ACCESS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACCESS Bundle

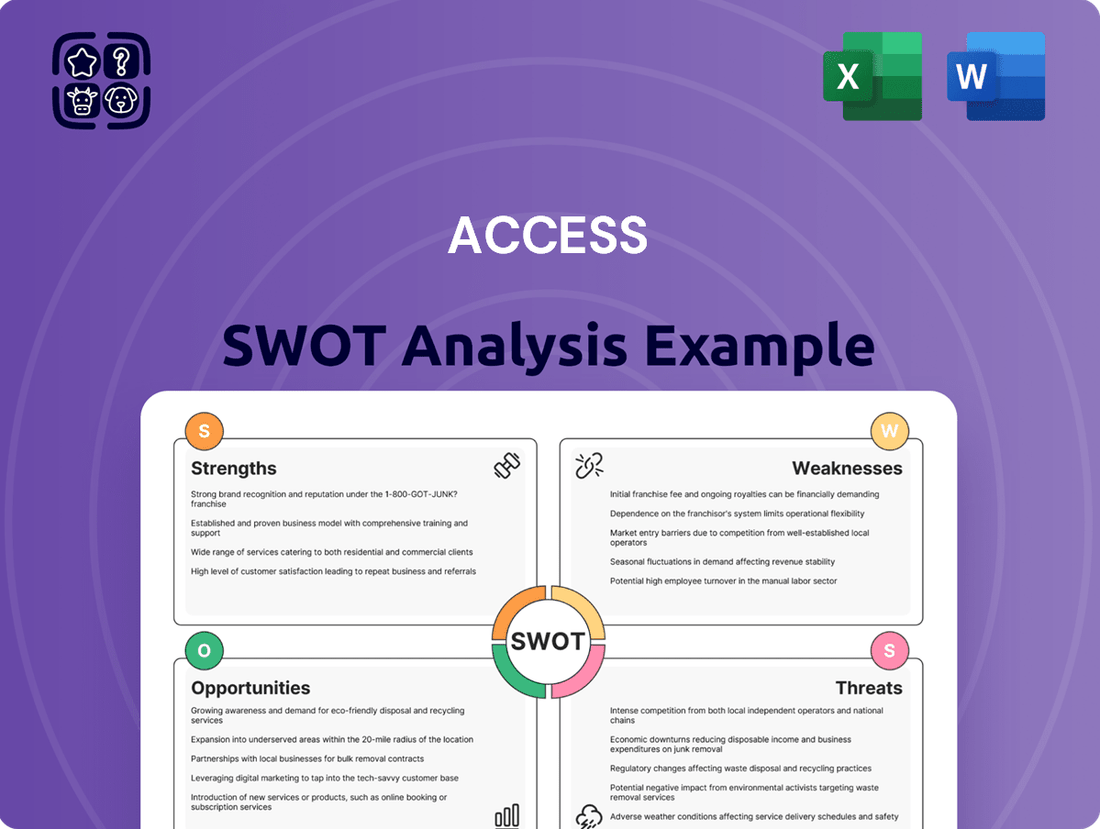

Our ACCESS SWOT Analysis provides a critical look at the company's current standing, highlighting key internal strengths and potential external opportunities. It also pinpoints significant weaknesses and the competitive threats that could impact its future success.

Want the full story behind ACCESS's market position, including actionable strategies and detailed risk assessments? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

ACCESS CO., LTD. boasts a diverse software solutions portfolio, encompassing embedded software, mobile applications, and advanced network technologies. This broad range allows them to serve a wide spectrum of industries, from the demanding automotive sector to consumer electronics and the dynamic publishing world.

This strategic diversification is crucial for mitigating market-specific risks, as it prevents over-reliance on any single industry segment. For instance, in 2024, while the automotive software market saw steady growth, the consumer electronics sector experienced a slight slowdown, demonstrating the benefit of ACCESS’s varied market presence.

Their comprehensive offerings include foundational technologies like browser solutions and operating systems, alongside specialized digital publishing platforms. This breadth of solutions positions ACCESS as a versatile technology partner capable of addressing complex needs across multiple business verticals.

ACCESS boasts a robust presence in high-growth sectors such as automotive and the Internet of Things (IoT). The automotive industry, projected to reach $1.7 trillion by 2028, offers significant opportunities for ACCESS's connected car and in-vehicle infotainment solutions. Their HTML engine technology is particularly well-suited to meet the escalating consumer demand for sophisticated digital experiences within vehicles.

