ACP Holding GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACP Holding GmbH Bundle

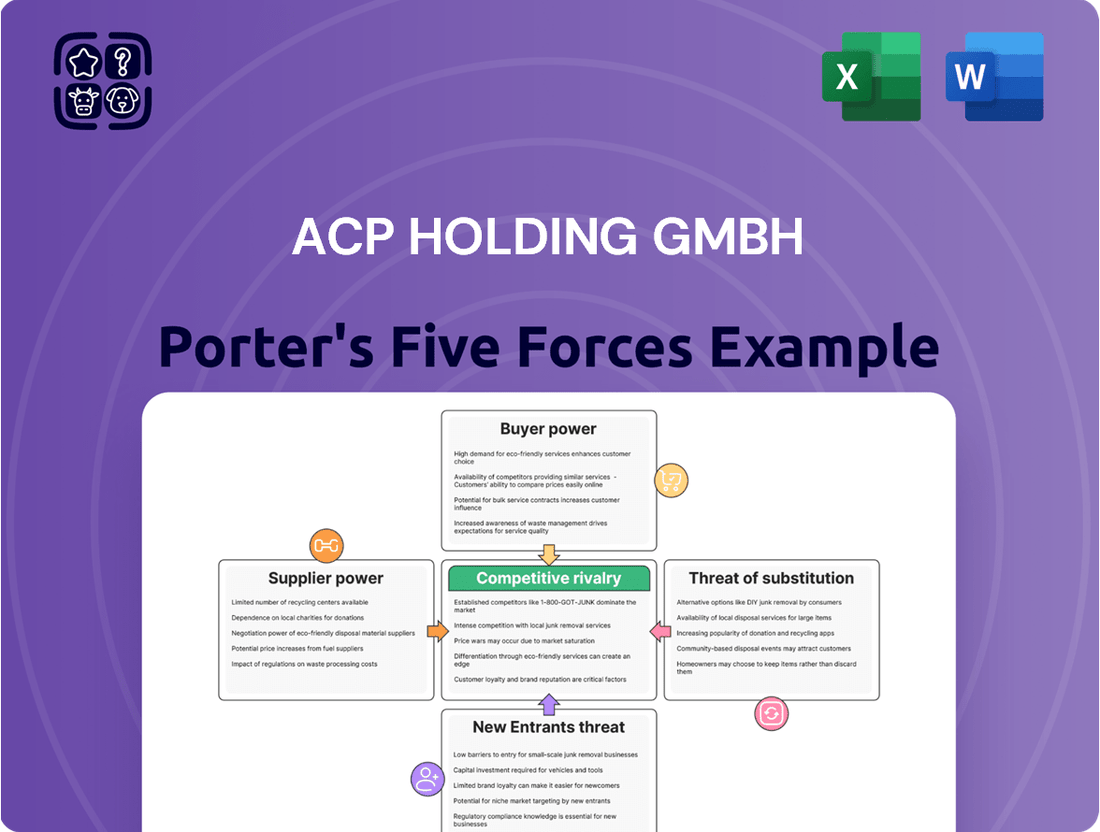

ACP Holding GmbH navigates a competitive landscape shaped by several key forces. Understanding the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the presence of substitutes is crucial for strategic planning. This brief overview offers a glimpse into these dynamics, highlighting areas where ACP Holding GmbH faces significant pressure and where opportunities may lie.

The complete report reveals the real forces shaping ACP Holding GmbH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for ACP Holding GmbH is considerably shaped by how critical and unique the hardware and software solutions they offer are. Major technology providers for data center infrastructure, networking, and cybersecurity, like Microsoft, Fortinet, HP, and Dell Technologies, can exert significant influence if their products are indispensable and costly to replace for ACP. For instance, in 2024, the global IT hardware market saw continued consolidation, with key players like Dell Technologies reporting strong demand for their enterprise solutions, potentially increasing their leverage.

