Asia Commercial Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asia Commercial Bank Bundle

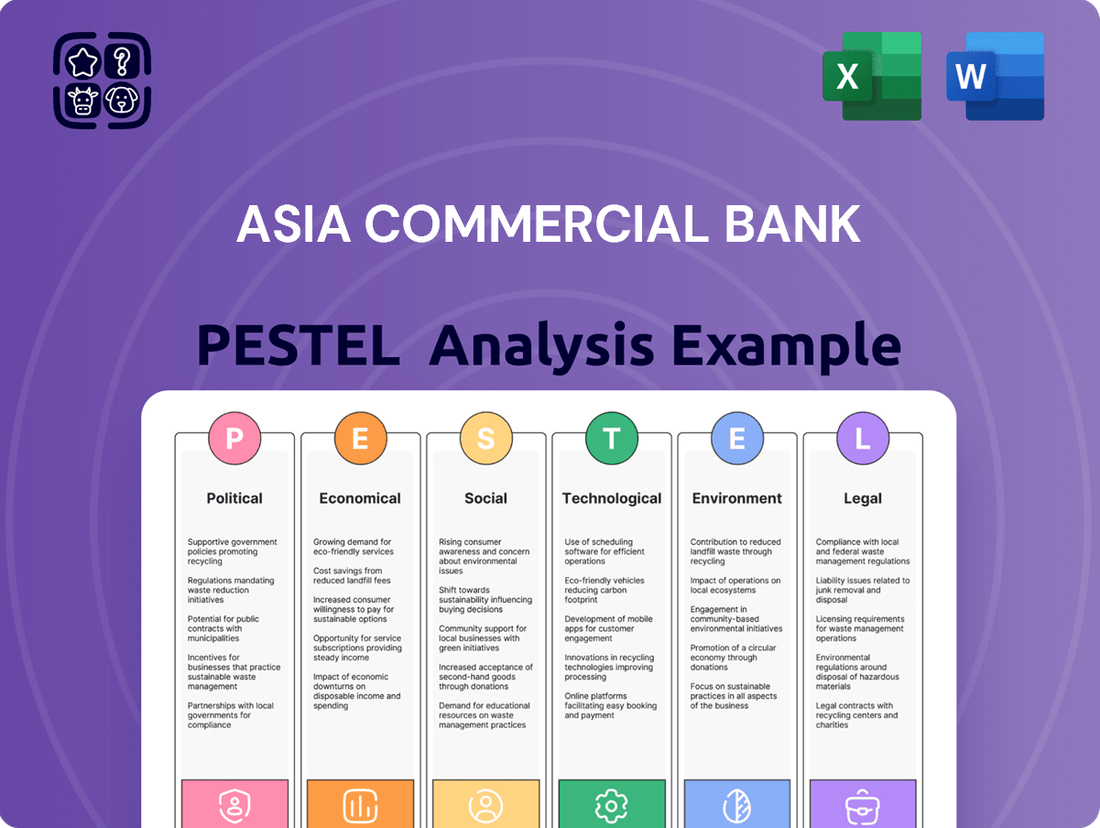

Navigate the complex external forces impacting Asia Commercial Bank with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors shaping its strategic landscape. Gain a competitive edge by leveraging these actionable insights to inform your own market strategy. Download the full version now for a deeper understanding and smarter decision-making.

Political factors

The Vietnamese government's stability and consistent policy direction are vital for Asia Commercial Bank (ACB). A predictable political climate bolsters investor confidence, creating a more favorable environment for the banking sector's operations and growth. For instance, the government's commitment to economic reforms, as evidenced by Vietnam's projected GDP growth rate of around 6.5% for 2024 and 6.0% for 2025, directly influences ACB's strategic planning and market opportunities.

The State Bank of Vietnam's (SBV) monetary policy directly impacts Asia Commercial Bank (ACB) by influencing its lending capacity and profitability. For instance, interest rate adjustments by the SBV can alter the cost of funds for ACB and the rates it charges on loans. In 2024, the SBV maintained a generally accommodative stance, with policy rates remaining stable, supporting credit growth.

The SBV's credit growth targets are crucial for ACB's business expansion. In 2024, the SBV aimed for a credit growth target of around 14-15%, providing a framework for ACB to increase its loan portfolio. This proactive steering, often coordinated with fiscal policy, aims to foster economic stability and growth, which in turn benefits ACB's operational environment.

