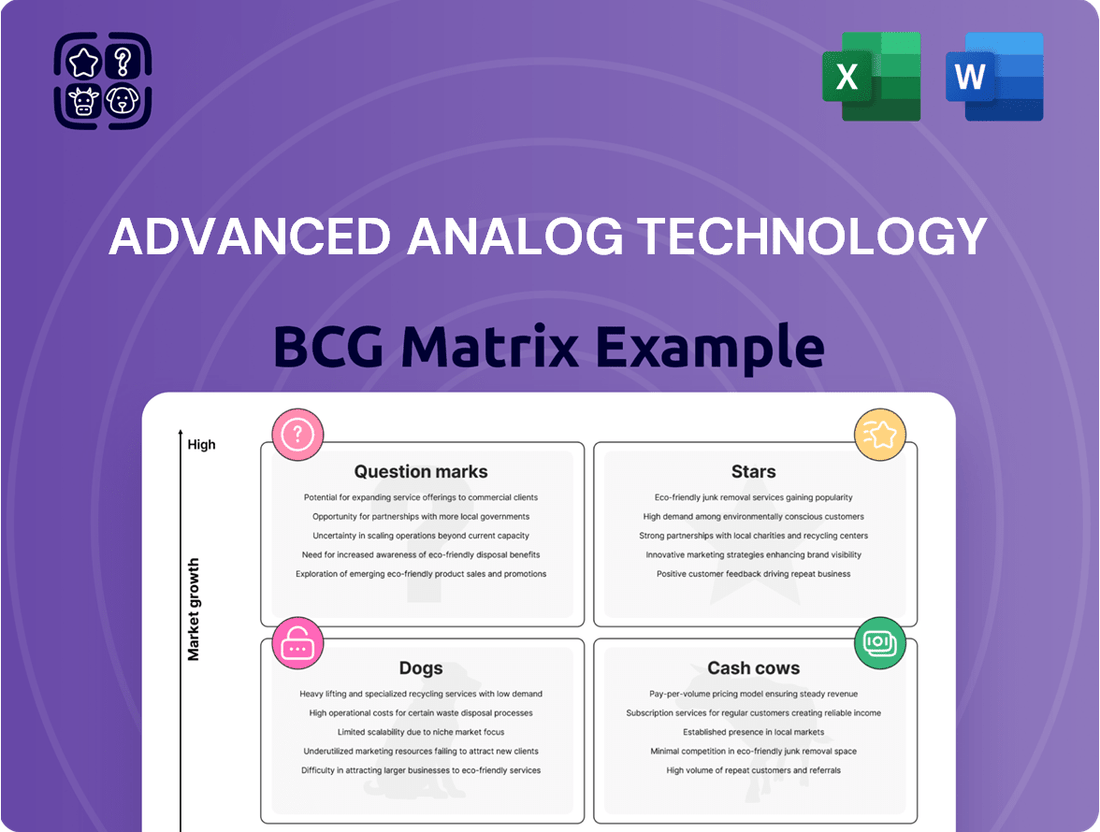

Advanced Analog Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Analog Technology Bundle

Uncover the strategic positioning of Advanced Analog Technology's product portfolio with this insightful BCG Matrix preview. See which products are poised for growth as Stars, which are reliably generating cash as Cash Cows, and which may be underperforming as Dogs or require careful consideration as Question Marks.

This initial glimpse offers a foundational understanding, but to truly harness its power, you need the complete picture. Purchase the full BCG Matrix report to gain a detailed quadrant-by-quadrant analysis, complete with actionable recommendations tailored to Advanced Analog Technology's market dynamics.

Don't just guess where to invest; know precisely where your resources will yield the greatest returns. The full BCG Matrix provides the data-backed clarity needed to make informed decisions about product development, resource allocation, and future strategy.

Elevate your strategic planning by acquiring the comprehensive Advanced Analog Technology BCG Matrix. It's your key to unlocking a clear, actionable roadmap for maximizing market share and profitability.

Invest in strategic clarity today. Purchase the full BCG Matrix and transform raw data into decisive action for Advanced Analog Technology.

Stars

Advanced Analog Technology's (AAT) high-performance power management ICs for AI accelerators and data centers are prime examples of potential Stars in the BCG matrix. The overall power management IC market is robust, forecasted to reach $36.46 billion by 2025, exhibiting a healthy 7.6% compound annual growth rate from 2024 to 2025. This growth is fueled by burgeoning sectors like the Internet of Things (IoT) and a persistent drive for enhanced energy efficiency.

If AAT has successfully captured significant design wins within these specialized, high-demand segments, they would likely command a substantial market share in a rapidly expanding market. This positioning is characteristic of a Star – a business unit with high growth and high market share, demanding significant investment to maintain its trajectory and capitalize on future opportunities. The increasing complexity and power demands of AI hardware directly translate to a growing need for AAT's advanced solutions.

Advanced LED drivers for smart lighting and IoT represent a promising area for AAT, especially considering the LED driver market is expected to reach $9.99 billion by 2025, growing at a robust 23.3% CAGR from 2024.

