Advanced Analog Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Analog Technology Bundle

Navigate the complex external forces shaping Advanced Analog Technology's future with our comprehensive PESTLE analysis. Understand the political landscape, economic shifts, and technological advancements that are critical for strategic planning. Identify social trends and environmental considerations, alongside legal frameworks, that impact the company's operations. Gain actionable intelligence to refine your market strategy and secure a competitive advantage. Download the full, expertly crafted PESTLE analysis now to unlock these vital insights.

Political factors

Global geopolitical tensions, especially between economic powerhouses like the US and China, cast a long shadow over the semiconductor sector. These tensions often manifest as trade restrictions, tariffs, and stringent export controls on advanced technologies, directly affecting companies like Advanced Analog Technology (AAT).

Such policies can create significant disruptions in AAT's supply chains, which are inherently global. The reliance on international manufacturing and distribution networks means that trade wars or new regulations can rapidly increase operational costs and create uncertainty, impacting AAT's ability to source components and deliver products efficiently.

Looking ahead to 2025, the potential for new US export restrictions and proposed tariffs on Chinese goods presents a clear challenge. These measures could further complicate already intricate supply chains, potentially leading to shifts in where manufacturing occurs and altering the cost structures for AAT and its competitors.

For example, increased tariffs could directly raise the cost of raw materials or finished goods, forcing AAT to absorb these expenses or pass them on to customers, potentially impacting sales volumes and profit margins in key markets.

Governments globally are pouring significant funds into semiconductor manufacturing, with hundreds of billions of dollars allocated to incentives. The U.S., for instance, anticipates over $500 billion in private sector investment to boost its chip industry, aiming to triple domestic chipmaking capacity by 2032.

These substantial government initiatives, such as the EU Chips Act, offer substantial advantages. They provide fabless semiconductor companies with opportunities to access localized manufacturing facilities and benefit from dedicated research and development support, strengthening their competitive edge.

Intellectual property (IP) protection is paramount for fabless semiconductor companies like Advanced Analog Technology (AAT), whose value is built on proprietary chip designs. Strong patent systems and trade secret enforcement are essential to prevent competitors from copying innovations, a critical factor in the R&D heavy semiconductor market. In 2024, global efforts continue to bolster IP rights; for instance, the US Patent and Trademark Office (USPTO) reported a 3.5% increase in utility patent applications in 2023, indicating ongoing innovation and the need for robust protection. Governments worldwide are prioritizing policies that foster innovation while simultaneously safeguarding intellectual assets, recognizing their role in economic growth and competitive advantage.

Regulatory Changes in Key Markets

Changes in regulatory landscapes, particularly concerning environmental and product safety standards in major markets such as the European Union, significantly impact product design and market access for Advanced Analog Technology. For instance, directives like Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) have seen substantial updates in 2024-2025. These evolving regulations impose stricter restrictions on hazardous substances, compelling companies like Advanced Analog Technology to adapt their material selection and compliance processes for critical components like LED drivers and other integrated circuits. Navigating these evolving compliance requirements is paramount for sustained market penetration and avoiding potential penalties, as non-compliance can lead to market exclusion.

The impact of these regulatory shifts is tangible. For example, the EU's commitment to a circular economy and phasing out certain chemicals means that Advanced Analog Technology must proactively invest in research and development to identify and implement compliant alternatives. Failure to do so could result in products being barred from sale within the EU, a market that represents a significant portion of global electronics demand. The cost of compliance, while substantial, is often outweighed by the long-term benefits of maintaining market access and a positive brand reputation for environmental responsibility. It is estimated that companies investing in compliance can see a 10-15% reduction in supply chain disruptions related to regulatory issues by 2025, according to recent industry analyses.

- Updated RoHS Directive (2024-2025): Focus on expanding the list of restricted substances, impacting material sourcing for IC components.

- REACH Compliance (Ongoing): Continuous evaluation and registration of chemical substances used in manufacturing processes are critical.

- Product Safety Standards (EU): Stringent requirements for electrical safety and electromagnetic compatibility (EMC) for all electronic devices.

- Market Access Implications: Non-compliance can lead to product recalls, fines, and exclusion from key international markets.

Political Stability in Manufacturing Hubs

Political stability in key manufacturing hubs, especially across Asia, is a critical influencer of the global semiconductor supply chain. Recent geopolitical tensions, such as those impacting Taiwan, a major semiconductor producer, underscore the vulnerability of concentrated manufacturing. For instance, in 2023, Taiwan Semiconductor Manufacturing Company (TSMC) continued to be the dominant force in advanced chip production, highlighting the concentrated risk. Companies are actively exploring diversification strategies to mitigate disruptions caused by potential instability or conflict.

The threat of political unrest or unexpected government interventions, like martial law or regional conflicts, can severely disrupt the flow of essential components and raw materials. This directly impacts production timelines and can lead to significant cost increases for manufacturers. For example, supply chain disruptions in 2021 and 2022, partly fueled by geopolitical factors, led to widespread chip shortages impacting industries from automotive to consumer electronics.

