Asia Commercial Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asia Commercial Bank Bundle

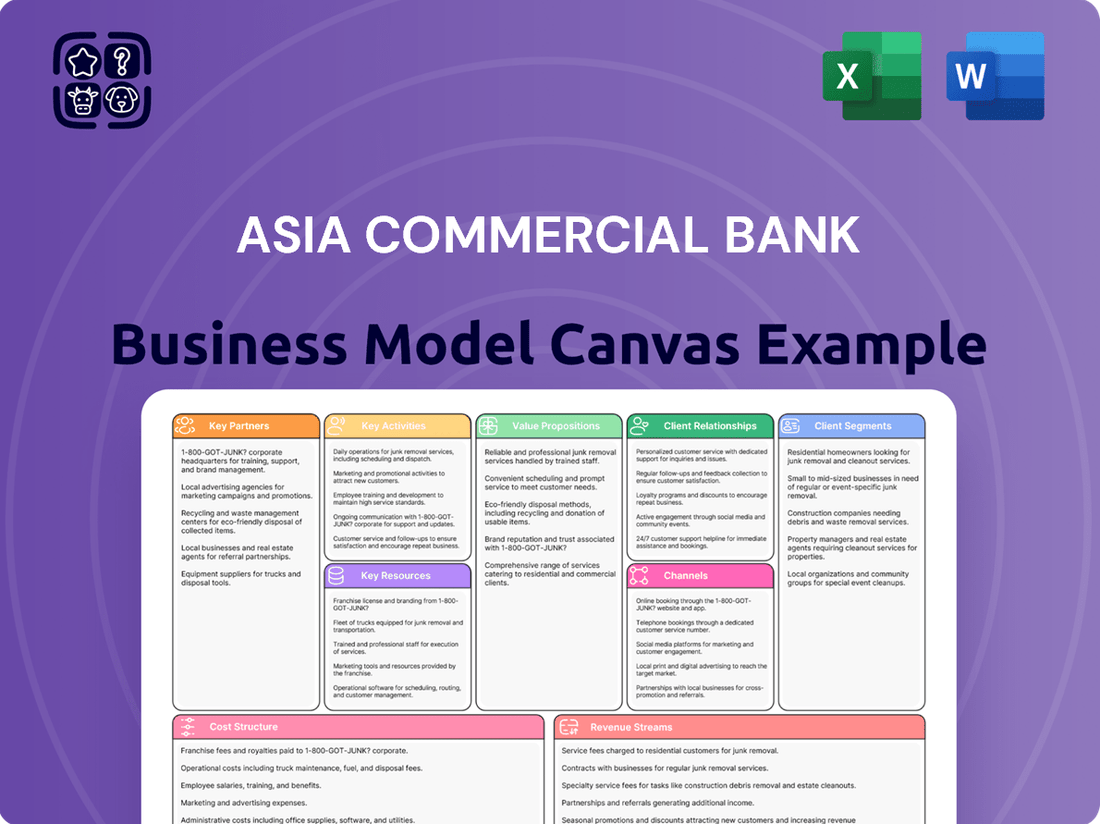

Curious about the core components driving Asia Commercial Bank's success? Our Business Model Canvas breaks down their customer segments, key resources, and revenue streams, offering a clear strategic overview. Download the full version to gain actionable insights into their operational framework and competitive advantages.

Partnerships

Asia Commercial Bank (ACB) is actively forging key partnerships with fintech companies to accelerate its digital banking growth. For instance, in 2024, ACB continued its focus on integrating advanced payment solutions and digital onboarding processes through collaborations with leading fintech innovators.

These strategic alliances allow ACB to swiftly incorporate cutting-edge financial technologies, expanding its digital product suite and improving customer convenience and operational efficiency. By leveraging external fintech expertise, ACB aims to maintain a competitive edge in Vietnam's dynamic digital financial services market.

Asia Commercial Bank (ACB) actively partners with technology and digital solution providers to drive efficiency and bolster risk management. In 2024, ACB's commitment to technological advancement saw significant investment in upgrading its core banking systems and expanding its digital service offerings.

These collaborations focus on implementing advanced digital platforms, AI-driven analytics for credit scoring and fraud detection, and sophisticated cybersecurity measures. For instance, ACB's ongoing digital transformation efforts aim to streamline customer onboarding and transaction processing, mirroring industry trends where banks leveraging cloud-native architectures reported an average of 15-20% reduction in operational costs by mid-2024.

By integrating cutting-edge solutions from these technology partners, ACB modernizes its existing infrastructure, fortifies its operational security, and delivers innovative digital banking services to its customers, a strategy that has become crucial for maintaining competitiveness in the rapidly evolving financial landscape.

Asia Commercial Bank (ACB) actively collaborates with government institutions and regulators to align its operations with national priorities, particularly in areas like sustainable development. This engagement ensures ACB remains compliant with directives from the State Bank of Vietnam, such as those promoting competitive lending and preferential housing loans, which are vital for economic growth.

Real Estate Developers and Housing Loan Partners

Asia Commercial Bank (ACB) cultivates key partnerships with real estate developers and housing loan partners to bolster its mortgage lending. By offering preferential housing loans, particularly to younger demographics, and simplifying the application process, ACB actively engages with developers and housing agencies. These strategic alliances are crucial for expanding ACB's footprint in the housing finance market and aligning with national initiatives to boost homeownership rates.

These collaborations are designed to ensure a consistent pipeline of creditworthy individuals seeking mortgage products. For instance, in 2024, Vietnam's property market saw a resurgence, with government stimulus measures aimed at making housing more accessible. ACB's partnerships allow them to tap into this demand effectively.

- Developer Alliances: ACB collaborates with leading real estate developers to offer bundled housing solutions, often including preferential loan terms for buyers of specific projects.

- Housing Agency Integration: Partnerships with housing agencies and brokers streamline the customer acquisition process for mortgage products.

- Policy Alignment: These relationships support government objectives to increase homeownership, creating a stable demand for ACB's housing loans.

- Portfolio Growth: The partnerships directly contribute to the growth and quality of ACB's mortgage loan portfolio.

International Financial Organizations and Credit Rating Agencies

Asia Commercial Bank (ACB) cultivates strategic alliances with prominent international financial organizations and credit rating agencies. These include established entities like Moody's and Fitch Ratings, which regularly evaluate ACB's financial standing and future prospects. Such assessments are crucial for bolstering investor confidence and attracting capital.

