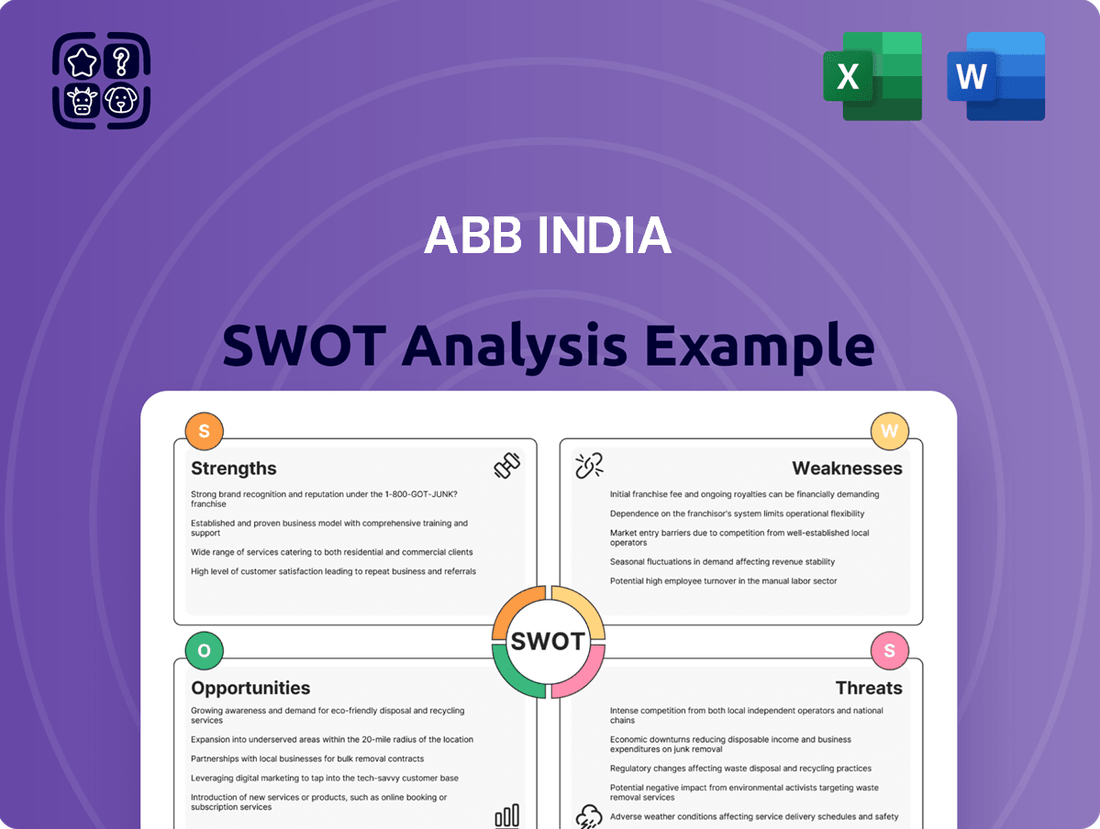

Abb India SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Abb India Bundle

ABB India's robust market presence and strong brand recognition present significant opportunities for growth. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for strategic advantage.

Want the full story behind ABB India's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ABB India boasts a robust and diverse portfolio, encompassing critical sectors like electrification, automation, robotics, and motion. This broad offering allows them to cater to a wide array of industries, from utilities and manufacturing to transportation and infrastructure development. This strategic diversification is a significant strength, enabling the company to weather economic fluctuations and seize growth opportunities across multiple markets.

ABB India has shown impressive financial resilience and growth. In calendar year 2024, the company achieved a substantial 17% revenue expansion and a remarkable 50.2% surge in net profit. This strong performance indicates effective operational management and market demand for its offerings.

Even with a few Q1 2025 analyst estimate misses, the company continued its positive trajectory, reporting growth in both net profit and revenue. This demonstrates an underlying strength that allows it to overcome short-term market fluctuations.

Furthermore, a substantial order backlog of ₹9,958 crore as of March 2025 is a key strength. This backlog provides significant revenue visibility, assuring continued business activity and financial stability for the upcoming quarters.

ABB India's advanced technological capabilities are a significant strength, stemming from its ability to integrate global expertise with local engineering and manufacturing prowess. This dual approach allows them to offer cutting-edge solutions tailored to the Indian market.

The company actively pioneers advancements in artificial intelligence and cultivates a vibrant ecosystem of digital partnerships. This forward-thinking strategy positions ABB India at the forefront of technological innovation in its sectors.