The concentration of specialized talent, particularly in niche IT fields such as advanced cybersecurity and AI integration, significantly bolsters the bargaining power of suppliers. Individual experts or specialized recruitment agencies in these high-demand areas can command premium rates and dictate terms.

The persistent IT talent shortage, a global issue, further amplifies supplier power. For instance, Europe faced a shortage of around 300,000 cybersecurity professionals in 2024. This scarcity translates to increased labor costs and potential project delays for companies like ACP Holding GmbH, as they compete for limited skilled resources.

ACP Holding GmbH faces significant supplier power, particularly with its core technology providers. The costs associated with switching these critical suppliers are substantial, often running into millions of euros. These costs include extensive staff re-training programs, rigorous re-certification of new solutions, and ensuring seamless compatibility with ACP's existing client infrastructures, which can take months to implement.

This reliance on specialized, deeply integrated technology means that major suppliers can exert considerable influence over pricing and contractual terms. For instance, in 2024, industry reports indicated that for companies similar to ACP, the average cost of migrating core enterprise software systems ranged from 15% to 30% of the annual software license fees, a significant figure that limits ACP's negotiation leverage.

Supplier Power 4

The bargaining power of suppliers is lessened when there are readily available substitute inputs that can perform similar functions. For ACP Holding GmbH, their strategic focus on vendor-independent consulting and a comprehensive IT portfolio is key. This approach means they can tap into a wide array of supplier options, significantly reducing their reliance on any single provider.

In 2023, the global IT consulting market was valued at approximately $327 billion, demonstrating a highly competitive landscape with numerous players and solution providers. This competitive environment inherently limits the power any single supplier can exert over a firm like ACP Holding GmbH, especially one that actively seeks diversified sourcing.

- Diversified Sourcing: ACP Holding GmbH's strategy of maintaining a broad IT portfolio inherently reduces dependence on any single supplier, thereby mitigating their bargaining power.

- Availability of Substitutes: The existence of numerous alternative components and software solutions in the market provides ACP Holding GmbH with leverage, as they can switch to different vendors if supplier terms become unfavorable.

- Market Competition: The highly competitive nature of the IT consulting market, with a global valuation exceeding $300 billion in 2023, means suppliers are often eager to secure business, limiting their ability to dictate terms.

- Vendor Independence: ACP Holding GmbH's commitment to vendor-independent consulting further empowers them by allowing them to objectively assess and select the best solutions, rather than being tied to specific suppliers.

Supplier Power 5

Suppliers in the IT services sector possess considerable power, particularly those with the capability for forward integration. For ACP Holding GmbH, this means vendors could potentially move into offering direct IT services, thereby competing with ACP's core business. This threat is amplified as major software providers, beyond just hardware, are increasingly bundling professional services with their products. In 2024, the trend of integrated service offerings from software giants continued, making it imperative for ACP to foster robust partnerships while clearly articulating the unique value of its end-to-end service solutions.

The bargaining power of suppliers is a critical consideration for ACP Holding GmbH within its Porter's Five Forces analysis. Suppliers' potential for forward integration, especially in the IT services domain, presents a direct competitive threat. As vendors increasingly offer their own professional services, they can bypass intermediaries like ACP and engage directly with end customers. This is particularly relevant for major software providers who are expanding their service portfolios beyond core product delivery.

- Forward Integration Threat: Suppliers may begin offering direct IT services, competing with ACP.

- Software Vendor Expansion: Major software companies are increasingly providing professional services alongside their products.

- Partnership Importance: ACP must maintain strong relationships with suppliers.

- Differentiation Necessity: ACP needs to highlight its comprehensive service offerings to stand out.

