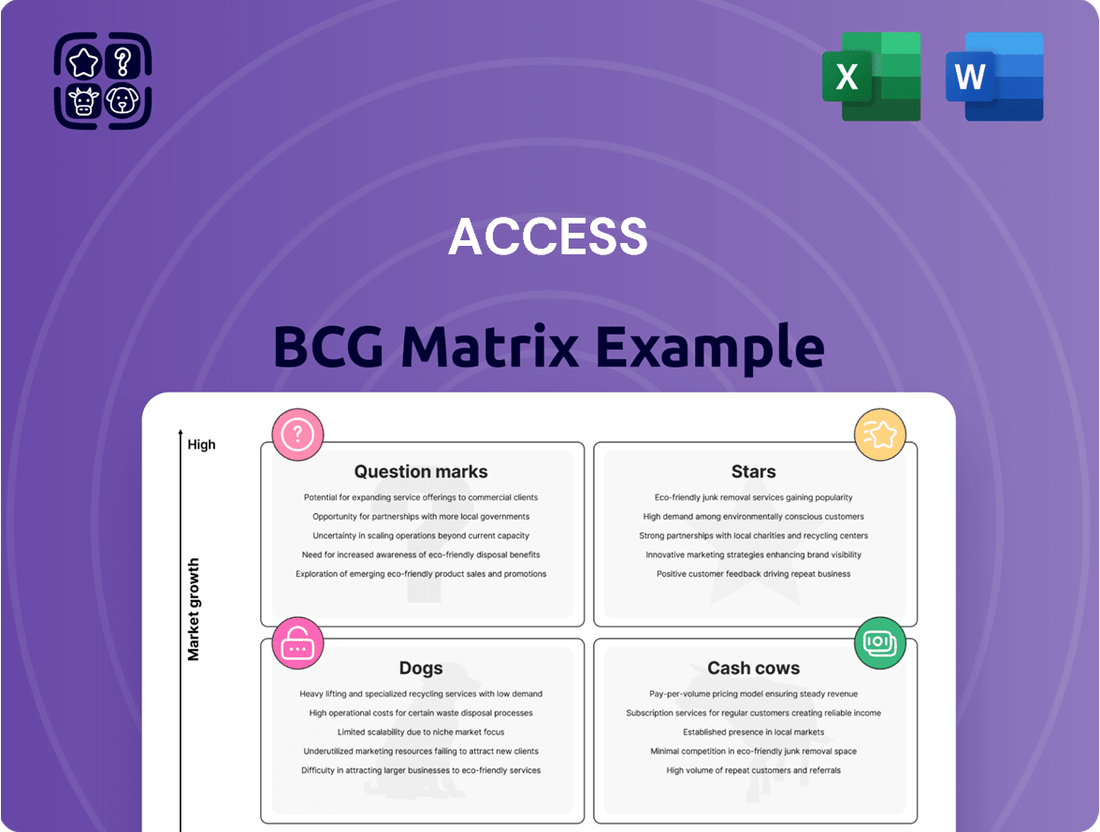

ACCESS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACCESS Bundle

Unlock the strategic potential of your product portfolio with the ACCESS BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual of their market performance and growth prospects. Don't just guess where to invest; get the full BCG Matrix for actionable insights and a roadmap to optimize your business strategy.

Stars

ACCESS CO., LTD.'s NetFront Browser and HTML Engine are positioned as Stars within the ACCESS BCG Matrix for automotive software solutions. Their integration into smart's next-generation electric vehicles in China, announced in January 2025, highlights a significant presence in a high-growth market.

The automotive industry's rapid shift towards connected and software-defined vehicles (SDVs) fuels the demand for advanced in-car infotainment and digital services, a segment where ACCESS’s offerings excel. This trend is expected to see the global automotive software market reach approximately $70 billion by 2027, according to recent industry analyses.

