ACP Holding GmbH Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACP Holding GmbH Bundle

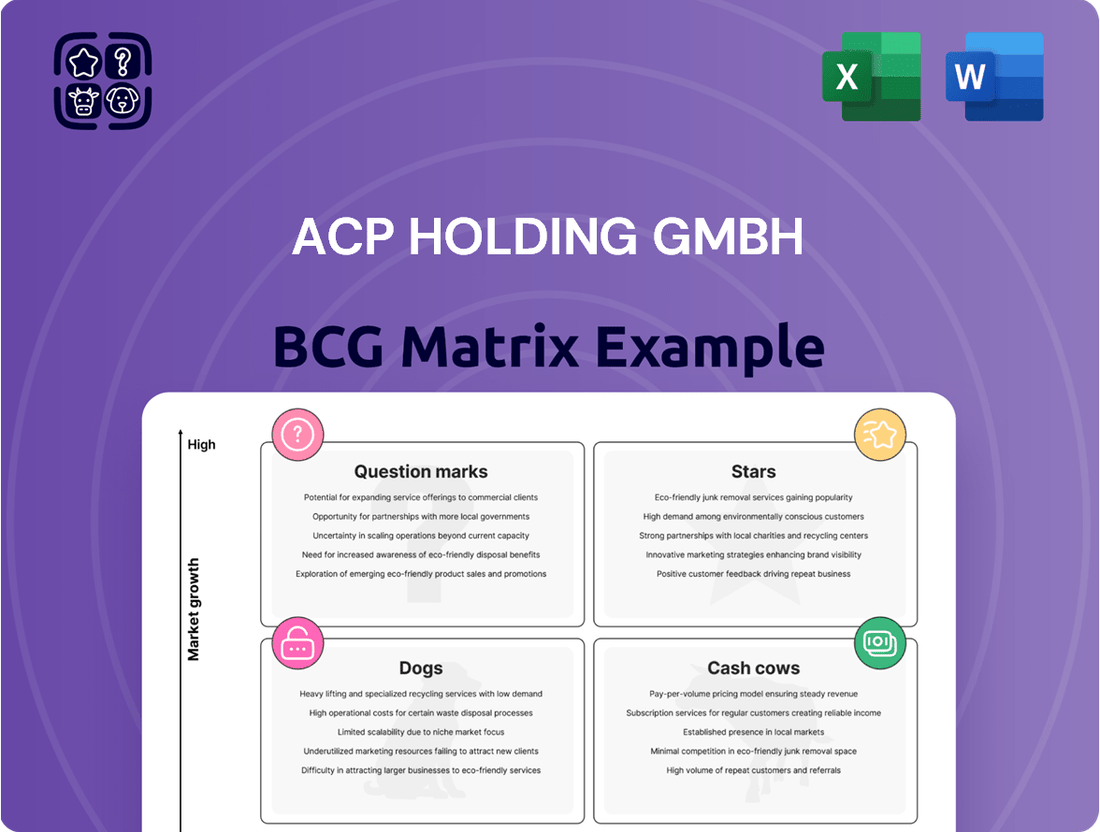

Curious about ACP Holding GmbH's strategic product portfolio? This preview offers a glimpse into their position on the BCG Matrix, hinting at their Stars, Cash Cows, Dogs, and Question Marks.

To truly understand ACP Holding GmbH's competitive landscape and make informed decisions, dive deeper into the full BCG Matrix.

Uncover the detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing their product investments.

This comprehensive report is your key to unlocking ACP Holding GmbH's strategic potential.

Purchase the full version now for actionable insights and a clear path to maximizing their market opportunities.

Stars

ACP Holding GmbH's cybersecurity solutions, encompassing managed security services and Security Operations Centers (SOC), are firmly positioned within the Stars quadrant. This strategic placement is fueled by the rapidly expanding global cybersecurity market, which is anticipated to experience a compound annual growth rate exceeding 9% between 2024 and 2033, with the services segment capturing a substantial portion of this growth.

