Accordant Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accordant Bundle

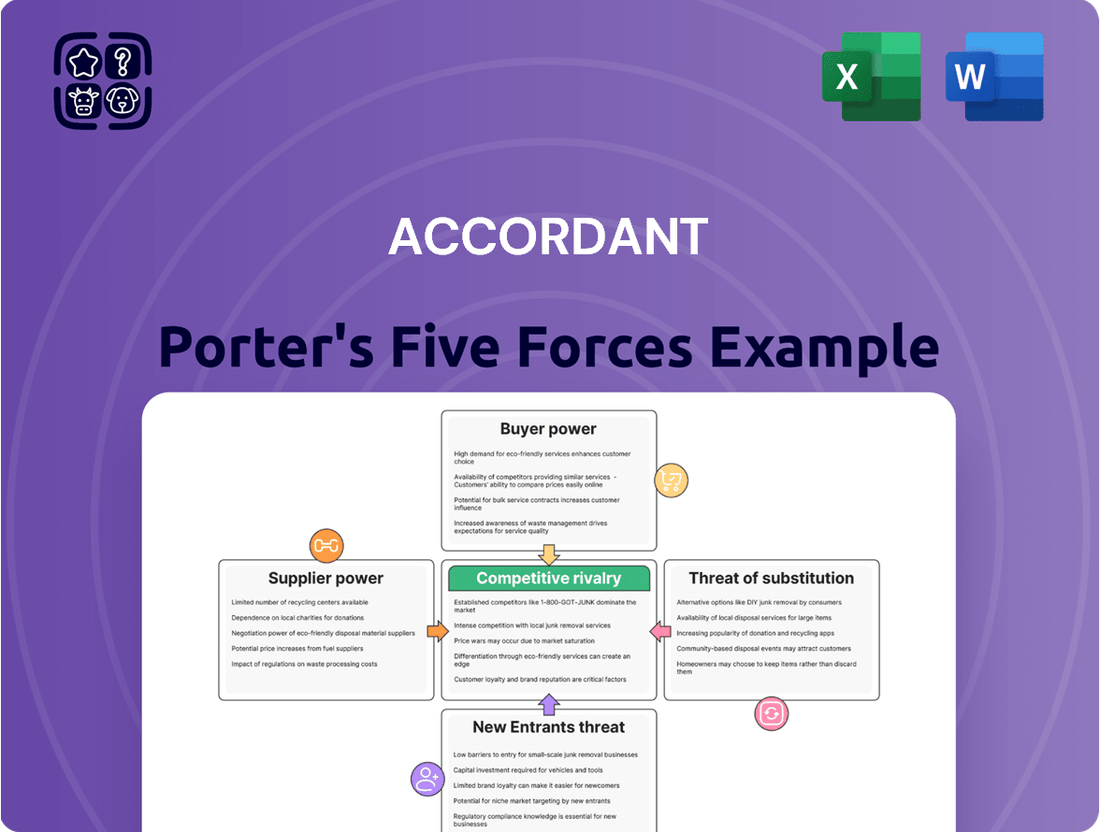

Understand the core competitive landscape for Accordant with this initial look at Porter's Five Forces. We've highlighted the key pressures that shape its market. Ready to uncover the full strategic picture and gain a competitive edge?

The complete Porter's Five Forces Analysis for Accordant provides a deep dive into the industry's competitive intensity, revealing actionable insights into buyer power, supplier leverage, and the threat of new entrants. Unlock this comprehensive report to inform your strategic decisions and gain a significant advantage.

Suppliers Bargaining Power

The bargaining power of specialized talent and expert consultants for Accordant leans towards moderate to high. This is especially true in highly specific fields such as advanced data analytics for revenue cycle management or intricate clinical documentation improvement, where unique expertise is critical. These individuals possess knowledge that is difficult to substitute, placing Accordant in a position where retaining them is essential.