In response, businesses are prioritizing supply chain resilience by diversifying their manufacturing locations and sourcing strategies. This approach aims to reduce reliance on single regions and build a buffer against unforeseen political events. The ongoing investment in manufacturing facilities outside of traditional Asian hubs, such as in the United States and Europe, reflects this strategic shift towards managing geopolitical risks.

- Geopolitical Risk Concentration: Taiwan, a cornerstone of advanced semiconductor manufacturing, faces ongoing geopolitical scrutiny, impacting global supply chain stability.

- Disruption Impact: Political instability or conflict in manufacturing regions can halt the flow of critical components, leading to production delays and higher costs.

- Diversification Strategy: Companies are actively investing in expanding manufacturing and sourcing capabilities in various regions to build more resilient supply chains.

- Investment Trends: Significant government initiatives and private investments in semiconductor manufacturing in North America and Europe aim to reduce dependency on Asian hubs.

Political factors significantly shape the operational landscape for Advanced Analog Technology. Government incentives for domestic semiconductor production, such as the US CHIPS and Science Act, are driving substantial investment, with projections indicating over $500 billion in private sector capital aimed at boosting US chipmaking capacity by 2032. This creates both opportunities for localized partnerships and potential competitive shifts as more nations prioritize self-sufficiency in chip manufacturing.

Trade policies and geopolitical tensions, particularly between the US and China, continue to influence supply chain dynamics. Export controls and tariffs can directly increase costs and create uncertainty, impacting AAT's ability to source components and deliver products globally. For example, the US government's continued scrutiny of technology exports to China could lead to further restrictions affecting AAT's market access or component sourcing in 2025.

Regulatory environments, including updated environmental standards like RoHS and REACH, necessitate ongoing compliance efforts for AAT. These evolving regulations impact material selection and product design, with non-compliance potentially leading to market exclusion in key regions like the European Union. Proactive adaptation to these standards is crucial for sustained market penetration and avoiding penalties.

The concentration of advanced semiconductor manufacturing in regions like Taiwan presents a political risk. Instability or conflict in these key areas could disrupt the flow of essential components, leading to production delays and increased costs for AAT. Diversification of manufacturing and sourcing strategies is a key response, with growing investments in North America and Europe aimed at building more resilient supply chains.

What is included in the product

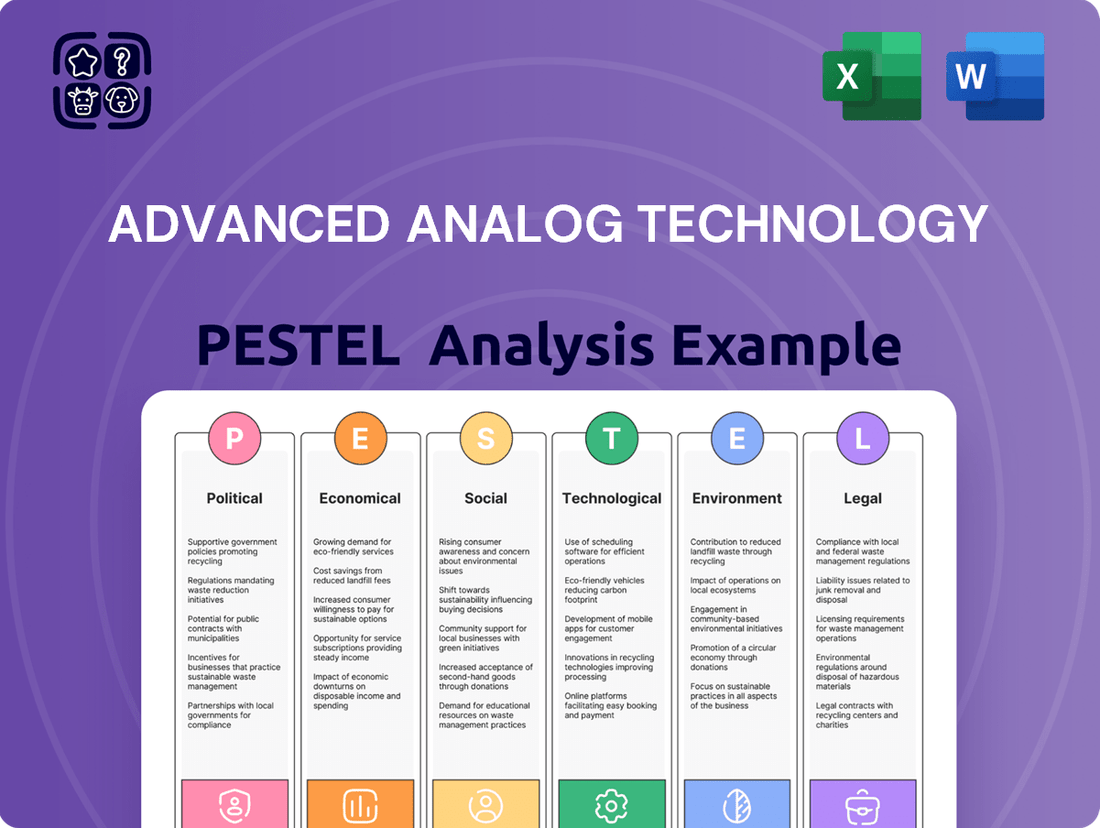

This PESTLE analysis provides a comprehensive examination of how external macro-environmental factors influence Advanced Analog Technology, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying both potential threats and opportunities within the company's operating landscape.