The increasing prevalence of sophisticated cyber threats and stringent regulatory requirements worldwide are key drivers for this high-growth market. ACP's proactive approach, including the strategic acquisition of Xnet Systems GmbH in July 2024, has significantly bolstered its Network & Security business field, reinforcing its competitive edge and market leadership in this dynamic sector.

ACP Holding GmbH's Digital Transformation & AI Consulting services are positioned as Stars. The digital transformation market is set to surge, with a projected CAGR of 33.8% between 2024 and 2029, highlighting substantial growth potential. ACP's strategic investment, including the launch of ACP IT Consulting GmbH in January 2025, directly targets this expanding sector, focusing on digitalization, automation, data utilization, and AI.

The global AI services market is experiencing exponential growth, forecasted to grow at a remarkable CAGR of 45.4% from 2024 to 2025 alone, underscoring the immense opportunities. ACP's early commitment, evidenced by the establishment of ACP Digital Holding GmbH in 2019, demonstrates a keen foresight into these high-growth segments, solidifying its position in a dynamic and lucrative market.

The market for IT infrastructure, especially data center infrastructure, is booming. It's expected to grow at a 9.11% compound annual growth rate from 2024 to 2032. This strong growth trajectory highlights a significant opportunity for companies like ACP Holding GmbH.

ACP's focus on data center infrastructure and hybrid cloud solutions positions them well in a market driven by increasing cloud adoption. Businesses worldwide are looking for flexible and scalable IT environments, making ACP's offerings highly relevant and in demand.

The surge in investment towards AI-related data centers is a particularly exciting development. This trend directly benefits ACP, offering a clear path to expand its market presence and capture a larger share of this rapidly evolving sector.

Modern Workplace Solutions

The shift towards hybrid work models and the demand for adaptable, connected office spaces are fueling substantial growth in modern workplace solutions. ACP Holding GmbH’s strategic expansion into this sector, marked by the opening of its Münster location in August 2024, underscores its commitment to this burgeoning market.

These solutions are critical for businesses aiming to boost collaboration, increase productivity, and foster employee well-being. Analysts project the global modern workplace market to reach over $70 billion by 2025, highlighting its significant economic impact and potential for continued expansion. ACP’s investment aligns with this trend, aiming to capture a larger share of this dynamic market.

- Market Growth: The modern workplace solutions market is experiencing robust expansion, driven by the adoption of hybrid work.

- ACP's Strategy: ACP Holding GmbH is actively investing in this area, evidenced by its new Münster facility opened in August 2024.

- Key Benefits: Solutions focus on enhancing collaboration, boosting productivity, and improving employee well-being, all crucial for current business operations.

- Future Outlook: Projections indicate continued strong performance, with the market expected to surpass $70 billion globally by 2025.

Managed Services (Next-Gen)

Managed Services, particularly those leveraging next-generation technologies like AI and automation, represent a significant growth area for ACP Holding GmbH. The global market for managed IT services is expected to expand robustly, with projections indicating a compound annual growth rate (CAGR) of 9.4% from 2024 to 2029. This upward trend highlights a strong demand for outsourced IT management and support.

ACP's strategic focus on advanced managed services, including sophisticated threat detection, seamless cloud migration, and AI-powered operational efficiencies, positions it favorably to capitalize on this market expansion. These specialized offerings directly address the evolving needs of businesses navigating increasingly complex IT landscapes and heightened cybersecurity threats.

- Strong Market Growth: The managed IT services market is projected to grow at a 9.4% CAGR between 2024 and 2029, indicating substantial opportunity.

- ACP's Strategic Advantage: ACP's focus on AI, automation, advanced threat detection, and cloud migration aligns with key market drivers.

- Demand Drivers: Increasing IT complexity and cybersecurity concerns are fueling the need for comprehensive managed service solutions.

- Star Category Potential: These factors collectively position ACP's managed services as a star performer within its BCG matrix, poised for high growth and market share capture.