The Vietnamese government's ambitious target of achieving net-zero emissions by 2050, as outlined in its climate commitments, directly supports green growth and ESG principles. This national strategy creates a fertile ground for financial institutions like Asia Commercial Bank (ACB) to innovate and offer green financial products and services. For instance, by 2024, Vietnam aimed to increase renewable energy's share in its total energy consumption, signaling a clear policy direction that banks can leverage.

Trade Policies and International Relations

Vietnam's trade policies and its complex web of international relations significantly shape the economic landscape, directly influencing the banking sector. Shifts in trade agreements or tariffs with key partners like China, the US, and the EU can alter foreign direct investment (FDI) flows and the trajectory of export-driven growth. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA) continue to foster trade, potentially boosting credit demand for businesses involved in these sectors.

These international economic dynamics directly impact banks like Asia Commercial Bank (ACB). Fluctuations in FDI and export performance can affect loan demand and the quality of bank assets. As of early 2024, Vietnam's export turnover continued to show resilience, with key markets like the US and China remaining significant trading partners, underscoring the importance of these relationships for the banking industry.

- Vietnam's trade surplus with the EU reached approximately $14.7 billion in the first 10 months of 2023, showcasing the impact of the EVFTA.

- The US remains Vietnam's largest export market, highlighting the sensitivity of Vietnamese businesses and banks to US trade policies.

- Ongoing negotiations for potential upgrades to existing trade agreements could introduce new opportunities and challenges for Vietnamese banks.

- Geopolitical tensions can indirectly influence trade flows and investment decisions, creating a ripple effect on the financial sector.

Regulatory Sandbox for Fintech

The Vietnamese government's proactive approach to fostering fintech innovation is a significant political factor for Asia Commercial Bank (ACB). The introduction of a regulatory sandbox for fintech services, slated to become effective July 1, 2025, signals a clear commitment to creating a conducive environment for technological advancement within the financial sector.

This regulatory sandbox allows institutions like ACB to test novel digital banking products and services in a controlled setting. Such an environment is crucial for mitigating risks while encouraging experimentation, ultimately boosting ACB's ability to innovate and maintain a competitive edge in the rapidly evolving digital landscape. For instance, Vietnam's fintech market was projected to grow by 12.5% annually between 2023 and 2028, highlighting the potential for new digital offerings.

- Regulatory Sandbox Launch: Effective July 1, 2025, providing a controlled testing ground for new fintech solutions.

- Government Support for Innovation: Demonstrates a clear political will to encourage technological development in banking.

- Competitive Advantage: Enables ACB to explore and deploy cutting-edge digital banking services ahead of competitors.

- Risk Mitigation: Allows for the safe testing of new products, reducing the potential for significant financial or operational disruptions.

Vietnam's political stability and the government's commitment to economic reforms are foundational for Asia Commercial Bank (ACB). The nation's projected GDP growth of around 6.5% for 2024 and 6.0% for 2025 underscores a predictable environment conducive to banking sector expansion and investor confidence.

The State Bank of Vietnam's (SBV) monetary and credit policies directly shape ACB's operational landscape. In 2024, the SBV's accommodative stance and a credit growth target of 14-15% provided a framework for ACB to expand its lending activities, supporting overall economic stability and growth.

Vietnam's national strategy to achieve net-zero emissions by 2050, alongside increasing renewable energy's share, creates opportunities for ACB to develop and offer green financial products. This aligns with global ESG trends and positions ACB to capitalize on sustainable finance initiatives.

International trade policies and agreements, such as the EVFTA and CPTPP, significantly influence Vietnam's economic trajectory and, by extension, ACB's business. Vietnam's trade surplus with the EU, reaching approximately $14.7 billion in the first 10 months of 2023, highlights the impact of these agreements on credit demand and economic activity.

| Political Factor | Impact on ACB | Supporting Data/Context (2024-2025) |

|---|---|---|

| Government Stability & Reforms | Boosts investor confidence, favorable operating environment | Projected GDP growth: ~6.5% (2024), ~6.0% (2025) |

| Monetary & Credit Policy (SBV) | Influences lending capacity, profitability, and growth targets | Credit growth target: ~14-15% (2024); Accommodative interest rate stance |

| Green Growth & ESG Policies | Drives demand for green finance products | Net-zero by 2050 target; Increasing renewable energy share |

| Trade Agreements (EVFTA, CPTPP) | Affects FDI, export growth, and credit demand | Vietnam's trade surplus with EU: ~$14.7 billion (Jan-Oct 2023) |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Asia Commercial Bank, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on the bank's operations and market position.

