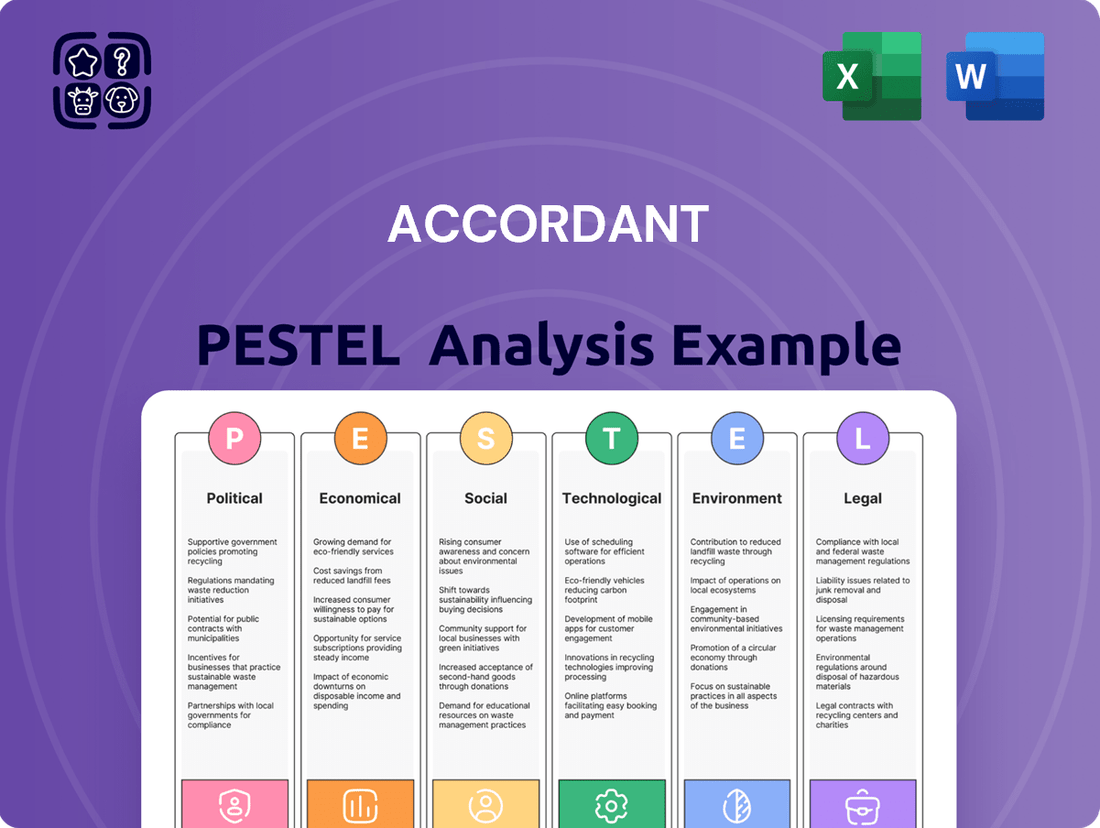

Accordant PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accordant Bundle

Unlock the strategic advantages Accordant is poised to leverage by understanding the intricate web of external forces. Our meticulously researched PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping Accordant's trajectory. Equip yourself with actionable intelligence to anticipate market shifts and refine your own business strategies. Download the complete PESTLE analysis now for unparalleled foresight.

Political factors

Government healthcare policies, like the ongoing evolution of the Affordable Care Act (ACA) and anticipated legislative shifts, profoundly shape the healthcare sector. Accordant must remain agile, guiding clients through new regulations, the adoption of value-based care payment models, and increasing compliance demands from both federal and state authorities.

These policy shifts directly influence reimbursement frameworks and operational mandates for healthcare providers, such as hospitals and health systems, thereby impacting the demand and nature of Accordant's consulting services. For instance, the Centers for Medicare & Medicaid Services (CMS) announced a 2.1% increase in the Medicare Physician Fee Schedule for 2024, a key factor for providers and consultants alike.

Changes in reimbursement rates from government payers like Medicare and Medicaid, as well as commercial insurers, significantly impact hospital and health system finances. For instance, Medicare's inpatient prospective payment system (IPPS) rates for fiscal year 2024 saw an estimated increase of 3.1%, but this can vary based on specific hospital adjustments and the ongoing transition to value-based care models.

Accordant's revenue cycle management services are vital in navigating these shifting landscapes, helping clients optimize reimbursements and manage intricate payer relationships. The company's advisory services are essential for clients to maintain financial viability amidst fluctuating rates and the increasing adoption of value-based purchasing initiatives, which tie payments to quality and outcomes.