ACP Holding GmbH's cybersecurity, digital transformation, AI consulting, IT infrastructure, and modern workplace solutions are all firmly in the Stars quadrant due to their strong market growth and ACP's strategic investments. Managed services also show significant potential.

The global cybersecurity market is expected to grow at over 9% CAGR between 2024 and 2033. Digital transformation and AI services are seeing even higher growth rates, with AI services forecasted to grow at 45.4% from 2024 to 2025. IT infrastructure, particularly data centers, is projected for 9.11% CAGR growth from 2024 to 2032. The modern workplace market is expected to exceed $70 billion by 2025, and managed IT services are set for 9.4% CAGR growth from 2024 to 2029.

| Business Area | Market Growth Indicator | ACP's Strategic Action |

|---|---|---|

| Cybersecurity | Global market CAGR > 9% (2024-2033) | Acquisition of Xnet Systems GmbH (July 2024) |

| Digital Transformation & AI Consulting | Digital Transformation CAGR 33.8% (2024-2029); AI Services CAGR 45.4% (2024-2025) | Launch of ACP IT Consulting GmbH (Jan 2025) |

| IT Infrastructure | Data Center Infrastructure CAGR 9.11% (2024-2032) | Focus on hybrid cloud solutions, AI data centers |

| Modern Workplace Solutions | Market to exceed $70 billion by 2025 | Opening of Münster location (Aug 2024) |

| Managed Services | Managed IT Services CAGR 9.4% (2024-2029) | Focus on AI, automation, advanced threat detection |

What is included in the product

This ACP Holding GmbH BCG Matrix analysis provides strategic insights into its product portfolio, highlighting which units to invest in, hold, or divest.

The ACP Holding GmbH BCG Matrix offers a clear, one-page overview, relieving the pain of scattered portfolio data for strategic decision-making.

Cash Cows

ACP Holding GmbH's traditional IT infrastructure services, encompassing foundational networking and server management, are likely their established cash cows. These services represent a stable revenue stream due to their essential nature for businesses. The market for these core services, while mature, provides consistent cash flow with minimal need for substantial new investment beyond maintenance.

The global IT infrastructure market is projected to reach US$120.15 billion by 2025, underscoring the substantial and enduring demand for these services. This large, established market allows ACP to leverage its existing expertise and client base for predictable earnings. Consequently, these offerings are well-positioned to generate consistent cash for the company.

ACP Holding GmbH's Legacy System Integration & Support segment functions as a classic Cash Cow. The continued reliance on established IT infrastructure across many industries ensures a consistent, albeit slow-growing, revenue stream. ACP leverages its deep expertise to maintain and enhance these critical systems for its client base.

This segment benefits from the sticky nature of legacy systems; once integrated, clients often require long-term support and maintenance contracts, leading to predictable, recurring revenue. For instance, in 2024, the global market for legacy system modernization and support was valued at billions, with a significant portion attributed to ongoing maintenance and integration services.

ACP's established client relationships are a key asset here, fostering loyalty and repeat business. The demand for these services is driven by the sheer volume of existing, functional, yet aging IT systems that businesses cannot afford to replace entirely, making ACP's offerings indispensable.

ACP Holding GmbH's standardized managed services, encompassing helpdesk, system monitoring, and patch management, function as robust cash cows. These offerings tap into a broad customer base seeking reliable IT operations, generating stable and predictable revenue without significant new market investment.

The managed services sector, particularly its mature segments, continues to be a consistent income generator. In 2024, the global managed services market was projected to reach over $315 billion, showcasing the substantial demand for these foundational IT support functions.

On-Premise Data Center Management

On-premise data center management remains a cornerstone for ACP Holding GmbH, acting as a significant cash cow. While the cloud migration trend is undeniable, many organizations continue to leverage on-premise solutions for critical reasons such as stringent security protocols, regulatory compliance, and specialized performance demands. This enduring need provides ACP with a stable, high-market-share service.