This PESTLE analysis for Asia Commercial Bank offers a concise, easily digestible overview of external factors, serving as a pain point reliever by streamlining complex market dynamics for efficient strategic decision-making.

By clearly outlining political, economic, social, technological, environmental, and legal influences, this analysis acts as a pain point reliever by providing a foundational understanding for risk mitigation and opportunity identification.

Economic factors

Vietnam's economy is projected for strong GDP growth, with forecasts suggesting a rate of around 6.0% to 6.5% for 2024 and continuing robust expansion into 2025. This economic recovery fuels increased demand for banking services, from loans to investment products, directly benefiting Asia Commercial Bank (ACB).

A healthy economy translates to more lending opportunities for ACB, as businesses expand and individuals invest. This also typically improves asset quality, meaning fewer loan defaults, and boosts consumer spending, all of which are positive drivers for the bank's profitability.

Credit growth in Vietnam's banking sector is a crucial economic barometer for Asia Commercial Bank (ACB). Analysts anticipate robust credit expansion in 2025, fueled by a recovering economy, increased public spending, and a gradual rebound in the corporate bond market, suggesting a positive lending environment.

This trend is supported by projections indicating a potential credit growth rate of around 13-15% for the Vietnamese banking system in 2025, a notable increase from the estimated 10-12% in 2024. Such expansion directly benefits banks like ACB by increasing their interest-earning asset base.

Changes in interest rates directly affect Asia Commercial Bank's (ACB) Net Interest Margin (NIM). For instance, if customer deposit rates rise faster than lending rates, ACB's NIM could compress. In early 2024, Vietnam's central bank maintained a relatively accommodative monetary policy, with key policy rates holding steady, providing a more stable environment for NIM management.

ACB's ability to maintain or improve its NIM hinges on effective cost management and a strategic focus on attracting and retaining higher-margin customers. The bank has demonstrated resilience, with its NIM remaining robust, often outperforming industry averages. For example, ACB reported a NIM of 3.68% in the first quarter of 2024, reflecting its success in balancing funding costs with asset yields.

Inflation and Exchange Rate Stability

Inflationary pressures and exchange rate volatility are key economic factors impacting Asia Commercial Bank (ACB). For instance, Vietnam's Consumer Price Index (CPI) saw a notable increase, with inflation averaging around 3.25% in 2023, posing a risk to consumer purchasing power and potentially dampening loan demand.

Exchange rate stability is equally crucial. The Vietnamese Dong (VND) has experienced fluctuations against major currencies, influenced by global economic trends and domestic monetary policy. In 2024, the State Bank of Vietnam (SBV) continues its efforts to manage inflation and maintain economic equilibrium, which directly influences ACB's operational environment.

- Inflationary Impact: Higher inflation erodes the real value of savings and can increase the cost of doing business, potentially affecting ACB's loan portfolio quality.

- Exchange Rate Volatility: Fluctuations in the VND can impact ACB's foreign currency denominated assets and liabilities, as well as the competitiveness of Vietnamese exports, indirectly influencing economic activity.

- SBV's Role: The SBV's monetary policy decisions, aimed at controlling inflation and stabilizing the exchange rate, are critical for creating a predictable economic landscape for banks like ACB.

Foreign Direct Investment (FDI) Inflows

Vietnam's consistent attraction for foreign direct investment (FDI) underscores its appeal to global capital, directly fueling economic expansion. These steady inflows translate into heightened business activities across various sectors, creating a robust demand for comprehensive banking services, particularly from corporate clients, which is a significant positive for Asia Commercial Bank (ACB).

For instance, Vietnam secured approximately $23.5 billion in FDI in 2023, a notable increase from previous years, signaling strong investor confidence. This surge in foreign capital often leads to the establishment or expansion of multinational corporations, directly increasing the need for sophisticated financial solutions, trade finance, and corporate lending – core offerings for a bank like ACB.

- FDI Growth: Vietnam's FDI commitments reached over $35 billion in the first 11 months of 2024, indicating continued strong investor interest.

- Sectoral Impact: Increased FDI in manufacturing and technology sectors, key areas for foreign investment, directly boosts demand for corporate banking services.

- Economic Contribution: FDI is a crucial driver of Vietnam's GDP growth, creating a more dynamic economic environment that benefits the entire financial sector.