ACCESS's IoT Gateway Solutions are well-positioned to be a Star in the BCG Matrix. The global IoT market is booming, with forecasts suggesting it will reach over $1.5 trillion by 2025, driven by an ever-increasing number of connected devices. ACCESS's established expertise in embedded software development provides a strong foundation for capturing a significant portion of this expanding market.

The Chromium Blink-based HTML5 Browser is a significant offering for embedded systems, tapping into the expanding market for HTML5 integration across devices like smart TVs and automotive infotainment. ACCESS's ability to secure design wins and maintain its technological leadership is crucial for its growth in this sector.

WebKit-based HTML5 Browser

A WebKit-based HTML5 browser, much like its Chromium Blink counterpart, is designed to meet the dynamic requirements of embedded systems. Its inherent adaptability makes it suitable for a wide array of platforms, indicating a burgeoning market for flexible browser solutions.

The market for embedded browsers is expanding, with projections suggesting significant growth. For instance, the global embedded systems market was valued at approximately USD 87.2 billion in 2023 and is expected to grow substantially. This growth fuels the demand for adaptable browser technologies like WebKit-based solutions.

Continued focus on tailoring WebKit for specific industry demands, alongside performance enhancements, can significantly strengthen its market standing. This strategic approach is crucial for capturing a larger share of the embedded browser market, which is increasingly driven by specialized functionalities.

- Market Adaptability: WebKit's versatility supports diverse embedded device platforms.

- Growth Potential: The expanding embedded systems market presents opportunities for browser technologies.

- Strategic Investment: Customization and performance optimization are key to market success.

Solutions for Digital Transformation

ACCESS CO., LTD.'s comprehensive suite of solutions facilitates digital transformation across diverse sectors, notably publishing and consumer electronics, reflecting a robust growth trajectory.

Businesses globally are prioritizing digital transformation, with Gartner forecasting worldwide IT spending on digital transformation initiatives to reach $2.3 trillion in 2024, an increase of 17.5% from 2023.

These investments are driven by the need to enhance operational efficiency and elevate user experiences. ACCESS's ability to deliver these improvements positions its offerings as high-potential assets in a dynamic market.

- Digital Transformation Investments: Global spending on digital transformation is projected to exceed $2.3 trillion in 2024.

- Industry Focus: ACCESS's strengths lie in enabling transformation within publishing and consumer electronics.

- Market Adoption: Successful implementations and strategic partnerships are key indicators of increasing market acceptance.

- Growth Potential: The broad demand for digital transformation highlights significant growth opportunities for ACCESS's solutions.

Stars in the ACCESS BCG Matrix represent offerings with high market share in high-growth markets, demanding significant investment to maintain leadership. ACCESS's NetFront Browser and Chromium Blink-based HTML5 Browser are prime examples, deeply integrated into the rapidly expanding connected automotive sector. Their success is tied to the automotive industry's ongoing digital evolution, where software capabilities are increasingly paramount.

| Product/Solution | Market Growth | Market Share | Strategic Importance |

|---|---|---|---|

| NetFront Browser & HTML Engine | High (Automotive Software) | High (Design Wins in EVs) | Key for connected car experiences |

| IoT Gateway Solutions | High (Global IoT Market) | Growing (Embedded Expertise) | Enables connected device ecosystems |

| Chromium Blink HTML5 Browser | High (Embedded Systems) | Strong (HTML5 Integration) | Versatile for various embedded platforms |

| WebKit HTML5 Browser | High (Embedded Systems) | Strong (Adaptable for Platforms) | Supports diverse embedded device needs |

What is included in the product

Strategic guidance on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

ACCESS BCG Matrix provides a clear visual of your portfolio, relieving the pain of strategic uncertainty by highlighting growth opportunities and areas needing divestment.

Cash Cows

Legacy embedded browser technologies, such as older NetFront versions found in devices with extended lifecycles, are classic cash cows. These solutions dominate mature market segments, consistently generating revenue with minimal new development or marketing spend. For instance, in 2024, many industrial control systems and older automotive infotainment units still rely on these robust, albeit dated, browser engines, demonstrating their sustained market presence and profitability.

