Accordant Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accordant Bundle

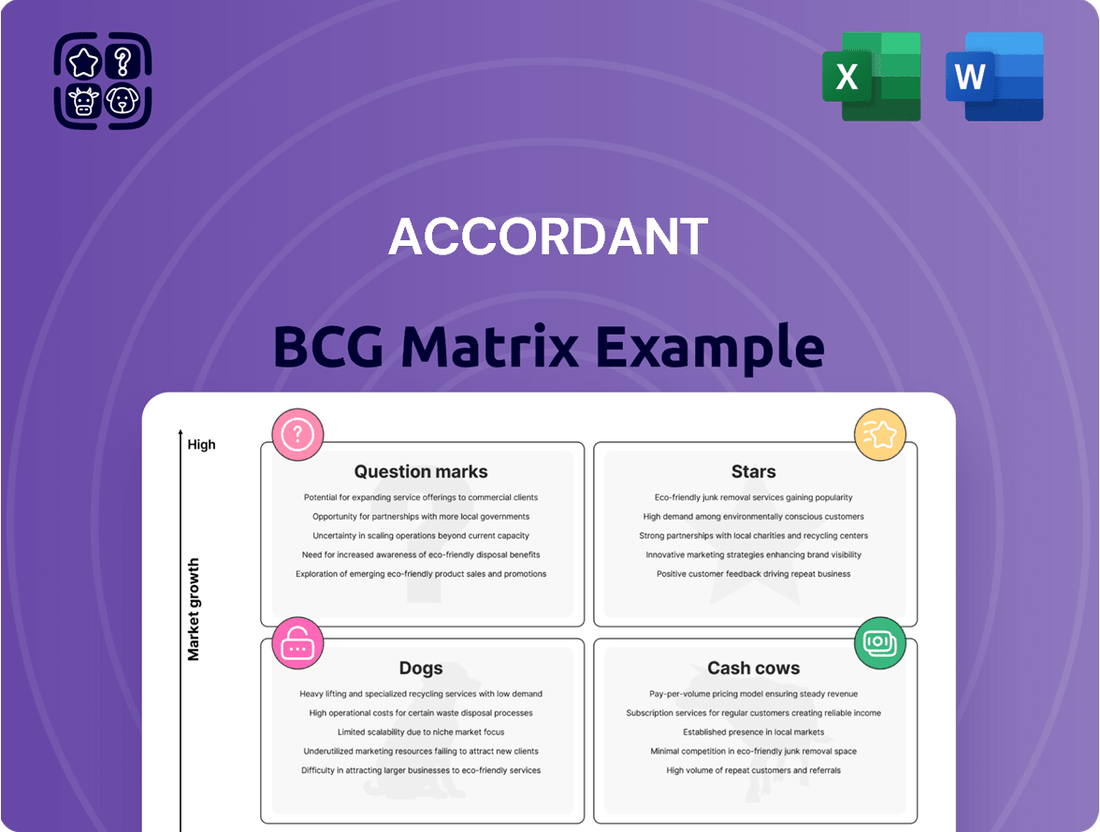

Understanding a company's product portfolio is crucial for strategic growth. The Accordant BCG Matrix categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for resource allocation. This initial glimpse highlights the core of this powerful analytical tool.

Don't settle for a partial view; unlock the full potential of the Accordant BCG Matrix. Purchase the complete report to gain in-depth analysis for each product category, actionable insights, and a clear strategy for optimizing your business's performance and future investments.

Stars

AI-Driven Revenue Cycle Optimization fits into the Stars quadrant of the Accordant BCG Matrix. This reflects its position in a high-growth market, specifically the rapidly expanding AI in healthcare RCM sector. Hospitals are actively adopting these technologies to improve billing, coding, and claims processing efficiency.

Accordant's deep expertise in revenue cycle management (RCM) is a key differentiator here. This specialized knowledge, combined with the significant market demand for enhanced accuracy and streamlined operations, positions Accordant to capture a substantial market share in this burgeoning segment.

The global value-based healthcare services market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) of approximately 15% through 2028. This surge is primarily fueled by the widespread adoption of value-based care models, moving away from traditional fee-for-service reimbursements.