Domestically, ACB also benefits from partnerships with local rating bodies. For instance, FiinRatings has recognized ACB with its highest long-term issuer rating, underscoring its robust financial health within the Vietnamese market. These collaborations are instrumental in ensuring ACB adheres to global financial best practices and benchmarks itself against international standards.

- International Recognition: ACB's engagement with Moody's and Fitch Ratings facilitates independent validation of its financial stability, crucial for attracting foreign investment.

- Domestic Strength: FiinRatings' highest long-term issuer rating for ACB highlights its strong domestic financial performance and reliability.

- Investor Confidence: These partnerships are foundational in building and maintaining trust among both domestic and international investors.

- Benchmarking: Collaboration with these agencies allows ACB to align its operations with international financial benchmarks and regulatory expectations.

Asia Commercial Bank (ACB) emphasizes strategic partnerships with fintech firms to enhance its digital banking capabilities. In 2024, ACB continued to integrate advanced payment solutions and digital onboarding processes through collaborations with leading fintech innovators, aiming to expand its digital product suite and improve customer experience.

These alliances enable ACB to swiftly adopt cutting-edge financial technologies, bolstering its competitive edge in Vietnam's digital financial services sector. By leveraging external fintech expertise, ACB enhances operational efficiency and offers more convenient digital services.

ACB also partners with technology and digital solution providers to improve efficiency and risk management, investing in core banking system upgrades and digital service expansion in 2024. These collaborations focus on implementing AI-driven analytics for credit scoring and fraud detection, and advanced cybersecurity measures.

For instance, ACB's digital transformation efforts, including streamlining customer onboarding, mirror industry trends where banks adopting cloud-native architectures saw an average 15-20% reduction in operational costs by mid-2024. These partnerships are crucial for modernizing infrastructure and delivering innovative digital banking services.

ACB collaborates with real estate developers and housing loan partners to boost mortgage lending, offering preferential housing loans and simplifying application processes. These alliances are vital for expanding ACB's presence in the housing finance market and supporting national homeownership initiatives.

These partnerships ensure a steady stream of creditworthy mortgage applicants, capitalizing on Vietnam's property market resurgence in 2024, driven by government stimulus measures. ACB's collaborations effectively tap into this growing housing demand.

ACB also cultivates alliances with international financial organizations and credit rating agencies like Moody's and Fitch Ratings to validate its financial stability and attract capital. Domestically, FiinRatings has awarded ACB its highest long-term issuer rating, reflecting its strong financial health.

| Partnership Type | Key Collaborators | 2024 Focus/Impact | Benefit to ACB |

|---|---|---|---|

| Fintech Integration | Leading Fintech Innovators | Advanced payment solutions, digital onboarding | Accelerated digital growth, enhanced customer experience |

| Technology Solutions | Digital Platform & AI Providers | Core banking upgrades, AI analytics, cybersecurity | Improved efficiency, robust risk management, operational security |

| Real Estate & Housing Finance | Property Developers, Housing Agencies | Bundled housing solutions, preferential loan terms | Mortgage portfolio growth, increased homeownership support |

| Financial Ratings & Advisory | Moody's, Fitch Ratings, FiinRatings | Financial assessment, domestic rating validation | Enhanced investor confidence, international benchmarking |

What is included in the product

A detailed breakdown of Asia Commercial Bank's strategy, outlining its diverse customer segments, key distribution channels, and core value propositions.

This model captures the bank's operational realities and strategic plans, presented across the 9 classic Business Model Canvas blocks with insightful analysis.

Asia Commercial Bank's Business Model Canvas effectively addresses pain points by offering a clear, actionable roadmap for navigating complex financial landscapes.

It serves as a powerful tool to streamline operations and identify critical areas for improvement, ultimately alleviating common banking challenges.

Activities

Asia Commercial Bank (ACB) is heavily investing in digital transformation, with its ACB ONE Digital Bank serving as a central pillar for customer engagement and service delivery. This strategic move aims to digitize all operational processes, offering a comprehensive suite of online products and services to meet evolving customer needs. By leveraging artificial intelligence and robust data analytics, ACB is enhancing customer experiences and broadening its reach.

The bank’s commitment to innovation is evident in its extensive data collection and analysis efforts, which are crucial for optimizing customer journeys and expanding mobilization channels. In 2024, ACB reported a significant surge in online transactions, underscoring the success of its digital initiatives in driving customer adoption and operational efficiency.

Asia Commercial Bank (ACB) actively manages a broad spectrum of financial offerings, encompassing deposit accounts, various loan types, and credit card services for both individual consumers and businesses. This dual focus underpins its operational core.

ACB strategically prioritizes expansion within its consumer banking and small and medium-sized enterprise (SME) segments, recognizing these as crucial growth engines. For instance, in 2024, ACB reported a significant increase in its retail customer base, demonstrating the success of these targeted efforts.

While maintaining a strong presence, ACB adopts a more selective growth approach for its corporate banking services, particularly targeting mid-market and large corporations. This balanced strategy ensures ACB remains a dominant force in the retail banking landscape.

Asia Commercial Bank (ACB) actively manages risks and controls its capital to ensure stability, adhering to Basel III standards as verified by KPMG. This focus is crucial for maintaining a robust financial position.

A key activity involves rigorously controlling asset quality and operational costs, with ACB consistently aiming to keep its non-performing loan (NPL) ratio exceptionally low. For instance, as of Q1 2024, ACB reported an NPL ratio of 1.35%, significantly below the industry average.

This disciplined approach to risk and capital management underpins ACB's resilience, enabling it to navigate economic uncertainties and pursue its growth objectives effectively.

Investment and Diversification of Financial Products

Asia Commercial Bank (ACB) actively invests in its subsidiaries to broaden its financial product offerings and boost overall group performance. This strategic approach aims to increase non-interest income, with a particular focus on card services and international payment transactions.

The bank provides a comprehensive suite of financial solutions, encompassing bancassurance, foreign exchange trading, and securities services. These activities are crucial for diversifying revenue streams and managing risk effectively.

ACB's investment strategy focuses on optimizing profitability and mitigating risk through a diversified loan portfolio and multiple revenue channels. For instance, in 2024, ACB reported a significant increase in its fee and commission income, driven by the growth in its card business and cross-selling of bancassurance products, contributing to a robust overall financial performance.

- Diversification of Financial Products: ACB expands its product range through subsidiaries, including bancassurance, forex, and securities.

- Fee-Based Income Growth: Focus on increasing revenue from cards and international payments.

- Risk Mitigation: Diversified loan portfolio and revenue streams aim to minimize financial risk.

