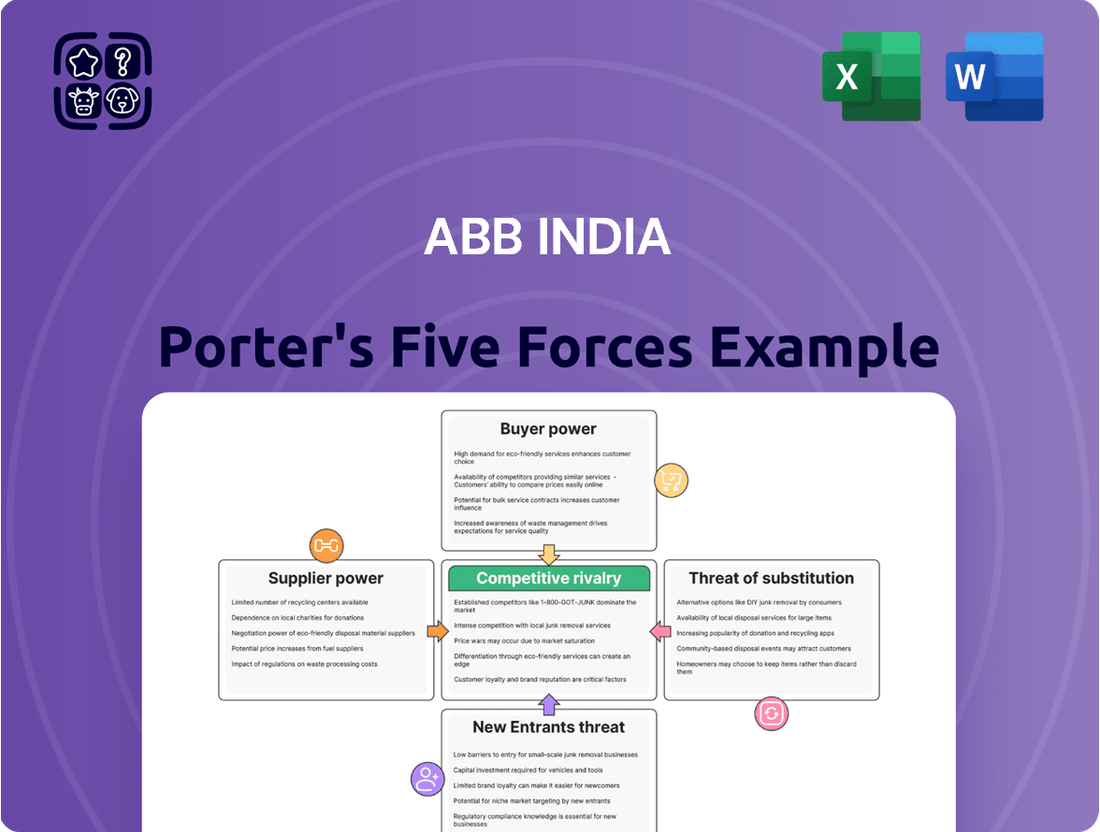

Abb India Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Abb India Bundle

Abb India navigates a complex landscape shaped by intense rivalry, moderate buyer power, and significant supplier leverage. Understanding these dynamics is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Abb India’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ABB India's reliance on a concentrated supplier base for specialized components in electrification and automation gives these suppliers considerable bargaining power. For instance, in the semiconductor industry, a critical input for advanced automation, supply chain disruptions in 2024 continued to highlight the leverage held by a few key manufacturers, impacting lead times and pricing for companies like ABB India.

ABB India actively cultivates robust relationships with its suppliers, recognizing their crucial role in the company's success. This focus extends to promoting sustainability within its supply chain, evidenced by a significant 33% rise in supplier environmental, social, and governance (ESG) awareness, training, and support programs during the 2024 calendar year.

This strategic emphasis on supplier collaboration and sustainability initiatives appears designed to proactively manage and potentially reduce the bargaining power of suppliers. By fostering long-term partnerships and integrating ESG principles, ABB India aims to build a more resilient and cooperative supply chain, mitigating risks associated with supplier dependency.

Global supply chain disruptions, geopolitical shifts, and raw material price volatility in 2024 have heightened the bargaining power of suppliers. For instance, disruptions in key electronics components, crucial for ABB India's automation and electrification products, have led to extended lead times and increased costs. ABB India's profitability hinges on its ability to navigate these external pressures and secure essential inputs on favorable terms.