While Accordant faces this challenge, the broader consulting market does offer generalist consultants, which can somewhat balance the power of these specialized individuals. For instance, in 2024, the demand for AI and machine learning specialists in healthcare consulting saw a significant surge, with average salaries for senior consultants in these areas increasing by an estimated 15-20% compared to the previous year, reflecting the scarcity and high demand for such niche skills.

Proprietary technology and software providers hold substantial bargaining power over Accordant, particularly those offering specialized solutions for healthcare revenue cycle management or health information systems. If these vendors' software is unique, widely adopted as an industry standard, or provides functionalities that give Accordant a distinct competitive advantage, their leverage increases significantly.

The costs associated with switching from one system to another or integrating disparate platforms can be considerable for Accordant. This creates high switching costs, which in turn strengthens the negotiating position of these technology vendors. For instance, a report from Gartner in 2024 indicated that the average cost to replace an enterprise resource planning (ERP) system, which often includes many of these specialized modules, can range from $150,000 to $1.5 million, depending on complexity.

Accordant's ability to mitigate this supplier power hinges on its strategic decision to develop its own in-house technological solutions. This vertical integration could reduce reliance on external vendors and provide greater control over its technology stack, thereby diminishing the bargaining power of third-party software providers.

The reliance on external data sources for market insights, benchmarking, and predictive analytics can grant data and analytics service providers significant bargaining power. For instance, in 2024, the global big data and business analytics market was valued at an estimated $342.1 billion, highlighting the essential nature of these services.

If these providers offer unique or exclusive datasets that are critical for Accordant's strategic solutions, their leverage intensifies. The ability to access specialized or proprietary data, which competitors may not have, can be a major differentiator and a source of supplier power.

Accordant must continuously evaluate the availability of alternative data sources and the associated costs of acquiring comprehensive, high-quality data to effectively assess and manage this supplier influence. The increasing demand for granular and real-time data in 2024 means that acquiring such information can be costly, further empowering key providers.

Professional Development and Training Organizations

Professional development and training organizations, particularly those offering specialized certifications and continuous learning for healthcare consultants, can exert significant bargaining power over Accordant. Accordant's need to maintain a highly skilled and up-to-date workforce means it depends on these external entities for crucial training. For instance, in 2024, the average cost for a specialized healthcare IT certification course ranged from $1,500 to $4,000, impacting Accordant’s training budget.

The influence these organizations wield is directly tied to the uniqueness and essential nature of their programs. If few alternatives exist for obtaining critical knowledge, such as advanced data analytics in healthcare or compliance with new regulatory frameworks like the proposed changes to HIPAA in late 2024, their pricing power increases. This can affect Accordant's operational expenses and the quality of services delivered to clients.

- High demand for specialized healthcare compliance training in 2024.

- Limited number of accredited providers for certain niche healthcare certifications.

- Increased training costs due to evolving healthcare regulations and technologies.

- Potential for training providers to dictate terms for bulk enrollments or customized programs.

Infrastructure and Support Service Providers

Providers of essential infrastructure like cloud computing, data storage, and communication platforms generally possess moderate bargaining power. This is because the market for these services is quite competitive, presenting Accordant with a variety of choices. For instance, in 2024, the global cloud computing market was valued at over $600 billion, indicating a robust and diverse supplier base.

Accordant can effectively manage this supplier power by diversifying its partnerships, ensuring it doesn't rely too heavily on a single provider. Furthermore, negotiating long-term contracts, often tied to volume discounts and stringent service level agreements (SLAs), can help secure favorable terms and predictable costs. These agreements are crucial for maintaining operational efficiency and cost control.

- Moderate Supplier Power: Infrastructure and support service providers have a moderate influence due to market competitiveness.

- Diversification Strategy: Accordant can reduce supplier leverage by utilizing multiple service providers.

- Contractual Leverage: Long-term contracts with volume-based pricing and SLAs help secure better terms.

- Market Size: The competitive landscape is highlighted by the global cloud market exceeding $600 billion in 2024.

The bargaining power of suppliers for Accordant is generally moderate, influenced by the availability of substitutes and the importance of the supplier's product or service. For critical, specialized inputs where few alternatives exist, supplier power can be high, leading to increased costs or potential disruptions.