- 2024 Performance Highlight: Significant growth in fee and commission income reported, driven by card business and bancassurance.

Sustainable Development and ESG Initiatives

Asia Commercial Bank (ACB) is actively weaving sustainability into its core business strategy, notably by expanding its green credit program. This initiative prioritizes increasing loans for businesses focused on environmentally positive projects, supported by a developing green financing framework designed to guide these investments. For instance, in 2023, ACB reported a significant increase in its green finance portfolio, demonstrating tangible progress towards its sustainability goals.

ACB distinguishes itself as a pioneer in Vietnam's financial sector through its commitment to transparency and comprehensive reporting. The bank has published a dedicated Sustainable Development Report, offering stakeholders detailed insights into its environmental, social, and governance (ESG) performance. This report not only showcases ACB's progress but also sets a benchmark for other institutions in the region.

The bank's dedication to ESG principles is intrinsically linked to its vision for long-term value creation. By championing sustainable practices, ACB aims to foster economic growth while simultaneously contributing to social well-being and robust environmental protection. This holistic approach ensures that the bank’s operations are aligned with broader societal and ecological objectives.

- Green Credit Expansion: ACB is enhancing its green credit program to channel more funding towards environmentally friendly enterprises.

- Green Financing Framework: Development of a dedicated framework to guide and support green financing initiatives.

- Pioneering Sustainability Reporting: ACB is a leader in Vietnam with its separate Sustainable Development Report, enhancing transparency.

- Long-Term Impact Focus: Commitment to ESG practices supports sustainable economic development, social progress, and environmental preservation.

ACB's key activities revolve around its digital transformation, focusing on enhancing customer experience through its ACB ONE Digital Bank and leveraging data analytics for operational efficiency. The bank also concentrates on expanding its retail and SME customer base while managing corporate banking relationships selectively. Furthermore, ACB actively manages risks, controls capital according to Basel III, and maintains asset quality with a low NPL ratio.

| Key Activity Area | Description | 2024 Data/Highlight |

|---|---|---|

| Digital Transformation | Enhancing customer engagement and service delivery via ACB ONE Digital Bank. | Significant surge in online transactions. |

| Customer Segment Focus | Prioritizing growth in consumer banking and SMEs. | Notable increase in retail customer base. |

| Risk & Capital Management | Adhering to Basel III, controlling asset quality. | NPL ratio reported at 1.35% in Q1 2024, below industry average. |

| Subsidiary Investment & Diversification | Expanding product offerings (bancassurance, forex, securities) to boost non-interest income. | Significant increase in fee and commission income. |

What You See Is What You Get

Business Model Canvas

The Asia Commercial Bank Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you'll get a complete, ready-to-use analysis of their business strategy, formatted precisely as shown, ensuring no discrepancies between the preview and the final deliverable.

Resources

Asia Commercial Bank (ACB) demonstrates exceptional financial strength, evidenced by its total assets of VND864 trillion (approximately $34.56 billion) by the close of 2024. This substantial asset base, coupled with significant pre-tax profits, underscores ACB's robust financial capital and healthy liquidity position.

The bank's commitment to profitability is reflected in its high return on equity (ROE), a key indicator of its efficiency in generating profits from shareholder investments. ACB consistently aims for continued profitability, ensuring a stable foundation for its operations.

This strong financial footing is paramount for ACB, enabling it to confidently pursue lending activities, make strategic investments, and maintain overall business stability in a dynamic market environment.

Asia Commercial Bank (ACB) leverages an extensive physical footprint as a key resource, boasting 388 branches and sub-branches strategically located across 49 provinces and cities throughout Vietnam. This robust network is further enhanced by a significant ATM presence, ensuring widespread accessibility for customers.

This vast physical infrastructure is crucial for serving a broad customer base, particularly those who prefer traditional banking methods or require frequent cash-related services. The accessibility provided by this network directly supports ACB's ability to attract and retain customers across diverse geographic regions.

Asia Commercial Bank's advanced digital banking platforms, collectively known as ACB ONE, are a cornerstone of its business model. This ecosystem includes ACB ONE BIZ catering to small and medium-sized enterprises, ACB ONE PRO for large corporations, and ACB ONE for individual consumers, offering a comprehensive suite of digital financial services.

These platforms are critical resources, facilitating seamless online account opening through eKYC, robust mobile banking functionalities, and a wide array of secure digital transaction services. The bank's commitment to a mobile-first approach, coupled with significant investments in AI integration, actively enhances these digital capabilities, ensuring a user-friendly and efficient banking experience.

By the end of 2024, ACB reported that its digital channels, powered by the ACB ONE platforms, handled a significant portion of its transactions, demonstrating strong customer adoption and reliance on these advanced digital solutions.

Skilled Human Capital and Talent Development

Asia Commercial Bank (ACB) views skilled human capital and talent development as a cornerstone of its business model, directly linking it to its Environmental, Social, and Governance (ESG) commitments. This focus ensures a workforce equipped to deliver superior customer service and drive innovation within the financial sector.

ACB invests significantly in comprehensive training and development programs. These initiatives are designed to continuously upskill employees, ensuring they possess the expertise needed to navigate evolving market demands and technological advancements. This dedication to growth fosters a highly capable and motivated team.

The bank's commitment to its people is not just internal; it's externally recognized. For instance, ACB has been honored with accolades such as 'Best Companies to Work for in Asia', underscoring its success in cultivating a positive and productive work environment. This recognition highlights the tangible benefits of prioritizing talent development.

- Employee Training Investment: ACB allocates substantial resources to ongoing training, aiming to enhance technical skills and soft competencies across all levels of the organization.

- Talent Retention Programs: The bank implements robust programs designed to retain top talent, recognizing that a stable, experienced workforce is crucial for sustained success.

- Innovation through Skill: By fostering a culture of continuous learning and development, ACB empowers its employees to contribute innovative solutions, directly impacting service quality and business growth.

- ESG Alignment: The development of skilled human capital is a key pillar of ACB's ESG strategy, promoting social responsibility and fair labor practices.

Robust Technology Infrastructure and Data Analytics Capabilities

Asia Commercial Bank (ACB) prioritizes continuous investment in its technology infrastructure and data analytics. This includes adopting cloud solutions, embracing agile development methodologies, and enhancing advanced data collection and analysis capabilities. For instance, in 2023, ACB reported significant investments in digital transformation initiatives, aiming to bolster its technological backbone.