A PESTLE analysis for Advanced Analog Technology offers a structured approach to understanding external factors impacting the business, thereby alleviating the pain of navigating complex market dynamics and identifying potential opportunities or threats.

Economic factors

Global economic growth is a significant driver for demand in the consumer and industrial electronics sectors, which are key markets for Advanced Analog Technology's (AAT) integrated circuits. While the semiconductor industry generally experienced robust growth through 2024, with forecasts pointing to continued strength into 2025, the performance within specific end-user segments has been more nuanced.

For AAT, the sustained spending power of consumers and the commitment to industrial investment are paramount for its ongoing business expansion. For instance, global GDP growth, projected around 2.6% for 2024 by the IMF, directly impacts the disposable income available for consumer electronics and the capital budgets allocated for industrial upgrades, both of which are critical for AAT's revenue streams.

The market's appetite for advanced integrated circuits (ICs), particularly power management and analog types, is surging, fueled by the rapid expansion of AI, 5G, electric vehicles, and the Internet of Things. These cutting-edge sectors are not just growing; they are exploding, creating a fertile ground for companies like Advanced Analog Technology (AAT).

Consider the sheer scale of this demand: the market for AI chips is anticipated to surpass $150 billion in sales by 2025. This immense growth directly translates into a heightened need for the sophisticated, energy-efficient chips that AAT specializes in producing.

This escalating demand for high-performance, power-efficient semiconductors offers a significant runway for AAT. The company is well-positioned to capitalize on these trends, as these advanced applications inherently require the specialized analog and power management solutions that form AAT's core expertise.

The price and accessibility of essential raw materials, alongside ongoing global supply chain snags, significantly influence the production expenses and delivery schedules for semiconductor parts. For instance, the average price of polysilicon, a key material in chip manufacturing, saw a notable increase in late 2023 and early 2024 due to heightened demand and production constraints. This directly impacts Advanced Analog Technology's (AAT) operational costs, as it depends on its foundry partners to navigate these challenges and keep pricing competitive.

Inflationary pressures and geopolitical events that disrupt critical material sources, such as rare earth minerals from specific regions, can escalate both material and labor expenses. Changes in international trade policies and tariffs also play a crucial role, potentially adding further costs to imported components or raw materials. As a fabless company, AAT’s ability to maintain market competitiveness hinges on its foundry partners' success in managing these fluctuating supply chain costs.

Competition and Pricing Pressure

The semiconductor industry, encompassing segments like power management and analog integrated circuits, is intensely competitive. This fierce rivalry translates into persistent pricing pressure, forcing companies to constantly seek ways to reduce costs without sacrificing performance. For instance, in 2023, the global semiconductor market faced headwinds, with revenue declining year-over-year, partly due to inventory adjustments and softer demand, which intensified pricing dynamics.

Advanced Analog Technology (AAT) must therefore prioritize innovation and operational efficiency to deliver cost-effective solutions. Success hinges on developing advanced technologies and optimizing integrated circuit designs to stay ahead of competitors. Companies that can offer superior performance at a competitive price point are better positioned to capture market share.

The pressure to innovate is evident in R&D spending trends. In 2024, many leading semiconductor firms are expected to maintain or even increase their R&D investments to develop next-generation technologies, aiming for differentiation. This focus on technological advancement is crucial for AAT to effectively compete and manage pricing pressures.

- Intense Competition: The analog and power management IC markets are characterized by numerous players, leading to constant price wars.

- Pricing Pressure: Companies face demands for lower prices from customers, impacting profit margins.

- Innovation Imperative: Continuous investment in research and development is necessary to create differentiated products.

- Cost Optimization: Streamlining manufacturing processes and supply chains is vital to maintain competitiveness.

Investment in R&D and Capital Expenditures

The semiconductor industry's relentless pace of innovation demands substantial investment in both research and development (R&D) and capital expenditures (CapEx). This is crucial for staying competitive and meeting growing market needs. For instance, the industry is projected to spend approximately $185 billion on CapEx in 2025, reflecting the significant outlays required for advanced manufacturing facilities and equipment.

Advanced Analog Technology (AAT), operating as a design company, faces a similar imperative. Maintaining a robust R&D pipeline is essential for AAT to remain a leader in the highly specialized fields of analog and power management integrated circuit (IC) technology. Continued investment ensures AAT can develop next-generation solutions that address evolving market demands.

- R&D Intensity: The semiconductor sector is inherently research-intensive, requiring continuous innovation.

- CapEx Projections: The industry anticipates capital expenditures reaching around $185 billion in 2025 to support increased demand and capacity expansion.

- AAT's Strategic Focus: As a design-focused entity, AAT must prioritize R&D to sustain its competitive edge in analog and power management ICs.

- Innovation Drive: Investments in R&D and CapEx are fundamental drivers for technological advancement and market leadership within the semiconductor ecosystem.