Supplier Integration and Technology Partnerships

Suppliers who offer integrated solutions or actively participate in technology partnerships with ABB India can significantly enhance their bargaining power. This is particularly true as ABB India deepens its commitment to digital transformation and the development of advanced solutions.

Strategic suppliers that provide cutting-edge components or engage in joint technology development with ABB India become increasingly indispensable. This critical reliance can translate into a stronger negotiating position for these suppliers.

- Supplier Integration: Suppliers offering seamless integration with ABB India's existing systems and future digital platforms gain leverage.

- Technology Partnerships: Collaborations on R&D for new technologies or components can elevate a supplier's influence.

- Critical Components: Suppliers providing unique or highly specialized components essential for ABB India's advanced solutions hold greater power.

Switching Costs and Customization

The specialized nature of ABB India's products means that switching suppliers can be costly. These costs can include re-tooling manufacturing lines, obtaining new certifications, and the potential for production downtime during the transition. For instance, in 2024, a significant portion of ABB India's advanced automation components are highly integrated, making a switch to a new vendor a complex undertaking. This situation grants suppliers considerable leverage, especially when dealing with customized or unique parts essential to ABB India's operations.

This reliance on specialized suppliers for critical components strengthens their bargaining power. ABB India faces a challenge in readily shifting to alternative suppliers due to the deep integration and specific requirements of these components. For example, in the fiscal year ending March 31, 2024, ABB India reported that a substantial percentage of its key electrical equipment relied on proprietary supplier technologies, limiting its flexibility.

- High Switching Costs: Re-tooling and re-certification expenses can be substantial for ABB India when changing suppliers.

- Production Disruptions: Transitioning suppliers can lead to temporary halts or inefficiencies in ABB India's manufacturing processes.

- Customization Impact: Highly customized or integrated components increase supplier bargaining power due to the difficulty in finding direct replacements.

- Supplier Leverage: These factors collectively empower suppliers, allowing them to potentially command higher prices or more favorable terms from ABB India.

ABB India's bargaining power with its suppliers is influenced by the concentration of its supplier base for specialized components. In 2024, global supply chain issues, particularly for advanced electronics, amplified the leverage of a few key manufacturers, impacting ABB India's lead times and costs.

The specialized nature of ABB India's products means switching suppliers involves significant costs, including re-tooling and potential production downtime. For instance, proprietary technologies in key electrical equipment, as noted in the fiscal year ending March 31, 2024, limit ABB India's flexibility with its current vendors.

ABB India's efforts to foster strong supplier relationships and promote ESG practices, with a 33% increase in such programs in 2024, aim to mitigate this supplier leverage by building a more collaborative and resilient supply chain.

| Factor | Impact on ABB India | Supplier Leverage |

| Supplier Concentration | Reliance on few suppliers for specialized components | High |

| Switching Costs | High costs for re-tooling and potential downtime | High |

| Component Specialization | Difficulty finding direct replacements for critical parts | High |

| Supplier Relationships | Proactive engagement and ESG focus aim to reduce power | Moderate to High |

What is included in the product

This analysis delves into the competitive forces impacting Abb India, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the industry.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

ABB India's broad customer base, spanning utilities, manufacturing, transportation, and infrastructure, significantly dilutes individual customer bargaining power. This diversification means the company isn't dependent on any single buyer, as evidenced by its presence in numerous market segments like electronics, railways, and data centers.

Customers in ABB India's key sectors are placing a premium on efficiency, productivity, and sustainability. This trend is a significant driver for ABB India's advanced technological solutions.

This heightened customer focus translates into increased bargaining power, as clients expect solutions that demonstrably improve energy usage and operational output. For instance, in 2023, the Indian manufacturing sector saw a growing emphasis on green manufacturing initiatives, with many companies actively seeking technologies that reduce their carbon footprint and operational costs.

ABB India's ability to deliver measurable improvements in these areas directly influences customer loyalty and their willingness to pay a premium. Consequently, ABB India must continually invest in research and development to offer cutting-edge products and services that meet these evolving customer demands.