Accordant's strategic advisory services are perfectly aligned with this market trend, focusing on helping healthcare organizations enhance their operational efficiency and financial health. By offering solutions that directly address the core needs of this transition, Accordant is well-positioned to capitalize on this high-growth sector.

Their expert guidance assists clients in successfully navigating intricate regulatory environments and achieving superior patient outcomes, thereby solidifying Accordant's competitive advantage and market standing.

Cloud ERP implementations for healthcare represent a strong opportunity within the Accordant BCG Matrix. The healthcare sector's digital transformation journey, heavily reliant on cloud adoption, signifies a high-growth market. By 2024, the global healthcare cloud computing market was projected to reach over $60 billion, showcasing substantial expansion.

Accordant's established expertise as a Sage Platinum Partner and Acumatica Gold Partner positions it favorably to capture significant market share in this growing segment. Their proven track record in implementing cloud ERP solutions, coupled with a deep understanding of healthcare's unique demands, allows them to effectively serve this expanding client base.

Advanced Clinical Documentation Improvement (CDI) with AI

Advanced Clinical Documentation Improvement (CDI) with AI represents a significant technological leap in a mature market. By leveraging AI and Natural Language Processing (NLP), Accordant BCG can achieve unprecedented accuracy and efficiency in identifying and capturing clinical severity and risk. This technological edge is crucial as the healthcare industry increasingly relies on precise data for reimbursement and quality reporting.

Accordant's strategic positioning in this niche is bolstered by the growing demand for AI-driven healthcare solutions. The global healthcare AI market was valued at approximately $15.4 billion in 2023 and is projected to grow substantially, with CDI being a key application area. This rapid expansion presents a prime opportunity for Accordant to capture a significant market share.

- AI-powered CDI enhances coding accuracy, leading to an estimated 5-10% increase in appropriate reimbursement for healthcare providers.

- NLP can process vast amounts of clinical notes in minutes, drastically reducing manual review time by up to 70%.

- The global market for healthcare AI is expected to reach over $180 billion by 2030, indicating a strong growth trajectory for AI-driven solutions like advanced CDI.

- Providers adopting advanced CDI are seeing improved patient safety metrics and reduced compliance risks due to more complete documentation.

Philanthropy Consulting for Health Systems

Accordant’s philanthropy consulting for health systems positions them as a leader in a specialized, high-impact niche. They champion philanthropy not just as a charitable endeavor, but as a strategic, high-return investment for healthcare organizations. This focus has driven substantial growth in their clients' fundraising achievements.

Their expertise in this area is a key differentiator. Accordant’s approach emphasizes maximizing the return on investment for philanthropic initiatives within health systems. This strategic perspective has led to a demonstrable track record of success, solidifying their market share in this segment.

- High ROI Focus: Accordant advocates for philanthropy as a significant alternative revenue stream for healthcare, emphasizing measurable financial returns.

- Proven Fundraising Success: Their consulting has demonstrably increased fundraising outcomes for health systems, a testament to their effective strategies.

- Market Leadership: Despite being a specialized niche, Accordant holds a strong market share due to their established reputation and successful client engagements.

- Strategic Partnership: They work closely with health systems to integrate philanthropy into their overall financial and strategic planning.

Stars represent Accordant's offerings in high-growth, high-share markets. AI-Driven Revenue Cycle Optimization and Advanced Clinical Documentation Improvement with AI are prime examples. These solutions leverage cutting-edge technology to address critical needs in healthcare, driving significant efficiency and financial gains for providers.

Accordant's strategic advisory services for value-based healthcare also fall into this category. The shift towards value-based care models creates a fertile ground for Accordant's expertise in optimizing operations and financial performance. Cloud ERP implementations for healthcare further solidify Accordant's presence in a rapidly expanding digital transformation landscape.

| Offering | Market Growth | Accordant's Share | Key Differentiator |

|---|---|---|---|

| AI-Driven RCM | High | Strong | Deep RCM expertise, AI integration |

| Advanced CDI with AI | High | Strong | AI/NLP for accuracy, market demand |

| Value-Based Healthcare Advisory | High | Strong | Alignment with market trends, operational focus |

| Cloud ERP Implementations | High | Strong | Sage/Acumatica partnership, healthcare focus |

What is included in the product

The Accordant BCG Matrix analyzes product portfolios by market share and growth, guiding investment decisions.

