Asia Commercial Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asia Commercial Bank Bundle

Asia Commercial Bank operates in a dynamic sector where buyer power and the threat of substitutes significantly influence its strategic landscape. Understanding the intensity of rivalry among existing competitors and the bargaining power of suppliers is crucial for navigating this market. This brief overview highlights key pressures, but the full Porter's Five Forces Analysis provides a comprehensive, data-driven blueprint.

The complete report reveals the real forces shaping Asia Commercial Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The primary suppliers to a bank like Asia Commercial Bank are its depositors and various other funding sources, such as the interbank market and bond markets. The influence these suppliers wield is directly tied to how easily and affordably the bank can access alternative funding options.

In Vietnam, a key indicator of supplier power emerged by the end of September 2024. Deposit growth lagged behind credit growth, a situation that can signal mounting liquidity pressures for banks. This dynamic typically intensifies competition for available deposits, potentially increasing the cost of capital for institutions.

Technology and infrastructure providers are gaining significant leverage over Asia Commercial Bank (ACB) as digital transformation becomes a critical focus for Vietnamese banks. ACB's commitment to enhancing its digital offerings means a growing dependence on specialized IT vendors for essential services like software development, robust cybersecurity solutions, and advanced digital infrastructure. Many Vietnamese banks, including ACB, are targeting over 70% of their transactions to be conducted digitally by the close of 2025, underscoring the vital role these tech partners play in achieving strategic objectives.

The demand for skilled human capital in Vietnam's banking sector, especially in tech-related fields like AI and cybersecurity, is soaring. This intense competition for talent significantly boosts the bargaining power of these skilled employees, allowing them to negotiate for higher salaries and better benefits.

Regulatory Bodies (State Bank of Vietnam - SBV)

The State Bank of Vietnam (SBV) wields significant bargaining power as a key regulator and monetary authority for banks like Asia Commercial Bank (ACB). The SBV dictates critical operational parameters, including licensing, capital adequacy ratios, and lending policies, directly influencing ACB's ability to conduct business and generate revenue.

New regulations introduced in 2024, such as the Law on Credit Institutions and Decree No. 52/2024/ND-CP on cashless payments, exemplify the SBV's influence. These directives shape ACB's strategic direction, forcing adaptations in areas like digital transformation and risk management, thereby increasing the SBV's leverage.

- SBV as a Supplier: The SBV provides essential operating licenses and sets the regulatory framework.

- Impact of 2024 Laws: The Law on Credit Institutions and Decree No. 52/2024/ND-CP mandate changes in banking operations.

- Operational Constraints: Regulations affect lending limits, capital requirements, and digital payment strategies for ACB.

Payment Network Operators

Payment network operators, such as NAPAS in Vietnam, hold significant bargaining power over banks. NAPAS facilitates essential services like instant payments and ATM switching, making it a critical supplier for banks to conduct digital transactions.

With the ongoing surge in non-cash transactions in Vietnam, banks are becoming increasingly dependent on these established payment infrastructures. This reliance amplifies the bargaining power of network operators, as banks need their services to remain competitive and meet customer demand for digital payment solutions.

- NAPAS’s role: NAPAS is crucial for interbank connectivity and processing various payment types, including ATM transactions and instant payments.

- Growing digital payments: Vietnam's digital payment market is expanding rapidly, with transaction volumes increasing year-on-year. For instance, in 2023, the total transaction value through NAPAS reached trillions of Vietnamese Dong, highlighting its systemic importance.

- Bank reliance: Banks must partner with NAPAS to offer these widely used payment services, giving NAPAS leverage in negotiations regarding fees and service terms.

Depositors and funding markets represent key suppliers for Asia Commercial Bank (ACB). Their bargaining power is amplified when alternative funding sources are scarce or costly, as seen in late 2024 when deposit growth trailed credit expansion in Vietnam, potentially increasing capital costs for banks.