Once ABB India's sophisticated systems and integrated solutions are embedded within a customer's operational framework, the financial and logistical hurdles to switching become considerable. These costs can encompass the acquisition of entirely new hardware, extensive employee retraining, and the inevitable disruption to ongoing business processes during the transition period.

For instance, a manufacturing plant relying on ABB's automation and control systems for its production lines would face significant capital expenditure and a steep learning curve if it were to migrate to a competitor's platform. This deep integration effectively locks in customers, thereby diminishing their leverage in future price negotiations or service demands.

Customer Demand for Digital Transformation and Smart Solutions

The increasing adoption of Industry 4.0, the Internet of Things (IoT), and Artificial Intelligence (AI) across India's industrial landscape significantly shapes customer expectations. Businesses are actively seeking smart, interconnected, and data-driven solutions to enhance efficiency and competitiveness.

ABB India's focus on delivering these advanced digital transformation capabilities, often through strategic alliances such as its collaboration with PwC India, directly addresses this burgeoning customer demand. This positions ABB to meet market needs but also elevates customer expectations for state-of-the-art technology and effortless system integration.

- Customer Demand for Digital Transformation: Indian industries are increasingly investing in digital solutions, with the Indian digital transformation market projected to reach $120 billion by 2025, indicating a strong pull for advanced technologies.

- Smart Solutions Expectation: Customers expect integrated systems that leverage IoT and AI for real-time data analysis and predictive maintenance, driving operational improvements.

- Partnership Impact: Collaborations with firms like PwC India enable ABB to offer comprehensive digital solutions, further solidifying customer expectations for end-to-end service and expertise.

- Competitive Pressure: The ability of competitors to offer similar smart solutions can increase customer bargaining power, as they have more options to choose from.

Government Initiatives and Industry Growth

Government initiatives such as 'Make in India' and a pronounced emphasis on infrastructure, particularly in railways and electric vehicles, are fueling substantial investments in industrial automation and electrification. This surge in development presents a vast market opportunity for ABB India, enhancing its growth prospects.

However, the government itself, along with large public sector undertakings, represents a significant customer base. Their substantial project scale and established procurement policies grant them considerable bargaining power, influencing pricing and contract terms for ABB India.

- Government's 'Make in India' initiative: Aimed at boosting domestic manufacturing and attracting foreign investment.

- Infrastructure focus: Significant investments in railways and electric vehicle infrastructure create demand for automation and electrification solutions.

- Public Sector Undertakings (PSUs) as key customers: Their large-scale projects and procurement processes can lead to strong bargaining power.

- Impact on ABB India: While the initiatives create market opportunities, the bargaining power of government and PSUs can affect ABB India's margins and operational flexibility.

ABB India's diverse customer base, from utilities to manufacturing, generally limits individual customer bargaining power. However, the increasing demand for digital transformation and smart solutions, driven by Industry 4.0, empowers customers. They expect integrated, data-driven offerings, pushing ABB to continually innovate.

The Indian digital transformation market is substantial, projected to reach $120 billion by 2025, highlighting customer demand for advanced technologies. Customers are increasingly sophisticated, seeking measurable improvements in efficiency and sustainability, which grants them leverage.

Furthermore, large government projects and Public Sector Undertakings (PSUs) represent significant customers with considerable bargaining power due to their scale and established procurement processes. This can influence pricing and contract terms for ABB India.

| Customer Segment | Bargaining Power Influence | Key Drivers |

|---|---|---|

| General Industrial & Utilities | Low to Moderate | Diversified customer base, switching costs due to system integration |

| Large Corporations & PSUs | Moderate to High | Project scale, established procurement, potential for bulk discounts |

| Customers Demanding Digitalization | High | Demand for advanced solutions (IoT, AI), increasing market options |

Preview Before You Purchase

Abb India Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for ABB India, detailing the competitive landscape and strategic implications for the company. The document you see here is the exact, fully formatted report you will receive immediately upon purchase, providing actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The industrial automation, electrification, and robotics sectors in India are characterized by fierce competition, featuring both established global powerhouses and robust domestic companies.

Key global players like Siemens AG, Honeywell International Inc., Mitsubishi Electric, Rockwell Automation, and Schneider Electric actively compete with ABB Ltd. in the Indian market.

This dynamic landscape demands constant innovation and a clear strategy for differentiation to maintain market share.