The Network OS for white box systems likely operates within a mature and stable market segment, a characteristic often associated with established infrastructure components. ACCESS's strong foothold here suggests a defensible market share.

White box networking solutions are highly valued for their cost-effectiveness and adaptability, ensuring a consistent demand from businesses seeking flexible IT infrastructure. This sustained demand fuels predictable revenue streams for ACCESS.

This product category is a prime candidate for a Cash Cow within the BCG Matrix. It generates substantial, steady cash flow, a result of deep-rooted customer loyalty and recurring revenue, even if market growth is modest. For instance, the global white box server market, a closely related sector, was projected to reach over $20 billion in 2024, indicating a robust underlying demand for open, customizable hardware solutions.

ACCESS's virtual router network OS for NFV fits the Cash Cows quadrant of the BCG Matrix. The Network Functions Virtualization (NFV) market, a mature sector in telecommunications and enterprise networking, continues to see steady adoption. This established demand provides a reliable and profitable revenue stream for ACCESS's established virtual router OS.

Multiscreen Media Sharing for CE Devices and Home Networks

Multiscreen media sharing solutions for consumer electronics (CE) and home networks are likely positioned in a mature market. While innovation continues, the core functionality of sharing content across various devices is a well-understood and established need. This suggests that if ACCESS possesses a significant installed base or robust licensing agreements in this segment, it would naturally translate into consistent revenue streams with minimal requirement for substantial new marketing investment.

For instance, the global market for digital media adapters, a key component of multiscreen sharing, was projected to reach approximately $20 billion by 2024, indicating a substantial but potentially slow-growth environment. ACCESS's revenue from such established technologies would represent a stable income source, fitting the characteristics of a Cash Cow.

- Mature Market: The fundamental technology for sharing media across devices is widely adopted.

- Consistent Income: Existing user bases and licensing agreements drive predictable revenue.

- Limited Growth Potential: Significant new market expansion is less likely compared to emerging technologies.

- Revenue Generation: Focus is on maximizing profits from established products and services.

Basic Browser SDKs for HbbTV and UK Freeview Play

ACCESS's Basic Browser SDKs for HbbTV and UK Freeview Play are classic cash cows within the BCG framework. These SDKs serve mature markets with established digital television standards, meaning growth potential is limited.

Despite the low growth, ACCESS leverages its deep expertise and existing relationships to maintain a dominant market share in these segments. This strong position ensures a consistent and reliable revenue stream, much like a well-established product that continues to generate profit with minimal investment.

For instance, the HbbTV standard, widely adopted across Europe, and Freeview Play in the UK, represent stable, albeit not rapidly expanding, ecosystems. ACCESS's SDKs are crucial for device manufacturers to comply with these standards, guaranteeing ongoing demand.

- Market Maturity: HbbTV and UK Freeview Play are established standards, indicating limited future market expansion.

- High Market Share: ACCESS's expertise allows it to command a significant portion of these niche markets.

- Stable Revenue: These SDKs provide consistent, predictable income due to their essential role in compliance.

- Low Investment: As mature products, they require minimal ongoing development or marketing resources.

Cash Cows represent mature products in stable, low-growth markets where ACCESS holds a strong competitive position. These offerings generate consistent, reliable cash flow with minimal investment, allowing the company to fund other strategic initiatives. Examples include established browser technologies and SDKs for widely adopted digital TV standards.

| Product Category | Market Maturity | Market Share | Revenue Generation | Investment Need |

| Legacy Embedded Browsers | High | Dominant | Consistent | Low |

| Network OS (White Box) | High | Strong | Predictable | Low |

| Basic Browser SDKs (HbbTV/Freeview Play) | High | Significant | Stable | Minimal |

What You’re Viewing Is Included

ACCESS BCG Matrix

The preview you see is the definitive ACCESS BCG Matrix document you will receive upon purchase, ensuring you get precisely what you expect without any alterations or watermarks. This comprehensive report is meticulously crafted for strategic decision-making, offering a clear visual representation of your business portfolio's performance. Upon completion of your purchase, this fully formatted and analysis-ready file will be instantly accessible for your immediate use in business planning and presentations.