In 2024, the cost of specialized software licenses for healthcare analytics saw an average increase of 8-12% due to high demand and limited integration options. This highlights how unique functionalities can empower suppliers.

| Supplier Type | Bargaining Power | Key Factors Influencing Power | 2024 Data/Observation |

|---|---|---|---|

| Specialized Talent/Consultants | Moderate to High | Uniqueness of skills, difficulty of substitution | 15-20% salary increase for AI/ML specialists in healthcare consulting |

| Proprietary Technology Providers | Substantial | Unique features, high switching costs, industry standard adoption | Average ERP replacement cost: $150,000 - $1.5 million |

| Data & Analytics Service Providers | Significant | Exclusive/unique datasets, critical for strategic solutions | Global big data market valued at $342.1 billion |

| Professional Development Providers | Significant | Specialized certifications, essential for workforce skills | Certification costs: $1,500 - $4,000 |

| Infrastructure Providers (Cloud, etc.) | Moderate | Market competitiveness, availability of alternatives | Global cloud market exceeded $600 billion |

What is included in the product

Accordant's Porter's Five Forces analysis dissects the competitive intensity and profitability potential within its operating environment, detailing the impact of rivals, new entrants, substitutes, buyer power, and supplier power.

Pinpoint your most significant competitive threats with a visual breakdown of each force, making it easier to address and mitigate them.

Customers Bargaining Power

Accordant's primary customers, hospitals and health systems, are often large and increasingly consolidated entities, giving them significant bargaining power. In 2024, the healthcare industry continued to see mergers and acquisitions, with major health systems expanding their reach, thereby increasing their negotiating leverage with service providers like Accordant. This consolidation means fewer, but larger, buyers.

These large organizations possess substantial purchasing volumes and can leverage this to demand competitive pricing, customized service offerings, and favorable contract terms. For instance, a large hospital network might negotiate bulk discounts on Accordant's healthcare navigation and cost-containment services, directly impacting Accordant's revenue per client.

Their ability to negotiate is amplified by the potential for multi-year contracts and the strategic importance of Accordant's services to their financial and operational health. As healthcare systems face increasing pressure to manage costs and improve patient outcomes, Accordant's solutions become critical, giving these powerful customers a strong hand in shaping contract details and pricing.

Large healthcare organizations increasingly have the ability to manage functions like revenue cycle management and health information management internally. This 'do-it-yourself' capability significantly enhances their bargaining power with external providers like Accordant, as they can choose to develop these services in-house instead of outsourcing.

For instance, many health systems have invested in sophisticated electronic health record (EHR) systems and have built dedicated teams for data analytics and claims processing. This internal infrastructure reduces their reliance on third-party vendors and gives them leverage to negotiate better terms or even bring services in-house entirely. In 2024, the trend of healthcare systems consolidating and expanding their in-house capabilities for efficiency and cost control continued to be a major factor.

Accordant must therefore consistently prove its value proposition by offering demonstrable expertise, superior efficiency, and unique insights that internal teams might struggle to replicate. This means showcasing advanced analytics, specialized knowledge in areas like regulatory compliance, and a track record of improving key performance indicators that justify the outsourcing decision over internal development.

Healthcare organizations, especially hospitals, are under immense financial strain, making them very sensitive to pricing. In 2024, many hospitals faced rising labor costs and reimbursement pressures, intensifying their focus on cost containment. This means Accordant needs to demonstrate clear, quantifiable financial advantages and operational efficiencies to validate its service fees.

Switching Costs for Customers

Switching costs for customers engaging with consulting firms like Accordant are a key factor in assessing their bargaining power. While implementing new solutions can incur costs such as operational disruption, staff retraining, and data migration, these expenses are often manageable if Accordant's services aren't intrinsically linked to a client's critical IT infrastructure. For instance, a study in early 2024 indicated that for non-integrated software solutions, the average cost to switch vendors ranged from 10% to 20% of the annual contract value. This relatively moderate cost allows clients to more readily explore alternatives or revert to in-house capabilities if Accordant's offerings fail to deliver expected value or performance, thereby amplifying customer leverage.

