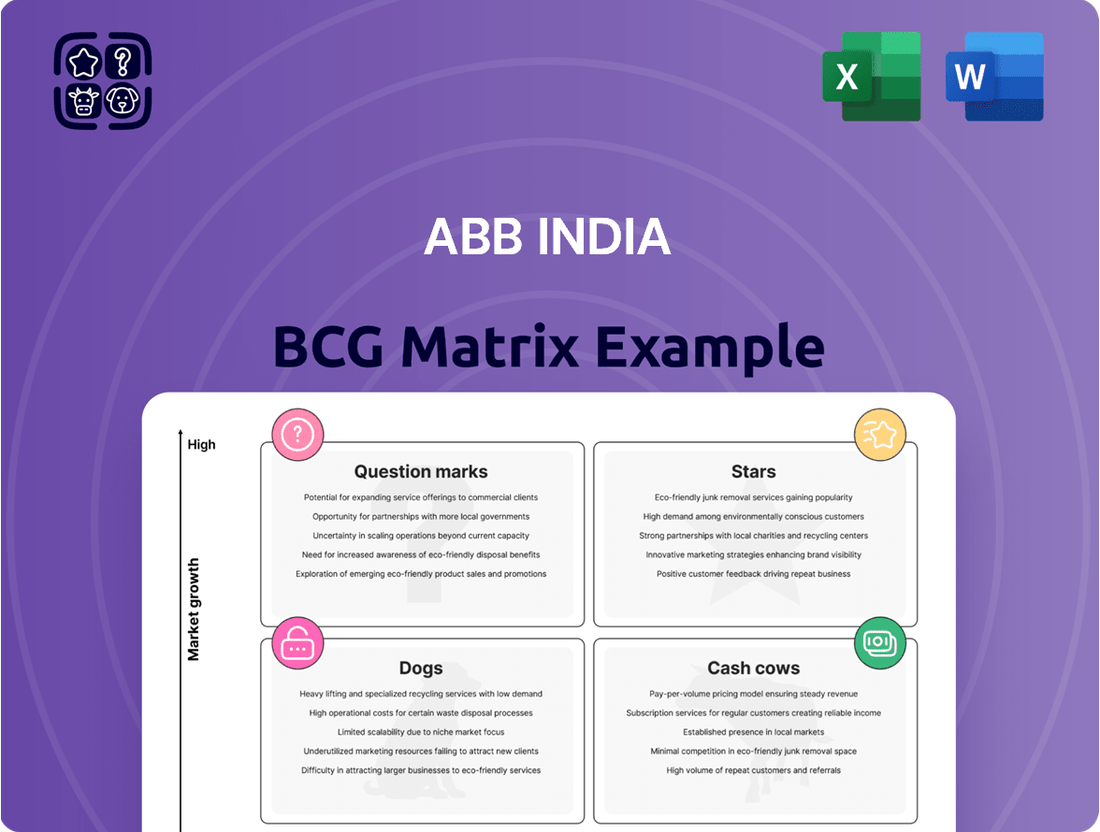

Abb India Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Abb India Bundle

Curious about Abb India's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. Understand where their products are positioned as Stars, Cash Cows, Dogs, or Question Marks to unlock vital strategic advantages.

Don't miss out on the complete picture! Purchase the full Abb India BCG Matrix for detailed quadrant analysis, actionable insights, and a clear roadmap to optimizing your investments and product development strategies.

Stars

ABB India is a dominant player in the renewable energy automation sector, having supplied solutions for over 10 gigawatts (GW) of solar, wind, and battery energy storage systems (BESS) across India. This substantial delivery highlights their strong market position in a rapidly expanding industry driven by India's commitment to a clean energy transition and its goal of achieving 500 GW of non-fossil fuel capacity by 2030.

The company's IoT-based PLC and SCADA systems are instrumental in enhancing the operational efficiency and energy management of these renewable energy facilities. By providing advanced automation, ABB India contributes directly to optimizing performance and ensuring the reliable integration of renewable sources into the national grid, a critical aspect of meeting ambitious sustainability targets.