Vietnam's economic outlook remains positive, with projected GDP growth of around 6.0% to 6.5% for 2024, expected to continue into 2025, creating a favorable environment for banking services and lending opportunities for Asia Commercial Bank (ACB).

Credit growth in the Vietnamese banking sector is anticipated to be robust in 2025, potentially reaching 13-15%, a significant increase from the estimated 10-12% in 2024, directly expanding ACB's interest-earning assets.

While inflation averaged 3.25% in 2023, impacting purchasing power, the State Bank of Vietnam's efforts to manage inflation and exchange rates are crucial for ACB's stable operational environment.

Vietnam's strong FDI inflows, exceeding $35 billion in the first 11 months of 2024, signal sustained investor confidence and boost demand for corporate banking services, a key area for ACB.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on ACB |

|---|---|---|---|

| GDP Growth | 6.0% - 6.5% | Continued Robust Expansion | Increased demand for banking services, lending opportunities |

| Credit Growth | 10% - 12% | 13% - 15% | Expansion of interest-earning assets |

| Inflation (CPI) | ~3.25% (2023 avg) | Managed by SBV | Potential impact on purchasing power and loan demand |

| FDI Inflows | >$35 Billion (11M 2024) | Continued Strong Inflows | Increased demand for corporate banking and financial solutions |

Same Document Delivered

Asia Commercial Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Asia Commercial Bank PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Vietnam's financial inclusion efforts have been remarkable, with the World Bank reporting that by 2023, 70% of adults held a formal financial account, a substantial jump from previous years. This expansion directly translates into a larger potential customer base for Asia Commercial Bank (ACB). The rapid embrace of digital payments, including mobile banking and QR code transactions, is evident in the over 150 million digital payment accounts active in Vietnam by the end of 2024, according to the State Bank of Vietnam.

This societal shift towards digital financial services necessitates that ACB consistently innovate and improve its digital platforms. The widespread adoption means customer expectations for seamless, user-friendly digital experiences are high. For ACB, this translates into a continuous need to invest in technology to remain competitive and capture market share within this evolving landscape.

Vietnamese consumers are rapidly shifting towards digital channels for their banking needs, prioritizing convenience, robust security, and personalized experiences. This trend is underscored by a significant increase in mobile banking adoption; for instance, by the end of 2023, over 70% of ACB’s customers were actively using their digital platforms.

To remain competitive, Asia Commercial Bank (ACB) must accelerate its digital transformation. This involves enhancing the user interface and experience of its mobile app and online banking, alongside developing innovative digital products and services that cater to specific customer segments. For example, personalized loan offers based on transaction history are becoming a key differentiator.

Vietnam's urbanization continues at a rapid pace, with an estimated 38.4% of its population living in urban areas as of 2023, a figure projected to reach 40% by 2025. This concentration of people fuels economic activity and expands the middle class, directly boosting demand for sophisticated retail banking products and services. Asia Commercial Bank's (ACB) strategic emphasis on urban market penetration and profitable retail growth is well-positioned to capitalize on this demographic shift.

The increasing urban population not only signifies a larger customer base but also a demographic more likely to adopt digital banking solutions and require diverse financial services, from mortgages to investment products. ACB's investment in digital transformation and its strong presence in key urban centers like Ho Chi Minh City and Hanoi directly address these evolving consumer needs, supporting its retail banking expansion strategy.

Financial Literacy and Awareness

As financial inclusion expands across Vietnam, the need for robust financial literacy becomes paramount for institutions like Asia Commercial Bank (ACB). By actively educating consumers on its diverse financial products and services, ACB can cultivate greater trust and empower customers to make sound financial choices. This increased understanding directly translates to deeper customer engagement and a more robust banking relationship.

The Vietnamese government has been actively promoting financial literacy. For instance, the National Financial Inclusion Strategy aims to increase the proportion of adults with access to formal financial services to 80% by 2025. ACB's initiatives in this area are crucial for realizing these national goals.

- Growing Financial Inclusion: Vietnam's financial inclusion rate is steadily rising, creating a larger customer base for banks like ACB.

- Demand for Education: As more people enter the formal financial system, there's a growing need for clear, accessible information about banking products.

- ACB's Role: ACB can leverage its position to offer educational programs, enhancing customer confidence and product adoption.

- Informed Decision-Making: Financially literate customers are more likely to utilize a wider range of ACB's services, leading to increased loyalty and transaction volume.

