protection across all sectors.

ACP Holding GmbH is well-positioned to capitalize on this trend, leveraging its established strengths in Network & Security. The company’s existing capabilities, including its Managed Security Services and its proprietary Security Operations Center (SOC), provide a solid foundation for further market penetration.

By enhancing these offerings and potentially developing new, innovative cybersecurity solutions, ACP can tap into this booming market. This strategic focus allows ACP to address critical client needs for advanced security, driving revenue and solidifying its position as a key player in the cybersecurity landscape.

The IT infrastructure market is experiencing robust growth, with cloud computing and hybrid cloud solutions at its forefront. This trend presents a significant opportunity for ACP Holding GmbH, given its established expertise in designing, deploying, and managing both physical and virtual data environments. As businesses increasingly transition to cloud-based operations, ACP is well-positioned to expand its service offerings in this booming sector.

Further Vertical Market Penetration

ACP can capitalize on its broad service offering by focusing on specialized industry verticals. For instance, the healthcare sector, with its stringent data privacy requirements and increasing reliance on IT infrastructure, presents a significant opportunity. In 2024, the global healthcare IT market was valued at over $300 billion, with cybersecurity alone projected to grow substantially. By developing tailored solutions for healthcare IT security, ACP could unlock high-value contracts and build deeper, more resilient client relationships.

Similarly, the industrial IT security market, often referred to as Operational Technology (OT) security, is another promising area. As industries increasingly digitize their operations, the vulnerability of critical infrastructure to cyber threats grows. Reports from 2025 indicate that the OT cybersecurity market is expanding rapidly, driven by the need to protect manufacturing plants and energy grids. ACP's expertise could be leveraged to offer specialized protection, potentially capturing a larger market share within these critical sectors.

- Deepen presence in healthcare IT security: This sector demands specialized, compliant solutions.

- Target industrial IT security (OT security): Growing demand due to operational digitization.

- Develop tailored, high-value solutions: Addresses specific regulatory and operational needs.

- Strengthen client relationships: Specialization fosters loyalty and long-term partnerships.

Innovation in Managed Services and Modern Workplace Solutions

The global managed services market is on a strong upward trajectory, projected to hit an impressive $850 billion by 2025. Concurrently, the demand for modern workplace solutions continues to surge, reflecting a significant shift in how businesses operate and collaborate.

ACP Holding GmbH's strategic focus on investing in Artificial Intelligence (AI) and automation within its managed services and modern workplace portfolios presents a compelling opportunity. These investments are poised to deliver enhanced productivity for clients and elevate customer satisfaction levels. By leveraging AI and automation, ACP can solidify its position in these rapidly expanding, high-growth market segments and attract a broader client base.

- Market Growth: Managed services market to reach $850 billion by 2025.

- Modern Workplace Demand: Significant and ongoing growth in modern workplace solutions.

- AI & Automation Integration: ACP's investment enhances productivity and customer satisfaction.

- Client Base Expansion: Opportunity to capture more clients in these lucrative areas.

ACP Holding GmbH can capitalize on the expanding digital transformation market, projected to reach $1.009 trillion by 2025, by leveraging its AI and data analytics expertise. The company is also well-positioned within the growing cybersecurity market, expected to reach $345.7 billion in 2024, by utilizing its strengths in Network & Security and its proprietary SOC. Furthermore, ACP can expand its IT infrastructure services, particularly in cloud and hybrid cloud solutions, to cater to the increasing demand for modernized data environments.

The company has a significant opportunity to specialize in high-demand sectors like healthcare IT security, a market valued at over $300 billion in 2024, and industrial IT security (OT security), which is rapidly expanding as industries digitize. By developing tailored solutions for these verticals, ACP can foster deeper client relationships and secure high-value contracts.

ACP's investment in AI and automation within its managed services and modern workplace offerings presents a key opportunity, as the managed services market is expected to reach $850 billion by 2025. This strategic focus is anticipated to boost client productivity and satisfaction, thereby expanding ACP's reach in these lucrative segments.

Threats

The IT sector is in constant flux, with innovations in AI, cloud, and cybersecurity emerging at an unprecedented pace. For ACP Holding GmbH, this means existing technological solutions and internal expertise risk becoming outdated rapidly. This necessitates substantial and continuous investment in research and development to stay ahead of the curve.

To counter this, significant budget allocation towards employee upskilling and retraining programs is crucial. For instance, in 2024, the global IT spending was projected to reach $5.1 trillion, with a substantial portion dedicated to upgrading infrastructure and adopting new technologies, highlighting the industry's commitment to combating obsolescence.

The IT services landscape is fiercely competitive, with ACP Holding GmbH contending against both large, global IT firms and nimbler, niche providers. This crowded market environment, particularly in areas like cloud services and cybersecurity where growth is robust, often results in significant pricing pressure. For instance, the global IT services market was projected to reach $1.3 trillion in 2024, a substantial increase that also signifies intense rivalry for market share.