ACP's established expertise in managing these traditional data center environments ensures a consistent generation of cash flow. Although growth prospects in this segment are more moderate compared to rapidly expanding cloud services, its foundational stability is crucial for the holding's overall financial health. In fact, the IT infrastructure market is projected to see on-premise solutions holding a substantial share, estimated at 58.7% in 2025, underscoring its continued relevance.

- Stable Revenue: On-premise data center services provide predictable and consistent cash inflows for ACP.

- High Market Share: ACP benefits from its established position and expertise in managing traditional data center environments.

- Enduring Demand: Security, compliance, and performance needs continue to drive demand for on-premise solutions.

- Market Dominance: On-premise IT infrastructure is expected to represent 58.7% of the market in 2025, highlighting its significant ongoing role.

Volume Hardware & Software Reselling

ACP Holding GmbH's Volume Hardware & Software Reselling segment operates as a significant cash cow within its business portfolio. While not the primary driver for aggressive expansion, this area leverages ACP's robust partnerships with major vendors to secure high-volume sales of established IT products. The consistent demand for these foundational IT solutions, coupled with efficient procurement, ensures a steady revenue stream, even with typically lower profit margins.

This segment benefits from ACP's established market presence and its '360° IT portfolio' approach. By offering these essential hardware and software reselling services, ACP provides a comprehensive IT solution for its clients, reinforcing its position as a reliable IT partner. The segment requires less intensive marketing spend compared to emerging technologies, making it a stable contributor to the company's overall financial health.

In 2024, the IT hardware and software reselling market continued to demonstrate resilience. For instance, global IT spending was projected to reach over $5 trillion, with a substantial portion attributed to hardware and software purchases by businesses seeking to maintain and upgrade their existing infrastructure. ACP's focus on high-volume reselling aligns with this ongoing demand.

- Consistent Revenue: High volume sales of established hardware and software provide predictable income.

- Established Partnerships: Strong relationships with key vendors facilitate access to products and favorable terms.

- Lower Promotional Costs: Reduced marketing investment is needed due to existing market demand.

- Foundation of IT Portfolio: These services support ACP's broader '360° IT portfolio' offering.

ACP Holding GmbH's standardized managed services, such as helpdesk and system monitoring, are prime examples of cash cows. These services cater to a broad clientele seeking dependable IT operations, thus generating consistent revenue with minimal need for new market investment. The global managed services market, projected to exceed $315 billion in 2024, highlights the significant and ongoing demand for these essential IT support functions.

| Service Segment | BCG Matrix Category | Rationale | 2024 Market Context |

|---|---|---|---|

| Standardized Managed Services | Cash Cow | Stable revenue from essential IT support, low investment needs. | Global managed services market projected over $315 billion. |

| Legacy System Integration & Support | Cash Cow | Recurring revenue from maintenance of existing systems, high client stickiness. | Significant portion of billions in legacy system modernization market attributed to ongoing support. |

| On-Premise Data Center Management | Cash Cow | Enduring demand due to security and compliance needs, stable market share. | On-premise solutions expected to hold 58.7% of the IT infrastructure market in 2025. |

Full Transparency, Always

ACP Holding GmbH BCG Matrix

The preview you see is the exact ACP Holding GmbH BCG Matrix report you will receive upon purchase. This comprehensive document is fully formatted and ready for immediate strategic application, offering deep insights into the company's product portfolio. You'll gain access to the complete analysis, enabling informed decision-making without any hidden surprises or additional steps.

Dogs

The sale of specific, rapidly commoditizing, or outdated hardware components, characterized by razor-thin margins and declining demand, fits the 'Dog' category within ACP Holding GmbH's BCG Matrix. These products offer minimal competitive advantage and necessitate substantial inventory management without generating significant returns. For instance, in 2024, the global market for legacy server components saw a year-over-year decline of approximately 8%, with average gross margins dropping below 5% for many suppliers.