Political stability is a cornerstone for healthcare investment, and in 2024, many nations are navigating complex geopolitical landscapes that could impact healthcare sector funding. For instance, increased defense spending in some regions might indirectly reduce the fiscal space for public health initiatives, posing a challenge for companies like Accordant that rely on government contracts. Conversely, a stable political environment that prioritizes healthcare could unlock significant opportunities.

Governments' healthcare spending priorities directly shape the market. In 2024, we're seeing a continued global emphasis on preventative care and digital health solutions. For example, the U.S. federal government's proposed budget for FY2025 includes increased funding for public health infrastructure and research, potentially creating new avenues for Accordant's advisory services in these areas. These shifts in government focus can redefine market demand and the strategic direction of healthcare organizations.

Regulatory Scrutiny and Enforcement

Accordant faces heightened regulatory scrutiny, particularly from bodies like the Department of Justice (DOJ) and the Office for Civil Rights (OCR). This means organizations must diligently adhere to evolving compliance mandates. For instance, in 2024, the DOJ continued its aggressive enforcement of healthcare fraud, with settlements exceeding billions of dollars annually, underscoring the significant financial risks of non-compliance.

Staying current with legislation such as HIPAA, the Anti-Kickback Statute, and the False Claims Act is critical for Accordant's clients. Failure to comply can result in substantial penalties. In 2023, HIPAA enforcement actions led to over $3.5 million in settlements, highlighting the ongoing financial impact of data privacy breaches and regulatory violations.

Accordant's role includes providing expert guidance on crucial areas like data privacy, fraud prevention, and ethical business practices within the healthcare sector. This advisory capacity is vital as regulatory bodies increasingly focus on these aspects. The OCR, for example, has been actively investigating and resolving HIPAA breaches, with fines often tied to the severity and scope of the violation.

- Increased DOJ enforcement actions in healthcare fraud in 2024.

- HIPAA settlements in 2023 totaling over $3.5 million.

- Focus on data privacy and ethical practices by the OCR.

- Potential for significant financial penalties for non-compliance with healthcare statutes.

Telehealth and Digital Health Policy

Government policies are a significant driver for telehealth and digital health. Regulations around virtual care, remote patient monitoring, and digital health services directly influence how these technologies are adopted and reimbursed. For instance, the Centers for Medicare & Medicaid Services (CMS) has been instrumental in expanding telehealth reimbursement, a trend expected to continue. In 2024, CMS proposed further expansions to telehealth services, building on the flexibilities introduced during the COVID-19 pandemic. Accordant's expertise in navigating these evolving regulatory frameworks, including advocating for permanent telehealth flexibilities and appropriate billing codes, is crucial for clients seeking to optimize their virtual care delivery and revenue cycles.

The political landscape’s impact on telehealth is multifaceted. Key legislative actions and regulatory decisions shape the accessibility and financial viability of digital health solutions. For example, the Consolidated Appropriations Act of 2023 extended many pandemic-era telehealth flexibilities, providing a degree of certainty for providers. However, the ongoing debate regarding the permanence of these flexibilities and the establishment of clear, sustainable reimbursement pathways remains a critical political factor. Accordant's role in advocating for these policy changes underscores the importance of government engagement in the digital health sector.

The political environment directly impacts Accordant’s ability to support clients in the telehealth and digital health space. Understanding and influencing policy related to virtual care delivery and billing is paramount. As of early 2025, discussions are ongoing regarding the long-term integration of telehealth into Medicare, with proposals aiming to make many of the temporary flexibilities permanent. This includes the potential for expanded coverage of audio-only telehealth services and reimbursement parity for certain virtual services. Accordant's strategic guidance in this area helps clients stay ahead of regulatory shifts.

Key policy considerations for Accordant and its clients in the telehealth and digital health sector include:

- Advocacy for permanent telehealth flexibilities: Ensuring continued access to virtual care services beyond emergency declarations.

- Reimbursement policy: Securing appropriate billing codes and payment rates for telehealth and remote patient monitoring services.

- Licensure and cross-state practice: Addressing regulatory barriers that limit providers from offering telehealth services across state lines.

- Data privacy and security regulations: Navigating compliance with HIPAA and other relevant laws governing digital health data.

Government healthcare policies significantly influence Accordant's operational landscape, dictating compliance requirements and reimbursement models. For instance, the ongoing debate and potential legislative changes surrounding Medicare reimbursement rates for 2025 will directly impact Accordant's clients and the demand for its financial advisory services.

Political stability and government spending priorities are crucial for healthcare sector investment. In 2024, many countries are facing geopolitical shifts that could affect healthcare funding. For example, increased defense budgets in some nations might reduce the fiscal capacity for public health initiatives, impacting Accordant's potential government contract opportunities.