Technology providers are increasingly influential due to ACB's digital transformation goals, with many Vietnamese banks aiming for over 70% of transactions to be digital by the end of 2025. This reliance on specialized IT vendors for software, cybersecurity, and infrastructure bolsters their negotiating position.

The State Bank of Vietnam (SBV) acts as a powerful supplier through its regulatory and monetary authority. New regulations like the 2024 Law on Credit Institutions and Decree No. 52/2024/ND-CP directly shape ACB's operations, from lending policies to digital payment strategies, enhancing the SBV's leverage.

Payment network operators, such as NAPAS, hold significant sway. Their role in facilitating essential services like instant payments and ATM switching is critical, especially as Vietnam's digital payment market expands, with transaction values in the trillions of Vietnamese Dong in 2023, making banks highly dependent on these networks.

| Supplier Type | Key Role for ACB | Indicative Bargaining Power Factor (Late 2024/Early 2025) | Impact on ACB |

|---|---|---|---|

| Depositors/Funding Markets | Source of capital | Deposit growth lagging credit growth | Potential increase in cost of capital |

| Technology Providers | Digital transformation enablers | Target of >70% digital transactions by end-2025 | Increased dependence on IT vendors for critical services |

| State Bank of Vietnam (SBV) | Regulator and monetary authority | New laws (e.g., Law on Credit Institutions, Decree 52/2024) | Dictates operational parameters, strategic direction |

| Payment Network Operators (e.g., NAPAS) | Facilitators of digital transactions | High reliance due to rapid digital payment growth (e.g., trillions VND in 2023) | Leverage in fees and service terms negotiation |

