ACCESS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACCESS Bundle

ACCESS operates within a dynamic market shaped by intense competition, the bargaining power of its buyers, and the ever-present threat of new entrants. Understanding these forces is crucial for navigating its strategic landscape.

The complete report reveals the real forces shaping ACCESS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for ACCESS CO., LTD. is significantly shaped by the concentration of providers for its essential technologies. For instance, if only a handful of companies supply critical browser engines or operating system components, those suppliers gain considerable leverage.

This concentration is particularly impactful for specialized hardware used in embedded systems, where ACCESS might operate. In 2024, the semiconductor industry, a key area for embedded hardware, continued to see consolidation, with major players like TSMC and Intel dominating advanced manufacturing. This limited supplier pool grants them greater influence over pricing and terms for ACCESS.

Suppliers offering highly specialized or proprietary inputs, such as unique software components or niche hardware, can wield considerable bargaining power. For instance, in the automotive sector, a supplier of a critical, patented engine management system for electric vehicles would have significant leverage. Similarly, in consumer electronics, a provider of a unique display technology not readily available elsewhere could command higher prices.

ACCESS faces significant supplier power due to high switching costs, particularly with embedded software and network technologies. Re-engineering, re-testing, and integration efforts can be substantial, making it difficult and expensive to change suppliers. For instance, in the telecommunications sector, where ACCESS operates, the integration of new network hardware or software can take months and involve considerable capital expenditure, giving incumbent suppliers considerable leverage.

Threat of Forward Integration by Suppliers

If key suppliers possess the capability and a strong incentive to create their own end-user software solutions or directly enter specific market segments, their bargaining power escalates significantly. This could manifest as suppliers offering integrated platforms to automotive original equipment manufacturers (OEMs), thereby bypassing ACCESS.

This threat of forward integration by suppliers can exert considerable pressure on ACCESS's pricing and profit margins. For instance, a supplier that can offer a complete software package, including features ACCESS provides, could command better terms or even capture market share.

- Supplier Capability: Assess if suppliers have the technical expertise and resources to develop competing software.

- Supplier Incentive: Evaluate if suppliers see a greater profit opportunity in direct competition versus supplying ACCESS.

- Market Segments: Identify specific areas where suppliers could credibly integrate forward and compete directly.

- Impact on ACCESS: Understand how supplier integration could affect ACCESS's revenue, market position, and strategic options.

Importance of ACCESS to Suppliers

The significance of ACCESS as a customer to its suppliers directly impacts the bargaining power of those suppliers. If ACCESS accounts for a substantial portion of a supplier's total revenue, that supplier's leverage is inherently diminished. For instance, if a key supplier's business is heavily reliant on ACCESS, they are less likely to impose unfavorable terms or price increases, as losing ACCESS as a client would be a significant blow.

Conversely, a supplier whose products or services are critical and unique to ACCESS, and for which there are few viable alternatives, will possess greater bargaining power. This is particularly true if ACCESS's operations would be severely disrupted without that specific supplier. In 2024, many industries experienced supply chain volatility, making the dependency on key suppliers a critical factor in operational stability and cost management.

- Supplier Dependence: If ACCESS constitutes a large percentage of a supplier's sales, the supplier's power is weakened.

- ACCESS's Importance: Conversely, if ACCESS is a small customer for a supplier, the supplier holds more sway.

- Critical Inputs: Suppliers of unique or essential components for ACCESS's operations can exert significant influence.

- Market Conditions: In 2024, supply chain disruptions highlighted how critical supplier relationships are, potentially increasing the bargaining power of suppliers who could guarantee consistent delivery.

ACCESS CO., LTD. faces considerable bargaining power from its suppliers, particularly when those suppliers offer unique or highly specialized inputs, such as proprietary software components or patented hardware. This leverage is amplified if switching to alternative suppliers involves high costs, including re-engineering and integration efforts.

In 2024, the semiconductor industry, a critical supplier base for embedded systems, continued to be dominated by a few key players, such as TSMC and Intel, granting them significant pricing power. Furthermore, suppliers who can credibly threaten to integrate forward into ACCESS's market segments, offering end-user solutions themselves, can exert substantial pressure on ACCESS's margins and market position.