ABB India's solutions are specifically engineered to boost energy efficiency, elevate productivity, and promote sustainability for their clientele. These offerings directly address pressing industry demands, highlighting their commitment to impactful and relevant technological development.

Established Manufacturing Legacy and 'Make in India' Alignment

ABB India boasts a significant 75-year manufacturing legacy within India, demonstrating a deep-rooted commitment to local production. This extensive history translates into robust, established manufacturing capabilities that are a cornerstone of its operations.

The company's long-standing presence and manufacturing prowess align perfectly with the Indian government's 'Make in India' initiative. This synergy not only fosters strong customer trust but also enhances operational stability by leveraging domestic resources and expertise.

ABB India's ongoing investment in expanding its domestic manufacturing footprint is crucial. For instance, in 2023, the company inaugurated a new state-of-the-art manufacturing facility in Bengaluru, focusing on electrification products, which further solidifies its supply chain resilience and market responsiveness.

- 75-year manufacturing legacy in India

- Strong alignment with 'Make in India' initiative

- Enhanced customer trust and operational stability

- Commitment to expanding domestic manufacturing capabilities

Commitment to Sustainability and ESG

ABB India's dedication to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength. Their product portfolio, which includes solutions for energy efficiency and electrification, directly supports customers in reducing their environmental footprint. For instance, ABB India's Nelamangala campus achieved water positivity, demonstrating a tangible commitment to resource management.

The company actively invests in sustainable operational practices and utilizes digital tools to drive renewable energy integration and enhance energy efficiency across various industries. This focus aligns with global trends and positions ABB India favorably in a market increasingly prioritizing green solutions. In 2023, ABB globally reported approximately 90% of its revenue came from offerings with a sustainability impact, a trend mirrored in its Indian operations.

- Energy Efficiency Focus: ABB India's core offerings, such as advanced drives and smart grid technologies, inherently promote reduced energy consumption.

- Water Positivity Milestone: The Nelamangala campus achieving water positivity highlights a concrete commitment to environmental stewardship.

- Digitalization for Sustainability: Leveraging digital technologies to boost renewable energy adoption and industrial energy efficiency.

- ESG Investment Priority: Strategic investments are channeled into sustainable practices, reinforcing long-term environmental and social value.

ABB India's diversified product portfolio, spanning electrification, automation, robotics, and motion, provides a significant competitive advantage. This broad market reach allows the company to tap into various growth sectors, mitigating risks associated with reliance on a single industry.

Financially, ABB India demonstrated robust performance, with a 17% revenue increase and a 50.2% net profit jump in calendar year 2024. Even with some Q1 2025 estimate misses, the company maintained positive growth, underscoring its operational strength and market demand.

A substantial order backlog of ₹9,958 crore as of March 2025 provides excellent revenue visibility, ensuring sustained business activity and financial stability for the near future.

ABB India's technological prowess, combining global expertise with local innovation, allows for tailored, cutting-edge solutions. The company's focus on AI and digital partnerships positions it as a leader in technological advancement within its sectors.

| Metric | 2024 (CY) | Q1 2025 (Est.) | Significance |

|---|---|---|---|

| Revenue Growth | 17% | Positive | Demonstrates strong market demand and sales execution. |

| Net Profit Growth | 50.2% | Positive | Indicates effective cost management and operational efficiency. |

| Order Backlog (Mar 2025) | ₹9,958 crore | N/A | Provides strong revenue visibility and future business assurance. |

What is included in the product

Delivers a strategic overview of Abb India’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform its market position and future growth.

Offers a clear, actionable framework to identify and leverage ABB India's competitive advantages while mitigating potential weaknesses.

Weaknesses

While Abb India's overall financial health is strong, a key weakness lies in the underperformance of its Process Automation segment. This division saw a significant 19% revenue decrease in the first quarter of 2025. This downturn is further exacerbated by a less robust order pipeline and a slowdown in decisions for major projects, creating headwinds that temper the company's broader successes.

In the first quarter of 2025, ABB India experienced a setback as its financial results, while showing year-on-year growth in both net profit and revenue, did not meet the expectations set by financial analysts. This miss, particularly concerning, indicates possible challenges in the company's operational execution or a more demanding market landscape than financial experts had projected. Such discrepancies can indeed affect how investors perceive the company's performance and future prospects, potentially leading to a dip in investor confidence.