ACCESS CO., LTD.'s established expertise in core technologies, dating back to 1984, is a significant strength. Their deep knowledge in mobile and network software has led to solutions deployed on over 1.5 billion devices, showcasing a proven track record in complex embedded systems and network operating systems.

Global Reach and Subsidiary Network

ACCESS CO., LTD. boasts a significant global footprint, with operations and subsidiaries strategically positioned across Asia, Europe, and the United States. This extensive international network is a core strength, enabling the company to effectively serve a diverse clientele and adapt to varied market demands. For instance, in 2024, ACCESS reported that over 60% of its revenue was generated from international markets, highlighting the success of its global expansion strategy.

This widespread presence facilitates localized support and tailored solutions, crucial for navigating the complexities of different regional business environments. The company's ability to offer region-specific services, backed by its global infrastructure, allows it to build stronger relationships and maintain a competitive edge. By having local teams and resources in key economic hubs, ACCESS can respond more agilely to emerging trends and customer needs.

- Global Operations: Subsidiaries and affiliates in Asia, Europe, and the United States.

- Market Diversification: Reduced reliance on any single geographic market.

- Localized Support: Tailored solutions and customer service for diverse client bases.

- Revenue Contribution: Over 60% of ACCESS's revenue in 2024 stemmed from international markets.

Focus on Connected Experiences and Digital Transformation

ACCESS's strategic focus on connected experiences and digital transformation is a significant strength, directly addressing the growing demand for seamless integration across devices and services. This focus positions them well in a market increasingly driven by IoT and digital-first strategies. For instance, the global IoT market was valued at approximately $1.57 trillion in 2023 and is projected to reach $3.27 trillion by 2028, according to Statista, highlighting the immense opportunity in this space.

Their solutions are engineered to bridge the gap between physical and digital realms, enabling businesses to enhance customer engagement and operational efficiency. This is particularly vital for sectors like retail, healthcare, and manufacturing, all undergoing substantial digital shifts. A report from McKinsey in 2024 indicated that companies prioritizing digital transformation are seeing an average of 20-30% revenue growth compared to their peers.

- Market Alignment: ACCESS's emphasis on connected experiences directly taps into the booming IoT and digital transformation market.

- Industry Relevance: Their solutions cater to the critical needs of industries actively pursuing digital integration for improved customer interaction and efficiency.

- Growth Potential: The company's strategic direction aligns with market forecasts showing substantial growth in digital transformation and connected technologies.

ACCESS's core strength lies in its deep-rooted technical expertise, cultivated since its founding in 1984. This long-standing knowledge in mobile and network software has resulted in deployments on over 1.5 billion devices, a testament to their mastery of complex embedded systems and network operating systems.

Their diversified software portfolio, spanning embedded systems, mobile applications, and advanced network technologies, effectively mitigates risks associated with single-market dependency. This breadth allows them to serve a wide array of industries, including automotive and consumer electronics.

ACCESS possesses a significant global presence, with operations across Asia, Europe, and the United States, contributing to over 60% of its 2024 revenue from international markets. This global footprint enables localized support and tailored solutions, crucial for navigating diverse regional business landscapes.

The company's strategic focus on connected experiences and digital transformation aligns perfectly with the burgeoning IoT market, valued at approximately $1.57 trillion in 2023. Their solutions are designed to enhance customer engagement and operational efficiency, mirroring the 20-30% revenue growth observed in digitally transforming companies in 2024.

| Strength Area | Description | Supporting Data/Impact |

|---|---|---|

| Technical Expertise | Deep knowledge in mobile and network software. | Deployed on over 1.5 billion devices. |

| Market Diversification | Broad software portfolio across multiple industries. | Mitigates reliance on single market segments. |

| Global Footprint | Operations in Asia, Europe, and the US. | Over 60% of 2024 revenue from international markets. |

| Strategic Focus | Emphasis on connected experiences and digital transformation. | Aligns with $1.57 trillion IoT market (2023); supports 20-30% revenue growth in digital transformation. |

What is included in the product

Analyzes ACCESS’s internal capabilities and external market dynamics.

Simplifies complex SWOT data into an actionable framework for immediate strategic adjustments.

Weaknesses

ACCESS CO., LTD. has faced considerable financial headwinds. For the fiscal year ending January 31, 2025, the company reported a substantial profit attributable to owners of the parent of (5,383) million yen, alongside an ordinary loss of (1,884) million yen. This trend continued into the first quarter of fiscal year 2026, with a reported loss of (1,270) million yen for the three months ending April 30, 2025.