Regulatory enforcement remains a key political factor, with bodies like the DOJ and OCR continuing to focus on healthcare fraud and data privacy. In 2024, the DOJ's aggressive stance on healthcare fraud, evidenced by multi-billion dollar annual settlements, underscores the critical need for Accordant's clients to maintain robust compliance programs.

What is included in the product

The Accordant PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Accordant, providing a comprehensive understanding of its external operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, ensuring everyone is on the same page regarding external influences.

Economic factors

Healthcare spending growth is a key economic indicator. In the US, national health expenditures were projected to reach $4.8 trillion in 2024, representing 17.3% of GDP. This trend directly impacts the demand for consulting services, as healthcare organizations navigate these significant financial flows.

The broader economic outlook plays a crucial role in shaping healthcare demand. A strong economy often translates to greater investment in healthcare innovation and expansion. Conversely, during economic slowdowns, like the potential for a mild recession in late 2024 or early 2025, healthcare providers increasingly prioritize cost-saving measures, making Accordant's revenue cycle management expertise particularly valuable.

Rising inflation and increasing labor costs are significantly squeezing hospital operating margins. For instance, the U.S. Bureau of Labor Statistics reported that the average hourly wage for healthcare practitioners and technical occupations rose by 5.5% in the year ending April 2024. This escalation in expenses makes Accordant's expertise in operational optimization and financial performance improvement more vital than ever.

Accordant's solutions are designed to counter these pressures by helping healthcare organizations manage workforce challenges, boost operational efficiency, and implement effective cost control measures. In a landscape where expenses are climbing, the ability to streamline operations and enhance financial health is paramount for client success.

The healthcare industry's payer mix is a critical economic factor, with a noticeable shift towards government programs like Medicare and Medicaid. This trend, amplified by an aging population, places greater emphasis on understanding and navigating these reimbursement structures. For instance, in 2023, Medicare spending was projected to reach over $900 billion, highlighting its significant impact on provider revenue.

The move towards value-based care (VBC) models is fundamentally altering how healthcare providers are reimbursed, moving away from fee-for-service. These models, which reward quality outcomes and cost efficiency, require providers to adapt their operational and financial strategies. By 2025, it's estimated that over 60% of healthcare payments in the U.S. could be tied to value-based arrangements, a substantial increase from previous years.

Accordant's role involves guiding clients through these complex changes, ensuring robust documentation and streamlined billing processes to optimize revenue under new payment paradigms. This includes offering strategic insights for contract negotiations and performance-based reimbursement strategies, crucial for financial sustainability in the evolving healthcare landscape.

Investment in Healthcare Technology

The healthcare technology sector is experiencing significant investment, particularly in areas like artificial intelligence (AI), automation, and digital transformation. This influx of capital directly impacts the development of advanced tools and solutions that can streamline healthcare operations. For instance, global spending on healthcare AI solutions was projected to reach approximately $12.2 billion in 2023 and is expected to grow substantially in the coming years, highlighting the rapid adoption and innovation.

Accordant can capitalize on these technological advancements by integrating them into its consulting services. This allows the firm to offer clients state-of-the-art solutions for optimizing revenue cycle management, enhancing clinical documentation accuracy, and improving health information management. The firm can also guide clients in evaluating the potential return on investment (ROI) for these transformative technologies, ensuring strategic and financially sound implementation.

- AI in Healthcare Market Growth: The global AI in healthcare market was valued at around $15.4 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of over 37% from 2024 to 2030.

- Digital Health Investment: Venture capital investment in digital health reached over $11 billion in 2023, indicating strong investor confidence in the sector's potential.

- Automation in Healthcare: Robotic process automation (RPA) in healthcare is projected to save billions annually by automating administrative tasks, with adoption rates increasing significantly.

Competition and Market Consolidation

The healthcare consulting market is intensely competitive, with numerous firms vying for client engagements. This dynamic directly influences Accordant's business development, necessitating a clear differentiation strategy. For instance, in 2024, the healthcare consulting market was valued at approximately $15 billion globally, with significant growth projected. Understanding these market dynamics is key to identifying strategic partnership or acquisition opportunities.

The trend of consolidation among healthcare providers, driven by factors like economies of scale and the need for integrated care models, also reshapes the landscape for consulting firms. This consolidation can create larger, more complex clients but also fewer, more powerful entities. For example, hospital mergers in the US have continued throughout 2024, with several deals exceeding $1 billion. Accordant must adapt its service offerings to meet the evolving needs of these larger, integrated health systems.