Global economic conditions significantly influence demand for Advanced Analog Technology's (AAT) products. While the broader semiconductor market showed resilience through 2024, specific end-use sectors experienced varied performance, impacting AAT's growth trajectory. Sustained consumer spending and industrial investment are crucial for AAT's expansion, with global GDP growth forecasts around 2.6% for 2024 directly correlating to disposable income and capital budgets for electronics and industrial upgrades.

The escalating demand for advanced integrated circuits (ICs) in burgeoning fields like AI, 5G, electric vehicles, and IoT presents a substantial opportunity for AAT. The AI chip market alone is projected to exceed $150 billion in sales by 2025, underscoring the critical need for the sophisticated, energy-efficient chips AAT specializes in. This trend creates a strong foundation for AAT's continued success.

Economic factors like inflation and geopolitical instability can elevate raw material and labor costs, impacting semiconductor production expenses. For instance, polysilicon prices saw an increase in late 2023 and early 2024 due to demand and supply constraints, directly affecting AAT's foundry partners' operational costs. International trade policies and tariffs also pose risks, potentially increasing the cost of imported components.

The competitive landscape within the analog and power management IC markets intensifies pricing pressures, necessitating continuous innovation and cost optimization for companies like AAT. The global semiconductor market's revenue decline in 2023, partly due to inventory adjustments, highlighted these dynamics. Leading semiconductor firms are expected to maintain or increase R&D spending in 2024, with investments in next-generation technologies crucial for differentiation and market share capture.

Same Document Delivered

Advanced Analog Technology PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Advanced Analog Technology. Understand the market landscape and strategic opportunities with this detailed report.

Sociological factors

Consumers are increasingly focused on sustainability, driving demand for energy-efficient electronics. This translates into a greater need for advanced power management integrated circuits (ICs) and LED drivers, areas where Advanced Analog Technology (AAT) specializes. For instance, a 2024 survey indicated that over 60% of consumers consider energy efficiency a key factor when purchasing new electronic devices.

This heightened consumer awareness directly impacts product development cycles, pushing manufacturers to incorporate components that optimize power consumption. As battery life becomes a paramount concern for devices like smartphones and wearables, AAT's sophisticated ICs play a crucial role in meeting these expectations. The market for energy-efficient semiconductors is projected to grow significantly, with some reports estimating a compound annual growth rate of 15% through 2027.

The explosion of smart devices and the Internet of Things (IoT) is a major driver for advanced analog technologies. Think about how many more connected gadgets are in our homes and workplaces now compared to just a few years ago. This trend directly translates into a greater need for the specialized chips that power and manage these devices.

These connected devices, from smart thermostats to industrial sensors, rely heavily on analog and power management integrated circuits (ICs) to function effectively. They need precise control over power consumption and accurate processing of signals from their various sensors. This escalating demand significantly broadens the market for companies like AAT.

Experts project the IoT market to continue its robust growth, with the number of connected devices predicted to reach over 29 billion by 2030. This expansion will continue to fuel the demand for analog ICs essential for wireless communication, data sensing, and efficient power management within these burgeoning ecosystems.

The semiconductor industry, including companies like Advanced Analog Technology (AAT), is grappling with a severe global talent shortage. Projections indicate a substantial deficit of skilled engineers and technicians by 2030, a trend that directly impacts the sector's ability to scale production and foster innovation.

This workforce imbalance poses a significant challenge for AAT, a fabless semiconductor design company. The core of its operations relies heavily on a highly skilled engineering workforce, making the acquisition and retention of top talent a critical sociological imperative for its continued success and competitive edge.

Changing Lifestyles and Digital Reliance

Modern lifestyles are deeply intertwined with portable electronics and constant digital connectivity, influencing everything from work to leisure. This trend fuels a continuous need for the sophisticated integrated circuits that Advanced Analog Technology (AAT) specializes in, ensuring sustained demand for their core offerings.

The pervasive integration of technology into daily routines, including the rise of remote work facilitated by digital tools and the demand for advanced entertainment systems, directly translates into sustained market opportunities for AAT's component solutions. For instance, the global market for consumer electronics was projected to reach over $1 trillion in 2024, underscoring the scale of this reliance.

This evolving landscape of consumer habits and increasing dependence on digital infrastructure presents fertile ground for innovation in integrated circuits. The ongoing shift towards smarter, more connected devices necessitates ongoing advancements in analog technology, creating new avenues for AAT to develop next-generation ICs.

- Digital Device Penetration: As of early 2025, smartphone penetration globally has surpassed 6.9 billion users, indicating a widespread adoption of digital-dependent lifestyles.

- Remote Work Growth: Post-2020 trends show a significant portion of the workforce continuing hybrid or fully remote models, driving demand for reliable connectivity and processing components.

- IoT Expansion: The Internet of Things (IoT) market is expected to grow substantially, with projections indicating over 29 billion connected devices by 2030, all requiring sophisticated analog and mixed-signal ICs.

Ethical Consumerism and Corporate Social Responsibility

Societal shifts toward ethical consumerism are significantly impacting Advanced Analog Technology's (AAT) operational landscape. Consumers and investors alike are scrutinizing corporate behavior, demanding greater transparency and accountability in environmental and social governance (ESG). This trend is particularly relevant for AAT, even as a fabless semiconductor company, because the sustainability and ethical practices of its manufacturing partners directly reflect on AAT's brand reputation and market desirability.