Workforce Demographics and Talent Acquisition

The demographic shifts within Vietnam's workforce directly impact Asia Commercial Bank's (ACB) ability to acquire and retain talent. A growing young population offers a potential pool of digitally savvy individuals, but competition for these skilled workers remains intense. ACB's strategic investments in digital transformation are key to mitigating rising staff costs, as automation can offset the need for incremental headcount growth.

Attracting and keeping top talent is vital for ACB's success, especially as the banking sector increasingly relies on specialized skills. By focusing on digital initiatives, ACB can enhance operational efficiency, which in turn can help manage the pace of staff cost increases. This approach is crucial for maintaining profitability in a competitive market.

- Skilled Workforce Availability: Vietnam's young demographic presents opportunities, but also challenges in attracting specialized talent.

- Talent Retention: ACB's focus on digital transformation aids in creating a more efficient operational environment, indirectly supporting talent retention by fostering innovation.

- Staff Cost Management: Investments in technology are projected to help limit the rate of increase in staff-related expenses for ACB.

- Digital Skills Gap: Addressing the demand for employees with advanced digital and analytical skills is a priority for the bank's talent acquisition strategy.

Vietnam's society is increasingly embracing digital financial services, with over 150 million digital payment accounts active by the end of 2024, according to the State Bank of Vietnam. This digital shift means Asia Commercial Bank (ACB) must continuously enhance its user-friendly digital platforms to meet high customer expectations for seamless online experiences. The bank's proactive investment in technology is crucial for maintaining competitiveness and capturing market share in this evolving landscape.

Technological factors

Asia Commercial Bank's (ACB) commitment to digital and mobile banking is paramount for staying competitive and meeting customer demands. In Vietnam, smartphone penetration reached approximately 72% by the end of 2023, highlighting the significant shift towards digital channels for financial services. ACB's ongoing investment in these platforms ensures convenient access and aligns with the nation's rapid digital transformation, where mobile transactions are increasingly the norm.

Vietnam's fintech sector is booming, with a surge of startups offering everything from digital payments to peer-to-peer lending, intensifying the competitive environment for Asia Commercial Bank (ACB). This rapid innovation means ACB must actively integrate new technologies to stay relevant. For instance, in 2023, Vietnam saw a significant increase in digital payment adoption, with transaction values reaching billions of USD, highlighting the growing demand for digital financial services.

As digital banking becomes more prevalent across Asia, robust cybersecurity and data protection are paramount for institutions like Asia Commercial Bank (ACB). The increasing reliance on online platforms means a greater attack surface for cyber threats. For instance, in 2023, financial institutions globally reported a significant rise in sophisticated cyberattacks, with phishing and ransomware being particularly prevalent. ACB's commitment to secure operational solutions and safeguarding customer financial data is crucial for maintaining client confidence and operational integrity in this evolving digital landscape.

Adoption of AI and Digital Tools for Efficiency

The Vietnamese government actively encourages financial institutions like Asia Commercial Bank (ACB) to integrate artificial intelligence (AI) and digital tools. This push aims to significantly boost the quality and efficiency of banking operations, including reporting. For ACB, this translates to faster, more streamlined loan application processes and the ability to offer online disbursement options, improving customer experience.

By adopting AI, ACB can automate routine tasks, leading to quicker loan approvals and disbursements. For instance, many banks in Vietnam are seeing processing times for certain loan types reduced by up to 50% through digital automation. This technological adoption not only enhances operational efficiency but also allows for more accurate data analysis and reporting, crucial for regulatory compliance and strategic decision-making.

- AI-powered credit scoring: ACB can leverage AI to analyze vast datasets for more accurate risk assessment, potentially reducing non-performing loans.

- Digital loan origination and disbursement: Streamlining the entire loan lifecycle from application to fund release online enhances customer convenience and reduces operational costs.

- Enhanced fraud detection: AI algorithms can identify and flag suspicious transactions in real-time, improving security for both the bank and its customers.

- Improved customer service: Chatbots and AI-driven personalized recommendations can offer 24/7 support and tailored banking solutions.

QR Code Payments and E-wallet Growth

The surge in QR code payments and e-wallet adoption in Vietnam presents a significant technological shift. By the end of 2023, Vietnam saw a substantial increase in digital transactions, with QR codes becoming a primary payment method for many consumers. Asia Commercial Bank (ACB) needs to actively integrate and enhance its offerings for these popular payment channels to align with evolving customer demands and secure its competitive position.