Robotics and advanced automation represent a significant growth area for ABB India, aligning with the nation's push for manufacturing excellence. The industrial robotics market in India is booming, with automation adoption accelerating across manufacturing, automotive, and electronics. ABB is at the forefront of this expansion, introducing new modular robot arm lines and exploring innovative uses such as 3D printing in construction, as seen in their 2024 initiatives.

ABB's robotics division demonstrated strong performance, contributing to revenue growth in key sectors like electronics and automotive during Q4 of the 2024 fiscal year. This segment is crucial for ABB India's strategic positioning, reflecting the increasing demand for sophisticated automation solutions to enhance productivity and competitiveness in emerging industries.

ABB India's Bengaluru facility, a hub for smart power solutions, has undergone a significant Industry 5.0 upgrade to address the surging demand for intelligent energy management. This expansion directly supports the booming data center sector, a key growth driver for the company.

The Electrification business, a major contributor to ABB India's Q4 CY2024 revenue surge, is capitalizing on substantial data center orders. This segment is leveraging advanced digitalization and collaborative robotics to deliver cutting-edge smart power and digital electrification solutions.

Industry 5.0 Technologies & AI-driven Manufacturing

ABB India is heavily investing in Industry 5.0 technologies, including advanced collaborative robots and AI, to drive its manufacturing operations. This strategic push is evident in its smart factories, like the Nelamangala facility, which exemplifies the integration of sophisticated digitalization. These investments are geared towards boosting productivity and energy efficiency, aligning with the increasing market need for automated and future-ready production.

The company's commitment to smart manufacturing was underscored when its Smart Power Division received the 'Smart Factory of the Year' award in 2023, recognizing its high level of digital readiness. This award highlights ABB India's successful implementation of cutting-edge technologies to create more agile and efficient production environments.

- Investment in AI and Robotics: ABB India is actively deploying AI and collaborative robots to enhance manufacturing processes.

- Smart Factory Recognition: The Nelamangala plant showcases the company's progress in Industry 5.0, leading to accolades like the 'Smart Factory of the Year' award in 2023.

- Focus on Efficiency: These technological advancements are designed to improve both productivity and energy efficiency in manufacturing.

- Future-Ready Operations: ABB India's strategy aims to meet the growing demand for automated and advanced manufacturing solutions.

Integrated Digital & Automation Solutions for Infrastructure

ABB India is a key player in providing integrated digital and automation solutions for India's burgeoning infrastructure sector. Their offerings are vital for modernizing critical systems, as seen in projects like the Centralized Pipeline Information Management System for Indian Oil. This focus aligns directly with India's ambitious infrastructure development goals, presenting a significant growth opportunity.

The company's involvement in railway and metro projects further underscores its commitment to this high-growth segment. These sophisticated, high-value solutions are designed to enhance efficiency and reliability in essential public services. ABB India's substantial order backlog, reaching INR 46,570 crore as of December 31, 2023, demonstrates strong future revenue visibility from these infrastructure initiatives.

- Infrastructure Focus: ABB India provides advanced automation and digital solutions for critical infrastructure, including pipelines and transportation networks.

- Market Alignment: These offerings directly support India's extensive infrastructure development agenda, a key growth driver.

- Revenue Visibility: The company's robust order backlog, exceeding INR 46,000 crore at the end of 2023, indicates strong future revenue from these projects.

ABB India's robotics and discrete automation segment is a strong performer, exhibiting significant growth driven by increased automation adoption across various industries. This business unit is a prime example of a Star within the BCG matrix, characterized by high market share in a rapidly expanding market.

The company's robotics division saw robust demand, particularly from the electronics and automotive sectors, contributing to overall revenue growth in the latter half of 2024. This upward trajectory is supported by ongoing investments in new technologies and applications, such as 3D printing in construction, further solidifying its market leadership.

ABB India's strategic focus on advanced automation and its ability to cater to emerging industrial needs position this segment for continued high growth and market dominance. The segment's performance is a key indicator of the company's success in leveraging technological advancements to capture market opportunities.

| Segment | Market Growth | Market Share | BCG Classification |

| Robotics & Discrete Automation | High | High | Star |

| Renewable Energy Automation | High | High | Star |

| Electrification (Data Centers) | High | High | Star |

| Infrastructure Solutions | High | Medium | Question Mark / Star |

What is included in the product

Highlights which of Abb India's business units to invest in, hold, or divest based on market growth and share.