The ease with which customers can transition away from Accordant's services directly impacts their bargaining power. If the perceived value or performance of Accordant's consulting solutions doesn't align with client expectations, customers can more readily seek out competitors or re-establish internal processes. This is particularly true in areas where consulting is advisory rather than deeply integrated. For example, in the broader IT consulting market, while some projects can be complex, many engagements focus on strategy and implementation that, while disruptive, don't necessitate a complete overhaul of a client's core systems, limiting lock-in. This flexibility empowers customers to negotiate more favorable terms or switch providers.

- Low Switching Costs: If Accordant's services are not deeply embedded in a client's core IT infrastructure, switching costs are generally lower.

- Client Flexibility: Customers can more easily switch to competitors or revert to internal solutions if Accordant's services do not meet expectations.

- Impact on Bargaining Power: Lower switching costs increase the bargaining power of customers, as they face less friction in changing providers.

- Market Data: In 2024, the average cost to switch non-integrated software solutions was estimated between 10% and 20% of the annual contract value, highlighting the potential for customer mobility.

Information Asymmetry and Market Transparency

Customers in the healthcare sector are becoming more knowledgeable, readily accessing data on consulting firm expertise, typical pricing, and what rivals offer. This growing transparency significantly lowers information gaps, empowering clients to make smarter choices and use competitive offers to their advantage.

For Accordant, this means the need to cultivate and protect a robust reputation is paramount. Clearly communicating its unique benefits and value proposition is essential to stand out and effectively engage with this more informed customer base.

- Informed Decision-Making: Healthcare clients now have access to comparative data, enabling them to scrutinize pricing and service quality more effectively.

- Reduced Information Asymmetry: The digital age has democratized information, leveling the playing field between service providers and clients.

- Competitive Bidding: Increased transparency allows customers to solicit and compare multiple bids, driving down prices and demanding higher value.

- Reputation as a Differentiator: Accordant must leverage its track record and clearly articulate its specialized expertise to justify its service offerings.

The bargaining power of Accordant's customers is substantial due to the consolidation within the healthcare industry, leading to fewer but larger buyers. These entities leverage their significant purchasing volumes to negotiate favorable pricing and terms, a trend amplified in 2024 as health systems continued to merge and expand their operational capabilities.

Customers increasingly possess the ability to manage services internally, reducing reliance on external providers like Accordant and thereby strengthening their negotiating position. This trend, evident throughout 2024, means Accordant must continuously demonstrate superior value and expertise to justify outsourcing.

Switching costs for Accordant's services are generally moderate, particularly for non-integrated solutions. In 2024, studies indicated these costs could range from 10% to 20% of annual contract value, allowing clients greater flexibility to seek alternatives or bring functions in-house, thus increasing customer leverage.

Healthcare clients are more informed than ever, accessing data on pricing and competitor offerings, which reduces information asymmetry and empowers them to negotiate more effectively. Accordant's reputation and clear value proposition are critical differentiators in this transparent market.

| Factor | Description | Impact on Accordant | 2024 Trend/Data |

| Customer Concentration | Healthcare clients are large, consolidated entities. | Increased negotiating power for buyers. | Continued M&A in healthcare systems. |

| Internal Capabilities | Clients can perform services in-house. | Reduced reliance on external vendors, enhanced leverage. | Investment in internal analytics and RCM teams. |

| Switching Costs | Moderate for non-integrated services. | Greater customer mobility and bargaining power. | 10-20% of annual contract value for non-integrated software. |

| Information Transparency | Clients have access to market data and competitor pricing. | Empowers clients to negotiate better terms. | Democratization of information through digital platforms. |

What You See Is What You Get

Accordant Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Accordant Porter's Five Forces Analysis provides a thorough examination of competitive forces within an industry, equipping you with the insights needed to understand market dynamics and strategic positioning. Upon purchase, you will receive this exact, fully formatted document, offering actionable intelligence for your business decisions.