What is included in the product

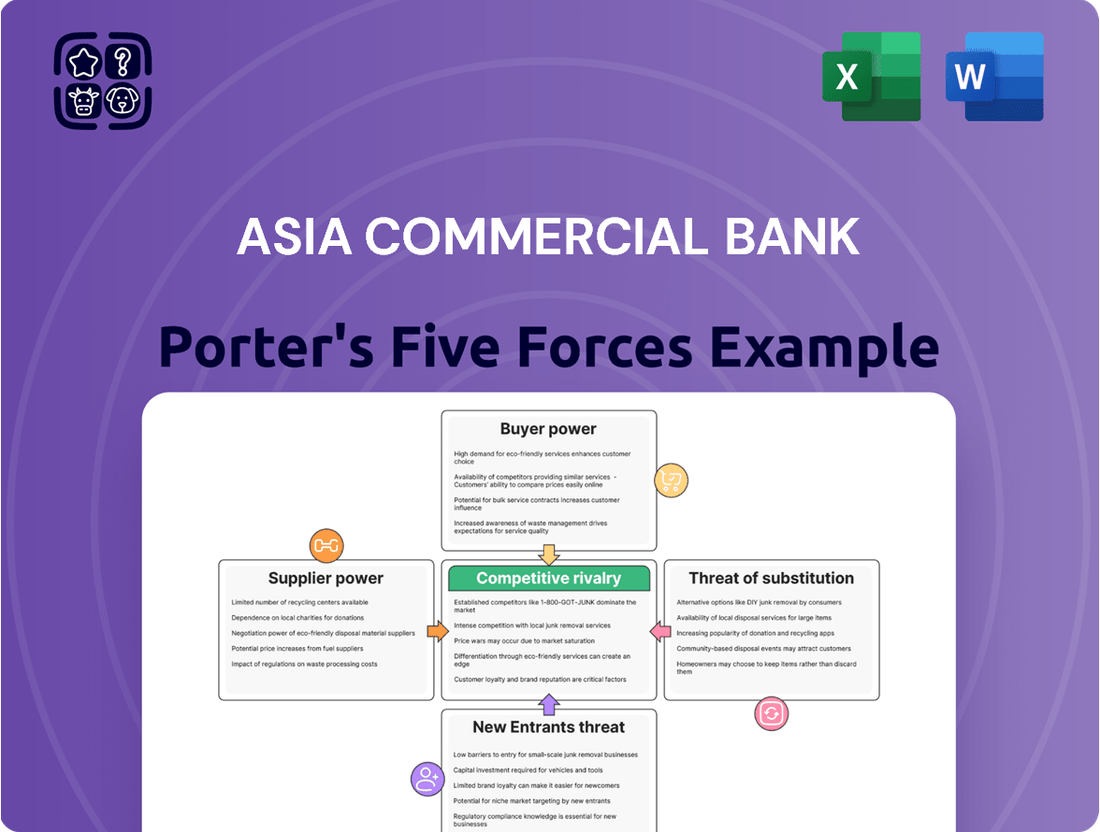

This Porter's Five Forces analysis specifically examines the competitive landscape for Asia Commercial Bank, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces for Asia Commercial Bank.

Customers Bargaining Power

Customers in Vietnam now have a significantly wider range of financial service providers to choose from. Beyond traditional banks like Asia Commercial Bank (ACB), the landscape is increasingly populated by agile fintech companies. These new players are offering innovative digital payment solutions and a variety of financial services, directly competing for customer attention and loyalty.

This heightened competition is largely fueled by Vietnam's robust digital transformation. With smartphone penetration reaching around 84% in 2024, a vast majority of the population has access to the internet and mobile banking. Furthermore, the number of operational e-wallets had surpassed 34 million by June 2024, indicating a strong consumer adoption of digital financial tools. This growing digital infrastructure empowers customers, giving them more leverage and choice when selecting financial partners.

Customers today face remarkably low switching costs when considering a change in their banking provider. The rise of digital banking platforms and the increasing interoperability of payment systems significantly reduce the perceived effort and hassle involved in moving funds and services. For instance, in 2024, many neobanks offer seamless account opening processes that can be completed in minutes, directly challenging traditional institutions.

Furthermore, government initiatives aimed at fostering a cashless society and driving digital transformation are actively lowering barriers to entry for new financial service providers and making it easier for customers to switch. This trend is evident across many Asian economies, where digital payment adoption rates are soaring, empowering consumers with greater choice and flexibility in their banking relationships.

Customers are increasingly empowered by readily available information and growing financial literacy. This allows them to easily compare interest rates on loans and deposit accounts across different banks, putting pressure on institutions like Asia Commercial Bank to offer competitive terms. For instance, in 2024, a significant portion of banking customers actively researched financial products online before making decisions, a trend that has steadily risen over the past few years.

Growth of Digital Payments and E-wallets

The increasing prevalence of digital payment solutions, such as e-wallets and QR code systems, significantly enhances customer bargaining power. This shift provides consumers with more choices for transactions, diminishing their reliance on traditional banking methods and fostering a greater ability to switch providers based on convenience and cost.

By 2024, the digital payment landscape in many Asian markets has become highly competitive, offering consumers a wide array of alternatives to conventional banking services. For instance, the rapid growth of mobile payment adoption, with a significant portion of the population in countries like Vietnam utilizing these platforms, means customers are less tethered to a single institution. This increased flexibility directly translates to stronger bargaining leverage as customers can easily move their transaction volume to providers offering better terms or user experiences.

- Increased Transactional Alternatives: Customers can choose from numerous digital payment providers, reducing dependence on any single bank.

- Reduced Switching Costs: The ease of adopting new digital payment methods lowers the effort and cost for customers to change their preferred transaction channels.

- Price Sensitivity: Greater choice often leads to increased price sensitivity among customers, pushing banks to offer more competitive fees and services.

Customer Segmentation and Value Proposition

The bargaining power of customers in the banking sector, particularly for institutions like Asia Commercial Bank (ACB), is influenced by customer segmentation. While individual retail customers typically exert limited power, large corporate clients and high-net-worth individuals can wield significant influence due to the substantial volume of business they represent. For instance, in 2024, major corporate clients often negotiate for better loan rates or specialized treasury services, directly impacting ACB's profitability on those accounts.