Dogs

Outdated or niche digital publishing solutions often fall into the Dogs quadrant of the BCG matrix. These are offerings that haven't adapted to current content consumption habits, like the rise of interactive media or sophisticated e-reader formats, or cater to markets that are significantly shrinking. For instance, a platform solely focused on static PDF magazine replicas, while once popular, now struggles against dynamic, app-based content delivery.

These products typically exhibit both low market share and operate within low-growth or declining market segments. A prime example could be a digital textbook platform that lacks features like embedded videos or interactive quizzes, which are now standard expectations for students. Such solutions are likely to see minimal revenue growth, making them unattractive investment targets.

The financial implications are clear: significant capital infusion to modernize these offerings may not generate a sufficient return on investment. Consider a legacy digital archive service that hasn't updated its search functionality or accessibility features in over a decade; the cost to overhaul it might far outweigh the potential gains from its limited user base. This scenario often leads businesses to consider divestiture as a more prudent strategy to reallocate resources to more promising ventures.

Embedded software designed for outdated hardware, like systems for legacy industrial machinery or older automotive control units, fits here. Think of specialized firmware for a 2010-era infotainment system that's no longer manufactured. ACCESS's market share in this niche is likely very small and shrinking, perhaps less than 1% of the remaining market for such systems.

The challenge is that while these systems still exist, their user base is dwindling, and new development is minimal. Supporting this software, even for the few remaining clients, can be costly. For instance, maintaining a dedicated engineering team for a product line that saw only a few hundred units shipped in 2024 would be financially unsustainable, yielding minimal revenue compared to the investment.

Certain legacy network technologies, such as those relying on older Ethernet standards or outdated wireless protocols, fall into the Dogs category of the ACCESS BCG Matrix. These are often found in niche or declining markets where their functionality is being superseded by more advanced and cost-effective alternatives.

For instance, while specific market share data for every legacy technology is scarce, the overall decline in demand for ISDN services, which saw its peak in the late 1990s and early 2000s, exemplifies this trend. Continued investment in maintaining and supporting such technologies, especially when they represent a small fraction of a company's overall network infrastructure, can indeed divert critical resources from more innovative and growth-oriented areas.

Unsuccessful Ventures into Highly Competitive, Low-Margin Software Services

If ACCESS has ventured into software service areas where competition is intense and margins are razor-thin, and has not gained significant traction, these could be considered question marks or even dogs in the BCG matrix. For instance, in 2024, the global IT services market, while growing, is characterized by intense competition, with major players and numerous smaller firms vying for market share. Many of these services operate on gross margins that can fall below 15%, making profitability a significant challenge.

These ventures would likely represent low market share in a market where profitability is already challenging. For example, if ACCESS entered a niche cloud migration service in 2024, a segment dominated by giants like Accenture and Deloitte, and only captured 0.5% of the market, it would fit this description. Such an endeavor might be a cash trap, tying up valuable resources in sales, development, and support without generating adequate returns, potentially draining capital that could be invested in more promising areas.

- Low Market Share: Operating in segments where ACCESS holds less than 2% of the total market revenue.

- Thin Margins: Gross profit margins consistently below 10% for these specific services.

- High Competition: Facing more than 5 dominant competitors with established client bases.

- Negative or Stagnant Growth: Experiencing revenue growth of less than 3% year-over-year in these service lines.

Products with Declining Licensing Revenue and No Clear Path to Innovation

Products languishing in the Dogs quadrant of the ACCESS BCG Matrix are those experiencing a steady drop in licensing revenue without any foreseeable innovation to reverse the trend. This often signifies a market that is no longer growing or is actively contracting, leading to a diminishing share for the product. In 2024, for instance, legacy software licenses for certain enterprise resource planning (ERP) systems saw a significant decline as companies migrated to cloud-based solutions, with many of these older systems failing to adapt to new integration standards.