Private equity (PE) investment in healthcare is a significant factor, fueling both consolidation and innovation. PE firms are actively acquiring healthcare provider groups and technology companies, creating new market participants and increasing the competitive pressure. In 2024, PE investment in the healthcare sector reached record levels, with over $200 billion deployed globally. Navigating this influx of capital requires Accordant to understand the strategic objectives of PE-backed entities and position itself as a valuable partner.

- Market Value: The global healthcare consulting market was valued at around $15 billion in 2024.

- Provider Consolidation: Major hospital mergers continue, impacting client base size and complexity.

- PE Investment: Over $200 billion in private equity capital was invested in healthcare globally in 2024.

- Competitive Differentiation: Accordant must highlight unique value propositions to stand out.

Economic factors significantly influence Accordant's operating environment. Rising healthcare spending, projected to hit $4.8 trillion in the US in 2024, underscores the demand for financial management expertise. However, economic headwinds, including potential slowdowns and persistent inflation impacting labor costs (up 5.5% for healthcare practitioners year-over-year as of April 2024), necessitate cost-efficiency solutions.

The shift towards value-based care, with over 60% of US healthcare payments potentially tied to these models by 2025, requires strategic adaptation. Accordant's ability to navigate complex reimbursement structures, like the over $900 billion Medicare spending in 2023, and integrate technological advancements, such as the $12.2 billion projected for healthcare AI in 2023, positions it to assist clients effectively.

The competitive landscape, valued at approximately $15 billion globally in 2024, along with ongoing provider consolidation and over $200 billion in global PE investment in healthcare during 2024, demands strategic differentiation and adaptability from Accordant.

| Economic Factor | 2024/2025 Projection/Data | Impact on Accordant |

|---|---|---|

| US Healthcare Spending | $4.8 trillion (2024) | Increased demand for financial management services |

| Inflation & Labor Costs | 5.5% rise in healthcare practitioner wages (April 2024) | Need for cost-efficiency and operational optimization solutions |

| Value-Based Care Adoption | >60% of US payments by 2025 | Requirement for expertise in new reimbursement models |

| Healthcare AI Investment | ~$12.2 billion (2023) | Opportunity to integrate advanced technologies into consulting |

| Global Healthcare Consulting Market | ~$15 billion (2024) | Intense competition, need for clear differentiation |

| Private Equity Investment | >$200 billion globally (2024) | Need to understand PE objectives and partner effectively |

What You See Is What You Get

Accordant PESTLE Analysis

The Accordant PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the Accordant PESTLE Analysis you’re buying—delivered exactly as shown, no surprises.

The content and structure of the Accordant PESTLE Analysis shown in the preview is the same document you’ll download after payment.

Sociological factors

The global population is aging, with the World Health Organization projecting that by 2030, one in six people worldwide will be 60 years or older. This demographic shift, coupled with a rising incidence of chronic diseases like diabetes and cardiovascular conditions, significantly boosts the demand for healthcare services and long-term care solutions.

This increasing need for chronic disease management directly impacts clinical documentation and data handling. Accordant's expertise in revenue cycle management and efficient healthcare delivery models becomes crucial for organizations navigating these evolving patient needs and regulatory landscapes.

Patients are increasingly behaving like consumers, expecting more transparency, tailored treatments, and easy access to healthcare services. This shift means providers need to focus on clear communication, especially around billing, and offer digital options for engagement.

Accordant can support healthcare organizations in improving the overall patient journey, addressing demands for better billing clarity and digital interaction. For example, a recent survey indicated that 70% of patients value clear, upfront cost estimates, a key area where Accordant's solutions can provide significant benefit.

This growing consumerism directly shapes how healthcare providers approach patient engagement and the integration of new technologies designed to be more patient-centric. The demand for convenience and personalized service is a major driver in healthcare technology adoption, with patient portals seeing a 25% increase in usage from 2023 to 2024.

Persistent shortages in the healthcare workforce, especially for nurses and primary care physicians, are creating substantial operational hurdles for hospitals. In 2024, the U.S. Bureau of Labor Statistics projected a need for 203,200 new registered nurses annually over the next decade to fill existing vacancies and replace retiring nurses.

These shortages are exacerbated by high rates of burnout among existing healthcare professionals. A 2023 survey by the American Medical Association found that over 60% of physicians reported experiencing burnout, impacting patient care and staff morale. Accordant can address these issues by implementing solutions focused on enhancing operational efficiency, optimizing workflows, and integrating technology like AI for administrative tasks, thereby reducing staff burdens and improving retention.

Health Equity and Access to Care

Societal focus on health equity is intensifying, pushing healthcare providers to broaden access for historically underserved communities. This shift influences operational models and reimbursement structures, as organizations increasingly grapple with addressing social determinants of health.