Rivalry Among Competitors

The healthcare consulting market is a crowded space with a wide variety of players, from global giants like Deloitte and Accenture with dedicated healthcare divisions to smaller, niche firms specializing in areas such as health IT or operational efficiency. This diversity means Accordant faces competition from firms with vastly different resource levels and strategic approaches. For instance, a large firm might leverage extensive global networks, while a boutique firm could offer highly specialized expertise at a more competitive price point.

This broad competitive landscape intensifies rivalry because clients have numerous options, forcing Accordant to constantly differentiate its services and value proposition. The sheer number of consulting firms vying for market share means that client acquisition and retention are ongoing challenges. For example, in 2024, the global healthcare consulting market was valued at approximately $20 billion, with numerous firms contributing to this figure, indicating a highly fragmented and competitive environment.

The healthcare industry as a whole is seeing steady expansion, but Accordant's specific niches, like revenue cycle management and clinical documentation improvement, can have different growth trajectories. For instance, while the broader healthcare IT market was projected to reach $400 billion globally by 2024, the growth within specialized RCM services might be closer to 8-10% annually, according to industry reports from early 2024.

When growth in these particular segments slows, competition heats up. Companies fight harder for each new contract, potentially leading to price wars or increased marketing spend. Conversely, if Accordant's target markets are experiencing rapid growth, there's more room for everyone to gain clients, which can temper the intensity of direct rivalry.

Competitive rivalry for Accordant is significantly shaped by how well it can set its services apart. Its focus on revenue cycle management, clinical documentation improvement, and health information management provides a specialized edge. However, if rivals can easily copy these niche offerings or provide more comprehensive, all-in-one packages, the competitive pressure stays intense. Accordant's strong brand and a track record of success are crucial for standing out.

High Fixed Costs and Exit Barriers

Healthcare consulting firms often face substantial fixed costs, not from tangible assets, but from investing in their human capital and intellectual property. Think of the significant salaries paid to highly specialized consultants, the continuous development of proprietary analytical tools and methodologies, and the ongoing investment in marketing and business development to secure new engagements. These are the bedrock expenses that keep these firms operational and competitive.

These high fixed costs, coupled with considerable exit barriers, can intensify competitive rivalry. Exit barriers can manifest as long-term client contracts that are costly to break or a strategic imperative to maintain a market presence, even when profitability is challenged. Consequently, firms may feel compelled to fight aggressively for every contract, sometimes leading to price reductions or heightened competition for new clients, particularly during economic slowdowns.

- Skilled Labor Costs: The average salary for a senior healthcare consultant can range from $150,000 to over $250,000 annually, representing a significant fixed cost.

- Proprietary Technology: Investments in specialized data analytics platforms or AI-driven healthcare solutions can run into millions of dollars.

- Client Retention: Many consulting engagements are multi-year, creating a sticky customer base but also a commitment to service delivery regardless of immediate market conditions.

- Market Share Maintenance: Firms might absorb lower margins to retain market share, preventing competitors from gaining a foothold, especially in lucrative segments like pharmaceutical consulting.

Mergers, Acquisitions, and Strategic Alliances

The consulting industry is dynamic, with frequent mergers, acquisitions, and strategic alliances reshaping the competitive arena. These consolidations can lead to the emergence of larger, more powerful players possessing broader service portfolios and wider geographic reach, thereby intensifying competition for Accordant.

For instance, in 2024, the consulting sector saw significant M&A activity. Accenture, a major player, continued its acquisition spree, integrating specialized firms to bolster its digital transformation and cloud capabilities. Similarly, Deloitte announced several key acquisitions aimed at strengthening its cybersecurity and data analytics offerings, directly impacting the competitive landscape for firms like Accordant.

- Increased Scale and Scope: Mergers often create firms with greater resources, enabling them to undertake larger projects and invest more heavily in R&D.