ACCESS faces a significant weakness due to suspicions of improper sales recognition at a U.S. subsidiary within its Network business segment. A special investigation committee was formed following an internal probe into certain transactions, highlighting potential deficiencies in internal controls.

This situation raises concerns about the accuracy of reported revenue and could erode investor trust. The potential for increased regulatory scrutiny also poses a risk, especially given the company's reliance on transparent financial reporting to maintain market confidence.

ACCESS faced significant non-operating expenses in the recent fiscal year, including substantial foreign exchange losses stemming from its international operations. These currency fluctuations directly impacted the company's bottom line, highlighting the inherent risks in global business dealings.

Furthermore, the company incurred extraordinary losses associated with restructuring initiatives at its European subsidiary. These costs, while aimed at long-term efficiency, presented a drag on short-term profitability, underscoring the financial implications of strategic realignments.

Dependence on Specific Business Segments

ACCESS's reliance on key business segments such as IoT, Web Platform, and Network presents a notable weakness. While the company is diversified, these specific areas contribute a substantial portion of its revenue. For instance, in the first half of 2024, ACCESS reported that its IoT business unit was a significant driver of growth, alongside its established web platform services.

This concentration means that any downturn or intensified competition within these particular segments could have a disproportionately negative impact on ACCESS's overall financial health. Should these core areas falter, the company's ability to offset these declines through its other, less dominant business segments may be limited, highlighting a vulnerability in its revenue streams.

- Revenue Concentration: Key segments like IoT and Web Platform are major revenue contributors.

- Competitive Sensitivity: Increased competition in these specific areas poses a direct threat to overall performance.

- Limited Offset Potential: Other segments may not be robust enough to compensate for significant declines in core areas.

Competitive Market Landscape

ACCESS operates in a fiercely competitive arena. The embedded software and network technology sectors are characterized by a constant stream of innovation from both long-standing companies and emerging startups. This dynamic environment can significantly impact pricing power and market share.

Specifically, ACCESS faces robust competition across its key business segments, including embedded software solutions, Internet of Things (IoT) platforms, and digital publishing technologies. Companies like Google with its Android Automotive OS, and various specialized IoT platform providers, present significant challenges. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to grow substantially, indicating a crowded space where differentiation is key.

- Intense Rivalry: Established tech giants and agile startups continuously introduce new products and services, intensifying competition.

- Price Pressure: The crowded market often leads to downward pressure on pricing, impacting ACCESS's profit margins.

- Market Share Erosion: Competitors' rapid innovation and aggressive market strategies pose a risk to ACCESS's existing market share.

ACCESS's financial performance shows significant weaknesses, including substantial losses reported for the fiscal year ending January 31, 2025, with a profit attributable to owners of the parent of (5,383) million yen. This negative trend continued into the first quarter of fiscal year 2026, with a reported loss of (1,270) million yen for the three months ending April 30, 2025. These figures indicate ongoing financial struggles that could deter investors and impact operational stability.

Same Document Delivered

ACCESS SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The global embedded software market is poised for robust expansion, with projections indicating a compound annual growth rate of 6.96% from 2025 through 2033. This growth, coupled with the burgeoning Internet of Things (IoT) sector, creates a fertile ground for ACCESS CO., LTD. to broaden its product portfolio and capture a larger market share.

ACCESS can capitalize on the escalating demand for sophisticated real-time data processing capabilities and the increasing adoption of autonomous systems across various industries. These trends directly align with the core competencies of embedded software development, offering a clear pathway for innovation and revenue growth.

The automotive sector's rapid evolution towards electric and autonomous vehicles, alongside a growing consumer appetite for advanced in-car digital experiences, presents a significant growth avenue for ACCESS. Their established automotive platforms and browser technologies are well-positioned to capitalize on this trend, offering integrated solutions for infotainment and connectivity.

By forging strategic alliances and consistently innovating within this dynamic market, ACCESS can further entrench itself as a crucial enabler of intelligent mobility. For instance, the global connected car market was valued at approximately $226.5 billion in 2023 and is projected to reach $717.4 billion by 2030, indicating substantial room for expansion.

The integration of AI and machine learning into embedded systems presents a substantial growth opportunity for ACCESS. By embedding these advanced capabilities, ACCESS can create more sophisticated and self-governing software solutions. This enhancement will bolster their product offerings across diverse sectors, from industrial automation to smart consumer electronics, driving innovation and competitive advantage.