The Abb India BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of complex data analysis for strategic decision-making.

Cash Cows

ABB India's core electrification products, like switchgear and circuit breakers, are solid cash cows. These are established offerings serving industries, businesses, and homes, benefiting from consistent demand. In 2023, ABB India's Electrification segment revenue was INR 8,772 crore, highlighting its significant contribution.

Standard Motors & Drives, a core component of ABB India's Motion business, offers motors, generators, and drives essential for industrial productivity and energy efficiency. This segment thrives in a mature market, consistently delivering robust and stable cash flow thanks to the fundamental demand for its products and the increasing focus on energy-saving technologies.

In 2023, ABB India's Motion segment, which includes these standard products, saw a significant increase in orders, growing by 34% to INR 4,678 crore. This strong performance highlights the continued revenue growth driven by these reliable cash cows.

ABB India's Process Automation segment, a cornerstone of its operations, offers vital control systems and measurement products to established sectors such as metals, mining, and energy. This segment, while experiencing stable growth rather than rapid expansion, consistently delivers revenue through its indispensable role in optimizing operations and its reliance on enduring service agreements, solidifying its position as a dependable cash cow.

In the fourth quarter of fiscal year 2024, the Process Automation division demonstrated remarkable stability, underscoring its mature yet robust market presence. This consistent performance highlights the segment's ability to generate predictable cash flows, essential for funding other growth initiatives within ABB India.

Long-Term Service & Maintenance Contracts

ABB India's long-term service and maintenance contracts are a prime example of a Cash Cow within its BCG Matrix. The company leverages its extensive installed base of equipment and systems across diverse industries to generate a consistent and recurring revenue stream. This segment benefits from low market growth but commands a high market share, ensuring stable and predictable cash flows that bolster overall profitability and operational efficiency.

These service and maintenance agreements are crucial for ABB India's financial stability. For instance, in 2023, the company reported strong growth in its Process Automation segment, which heavily relies on such service revenues, contributing significantly to its overall revenue momentum. This predictable income allows for greater financial planning and investment in other business areas.

- Recurring Revenue: Service and maintenance contracts provide a consistent and predictable income stream, insulating ABB India from market volatility.

- High Market Share: ABB India's established presence and expertise allow it to capture a significant portion of the service market for its installed base.

- Profitability Driver: These contracts are typically high-margin, contributing substantially to the company's bottom line and supporting its operational efficiency.

- Revenue Momentum: Service and export revenues have been key contributors to ABB India's recent revenue growth, highlighting the importance of this segment.

Established Power Infrastructure Solutions

ABB India's Established Power Infrastructure Solutions are indeed strong contenders in the cash cow category of the BCG matrix. Their deep involvement in large-scale, ongoing power infrastructure projects, such as providing reliable power distribution for metro systems and implementing advanced grid automation solutions, highlights a market segment characterized by consistent and stable demand.

These projects frequently leverage established technologies where ABB India holds a significant competitive edge and a substantial market share. This strong market position translates into steady and predictable revenue streams, a hallmark of a cash cow. For instance, in 2023, ABB India secured orders worth approximately INR 4,200 crore for grid modernization projects, demonstrating the ongoing demand for their infrastructure expertise.

- Stable Market Presence: ABB India consistently participates in critical national infrastructure development, ensuring a continuous flow of revenue from established projects.

- Strong Competitive Advantage: Deep expertise in grid automation and power distribution technologies allows ABB to maintain a dominant market position.

- Predictable Revenue Generation: Long-term contracts and recurring needs in infrastructure provide a reliable and steady income for this business segment.

- Robust Cash Position: The consistent profitability from these operations significantly bolsters ABB India's overall cash reserves.

ABB India's Electrification products, like switchgear and circuit breakers, are solid cash cows, benefiting from consistent demand in established markets. In 2023, this segment contributed INR 8,772 crore to revenue, showcasing its significant and stable financial contribution.

Standard Motors & Drives, part of the Motion business, consistently generates robust cash flow due to the fundamental demand for industrial productivity and energy efficiency. The segment's orders grew by 34% to INR 4,678 crore in 2023, underscoring its reliable revenue generation.