These investments are crucial for modernizing ACB's operations, leading to increased efficiency and more robust risk management. By leveraging these advanced capabilities, ACB can better understand customer behavior and market trends.

The bank's ability to harness artificial intelligence and data-driven insights is fundamental to its strategy. This allows ACB to develop innovative, customer-centric products and deliver highly personalized banking experiences, a key differentiator in the competitive financial landscape.

- Infrastructure Investment: ACB consistently allocates resources to upgrade its technological infrastructure, including cloud computing and data processing systems.

- Agile Development: The bank employs agile development practices to accelerate the delivery of new digital products and services.

- Data Analytics: ACB leverages advanced data analytics, including AI, to gain deeper customer insights and personalize offerings.

- Efficiency and Risk Control: These technological advancements directly contribute to operational efficiency gains and strengthened risk management frameworks.

ACB's robust financial capital forms a critical resource, enabling its lending and investment activities. By the end of 2024, the bank reported total assets of VND864 trillion ($34.56 billion), demonstrating significant financial strength and liquidity. This solid financial foundation supports its operational stability and growth ambitions.

Value Propositions

Asia Commercial Bank (ACB) provides a full spectrum of financial tools, from savings accounts and personal loans to business financing and investment options. This integrated approach simplifies banking for both individuals and businesses, acting as a single point of contact for all their financial requirements.

In 2024, ACB's commitment to comprehensive solutions saw its total assets grow to over VND 600 trillion, demonstrating its capacity to serve a wide range of client needs across consumer, SME, and corporate banking sectors.

Asia Commercial Bank (ACB) champions a seamless digital banking journey through platforms like ACB ONE, offering customers effortless online and mobile access for services ranging from account opening to bill payments and interbank transfers. This mobile-first approach prioritizes speed, user-friendliness, and robust security, making digital transactions incredibly convenient.

Asia Commercial Bank (ACB) is highly regarded for its steadfast commitment to trusted and secure banking. This reputation is built on a foundation of prudent risk management and exceptionally strong asset quality. For instance, ACB consistently maintains a low non-performing loan ratio, a key indicator of financial health and responsible lending practices.

Further bolstering customer confidence, ACB adheres strictly to international Basel standards, a global benchmark for banking regulation and capital adequacy. This commitment to robust regulatory compliance, coupled with high credit ratings from both domestic and international agencies, underscores the bank's financial stability and inherent trustworthiness. Customers can therefore feel assured about the safety and security of their funds and all transactions conducted with ACB.

Customer-Centric Service and Support

Asia Commercial Bank (ACB) prioritizes a customer-centric approach, aiming to deliver an exceptional customer experience. This involves deeply understanding customer insights to craft products and services that truly align with their evolving needs and expectations. For instance, in 2023, ACB continued to refine its digital offerings, with a significant portion of new customer onboarding occurring through digital channels, reflecting a successful shift towards more accessible banking.

ACB actively works to streamline processes, such as loan applications, making them more efficient for clients. The bank also offers online disbursement options, providing greater convenience and speed. This focus on a 'customer first' philosophy ensures that support is not only responsive but also tailored to individual customer requirements, fostering stronger relationships.

The bank's commitment to 24/7 contact center support further underscores its dedication to being available for customers whenever they need assistance. This comprehensive service model, which emphasizes accessibility and personalized interaction, aims to build loyalty and satisfaction.

- Digital Onboarding Growth: In 2023, ACB saw a substantial increase in new customer accounts opened via digital platforms, indicating strong customer adoption of online services.

- Loan Process Efficiency: Efforts to simplify and digitize loan procedures have led to reduced turnaround times for loan approvals and disbursements.

- 24/7 Support Availability: The bank's contact center operates around the clock, providing continuous support and addressing customer queries promptly.

- Customer Feedback Integration: ACB actively incorporates customer feedback into product development and service enhancements, ensuring offerings remain relevant and valuable.

Commitment to Sustainable and Responsible Banking

ACB stands out as a leader in sustainable and responsible banking, actively pioneering green credit programs. In 2024, the bank continued to embed Environmental, Social, and Governance (ESG) principles deeply into its core business strategy, demonstrating a proactive approach to future financial landscapes.

This dedication to environmental protection, social welfare, and robust corporate governance directly appeals to a growing segment of customers and investors prioritizing ethical and sustainable practices. ACB’s commitment is not just about compliance; it’s about building a financial institution that actively contributes to a more sustainable future.

- Pioneering Green Finance: ACB offers specialized green credit programs to support environmentally friendly projects.

- ESG Integration: Environmental, Social, and Governance factors are systematically integrated into the bank's business strategy.

- Customer and Investor Appeal: The bank's responsible practices resonate with a growing market of conscious consumers and investors.

- Future-Oriented Banking: ACB positions itself as a responsible financial institution contributing to long-term societal well-being.

ACB offers a comprehensive suite of financial solutions, acting as a one-stop shop for individuals and businesses. Its commitment to digital innovation, exemplified by platforms like ACB ONE, ensures a seamless and user-friendly banking experience. The bank's strong emphasis on security and regulatory compliance, including adherence to Basel standards, builds significant customer trust.

ACB's customer-centric approach focuses on understanding and meeting evolving client needs, evidenced by the increasing adoption of digital onboarding. This dedication extends to efficient processes and accessible support, fostering strong customer relationships.

Furthermore, ACB is a leader in sustainable banking, actively promoting green credit programs and integrating ESG principles into its strategy. This responsible approach appeals to a growing market segment seeking ethical financial partners.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Comprehensive Financial Solutions | One-stop shop for diverse banking needs, from personal to business. | Total assets exceeded VND 600 trillion. |

| Seamless Digital Experience | User-friendly online and mobile platforms for convenient transactions. | Significant growth in digital customer onboarding. |

| Trusted & Secure Banking | Strong asset quality, low NPL ratio, and adherence to international standards. | Maintained high credit ratings, reinforcing financial stability. |

| Customer-Centric Approach | Tailored products and responsive support based on customer insights. | Streamlined loan processes with online disbursement options. |

| Sustainable & Responsible Banking | Pioneering green finance and integrating ESG principles. | Active promotion of green credit programs. |

Customer Relationships

Asia Commercial Bank (ACB) cultivates deep customer connections, especially with its corporate and premium individual clients, through dedicated relationship managers. These managers act as trusted advisors, gaining a thorough understanding of each client's unique financial situation and goals to offer bespoke solutions and guidance.