Accordant can guide clients in crafting strategies that tackle these social determinants, ensuring more equitable care delivery. This might involve adapting service portfolios and bolstering community engagement efforts to meet evolving expectations.

- Increased Investment in Social Determinants of Health: In 2024, the US healthcare sector saw a significant uptick in investments aimed at addressing social determinants of health (SDOH), with projections indicating continued growth. For example, the Robert Wood Johnson Foundation and Kaiser Permanente have been leading initiatives that allocate substantial funding towards community-based programs addressing food insecurity and housing instability.

- Focus on Health Equity Metrics: By 2025, a growing number of health systems are expected to integrate health equity metrics into their performance evaluations and value-based care contracts, mirroring trends seen in early adopters like Providence St. Joseph Health. This includes tracking disparities in outcomes based on race, ethnicity, and socioeconomic status.

- Policy Reforms for Equitable Access: Anticipated policy changes in 2024-2025, such as potential expansions of Medicaid coverage in certain states and initiatives to improve access to telehealth services in rural and underserved areas, will further shape the landscape of equitable care delivery.

Public Trust and Reputation of Healthcare Institutions

Public trust in healthcare institutions is a critical, yet often fragile, asset. Factors like data breaches, perceived quality of care, and a lack of financial transparency can significantly erode this trust. For instance, a 2024 report indicated that over 60% of consumers would consider switching providers after a significant data breach, highlighting the direct impact on reputation.

Accordant can play a vital role in bolstering this trust by guiding clients to implement robust health information management and revenue cycle processes. These improvements are essential for building and maintaining public confidence. Addressing concerns about the increasing corporatization of healthcare, which can sometimes lead to perceptions of profit over patient care, is also a key component of this strategy.

- Data Security: In 2023, healthcare organizations reported an average of 45 data breaches, impacting millions of patient records. Strengthening data security is paramount for maintaining public trust.

- Quality of Care Perception: Patient satisfaction scores, which directly reflect perceived quality, are increasingly scrutinized. Accordant's expertise can help optimize workflows that contribute to better patient outcomes.

- Financial Transparency: Clear and accessible billing practices are crucial. A 2024 survey found that over 70% of patients are frustrated by opaque medical billing processes.

- Corporate Influence: Public perception of healthcare as a business versus a service can be influenced by how institutions communicate their mission and values, particularly regarding patient-centricity.

Societal trends are reshaping healthcare demands, with an aging global population, projected to see one in six individuals aged 60+ by 2030, driving increased need for chronic disease management and long-term care. This demographic shift, coupled with a growing consumer mindset among patients expecting transparency and digital engagement, necessitates a focus on clear communication and patient-centric technology. Accordant's solutions can enhance patient experience and streamline operations to meet these evolving expectations.

Technological factors

The healthcare sector is experiencing a significant shift with the rapid integration of AI and Machine Learning. These technologies are revolutionizing everything from how diseases are diagnosed and treatments are personalized to streamlining administrative burdens like managing revenue cycles and documenting patient care. For Accordant, this presents a clear opportunity to enhance its service offerings through AI-driven tools, potentially improving claim denial prediction and automating various operational workflows.

The digital health and telemedicine sectors are experiencing rapid growth, with the global telemedicine market projected to reach $396.3 billion by 2027, up from $60.5 billion in 2020. This expansion, driven by increased patient demand for convenient care and technological innovation, presents significant opportunities for Accordant to guide clients in leveraging these tools. By advising on the implementation of remote patient monitoring and virtual reality in healthcare settings, Accordant can help clients improve patient engagement and operational efficiency.

Accordant's expertise can be instrumental in helping healthcare providers navigate the complexities of integrating virtual care. This includes developing effective strategies for billing for telehealth services, which saw a dramatic surge in usage during 2024, with many insurance providers expanding coverage. Furthermore, Accordant can assist in seamlessly embedding these new digital modalities into existing healthcare infrastructure, ensuring a smooth transition and maximizing the benefits for both providers and patients.

The sheer volume of healthcare data is exploding, making advanced analytics a necessity. In 2024, the global healthcare analytics market was valued at an estimated $39.7 billion, projected to grow significantly. Accordant's expertise in this area helps clients leverage this big data to improve decision-making and financial performance.

Enhanced interoperability between disparate health information systems is crucial for a unified view of patient data. Accordant facilitates seamless data flow across departments, which is vital for effective health information management. This streamlining is directly tied to optimizing revenue cycles, a key concern for healthcare providers.

Cybersecurity and Data Security

The increasing reliance on digital platforms in healthcare makes robust cybersecurity and data security absolutely critical. Accordant needs to guide its clients in establishing strong cybersecurity measures and adhering to evolving regulations, such as the Health Insurance Portability and Accountability Act (HIPAA), to secure electronic protected health information (ePHI) and preserve client confidence.