The bargaining power of suppliers for ACP Holding GmbH is significant, particularly concerning specialized hardware and software. Key technology providers can leverage their critical offerings and the high costs associated with switching, which for similar firms in 2024, could range from 15% to 30% of annual license fees for core system migrations. This reliance amplifies supplier influence over pricing and terms. The global IT talent shortage, with Europe alone needing approximately 300,000 cybersecurity professionals in 2024, further strengthens the hand of skilled labor suppliers.

| Factor | Impact on ACP Holding GmbH | Supporting Data (2024 unless specified) |

|---|---|---|

| Criticality of Supplies | High | Dependence on major providers like Dell, HP, Microsoft for data center and cybersecurity solutions. |

| Switching Costs | High | Millions of euros for re-training, re-certification, and integration. Estimated 15-30% of annual license fees for core system migration. |

| Supplier Concentration | High | Consolidation in hardware market increases leverage of dominant players. |

| Talent Scarcity | High | Europe's shortage of ~300,000 cybersecurity professionals drives up labor costs and supplier power. |

| Availability of Substitutes | Moderate | ACP's diversified sourcing strategy mitigates this, but niche areas may have fewer alternatives. |

| Threat of Forward Integration | Moderate | Software vendors increasingly offering direct professional services, potentially bypassing ACP. |

What is included in the product

This analysis delves into the competitive forces shaping ACP Holding GmbH's market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of existing rivalry.

Instantly identify the most impactful competitive pressures on ACP Holding GmbH, allowing for focused strategic adjustments.

Customers Bargaining Power

ACP Holding GmbH faces varied customer bargaining power. Larger enterprise clients, who procure significant IT infrastructure solutions and managed services, can exert considerable influence. These high-volume buyers leverage their purchasing power to negotiate better pricing and service level agreements, impacting ACP Holding's margins.

For instance, in 2024, the IT outsourcing market saw significant price competition, with large enterprise contracts often involving lengthy negotiation periods. Smaller businesses, conversely, typically have less leverage due to lower purchase volumes, making them less of a bargaining force.

ACP Holding GmbH faces significant buyer power due to the vast array of IT service providers available. Customers can readily access alternatives, from large international consulting firms to specialized regional IT companies, giving them leverage in negotiations.

The highly competitive nature of the European IT services sector, with an estimated market size of USD 975.60 billion by 2033, further amplifies customer bargaining power. This competitive landscape allows buyers to easily benchmark services and pricing, making them more inclined to switch providers if they find better value or superior quality elsewhere.

ACP Holding GmbH faces moderate buyer power from its customers. The significant costs associated with switching IT service providers, which can include complex data migration, system re-integration, and the potential for business disruption, generally limit customers' willingness to change vendors. For instance, in 2024, the average cost for a business to migrate its IT infrastructure to a new provider was estimated to be upwards of $100,000, depending on the scale and complexity of operations. This acts as a deterrent, making customers less likely to switch for minor service issues, thus strengthening ACP Holding's position.

Buyer Power 4

The bargaining power of customers for IT services, particularly those integral to digital transformation and cybersecurity, can be significantly influenced by their reliance on the provider. When clients depend on ACP for critical functions, their sensitivity to price can decrease, as the perceived value of expertise and uninterrupted service outweighs marginal cost savings. This holds true as global IT spending was projected to reach $5.1 trillion in 2024, with a substantial portion dedicated to digital transformation initiatives.

Customers deeply integrated with ACP's solutions for core business processes, such as cloud migration or data analytics, may find it costly and disruptive to switch providers. This lock-in effect strengthens ACP's position by making price a less dominant factor in purchasing decisions. For instance, in 2023, the average cost of a data breach was estimated at $4.45 million, underscoring the high stakes for cybersecurity services.

- Reduced Price Sensitivity: Clients focused on essential digital transformation and cybersecurity are less likely to prioritize cost over ACP's expertise and reliability.

- High Switching Costs: The complexity and expense associated with migrating critical IT infrastructure from ACP can limit a customer's ability to negotiate aggressively on price.