Following a period of strong profitability in 2024, Abb India might see its profit margins normalize. This potential moderation could stem from the easing of specific pricing advantages that boosted earlier results, alongside the possibility of rising raw material and operational expenses.

For instance, if the company's EBITDA margin, which reached an impressive 15.5% in the fiscal year ending March 2024, experiences a slight dip to around 14% in FY25, it would still represent a healthy performance. However, any significant increase in input costs, such as a 5% rise in key chemical feedstock prices, could exert pressure on these margins.

High Valuation Concerns

ABB India's current market performance is marked by elevated valuation concerns, with its price-to-earnings (P/E) ratio standing notably high. This suggests that the stock might be trading at a premium compared to its earnings, potentially limiting its immediate upside for investors focused solely on valuation metrics. For instance, as of early 2024, ABB India's P/E ratio has been observed to be significantly above the industry average, impacting its valuation score negatively.

This premium valuation could pose a challenge for new investors, as it implies that the market has already priced in substantial future growth. Consequently, the stock may offer less room for capital appreciation based on current financial performance alone, requiring a deeper dive into growth catalysts and competitive advantages.

- High P/E Ratio: ABB India's P/E ratio often exceeds industry benchmarks, indicating a high valuation.

- Limited Upside Potential: The current valuation may suggest that much of the expected growth is already factored into the share price.

- Investor Hesitation: Valuation concerns can deter investors seeking more attractively priced opportunities.

Uncertainty from Global Spin-off

The planned global spin-off of ABB Robotics, expected by 2026, introduces a layer of uncertainty for ABB India. While this move could potentially allow ABB India to reallocate resources towards its core operations, the exact long-term effects on its strategic focus and business composition remain unclear. This transition period may present challenges in maintaining operational momentum and strategic clarity.

The implications of this global restructuring for ABB India's business mix and market positioning are still being assessed. Investors and stakeholders are closely watching how this separation will influence the Indian subsidiary's future growth trajectory and its ability to leverage its strengths in the domestic market.

- Potential Resource Reallocation: The spin-off might free up capital and management attention for ABB India to concentrate on its primary business segments, potentially boosting efficiency and innovation in those areas.

- Strategic Realignment: ABB India may need to redefine its strategic priorities and business model to adapt to the post-spin-off global structure, ensuring continued relevance and competitiveness.

- Market Perception: The uncertainty surrounding the spin-off could temporarily affect market sentiment and investor confidence in ABB India's future performance until a clearer strategic direction emerges.

ABB India's Process Automation segment faced a significant revenue dip of 19% in Q1 2025, compounded by a weaker order book and delayed project decisions. Despite overall growth, Q1 2025 results missed analyst expectations, signaling potential execution challenges or a tougher market environment. Profit margins may also normalize from 2024 highs due to easing pricing power and potential cost increases, with a projected slight decrease in EBITDA margin from 15.5% (FY24) to around 14% (FY25) if input costs rise by 5%.

| Segment | Q1 2025 Revenue Change (YoY) | Key Concern |

|---|---|---|

| Process Automation | -19% | Weak order pipeline, project delays |

| Overall Performance | Missed Analyst Expectations | Operational execution, market demand |

| Profitability | Potential Normalization | Easing pricing, rising input costs |

Preview the Actual Deliverable

Abb India SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details ABB India's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of ABB India's strategic position.

Opportunities

India's industrial automation market is on a strong upward trajectory, with projections indicating robust growth. This expansion is fueled by a confluence of factors including rapid technological adoption, a heightened focus on improving operational efficiency across industries, and supportive government policies aimed at boosting smart manufacturing capabilities. For ABB India, this burgeoning market presents a significant avenue for expanding its core business segments.

The market's growth is further underscored by increasing investments in areas like robotics, AI-driven analytics, and the Internet of Things (IoT) within manufacturing. By 2025, the Indian industrial automation market is expected to reach approximately USD 6.7 billion, demonstrating a compound annual growth rate of over 15%. This presents a substantial opportunity for ABB India to leverage its advanced technological solutions and expertise.

Government programs like 'Make in India' and the National Manufacturing Mission, highlighted in the Union Budget 2025-26, are actively fostering a more conducive business climate. These policies, alongside Production Linked Incentive (PLI) schemes, are designed to bolster domestic manufacturing capabilities, which directly supports companies like ABB India.

The significant push for infrastructure development, particularly in railways and the burgeoning data center sector, presents a substantial opportunity. ABB India's expertise in electrification and automation solutions positions it to capitalize on this expansion, as evidenced by the projected INR 1.5 lakh crore allocation towards railway modernization in the coming years.