ACB addresses this by developing tailored value propositions for different customer segments. This involves offering preferential interest rates, customized financial solutions, and dedicated relationship management for high-value clients. This strategic approach aims to secure loyalty and mitigate the risk of these key customers seeking services elsewhere, thereby managing their bargaining power effectively.

- Customer Segmentation: Differentiating between retail, small and medium enterprises (SMEs), and corporate clients is crucial.

- High-Value Client Leverage: Large deposits and loan volumes grant significant bargaining power to corporate and affluent individuals.

- Tailored Solutions: Banks like ACB offer customized pricing and services to retain key customer segments.

- Impact on Profitability: The ability to negotiate preferential terms can directly affect a bank's net interest margin.

Customers in Vietnam, and indeed across many Asian markets, now possess considerably enhanced bargaining power. This is driven by a proliferation of financial service providers, including nimble fintech firms, offering diverse digital solutions. By 2024, Vietnam's smartphone penetration, around 84%, coupled with over 34 million e-wallets in operation by June 2024, signifies a digitally empowered consumer base with ample choices.

Switching between financial institutions has become remarkably frictionless, with digital platforms enabling quick account transfers and new banks offering swift, online onboarding processes. This ease of transition, combined with readily available online comparisons of rates and fees, pressures banks like ACB to maintain competitive offerings, directly impacting their ability to dictate terms.

While individual retail customers have limited sway, large corporate clients and high-net-worth individuals, due to their substantial transaction volumes, retain significant bargaining power. They can negotiate preferential loan rates and specialized services, as seen with major corporate clients in 2024 seeking better terms, which directly influences a bank's profitability on such accounts.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Provider Proliferation | Increases choice, reduces reliance on single bank | Growing number of fintechs and digital banks |

| Switching Costs | Lowers barriers to changing providers | Digital onboarding times measured in minutes |

| Information Availability | Enables easy comparison of rates and fees | High online research activity by banking customers |

| Digital Payment Adoption | Provides alternative transaction channels | Over 34 million e-wallets operational (June 2024) |

| Customer Segmentation | High-value clients wield significant influence | Corporate clients negotiate for preferential loan rates |

Full Version Awaits

Asia Commercial Bank Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Asia Commercial Bank, detailing the competitive landscape and strategic implications for the Vietnamese banking sector. You're viewing the exact, professionally formatted document that will be available for immediate download upon purchase, ensuring you receive a comprehensive and actionable strategic tool.

Rivalry Among Competitors

Asia Commercial Bank operates in a crowded Vietnamese banking market. The sector includes numerous commercial banks, dominant state-owned institutions, and branches of international banks, all competing aggressively for customers and capital.

This intense rivalry is further amplified by the rapid growth of fintech. With over 260 fintech startups emerging in Vietnam, these nimble players are introducing innovative digital solutions, challenging traditional banking models and increasing competitive pressure on established institutions like ACB.

The Vietnamese economy is anticipated to experience sustained growth, with the State Bank of Vietnam targeting a robust 16% credit growth for 2025. This expansionary environment, while presenting opportunities, intensifies rivalry among commercial banks as they vie to capture market share and grow their lending operations.

The banking sector is locked in a fierce digital transformation race, with institutions like Asia Commercial Bank pouring resources into cutting-edge technologies. This intense focus on digitalization is reshaping customer experiences and driving down operational costs, creating a highly dynamic competitive landscape.

By 2024, many banks are expected to have significantly increased their IT spending, with a notable portion dedicated to AI, cloud computing, and cybersecurity to stay ahead. This technological arms race means that banks not investing aggressively in digital innovation risk falling behind in offering competitive products and services.