ABB India's Process Automation segment, with its vital control systems and measurement products, acts as a dependable cash cow. Its stable growth and reliance on enduring service agreements solidify its role in optimizing operations and providing predictable cash flows, as demonstrated by its robust performance in Q4 2024.

Long-term service and maintenance contracts are prime examples of ABB India's cash cows, offering consistent, recurring revenue from its extensive installed base. These high-margin contracts, crucial for financial stability, significantly contribute to the company's bottom line and revenue momentum, as seen in the Process Automation segment's 2023 performance.

| ABB India Segment | BCG Category | 2023 Revenue (INR Cr) | Key Characteristics |

|---|---|---|---|

| Electrification | Cash Cow | 8,772 | Established products, consistent demand, high market share. |

| Motion (Standard Motors & Drives) | Cash Cow | 4,678 (Orders) | Mature market, stable cash flow, energy efficiency focus. |

| Process Automation | Cash Cow | N/A (Segment Data) | Indispensable role, enduring service agreements, predictable cash flow. |

| Service & Maintenance Contracts | Cash Cow | N/A (Integrated) | Recurring revenue, high margins, financial stability driver. |

Preview = Final Product

Abb India BCG Matrix

The Abb India BCG Matrix preview you are viewing is the exact, fully completed document you will receive upon purchase. This comprehensive analysis, meticulously prepared, contains no watermarks or placeholder text, ensuring you get a professional and actionable strategic tool immediately. You can confidently download this report, knowing it's ready for immediate integration into your business planning and decision-making processes.

Dogs

In Abb India's BCG Matrix, outdated legacy product offerings represent those older technologies or product lines that have been surpassed by more advanced alternatives. These products typically hold a small market share within stagnant or shrinking market segments. For instance, if a company like ABB India had a legacy product line for older industrial automation systems that have been replaced by their own newer, more integrated digital solutions, these would fall into this category.

These legacy products often generate very little revenue and can consume valuable resources that could be better allocated to newer, high-growth areas. While specific figures for Abb India's legacy products aren't publicly disclosed, it's common for such offerings to contribute less than 5% to a company's overall revenue in mature industries, especially when newer, more efficient technologies are readily available. For example, if a company's older transformer designs are no longer competitive against newer, more energy-efficient models, they would represent a legacy offering.

Such offerings are often prime candidates for divestiture or discontinuation. This strategic move allows the company to streamline its portfolio, reduce operational complexity, and focus investment on products that align with current market demands and future growth potential. By shedding these underperforming assets, Abb India can free up capital and management attention for its Stars and Cash Cows.

Low-margin, highly commoditized components in ABB India's portfolio, such as basic electrical switches or standard automation sensors, face intense price competition. In 2024, the global market for these components often sees profit margins in the low single digits, making it challenging to achieve significant returns.

If ABB India possesses a small market share in these commoditized segments, and the overall market growth is sluggish, these areas would likely be classified as Dogs. This classification signifies their limited ability to generate substantial profits or cash flow for the company.

Consequently, ABB India would strategically aim to reduce or divest its investment in these low-growth, low-margin areas, focusing resources on more promising business units.

Niche Solutions with Failed Market Adoption in ABB India's portfolio would represent products or services that, despite targeting specific markets, couldn't capture significant share or demonstrate growth. These are often characterized by low sales volume and limited future prospects, potentially draining resources without yielding returns.

Consider a hypothetical scenario where ABB India launched a specialized industrial automation solution for a very specific manufacturing process. If this solution, perhaps due to high implementation costs or a lack of widespread demand for that particular niche, only achieved a minimal market penetration, it would fall into this category. For instance, if such a product only secured 0.5% of its intended niche market by 2024, it would be a prime example.

Underperforming Non-Core Ventures

Underperforming non-core ventures within ABB India's portfolio, if any exist, would represent business segments that consistently generate low returns and operate in markets with limited growth prospects. These ventures typically hold a small market share and drain company resources without making a significant contribution to overall profitability. For instance, if ABB India had a minor segment in, say, legacy industrial automation components with declining demand, it might fit this description. The company’s strategy would likely involve a thorough evaluation for potential divestment or scaling down to redirect capital towards more promising, core business areas.