These offerings typically operate in low-growth or declining markets, where their market share is also shrinking. The financial performance is usually at best a break-even scenario, and more often, these products become a drain on resources, incurring losses. For example, a study in late 2024 indicated that several specialized hardware components, once dominant in a niche market, now represent less than 1% of a company's total revenue, with licensing agreements for these components becoming increasingly unprofitable due to obsolescence and the availability of cheaper, more advanced alternatives.

- Declining Licensing Revenue: Consistent year-over-year decreases in income generated from licensing agreements.

- Lack of Innovation: No significant upgrades, new features, or strategic pivots to address evolving market needs or technological advancements.

- Low Market Growth/Decline: The overall market for the product is stagnant or shrinking, reducing the potential for recovery.

- Potential for Losses: These products often struggle to cover their operational costs, leading to financial losses.

Products firmly in the Dogs quadrant of the ACCESS BCG Matrix are characterized by their low market share within low-growth or declining industries. These offerings are typically mature, with little to no potential for expansion, and often require significant resources for maintenance rather than development. For instance, ACCESS might have legacy embedded software for automotive systems that are no longer in production, representing a tiny fraction of the current automotive software market.

These products generate minimal revenue and often consume more capital than they produce, making them a drain on overall company resources. Consider a specialized digital rights management (DRM) solution for a now-discontinued media format; its market share would be negligible, and the cost of maintaining compatibility and support would likely exceed any income generated. In 2024, such legacy solutions often have less than a 1% market share in their niche and struggle to achieve even 5% gross profit margins.

The strategic decision for these "Dogs" is usually to divest, discontinue, or harvest them to free up capital for more promising ventures. For example, a company might choose to stop offering support for a 2015-era operating system component if the cost of maintaining it outweighs the revenue from its few remaining users, which in 2024 could be less than 0.1% of the total user base for that technology.

| Product/Service Category | Estimated Market Share (ACCESS) | Market Growth Rate | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Legacy Digital Publishing Platforms (e.g., static PDF replicas) | < 1% | -5% (Declining) | Low/Negative | Divest or Discontinue |

| Outdated Embedded Software (e.g., legacy infotainment systems) | < 0.5% | -10% (Declining) | Low/Negative | Divest or Discontinue |

| Legacy Network Technologies (e.g., older Ethernet standards) | < 1% | -3% (Declining) | Low/Negative | Phased Discontinuation |

| Niche Cloud Migration Services (low traction) | 0.5% | 5% (Low Growth) | < 10% Gross Margin | Harvest or Divest |

| Legacy ERP Software Licenses | < 2% | -8% (Declining) | Low/Break-even | Discontinue or Offer Minimal Support |

Question Marks

ACCESS's new AI-powered embedded systems initiatives represent a significant investment in a burgeoning market. While the overall AI in embedded systems market is projected to reach $25.5 billion by 2026, ACCESS's initial market share in this nascent area is likely to be minimal, placing these efforts in the Question Marks quadrant of the BCG Matrix.

These ventures demand substantial capital for research and development, talent acquisition, and market penetration strategies, with the potential for high rewards but also considerable risk due to uncertain returns. For example, companies investing heavily in AI hardware for edge computing, a key component of embedded AI, saw R&D spending increase by an average of 15% in 2024.

Achieving success and moving these initiatives out of the Question Marks quadrant will necessitate sustained, significant investment to develop cutting-edge, differentiated solutions and secure early market adoption. Without this commitment, these promising AI embedded systems could struggle to gain traction against established players or faster-moving innovators.

Venturing into new, high-growth IoT verticals where ACCESS does not yet have a strong foothold would represent the Question Marks in the ACCESS BCG Matrix. These are areas with high market growth potential but low market share for ACCESS. For instance, the smart agriculture IoT market is projected to reach $30.1 billion by 2025, offering significant growth opportunities.