- Strategic Importance of Services: When ACP's IT services are fundamental to a customer's competitive advantage or operational continuity, the bargaining power shifts towards ACP.

- Industry Trends: The increasing reliance on specialized IT services, as evidenced by the projected growth in the global cloud computing market to over $1 trillion by 2025, further solidifies the value proposition of providers like ACP.

Buyer Power 5

The bargaining power of customers for ACP Holding GmbH is influenced by the potential for clients to bring IT services in-house. Large enterprises, especially those with existing robust IT departments, can leverage this capability as a negotiation tool. This means ACP Holding GmbH needs to consistently showcase its distinct advantages, specialized skills, and economic efficiency when compared to clients building or enhancing their internal IT functions.

For instance, in 2024, the global IT outsourcing market was valued at approximately $407 billion, indicating a significant demand for external services. However, the trend of digital transformation also empowers larger organizations to develop internal competencies, potentially reducing their reliance on third-party providers for core IT functions. This dynamic necessitates a clear demonstration of value by ACP Holding GmbH, emphasizing areas where their expertise surpasses what clients can achieve internally, such as advanced cybersecurity solutions or niche cloud migration strategies.

- Potential for Insourcing: Large clients with substantial IT infrastructure can consider bringing services in-house, increasing their negotiation leverage.

- Value Proposition: ACP Holding GmbH must continually prove its unique value, specialized knowledge, and cost-effectiveness against in-house alternatives.

- Market Dynamics: While the IT outsourcing market is robust, digital transformation empowers some clients to build internal capabilities, shifting the power balance.

Customer bargaining power at ACP Holding GmbH is a complex interplay of factors, with large enterprise clients wielding significant influence due to their substantial procurement volumes and ability to negotiate favorable pricing and service level agreements. This is particularly evident in 2024's competitive IT outsourcing market, where lengthy negotiations for large contracts are common.

The availability of numerous alternative IT service providers, ranging from global consultancies to specialized regional firms, further empowers customers. In 2023, the IT services market in Europe was substantial, and this competitive landscape allows buyers to easily compare offerings, making them inclined to switch for better value or quality.

| Factor | Impact on ACP Holding GmbH | Supporting Data/Trend (2024) |

|---|---|---|

| Volume Purchases | High leverage for large clients | Large enterprise contracts often involve lengthy price negotiations. |

| Availability of Alternatives | Increased buyer power | Vast array of IT service providers available in the market. |

| Switching Costs | Moderate leverage for ACP | Average IT infrastructure migration cost estimated over $100,000 in 2024. |

| Insourcing Potential | Negotiation tool for large clients | Digital transformation empowers some clients to build internal IT capabilities. |

Preview the Actual Deliverable

ACP Holding GmbH Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for ACP Holding GmbH, detailing the competitive landscape, buyer power, supplier power, threat of new entrants, and threat of substitutes. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It provides an in-depth examination of the strategic positioning and potential challenges faced by ACP Holding GmbH within its industry. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, enabling immediate strategic planning and decision-making.

Rivalry Among Competitors

Competitive rivalry within the European IT service market is fierce, with ACP Holding GmbH contending against a diverse array of competitors. These range from broad IT consultancies to highly specialized firms focusing on areas like data centers, networking, and cybersecurity.

This fragmentation intensifies competition as numerous players vie for market share. Despite the market's significant growth, projected to reach USD 483.81 billion by 2025, the pressure to stand out and capture new business remains substantial for all participants.

The IT services market can be intensely competitive, especially when certain segments face slower growth or economic headwinds. ACP Holding GmbH's impressive 12% revenue jump to €1.05 billion for fiscal year 2024/2025, achieving growth contrary to market trends, highlights the significant competitive pressures they are navigating. This performance suggests ACP Holding GmbH is effectively differentiating itself and capturing market share amidst a challenging landscape.