Competition in the industrial automation and electrification sectors is intensely driven by rapid technological advancements. Companies like ABB India are constantly innovating, focusing on areas such as artificial intelligence (AI), the Internet of Things (IoT), robotics, and broader digital transformation initiatives to stay ahead. This technological race means that offering the most advanced and efficient solutions is paramount.

ABB India strategically leverages its expertise by integrating software capabilities across its core business segments, including electrification, robotics, and automation. This focus on software-defined solutions, coupled with strategic partnerships, is crucial for maintaining its competitive edge. By delivering advanced, efficient, and sustainable technologies, ABB India aims to meet the evolving demands of its diverse customer base.

The Indian industrial automation and robotics markets are booming, with strong growth expected to continue. This expansion is a magnet for new companies entering the space and prompts existing players to invest more aggressively. For example, the Indian industrial automation market was projected to reach USD 39.65 billion by 2033, highlighting the significant opportunities and the resulting competitive pressures.

Differentiation through Sustainability and Efficiency

ABB India actively differentiates itself by championing enhanced energy efficiency, productivity, and sustainability for its diverse client base. This strategic focus has yielded tangible results, including achieving water positivity at select company campuses, underscoring a commitment to environmental stewardship.

The competitive landscape is increasingly shaped by sustainability initiatives, transforming it into a crucial arena for securing market share and influencing customer loyalty. Competitors are also channeling resources into eco-friendly solutions, intensifying the rivalry.

- Energy Efficiency Focus: ABB India's dedication to improving energy efficiency directly addresses a major concern for industrial clients, aiming to reduce operational costs and environmental impact.

- Sustainability Milestones: Achieving water positivity at its campuses demonstrates a tangible commitment to sustainability, setting a benchmark for competitors.

- Growing Competitive Emphasis: The increasing focus on sustainability by rivals highlights its importance as a differentiator and a driver of customer preference in the Indian market.

Strategic Partnerships and Local Manufacturing

Competitors are increasingly forming strategic alliances and bolstering local manufacturing to gain a competitive edge. These moves are designed to enhance market presence and operational efficiency.

ABB India is actively participating in this trend. For instance, its collaboration with PwC India aims to accelerate digital transformation, a key area for many players in the industry. Furthermore, ABB India's focus on 'Made in India' initiatives is vital for building a robust and resilient supply chain.

- Strategic Alliances: Competitors are partnering to leverage complementary strengths.

- Local Manufacturing Expansion: Increased investment in domestic production facilities is a common strategy.

- ABB India's Collaborations: Partnerships like the one with PwC India for digital solutions are critical.

- 'Made in India' Focus: Enhancing local capabilities strengthens supply chain resilience and market positioning.

Competitive rivalry in India's industrial automation sector is exceptionally strong, with both global giants and local firms vying for market share. This intense competition is fueled by rapid technological advancements, particularly in AI, IoT, and robotics, forcing companies like ABB India to continuously innovate and focus on digital transformation to maintain their edge.

The market's significant growth potential, with projections indicating substantial expansion, attracts new entrants and encourages aggressive investment from existing players. For instance, the Indian industrial automation market was expected to reach USD 39.65 billion by 2033, underscoring the high stakes and intense rivalry.

Companies are differentiating themselves through a strong emphasis on energy efficiency, sustainability, and localized production. Strategic alliances are also becoming crucial for leveraging complementary strengths and enhancing market presence, as seen with ABB India's collaborations to accelerate digital transformation and bolster its 'Made in India' initiatives.

| Competitor | Key Focus Areas | Recent Developments/Strategies |

|---|---|---|

| Siemens AG | Digitalization, Automation, Electrification | Expanding local manufacturing, investing in smart factory solutions |

| Honeywell International Inc. | Building Automation, Process Solutions, Aerospace | Focus on IoT integration for industrial clients, sustainability initiatives |

| Rockwell Automation | Industrial Automation, Information Solutions | Strategic partnerships for software development, emphasis on connected enterprise |

| Schneider Electric | Energy Management, Automation | Investing in smart grid technologies, promoting energy efficiency solutions |

SSubstitutes Threaten

In certain sectors, the most significant substitute for ABB India's cutting-edge automation and robotics is still manual labor or older, simpler equipment. While the drive for efficiency and cost reduction pushes industries towards automation, the upfront cost of advanced systems can deter smaller or less capitalized companies.