The balance of power also hinges on the relative importance of ACCESS to its suppliers. If ACCESS represents a significant portion of a supplier's revenue, the supplier's ability to dictate terms is reduced. Conversely, if ACCESS relies heavily on a supplier for critical, non-substitutable inputs, that supplier's bargaining power increases, a dynamic exacerbated by supply chain volatility observed in 2024.

| Factor | Impact on ACCESS | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High leverage for few dominant suppliers | Semiconductor sector consolidation |

| Switching Costs | Limits flexibility, increases supplier power | Embedded software integration challenges |

| Supplier Forward Integration Threat | Potential for direct competition, margin erosion | Suppliers offering integrated platforms |

| Customer Dependence (ACCESS on Supplier) | Weakens supplier power if ACCESS is a major client | Supplier reliance on ACCESS's volume |

| Supplier Dependence (Supplier on ACCESS) | Increases supplier power if ACCESS is a minor client or relies on unique inputs | Critical component dependency, supply chain risks |

What is included in the product

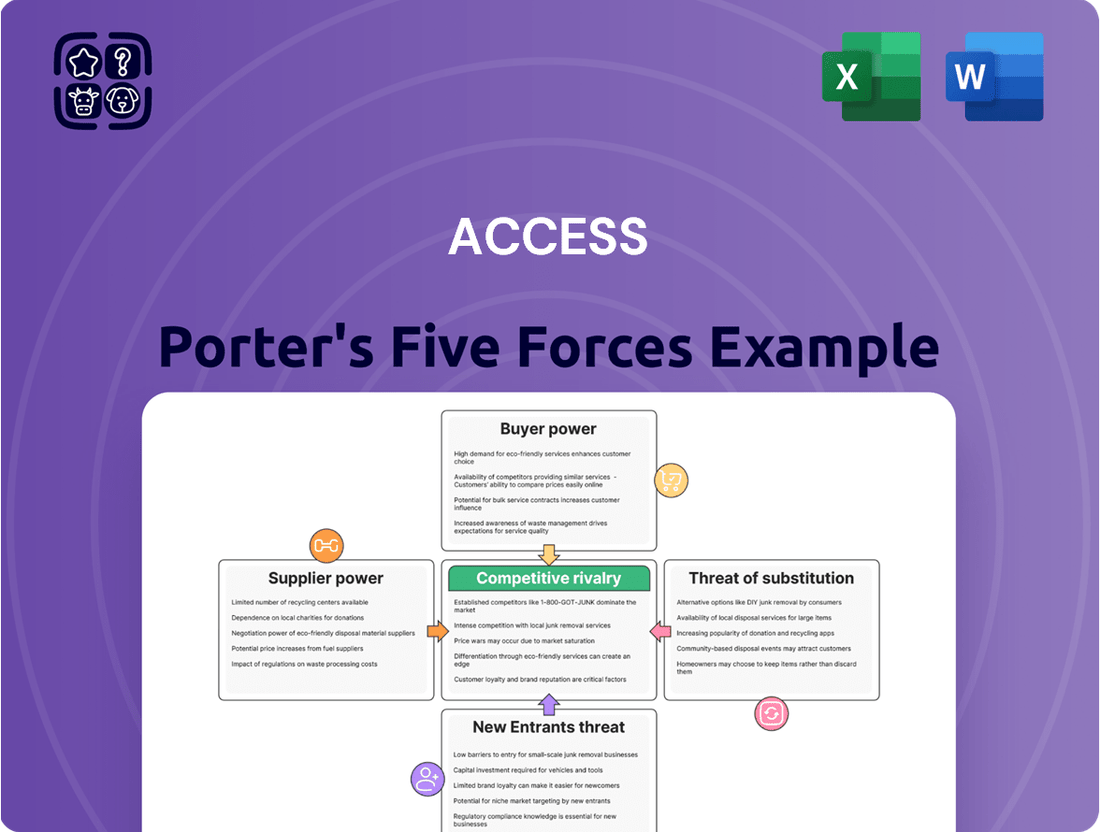

This analysis dissects the competitive forces impacting ACCESS, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of all five forces, simplifying complex market pressures.

Customers Bargaining Power

The bargaining power of ACCESS's customers is significantly influenced by customer concentration. If a few major players, like automotive giants or leading consumer electronics firms, account for a substantial part of ACCESS's sales, these large clients gain considerable leverage. For instance, if the top three clients represent over 60% of ACCESS's revenue, they can effectively dictate terms, pushing for lower prices or more favorable contract conditions, which can squeeze ACCESS's profit margins.