Interest Rate Environment and NIM Pressure

The interest rate environment significantly impacts competitive rivalry within the banking sector. In late 2024, lending rates reached historic lows, squeezing banks' net interest margins (NIMs). For instance, the average prime lending rate in many Asian markets hovered around 4-5% during this period.

However, projections for the second half of 2025 indicate a potential modest uptick in lending rates. This expected shift, coupled with the lingering effects of the low-rate environment, intensifies competition. Banks are vying more aggressively for deposits to fund their lending activities and seeking to attract borrowers in a market where margins remain tight.

- NIM Pressure: Low lending rates in late 2024 compressed NIMs, forcing banks to seek cost efficiencies and alternative revenue streams.

- Deposit Competition: As rates are expected to rise modestly in 2H2025, competition for stable, low-cost deposits will likely intensify.

- Lending Rate Fluctuations: The anticipated increase in lending rates, while beneficial, also introduces volatility that banks must navigate, potentially impacting loan demand and credit quality.

Regulatory Changes and Compliance Burden

New banking laws, like Vietnam's 2024 Law on Credit Institutions, are significantly reshaping the competitive landscape. These regulations impose more stringent capital adequacy ratios and introduce enhanced reporting requirements, directly impacting operational costs and strategic flexibility for all banks.

For Asia Commercial Bank (ACB), navigating these evolving regulatory waters presents both challenges and opportunities. The bank's ability to adapt quickly and efficiently to stricter compliance demands, such as reduced lending limits and increased transparency, can serve as a key differentiator against less agile competitors.

The compliance burden acts as a natural barrier to entry and a challenge for smaller or less capitalized financial institutions. ACB's proactive approach to regulatory adherence, potentially involving significant investment in technology and personnel, can solidify its market position.

- Stricter Capital Requirements: The 2024 Law on Credit Institutions mandates higher capital buffers, impacting how banks can deploy capital and manage risk.

- Enhanced Reporting Obligations: Increased data submission and transparency requirements necessitate robust IT infrastructure and compliance teams.

- Reduced Lending Limits: New regulations may impose caps on certain types of lending, forcing banks to diversify their portfolios and revenue streams.

- Competitive Differentiator: Banks that effectively manage compliance can gain a strategic advantage through enhanced trust and operational efficiency.

The competitive rivalry within Vietnam's banking sector, where Asia Commercial Bank (ACB) operates, is exceptionally high. This is driven by a crowded market featuring state-owned banks, other commercial banks, and international branches, all vying for market share. The rapid rise of fintech, with over 260 startups in Vietnam by 2024, further intensifies this rivalry by introducing innovative digital solutions that challenge traditional banking models.

Banks like ACB are heavily investing in digital transformation, with significant IT spending expected in 2024, particularly in AI and cloud computing, to stay competitive. This technological arms race means that lagging institutions risk losing ground. Furthermore, the interest rate environment creates pressure; low lending rates in late 2024 squeezed net interest margins (NIMs), with average prime lending rates around 4-5% in many Asian markets. While rates may modestly rise in the latter half of 2025, competition for deposits and borrowers will remain fierce.

| Factor | Impact on Rivalry | Example/Data Point (2024-2025) |

|---|---|---|

| Market Saturation | High | Numerous commercial, state-owned, and international banks competing in Vietnam. |

| Fintech Growth | Increasing | Over 260 fintech startups in Vietnam by 2024, offering digital alternatives. |

| Digital Transformation | Intensifying | Banks increasing IT spending on AI and cloud in 2024 to enhance customer experience and efficiency. |

| Interest Rate Environment | Pressuring Margins | NIM compression due to low lending rates (around 4-5% in late 2024); expected modest rate increase in 2H2025 intensifies deposit competition. |

SSubstitutes Threaten

Fintech companies pose a significant threat to traditional banks like Asia Commercial Bank. These agile innovators are disrupting the market, especially in digital payments and e-wallets, with platforms like MoMo, ZaloPay, and VNPAY gaining substantial traction in Vietnam.