ACP Holding GmbH would strategically aim to reduce its involvement in these low-value offerings. The focus would shift towards more profitable, integrated solutions rather than struggling with obsolete hardware. This approach minimizes capital tied up in slow-moving inventory and reduces the operational costs associated with supporting products with little future market relevance.

Non-Strategic Basic IT Support, often characterized as commoditized break-fix services, typically falls into the 'Dog' category of the BCG Matrix. These services, lacking integration into broader managed IT solutions, struggle with profitability due to high operational expenses compared to their revenue generation potential. For instance, a typical break-fix service might see a gross margin of only 10-15% in 2024, significantly lower than managed services.

These offerings are usually not central to fostering long-term client partnerships or driving substantial strategic growth for ACP Holding GmbH. They primarily attract customers focused solely on cost, offering little room for value-added services or client retention beyond immediate problem resolution. The market for these basic services is highly competitive, with limited opportunities for differentiation.

In 2024, the IT support market saw a significant portion, estimated at 30-40%, dedicated to basic break-fix, yet this segment contributed disproportionately less to overall industry profit growth. Companies relying heavily on these 'Dogs' often face declining market share and minimal competitive advantage, making them candidates for divestment or significant restructuring.

Generic, undifferentiated consulting services, those easily replicated and lacking unique value, are firmly positioned as Dogs within ACP Holding GmbH's BCG Matrix. These offerings typically face intense price competition and struggle to generate significant profit margins, often hovering around a 3-5% profit margin in the broader consulting market, as reported by industry analyses throughout 2024.

Such commoditized services, by their very nature, do not foster innovation or build a defensible competitive moat for ACP. Their low differentiation means they cannot command premium pricing, directly impacting revenue growth and profitability, a common challenge for many consulting firms in the highly competitive landscape of 2024.

ACP's strategic pivot towards specialized areas like its 'digitalization portfolio' and 'IT Consulting' is a deliberate effort to escape this Dog category. This shift aims to cultivate high-growth, high-margin services that build distinct capabilities and offer tangible value propositions, moving away from the generalized consulting that characterized earlier market phases.

Legacy Software Customization (Niche, Declining)

Customization and support for highly specialized, legacy software platforms, particularly those with a shrinking user base and minimal future development, fall squarely into the 'Dog' category within the BCG Matrix for ACP Holding GmbH. While pockets of niche demand might persist, the significant investment needed to retain specialized expertise and deliver services for these declining platforms often eclipses the potential revenue.

This segment is characterized by both low market growth and a low market share for ACP Holding GmbH. For instance, in 2024, the global market for supporting end-of-life enterprise software is projected to contract by an estimated 5-7% annually, according to industry analysts.

- Low Growth: The market for legacy software customization experiences minimal to negative growth, as businesses migrate to modern solutions.

- Low Market Share: ACP Holding GmbH likely holds a small share in these highly fragmented and specialized legacy markets.

- Resource Drain: Continued investment in maintaining expertise for these platforms can divert resources from more promising growth areas.

- Declining Revenue Potential: The shrinking user base directly translates to diminishing revenue opportunities, making profitability a challenge.

Basic Web Hosting (Non-Managed)

Basic web hosting, often characterized by its simplicity and lack of managed services, can be categorized as a 'Dog' within the BCG Matrix for ACP Holding GmbH. This segment of the market is intensely competitive and commoditized, leading to thin profit margins. For instance, the global web hosting market was valued at approximately USD 13.9 billion in 2023 and is projected to grow, but the basic, unmanaged tier faces immense price pressure from numerous providers.

ACP Holding GmbH would likely find it challenging to generate substantial profits or gain significant market share in this low-margin, high-volume space without considerable economies of scale. The absence of value-added services such as security enhancements, managed updates, or performance tuning further limits its appeal and differentiation. In 2024, many smaller hosting providers continue to compete aggressively on price for these fundamental services.

- Market Saturation: The unmanaged web hosting market is highly saturated with numerous global and regional players.