If ACCESS's customers find it simple and cheap to switch to other software or build their own, their power to negotiate prices and terms grows. For instance, if a competitor offers a similar cloud-based solution with minimal setup, a customer might easily migrate, forcing ACCESS to be more competitive.

Conversely, if ACCESS's software is deeply integrated into a customer's existing systems, requiring significant time and expense to replace or replicate, customer leverage is diminished. Think about a large enterprise whose entire workflow relies on ACCESS's proprietary data management system; the cost of switching would be prohibitive, giving ACCESS more pricing power.

In 2024, the average cost for an enterprise to switch cloud-based software providers can range from tens of thousands to millions of dollars, depending on data migration, training, and integration needs. This highlights how high switching costs can significantly bolster a software provider's position by reducing customer bargaining power.

Customer price sensitivity significantly impacts bargaining power, especially in competitive markets like mass-market consumer electronics. In 2024, for instance, the average consumer spending on electronics saw a notable shift towards value-driven purchases, with many consumers actively seeking discounts and promotions. This heightened sensitivity means that companies like ACCESS, operating in such sectors, face considerable pressure to keep prices competitive or risk losing market share to rivals offering more attractive deals.

Threat of Backward Integration by Customers

Customers might possess the capability or inclination to develop their own embedded software, browser technology, or digital publishing solutions internally. This would diminish their dependence on ACCESS, thereby amplifying their bargaining leverage. For instance, a major automotive manufacturer, a significant client for embedded software, could invest in building its own in-house development team for infotainment systems, a move that would directly challenge ACCESS's market position.

The threat of backward integration by customers significantly impacts ACCESS's bargaining power. If key clients, particularly those in the automotive or consumer electronics sectors, decide to develop their own proprietary software solutions, they can reduce their reliance on ACCESS. This potential shift means customers could dictate terms more forcefully or seek alternative providers, putting pressure on ACCESS's pricing and service agreements. For example, if a large OEM decides to bring its browser development in-house, it could reduce the addressable market for ACCESS's browser solutions by a considerable margin, impacting revenue streams.

- Customer In-house Development: Customers may develop their own embedded software, browser technology, or digital publishing solutions, reducing reliance on ACCESS.

- Increased Bargaining Power: This capability directly enhances customers' leverage in negotiations with ACCESS.

- Market Impact: A significant shift towards in-house development by major clients could shrink ACCESS's addressable market and revenue potential.

Standardization of Products

When ACCESS's software solutions are highly standardized, customers gain significant leverage. This is because they can easily switch to a competitor's offering if pricing or terms become unfavorable. For instance, if a large enterprise client finds that ACCESS's core functionalities are readily available from multiple vendors, they can demand better pricing or service levels, knowing alternatives exist.

Conversely, if ACCESS provides unique or highly customized solutions, the bargaining power of customers is diminished. These specialized offerings create switching costs and lock-in effects, making it more difficult and expensive for customers to move to another provider. In 2024, the market for general-purpose CRM software saw a significant increase in standardization, with many providers offering similar feature sets, thereby increasing customer bargaining power in that segment.

- Increased Customer Choice: Highly standardized products mean more competitors offering similar solutions, giving customers more options to compare and choose from.

- Price Sensitivity: When products are easily substitutable, customers are more likely to base their purchasing decisions on price, putting pressure on vendors like ACCESS to remain competitive.

- Reduced Switching Costs: Standardized software typically involves less customization, making it simpler and cheaper for customers to migrate to a different vendor if dissatisfied.

Customers' bargaining power is amplified when ACCESS's offerings are easily substitutable or when they have the ability to develop similar solutions in-house. In 2024, the trend towards open-source alternatives and low-code/no-code platforms has empowered businesses to reduce reliance on proprietary software, increasing their negotiation leverage. For example, a significant portion of mid-sized businesses in 2024 reported exploring or implementing in-house development for certain software functionalities to gain cost savings and greater control.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High concentration increases power. | If top 3 clients represent >60% of ACCESS revenue, they have significant leverage. |

| Switching Costs | Low switching costs increase power. | Enterprise cloud software migration costs can range from $10k-$1M+ in 2024. |

| Price Sensitivity | High sensitivity increases power. | Consumers in 2024 actively sought value purchases, increasing pressure on pricing. |

| In-house Development Capability | Capability increases power. | Major OEMs exploring in-house development for embedded systems. |

| Product Standardization | Standardization increases power. | Increased standardization in CRM software in 2024 led to more customer choice. |

Preview the Actual Deliverable

ACCESS Porter's Five Forces Analysis

This preview showcases the complete ACCESS Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive instantly upon purchase, ensuring no surprises and immediate applicability for your strategic planning.