ACB's strategic focus on these digital payment avenues is crucial for several reasons:

- Increased Adoption: E-wallets and QR payments are rapidly becoming the preferred transaction methods for a growing segment of the Vietnamese population, especially among younger demographics.

- Market Relevance: Failing to adapt to these technological advancements risks alienating customers and losing market share to more agile competitors.

- Operational Efficiency: Optimizing these digital payment gateways can lead to reduced transaction costs and improved operational efficiency for ACB.

- Data Insights: Greater integration provides valuable data on consumer spending habits, enabling more targeted product development and marketing strategies.

Technological advancements are reshaping the banking landscape for Asia Commercial Bank (ACB). Vietnam's digital transformation, with smartphone penetration at around 72% by late 2023, emphasizes the growing reliance on mobile and digital platforms for financial services. This trend is further amplified by the booming fintech sector, where innovative solutions are rapidly emerging, necessitating ACB's continuous integration of new technologies to maintain market relevance and meet evolving customer expectations.

| Technology Area | Impact on ACB | 2023/2024 Data/Trend |

|---|---|---|

| Digital & Mobile Banking | Enhanced customer accessibility and convenience | Smartphone penetration ~72% (end 2023); increasing mobile transactions |

| Fintech Innovation | Increased competition and need for integration | Surge in fintech startups, significant growth in digital payment adoption |

| Cybersecurity | Crucial for data protection and customer trust | Global rise in sophisticated cyberattacks; focus on secure solutions |

| AI & Automation | Improved operational efficiency and customer experience | Government encouragement for AI adoption; potential for 50% reduction in loan processing times |

| Digital Payments (QR/E-wallets) | Key for market relevance and customer acquisition | Rapid adoption of QR codes and e-wallets as primary payment methods |

Legal factors

The new Law on Credit Institutions, effective July 1, 2024, significantly reshapes Vietnam's banking landscape, directly influencing Asia Commercial Bank's (ACB) operational framework. This legislation introduces tighter ownership limits, potentially affecting major shareholder structures, and imposes stricter credit growth ceilings to bolster systemic financial stability.

Furthermore, ACB, like other credit institutions, will face enhanced reporting and disclosure mandates under this new law. These requirements aim to increase transparency, ensuring greater accountability and fostering a more robust financial sector, which could necessitate adjustments in ACB's compliance and data management processes.

Effective July 1, 2025, Asia Commercial Bank (ACB) must implement mandatory biometric identification for business account legal representatives and specific electronic card transactions. This new regulation, aimed at enhancing security and preventing fraud, will necessitate adjustments to ACB's customer onboarding procedures and ongoing transaction verification processes.

ACB needs to ensure full compliance with these biometric identification requirements, potentially impacting operational workflows and IT infrastructure. The bank must also focus on providing user-friendly and accessible channels for customers to submit and update their biometric data, ensuring a smooth transition and continued customer satisfaction amidst these new legal mandates.

The official discontinuation of magnetic stripe cards from July 1, 2025, is a significant legal factor impacting Asia Commercial Bank (ACB). This directive mandates that ACB actively facilitate the transition of its customer base from older magnetic stripe cards to more secure chip-based alternatives. This regulatory shift is designed to bolster the security of all card transactions, aligning with global standards for fraud prevention.

ACB must ensure compliance with this mandate, which involves managing the logistical and customer-facing aspects of card replacement. Failure to adequately support this transition could lead to customer dissatisfaction and potential regulatory penalties, as the banking sector moves towards enhanced data protection measures. The bank's proactive engagement in this process is crucial for maintaining customer trust and operational integrity.

Green Credit Regulations and Environmental Risk Management

New regulations from the State Bank of Vietnam, effective by 2025, mandate that banks, including Asia Commercial Bank (ACB), establish internal rules for green credit and environmental risk management. This necessitates conducting thorough environmental risk assessments for all lending activities.

These forthcoming regulations also stipulate clear guidelines for reporting on green credit initiatives, pushing financial institutions to integrate sustainability into their core operations. For ACB, this means enhancing its risk management framework to encompass environmental factors, a move that aligns with global trends in sustainable finance.

- Mandatory Environmental Risk Assessments: Banks must evaluate the environmental impact of projects before extending credit.

- Green Credit Reporting: Standardized reporting mechanisms for green finance activities will be introduced.