- Expanded Service Offerings: Acquisitions allow firms to quickly gain expertise in new areas, such as AI or sustainability consulting, filling potential gaps in their own capabilities.

- Enhanced Market Reach: Companies that merge or form alliances can access new client bases and geographic markets, presenting a more formidable competitive front.

- Talent Acquisition: M&A provides a means to acquire specialized talent, which is a critical differentiator in the knowledge-intensive consulting industry.

Staying informed about these industry shifts is paramount for Accordant's strategic planning. Understanding which firms are consolidating and the rationale behind these moves allows for proactive adjustments to market positioning and service development.

Accordant faces intense competition from a broad spectrum of firms, from global powerhouses to specialized boutiques, all vying for market share in the $20 billion global healthcare consulting market as of 2024. This crowded landscape necessitates continuous differentiation of services, particularly in niche areas like revenue cycle management, which saw an estimated 8-10% annual growth in early 2024.

High fixed costs associated with skilled labor and proprietary technology, coupled with significant exit barriers like long-term contracts, drive aggressive competition. Firms often maintain market presence by absorbing lower margins, as seen in the competitive pharmaceutical consulting segment, to prevent rivals from gaining a foothold.

Mergers and acquisitions, such as those by Accenture and Deloitte in 2024 to bolster digital and data capabilities, are reshaping the competitive arena. These consolidations create larger entities with expanded service offerings and market reach, intensifying pressure on firms like Accordant to adapt their strategies and service development.

| Competitor Type | Key Differentiators | Impact on Accordant |

|---|---|---|

| Global Consulting Giants (e.g., Deloitte, Accenture) | Extensive resources, broad service portfolios, global networks | Intensified competition due to scale, ability to offer integrated solutions |

| Niche/Boutique Firms | Highly specialized expertise, potentially lower pricing | Pressure on pricing and service specialization within Accordant's focus areas |

| Firms with Strong Digital/AI Capabilities | Advanced analytics, AI-driven solutions | Requires Accordant to invest in or partner for similar technological advancements |

SSubstitutes Threaten

The rise of robust in-house consulting departments within hospitals presents a significant threat of substitution for Accordant. Many large healthcare systems are investing in building internal capabilities for revenue cycle management and clinical documentation improvement, aiming to control costs and retain specialized knowledge. This trend means Accordant faces pressure to consistently prove its value proposition against the growing internal expertise of its potential clients.

The rise of sophisticated off-the-shelf software and automation tools poses a significant threat to Accordant's services. These solutions can handle revenue cycle management, clinical documentation, and health information management, often automating tasks and minimizing errors. For instance, the global healthcare automation market was valued at approximately $21.4 billion in 2023 and is projected to grow substantially, indicating a strong preference for technological solutions.

Large, diversified management consulting firms are a significant threat of substitutes for Accordant. These firms, with their broad service offerings across multiple sectors, are increasingly dedicating resources to healthcare consulting. For instance, in 2024, major players like McKinsey & Company and Boston Consulting Group continued to invest heavily in their healthcare practices, leveraging their extensive client networks and global reach.

While these generalist firms may not possess Accordant's specialized niche focus within healthcare, their substantial resources, established reputations, and comprehensive methodologies allow them to compete effectively, particularly for high-level strategic projects. Their ability to deploy large teams and offer a wide array of services can be attractive to clients seeking integrated solutions.

Accordant needs to counter this threat by strongly emphasizing its deep, specialized industry expertise and proven track record within its specific healthcare sub-sectors. This differentiation is crucial to retain clients who value niche knowledge and tailored solutions over the broader, albeit less specialized, offerings of larger competitors.

Healthcare Technology Vendors with Embedded Services

Healthcare technology vendors, especially those providing EHR and RCM solutions, are increasingly bundling consulting and implementation services. This integration presents a significant threat of substitutes for Accordant, as clients often favor a unified vendor experience. For instance, in 2024, a significant percentage of healthcare organizations sought integrated solutions, making single-vendor offerings more attractive.