The rapid growth of the Vietnamese fintech sector, with projections to reach $18 billion, underscores this competitive pressure. These digital platforms offer convenient, often lower-cost alternatives for transactions and financial services, directly challenging established banking models.

Informal lending and shadow banking represent a significant threat of substitutes for Asia Commercial Bank. These channels, often operating outside regulatory oversight, provide credit to segments of the population and businesses that formal institutions may deem too risky or costly to serve. For instance, peer-to-peer lending platforms and microfinance institutions, while sometimes regulated, can offer faster and more flexible loan terms, directly competing with traditional bank offerings.

The accessibility of these substitute channels is particularly concerning in economies where financial inclusion remains a challenge. In many Asian markets, a substantial portion of SMEs and individuals rely on informal credit sources due to stringent collateral requirements or lengthy approval processes at commercial banks. This reliance means that if shadow banking entities offer more attractive terms, Asia Commercial Bank could see a portion of its potential loan portfolio diverted.

While precise figures for the shadow banking sector's impact on traditional banks are difficult to quantify, its growth is undeniable. In 2024, reports indicated that non-bank financial institutions in several key Asian markets grew their assets by an average of 15% year-on-year, suggesting a material shift in credit provision. This trend poses a direct competitive challenge, as these entities can often operate with lower overheads and regulatory burdens, allowing them to offer more competitive pricing on loans.

For corporate clients, direct investment and the broader capital markets represent significant substitutes for traditional bank loans. Companies can bypass banks by issuing corporate bonds or engaging in equity offerings, especially when market conditions are favorable. For instance, in 2024, global corporate bond issuance reached trillions of dollars, demonstrating a robust alternative to bank financing for many firms.

A mature and accessible capital market directly diminishes a company's dependence on commercial banks for funding. When companies can easily access funds through stock or bond markets, the bargaining power of banks is reduced. This trend is particularly evident in developed economies where capital markets are deep and liquid, offering competitive rates and diverse financing options.

Cryptocurrencies and Blockchain-based Solutions

The emergence of cryptocurrencies and blockchain technology presents a potential long-term threat of substitutes for traditional banking services offered by Asia Commercial Bank. While still in their early stages and facing regulatory uncertainty in Vietnam, these digital assets and decentralized systems could eventually offer alternative solutions for transactions, remittances, and digital asset management. For instance, the global remittance market, a significant revenue stream for many banks, is increasingly being eyed by crypto platforms for faster and potentially cheaper cross-border transfers.

The ongoing exploration of Central Bank Digital Currencies (CBDCs) by various nations, including those in Asia, further underscores this threat. If Vietnam were to adopt a CBDC, it could streamline digital payments and potentially reduce reliance on commercial banks for certain services. By mid-2024, over 130 countries were exploring or piloting CBDCs, indicating a significant global shift towards digital currencies that could bypass traditional financial intermediaries.

- Growing Interest in Digital Assets: Global cryptocurrency market capitalization reached approximately $2.5 trillion in early 2024, signaling increasing adoption and acceptance of digital assets as alternatives for wealth storage and transfer.

- Blockchain for Remittances: Companies utilizing blockchain technology have reported reducing remittance fees by up to 50% compared to traditional methods, directly impacting a key banking service.

- CBDC Development: As of July 2025, 50 countries have launched or are piloting CBDCs, with many Asian economies actively engaged in these initiatives, creating a future landscape where digital currencies may offer direct alternatives to bank-provided payment rails.

Internal Financing by Businesses

Large corporations in Asia, with robust cash reserves, increasingly favor internal financing over traditional bank loans. For instance, in 2024, many major conglomerates across Southeast Asia reported significant retained earnings, allowing them to fund capital expenditures and expansion plans without external debt. This trend directly impacts banks like Asia Commercial Bank by reducing the demand for corporate lending products.