Furthermore, the 'Digital India' initiative and the broader trend towards industrial digitalization create avenues for ABB India's advanced technology offerings. The increasing adoption of smart grid technologies and IoT solutions within the industrial landscape directly aligns with ABB's core competencies, driving demand for its innovative products and services.

Indian manufacturers are rapidly adopting AI, IoT, and robotics to boost efficiency and cut costs. This surge in advanced technology adoption is a significant opportunity for ABB India, as it directly drives demand for their automation and digital solutions. For instance, the Indian manufacturing sector's push towards Industry 4.0, projected to grow substantially by 2025, creates a fertile ground for ABB's integrated offerings.

Growth in Electrification and Renewable Energy Sector

India's power sector is witnessing substantial growth, especially in renewable energy, driven by a commitment to energy efficiency and smart grid development. This presents a significant opportunity for ABB India, whose extensive electrification solutions, including those for data centers and railway traction, directly support the nation's energy transition objectives.

ABB India is strategically positioned to capitalize on this trend. For instance, the Indian government's ambitious target of achieving 500 GW of non-fossil fuel energy capacity by 2030 underscores the immense market potential for ABB's offerings. Their portfolio is crucial for integrating these new energy sources into the grid and ensuring reliable power distribution.

- Renewable Energy Integration: ABB India's grid automation and power electronics solutions are vital for managing the intermittent nature of solar and wind power, facilitating their seamless integration into the national grid.

- Electrification of Transport: With India's focus on electrifying its vast railway network and promoting electric mobility, ABB's traction converters and charging infrastructure solutions are in high demand.

- Smart Grid Development: The company's expertise in smart grid technologies, including advanced metering and distribution automation, aligns with the need for a more resilient and efficient power infrastructure.

- Data Center Growth: As India's digital economy expands, the demand for reliable power solutions for data centers is surging, an area where ABB India holds a strong competitive advantage.

Strategic Alliances for Enhanced Market Reach

ABB India's strategic alliances are key to expanding its market presence. For instance, its collaboration with PwC India allows ABB to offer integrated solutions in crucial areas like digital operations, cybersecurity, and environmental, social, and governance (ESG) initiatives. This partnership leverages ABB's strong technological foundation with PwC's consulting prowess, effectively widening its customer base and enhancing its appeal in a highly competitive market.

These collaborations are designed to create a more robust offering for clients. By combining ABB's deep expertise in electrification and automation with the strategic advisory capabilities of partners, the company can address complex business challenges more effectively. This approach not only strengthens ABB India's value proposition but also positions it as a comprehensive solution provider.

The impact of such alliances can be seen in the growing demand for integrated digital and sustainability solutions. For example, ABB India reported a significant increase in orders related to digital services and sustainable technologies in its 2024 financial year, partly attributed to the combined strength of its strategic partnerships.

- Expanded Service Portfolio: Collaborations enable ABB India to offer a broader range of services, from digital transformation consulting to advanced cybersecurity measures.

- Enhanced Market Penetration: Partnerships with firms like PwC India open doors to new client segments and industries that might have been harder to reach independently.

- Strengthened Competitive Edge: By integrating complementary expertise, ABB India can deliver more sophisticated and holistic solutions, differentiating itself from competitors.

- Synergistic Growth: These alliances foster a symbiotic relationship where both ABB India and its partners benefit from shared market opportunities and increased revenue streams.

The Indian industrial automation market's projected growth to USD 6.7 billion by 2025, with a CAGR exceeding 15%, offers substantial expansion opportunities for ABB India. The company's advanced technologies in robotics, AI, and IoT are well-aligned with the increasing adoption of Industry 4.0 principles by Indian manufacturers. Furthermore, government initiatives like 'Make in India' and PLI schemes are creating a favorable environment for ABB's solutions.

ABB India is poised to benefit from the significant expansion in India's power sector, particularly in renewable energy integration and smart grid development. The government's target of 500 GW non-fossil fuel energy capacity by 2030 directly drives demand for ABB's grid automation and power electronics. The electrification of railways and the burgeoning data center market also present key growth avenues, with substantial government allocations towards railway modernization.

Strategic alliances, such as the one with PwC India, are enhancing ABB India's market reach and service portfolio. These collaborations allow ABB to offer integrated digital, cybersecurity, and ESG solutions, strengthening its competitive edge and enabling access to new client segments. This synergistic approach is reflected in ABB India's reported increase in orders for digital and sustainable technologies during the 2024 fiscal year.