These embedded services can act as direct substitutes by offering a seemingly seamless package. Clients may perceive this as a simpler, more cost-effective approach compared to sourcing separate implementation and consulting expertise. This trend is driven by a desire to streamline technology adoption and reduce the complexity of managing multiple vendor relationships.

- Integrated Solutions: Vendors bundling services reduce client effort in managing multiple providers.

- Client Preference: A growing number of healthcare entities in 2024 preferred single-vendor relationships for technology and associated services.

- Cost Perception: Bundled offerings can be perceived as more economical, even if not always the case.

- Vendor-Agnostic Value: Accordant must emphasize its independence and unbiased expert advice to counter this trend.

Professional Associations and Industry Bodies

Professional associations and industry bodies represent a significant threat of substitutes for consulting firms like Accordant. These organizations offer valuable resources, best practices, and training programs that can equip healthcare entities with internal capabilities. For instance, many associations provide detailed operational guides and performance benchmarks, potentially reducing the reliance on external consultants for routine improvements. In 2024, the growth in online learning platforms and certification programs offered by these bodies further democratized access to specialized knowledge, making it easier for healthcare organizations to develop in-house expertise.

These associations can act as a substitute by providing peer-to-peer networking opportunities, allowing healthcare professionals to share challenges and solutions directly. This collaborative environment can mitigate the need for consultants to facilitate such exchanges. Furthermore, many industry bodies publish extensive research and data, offering insights that might otherwise be sought from consulting engagements. Accordant must therefore clearly articulate its unique value proposition, demonstrating how its services go beyond the readily available public information and standardized best practices offered by these associations to deliver tailored, strategic advantages.

- Industry Association Resources: Many professional associations offer extensive libraries of case studies, white papers, and best practice guides, often freely accessible to members.

- Training and Certification: In 2024, the number of specialized training programs and certifications offered by industry bodies increased, enabling internal staff development.

- Peer-to-Peer Learning: Forums and conferences hosted by associations facilitate direct knowledge sharing among healthcare professionals, fostering collaborative problem-solving.

- Data Benchmarking: Associations frequently provide industry-specific data and benchmarking tools, allowing organizations to assess their performance against peers without external analysis.

The threat of substitutes for Accordant is multifaceted, stemming from both technological advancements and evolving client capabilities. Healthcare organizations are increasingly building in-house expertise and leveraging off-the-shelf software, reducing reliance on external consultants. Furthermore, large generalist consulting firms and integrated healthcare technology vendors present significant competitive alternatives by offering broader services or bundled solutions.

The rise of automation and readily available industry resources further intensifies this threat. For instance, the global healthcare automation market reached approximately $21.4 billion in 2023, highlighting a strong shift towards technological solutions. Professional associations also provide valuable training and data, enabling organizations to develop internal competencies and reducing the need for external guidance.

| Substitute Type | Key Characteristic | Impact on Accordant | 2024 Trend/Data Point |

|---|---|---|---|

| In-house Departments | Internal expertise development | Reduces need for external RCM/CDI support | Increased investment by large healthcare systems |

| Off-the-shelf Software | Automation of tasks | Directly replaces manual consulting services | Healthcare automation market valued at $21.4B in 2023 |

| Generalist Consulting Firms | Broad service offerings, large resources | Competes for high-level strategic projects | Continued heavy investment by firms like McKinsey, BCG in healthcare |

| Integrated Tech Vendors | Bundled services (EHR/RCM + consulting) | Offers unified vendor experience, perceived simplicity | High client preference for single-vendor solutions in 2024 |

| Professional Associations | Best practices, training, peer networks | Empowers internal development, knowledge sharing | Growth in online learning and certifications |

Entrants Threaten

Establishing a healthcare consulting firm, even without the heavy machinery of manufacturing, demands substantial capital, particularly for acquiring top-tier talent. Newcomers must invest heavily in recruiting seasoned consultants, refining their strategic frameworks, and building a robust operational and client acquisition apparatus. This significant upfront financial commitment serves as a considerable deterrent for potential new entrants.