A clear visual representation of your portfolio, simplifying complex strategic decisions.

Cash Cows

Accordant's core Revenue Cycle Management (RCM) consulting, focusing on billing, claims, and payments, forms the bedrock of their service offerings. These essential functions are vital for hospitals and health systems to maintain financial stability.

This segment operates within a mature market, meaning demand is consistent and predictable. Hospitals always need efficient RCM to get paid. This stability allows for high-margin revenue generation with minimal need for significant new capital investment to grow.

In 2024, the RCM market is projected to reach over $10 billion globally, underscoring its essential nature. Accordant's foundational RCM services are well-positioned to capture a significant share of this steady revenue stream, acting as a reliable cash cow.

Accordant's Health Information Management (HIM) Optimization services are a cornerstone of their business, acting as a classic Cash Cow. Their deep expertise ensures healthcare organizations efficiently and compliantly manage patient data, a non-negotiable aspect of modern healthcare operations.

This mature market segment generates a consistent and predictable revenue stream. While not experiencing explosive growth, the continuous need for HIM optimization provides a stable income, reflecting its established position within the healthcare IT landscape.

The HIM market, while mature, still presents opportunities for incremental gains. For instance, the global HIM market was valued at approximately $33.5 billion in 2023 and is projected to grow at a CAGR of around 9.8% through 2030, indicating ongoing demand for optimization services.

General Operational Efficiency Consulting within Accordant's BCG Matrix represents a stable, cash-generating business. These services focus on optimizing broader healthcare operations, not just specific tech solutions, and are consistently sought after in the mature healthcare industry.

This segment benefits from the ongoing need for efficiency gains in healthcare, a sector that experienced significant operational challenges and a push for cost reduction throughout 2024. For instance, reports from late 2024 indicated that healthcare providers were actively seeking consulting to streamline administrative processes and improve patient flow, directly impacting their bottom line.

Legacy ERP System Support & Maintenance

Accordant's legacy ERP system support and maintenance, primarily for Sage and Acumatica platforms, functions as a Cash Cow within the BCG Matrix. This segment generates consistent, predictable revenue from a large, established client base that relies on these mature systems.

The demand for ongoing support and maintenance is driven by the critical nature of ERP systems for business operations, ensuring a stable, albeit low-growth, income stream. For instance, in 2024, Accordant continued to see robust demand for these services, with client retention rates remaining high, indicating the essential nature of this offering.

- Stable Revenue: The recurring nature of support contracts provides a predictable income base.

- Low Growth Market: While the systems are mature, the need for ongoing support is constant.

- Client Dependency: Businesses are heavily reliant on their ERP infrastructure, making support indispensable.

- Profitability: Mature service offerings often have optimized cost structures, leading to healthy profit margins.

Standardized Training and Workforce Development

Standardized Training and Workforce Development within Accordant's framework represents a classic Cash Cow. These programs, focusing on established healthcare operational pillars like Revenue Cycle Management (RCM) best practices and Health Information Management (HIM) compliance, cater to a market with enduring needs. The demand for upskilling and maintaining compliance is consistent, making these offerings a reliable revenue stream.

Accordant's commitment to providing dynamic training for executives, boards, and clinicians further solidifies this position. By enhancing influence and engagement, these standardized programs ensure continued relevance and adoption. For instance, in 2024, the healthcare sector continued to see significant investment in workforce training, with reports indicating an average of $1,200 per employee spent on professional development in the US healthcare industry, highlighting the market's readiness to invest in skill enhancement.

- Stable Revenue: Consistent demand for RCM and HIM compliance training provides a predictable income.

- Mature Market: The healthcare industry's ongoing need for skilled professionals ensures a steady customer base.

- High Adoption: Standardized programs are easily integrated into existing workflows, encouraging uptake.

- Low Investment: Minimal need for R&D means higher profit margins from established offerings.

Accordant's foundational Revenue Cycle Management (RCM) consulting, focusing on billing, claims, and payments, acts as a classic Cash Cow. This segment operates in a mature market with consistent demand, ensuring a stable, high-margin revenue stream with minimal new capital investment. The global RCM market was projected to exceed $10 billion in 2024, and Accordant's essential services are well-positioned to capture a significant portion of this predictable income.