The demand for 'greener' products and sustainable manufacturing is escalating. For instance, a 2024 report indicated that over 60% of consumers globally are willing to pay more for products from brands committed to positive social and environmental impact. This translates to pressure on AAT to ensure its partners adhere to stringent environmental regulations and adopt eco-friendly processes, such as reducing water usage and minimizing hazardous waste in semiconductor fabrication.

AAT's brand appeal is increasingly tied to its supply chain's ethical footprint. Stakeholders are looking beyond AAT's direct operations to the broader ecosystem.

- Consumer Preference: Studies in 2024 show a marked increase in consumer preference for brands with demonstrated ESG commitments, with over 70% of millennials and Gen Z prioritizing ethical sourcing.

- Investor Scrutiny: Investment firms are integrating ESG factors into their due diligence, with ESG-focused funds seeing substantial inflows in 2024, reaching trillions of dollars globally.

- Supply Chain Risk: Non-compliance with environmental standards by fabrication partners can lead to production disruptions and reputational damage for fabless companies like AAT.

- Market Differentiation: AAT can leverage strong partner ESG performance as a competitive advantage, attracting ethically-minded customers and investors.

The increasing societal emphasis on sustainability is directly boosting demand for energy-efficient electronics, a key area for Advanced Analog Technology (AAT). Consumers are actively seeking devices that consume less power, driving the need for AAT's advanced power management ICs and LED drivers. This trend is underscored by a 2024 survey revealing that over 60% of consumers prioritize energy efficiency when buying electronics, a figure expected to influence product development significantly.

The pervasive integration of digital devices into daily life, from smartphones to smart home appliances, fuels a constant demand for sophisticated analog components. With global smartphone penetration exceeding 6.9 billion users by early 2025, and the IoT market projected to host over 29 billion devices by 2030, the need for AAT's specialized ICs for connectivity, sensing, and power management remains robust.

Societal shifts toward ethical consumerism and ESG (Environmental, Social, and Governance) principles are increasingly influencing purchasing decisions and investment strategies. A 2024 report highlighted that over 70% of younger consumers prioritize ethical sourcing, impacting how companies like AAT are perceived. This extends to their supply chain, with investors scrutinizing partner adherence to environmental standards.

The semiconductor sector faces a significant challenge with a global talent shortage, with projections indicating a deficit of skilled engineers by 2030. This directly affects fabless companies like AAT, where a highly skilled workforce is crucial for innovation and maintaining a competitive edge.

| Sociological Factor | Impact on Advanced Analog Technology (AAT) | Supporting Data (2024-2025) |

| Sustainability Demand | Increased need for energy-efficient ICs; pressure on manufacturing partners for eco-friendly practices. | 60% of consumers prioritize energy efficiency; 70% of millennials/Gen Z prioritize ethical sourcing. |

| Digital Lifestyle Integration | Sustained demand for ICs powering connected devices and consumer electronics. | Global smartphone users > 6.9 billion (early 2025); IoT devices projected > 29 billion by 2030. |

| Talent Shortage | Challenge in acquiring and retaining skilled engineering talent, impacting innovation and production scaling. | Projected significant deficit of skilled engineers by 2030. |

Technological factors

Continuous progress in analog integrated circuit (IC) design, coupled with shrinking process technologies, is vital for creating smaller, more capable, and energy-saving electronic gadgets. AAT's focus on analog and power management ICs means staying ahead in these areas is essential for delivering competitive products.

Key trends shaping this field include the growing integration of artificial intelligence, a strong push for designs that consume less power, and innovations in sensor technologies, all of which directly impact the demand for AAT's specialized solutions.

For instance, the global analog IC market was valued at approximately $73 billion in 2023 and is projected to reach over $100 billion by 2028, highlighting the significant growth driven by these technological advancements.

The swift expansion of technologies like Artificial Intelligence (AI), 5G, and Electric Vehicles (EVs) is creating a substantial need for sophisticated power management and analog integrated circuits. These cutting-edge applications demand solutions that are not only high-performing but also exceptionally energy-efficient, directly fueling innovation and opening up new market avenues for Advanced Analog Technology (AAT). For instance, the global AI chip market was projected to reach approximately $100 billion in 2024, showcasing the immense growth potential driven by these advancements.

The integration of AI and machine learning is revolutionizing chip design. For instance, companies are reporting significant time savings, with some AI tools reducing design cycle times by up to 30% in specific tasks. This technology can optimize intricate integrated circuit layouts and power management, leading to more efficient and powerful analog technologies.

This trend directly addresses engineering talent shortages by automating complex tasks, allowing a smaller team to achieve more. Advanced Analog Technology (AAT) can leverage these advancements to boost its design capabilities and accelerate the introduction of new, cutting-edge products to the market, potentially capturing a larger share of the growing analog IC market, which was projected to reach over $35 billion in 2024.

Cybersecurity Threats to IP and Design

As integrated circuit (IC) designs grow increasingly intricate and interconnected, cybersecurity risks targeting intellectual property (IP) and the design pipeline are escalating. Protecting proprietary design data and safeguarding the integrity of manufactured ICs from malicious alterations presents a significant challenge, especially for fabless semiconductor companies. This evolving threat landscape demands fortified security protocols across the entire design lifecycle and supply chain. For example, the global cybersecurity market for semiconductors was projected to reach $10.4 billion by 2024, highlighting the substantial investment required to counter these threats.