Such ventures would be characterized by their low growth and low market share, making them prime candidates for strategic pruning. ABB India's focus in 2024 is on its core electrification and robotics & discrete automation segments, which are experiencing robust demand. For example, in Q1 2024, ABB India reported a significant order intake growth in its Process Automation division, indicating strong performance in its key operational areas, rather than in ancillary or underperforming units.

- Low Return on Investment: Ventures that consistently fail to meet profitability benchmarks.

- Limited Market Growth: Operating in sectors with stagnant or declining demand.

- Resource Drain: Consuming management attention and capital without commensurate returns.

- Strategic Reallocation: Potential for divestment or downsizing to focus on core strengths.

Products Affected by Rapid Technological Obsolescence

In the context of ABB India's BCG Matrix, products susceptible to rapid technological obsolescence fall into the Dogs category. These are offerings that, due to a failure to innovate alongside fast-paced technological advancements, are experiencing declining demand and market share. For instance, if ABB India had legacy automation systems or older industrial software that haven't been updated to meet current Industry 4.0 standards, they would likely be classified as Dogs.

Such products are often found in segments with low market growth, exacerbated by their outdated technology. For example, while the global industrial automation market was projected to reach approximately $250 billion by 2024, products failing to integrate AI or advanced analytics would struggle to capture even a small fraction of this expanding market. These "Dogs" typically necessitate significant investment in turnaround strategies, which carry a high risk of failure given the entrenched obsolescence.

- Obsolescence Risk: Products in sectors like industrial robotics or power electronics face constant upgrades. For example, the lifespan of certain specialized control systems can be as short as 5-7 years due to rapid advancements in processing power and connectivity standards.

- Market Share Decline: If ABB India's offerings in, say, legacy switchgear technology are not upgraded with smart grid capabilities, their market share could shrink as competitors offer more efficient, connected solutions.

- Low Growth Segment: Products that haven't adapted to digital transformation trends, such as basic motor control units without variable speed drives, would be in a low-growth segment of the broader electrical equipment market.

- Turnaround Costs: Revitalizing an obsolete product line might involve substantial R&D investment, potentially running into millions of dollars, with no guarantee of market acceptance against newer, more advanced alternatives.

In ABB India's BCG Matrix, 'Dogs' represent products or business units with low market share in low-growth markets. These offerings often struggle with profitability and may consume resources without generating significant returns. Examples include legacy product lines, commoditized components, or niche solutions that failed to gain traction.

ABB India's strategy for 'Dogs' typically involves minimizing investment, seeking divestiture, or discontinuing them to reallocate capital to more promising areas. For instance, if a specific type of older industrial sensor experiences declining demand and ABB India holds a small market share, it would be classified as a Dog.

The focus for these underperforming assets is on efficiency and eventual exit, rather than growth. By shedding these, ABB India can better concentrate on its 'Stars' and 'Cash Cows', ensuring a more robust and profitable product portfolio. This strategic pruning is crucial for long-term financial health.

Question Marks

ABB India's early-stage EV charging infrastructure solutions are in a classic question mark position within the BCG matrix. While the Indian EV market is experiencing robust growth, with projections indicating a significant expansion in the coming years, ABB India's current market share in charging infrastructure is still nascent. For instance, the Indian government aims for 30% EV penetration by 2030, a target that necessitates a massive build-out of charging networks.

Despite the acquisition of Numocity in 2022, which aimed to bolster its presence, ABB India faces intense competition in this high-growth segment. This means substantial investment is required to capture a leading market position and scale operations effectively. The sector's rapid evolution and the strong government push for EV adoption underscore the immense potential, but also the need for strategic capital allocation to overcome current market share limitations.

ABB India's advanced and niche digital solutions, like specialized IoT platforms for industrial challenges, are likely positioned as question marks in the BCG matrix. These offerings target burgeoning sectors such as digital operations and cybersecurity, areas with significant growth potential.

Despite the high-growth potential, these innovative solutions may currently possess a low market share. For instance, while the Indian Industrial IoT market was valued at approximately USD 2.5 billion in 2023 and is projected to reach over USD 10 billion by 2028, ABB India's specific niche offerings might still be in the early stages of market penetration.

Significant investment in marketing and customer education is crucial for these question mark products. This is to ensure they gain traction and transition into stars, rather than stagnating and becoming dogs. The focus is on building awareness and demonstrating the value proposition to overcome initial market adoption hurdles.