Health Information Management (HIM) Optimization services also function as a Cash Cow, generating consistent revenue from the non-negotiable need for efficient and compliant patient data management. While the HIM market is mature, it still shows growth, with a global valuation around $33.5 billion in 2023 and projected growth. This indicates ongoing demand for Accordant's optimization expertise.

General Operational Efficiency Consulting and legacy ERP system support for platforms like Sage and Acumatica further contribute to Accordant's Cash Cow portfolio. These services address the ongoing need for efficiency and critical system maintenance in the healthcare sector, driven by a large, established client base. The continued demand for these mature offerings, as seen in high client retention rates in 2024, underscores their role as reliable profit generators.

Standardized Training and Workforce Development, particularly in RCM best practices and HIM compliance, also represent a strong Cash Cow. The healthcare industry's consistent investment in professional development, with US healthcare employees averaging $1,200 spent on training in 2024, validates the market's readiness for these established skill-enhancement programs.

| Service Area | BCG Category | Market Maturity | 2024 Relevance | Key Driver |

|---|---|---|---|---|

| RCM Consulting | Cash Cow | Mature | Essential for financial stability | Predictable demand for billing/claims |

| HIM Optimization | Cash Cow | Mature with growth | Compliance and data efficiency | Ongoing need for data management |

| Operational Efficiency | Cash Cow | Mature | Cost reduction focus | Streamlining administrative processes |

| Legacy ERP Support | Cash Cow | Mature | Critical system reliance | High client retention for essential support |

| Standardized Training | Cash Cow | Mature | Workforce skill enhancement | Consistent investment in healthcare training |

Preview = Final Product

Accordant BCG Matrix

The Accordant BCG Matrix document you are previewing is the identical, fully polished report you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no hidden surprises – just a comprehensive, ready-to-implement strategic tool for analyzing your business portfolio.

Rest assured, the preview you are currently viewing is the exact Accordant BCG Matrix report that will be delivered to you upon completion of your purchase. This ensures you know precisely what you are acquiring: a professionally formatted and insightful analysis tool, ready for immediate integration into your strategic planning.

Dogs

Consulting on obsolete healthcare IT systems, particularly those stuck on-premise without a cloud migration strategy, falls into the Dogs category of the Accordant BCG Matrix. This segment of the market is contracting as healthcare organizations increasingly embrace digital transformation and cloud technologies. In 2024, the global healthcare IT market saw significant growth, with cloud services alone projected to reach over $100 billion, highlighting the shift away from legacy systems.

Firms focusing solely on maintaining outdated systems face declining relevance and profitability. The demand for these services is diminishing because they offer limited future growth potential and are not aligned with the industry's trajectory towards interoperability and advanced data analytics facilitated by modern platforms. Accordant, as a forward-thinking firm, would likely see these services as having a low market share and poor growth prospects.

Undifferentiated basic data entry and manual process optimization, when viewed through the lens of the BCG Matrix, fall into the Dogs category. This is because these services, while foundational, are increasingly being outpaced by technological advancements.

The healthcare revenue cycle management (RCM) sector, for instance, saw significant investment in automation in 2024. Companies focusing solely on manual data entry optimization are struggling to compete with AI-powered solutions that can process claims with up to 98% accuracy, a stark contrast to the error rates often seen in manual processes.

These manual services face intense competition from AI-driven solutions that offer superior efficiency and accuracy. This leads to low growth prospects and limited market share potential, as clients increasingly demand automated and intelligent solutions rather than just incremental improvements to outdated manual workflows.

If Accordant were to offer broad, non-specialized healthcare consulting, it would likely fall into the "Question Mark" category of the BCG Matrix. This is because such a strategy would dilute its competitive advantage, placing it in a crowded market against established, diversified firms. For example, in 2024, the global healthcare consulting market is projected to reach over $60 billion, with a significant portion dominated by large, generalist players.

Without leveraging its specialized expertise, Accordant would struggle to gain significant market share or command premium pricing. This lack of differentiation would lead to low growth potential and weak profitability, characteristic of a Question Mark. The intense competition means that without a clear unique selling proposition, securing substantial contracts would be challenging, impacting revenue streams.