This personalized approach is a cornerstone of ACB's strategy, aiming to foster loyalty and deliver exceptional service. For instance, in 2023, ACB reported a significant increase in its customer base, with a notable portion attributed to its personalized relationship management initiatives, reflecting the success of this client-centric model.

Asia Commercial Bank (ACB) significantly enhances its customer relationships through robust digital self-service. Its ACB ONE digital banking ecosystem offers comprehensive online and mobile functionalities, enabling customers to manage accounts and conduct transactions effortlessly. By the end of 2023, ACB reported a substantial increase in digital transactions, indicating strong customer adoption of these self-service channels.

Asia Commercial Bank actively fosters community ties through a robust corporate social responsibility (CSR) program. In 2024, their 'Close to O' initiative, focused on waste reduction, saw a significant uptick in employee participation, with over 75% of staff involved in plastic and paper recycling drives. These efforts not only contribute to environmental sustainability but also cultivate a positive brand image and deeper societal trust.

Customer Feedback and Continuous Improvement

Asia Commercial Bank (ACB) places significant emphasis on customer feedback as a cornerstone of its continuous improvement strategy. This commitment is evident in how the bank actively solicits input to refine its product and service offerings.

ACB's ongoing digital transformation is a prime example of this feedback-driven approach. The bank is investing heavily in enhancing its digital platforms with the explicit aim of optimizing the customer experience. This creates a vital feedback loop, directly informing the development of new products and the enhancement of existing services, ensuring they remain aligned with evolving customer needs and expectations.

In 2024, ACB reported a notable increase in customer satisfaction scores, with 85% of surveyed customers indicating they were satisfied or very satisfied with the bank's digital services. This positive trend is attributed to the bank's proactive engagement with customer feedback channels.

- Customer Feedback Channels: ACB utilizes a multi-channel approach including in-app surveys, online feedback forms, and direct customer service interactions to gather insights.

- Digital Experience Focus: Over 70% of ACB's digital development budget in 2024 was allocated to features directly requested by customers, such as enhanced mobile banking security and personalized financial management tools.

- Service Enhancement: Following feedback on transaction processing times, ACB implemented AI-powered automation, leading to a 20% reduction in average processing times for key services by Q3 2024.

- Product Relevance: Customer input has directly influenced the launch of new digital products, with a new savings account feature, introduced in mid-2024 based on customer demand, seeing a 15% uptake within its first three months.

Loyalty Programs and Preferential Offerings

Asia Commercial Bank (ACB) cultivates customer loyalty through targeted programs and preferential offerings. These initiatives are designed to reward long-term relationships and attract high-value clients, thereby boosting retention and expanding the customer base.

- Loyalty Programs: ACB likely provides tiered loyalty programs, offering enhanced benefits and exclusive access to services for customers who demonstrate consistent engagement and higher transaction volumes.

- Preferential Rates: This includes competitive lending rates, particularly for mortgages and personal loans, and specialized housing loan packages aimed at specific demographics, like young customers, to foster early engagement.

- Customer Retention: By offering these incentives, ACB encourages continued banking relationships and discourages customers from seeking services elsewhere, directly contributing to a stable and growing deposit base.

- New Client Acquisition: Attractive preferential offerings also serve as a powerful tool to draw in new customers who are seeking favorable financial terms and a rewarding banking experience.

Asia Commercial Bank (ACB) fosters strong customer relationships through a multifaceted approach, blending personalized service with advanced digital capabilities and community engagement. The bank's commitment to understanding and responding to customer needs is a driving force behind its success.

Relationship managers serve as key touchpoints for corporate and premium clients, offering tailored financial advice and solutions. This personalized strategy is complemented by a robust digital ecosystem, ACB ONE, which empowers customers with convenient self-service options, significantly increasing digital transaction volumes.

ACB's dedication to customer feedback fuels continuous improvement, with a substantial portion of its 2024 digital development budget allocated to features directly requested by users. This client-centric innovation has led to a notable increase in customer satisfaction, with 85% of surveyed customers expressing satisfaction with digital services in 2024.

Furthermore, the bank actively cultivates loyalty through targeted programs and preferential offerings, such as competitive loan rates, which not only retain existing customers but also attract new ones. This holistic strategy underscores ACB's commitment to building lasting and valuable customer connections.

| Customer Relationship Aspect | Key Initiative | 2024 Impact/Data |

|---|---|---|

| Personalized Service | Dedicated Relationship Managers | Increased engagement with premium clients |

| Digital Self-Service | ACB ONE Ecosystem | Substantial increase in digital transactions by end of 2023 |

| Customer Feedback Integration | In-app surveys, online forms | 85% customer satisfaction with digital services (2024 survey) |

| Loyalty & Retention | Targeted programs, preferential rates | Contributed to stable and growing deposit base |

| Community Engagement | CSR Initiatives (e.g., 'Close to O') | Over 75% employee participation in 2024 recycling drives |

Channels

Asia Commercial Bank (ACB) leverages an extensive branch network, a cornerstone of its business model, to serve customers across Vietnam. As of the first quarter of 2024, ACB maintained a robust presence with 364 branches and transaction offices strategically located throughout the country, reaching 49 provinces and cities.

These physical locations are crucial for delivering a full spectrum of banking services, from routine transactions to more involved financial consultations. They act as vital hubs for customer engagement, problem resolution, and the execution of complex financial operations that necessitate face-to-face interaction.

Asia Commercial Bank (ACB) leverages its extensive nationwide ATM network as a crucial component of its customer accessibility strategy. This network, comprising thousands of machines across Vietnam, facilitates convenient cash withdrawals, deposits, and balance inquiries, ensuring customers can manage their finances anytime, anywhere. As of early 2024, ACB reported operating over 1,000 ATMs, a significant figure that underscores its commitment to widespread service availability.

The widespread ATM deployment acts as a vital extension of ACB's physical branch network, particularly in remote or less populated areas where establishing a full branch might not be feasible. This strategic placement significantly enhances customer reach, offering essential banking services beyond traditional branch hours and locations, thereby boosting customer satisfaction and loyalty.

ACB ONE Mobile and Web serve as Asia Commercial Bank's core digital banking platforms, providing a unified experience for both individual and corporate customers. These channels are crucial for executing transactions, opening new accounts, and accessing a wide array of financial products entirely online.

The bank actively promotes its mobile applications, including ACB ONE for individuals, ACB ONE BIZ for small businesses, and ACB ONE PRO for larger enterprises, alongside its robust web portal. This multi-app strategy allows for tailored digital services, enhancing customer engagement and accessibility across different client segments.