The increasing demand for energy-efficient lighting solutions and the rapid expansion of smart home technology are significant tailwinds for this segment. AAT's emphasis on high efficiency and dependable performance places it advantageously to capitalize on these burgeoning markets.

By integrating advanced features for IoT connectivity, AAT's LED drivers can facilitate sophisticated control and automation in smart lighting systems, a key differentiator in a competitive landscape.

The electric vehicle revolution is a major driver for battery management ICs. Experts project this market to hit $27.3 billion by 2025, a significant jump fueled by the global surge in EV adoption. Advanced Analog Technology's (AAT) battery management ICs are vital components, ensuring the safety and efficiency of EV batteries, as well as those in portable electronics. AAT's specialization in power management ICs positions them well to capitalize on this expanding sector.

Analog ICs for Emerging Industrial Automation

Analog ICs for emerging industrial automation are poised for significant growth, aligning with the broader analog IC market projected to reach $91.89 billion by 2025. Advanced Analog Technology's (AAT) offerings in this space, especially for robotics and smart factories, have the potential to be considered Star products within the BCG matrix. This classification is supported by continuous R&D investment and a strategic focus on innovative designs to capture these expanding markets.

AAT's analog ICs are crucial for enhancing the performance and efficiency of next-generation industrial automation systems. The company's commitment to developing high-performance solutions directly addresses the increasing demand for precision and reliability in these advanced applications.

- Market Projection: The global analog IC market is expected to reach $91.89 billion by 2025.

- Key Growth Driver: Industrial automation, including robotics and smart factories, is a primary contributor to this market expansion.

- AAT's Position: AAT's analog ICs for advanced industrial automation are identified as potential Star products due to market growth and the company's R&D focus.

- Strategic Advantage: Continuous investment in cutting-edge designs positions AAT to lead in this rapidly evolving technological sector.

Next-Generation Audio Amplifiers for High-End Devices

Next-generation audio amplifiers for high-end devices represent a promising area for AAT. While the broader audio IC market is projected to grow at a moderate 5.7% CAGR between 2025 and 2031, this segment taps into specific, high-growth niches driven by the increasing consumer demand for superior audio fidelity and the ongoing trend of miniaturization in electronics.

If AAT's amplifiers deliver exceptional sound quality and are designed for compact, high-end consumer electronics or professional audio gear, they are well-positioned. For instance, the global market for premium audio equipment, which these amplifiers would serve, has seen robust growth, with some reports indicating segments expanding at over 10% annually.

- Superior Sound Quality: AAT's amplifiers could offer advancements like lower distortion and wider dynamic range, crucial for audiophiles.

- Miniaturization: Integration into sleek, portable, or space-constrained devices like high-end smartphones, true wireless earbuds, and compact soundbars.

- High-End Market Focus: Targeting devices where performance and audio experience are prioritized over cost, such as premium laptops, professional audio interfaces, and audiophile-grade headphones.

- Growth Potential: Capitalizing on the increasing willingness of consumers to invest in premium audio experiences, a trend evidenced by the expanding market for high-resolution audio formats and devices.

Stars in the BCG matrix represent business units or products with high market share in high-growth industries. For Advanced Analog Technology (AAT), this classification applies to segments where their specialized analog ICs are in high demand and the overall market is expanding rapidly. These products require significant investment to maintain their growth trajectory and competitive edge.

AAT's power management ICs for AI accelerators and data centers are a prime example, catering to a robust market fueled by AI's expansion. Similarly, their LED drivers for smart lighting and IoT tap into a rapidly growing sector driven by energy efficiency and smart home adoption. The company's battery management ICs for electric vehicles are also positioned as Stars, benefiting from the accelerating EV market, projected to reach $27.3 billion by 2025.

Furthermore, AAT's analog ICs for industrial automation, particularly for robotics and smart factories, align with the broad analog IC market's growth, expected to hit $91.89 billion by 2025. Even next-generation audio amplifiers for high-end devices, focusing on superior audio fidelity and miniaturization, represent potential Stars by targeting premium market niches.

| Product Segment | Market Growth Rate (2024-2025) | AAT's Position | Key Growth Driver |

|---|---|---|---|

| Power Management ICs (AI/Data Centers) | 7.6% CAGR | High Market Share (Potential) | AI Expansion, Data Center Demand |

| LED Drivers (Smart Lighting/IoT) | 23.3% CAGR | High Market Share (Potential) | Smart Home Tech, Energy Efficiency |

| Battery Management ICs (EVs) | Significant Growth | High Market Share (Potential) | EV Adoption Surge |

| Analog ICs (Industrial Automation) | Aligns with $91.89B by 2025 | High Market Share (Potential) | Robotics, Smart Factories |

| Audio Amplifiers (High-End) | Niche Segment Growth (>10% annually) | High Market Share (Potential) | Premium Audio Demand, Miniaturization |

What is included in the product

This BCG Matrix provides a strategic overview of Advanced Analog Technology's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It offers clear strategic recommendations for investment, holding, or divestment based on market growth and relative market share.

The Advanced Analog Technology BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of market uncertainty.