Demand for Digital Publishing Solutions

The digital publishing market is poised for significant expansion, with projections indicating continued robust growth through 2025 and beyond. This surge is fueled by the ever-increasing global internet penetration and the widespread adoption of smartphones, making digital content more accessible than ever.

ACCESS CO., LTD.'s suite of digital publishing solutions, particularly its PUBLUS platform, is well-positioned to leverage this expanding market. PUBLUS offers sophisticated tools designed for the creation, seamless publishing, and efficient distribution of digital content. The platform's capabilities are especially relevant for interactive eBooks, a format gaining traction among consumers seeking engaging reading experiences.

Key opportunities for ACCESS include:

- Capitalizing on the growth of the global digital publishing market, which is projected to reach over $250 billion by 2025.

- Expanding market share by offering innovative features for interactive eBook creation and distribution.

- Partnering with educational institutions and content creators to meet the rising demand for digital learning materials.

- Leveraging the increasing mobile internet usage, which is expected to surpass 70% of the global population by 2025.

Strategic Partnerships and Collaborations

Forming strategic partnerships is a key opportunity for ACCESS. For instance, their Memorandum of Understanding (MoU) with Neusoft in 2023 to develop in-vehicle intelligent mobility solutions demonstrates a commitment to expanding into new markets and enriching their product portfolio. This collaboration aims to leverage Neusoft's expertise in automotive software and ACCESS's experience in embedded systems and connected services.

Collaborations with other technology firms and industry frontrunners are crucial for ACCESS to broaden its ecosystem. By working with partners, ACCESS can develop more comprehensive and integrated solutions that address the evolving needs of the connected car and IoT sectors. Such alliances can accelerate innovation and market penetration, as seen with their ongoing efforts to integrate their ACCESS Twine for Car platform with various automotive manufacturers and service providers.

- Market Expansion: Partnerships like the one with Neusoft provide direct access to new customer segments and geographical regions within the automotive industry.

- Enhanced Offerings: Collaborations allow ACCESS to integrate complementary technologies, creating more robust and attractive solutions for clients.

- Ecosystem Growth: Working with industry leaders fosters a stronger ecosystem around ACCESS's platforms, increasing their value and reach.

- Innovation Acceleration: Joint development efforts with partners can speed up the creation of next-generation intelligent mobility and connected services.

ACCESS can leverage the expanding digital publishing market, which is expected to exceed $250 billion by 2025, by enhancing its PUBLUS platform for interactive eBooks. The company can also tap into the automotive sector's growth, with the connected car market projected to reach $717.4 billion by 2030, by collaborating on in-vehicle intelligent mobility solutions. Furthermore, integrating AI and machine learning into embedded systems offers a significant opportunity to create more sophisticated solutions across various industries.

| Opportunity Area | Market Projection/Data Point | Strategic Action for ACCESS |

|---|---|---|

| Digital Publishing | Market to exceed $250 billion by 2025 | Enhance PUBLUS for interactive eBooks |

| Connected Automotive | Market to reach $717.4 billion by 2030 | Develop in-vehicle solutions via partnerships (e.g., Neusoft MoU) |

| Embedded AI/ML | Growing adoption across IoT and automation | Integrate AI/ML for advanced, self-governing software |

Threats

The software sector, especially in areas like embedded systems, mobile applications, and network infrastructure, is a battlefield. ACCESS faces a crowded market with many established giants and nimble new companies constantly vying for attention and customers.

This fierce rivalry often translates into price wars, squeezing ACCESS's potential profits and making it harder to hold onto its slice of the market. For instance, in 2024, the global software market reached an estimated $800 billion, with growth heavily influenced by competitive pricing strategies across all segments.

The relentless pace of technological evolution, marked by the swift emergence of novel platforms, programming languages, and disruptive forces such as sophisticated AI, presents a significant challenge. ACCESS CO., LTD. faces the imperative of sustained investment in research and development to maintain its market position and ensure its offerings remain competitive in the face of these rapidly advancing technologies.

For instance, the global AI market is projected to reach $1.81 trillion by 2030, growing at a CAGR of 37.3% from 2022, according to Grand View Research. This rapid growth underscores the need for continuous adaptation and innovation to avoid obsolescence.

The increasing sophistication of cyber threats poses a significant risk to ACCESS CO., LTD., given its focus on software for connected devices and digital transformation. A data breach could expose sensitive customer information, leading to severe reputational damage and potential regulatory fines. For instance, the average cost of a data breach in 2024 reached an estimated $4.73 million globally, according to IBM's Cost of a Data Breach Report.