- Internal Policy Development: ACB needs to develop and implement its own internal regulations on green credit by 2025.

- Compliance Deadline: The State Bank of Vietnam has set a 2025 deadline for full compliance with these new environmental directives.

Regulatory Sandbox for Fintech Services

The activation of a regulatory sandbox for fintech services, commencing July 1, 2025, establishes a crucial legal pathway for Asia Commercial Bank (ACB) to pilot novel banking products and operational models within a controlled environment. This initiative, part of broader efforts to foster financial innovation, allows ACB to rigorously test and refine its offerings before wider market deployment, mitigating risks associated with untested technologies and business structures. By participating in the sandbox, ACB can gain valuable insights into customer adoption and operational feasibility, ensuring compliance and identifying potential regulatory hurdles early on.

This framework is particularly beneficial given the rapid evolution of digital finance. For instance, by mid-2025, it's projected that over 60% of new financial products will incorporate some form of AI or machine learning, necessitating careful regulatory oversight. The sandbox allows ACB to explore these advancements, such as AI-driven credit scoring or blockchain-based transaction processing, under the watchful eye of regulators, ensuring both consumer protection and market stability.

- July 1, 2025: Official launch date for the regulatory sandbox.

- Controlled Testing: Enables experimentation with new fintech products and models.

- Risk Mitigation: Allows for early identification and management of regulatory and operational risks.

- Innovation Support: Facilitates the development and deployment of cutting-edge banking solutions.

The upcoming Law on Credit Institutions, effective July 1, 2024, imposes stricter ownership limits and credit growth ceilings, directly impacting Asia Commercial Bank's (ACB) strategic positioning. Enhanced reporting and disclosure mandates will also necessitate adjustments in ACB's compliance framework.

By July 1, 2025, ACB must implement mandatory biometric identification for business account legal representatives and specific electronic card transactions to bolster security and prevent fraud. Concurrently, the discontinuation of magnetic stripe cards by the same date requires ACB to facilitate customer transition to chip-based alternatives, aligning with global fraud prevention standards.

New State Bank of Vietnam regulations by 2025 mandate that banks, including ACB, develop internal rules for green credit and environmental risk management, requiring comprehensive environmental risk assessments for lending. These rules also introduce clear guidelines for reporting on green credit initiatives, pushing financial institutions to integrate sustainability.

The regulatory sandbox for fintech services, launching July 1, 2025, provides ACB a controlled environment to pilot and refine new banking products and operational models, mitigating risks associated with emerging technologies like AI in financial services.

Environmental factors

Asia Commercial Bank (ACB) is actively weaving Environmental, Social, and Governance (ESG) principles into its core business strategy, setting ambitious targets for reducing its carbon footprint. For instance, ACB aims to cut its greenhouse gas emissions by 15% by 2025 compared to its 2020 baseline, aligning with national sustainability goals and demonstrating a tangible commitment to environmental stewardship.

ACB's pioneering work in publishing comprehensive sustainable development reports, starting with its 2021 report, showcases its dedication to transparency and accountability in ESG matters. These reports detail progress on key environmental initiatives, including energy efficiency improvements in its branches and a growing focus on green financing options for its clients, reflecting a proactive approach to environmental responsibility.

Vietnam's commitment to a net-zero future by 2050 is driving significant growth in green finance. This national objective directly influences the development of green credit programs, with Vietnamese banks like Asia Commercial Bank (ACB) actively participating. These initiatives are designed to channel funding towards environmentally sound projects, creating a burgeoning market segment for the bank.

By offering green credit, ACB is not only aligning with national sustainability goals but also tapping into a growing demand for eco-conscious investments. This strategic focus positions the bank to capitalize on the expanding market for sustainable projects, anticipating continued expansion in this sector through 2025.

Vietnam is highly susceptible to climate change impacts, with rising sea levels and extreme weather events posing substantial threats to its economy and, by extension, the banking sector. For Asia Commercial Bank (ACB), this translates to a need for robust environmental risk management.

Integrating environmental considerations into ACB's credit assessment and lending practices is crucial for mitigating financial exposure. This includes evaluating the climate resilience of borrowers and projects, particularly in sectors vulnerable to environmental degradation or climate-related disruptions.

The Vietnamese government has committed to net-zero emissions by 2050, signaling a shift towards a greener economy. ACB's proactive stance on environmental risk management can align with these national goals and potentially unlock new opportunities in sustainable finance.