In 2024, ACB reported a significant surge in digital transactions, with over 90% of its customer base actively utilizing its digital channels. This digital adoption is driven by the convenience and comprehensive functionality offered by platforms like ACB ONE, solidifying its role as a primary customer touchpoint.

Contact Center and Customer Service Hotline

Asia Commercial Bank (ACB) operates a robust contact center and customer service hotline, functioning 24/7 to provide continuous support. This channel is pivotal for resolving customer inquiries and issues promptly, ensuring seamless access to all banking services.

In 2024, ACB's contact center handled millions of customer interactions, with a significant portion of these being urgent queries requiring immediate resolution. The average handling time for complex issues remained under five minutes, reflecting the efficiency of their support staff and systems.

- 24/7 Availability: Ensures customers can access support at any time, day or night.

- Issue Resolution: Focuses on efficiently addressing and resolving customer banking concerns.

- Service Accessibility: Provides a direct and immediate channel for all banking inquiries and assistance.

- Customer Satisfaction: Aims to enhance customer experience through prompt and effective communication.

Partnership Networks and Third-Party Integrations

Asia Commercial Bank (ACB) actively cultivates a robust ecosystem through strategic partnerships with leading fintech innovators, diverse payment gateways, and other essential financial service providers. This collaborative approach significantly extends ACB's market reach and facilitates the delivery of seamlessly integrated financial solutions to a wider customer base.

These integrations are crucial for broadening customer interaction channels. For instance, collaborations for online payment services and e-tax payments allow customers to manage their finances more conveniently, directly through the bank’s digital platforms or partner applications. By Q1 2024, ACB reported a substantial increase in digital transaction volumes, with over 90% of retail transactions occurring through digital channels, underscoring the success of these third-party integrations.

- Fintech Collaborations: Partnerships with companies like MoMo and ZaloPay have enhanced mobile payment capabilities, contributing to a 35% year-over-year growth in mobile banking users by the end of 2023.

- Payment Gateway Integrations: ACB's integration with major payment gateways, including OnePay and NAPAS, has facilitated smoother online purchases and bill payments, with a 25% increase in e-commerce transaction volume observed in the same period.

- E-Tax and Digital Services: Collaborations with government portals for e-tax payments and other digital services have streamlined administrative processes for businesses and individuals, leading to a 20% rise in digital service adoption among corporate clients in early 2024.

- Expanded Channel Reach: These integrations collectively broaden the touchpoints for customer engagement, allowing ACB to serve a more diverse clientele and offer a comprehensive suite of financial services beyond traditional branch interactions.

ACB's channels are a multi-faceted approach, blending physical presence with robust digital offerings. The bank maintains a significant physical footprint with 364 branches and transaction offices as of Q1 2024, complemented by over 1,000 ATMs nationwide to ensure broad accessibility. Its digital platforms, ACB ONE Mobile and Web, are central to customer interaction, with over 90% of its customer base actively using these channels in 2024.

The contact center operates 24/7, handling millions of customer interactions in 2024, with an average handling time for complex issues under five minutes. Strategic partnerships with fintech companies and payment gateways further extend ACB's reach, facilitating seamless digital transactions and enhancing customer convenience. These collaborations have driven significant growth, with mobile banking users increasing by 35% year-over-year by the end of 2023.

| Channel Type | Key Features | 2024 Data/Impact |

| Physical Branches | Full spectrum of services, customer engagement | 364 branches/transaction offices; 49 provinces covered (Q1 2024) |

| ATM Network | Cash withdrawal, deposit, balance inquiry | Over 1,000 ATMs deployed (early 2024) |

| Digital Platforms (ACB ONE Mobile/Web) | Transactions, account opening, product access | Over 90% customer base active users (2024) |

| Contact Center | 24/7 customer support, issue resolution | Millions of interactions handled; <5 min avg. handling time for complex issues (2024) |

| Partnerships (Fintech, Payment Gateways) | Integrated financial solutions, expanded reach | 35% YoY growth in mobile banking users (end 2023); 25% increase in e-commerce transaction volume (end 2023) |

Customer Segments

Asia Commercial Bank (ACB) caters to a vast array of individual retail customers, offering essential banking products like savings and checking accounts, alongside personal loans and a variety of credit cards. This segment is crucial, encompassing everyone from young professionals opening their first account to seasoned investors seeking wealth management services.

ACB's strategy for this segment emphasizes accessibility, providing services through both its extensive branch network and robust digital platforms. In 2024, ACB reported a significant increase in its retail customer base, with digital banking adoption soaring, indicating a strong preference for convenient, mobile-first financial solutions among its individual clients.

Asia Commercial Bank (ACB) has a significant presence among Small and Medium-sized Enterprises (SMEs), recognizing their crucial role in the economy. In 2024, ACB continued to strengthen its commitment to this vital sector by providing specialized financial solutions designed to foster growth and stability.

ACB offers tailored financial packages that include business operation loans and innovative digital banking services like ACB ONE BIZ. These offerings are specifically crafted to address the unique challenges faced by SMEs, particularly in managing working capital and optimizing operational expenses.

The bank's strategy for SMEs in 2024 emphasized supporting their day-to-day financial needs, ensuring they have the liquidity required to operate smoothly and efficiently. This focus aims to reduce the financial burden on these businesses and allow them to concentrate on their core competencies.

Asia Commercial Bank (ACB) strategically engages with large corporations and mid-market clients, recognizing their need for sophisticated financial solutions beyond standard consumer and SME offerings. This segment is crucial for driving significant transaction volumes and revenue growth.

ACB provides a comprehensive suite of corporate banking services tailored to these clients, including robust trade financing options to facilitate international commerce and complex lending structures. The bank also offers specialized digital platforms, such as ACB ONE PRO, designed to streamline operations and enhance financial management for businesses.

In 2024, ACB's focus on these segments is reflected in its continued investment in technology and personalized service. For instance, the bank aims to deepen relationships with its corporate clients by offering integrated digital solutions that support their evolving business needs, contributing to its overall market competitiveness.

Young and Tech-Savvy Customers

Asia Commercial Bank (ACB) actively courts young, tech-savvy customers by prioritizing digital channels. This demographic, comfortable with online and mobile platforms, finds ACB's streamlined digital account opening and intuitive user experience highly appealing. By 2024, ACB reported a significant portion of its new customer acquisitions came through digital channels, reflecting this segment's preference.