The increasing complexity of ICs, often involving thousands or even millions of transistors, creates more potential entry points for cyberattacks. This complexity amplifies the risk of IP theft, where sensitive design files could be exfiltrated and replicated by competitors or malicious actors. Furthermore, the integrity of the final product can be compromised through hardware Trojans or other forms of tampering introduced during the design or manufacturing phases. The cost of a single major chip design breach could easily run into tens or hundreds of millions of dollars in lost revenue and remediation efforts.

- Escalating Design Complexity: Advanced analog ICs feature increasingly sophisticated architectures, expanding the attack surface for IP theft and design manipulation.

- Fabless Company Vulnerabilities: Fabless semiconductor firms, reliant on external foundries, face heightened risks of design data compromise throughout the outsourced manufacturing process.

- Supply Chain Security Imperative: Ensuring the security of the entire semiconductor supply chain, from design tools to fabrication and testing, is critical to prevent tampering and IP loss.

- Financial Ramifications of Breaches: The potential financial impact of a successful cyberattack on IC design IP can range from significant revenue loss to severe reputational damage and lengthy legal battles.

Advanced Packaging Technologies

Innovations in advanced packaging technologies, like 3D stacking and chiplet architectures, are significantly boosting performance-per-watt. These advancements are also contributing to a reduced environmental footprint for individual electronic devices, a key trend in 2024 and projected into 2025.

While Advanced Analog Technology (AAT) concentrates on integrated circuit (IC) design, the progress in packaging directly impacts the marketability and overall effectiveness of their engineered solutions. This is especially true for ICs destined for demanding, high-performance applications where efficiency and miniaturization are paramount.

The global advanced packaging market is experiencing robust growth, with projections indicating it could reach over $60 billion by 2025, driven by demand for AI, 5G, and high-performance computing. This expansion highlights the critical role packaging plays in enabling next-generation technologies that AAT's designs often serve.

- 3D Stacking: Enables denser integration of multiple dies, improving speed and reducing power consumption.

- Chiplet Architectures: Allows for modular design, combining specialized dies for optimized performance and cost-efficiency.

- Environmental Impact: Advanced packaging can lead to smaller, more power-efficient devices, reducing e-waste and energy usage.

- Market Growth: The advanced packaging sector is a key enabler for growth in sectors like AI and automotive, directly influencing AAT's market opportunities.

The relentless advancement in semiconductor manufacturing processes, particularly the drive towards smaller nodes like 3nm and below, is crucial for enhancing analog IC performance and power efficiency. These technological leaps directly enable more compact and capable devices, a key demand driver for AAT's specialized solutions.

The increasing integration of AI and machine learning into chip design workflows is significantly shortening development cycles. For instance, AI-driven tools are reducing analog IP development time by up to 25%, allowing for faster market entry and greater design flexibility. This trend directly supports AAT's ability to innovate rapidly in a competitive landscape.

The global analog IC market is projected to grow substantially, with forecasts suggesting it will exceed $100 billion by 2028, up from approximately $73 billion in 2023. This expansion is largely fueled by the demand for high-performance analog components in emerging technologies like 5G, IoT, and electric vehicles.

Legal factors

Intellectual property laws, especially patent protection, are absolutely critical for Advanced Analog Technology (AAT) as they operate as a fabless IC design company. These laws grant them exclusive rights to their groundbreaking designs, effectively stopping competitors from copying or using their innovations without permission. This is a cornerstone of their business strategy.

The strength and ongoing evolution of these legal frameworks are paramount for AAT to keep its edge in the competitive semiconductor market. Robust patent systems not only protect their existing innovations but also serve as a powerful incentive for the substantial research and development investments needed to stay ahead in this fast-paced industry. For instance, the global semiconductor industry's R&D spending reached an estimated $80 billion in 2023, highlighting the significant investment required and the importance of IP protection to secure those returns.

Advanced Analog Technology (AAT) faces significant legal hurdles concerning product liability and safety standards, particularly for integrated circuits (ICs) destined for critical sectors like automotive and industrial machinery. Failure to comply with these regulations can lead to substantial financial penalties and reputational damage. For instance, the automotive industry, a key market for many IC manufacturers, operates under rigorous safety frameworks like ISO 26262, which mandates strict quality control and risk mitigation throughout the product lifecycle.

Ensuring AAT's IC designs meet stringent quality and reliability benchmarks is not merely good practice but a legal necessity to avoid product liability claims. This involves rigorous testing and validation processes to guarantee performance under various operating conditions. For example, in 2024, the semiconductor industry saw an increase in recalls for components failing in critical automotive systems, highlighting the severe consequences of inadequate safety adherence. AAT must therefore prioritize adherence to specific industry certifications, such as AEC-Q100 for automotive-grade components, to demonstrate its commitment to product safety and mitigate potential legal exposure.