This relentless competition necessitates continuous innovation and service enhancement to maintain ACP's value proposition. Failure to differentiate effectively could erode profit margins, as clients increasingly scrutinize costs. Companies in this sector must therefore invest heavily in R&D and talent development to stay ahead, a challenge ACP must navigate to sustain its profitability amidst market demands.

ACP Holding GmbH, as a cybersecurity specialist, is itself a prime target for sophisticated cyber threats, including ransomware and data breaches. The increasing sophistication of cyberattacks means constant vigilance and investment in advanced defense mechanisms are crucial. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the scale of the threat landscape that ACP must navigate.

A major cybersecurity incident impacting ACP or its clients would be devastating. Such an event could lead to a severe blow to its reputation, a significant loss of client confidence, and considerable financial penalties and legal liabilities. For example, the average cost of a data breach in 2024 reached $4.73 million, a figure ACP would aim to avoid at all costs.

Economic Downturns and IT Spending Cuts

Global and regional economic downturns present a substantial threat to ACP Holding GmbH. Factors such as persistent inflation, ongoing supply chain disruptions, and a general reluctance to invest can significantly curb business activity. For instance, the International Monetary Fund (IMF) revised its global growth forecast downwards for 2024, citing these very pressures, indicating a challenging macroeconomic environment.

During economic slowdowns, companies typically implement cost-saving measures, and IT spending is often one of the first areas to face cuts. This reduction in discretionary spending directly impacts IT service providers like ACP, potentially leading to decreased demand for their solutions and services. A study by Gartner in late 2023 projected a slowdown in worldwide IT spending growth for 2024 compared to previous years, underscoring this trend.

- Reduced IT Budgets: Businesses may scale back on new technology adoption and IT project investments.

- Project Delays or Cancellations: Clients might postpone or cancel ongoing or planned IT projects, impacting ACP's project pipeline and revenue recognition.

- Increased Price Sensitivity: Customers may become more price-sensitive, demanding lower rates or seeking out cheaper alternatives, putting pressure on ACP's margins.

- Impact on Growth Trajectory: A sustained period of reduced client investment could hinder ACP's ability to invest in its own growth initiatives and expand market share.

Talent Poaching and Retention Challenges

The intense competition for IT talent, especially in niche areas like AI and cybersecurity, poses a significant threat to ACP Holding GmbH. Reports from early 2024 indicate IT skill shortages are worsening, with some specialized roles seeing up to a 50% increase in demand year-over-year. Competitors actively poach skilled individuals, often offering higher salaries and more attractive benefits, directly impacting ACP Holding's ability to retain its workforce.

Losing critical personnel can cripple project timelines and diminish the company's competitive edge. Institutional knowledge walks out the door, requiring substantial investment in recruitment and onboarding to replace lost expertise. For instance, the average cost to replace a highly skilled IT professional in Germany was estimated to be around €60,000 in late 2023, a figure likely to rise. This drain on resources diverts attention from innovation and service enhancement.

- High Demand for Specialized IT Skills: Sectors like cloud computing and data analytics are experiencing unprecedented demand, driving up recruitment costs.

- Aggressive Poaching by Competitors: Companies are increasingly using lucrative offers to lure away top IT talent from rivals.

- Cost of Employee Turnover: Replacing skilled IT staff can cost ACP Holding GmbH tens of thousands of euros per employee, impacting profitability.

- Impact on Innovation and Service Delivery: Loss of key personnel directly hinders the company's capacity for new product development and maintaining service quality.

The rapid evolution of technology, particularly in AI and cloud computing, presents a constant risk of ACP Holding GmbH's current solutions becoming obsolete. This demands continuous investment in R&D and employee upskilling to remain competitive. Global IT spending in 2024 was projected at $5.1 trillion, underscoring the sector's rapid advancement and the need for sustained investment.

Intense competition within the IT services market, with global players and niche providers vying for market share, leads to significant pricing pressure. The global IT services market was expected to reach $1.3 trillion in 2024, indicating a highly contested landscape where differentiation is key to maintaining profitability.

As a cybersecurity firm, ACP Holding GmbH is a prime target for increasingly sophisticated cyber threats, with global cybercrime costs projected to reach $10.5 trillion annually by 2025. A major breach could result in significant reputational damage, client loss, and substantial financial penalties, with average data breach costs reaching $4.73 million in 2024.

Economic downturns, characterized by inflation and supply chain issues, can significantly reduce IT spending as businesses cut costs. The IMF's revised global growth forecasts for 2024 reflect these pressures, potentially impacting ACP's project pipeline and revenue due to decreased client investment and increased price sensitivity.

The fierce competition for specialized IT talent, especially in AI and cybersecurity, poses a significant threat, with IT skill shortages worsening in early 2024. Aggressive poaching by competitors, offering higher salaries, increases employee turnover costs, estimated around €60,000 per highly skilled IT professional in Germany in late 2023, impacting innovation and service delivery.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from ACP Holding GmbH's official financial statements, comprehensive market intelligence reports, and expert analyses within the industry to provide a thorough and actionable SWOT assessment.