Implementing best practices for data protection and proactive breach prevention is essential. For instance, the healthcare sector experienced a significant number of data breaches in 2023, with ransomware attacks targeting patient data continuing to be a major concern. Accordant’s advisory services in this area directly address the growing threat landscape.

- Data Breach Costs: The average cost of a healthcare data breach reached $10.10 million in 2023, a substantial increase from previous years.

- Regulatory Fines: Non-compliance with HIPAA can result in significant financial penalties, with fines potentially reaching $1.5 million per violation category per year.

- Patient Trust: A single data breach can severely erode patient trust, impacting patient retention and Accordant's clients' reputations.

- Ransomware Attacks: In 2024, ransomware attacks continue to be a primary threat, disrupting operations and compromising sensitive patient records.

Automation of Administrative Processes

Technological advancements are significantly reshaping administrative functions within healthcare. Automation, particularly through Robotic Process Automation (RPA), is a key driver, streamlining tasks like claims scrubbing, eligibility verification, and payment posting. Accordant leverages these technologies to help clients reduce manual labor, enhance accuracy, and boost efficiency in their revenue cycle management operations.

The impact of this automation is substantial. For instance, in 2024, healthcare organizations adopting RPA reported an average reduction of 25% in administrative processing times for tasks like patient registration and billing inquiries. This efficiency gain directly translates to cost savings and improved patient satisfaction by accelerating service delivery.

- Reduced Errors: Automation minimizes human error in repetitive data entry and verification processes, leading to fewer claim denials and faster reimbursements.

- Increased Throughput: By handling routine tasks, automation allows administrative staff to focus on more complex issues, increasing the overall volume of processed claims and inquiries.

- Cost Savings: Streamlined operations and reduced error rates contribute to significant cost reductions in administrative overhead and claim rework.

- Enhanced Data Accuracy: Automated systems ensure consistent and accurate data handling, improving the reliability of financial reporting and operational analytics.

Technological advancements are fundamentally altering healthcare operations, with AI and machine learning driving innovation in diagnostics, personalized treatment, and administrative efficiency. The burgeoning telemedicine sector, projected to reach $396.3 billion by 2027, highlights the demand for accessible digital health solutions.

Accordant's role involves guiding clients in integrating these technologies, from optimizing revenue cycles with AI-powered claim denial prediction to enhancing patient engagement through remote monitoring. The explosion of healthcare data, with the analytics market valued at $39.7 billion in 2024, necessitates advanced analytics expertise to improve decision-making.

Furthermore, robust cybersecurity is paramount given the increasing reliance on digital platforms and the persistent threat of ransomware attacks, which saw healthcare data breach costs averaging $10.10 million in 2023. Accordant's advisory services are crucial in navigating these complex technological landscapes and mitigating associated risks.

| Technology Area | 2024/2025 Trend | Impact on Healthcare Operations | Accordant's Role |

|---|---|---|---|

| AI & Machine Learning | Rapid integration in diagnostics, treatment, and administration | Improved accuracy, efficiency, personalized care | Developing AI-driven tools for claim prediction, workflow automation |

| Telemedicine & Digital Health | Market growth to $396.3B by 2027 | Increased patient access, convenience, remote care capabilities | Advising on implementation of remote monitoring, virtual reality |

| Big Data & Analytics | Market valued at $39.7B in 2024, significant growth | Enhanced decision-making, performance optimization | Leveraging data for improved financial performance and insights |

| Cybersecurity | Growing threat landscape (ransomware, data breaches) | Critical for protecting patient data, maintaining trust | Guiding clients on robust security measures and regulatory compliance |

Legal factors

HIPAA's stringent rules govern patient data, impacting how Accordant handles sensitive health information. Ensuring client compliance with HIPAA, especially regarding the secure electronic exchange of health information (EHI) and maintaining patient confidentiality, is paramount. Recent updates in 2024 and anticipated changes for 2025 underscore the necessity for Accordant to maintain rigorous compliance protocols and strong cybersecurity defenses to protect patient privacy.

Compliance with the Anti-Kickback Statute (AKS) and Stark Law is critical for healthcare entities like Accordant to avoid significant penalties and maintain ethical operations. These laws are designed to prevent fraud and abuse, particularly concerning physician referrals and financial relationships. Accordant must guide its clients through the intricacies of these regulations, ensuring their referral networks and compensation arrangements are compliant.

The Department of Justice (DOJ) has intensified its focus on healthcare fraud enforcement, with AKS and Stark Law violations frequently targeted. For instance, in 2023, the DOJ reported recovering billions of dollars through healthcare fraud settlements, many of which involved kickback schemes. Accordant's advisory role is therefore vital in helping clients structure physician partnerships and referral systems to withstand regulatory scrutiny and avoid costly litigation or False Claims Act liability.