This shift creates a substitute for traditional banking services, as companies can self-fund growth initiatives. For example, a substantial portion of the capital expenditure by major tech firms in the region during 2024 was met through internally generated funds, bypassing bank financing entirely.

The availability of ample internal liquidity means that businesses can operate with less reliance on external financial institutions. This can lead to a decrease in the overall market share for banks offering corporate loans and other debt instruments.

Asia Commercial Bank, like its peers, faces the threat of these internally financed projects substituting for their core lending business:

- Reduced Demand for Loans: Companies with strong cash flow can self-finance projects, lessening their need for bank loans.

- Lower Fee Income: Internal financing bypasses loan origination fees and other associated banking charges.

- Shift in Corporate Relationships: Businesses may reduce their engagement with banks if their primary financial needs are met internally.

Fintech solutions, informal lending, and capital markets all offer viable alternatives to traditional banking services, directly impacting Asia Commercial Bank. The rise of digital payment platforms and the increasing acceptance of cryptocurrencies present new avenues for transactions and wealth management, bypassing conventional financial institutions. Furthermore, companies with strong internal liquidity are increasingly self-financing, reducing their reliance on corporate loans.

| Substitute Category | Key Characteristics | Impact on Asia Commercial Bank | 2024 Data/Trend Example |

|---|---|---|---|

| Fintech & Digital Payments | Convenience, lower fees, user-friendly interfaces | Loss of transaction volume and customer base in payments and e-wallets | Vietnamese fintech market projected to reach $18 billion; MoMo, ZaloPay, VNPAY gaining significant traction. |

| Informal Lending & Shadow Banking | Faster approvals, flexible terms, less stringent collateral | Diversion of potential loan portfolio, especially for SMEs and individuals | Non-bank financial institutions in Asia grew assets by ~15% YoY in 2024. |

| Capital Markets (Bonds, Equity) | Direct access to funding for corporations, bypasses banks | Reduced demand for corporate lending, lower bargaining power for banks | Global corporate bond issuance in 2024 reached trillions of dollars. |

| Internal Corporate Financing | Self-funding of projects using retained earnings | Decreased demand for corporate loans and associated fee income | Major Southeast Asian conglomerates reported significant retained earnings in 2024, funding CAPEX internally. |

| Cryptocurrencies & CBDCs | Decentralized transactions, alternative for remittances and asset management | Potential long-term disruption to payment rails and remittance services | Over 130 countries exploring CBDCs by mid-2024; global crypto market cap ~$2.5 trillion in early 2024. |

Entrants Threaten

The Vietnamese banking sector presents significant hurdles for new entrants due to stringent regulatory frameworks. The State Bank of Vietnam mandates rigorous licensing procedures and demanding capital adequacy ratios, effectively creating a high barrier to entry.

Further complicating market entry, the 2024 Law on Credit Institutions has intensified these regulations. This legislation introduces stricter compliance measures and oversight, making it considerably more difficult for aspiring banks to establish a foothold and compete with established institutions like Asia Commercial Bank.

Establishing a new commercial bank, like Asia Commercial Bank, demands enormous capital. We're talking about billions of dollars needed for state-of-the-art technology, physical branches, and a skilled workforce. For instance, in 2024, the average cost to launch a new digital-first bank in developed markets was estimated to be upwards of $100 million, with traditional brick-and-mortar banks requiring significantly more. This sheer financial hurdle naturally discourages many potential competitors from entering the market.

Existing banks like Asia Commercial Bank (ACB) have cultivated deep brand recognition and customer trust, a significant barrier for new entrants. ACB's extensive branch network and decades of consistent service have fostered loyalty, making it difficult for newcomers to replicate this established credibility. In 2024, ACB reported a substantial customer base, highlighting the ingrained trust it commands.

Access to Distribution Networks

Asia Commercial Bank (ACB) enjoys a significant advantage due to its well-established and widespread distribution network, encompassing numerous branches and ATMs across Vietnam. This extensive physical presence makes it convenient for customers to access banking services, a crucial factor in customer retention and acquisition.