Rivalry Among Competitors

The embedded software, mobile software, and network technology sectors where ACCESS CO., LTD. operates are crowded with a multitude of companies. These range from global tech giants with vast resources to smaller, highly specialized firms focusing on specific niches.

This high number of competitors, particularly the presence of well-funded, established players, significantly heightens the competitive rivalry for ACCESS. For instance, in the connected car software market, which ACCESS targets, major automotive manufacturers are increasingly developing in-house solutions or partnering with large software providers, intensifying pressure on independent suppliers.

The sheer volume of players means that market share gains are hard-won, and companies must constantly innovate and differentiate to stand out. This intense competition can lead to price pressures and a continuous need for investment in research and development to stay ahead of the curve.

In mature software markets, the battle for existing customers intensifies competition. For instance, the global software market grew by an estimated 10.5% in 2023, reaching approximately $875 billion, with mature segments experiencing slower, more contested growth. This means companies like ACCESS, operating in these areas, often face aggressive pricing and innovation pressures from rivals vying for the same limited market share.

Conversely, high-growth software sectors, such as specialized IoT platforms or advanced automotive software solutions, present different dynamics. These emerging areas, projected to see double-digit annual growth through 2027, often have fewer established players. This allows companies like ACCESS to potentially capture significant market share with less direct, head-to-head competition for every new customer acquisition, fostering a more favorable environment for expansion.

ACCESS's ability to differentiate its browser technology, operating systems, and digital publishing solutions significantly impacts competitive rivalry. If ACCESS offers unique features or superior performance, it can lessen the pressure to compete solely on price. For instance, in 2024, the demand for specialized embedded browser solutions within the automotive sector, where ACCESS has a presence, continued to grow, allowing for value-based differentiation beyond basic functionality.

Switching Costs for Customers

Low switching costs in the embedded software and digital publishing sectors can significantly fuel competitive rivalry. When customers can easily move to a competitor's offering with minimal effort or expense, it forces companies like ACCESS to constantly fight for market share through aggressive pricing and marketing. This dynamic is particularly evident in markets where digital solutions are commoditized.

ACCESS would experience intensified competition if its clients find it simple to migrate to alternative embedded software or digital publishing platforms. This ease of transition allows rivals to more readily poach customers, leading to a constant battle for retention and acquisition. For instance, a study by Gartner in early 2024 indicated that for many cloud-based software solutions, the average time to switch providers has decreased by 15% compared to previous years, directly impacting vendor loyalty.

- Intensified Price Wars: Low switching costs often translate into price-sensitive customer behavior, prompting competitors to engage in price reductions to attract new business.

- Increased Marketing Spend: Companies must invest more heavily in marketing and sales efforts to differentiate their offerings and persuade customers not to switch.

- Focus on Customer Retention: Strategies shift towards building strong customer relationships and providing superior value to minimize churn.

- Innovation Pressure: Continuous innovation is crucial to offer compelling reasons for customers to stay with a particular provider.

Exit Barriers

High exit barriers in the software industry can significantly intensify competitive rivalry. When it's difficult or costly for companies to leave the market, they may be forced to stay and fight, even if they are not performing well. This can lead to prolonged price wars or aggressive market share grabs.

Consider the case of specialized assets. If a software company has invested heavily in proprietary technology or infrastructure that has little resale value outside the industry, they face substantial losses if they decide to exit. For instance, a company with unique, custom-built data centers for its specific software platform might find it prohibitively expensive to shut down operations.

Long-term contracts also act as a significant exit barrier. Software providers often enter into multi-year agreements with clients, committing them to ongoing service and support. Breaking these contracts can incur penalties, and continuing to fulfill them, even at a loss, might be the more financially prudent option, thus keeping these firms active competitors.