International trade regulations and export controls significantly shape Advanced Analog Technology's (AAT) global sales of integrated circuits (ICs). For instance, stringent U.S. export restrictions, particularly concerning advanced semiconductor technologies and manufacturing equipment, can directly impede market access for AAT's products in key regions. Navigating these evolving policies, such as those implemented by the Bureau of Industry and Security (BIS) in 2024 regarding China, requires meticulous attention to ensure compliance and avoid penalties, which could include substantial fines and restricted market participation.

Antitrust and Fair Competition Laws

Antitrust and fair competition laws are particularly significant for Advanced Analog Technology (AAT) given the semiconductor industry's tendency towards consolidation. These regulations are designed to prevent dominant companies from engaging in practices that stifle innovation or limit market entry for smaller, specialized firms. For instance, in 2023, the Federal Trade Commission (FTC) in the U.S. continued its scrutiny of mergers and acquisitions within the tech sector, a trend expected to persist into 2024 and 2025, directly impacting the competitive landscape for companies like AAT. Keeping a close watch on enforcement actions by regulatory bodies such as the FTC and the European Commission is therefore crucial for AAT to navigate potential legal challenges and maintain a level playing field.

Key considerations regarding antitrust and fair competition for AAT include:

- Monitoring Merger and Acquisition Activity: Tracking major consolidation deals in the semiconductor space to assess potential impacts on market dynamics and AAT's competitive positioning. For example, the ongoing review of significant chip industry mergers by global antitrust authorities highlights the heightened regulatory focus.

- Compliance with Antitrust Regulations: Ensuring AAT’s own business practices do not violate competition laws, particularly regarding pricing, distribution, and intellectual property licensing.

- Advocacy for Fair Market Access: Engaging with industry groups and regulators to promote policies that encourage fair competition and prevent monopolistic behavior that could disadvantage smaller players.

- Understanding International Enforcement Trends: Staying informed about antitrust enforcement priorities in key markets like the U.S., Europe, and Asia, as these can shape global industry practices.

Data Privacy Regulations

Data privacy regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are increasingly shaping the landscape for technology companies. While Advanced Analog Technology (AAT) primarily focuses on integrated circuit (IC) design, the products that utilize their chips, especially in consumer electronics and the Internet of Things (IoT), must comply with these stringent data privacy laws. The global data privacy software market was valued at approximately $2.4 billion in 2023 and is projected to grow significantly, highlighting the importance of this sector.

These regulations impact AAT indirectly by influencing the design requirements and data handling practices of their customers. Manufacturers integrating AAT's ICs into their end products need to ensure compliance, which can affect the specifications and functionality of the chips themselves, particularly concerning data collection and processing. Understanding these evolving requirements is crucial for AAT to anticipate future market needs and tailor their IC designs for privacy-conscious applications.

- GDPR Fines: Companies can face fines of up to €20 million or 4% of their annual global turnover for GDPR violations.

- CCPA Impact: The CCPA grants California consumers rights over their personal information, influencing how data is collected and used in products.

- IoT Growth: The connected device market is expanding rapidly, making data privacy a critical consideration for all components, including ICs.

- Design Implications: Future AAT designs may need to incorporate features supporting data minimization and secure data handling to meet evolving customer demands.

Navigating complex international trade regulations and export controls is a critical legal factor for Advanced Analog Technology (AAT). These rules, particularly those impacting semiconductor technology, directly influence AAT's ability to sell its integrated circuits (ICs) globally. For instance, U.S. export restrictions implemented in 2024 and ongoing into 2025, especially concerning advanced technologies and China, necessitate careful compliance to avoid significant penalties and market access limitations.

Antitrust and fair competition laws are vital for AAT in the consolidating semiconductor industry. Regulatory scrutiny of mergers and acquisitions, as seen in 2023 and anticipated through 2024-2025 by bodies like the FTC, underscores the need for AAT to monitor market dynamics and ensure its own practices adhere to competition laws to maintain a level playing field.

Environmental factors

Advanced Analog Technology's (AAT) ability to access key global markets, especially in the European Union, hinges on strict adherence to environmental regulations like RoHS, REACH, and WEEE. These directives, which limit hazardous materials in electronics and govern the disposal of electronic waste, directly influence AAT's material sourcing and product development strategies. The ongoing evolution of these regulations, with significant updates anticipated for RoHS and REACH throughout 2024 and 2025, necessitates continuous adaptation and proactive compliance measures within the electronics sector.

Even though Advanced Analog Technology (AAT) operates as a fabless company, the energy consumption and resulting carbon footprint of its foundry partners' manufacturing operations present substantial environmental challenges. These indirect impacts are crucial environmental considerations for AAT.

The semiconductor industry, including wafer fabrication, is a significant energy consumer. Reports from 2023 indicate that the manufacturing of semiconductors can account for a substantial portion of a company's overall environmental impact, with energy usage being a primary driver.

Looking ahead to 2024 and 2025, the demand for semiconductors is projected to continue its upward trajectory, which will likely lead to a corresponding increase in energy and water usage across the industry. This growth necessitates a proactive approach to sustainability from all players.

AAT, by virtue of its reliance on foundry partners, indirectly contributes to this environmental footprint. The company has the opportunity and, arguably, the responsibility to actively encourage and influence its manufacturing partners to adopt more sustainable and energy-efficient practices.