Large industrial conglomerates and major customers with substantial R&D budgets, like those in the automotive or heavy manufacturing sectors, may choose to develop their own automation and electrification solutions. This can be a significant threat as it bypasses external providers entirely. For instance, in 2024, many global manufacturing giants continued to invest heavily in internal digital transformation initiatives, with some allocating billions to in-house technology development, potentially reducing their reliance on third-party suppliers.

For specific industrial needs, less complex and more affordable alternatives from niche providers can emerge as substitutes for ABB India's integrated solutions. These might include standalone components or simpler automation systems that cater to customers with tighter budgets or less demanding operational needs.

While these substitutes may not match the full spectrum of ABB India's advanced offerings, their lower price point can be a significant draw, especially for small and medium-sized enterprises. For instance, in 2024, the demand for basic motor control systems, which can be sourced from smaller players at a fraction of the cost of ABB's comprehensive drives, remained robust in certain segments of the Indian manufacturing sector.

Emerging Technologies and Disruptive Innovations

Rapid advancements in areas like advanced AI, new sensor technologies, and alternative energy storage are creating potential substitutes that could challenge ABB India's established product lines. For instance, the burgeoning market for decentralized energy solutions, powered by innovative battery technologies, presents a viable alternative to traditional grid infrastructure, a core area for ABB.

While ABB India is investing in these very technologies, a competitor's rapid innovation or the emergence of a new player with a significantly more cost-effective or performance-enhanced substitute could quickly impact market share. For example, by the end of 2024, the global energy storage market, a key area for potential substitutes, was projected to reach over $100 billion, highlighting the speed of innovation and potential for disruption.

- Disruptive Potential: Emerging technologies can offer entirely new ways to meet customer needs, potentially bypassing existing ABB India solutions.

- Competitive Landscape: Breakthroughs by rivals or new entrants in areas like AI-driven automation or advanced materials could introduce compelling alternatives.

- ABB India's Role: ABB India's own innovation in these fields is crucial to mitigating this threat, but external breakthroughs remain a significant risk.

- Market Dynamics: The rapid growth in sectors like renewable energy and smart grids means that substitute technologies can gain traction quickly, as evidenced by the projected 2024 market sizes for these segments.

Software-only Solutions and Cloud-based Platforms

The growing adoption of software-only solutions and cloud-based platforms presents a significant threat to ABB India. As businesses increasingly prioritize agility and cost-effectiveness, they may opt for these alternatives that bypass the need for substantial hardware investments.

This trend could directly impact ABB India's revenue streams, particularly for its integrated hardware and software offerings. For instance, the global industrial software market is projected to reach over $70 billion by 2024, indicating a strong preference for digital solutions that can be deployed without extensive physical infrastructure.

- Reduced Demand for Integrated Solutions: Customers seeking automation might find software-only platforms sufficient, lessening the need for ABB India's bundled hardware and software packages.

- Price Competition: Software-centric competitors can often offer more flexible pricing models, potentially undercutting ABB India's integrated offerings.

- Evolving Customer Expectations: As cloud technology matures, customer expectations shift towards scalable, subscription-based software services, which may not align with traditional hardware sales cycles.

The threat of substitutes for ABB India's offerings is multifaceted, ranging from basic manual labor to advanced, disruptive technologies. While the allure of cost savings and efficiency drives adoption of automation, the initial investment in sophisticated systems can be a barrier for smaller enterprises. For example, in 2024, many small and medium-sized businesses in India continued to rely on simpler machinery and manual processes due to budget constraints, presenting a persistent substitute.

Furthermore, the rise of software-only solutions and cloud-based platforms poses a significant challenge, as these can offer agility and cost-effectiveness without substantial hardware expenditure. The global industrial software market was projected to exceed $70 billion by 2024, underscoring a strong preference for digital solutions that bypass extensive physical infrastructure, directly impacting ABB India's integrated hardware and software sales.