Competitive rivalry within ACP Holding GmbH's sector is significant, driven by the need for specialized services. ACP's focus on data center infrastructure, cybersecurity, and modern workplace solutions helps differentiate its offerings, setting it apart from more generalized IT providers. This specialization is key to fending off intense competition.

However, the relatively low barriers to entry and the ease with which competitors can mimic service portfolios mean that rivalry remains a potent force. Companies in this space often find their unique selling propositions challenged as others adapt and offer similar capabilities, necessitating continuous innovation and service enhancement.

In 2024, the IT services market, particularly in areas like cloud migration and cybersecurity, saw sustained growth, with companies actively seeking specialized expertise. For instance, reports indicate a global IT services market valuation exceeding $1.3 trillion in 2024, with a substantial portion attributed to specialized managed services.

Competitive Rivalry 4

Customer switching costs can significantly temper competitive rivalry. For ACP Holding GmbH, fostering long-term client partnerships and offering managed services are key strategies to build client loyalty, making it more difficult for customers to switch to competitors.

This approach directly addresses the intensity of rivalry by increasing the "stickiness" of ACP's customer base. For instance, in the IT services sector where ACP operates, the average cost for a business to switch IT providers can range from 10% to 25% of their annual IT spending, often due to data migration, retraining, and integration complexities.

- ACP's focus on long-term managed service agreements reduces customer churn.

- High switching costs in IT services can range from 10% to 25% of annual IT expenditure.

- Client retention is bolstered by the complexity of data migration and system integration.

- Building deep partnerships creates a barrier to competitors seeking to poach ACP's clientele.

Competitive Rivalry 5

ACP Holding GmbH faces intensified competition due to high exit barriers. Specialized infrastructure, like proprietary manufacturing equipment, and long-term supply contracts can trap companies in the market even when unprofitable. This difficulty in exiting creates a pool of persistent competitors.

The challenge of redeploying a highly skilled workforce, particularly in niche sectors, further elevates these exit barriers. When firms struggle to shed these fixed costs, they are often forced to compete aggressively on price to maintain any level of revenue. This dynamic can lead to margin erosion across the industry as companies vie for market share and customer retention.

- High Exit Barriers: Specialized assets and long-term commitments make it costly for companies to leave the market.

- Workforce Rigidity: Difficulty in reassigning specialized labor adds to the cost of exiting.

- Aggressive Pricing: Companies may resort to price wars to stay operational and retain clients.

- Capacity Maintenance: The drive to keep operations running can fuel intense rivalry.

Competitive rivalry in the IT services sector remains intense, with many players vying for market share. ACP Holding GmbH's reported 12% revenue growth to €1.05 billion for fiscal year 2024/2025 demonstrates its ability to thrive amidst this competition, outperforming general market trends. This suggests ACP is effectively differentiating its specialized services in areas like data centers and cybersecurity to capture business.

The market's robust growth, with the global IT services market valued at over $1.3 trillion in 2024, fuels this rivalry as more specialized firms emerge. However, ACP's strategy of building deep client partnerships and offering managed services, which can involve switching costs of 10-25% of annual IT spending for clients, helps mitigate this intense competition by fostering loyalty.

| Competitor Type | ACP's Differentiation Strategy | Impact on Rivalry |

| Broad IT Consultancies | Specialized Data Center & Cybersecurity Services | Reduces direct comparison, focuses on niche expertise |

| Specialized Niche Firms | Managed Services & Long-Term Partnerships | Increases customer switching costs, builds loyalty |

| New Market Entrants | Proven Track Record & Scalable Solutions | Requires continuous innovation to maintain edge |

SSubstitutes Threaten

Internal IT departments within client organizations serve as a key substitute for ACP Holding GmbH. Large enterprises, in particular, possess the resources to maintain and manage their IT infrastructures internally, potentially reducing the need for external outsourcing providers. This internal capability offers a direct alternative to ACP's services.