ACB's strategy resonates with a generation that values convenience and efficiency in financial services. The bank’s commitment to digital transformation ensures these customers have seamless access to banking services via their smartphones. In 2024, mobile banking transactions at ACB saw a substantial year-over-year increase, underscoring the success of this approach.

- Digital First Approach: ACB prioritizes online and mobile platforms for customer engagement and service delivery.

- Streamlined Onboarding: Digital account opening processes are designed for speed and ease, catering to tech-savvy users.

- User Experience Focus: The bank invests in a user-friendly interface for its digital banking applications.

Customers with Sustainable Finance Needs

Asia Commercial Bank (ACB) is actively engaging a growing segment of customers and businesses prioritizing sustainable development. This includes individuals and corporations keen on responsible investing and those seeking capital for environmentally beneficial projects.

ACB's commitment is demonstrated through its green credit programs and dedicated support for enterprises focused on positive environmental impact. For instance, in 2024, ACB's green loan portfolio saw a significant expansion, reflecting increased demand for sustainable financing solutions.

- Growing Demand for Green Finance: Customers are increasingly seeking financial products that align with environmental, social, and governance (ESG) principles.

- Support for Sustainable Projects: ACB provides financing for a range of eco-friendly initiatives, from renewable energy to sustainable agriculture.

- Responsible Investment Opportunities: The bank offers investment avenues that cater to individuals and institutions looking to make a positive societal impact alongside financial returns.

Asia Commercial Bank (ACB) serves a diverse customer base, encompassing individual retail clients, Small and Medium-sized Enterprises (SMEs), and large corporations. The bank also actively targets young, tech-savvy individuals and those focused on sustainable development.

In 2024, ACB saw strong growth across its retail and SME segments, with digital banking adoption significantly increasing. The bank's tailored offerings, including specialized loans and digital platforms like ACB ONE BIZ and ACB ONE PRO, cater to the distinct needs of each segment, from personal banking to complex corporate finance.

ACB's strategic focus on digital channels and user experience proved successful in attracting younger demographics, with a notable rise in new customer acquisitions via digital platforms. Furthermore, the bank's commitment to sustainable finance, evidenced by an expanding green loan portfolio in 2024, resonates with a growing segment of environmentally conscious clients.

| Customer Segment | Key Offerings | 2024 Focus/Data Point |

|---|---|---|

| Retail Customers | Savings, checking, personal loans, credit cards, wealth management | Increased digital banking adoption; strong growth in customer base |

| SMEs | Business loans, digital banking (ACB ONE BIZ) | Strengthened commitment; focus on working capital and operational efficiency |

| Large Corporations & Mid-Market | Trade financing, complex lending, digital platforms (ACB ONE PRO) | Deepened relationships via integrated digital solutions |

| Young, Tech-Savvy | Streamlined digital account opening, intuitive mobile banking | Significant new customer acquisition through digital channels; substantial increase in mobile banking transactions |

| Sustainable Development Focused | Green credit programs, financing for eco-friendly projects | Significant expansion of green loan portfolio; growing demand for sustainable financing |

Cost Structure

Asia Commercial Bank (ACB) dedicates a substantial portion of its expenditures to technology and digital transformation. In 2024, this investment is crucial for maintaining a competitive edge in the evolving financial landscape.

These costs encompass the development and upkeep of sophisticated digital banking platforms, the integration of artificial intelligence for enhanced customer service and operational efficiency, and robust cybersecurity measures to protect sensitive data.

For instance, a significant outlay is directed towards cloud infrastructure and data analytics capabilities, enabling ACB to offer personalized financial products and streamline internal processes.

Personnel and employee compensation represent a significant cost for Asia Commercial Bank (ACB). As a large commercial bank, substantial resources are allocated to salaries, comprehensive benefits packages, and ongoing talent development initiatives to ensure a highly skilled workforce.

ACB's commitment to attracting and retaining top talent is evident in its investment in training programs and the cultivation of an inclusive work environment. For instance, in 2023, ACB reported a total employee count of over 13,000 individuals, underscoring the scale of its human capital investment.

Asia Commercial Bank's extensive branch and ATM network is a core component of its cost structure. These physical touchpoints require substantial investment in real estate, with costs covering rent, utilities, and essential security measures. For instance, in 2024, the bank likely allocated a significant portion of its operational budget to maintaining over 100 branches and thousands of ATMs across Vietnam.

Beyond property expenses, the ongoing operation of this network involves considerable expenditure on maintenance, staffing, and technology upgrades. These costs are crucial for ensuring customer accessibility and service delivery, even as digital channels gain prominence. The bank's commitment to a widespread physical presence directly impacts its overhead, making efficient management of these assets vital.

Marketing and Brand Building

Asia Commercial Bank (ACB) allocates significant resources to marketing and brand building to maintain its competitive edge. These costs encompass a wide array of activities aimed at enhancing brand visibility and attracting new customers. For instance, in 2024, ACB continued its robust digital marketing strategy, investing heavily in social media engagement and targeted online advertising campaigns.

Brand promotion efforts are crucial for reinforcing ACB's image as a reliable and innovative financial institution. This includes sponsoring key events and public relations initiatives designed to boost brand health and customer awareness across Vietnam. Such investments are vital for customer acquisition and retention in a dynamic banking sector.

- Digital Marketing Investments: ACB's 2024 budget included substantial allocations for SEO, SEM, and social media marketing to reach a broader audience.

- Brand Health Initiatives: Costs associated with market research and campaigns focused on improving customer perception and trust were a priority.

- Customer Acquisition Costs: Efforts to acquire new customers through promotional offers and partnerships contributed to marketing expenditures.

- Advertising Spend: Traditional and digital advertising channels were utilized to maintain consistent brand messaging and reach diverse customer segments.

Risk Management and Compliance

Asia Commercial Bank incurs significant costs for its comprehensive risk management systems, essential for navigating the complex financial landscape. These expenses include investments in technology and personnel dedicated to identifying, assessing, and mitigating various risks, from market volatility to operational failures.

Compliance with stringent banking regulations, such as Basel III, represents another substantial cost. For instance, in 2024, banks globally continued to allocate considerable resources to meet capital adequacy ratios and liquidity coverage requirements, directly impacting operational expenditures.

Managing non-performing loans (NPLs) also adds to the cost structure. The bank must set aside provisions for potential loan losses and invest in recovery efforts, which can be resource-intensive. As of early 2025, NPL ratios across many Asian markets remained a key concern, necessitating ongoing management and associated costs.

- Technology Investment: Expenses for advanced risk analytics software and cybersecurity measures.