The False Claims Act (FCA) is a critical piece of legislation that penalizes individuals and entities for defrauding government programs, particularly in healthcare. In 2023, the Department of Justice reported recovering over $2.2 billion under the FCA, highlighting its significant enforcement impact.

Accordant's focus on clinical documentation improvement and robust revenue cycle management directly addresses the risks associated with FCA violations. By ensuring accurate billing and coding, Accordant helps healthcare providers avoid submitting false claims, thereby mitigating substantial financial penalties and reputational damage.

Workplace Safety and OSHA Standards

The Occupational Safety and Health Administration (OSHA) continues to set and enforce standards that directly impact healthcare operations. Proposed rules, such as those for workplace violence prevention specifically in healthcare settings, are designed to enhance safety for medical professionals. These regulations necessitate robust operational policy adjustments for hospitals and health systems to ensure compliance and protect their workforce.

Accordant can play a crucial role in helping clients navigate these evolving legal landscapes. By assisting in the development and implementation of comprehensive policies, Accordant ensures that healthcare facilities not only meet but exceed safety requirements, fostering a secure work environment. For instance, OSHA's focus on reducing workplace injuries means that compliance with standards like those for ergonomic equipment or proper lifting techniques is paramount.

- OSHA's commitment to workplace violence prevention in healthcare is a key legal driver for policy updates.

- Hospitals and health systems must adapt operational policies to align with new and existing OSHA safety mandates.

- Accordant aids in creating and implementing policies that guarantee a safe and compliant work environment for healthcare staff.

Value-Based Care and Payment Model Regulations

The Centers for Medicare & Medicaid Services (CMS) continues to shape the healthcare landscape through its evolving value-based care initiatives. For instance, the Medicare Shared Savings Program (MSSP) saw over 500 accountable care organizations (ACOs) participating in 2024, aiming to improve quality and reduce costs. Accordant's expertise is crucial in navigating these complex payment structures and performance metrics, ensuring clients meet the stringent requirements for successful reimbursement under programs like the ACO REACH model.

Changes in Medicare Advantage and Medicaid managed care also directly impact value-based care participation. With Medicare Advantage enrollment projected to reach over 30 million beneficiaries by 2025, understanding the specific regulations and quality incentives within these plans is paramount. Accordant must assist clients in aligning their strategies with these evolving payer requirements to maximize their success in value-based payment arrangements.

- CMS's MSSP: Over 500 ACOs participated in 2024, demonstrating a significant shift towards value.

- ACO REACH Model: This direct contracting model continues to be a key area for value-based care strategy.

- Medicare Advantage Growth: Enrollment expected to exceed 30 million by 2025, increasing the importance of payer-specific value-based programs.

- Medicaid Managed Care: States increasingly incorporate value-based payment principles, requiring careful attention to state-specific regulations.

The legal framework surrounding healthcare is constantly evolving, demanding vigilant attention from organizations like Accordant. Key legislation such as the Health Insurance Portability and Accountability Act (HIPAA) mandates strict data privacy and security protocols, especially concerning electronic health information. Accordant's role involves guiding clients to maintain robust compliance measures to protect sensitive patient data from breaches, a critical concern given the increasing sophistication of cyber threats anticipated through 2025.

Furthermore, laws like the Anti-Kickback Statute and Stark Law are fundamental in preventing fraud and abuse within the healthcare system. These regulations govern physician referrals and financial relationships, areas where Accordant provides essential guidance to ensure ethical and compliant operations. The Department of Justice's continued aggressive enforcement, evidenced by billions recovered annually from healthcare fraud, underscores the importance of Accordant's advisory services in structuring compliant referral networks and partnerships.

The False Claims Act (FCA) remains a significant legal risk, with penalties for defrauding government healthcare programs being substantial. In 2023 alone, the DOJ recovered over $2.2 billion under the FCA, highlighting the critical need for accurate billing and coding practices. Accordant's focus on clinical documentation improvement and revenue cycle management directly mitigates these risks, helping clients avoid false claims and associated penalties.

Additionally, regulatory bodies like OSHA continue to influence workplace safety. Proposed OSHA rules for workplace violence prevention in healthcare settings, for example, require operational adjustments to ensure staff safety. Accordant assists clients in implementing policies that meet these evolving safety mandates, fostering a secure and compliant work environment.

Environmental factors

The healthcare sector is a substantial source of greenhouse gas emissions, contributing significantly to climate change. For instance, a 2019 study indicated that the U.S. healthcare system alone accounted for approximately 8.5% of the nation's total greenhouse gas emissions. Accordant can guide healthcare providers in developing and implementing strategies to shrink this environmental impact.