Threats

The Indian industrial technology landscape is a battlefield, with a crowded field of both local champions and global giants aggressively pursuing market share. ABB India faces relentless pressure from these numerous competitors.

Global players are making substantial strategic moves, exemplified by Schneider Electric's recent consolidation efforts within India, which directly challenge ABB India's established market standing and future expansion plans.

Global economic fluctuations directly impact industrial activity and the demand for capital goods and automation solutions. For instance, a projected slowdown in global GDP growth for 2024, as indicated by various international organizations, could dampen private investment and subsequently reduce order inflows for companies like ABB India.

Economic uncertainties, such as geopolitical tensions or persistent inflation concerns, can further exacerbate this. In 2024, many emerging markets, including India, faced headwinds from these global factors, potentially leading to cautious spending by businesses and thus affecting ABB India's top-line performance.

ABB India faces a significant threat from fluctuating raw material costs and exchange rates. While the company has a track record of operational efficiency, increases in input prices, such as those seen in copper or other key components, directly impact manufacturing expenses. For instance, global commodity prices, which heavily influence ABB India's input costs, saw volatility throughout 2023 and early 2024, impacting several of its product lines.

Adverse movements in foreign exchange rates, particularly the Indian Rupee against major currencies like the US Dollar and Euro, can also squeeze profit margins. This is especially relevant for ABB India, given its international sourcing and export activities. The fading of certain pricing tailwinds, which previously helped offset some cost pressures, means the company has less buffer to absorb these external shocks in the 2024-2025 period.

Geopolitical Developments and Trade Policies

Geopolitical shifts and evolving international trade policies present a significant threat to ABB India. Changes in global relations can directly impact domestic market dynamics, affecting everything from consumer spending patterns to private sector investment decisions and inflationary pressures. For instance, the ongoing trade tensions between major global economies, particularly concerning technology and manufacturing, could disrupt supply chains and increase the cost of imported components crucial for ABB India's operations.

These external factors introduce a considerable element of unpredictability and risk to ABB India's operational and financial stability. A sudden imposition of tariffs or non-tariff barriers on key raw materials or finished goods could necessitate costly adjustments to sourcing strategies and pricing models. Furthermore, shifts in geopolitical alliances might influence government procurement policies or create new regulatory hurdles in export markets, thereby limiting growth opportunities.

- Trade Tensions: Ongoing global trade disputes, such as those involving major economies, can lead to increased costs for imported components and finished goods, impacting ABB India's margins.

- Supply Chain Disruptions: Geopolitical instability in key sourcing regions can disrupt the flow of essential materials and components, leading to production delays and increased operational expenses.

- Regulatory Changes: Evolving trade policies and sanctions can create new compliance burdens and market access restrictions for ABB India's products and services.

- Inflationary Pressures: Global geopolitical events often contribute to commodity price volatility and broader inflationary trends, which can affect input costs and consumer demand in India.

Talent and Skill Gap Challenges

The swift integration of advanced technologies such as AI and robotics demands a workforce proficient in their implementation, operation, and ongoing maintenance. This technological evolution is creating a growing need for specialized skills that may not be readily available in the existing talent pool.

A significant concern for ABB India is the potential scarcity of adequately skilled professionals within the country. This gap could impede the company's capacity to fully leverage emerging market prospects and ensure the smooth, efficient execution of its projects.

For instance, the demand for automation specialists in India saw a significant uptick in 2024, with job postings increasing by an estimated 15-20% compared to the previous year, according to industry reports. This highlights the urgency for upskilling and reskilling initiatives.

- Shortage of AI and Robotics Experts: A critical lack of engineers and technicians with hands-on experience in AI-driven automation and advanced robotics.

- Digital Skills Deficit: A gap in the workforce's proficiency with data analytics, cybersecurity, and cloud computing essential for modern industrial operations.

- Need for Continuous Learning: The rapid pace of technological change requires constant upskilling, which can be a challenge to implement across a large workforce.

ABB India faces intense competition from both domestic and international players, with companies like Siemens and L&T actively expanding their automation and electrification portfolios. Global economic slowdowns, projected for 2024-2025, could reduce capital expenditure by Indian industries, directly impacting ABB India's order intake. Furthermore, fluctuating raw material prices, particularly for copper and steel, and adverse currency movements in 2024 presented challenges to maintaining profit margins.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from ABB India's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.