The decision for a client to keep IT functions in-house or outsource to a company like ACP often boils down to a careful evaluation of cost-effectiveness, the availability of specialized skills, and the potential for increased operational efficiency. For instance, many businesses will compare the total cost of ownership for an internal IT department, including salaries, training, and infrastructure, against the recurring fees of an outsourcing partner.

In 2023, a significant portion of companies, especially those with over 1,000 employees, maintained substantial internal IT teams. While specific figures vary by sector, reports from IT industry analysts indicated that approximately 60-70% of large enterprises still operate with a considerable in-house IT presence, viewing it as a strategic asset rather than a cost center.

The threat of these internal IT departments is amplified when they can demonstrably offer comparable or superior service levels at a lower overall cost. If an internal team can efficiently manage cloud migrations, cybersecurity, and data analytics, the value proposition for outsourcing diminishes, directly impacting ACP's market opportunities.

The burgeoning cloud computing landscape presents a significant threat of substitutes for ACP Holding GmbH. The widespread availability and increasing sophistication of Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) allow businesses to directly access IT resources and applications, bypassing traditional system integrators. For instance, by mid-2024, the global cloud computing market was projected to reach over $600 billion, showcasing its immense scale and accessibility.

While ACP Holding GmbH offers cloud integration services, the growing ease with which companies can manage their own cloud environments directly reduces the demand for certain outsourced IT functions. This trend means that clients might opt for direct cloud consumption models for their IT needs, diminishing the perceived value of traditional managed services or system integration projects that ACP typically provides. This shift is particularly evident in areas like data storage and basic application hosting, where cloud providers offer highly competitive and scalable solutions.

Generic IT consulting firms, independent contractors, or niche-specific software vendors can indeed act as substitutes for certain IT needs, particularly for project-based work that doesn't require ACP Holding GmbH's full suite of services. For instance, a company needing only cloud migration assistance might opt for a specialized cloud consulting firm rather than a full-service provider.

The consulting industry is increasingly witnessing a demand for hyper-specialized expertise. This trend means smaller, focused entities or even individual contractors with deep knowledge in areas like AI implementation or cybersecurity can present a viable alternative for specific tasks, potentially at a lower cost than a larger firm. For example, the global IT consulting market was projected to reach over $300 billion in 2024, indicating significant competition from various player types.

4

The threat of substitutes for ACP Holding GmbH's services is growing as off-the-shelf software and user-friendly plug-and-play systems become more accessible, particularly for small and medium-sized businesses. These commercial tools allow smaller companies to manage more of their IT needs internally, diminishing the reliance on custom system integration or ongoing managed services. This trend directly impacts the demand for specialized IT solutions and support that ACP Holding GmbH might offer.

For instance, the global market for SaaS (Software as a Service) is projected to reach over $300 billion in 2024, indicating a significant shift towards readily available software. This accessibility empowers clients to bypass more complex, tailored solutions.

- Increased adoption of cloud-based productivity suites like Microsoft 365 and Google Workspace allows SMEs to handle many IT functions without external support.

- The proliferation of low-code/no-code platforms enables businesses to build custom applications with minimal technical expertise, reducing the need for traditional software development services.

- The market for IT outsourcing services, while still substantial, faces pressure from the DIY capabilities enabled by these advanced, user-friendly tools.

- Companies are increasingly looking for cost-effective, scalable solutions, which off-the-shelf products often provide more readily than bespoke integrations.

5

The threat of substitutes for ACP Holding GmbH's managed IT services is a growing concern, particularly with advancements in artificial intelligence and automation. These technologies offer the potential to perform tasks previously handled by human IT professionals. For instance, AI-powered tools can automate routine system monitoring, software patching, and even basic troubleshooting, directly impacting the demand for ACP's managed IT operations. By 2024, many businesses are actively exploring and implementing these AI solutions to reduce operational costs and improve efficiency.