Global Economic Volatility and Supply Chain Issues

Global economic uncertainties, including persistent inflation and fluctuating interest rates, present a significant threat to ACCESS. These macroeconomic conditions can directly dampen customer spending on software solutions, impacting ACCESS's revenue streams. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slowdown from previous years, indicating a cautious economic environment that could curb discretionary IT spending.

Supply chain disruptions, a lingering effect of recent global events, also pose a considerable risk. These disruptions can inflate the cost of necessary hardware components or services that ACCESS might rely on, thereby increasing operational expenses and potentially squeezing profit margins. The ongoing geopolitical tensions and trade policy shifts continue to create an unpredictable landscape for global logistics.

- Inflationary Pressures: Rising inflation in major markets can reduce disposable income for businesses, leading to delayed or reduced software purchases.

- Interest Rate Hikes: Higher interest rates increase the cost of capital, potentially impacting ACCESS's ability to finance growth initiatives or making its solutions more expensive for customers.

- Supply Chain Bottlenecks: Continued disruptions in global supply chains can lead to increased costs for hardware or cloud infrastructure, affecting ACCESS's service delivery and profitability.

- Geopolitical Instability: International conflicts and trade disputes can disrupt global markets, impacting ACCESS's international sales and operational efficiency.

Regulatory and Compliance Risks

ACCESS CO., LTD. faces significant regulatory and compliance risks due to its operations spanning multiple industries and geographical regions. Navigating these diverse legal landscapes, from data privacy laws like GDPR and CCPA to industry-specific mandates such as automotive safety standards, demands constant vigilance and adaptation. For instance, as of early 2024, the global regulatory environment for AI and data handling continues to evolve rapidly, with new legislation being introduced in major markets like the EU and the US, potentially impacting ACCESS's product development and data processing activities.

Failure to adhere to these complex requirements can lead to severe consequences. These include substantial financial penalties, damage to brand reputation, and even operational disruptions. In 2023, fines for data breaches and non-compliance with privacy regulations reached record highs in many jurisdictions, underscoring the financial exposure companies like ACCESS face. The company must ensure robust compliance frameworks are in place to mitigate these threats.

- Data Protection Laws: Ongoing scrutiny of data handling practices, with potential fines for breaches.

- Industry-Specific Regulations: Compliance with evolving standards in sectors like automotive (e.g., UNECE WP.29 regulations for automated driving systems).

- Intellectual Property Rights: Protecting proprietary technology and avoiding infringement claims in a competitive market.

- Geopolitical Factors: Adapting to trade restrictions and varying regulatory approaches in different countries.

ACCESS faces intense competition from both established players and emerging startups, leading to price pressures and market share challenges. The rapid pace of technological advancement, particularly in AI, necessitates continuous R&D investment to avoid obsolescence. Cyber threats are a significant risk, with data breaches costing millions globally in 2024, impacting reputation and incurring fines.

Global economic uncertainties, including inflation and interest rate hikes, can dampen software spending, affecting ACCESS's revenue. Supply chain disruptions also increase operational costs for hardware and infrastructure. Navigating complex and evolving regulatory landscapes, such as data privacy laws, presents compliance risks with potential for substantial penalties.

| Threat Category | Specific Threat | Impact on ACCESS | 2024/2025 Data/Trend |

|---|---|---|---|

| Competition | Market Saturation & Price Wars | Reduced profit margins, difficulty gaining market share | Global software market valued at ~$800 billion in 2024, highly competitive pricing |

| Technology | Rapid Technological Evolution (e.g., AI) | Risk of product obsolescence, need for continuous R&D investment | Global AI market projected to reach $1.81 trillion by 2030 (CAGR 37.3%) |

| Cybersecurity | Sophisticated Cyber Threats & Data Breaches | Reputational damage, regulatory fines, operational disruption | Average cost of data breach in 2024 estimated at $4.73 million globally |

| Economic | Inflation & Interest Rate Hikes | Reduced customer spending on software, increased cost of capital | IMF projected global growth of 3.2% in 2024, indicating a cautious economic environment |

| Regulatory | Evolving Data Privacy & Industry Standards | Financial penalties, operational disruptions, compliance costs | Fines for data breaches and non-compliance reached record highs in many jurisdictions in 2023 |

SWOT Analysis Data Sources

This ACCESS SWOT analysis is built upon a robust foundation of data, including internal financial reports, comprehensive market research studies, and validated industry expert opinions. These sources provide the necessary insights to accurately assess strengths, weaknesses, opportunities, and threats.