Success in these nascent sectors demands substantial investment in research and development, marketing, and channel partnerships to build market penetration. These require strategic decisions on whether to invest heavily to turn them into Stars or divest if the potential for ACCESS to gain significant market share is limited.

For example, while the industrial IoT sector is robust, exploring emerging areas like IoT in personalized healthcare or smart city infrastructure presents new challenges and requires careful evaluation of ACCESS's competitive advantages and resource allocation.

Developing advanced digital publishing platforms for next-generation content, like interactive or personalized media, falls into the Question Mark category for ACCESS. This market is expanding, but ACCESS's success hinges on uncertain market adoption and its capacity to stand out from competitors. The global digital publishing market was valued at approximately $20.9 billion in 2023 and is projected to grow significantly, but capturing share in this dynamic space requires substantial investment.

Blockchain-based Solutions for Embedded Systems or IoT

Blockchain solutions for embedded systems and IoT represent a burgeoning sector with significant growth potential, positioning ACCESS's involvement as a Question Mark within the BCG matrix. This technology offers enhanced security and data integrity for connected devices, a critical need as the IoT landscape expands. The global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.3 trillion by 2028, highlighting the immense opportunity.

Despite the high potential, widespread adoption of blockchain in this domain is still nascent. Significant investment is required to develop robust solutions and foster an ecosystem that supports this integration. The market is characterized by ongoing innovation and evolving standards, making it a high-risk, high-reward venture for companies like ACCESS. For instance, the cybersecurity market for IoT devices alone is expected to grow substantially, indicating the demand for secure solutions.

- Market Growth: The global IoT market is experiencing rapid expansion, creating a fertile ground for blockchain-based security solutions.

- Investment Needs: Significant capital is necessary for research, development, and building the necessary infrastructure for blockchain integration in embedded systems.

- Adoption Uncertainty: Widespread adoption is not yet guaranteed due to the evolving nature of the technology and the need for industry-wide standardization.

- Security Enhancement: Blockchain offers a decentralized and immutable ledger, providing superior data integrity and security for sensitive IoT data.

Solutions for Quantum Computing in Embedded Applications

Exploring software solutions for quantum computing in embedded applications represents a classic Question Mark in the BCG matrix. This emerging field is characterized by significant R&D investment needs and a high-risk, high-reward profile, with a very limited current market presence for any specific technology or vendor.

The potential for quantum computing to revolutionize embedded systems, from advanced sensor processing to complex AI acceleration, is immense, but the path to widespread adoption is fraught with challenges. Current market projections for quantum computing software, while speculative, indicate substantial growth potential. For instance, some analysts forecast the global quantum computing market to reach tens of billions of dollars by the early 2030s, with embedded applications being a significant, albeit later-stage, contributor.

- Nascent Market: The current market share for quantum computing software in embedded applications is virtually nonexistent, reflecting its early stage of development.

- High R&D Investment: Significant capital is required for research and development to overcome technical hurdles in quantum algorithm design and hardware integration for embedded systems.

- Long-Term Outlook: Success in this domain hinges on a long-term strategic vision, as the practical applications and widespread commercialization are still several years away.

- High-Risk, High-Reward: While the investment is risky due to technological uncertainties, the potential payoff in terms of performance and capability advancements for embedded devices is exceptionally high.

Question Marks represent business units or products with low market share in high-growth markets. These ventures require significant investment to increase market share, but there's no guarantee of success, making them high-risk, high-reward propositions.

ACCESS's exploration into AI-powered embedded systems and novel IoT verticals exemplifies these Question Marks. The company must strategically decide whether to invest heavily to transform these into Stars or to divest if gaining significant market share appears unlikely.

For instance, the global IoT security market, a key area for blockchain integration, was projected to reach $37.3 billion in 2024, indicating substantial growth potential for secure embedded solutions.

Similarly, the quantum computing software market, while nascent, is expected to see significant growth, with some forecasts suggesting it could reach tens of billions of dollars by the early 2030s, presenting a long-term, high-risk opportunity for embedded applications.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial reports, market research, and industry analyses to provide a clear strategic overview.