While ACP is actively integrating AI into its own digital solutions, the accelerating pace of AI development means clients could increasingly bring these automation capabilities in-house. This could lead to a reduced need for external managed services, especially for standardized IT functions. The global AI market is projected to reach hundreds of billions of dollars by 2025, highlighting the significant investment and adoption of these technologies across industries.

- AI-driven automation in IT: Tools are increasingly capable of handling system maintenance, security monitoring, and user support.

- Client in-housing of capabilities: As AI sophistication grows, clients may opt to manage more IT processes internally.

- Cost reduction driver: Automation offers a compelling alternative to the ongoing expense of external managed services.

- Market growth of AI: The expanding AI market indicates widespread adoption and development of substitute technologies.

The threat of substitutes for ACP Holding GmbH is significant, stemming from internal IT departments, cloud computing, specialized IT firms, and off-the-shelf software. Internal IT teams can offer comparable services, especially in larger organizations that view IT as a strategic asset. By 2023, it was estimated that 60-70% of large enterprises maintained substantial in-house IT operations.

The burgeoning cloud market, projected to exceed $600 billion by mid-2024, allows businesses to manage IT resources directly, diminishing the need for traditional outsourcing. Generic IT consulting firms and independent contractors also pose a threat, particularly for project-based work, as the IT consulting market approaches $300 billion in 2024. Furthermore, the increasing accessibility of user-friendly software, with the SaaS market alone projected to surpass $300 billion in 2024, empowers SMEs to handle more IT functions internally.

Entrants Threaten

The threat of new entrants for ACP Holding GmbH is moderate, largely due to the substantial capital required to compete effectively. Investing in advanced IT infrastructure, data centers, and robust cybersecurity solutions demands significant upfront funding, acting as a considerable barrier. For instance, the global data center market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating the scale of investment needed.

Building competitive capabilities in areas like cloud services or specialized IT solutions requires not only financial resources but also expertise and established relationships. New players must overcome the learning curve and brand recognition that established companies like ACP Holding GmbH possess. The cost of acquiring talent with specialized IT skills further adds to the entry barrier.

While capital intensity is high, the digital nature of many IT services can also lower some traditional barriers, such as physical distribution networks. However, the need for compliance with data privacy regulations and industry-specific certifications necessitates further investment and time, making a swift, low-cost entry challenging.

The threat of new entrants for ACP Holding GmbH is moderated by significant entry barriers within the IT services sector. Establishing a presence requires substantial capital investment in infrastructure, including data centers and advanced networking capabilities. Furthermore, the necessity for extensive technical expertise across diverse IT domains like cybersecurity and cloud computing presents a formidable challenge for newcomers.

New entrants must not only attract but also retain certified professionals, a task complicated by the persistent IT talent shortage. For instance, by the end of 2023, the global cybersecurity skills gap was estimated to be around 3.4 million professionals, illustrating the difficulty in acquiring qualified personnel.

The IT services industry presents a moderate threat of new entrants. Building a strong reputation and fostering trusted client relationships is a significant hurdle, often taking years of consistent delivery and successful project outcomes. For instance, establishing brand recognition in a competitive market can cost millions in marketing and sales efforts.

Established firms like ACP Holding GmbH leverage their proven track records and existing client portfolios, which are invaluable assets for securing new business. Newcomers struggle to match this credibility, making it challenging to win large, complex contracts that require a high degree of assurance and reliability. A recent survey indicated that over 60% of enterprise IT outsourcing decisions are heavily influenced by vendor reputation and past performance.

4

The threat of new entrants in the IT services sector, particularly for a company like ACP Holding GmbH, is somewhat mitigated by significant barriers. Established players, benefiting from years of operation, often possess considerable economies of scale and scope. For instance, ACP Holding GmbH reported substantial revenue of €1.05 billion for the 2024/2025 period, indicating a large operational footprint and the ability to leverage scale for cost efficiencies.