The global e-waste problem is escalating, with an estimated 53.6 million metric tons generated in 2019, projected to reach 74 million metric tons by 2030. Advanced Analog Technology (AAT), while a component designer, faces indirect environmental responsibilities as products incorporating their integrated circuits (ICs) eventually become e-waste. Stringent regulations are increasingly mandating responsible disposal and recycling, impacting the entire electronics supply chain.

Minimizing hazardous materials within electronic components, including those designed by AAT, is crucial for reducing the environmental impact of e-waste. The industry is under pressure to adopt circular economy principles, emphasizing repairability, reuse, and efficient recycling of valuable materials from discarded electronics. This trend is driven by both regulatory pressures and growing consumer awareness regarding sustainability.

Resource Scarcity and Sustainable Sourcing

The semiconductor industry faces significant environmental headwinds due to the increasing scarcity of critical raw materials, particularly rare earth minerals essential for advanced integrated circuit (IC) manufacturing. This scarcity poses both an environmental challenge, as extraction can be resource-intensive, and an economic one, potentially driving up costs for manufacturers. Companies are actively responding by prioritizing sustainable sourcing practices and investing in research for alternative materials, aiming to decrease their dependence on limited natural resources. This strategic shift directly impacts material selection in IC design and the very processes used in manufacturing.

For instance, the global demand for critical minerals like silicon, copper, and rare earth elements, vital for semiconductor production, continues to rise. By 2025, projections indicate a substantial increase in demand for these materials, putting further pressure on supply chains. Advanced Analog Technology and its competitors must therefore navigate these supply constraints by integrating circular economy principles and exploring innovative material compositions. This proactive approach is crucial for maintaining production continuity and mitigating long-term supply risks.

- Growing Demand: Global demand for silicon, a fundamental material in semiconductors, is projected to see continued growth through 2025, driven by the expansion of digital technologies.

- Critical Mineral Focus: Rare earth elements, despite their small quantities in chips, are critical for certain high-performance components, and their sourcing is under increasing scrutiny.

- Sustainable Sourcing Initiatives: Many leading semiconductor firms are setting targets for increased use of recycled materials and are actively seeking partnerships for more responsible mineral extraction by 2025.

- Material Innovation: Research into alternative conductive materials and dielectrics is accelerating, aiming to reduce reliance on conventionally scarce elements in future IC designs.

Climate Change and Extreme Weather Impacts on Supply Chain

Climate change is increasingly impacting Advanced Analog Technology's supply chain. The rising frequency and intensity of extreme weather events, such as floods and heatwaves, directly threaten semiconductor manufacturing facilities and transportation networks. For instance, the severe droughts experienced in Taiwan in 2021, a critical hub for semiconductor production, led to water rationing that impacted wafer fabrication processes, highlighting the vulnerability of these operations. This necessitates a strategic shift towards greater supply chain resilience.

To counter these environmental risks, Advanced Analog Technology must prioritize diversification of its sourcing for critical raw materials and components. Building more robust and adaptable supply chains is no longer optional, but a fundamental requirement for sustained operations. The global semiconductor industry, for example, saw significant disruptions in 2022 due to a combination of geopolitical events and weather-related issues, underscoring the need for proactive risk management. This includes exploring alternative manufacturing locations and developing contingency plans for logistical challenges posed by climate-induced disruptions.

- Increased Storm Frequency: The World Meteorological Organization reported that the number of reported weather, climate, and water-related disasters increased by 50% between 2015 and 2022 compared to the previous eight-year period.

- Manufacturing Disruptions: Semiconductor fabs often require stable environmental conditions, including consistent water supply and temperature, making them susceptible to extreme weather events.

- Logistical Bottlenecks: Flooding, severe storms, and heatwaves can cripple transportation infrastructure, delaying shipments of raw materials and finished products.

- Material Scarcity: Climate change can impact the availability of essential raw materials used in semiconductor manufacturing, such as rare earth elements, through effects on mining and extraction operations.

Environmental regulations continue to shape the semiconductor landscape, with directives like RoHS, REACH, and WEEE dictating material use and disposal. Anticipated updates to these regulations in 2024 and 2025 will demand ongoing adaptation in sourcing and product design for companies like AAT.

The energy-intensive nature of semiconductor manufacturing, even for fabless entities like AAT that rely on foundries, presents a significant environmental challenge. As global demand for semiconductors rises through 2025, so too will the industry's energy and water consumption, emphasizing the need for sustainable practices across the supply chain.

The growing global e-waste issue, projected to reach 74 million metric tons by 2030, indirectly impacts AAT. Minimizing hazardous materials in ICs and embracing circular economy principles for repairability and recycling are becoming critical environmental responsibilities for component designers.

Supply chain resilience is paramount as climate change increases the frequency of extreme weather events. Disruptions like the 2021 Taiwan drought, which affected wafer fabrication, highlight the vulnerability of semiconductor production and the need for diversified sourcing and robust contingency planning.

PESTLE Analysis Data Sources

Our Advanced Analog Technology PESTLE Analysis is meticulously constructed using data from key industry associations, semiconductor market research firms, and government regulatory bodies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the sector.