- Low Profitability: Fierce price competition in this segment typically results in very low profit margins for providers.

- Lack of Differentiation: Basic offerings lack unique selling propositions, making it difficult to stand out from competitors.

- Strategic Bundling: ACP would likely integrate these basic services into more comprehensive and profitable managed solutions.

Products or services in the 'Dog' category of the BCG Matrix, like legacy hardware or basic IT support, are characterized by low market growth and a low market share for ACP Holding GmbH. These offerings often have thin profit margins, with basic IT support in 2024 averaging gross margins between 10-15%. Such segments strain resources and offer limited potential for future revenue growth.

ACP Holding GmbH's strategy for 'Dogs' involves minimizing investment and potentially divesting from these areas. The focus is on shifting capital and operational efforts towards more promising segments within the portfolio. This strategic repositioning aims to enhance overall profitability and competitive standing.

For instance, generic consulting services, which lack unique value and face intense price competition, exemplify 'Dogs'. These services might only yield profit margins of 3-5% in 2024. ACP's move towards specialized digital transformation services signifies a deliberate exit from such low-return activities.

Ultimately, managing 'Dogs' requires a disciplined approach to resource allocation, prioritizing the phasing out or streamlining of low-performing offerings to concentrate on areas with higher growth and profitability potential.

Question Marks

Quantum Computing Readiness Services represent a classic Question Mark within ACP Holding GmbH's BCG Matrix. As quantum technology matures, offering consulting and preparatory services to help businesses understand and adapt to its potential disruption is a strategic move.

The market for these services is still in its early stages, characterized by high growth expectations but currently limited adoption. Timelines for widespread commercial use remain uncertain, making it a high-risk, high-reward proposition.

For ACP to succeed in this nascent market, substantial investment in building specialized expertise and securing early market share will be crucial. This includes developing talent and establishing thought leadership in quantum readiness.

The global quantum computing market, projected to reach tens of billions of dollars by the early 2030s, underscores the immense potential, even as current adoption rates remain low. For example, consulting services in this area are typically project-based, with initial assessments potentially costing tens of thousands of dollars.

Hyper-specialized AI/ML implementations, like those in advanced scientific research or experimental industrial automation, would fall into the Question Mark category for ACP Holding GmbH within the BCG Matrix. These segments represent high-growth potential, with the global AI services market projected to reach over $500 billion by 2024. However, ACP currently holds a limited market share in these niche areas.

Significant investment in research and development is crucial for these specialized AI/ML applications to gain traction. The sheer complexity and novelty of these fields demand substantial upfront capital and expertise to build a competitive advantage. For instance, specialized AI for drug discovery or quantum computing integration is still nascent, offering substantial future rewards but requiring a long-term strategic commitment.

While these areas are characterized by rapid technological advancement and a burgeoning demand for tailored solutions, they also carry inherent risks. Establishing a strong market presence necessitates significant effort in market development, customer education, and proving the efficacy of these cutting-edge AI/ML solutions. Successfully navigating these challenges could transform these Question Marks into Stars for ACP in the future.

Edge computing infrastructure solutions represent a significant growth opportunity within the IT sector, fueled by the demand for immediate data processing and a move away from centralized data centers. ACP Holding GmbH's engagement in this dynamic market, especially if focused on pioneering new offerings or targeting specific industry niches, might position it as a Question Mark in the BCG matrix.

This classification would stem from a potentially low current market share coupled with substantial investment needs to establish a strong foothold and achieve market leadership. The global edge computing market size was estimated to be around $10.7 billion in 2023 and is projected to reach over $100 billion by 2030, highlighting the immense potential for companies like ACP.

Blockchain-as-a-Service for Enterprise

ACP Holding GmbH's exploration into Blockchain-as-a-Service (BaaS) for enterprise applications positions it in a sector experiencing significant growth, yet still in the early stages of adoption. This segment is characterized by high potential for innovation and efficiency gains in areas like supply chain management and secure data sharing, moving beyond basic cryptocurrency functions.