Reputation concerns play a role too. A poorly managed exit can damage a company's brand and affect future business prospects, even in unrelated ventures. This fear of tarnishing their image can deter companies from withdrawing from a struggling market, leading to continued, albeit potentially weakened, competition. In 2024, the global software market was valued at approximately $700 billion, with many smaller players facing pressure to consolidate or exit due to intense competition, yet high switching costs for enterprise clients often keep them engaged longer than might otherwise be expected.

- Specialized Assets: Companies with unique, industry-specific technology or infrastructure may face significant write-offs upon exit.

- Long-Term Contracts: Commitments to clients for ongoing software services and support can create financial penalties for early termination.

- Reputation Concerns: A messy or failed exit can negatively impact a company's brand and future business opportunities.

- Intensified Rivalry: High exit barriers compel less successful firms to remain, leading to sustained competitive pressure and potentially lower profitability for all players.

The competitive rivalry within the embedded software and digital publishing sectors is notably high. This is driven by a large number of players, including global tech giants and specialized firms, creating an environment where market share gains are challenging. For instance, the connected car software market, a key area for ACCESS, sees major automakers developing in-house solutions, intensifying pressure on independent providers.

The intensity of competition is further amplified by low switching costs for customers. When clients can easily transition to a competitor's offering with minimal effort or expense, companies like ACCESS are compelled to continuously compete on price and marketing. Data from early 2024 indicated a decrease in the average time to switch cloud-based software providers by 15%, underscoring this dynamic.

High exit barriers, such as specialized assets and long-term contracts, can also contribute to sustained competitive rivalry. Companies that find it difficult or costly to leave the market may remain active competitors, even if underperforming, leading to prolonged price wars and market share battles. In 2024, while many smaller software players faced consolidation pressures, enterprise clients' long-term contracts often kept them engaged with existing providers.

| Factor | Impact on Rivalry | Example/Data Point |

|---|---|---|

| Number of Competitors | High | Global tech giants and niche specialists compete in embedded and mobile software. |

| Switching Costs | Low | Average cloud software switching time decreased by 15% by early 2024. |

| Exit Barriers | High | Specialized assets and long-term contracts keep firms engaged in the market. |

| Differentiation Potential | Moderate to High | Unique features in automotive embedded software (2024 demand) allow value-based competition. |

SSubstitutes Threaten

The threat of substitutes for ACCESS's software offerings is significant, particularly concerning the price-performance trade-off. Customers can opt for open-source alternatives to proprietary operating systems, which often come at a lower direct cost, or choose simpler, less feature-rich embedded solutions that still fulfill basic functional needs without the premium associated with ACCESS's advanced capabilities.

For instance, in the automotive embedded software market, while ACCESS's infotainment solutions are robust, a manufacturer might consider a less integrated, more basic system if cost savings are paramount and the advanced features are not critical for their target demographic. The availability of these alternatives means ACCESS must continuously demonstrate the value and superior performance of its integrated solutions to justify its pricing.

Customer willingness to switch to alternatives hinges on how much value they perceive, how easy it is to make the switch, and the associated risks. For instance, in the automotive sector, where integrating a new vehicle into an existing ecosystem of parts and services can be complex, customers are less likely to switch unless a new option offers substantially better performance or cost savings.

In 2024, the growing demand for electric vehicles (EVs) illustrates this dynamic. While traditional gasoline-powered cars remain a substitute, the increasing availability of charging infrastructure and government incentives are lowering the barriers to EV adoption, thereby increasing customer propensity to substitute for those seeking sustainability and lower running costs.

Rapid technological advancements, especially in AI and cloud computing, are a significant driver for new substitutes. For example, the rise of cloud-native applications is diminishing the demand for traditional on-premise software solutions. In 2024, the global cloud computing market is projected to reach over $600 billion, highlighting the shift away from older technologies.

AI-powered content generation tools are also emerging as potent substitutes, impacting industries like digital publishing and marketing. These tools can automate tasks previously requiring human creative input, potentially reducing the need for certain specialized services. The AI market itself saw substantial growth in 2024, with investment in AI technologies reaching record highs, signaling a disruptive force for established business models.

Indirect Substitutes

Beyond direct software replacements, indirect substitutes can also pose a significant threat to ACCESS. For instance, in the automotive sector, evolving consumer preferences toward ride-sharing services or enhanced public transportation networks could indirectly diminish the demand for in-car infotainment systems. This shift in mobility trends directly impacts ACCESS's automotive software business by reducing the market for its core offerings.