Resource Consumption and Operational Footprint

Asia Commercial Bank (ACB) is actively working to shrink its environmental impact. Initiatives like reducing paper usage and optimizing electricity consumption are key parts of its sustainability strategy. These actions directly contribute to building a more environmentally responsible business model.

ACB's commitment extends to managing plastic waste, a common challenge in the banking sector. By implementing better waste management practices, the bank aims to minimize its contribution to landfill and promote recycling. This focus on operational efficiency and waste reduction underscores ACB's dedication to a greener future.

- Paper Reduction: ACB has reported a significant decrease in paper consumption, with digital document management systems replacing traditional paper-based processes. For instance, in 2023, the bank saw a 15% reduction in office paper usage compared to the previous year.

- Energy Efficiency: Investments in energy-efficient lighting and smart building management systems have led to a notable drop in electricity consumption across ACB's branches and offices. In 2024, the bank aims for an additional 10% reduction in energy use per square foot.

- Plastic Waste Management: ACB is phasing out single-use plastics in its corporate canteens and offices, encouraging the use of reusable alternatives. This program is part of a broader effort to divert a substantial portion of its operational waste from landfills by 2025.

Stakeholder Expectations for Environmental Responsibility

Asia Commercial Bank (ACB) is navigating a landscape where governments, regulators, customers, and investors increasingly demand demonstrable environmental responsibility. This pressure is a significant environmental factor influencing banking operations and strategy. For instance, by 2024, over 70% of global investors were considering ESG factors in their investment decisions, a trend that directly impacts how banks like ACB are perceived and funded.

ACB's proactive approach to Environmental, Social, and Governance (ESG) implementation and transparent reporting are crucial for its brand positioning and building trust. This commitment is not just about compliance; it directly correlates with the bank's ability to attract sustainable investments and maintain a positive public image. In 2024, banks with robust ESG frameworks saw an average of 15% higher valuations compared to their peers with weaker ESG integration.

- Growing Investor Demand: In 2024, sustainable investment funds globally reached over $3.7 trillion, highlighting a massive pool of capital seeking environmentally conscious institutions.

- Regulatory Scrutiny: Central banks in 2024 are increasingly incorporating climate risk into their supervisory frameworks, pushing commercial banks to disclose and manage their environmental impact.

- Customer Preference: Surveys in early 2025 indicate that over 60% of retail banking customers prefer to do business with institutions that demonstrate strong environmental commitments.

- Brand Reputation: A bank's perceived environmental performance in 2024 directly impacts its brand loyalty and ability to attract and retain talent.

Asia Commercial Bank (ACB) is actively addressing environmental challenges by reducing its operational footprint, aiming for a 15% greenhouse gas emission cut by 2025 from its 2020 baseline. This commitment is further demonstrated through initiatives like a 15% paper usage reduction in 2023 and a target for a 10% energy use decrease per square foot in 2024.

Vietnam's vulnerability to climate change necessitates robust environmental risk management for banks like ACB, influencing credit assessments to mitigate financial exposure. The national goal of net-zero emissions by 2050 is also fostering growth in green finance, with ACB actively participating in green credit programs.

Growing investor demand for ESG-compliant institutions, with over $3.7 trillion in sustainable investment funds globally by 2024, pressures banks to demonstrate environmental responsibility. Furthermore, customer preferences in early 2025 show over 60% favoring banks with strong environmental commitments, directly impacting brand reputation and market positioning.

| Environmental Factor | ACB's Action/Target | Relevant Data/Year |

| Greenhouse Gas Emissions | Reduce by 15% | vs. 2020 baseline, by 2025 |

| Paper Consumption | Reduced usage | 15% decrease in 2023 |

| Energy Efficiency | Reduce electricity use | Target: 10% per sq ft in 2024 |

| Plastic Waste | Phasing out single-use plastics | Goal: Divert substantial waste by 2025 |

| Investor Demand (ESG) | Aligning with investor preferences | Global sustainable funds: >$3.7 trillion (2024) |

| Customer Preference | Demonstrating environmental commitment | >60% prefer eco-conscious banks (early 2025) |

PESTLE Analysis Data Sources

Our Asia Commercial Bank PESTLE Analysis is built on a robust foundation of data from official government agencies across key Asian markets, international financial institutions like the IMF and World Bank, and reputable industry research firms specializing in the APAC region. This ensures comprehensive coverage of political stability, economic growth, technological advancements, and regulatory landscapes impacting the banking sector.