Emerging technologies like advanced AI and new sensor capabilities also introduce potential substitutes. For instance, the rapidly growing energy storage market, valued at over $100 billion globally by the end of 2024, highlights the potential for innovative alternatives to challenge established sectors like grid infrastructure where ABB operates.

| Substitute Category | Key Characteristics | Potential Impact on ABB India | Example (2024 Context) |

|---|---|---|---|

| Manual Labor / Simpler Equipment | Lower upfront cost, less complex operation | Limits adoption of advanced automation for cost-sensitive segments | Continued reliance by SMEs on basic machinery |

| In-house Developed Solutions | Tailored to specific needs, bypasses external suppliers | Reduces market for ABB's integrated solutions among large R&D-focused clients | Major manufacturing firms investing billions in internal digital transformation |

| Software-Only / Cloud Platforms | High agility, scalable, subscription-based | Threatens integrated hardware-software revenue streams, price competition | Growth in industrial software market exceeding $70 billion |

| Disruptive Technologies (e.g., AI, new energy storage) | Novel approaches, potentially superior performance/cost | Can displace existing product lines, requires continuous innovation from ABB | Energy storage market exceeding $100 billion, decentralized energy solutions |

Entrants Threaten

The sectors ABB India operates in, such as electrification, automation, and robotics, demand significant capital for manufacturing facilities and cutting-edge research and development. For instance, establishing a state-of-the-art robotics manufacturing plant can easily run into tens of millions of dollars. This substantial upfront investment, coupled with the need for highly specialized engineering talent, creates a formidable barrier to entry for aspiring competitors.

ABB India's offerings are built on intricate technologies and substantial intellectual property, a result of decades of dedicated research and development. This technological depth creates a significant barrier for newcomers.

Entering the market requires overcoming considerable technical challenges and potentially navigating a complex web of patents, demanding massive investment in R&D for any new competitor to gain traction.

ABB India benefits from a strong, established brand reputation and long-standing relationships with diverse customers across various industries, including utilities, industry, and transportation. New entrants would face the significant challenge of building trust, credibility, and a comparable customer base in a market where reliability and proven performance are critical, a process that often takes years and substantial investment.

Regulatory Requirements and Industry Standards

The industries ABB India operates in, such as power, automation, and electrification, are frequently subject to rigorous regulatory frameworks and demanding industry standards. For instance, compliance with Bureau of Indian Standards (BIS) certifications and specific safety protocols for electrical equipment is paramount.

New entrants face a significant hurdle in navigating and adhering to these complex regulations, which often require substantial investment in time and resources for approvals and certifications. This can significantly delay market entry and increase initial operational costs.

- High Capital Investment: Meeting stringent safety and quality standards often necessitates considerable upfront capital for manufacturing facilities and testing equipment.

- Compliance Burden: Navigating diverse and evolving regulatory landscapes across different sectors ABB serves, such as renewable energy mandates or industrial safety norms, presents a continuous challenge.

- Certification Lead Times: Obtaining necessary certifications, like those from the Central Power Research Institute (CPRI) for power sector products, can take months, acting as a barrier to rapid market entry.

- Established Relationships: Existing players like ABB India have built long-standing relationships with regulatory bodies, which can streamline compliance processes.

Economies of Scale and Supply Chain Integration

Established players like ABB India leverage significant economies of scale. This translates to lower per-unit production costs, more favorable terms with suppliers due to bulk purchasing power, and efficient distribution networks. For instance, in 2023, ABB India's robust manufacturing capabilities allowed them to serve a wide customer base, which is difficult for newcomers to replicate quickly.

Furthermore, ABB India's integrated supply chains offer a distinct advantage. They have established strong relationships with reliable suppliers and sophisticated logistics, ensuring timely delivery and consistent quality. New entrants would face considerable challenges and higher initial investment to build similar supply chain resilience and achieve comparable cost efficiencies, creating a substantial barrier to entry.

- Economies of Scale: ABB India's large-scale operations in 2023 contributed to cost advantages in manufacturing and procurement, making it harder for new entrants to compete on price.

- Supply Chain Integration: The company's established and efficient supply chain provides a critical advantage, requiring substantial investment and time for new competitors to match.

- Cost Disadvantage for New Entrants: Without similar scale and integration, new players would likely face higher operating costs, impacting their ability to gain market share.

The threat of new entrants for ABB India is generally low due to high capital requirements, strong brand loyalty, and established technological expertise. New companies would need substantial funding to match ABB's manufacturing scale and R&D investments, making market entry challenging.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ABB India is built upon a foundation of publicly available information, including ABB India's annual reports, investor presentations, and stock exchange filings. We also incorporate insights from reputable industry research firms and relevant government publications to ensure a comprehensive understanding of the competitive landscape.