Consider the broader implications of changing consumer behavior. As urban populations grow and environmental concerns intensify, the appeal of personal vehicle ownership might wane. This could lead to a substantial decrease in the number of vehicles sold, consequently shrinking the addressable market for embedded automotive software solutions like those provided by ACCESS. For example, by 2024, projections indicated continued growth in the global ride-sharing market, with companies like Uber and Lyft expanding their services and user bases, signaling a potential shift away from traditional car ownership.

- Shifting Mobility Trends: Increased adoption of ride-sharing and public transport directly competes with the need for personal vehicle features, impacting automotive software demand.

- Reduced Vehicle Sales: A decline in personal car ownership, driven by alternative mobility solutions, directly shrinks the market for embedded software.

- Consumer Behavior Evolution: Growing preference for convenience and cost-effectiveness over ownership can steer consumers away from features tied to private vehicles.

Regulatory or Industry Shifts

ACCESS faces a significant threat from substitutes due to potential regulatory or industry shifts. For instance, a move towards greater interoperability and hardware-agnostic solutions could diminish the appeal of ACCESS's current proprietary platforms. This is particularly relevant as global regulators increasingly scrutinize platform dominance and push for open standards to foster competition and innovation.

For example, in 2024, the European Union's Digital Markets Act (DMA) continued to enforce stricter rules on gatekeeper platforms, encouraging the adoption of alternative services and technologies. Such regulatory tailwinds could empower substitute offerings that are more flexible and less tied to specific hardware ecosystems, directly impacting ACCESS's market position.

The evolving business landscape also plays a crucial role. A heightened emphasis on open-source software or cloud-based services that are easily integrated with various devices could present formidable substitutes. Companies might prioritize these adaptable solutions to avoid vendor lock-in and ensure future compatibility, a trend observed across multiple technology sectors in recent years.

This dynamic necessitates that ACCESS remains agile and responsive to these external pressures.

- Regulatory Push for Interoperability: Initiatives like the DMA in 2024 aim to level the playing field, potentially benefiting substitute technologies.

- Hardware-Agnostic Trend: Growing demand for flexible solutions that work across diverse devices favors substitutes over closed ecosystems.

- Rise of Open-Source and Cloud: These models offer adaptability and cost-effectiveness, posing a direct challenge to proprietary offerings.

- Need for Strategic Adaptation: ACCESS must continually assess and adapt its strategy to counter the threat posed by these evolving market dynamics.

The threat of substitutes for ACCESS's software is substantial, driven by cost-effectiveness and evolving consumer preferences. Open-source alternatives and simpler embedded systems offer competitive price points, while shifts in mobility, such as increased ride-sharing, reduce the demand for in-car features. Regulatory actions promoting interoperability also empower substitute technologies.

| Substitute Category | Key Drivers | Impact on ACCESS | 2024 Data/Projections |

|---|---|---|---|

| Open-Source Software | Lower direct cost, community support | Pressure on pricing, potential feature parity | Global open-source software market projected to grow significantly, exceeding hundreds of billions USD. |

| Simpler Embedded Solutions | Cost savings, fulfilling basic needs | Loss of market share for non-premium features | Growth in IoT devices with less complex software requirements. |

| Ride-Sharing & Public Transport | Convenience, cost savings, environmental concerns | Reduced demand for in-car infotainment, shrinking automotive market | Global ride-sharing market expected to continue robust growth, impacting personal vehicle sales. |

| Cloud-Native & AI Applications | Scalability, advanced functionality, automation | Disruption of traditional on-premise models, need for adaptation | Global cloud computing market projected to surpass $600 billion in 2024; AI market investment at record highs. |

Entrants Threaten

Entering markets like embedded software, mobile software, and advanced network technologies demands significant upfront capital. Developing sophisticated browser technologies or operating systems, for instance, can easily require hundreds of millions of dollars in research, development, and talent acquisition. This high barrier to entry, driven by substantial capital needs, effectively deters many potential new competitors.

Established companies in the automotive sector, like ACCESS, often leverage significant economies of scale. This means they can spread their substantial development, manufacturing, and distribution costs over a much larger volume of vehicles. For instance, in 2024, major automakers continued to invest billions in R&D and production infrastructure, creating a high cost barrier for any newcomer aiming to match their per-unit efficiency.