Consulting for Declining Niche Healthcare Providers

Consulting for declining niche healthcare providers, particularly those facing severe market contraction without a clear turnaround plan, falls into the 'Dog' category of the Accordant BCG Matrix. These engagements are characterized by a shrinking client pool and substantial risk.

For instance, specialized rural hospitals or clinics focused on treatments with declining patient demand, such as certain types of audiology services or specific surgical procedures that have been superseded by less invasive alternatives, would fit this profile. In 2023, the National Rural Health Association reported that approximately 12% of rural hospitals were at high risk of closure, highlighting the challenges these niche providers face.

- Shrinking Market Share: Engagements involve providers with rapidly diminishing patient volumes or service utilization, making growth unlikely.

- High Financial Distress: Clients often exhibit significant operating losses and liquidity issues, demanding intensive, often unsuccessful, restructuring efforts.

- Limited Future Potential: The underlying market dynamics for these niche services are unfavorable, offering little prospect for long-term profitability or expansion.

- Resource Drain: Such consulting projects can consume significant resources with a low probability of achieving sustainable positive outcomes for the client or the consulting firm.

One-off, Project-Based Engagements without Recurring Revenue Potential

Engagements that are purely transactional, lacking opportunities for long-term partnerships, ongoing support, or upselling into higher-value service lines, could be considered 'Dogs' in the Accordant BCG Matrix.

These projects require constant new client acquisition in a competitive market, leading to higher client acquisition costs and lower overall profitability compared to recurring service models. For instance, a consulting firm solely focused on one-off IT system implementations might face significant challenges in building a stable revenue base. In 2024, the average client acquisition cost for service-based businesses can range from 20% to over 50% of the initial contract value, a figure amplified when each engagement is a standalone event.

- High Client Acquisition Costs: Businesses relying on one-off projects often spend considerably more to secure each new client.

- Limited Upselling Opportunities: These engagements typically do not lend themselves to expanding services or increasing revenue from existing clients.

- Market Volatility Impact: A dependence on project-based work makes revenue streams more susceptible to economic downturns and shifts in client spending priorities.

- Lower Profit Margins: The absence of recurring revenue and the need for continuous sales efforts generally result in thinner profit margins compared to subscription or retainer models.

Consulting services for legacy healthcare IT systems, particularly those not migrating to the cloud, are firmly in the Dogs category. This segment is shrinking as the healthcare industry embraces digital transformation, with cloud services in healthcare projected to exceed $100 billion in 2024.

Firms focusing on manual data entry and basic process optimization also fall into the Dogs quadrant. These services are being rapidly outpaced by AI-driven solutions offering superior efficiency and accuracy, as seen in the healthcare revenue cycle management sector where AI-powered claims processing can achieve up to 98% accuracy.

Consulting for declining niche healthcare providers, such as rural hospitals facing closure risks, also fits the Dogs profile. In 2023, around 12% of rural hospitals were identified as high-risk, underscoring the limited future potential for such engagements.

Transactional consulting projects that lack opportunities for long-term client relationships and upselling are considered Dogs. These require constant new client acquisition, driving up costs; for example, client acquisition costs for service businesses can range from 20% to over 50% of the initial contract value in 2024.

| Service Area | BCG Category | Market Trend | 2024 Data Point | Key Challenge |

| Obsolete Healthcare IT Systems | Dogs | Contracting | Global healthcare IT cloud services > $100B | Low future growth, declining relevance |

| Manual Data Entry/Process Optimization | Dogs | Rapidly declining | AI claims processing accuracy ~98% | Intense competition from automation |

| Declining Niche Healthcare Providers | Dogs | Shrinking | ~12% of rural hospitals at high risk (2023) | Limited client pool, financial distress |

| Transactional Consulting Projects | Dogs | Stable but low growth | Client acquisition costs 20-50%+ of contract value (2024) | High acquisition costs, low profitability |

Question Marks

Accordant could position AI-enhanced patient engagement tools as a Question Mark in its BCG matrix. While the company's core strength lies in operational optimization, this represents a significant, high-growth market ripe for expansion.

Advising healthcare providers on implementing AI-driven chatbots and virtual assistants for patient communication offers Accordant a chance to build new expertise. This segment is projected to grow substantially, with the global AI in healthcare market expected to reach over $187 billion by 2030, according to some industry forecasts.