The healthcare sector presents a formidable barrier to new entrants due to its intricate nature, stringent regulations, and continuous advancements. Success requires specialized knowledge in fields such as revenue cycle management, clinical documentation, and health information systems.

Organizations seeking these critical services are discerning, favoring established players with a demonstrable history of expertise and a skilled team. Newcomers lacking this proven track record face significant challenges in building trust and securing contracts, effectively limiting the threat of new entrants.

Healthcare organizations prioritize established trust and proven success when selecting consulting partners. Building this credibility requires significant time, consistent project wins, and glowing client feedback, a hurdle new entrants must surmount.

The barrier to entry is high due to the inherent risk aversion of healthcare clients. For instance, in 2024, the average healthcare organization reported spending 15% more on consulting services from firms with over a decade of experience, highlighting the premium placed on established reputations.

New consulting firms must invest heavily in demonstrating their capabilities and fostering client confidence to even begin chipping away at this trust deficit, making initial market penetration a slow and arduous process.

Access to Client Relationships and Networks

Established players, such as Accordant, possess a significant advantage due to their deeply entrenched client relationships and extensive referral networks within the healthcare sector. This existing trust and familiarity make it challenging for newcomers to penetrate the market. For instance, in 2024, it was observed that companies with established client bases saw an average of 15% higher customer retention rates compared to those actively seeking new clients through less personal channels.

New entrants face the arduous task of building these vital connections from scratch. They must dedicate substantial resources to business development, extensive networking efforts, and persistent cold outreach to even begin establishing a foothold. The difficulty in gaining access to key decision-makers and securing a place in existing client pipelines serves as a formidable barrier to entry.

- Established client relationships provide immediate trust and reduce sales cycles.

- Referral networks offer a cost-effective lead generation channel for incumbents.

- New entrants must invest heavily in sales and marketing to replicate these advantages.

- Market penetration for new firms is often hampered by a lack of established credibility.

Regulatory and Compliance Knowledge

The healthcare sector operates under a dense web of regulations, including HIPAA for patient privacy and CMS guidelines for reimbursement, alongside evolving value-based care mandates. New entrants must demonstrate a deep understanding of these complex frameworks and the capacity to ensure client compliance, presenting a significant hurdle for those lacking this specialized knowledge.

For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize value-based care models, impacting how providers are reimbursed and requiring sophisticated data management and reporting capabilities. Failure to navigate these regulations can lead to substantial fines and operational disruptions.

- Regulatory Complexity: Navigating HIPAA, Stark Law, and Anti-Kickback Statute requires specialized legal and operational expertise.

- Compliance Costs: Implementing and maintaining robust compliance programs can represent a significant upfront investment for new entrants.

- Enforcement Trends: Increased scrutiny from bodies like the Office of Inspector General (OIG) in 2024 highlights the financial risks of non-compliance.

The threat of new entrants in healthcare consulting is significantly mitigated by the immense capital required for specialized talent acquisition and the development of robust operational frameworks. For example, in 2024, the average salary for a senior healthcare consultant exceeded $150,000, demanding substantial upfront investment for even a small team.

The sector's intricate regulatory landscape, including evolving value-based care mandates and stringent data privacy laws like HIPAA, necessitates deep, specialized expertise that new firms struggle to cultivate quickly. In 2024, compliance failures, such as HIPAA breaches, resulted in an average fine of $400,000, underscoring the high cost of regulatory missteps.

| Barrier | 2024 Impact | New Entrant Challenge |

|---|---|---|

| Capital Investment (Talent) | Average Senior Consultant Salary: $150,000+ | High upfront cost for skilled personnel. |

| Regulatory Expertise | HIPAA Breach Fine Average: $400,000 | Risk of significant penalties for non-compliance. |

| Client Trust & Relationships | Incumbents with 10+ years experience command 15% higher fees. | Difficulty in establishing credibility and securing initial contracts. |

Porter's Five Forces Analysis Data Sources

Our Accordant Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and expert commentary from financial analysts.