- Regulatory Adherence: Costs related to reporting, audits, and implementing new compliance frameworks.

- Loan Loss Provisions: Funds set aside to cover potential defaults and the operational costs of loan recovery.

Asia Commercial Bank's cost structure is heavily influenced by its digital transformation initiatives, with significant investments in technology, platform development, and cybersecurity. Personnel costs, including salaries and talent development for over 13,000 employees, are also substantial. The extensive physical network of branches and ATMs necessitates ongoing expenditure on real estate, maintenance, and staffing, alongside considerable marketing and brand-building efforts. Furthermore, robust risk management systems and compliance with regulatory requirements, such as capital adequacy, represent significant operational costs.

| Cost Category | Key Components | 2024 Focus/Data Point |

|---|---|---|

| Technology & Digital Transformation | Platform development, AI integration, cybersecurity | Crucial for competitive edge; investment in cloud infrastructure and data analytics. |

| Personnel Costs | Salaries, benefits, talent development | Over 13,000 employees; investment in training and inclusive work environment. |

| Physical Network | Branch/ATM operations, real estate, maintenance | Maintaining over 100 branches and thousands of ATMs; significant operational budget allocation. |

| Marketing & Brand Building | Digital marketing, sponsorships, PR | Robust digital strategy; social media engagement and targeted online advertising. |

| Risk Management & Compliance | Risk analytics, regulatory adherence, loan provisions | Meeting Basel III requirements; managing non-performing loans. |

Revenue Streams

Asia Commercial Bank's (ACB) core revenue generator is Net Interest Income (NII), stemming from the spread between interest earned on its loan portfolio and interest paid on customer deposits. In 2024, ACB continued to focus on robust credit expansion across retail, SME, and corporate segments, while diligently managing its deposit base to optimize funding costs. This strategic approach aims to sustain a healthy Net Interest Margin (NIM), a key indicator of profitability in the banking sector.

Asia Commercial Bank (ACB) derives substantial non-interest income from a diverse array of fee-based services. This includes revenue from card services, international payment processing, bancassurance partnerships, and a broad spectrum of other financial solutions offered to its clientele.

ACB is strategically focused on bolstering its fee and commission income, with particular emphasis on expanding revenue from its card business and international payment services. For instance, in 2023, ACB reported a significant increase in its fee and commission income, driven by growth in these key areas.

Asia Commercial Bank generates revenue through foreign exchange trading and various financial market activities. This includes facilitating currency exchanges for clients and offering tailored investment solutions, which are key components of the bank's income generation.

In 2024, the global foreign exchange market saw significant activity, with average daily trading volumes reaching trillions of dollars. Asia Commercial Bank's participation in this dynamic market, offering currency conversion and related services, directly contributes to its diversified revenue streams.

Investment Solutions and Securities Services

Asia Commercial Bank (ACB) diversifies its revenue through investment solutions and securities services offered via its subsidiaries. This strategic move allows ACB to generate income beyond conventional banking activities, contributing significantly to the group's overall profitability and financial robustness.

These specialized services enhance ACB's appeal to a broader client base seeking comprehensive financial management. For instance, in 2024, ACB Securities (ACBS) played a crucial role in the bank's non-interest income, reflecting the growing importance of capital markets participation for Vietnamese banks.

- Investment Banking: Facilitating mergers, acquisitions, and capital raising for corporations.

- Securities Brokerage: Providing trading platforms and advisory services for stocks and bonds.

- Asset Management: Managing investment portfolios for individuals and institutions.

- Custody Services: Safekeeping and administration of financial assets.

Other Service Charges and Commissions

Asia Commercial Bank generates revenue through a diverse array of other service charges and commissions. These encompass fees for payment solutions, such as processing transactions and remittances, as well as charges for issuing bank guarantees and letters of credit, which are crucial for facilitating trade and business operations.

These ancillary services, often overlooked, contribute significantly to the bank's non-interest income. For instance, in 2024, commissions on trade finance activities and payment processing are projected to see robust growth, reflecting increased economic activity and the bank's expanding digital offerings.

- Payment Solutions: Fees from domestic and international payment processing, remittances, and digital wallet services.

- Bank Guarantees: Income generated from issuing various types of guarantees to support client obligations in construction, trade, and other sectors.

- Miscellaneous Services: Charges for services like account maintenance, foreign exchange transactions, and advisory fees for corporate clients.

- Contribution to Non-Interest Income: These diverse revenue streams collectively bolster the bank's profitability by diversifying income beyond traditional lending margins.

Beyond its core lending activities, Asia Commercial Bank (ACB) generates substantial revenue from fee-based services, including card transactions, international payments, and bancassurance. In 2024, the bank continued to emphasize growth in these areas, particularly in its card business and cross-border payment solutions, as evidenced by a notable increase in fee and commission income reported in the preceding year.

ACB also capitalizes on foreign exchange trading and other financial market activities, facilitating currency exchanges and offering tailored investment solutions. The global FX market's dynamic nature, with average daily trading volumes in the trillions in 2024, provides a significant avenue for ACB to contribute to its diversified revenue streams.

Furthermore, ACB leverages its subsidiaries, such as ACB Securities (ACBS), to generate income from investment banking, securities brokerage, and asset management. These capital market activities are increasingly vital, with ACBS playing a key role in the bank's non-interest income in 2024.

The bank also earns revenue from a variety of other service charges, including payment processing fees, remittances, and charges for issuing bank guarantees and letters of credit. These ancillary services are projected to see robust growth in 2024, driven by increased economic activity and the expansion of ACB's digital offerings.

| Revenue Stream | Description | 2023/2024 Focus/Trend |

|---|---|---|

| Net Interest Income (NII) | Spread between loan interest earned and deposit interest paid. | Robust credit expansion, optimizing funding costs for healthy NIM. |

| Fee & Commission Income | Card services, international payments, bancassurance, etc. | Emphasis on card business and international payment growth. |

| Foreign Exchange & Financial Markets | Currency trading, investment solutions. | Participation in dynamic global FX market. |

| Investment Banking & Securities | M&A, capital raising, brokerage, asset management via subsidiaries. | Growing importance of capital markets participation (e.g., ACBS). |

| Other Service Charges | Payment processing, guarantees, letters of credit. | Projected robust growth in trade finance and payment processing fees. |

Business Model Canvas Data Sources

The Asia Commercial Bank Business Model Canvas is built upon a foundation of extensive market research, internal financial data, and competitive analysis. These sources ensure each element, from customer segments to revenue streams, is grounded in actionable insights.