By focusing on personalized communication strategies, Accordant can tap into this burgeoning sector, aiming to establish a strong market share. This strategic move aligns with the increasing demand for improved patient experiences and more efficient healthcare delivery.

The global healthcare cybersecurity market is projected to reach USD 34.2 billion by 2024, a significant increase driven by escalating cyber threats and the need for robust compliance with regulations like HIPAA. Accordant's strategic move into this space positions it to capitalize on this high-growth sector, addressing critical needs for hospitals and health systems seeking to fortify their digital defenses.

Accordant's telehealth and remote monitoring integration consulting services would likely fall into the Question Marks category of the BCG Matrix. This is because the market for these solutions is experiencing rapid growth, with a significant portion of healthcare providers actively exploring or implementing them, yet the long-term market share and profitability for consulting firms in this specific niche are still being established. For instance, the global telehealth market was valued at approximately $100 billion in 2023 and is projected to grow substantially, indicating a high-potential area for Accordant to invest in developing specialized expertise.

Predictive Analytics for Clinical Outcomes

Accordant is likely positioning predictive analytics for clinical outcomes as a future growth engine, potentially a ‘Question Mark’ in the BCG framework. This involves sophisticated data analysis to forecast patient health, pinpoint those likely to experience adverse events, and refine treatment plans. This area demands substantial investment for development and market penetration.

The healthcare analytics market is booming, with projections indicating significant growth. For instance, the global healthcare analytics market was valued at approximately USD 30.1 billion in 2023 and is expected to reach USD 114.2 billion by 2030, growing at a compound annual growth rate (CAGR) of 21.1% during the forecast period. Accordant's focus here aligns with this trend.

Key aspects of this emerging field include:

- Forecasting Clinical Outcomes: Utilizing machine learning algorithms on patient data to predict disease progression or treatment success rates.

- Identifying At-Risk Populations: Proactively identifying patients who may require early intervention or specialized care to prevent negative outcomes.

- Optimizing Treatment Pathways: Analyzing data to determine the most effective and efficient treatment protocols for specific patient groups.

- Data Integration and AI Development: Requiring significant investment in data infrastructure, AI talent, and the development of robust analytical platforms.

Blockchain and Data Interoperability Solutions

Blockchain technology offers a promising avenue for enhancing data interoperability and secure sharing within the healthcare sector, a market experiencing significant growth in these areas.

Accordant is likely exploring its capabilities in consulting for blockchain-based health record systems and other advanced data interoperability solutions.

This segment of the market is characterized by high growth potential, though it remains in its early stages, making it ideal for Accordant to target early adopter clients.

- Market Growth: The global healthcare blockchain market was valued at approximately $350 million in 2023 and is projected to reach over $2.5 billion by 2028, demonstrating a compound annual growth rate of over 45%.

- Interoperability Needs: A 2024 survey indicated that over 70% of healthcare organizations identify data interoperability as a major challenge impacting patient care and operational efficiency.

- Accordant's Opportunity: By developing expertise in blockchain for health data, Accordant can position itself to capture a share of this expanding market, addressing critical industry pain points.

- Client Focus: Targeting healthcare providers and technology firms seeking to implement secure and interoperable data solutions will be key for Accordant's success in this nascent but rapidly evolving space.

Question Marks in the Accordant BCG Matrix represent business areas with low market share in high-growth industries. These are often new ventures or emerging technologies where Accordant is investing to build future market leadership.

The company's focus on AI-enhanced patient engagement tools, telehealth integration, and predictive analytics for clinical outcomes are prime examples of these Question Marks. These sectors are experiencing rapid expansion, as evidenced by the projected growth in the AI in healthcare market, which is anticipated to exceed $187 billion by 2030.

Accordant’s strategic positioning in these areas requires significant investment in research, development, and talent acquisition to capture a substantial market share. The goal is to convert these Question Marks into Stars or Cash Cows as the markets mature and Accordant solidifies its competitive advantage.

The company's exploration of blockchain for health data also fits this category, given the market's projected growth to over $2.5 billion by 2028, addressing critical interoperability needs where over 70% of healthcare organizations identify challenges.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.