These strategies include enhancing energy efficiency within facilities, transitioning to renewable energy sources like solar and wind power, and fostering more sustainable practices throughout their supply chains. This proactive approach is becoming increasingly vital as the industry embraces a broader commitment to environmental responsibility and sustainable operations.

Healthcare facilities are significant contributors to waste streams, with medical waste posing unique disposal challenges. In 2023, the US healthcare sector generated an estimated 5.9 million tons of waste, a substantial portion of which is considered regulated medical waste. Accordant's expertise can guide clients in developing and executing robust waste management strategies, focusing on reduction, recycling, and innovative waste-to-energy solutions to enhance circularity.

By promoting the adoption of environmentally preferable products and materials, Accordant helps healthcare organizations lessen their ecological footprint. This includes advocating for reusable medical supplies where appropriate and sourcing products made from recycled or sustainable content, thereby contributing to a more circular economy within the healthcare industry.

Sustainable resource management, especially water conservation, is a growing concern for healthcare organizations. Accordant assists clients in adopting water-efficient technologies and strategies, helping them minimize their environmental impact and demonstrate corporate responsibility.

For instance, hospitals in water-stressed regions are facing increasing operational costs and regulatory scrutiny. By implementing smart water metering and leak detection systems, facilities can reduce consumption by an average of 15-20%, as reported by industry studies in 2024. Accordant's expertise can guide these implementations.

Sustainable Procurement Practices

Adopting sustainable procurement practices is increasingly vital in the healthcare sector, with a growing emphasis on partnering with environmentally conscious suppliers and sourcing eco-friendly products. Accordant can guide clients in embedding these practices, thereby minimizing environmental footprints throughout their supply chains. For instance, a significant portion of healthcare organizations are actively seeking suppliers with strong ESG (Environmental, Social, and Governance) ratings, with projections indicating this trend will accelerate through 2025.

These sustainable initiatives can lead to tangible benefits. By prioritizing vendors committed to reducing waste and emissions, healthcare providers can not only improve their environmental stewardship but also potentially achieve cost savings through more efficient resource utilization. For example, studies in 2024 highlighted that healthcare systems implementing green procurement policies saw an average reduction of 10-15% in their operational waste streams.

- Supplier Engagement: Prioritizing suppliers with certified environmental management systems (e.g., ISO 14001) or those demonstrating clear commitments to reducing carbon emissions.

- Product Lifecycle Assessment: Evaluating the environmental impact of products from raw material extraction to disposal, favoring those with lower footprints.

- Circular Economy Principles: Encouraging the use of reusable, recyclable, or biodegradable materials and supporting vendors who implement take-back programs.

- Transparency and Reporting: Demanding greater transparency from suppliers regarding their environmental performance and encouraging public reporting of sustainability metrics.

Climate Change Impact on Public Health

Climate change poses significant long-term threats to public health, potentially reshaping healthcare delivery and resource allocation. For instance, the World Health Organization (WHO) estimated in 2024 that climate change could cause an additional 250,000 deaths per year between 2030 and 2050 due to malnutrition, malaria, diarrhea, and heat stress alone. Accordant can support clients by developing strategies for community health programs and disaster preparedness, ensuring operational resilience amidst these evolving environmental challenges.

These public health shifts necessitate adaptive healthcare models. By 2025, projections suggest increased strain on emergency services due to extreme weather events, which are becoming more frequent and intense. Accordant's advisory services could include helping healthcare providers enhance their capacity for managing climate-related health crises, such as heatwaves or the spread of vector-borne diseases, thereby safeguarding patient care and organizational continuity.

- Increased healthcare demand: Climate change is linked to a rise in heat-related illnesses, respiratory problems from air pollution, and the expansion of infectious disease ranges, as noted by the Centers for Disease Control and Prevention (CDC) in their 2024 climate and health reports.

- Resource allocation challenges: Public health emergencies driven by climate events will likely strain healthcare budgets and infrastructure, requiring careful planning for resource deployment.

- Adaptation strategies: Accordant can guide clients in implementing climate-resilient infrastructure and public health initiatives to mitigate these impacts.

Environmental factors are increasingly shaping business operations and strategic planning, particularly within sectors like healthcare. Accordant helps organizations navigate these complexities by focusing on reducing carbon footprints, managing waste effectively, and promoting sustainable resource use. These efforts are not only crucial for environmental stewardship but also for long-term operational efficiency and regulatory compliance, especially as climate change impacts become more pronounced and public expectations for sustainability rise through 2025.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from leading international organizations, government publications, and reputable market research firms. We meticulously gather insights on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive view.