While the BaaS market is projected to expand rapidly, with some estimates suggesting a compound annual growth rate exceeding 40% leading up to 2027, widespread enterprise integration remains a challenge. ACP would need substantial investment to develop robust solutions and clearly demonstrate their value proposition to a diverse enterprise client base, aiming to overcome initial skepticism and integration hurdles.

- Market Potential: The global BaaS market was valued at approximately $2.1 billion in 2023 and is anticipated to reach over $15 billion by 2027, indicating a substantial growth trajectory.

- Adoption Challenges: Despite the growth forecast, many enterprises are still in the pilot or proof-of-concept phase, with only a fraction having fully implemented BaaS solutions.

- ACP's Strategy: ACP's focus on building expertise and tailored solutions is crucial for differentiating itself in a market where many providers offer generic platforms, requiring significant R&D and client education efforts.

- Competitive Landscape: Major tech players are already investing heavily, meaning ACP must develop a clear competitive advantage, possibly through specialized industry solutions or superior integration capabilities, to capture market share.

Advanced IoT Integration & Analytics

Advanced IoT integration and analytics for specialized industrial or smart city applications often fall into the Question Mark category within the BCG Matrix. While the overall IoT market is expanding rapidly, with global IoT spending projected to reach over $1.1 trillion in 2024 according to IDC, these niche segments demand tailored solutions. This means significant upfront investment in research and development, along with securing specialized engineering and data science talent, is necessary to compete effectively and gain substantial market share.

The complexity of these integrations, requiring deep analytics for specific use cases, presents a challenge. For instance, implementing predictive maintenance in a smart factory or optimizing traffic flow in a smart city involves intricate data processing and specialized algorithms. These bespoke solutions, while potentially lucrative, are resource-intensive. The growth in IoT adoption is undeniably fueling demand for managed IT infrastructure services, but capturing a leading position in these advanced, custom IoT segments requires overcoming high barriers to entry and demonstrating clear value differentiation.

- High Growth Potential: The demand for sophisticated IoT solutions in sectors like manufacturing, logistics, and urban management is increasing.

- Significant Investment Required: Developing bespoke IoT integrations and advanced analytics necessitates substantial R&D funding and specialized personnel.

- Market Share Uncertainty: Despite high growth, achieving dominance is difficult due to the need for tailored, often costly, implementations.

- Talent Acquisition Challenge: Access to skilled engineers and data scientists proficient in advanced IoT technologies is crucial and often scarce.

Quantum Computing Readiness Services represent a classic Question Mark for ACP Holding GmbH. The market is high-growth, with the global quantum computing market projected to reach tens of billions of dollars by the early 2030s, but current adoption is limited.

ACP needs significant investment to build expertise and capture early market share in this nascent, high-risk, high-reward area. Success hinges on developing specialized talent and establishing thought leadership.

Advanced IoT integration and analytics for specialized industrial or smart city applications also fall into this category. While global IoT spending is projected to exceed $1.1 trillion in 2024, these niche segments demand substantial R&D and specialized talent.

ACP's foray into Blockchain-as-a-Service (BaaS) for enterprises places it in a rapidly growing sector, with the market anticipated to reach over $15 billion by 2027. However, widespread enterprise integration remains a hurdle, requiring significant investment and client education to overcome initial skepticism.

| Business Area | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| Quantum Computing Readiness Services | Question Mark | High | Low | High |

| Hyper-specialized AI/ML Implementations | Question Mark | High | Low | High |

| Edge Computing Infrastructure Solutions | Question Mark | High | Low | High |

| Blockchain-as-a-Service (BaaS) | Question Mark | High | Low | High |

| Advanced IoT Integration & Analytics | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix for ACP Holding GmbH is built on verified market intelligence, combining financial data from company filings, industry research from leading analysts, and official market reports to ensure reliable, high-impact insights.