New entrants into the Vietnamese banking sector face a substantial barrier in replicating ACB's distribution reach. Establishing a comparable network of physical branches and ATMs would require immense capital investment and considerable time, potentially spanning several years. This financial and temporal hurdle significantly dampens the threat of new entrants leveraging physical distribution as a primary competitive strategy.

While digital channels offer an alternative, ACB also maintains a strong digital footprint. Newcomers must not only build robust digital platforms but also attract customers away from established, trusted brands like ACB, which has cultivated strong customer loyalty through its accessibility and service offerings. For instance, as of Q1 2024, ACB reported over 13 million customers, highlighting its broad reach.

- Extensive Branch and ATM Network: ACB's nationwide presence provides a key competitive advantage.

- High Investment Costs for New Entrants: Building a comparable distribution infrastructure requires substantial capital and time.

- Digital Channel Competition: New entrants must also compete with ACB's established digital services.

- Customer Loyalty and Reach: ACB's large customer base (over 13 million in Q1 2024) presents a hurdle for new players.

Talent Acquisition and Retention

The demand for skilled banking and technology professionals in Vietnam is exceptionally high, creating a significant hurdle for new entrants. In 2024, the Vietnamese banking sector continued to grapple with a shortage of experienced IT and digital banking specialists, with salaries for these roles seeing an estimated 15-20% increase year-over-year.

Newcomers must therefore prepare for intense competition for talent, which is likely to inflate operational costs and impede the rapid assembly of a competent workforce. This talent war means that established banks, including Asia Commercial Bank, often have an advantage in attracting and retaining top-tier employees due to existing brand recognition and more competitive compensation packages.

- High Demand for Skilled Professionals: Vietnam's financial sector, particularly in digital banking and fintech, faces a significant talent gap.

- Increased Labor Costs: Fierce competition for qualified individuals drives up salary expectations and recruitment expenses for all players.

- Retention Challenges: New entrants may struggle to retain talent against established institutions with stronger employee value propositions.

The threat of new entrants in Vietnam's banking sector, including for Asia Commercial Bank (ACB), remains moderate but is influenced by significant barriers. Stringent regulations, such as those intensified by the 2024 Law on Credit Institutions, demand substantial capital and rigorous compliance, making market entry challenging.

The financial commitment required to establish a competitive presence, encompassing technology, infrastructure, and talent, is immense. For instance, building a distribution network comparable to ACB's extensive branch and ATM system, which served over 13 million customers by Q1 2024, would necessitate billions of dollars and years of effort.

Furthermore, new players must contend with ACB's deeply ingrained brand loyalty and a highly competitive talent market, where experienced professionals command premium salaries, estimated to have risen 15-20% year-over-year in 2024 for digital banking specialists.

| Barrier Type | Description | Impact on New Entrants | Example for ACB |

|---|---|---|---|

| Regulatory | Stringent licensing, capital adequacy, and compliance under 2024 Law on Credit Institutions. | High hurdle, requires significant legal and financial resources. | ACB operates within established, well-understood regulatory frameworks. |

| Capital Investment | Enormous costs for technology, branches, and workforce. | Discourages entry due to sheer financial scale. | Building a network comparable to ACB's nationwide presence is prohibitively expensive. |

| Brand & Loyalty | Established trust and customer relationships. | Difficult for newcomers to attract and retain customers. | ACB's base of over 13 million customers (Q1 2024) signifies deep-rooted trust. |

| Talent Acquisition | High demand and increasing costs for skilled professionals. | Increases operational costs and delays workforce assembly. | ACB likely benefits from its established reputation in attracting and retaining talent. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Asia Commercial Bank is built upon a foundation of publicly available financial statements, annual reports, and investor relations disclosures from the bank and its key competitors. We also integrate insights from reputable industry research reports and financial news outlets to capture market trends and competitive dynamics.