Newcomers typically find it challenging to match the pricing competitiveness and the breadth of services offered by such established firms. This disparity in cost structure and service portfolio presents a hurdle for potential new entrants aiming to gain market share.

- Economies of Scale: Large IT service providers like ACP can achieve lower per-unit costs due to high-volume operations, making it difficult for new, smaller firms to compete on price.

- Economies of Scope: ACP's ability to offer a wide range of integrated IT services, from hardware to software and consulting, creates a more comprehensive value proposition that new entrants may struggle to replicate quickly.

- Capital Requirements: Establishing the necessary infrastructure, technology, and talent pool for comprehensive IT services demands significant upfront investment, acting as a deterrent for many potential new market participants.

- Brand Reputation and Customer Loyalty: ACP's established brand and existing client relationships are significant assets that new entrants must work hard to overcome, often requiring a lengthy period to build trust and secure a customer base.

5

The threat of new entrants for ACP Holding GmbH is moderated by increasingly stringent regulatory landscapes. For instance, the General Data Protection Regulation (GDPR) and evolving cybersecurity standards like the NIS2 directive impose significant compliance burdens. New companies must invest heavily in legal, technical, and operational frameworks to meet these requirements, acting as a substantial barrier.

Obtaining industry-specific certifications, such as ISO standards, further elevates the cost and time investment for potential new market participants. These certifications are often non-negotiable for securing contracts with larger, more established clients, especially within sectors like IT services and data management where ACP Holding GmbH operates. For example, the global cybersecurity market was valued at approximately $217.9 billion in 2023, with compliance and certification forming a significant portion of operational costs for service providers.

- Regulatory Hurdles: Compliance with GDPR and NIS2 requires substantial investment in data protection and security infrastructure.

- Certification Costs: Obtaining and maintaining ISO certifications adds to the capital expenditure for new entrants.

- Client Prerequisites: Many lucrative contracts are contingent upon holding specific, often costly, certifications.

- Market Entry Barriers: The combined effect of these regulatory and certification demands significantly raises the cost and complexity of entering the market, thereby lowering the threat of new entrants.

The threat of new entrants for ACP Holding GmbH remains moderate, primarily due to the significant capital requirements and established brand loyalty in the IT services sector. Newcomers face high upfront costs for infrastructure, talent acquisition, and achieving necessary certifications. For instance, by the end of 2024, the global cloud computing market, a key area for IT service providers, was valued at over $600 billion, highlighting the scale of investment needed to compete.

ACP Holding GmbH benefits from economies of scale and scope, allowing it to offer competitive pricing and a broad service portfolio that new entrants find difficult to match. For example, ACP Holding GmbH reported revenues of approximately €1.05 billion for the 2024/2025 fiscal year, demonstrating its substantial operational capacity and market presence. This financial strength and operational efficiency create a considerable barrier to entry.

| Barrier Type | Description | Impact on New Entrants | Example for ACP Holding GmbH |

| Capital Requirements | Significant investment needed for IT infrastructure, data centers, and cybersecurity. | High barrier, deters new market participants. | Global data center market valued at ~ $200 billion in 2023. |

| Brand Reputation & Loyalty | Established trust and past performance are crucial in IT services. | Difficult for new firms to overcome, requires time and consistent delivery. | Over 60% of IT outsourcing decisions influenced by vendor reputation. |

| Economies of Scale & Scope | Lower per-unit costs and broader service offerings from established players. | Makes it challenging for new entrants to compete on price and service breadth. | ACP Holding GmbH's reported revenue of €1.05 billion (2024/2025). |

| Regulatory & Compliance | Adherence to data privacy laws (e.g., GDPR) and industry certifications. | Increases cost and complexity of market entry. | NIS2 directive imposes significant compliance burdens. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ACP Holding GmbH is built upon a foundation of diverse data, including publicly available annual reports, industry-specific market research from reputable firms, and relevant regulatory filings to ensure a comprehensive understanding of the competitive landscape.