These scale advantages translate directly into cost competitiveness. New entrants would struggle to achieve the same low per-unit costs for components, manufacturing, and even customer support, making it challenging to offer comparable pricing or profit margins, especially in large-scale fleet deployments which are crucial for market penetration.

ACCESS's formidable proprietary technology, encompassing its browser technology, operating systems, and digital publishing solutions, creates a substantial hurdle for potential new entrants. This extensive intellectual property portfolio represents a significant investment and a deep well of expertise that is difficult to replicate.

New companies looking to enter this space would face the daunting task of either developing comparable technologies from scratch or acquiring licenses for existing ones, both of which are exceptionally expensive and time-consuming endeavors. For instance, the cost of R&D for advanced browser engines and operating systems can run into hundreds of millions of dollars annually, a barrier that few startups can overcome.

Access to Distribution Channels

New players face a significant hurdle in accessing established distribution channels, a key factor in the threat of new entrants. For a company like ACCESS, which has spent years building partnerships with major automotive OEMs, consumer electronics manufacturers, and large publishing houses, this presents a strong barrier.

These established relationships mean that new entrants will find it difficult to get their products or services integrated into existing platforms and supply chains. For instance, securing a deal with a major car manufacturer for in-car infotainment systems requires extensive negotiation and proven reliability, something newcomers lack.

- Difficulty in securing partnerships with major automotive OEMs, consumer electronics manufacturers, or large publishing houses.

- Established distribution and integration channels are difficult for new entrants to penetrate.

- ACCESS's long-standing relationships provide a competitive advantage against potential new market entrants.

Brand Identity and Customer Loyalty

Building a strong brand and fostering customer loyalty in the enterprise software and embedded solutions market is a lengthy and capital-intensive endeavor. New entrants face a significant hurdle in replicating the established trust and market presence that companies like ACCESS have cultivated over years of consistent delivery and support.

Existing, deep-rooted customer relationships and a demonstrable history of success, such as ACCESS's extensive portfolio and long-standing partnerships, create a formidable barrier. This proven track record makes it challenging for newcomers to penetrate the market and win over discerning enterprise clients who prioritize reliability and proven performance.

For instance, in 2024, the average enterprise sales cycle for complex software solutions can extend from six months to over two years, underscoring the difficulty new entrants face in establishing initial traction. Furthermore, customer retention rates in the enterprise software sector often exceed 80%, indicating the stickiness of established vendor relationships.

- Brand Equity: ACCESS's established brand recognition in specialized markets like automotive infotainment and digital TV reduces the perceived risk for new customers.

- Customer Loyalty: Long-term contracts and high switching costs in embedded solutions create a loyal customer base that is reluctant to adopt unproven alternatives.

- Investment Barrier: The substantial marketing and sales investment required to build brand awareness and acquire customers deters many potential new entrants.

- Trust Factor: A history of successful deployments and robust support infrastructure, a hallmark of established players, is crucial for gaining enterprise trust.

The threat of new entrants for ACCESS is moderate, primarily due to high capital requirements and established economies of scale. Developing sophisticated embedded software or browser technologies demands substantial investment, often in the hundreds of millions of dollars, as seen in 2024 R&D spending by tech giants. This financial barrier, coupled with the cost efficiencies achieved by established players through large-scale production, makes it difficult for newcomers to compete on price and profitability.

| Barrier Type | Description | Impact on New Entrants | Example (2024) |

|---|---|---|---|

| Capital Requirements | High upfront investment for R&D, talent, and infrastructure. | Deters many potential entrants. | Hundreds of millions for advanced browser engine development. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants struggle to match cost competitiveness. | Billions invested by automakers in production infrastructure. |

| Proprietary Technology & IP | Unique, hard-to-replicate software and patents. | Requires costly development or licensing for competitors. | ACCESS's extensive browser and OS portfolio. |

| Distribution Channels & Partnerships | Existing relationships with OEMs and publishers. | Difficult for new players to secure integration and market access. | Securing deals with major car manufacturers for infotainment systems. |

| Brand Equity & Customer Loyalty | Established trust and long-term customer relationships. | New entrants face challenges in customer acquisition and retention. | Enterprise software sales cycles of 6-24 months; >80% customer retention. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ACCESS leverages a comprehensive array of data, including financial statements, investor presentations, and industry-specific market research reports. We also incorporate insights from competitor announcements and trade publications to provide a robust understanding of the competitive landscape.