ABB India is actively exploring cutting-edge robotics in developing sectors like construction 3D printing, often through strategic partnerships. These nascent applications hold substantial future growth prospects, though their current market share within these specialized areas remains minimal.

Significant investment in R&D and market development is essential for these ventures to transition from question marks to stars in ABB India's portfolio. For instance, the global construction 3D printing market was valued at approximately USD 1.5 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, highlighting the potential for companies like ABB India to capture significant market share as these technologies mature.

Emerging Smart Building & Home Automation Offerings

ABB India's emerging smart building and home automation offerings, such as the LIORA switch series, are positioned in a rapidly expanding market. While the overall smart building sector is experiencing significant growth, these advanced and modular solutions are likely in their early stages of market penetration, suggesting a low initial market share. This aligns with the characteristics of a question mark in the BCG matrix, requiring substantial investment to capture market potential.

- Market Growth: The global smart building market was valued at approximately USD 80.6 billion in 2023 and is projected to reach USD 217.5 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 15.3% during the forecast period. (Source: Verified Market Research, 2024)

- ABB's Position: ABB India's newer, advanced solutions likely face intense competition from established players and emerging technologies, necessitating aggressive marketing and sales strategies to build brand awareness and drive adoption.

- Investment Need: Significant investment in product development, marketing campaigns, and channel partnerships will be crucial for these offerings to gain traction and move towards a stronger market position.

- Strategic Focus: The strategy for these question mark products should focus on increasing market share through innovation, competitive pricing, and targeted customer engagement to convert them into stars.

Specialized Microgrid Solutions for Underserved Areas

ABB India views the development of specialized microgrid solutions for underserved areas as a significant growth opportunity, aligning with the nation's push for universal electrification. These solutions, while holding high potential, currently represent a smaller market share for ABB India within a segment that is rapidly expanding but also presents unique deployment challenges.

The company recognizes that strategic investments are crucial to scale up the development and implementation of these microgrids. This focus is essential for capturing a more substantial portion of this promising market, which is expected to see considerable growth in the coming years.

- Market Potential: India's vast rural and remote regions present a substantial demand for reliable power, making microgrids a key solution.

- Current Position: Specialized microgrids for these areas may currently constitute a low market share for ABB India, reflecting the segment's nascent stage.

- Strategic Imperative: Increased investment is necessary to overcome deployment hurdles and establish a dominant presence in this high-growth sector.

- Growth Projection: The microgrid market in India is projected to grow significantly, driven by government initiatives and the need for energy access.

ABB India's EV charging infrastructure, advanced IoT platforms, cutting-edge robotics, smart building solutions, and specialized microgrids are all prime examples of question marks in the BCG matrix. These represent high-growth potential markets where ABB India is still establishing its market share. Significant investment in research, development, marketing, and strategic partnerships is crucial for these ventures to mature and transition into stars.

The Indian EV market alone is projected to see substantial growth, with government targets driving the need for extensive charging infrastructure. Similarly, sectors like Industrial IoT and smart buildings are expanding rapidly, offering fertile ground for ABB India's innovative solutions. However, the current low market penetration necessitates a focused strategy to capture market share and capitalize on these emerging opportunities.

| Product/Solution Area | BCG Category | Market Growth Potential | Current Market Share | Strategic Imperative |

|---|---|---|---|---|

| EV Charging Infrastructure | Question Mark | High (India aims for 30% EV penetration by 2030) | Nascent | Significant investment to scale operations and capture market share. |

| Advanced IoT Platforms | Question Mark | High (Indian Industrial IoT market projected to reach over USD 10 billion by 2028) | Low | Marketing and customer education to drive adoption. |

| Cutting-Edge Robotics (e.g., Construction 3D Printing) | Question Mark | High (Global construction 3D printing market projected to grow at a CAGR of over 15% through 2030) | Minimal | R&D and market development investment to transition into stars. |

| Smart Building & Home Automation | Question Mark | High (Global smart building market projected to reach USD 217.5 billion by 2030) | Low | Aggressive marketing and channel partnerships to build awareness. |

| Specialized Microgrids | Question Mark | High (Driven by India's need for universal electrification) | Low | Strategic investments to overcome deployment hurdles and establish presence. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.