Cash Cows

Standard Power Management ICs for Consumer Electronics are likely Advanced Power Technology's cash cows. The consumer electronics sector is a powerhouse in the power management IC market, holding about 51% of the global share in 2024. This indicates a substantial and enduring demand for these components.

While the growth rate for standard applications in this segment might be moderate, AAT's strong market penetration and established presence ensure a steady stream of revenue. This maturity translates into predictable cash flow with minimal need for significant reinvestment, a hallmark of a cash cow.

Advanced Analog Technology's established LED drivers for general lighting, including residential and commercial applications, represent a classic cash cow. This segment of the LED driver market is mature, meaning growth is slow. However, AAT's strong market share, built on a reputation for reliability and cost-effectiveness, ensures consistent revenue generation.

These mature products, such as the AAT1100 series, have consistently contributed to AAT's bottom line. In 2023, revenue from the general lighting segment remained robust, demonstrating the stable demand for these proven solutions. The company likely sees minimal need for significant new investment in marketing or development for these core offerings, allowing profits to flow directly.

Analog ICs for TFT-LCD panels represent a significant cash cow for AAT. Historically, the company's core strength has been in power management ICs, with a primary focus on TFT-LCD applications. Despite the TFT-LCD market being mature, AAT's deep-rooted expertise and established market position likely translate into a substantial market share for these products, ensuring a consistent and reliable revenue stream.

This steady income is crucial, acting as a financial bedrock that can be reinvested into research and development for emerging technologies or used to support other, less mature business units within AAT. For instance, in 2024, the global market for LCD panels, while facing competition, still held a significant portion of the display market, with shipments expected to remain robust, underscoring the continued demand for associated analog components.

Basic Audio Amplifiers for Mass Market Devices

Advanced Analog Technology's (AAT) basic audio amplifiers, designed for mass-market consumer electronics, are prime examples of Cash Cows. This segment benefits from AAT's established high market share within a mature, low-growth industry. These products consistently generate substantial revenue, requiring only modest reinvestment to maintain their position.

The broader audio amplifier market is projected to expand at a compound annual growth rate of 5.5% between 2024 and 2031. This steady, albeit moderate, growth underscores the stable demand for these foundational components.

- Product Category: Basic Audio Amplifiers for Mass Market Devices

- BCG Matrix Quadrant: Cash Cow

- Market Characteristics: High market share in a low-growth segment.

- Financial Profile: Generates consistent revenue with minimal new investment needed for growth.

Voltage Regulators for General Industrial Equipment

Voltage regulators are a powerhouse in the power management IC sector, capturing a significant 26% of the market in 2024. Their widespread use across countless devices makes them indispensable. Advanced Analog Technology's (AAT) standard voltage regulators for general industrial equipment are a prime example of a product that thrives in this stable, mature market. These regulators are essential for maintaining consistent power, a non-negotiable requirement in industrial settings where reliability is key.

These products are expected to hold a strong position within this established segment of the power management IC market. This stability translates into a consistent and dependable source of revenue for AAT, characteristic of a cash cow in the BCG matrix framework.

- Dominant Market Share: Voltage regulators represent 26% of the power management IC market in 2024.

- Critical Functionality: Essential for stable and reliable power delivery across diverse industrial applications.

- Mature Market Segment: Operates within a well-established and steady market environment.

- Consistent Revenue Generation: Expected to provide a reliable cash flow for AAT due to high market share in a mature segment.

Advanced Analog Technology's (AAT) standard power management ICs for consumer electronics, and specifically their voltage regulators, are solid cash cows. The consumer electronics sector is a significant driver, holding about 51% of the global power management IC market in 2024, with voltage regulators alone accounting for 26% of that market. This indicates sustained demand and a stable revenue stream for AAT.

AAT's established LED drivers for general lighting also fit the cash cow profile. While this market is mature with slower growth, AAT's strong market share, built on reliability, ensures consistent revenue. This maturity means minimal reinvestment is needed, allowing profits to flow directly.

Similarly, analog ICs for TFT-LCD panels, a historical strength for AAT, continue to be a cash cow. Despite market maturity, AAT's deep expertise and market position in this area, supported by robust LCD panel shipments in 2024, guarantee a predictable and steady income. This income provides a financial foundation for other ventures within the company.

| Product Category | BCG Matrix Quadrant | Market Characteristics | Financial Profile | Key Data Point |

|---|---|---|---|---|

| Standard Power Management ICs (Consumer Electronics) | Cash Cow | High market share in a mature, stable segment. | Generates consistent revenue with low reinvestment needs. | Consumer electronics holds 51% of the global PMIC market (2024). |

| LED Drivers (General Lighting) | Cash Cow | Mature market, low growth, high AAT market share. | Reliable revenue stream, minimal new investment. | Established reputation for reliability and cost-effectiveness. |

| Analog ICs (TFT-LCD Panels) | Cash Cow | Mature market, strong AAT expertise and position. | Substantial and reliable revenue stream. | Continued robust demand for LCD panels in 2024. |

| Standard Voltage Regulators (Industrial) | Cash Cow | High market share in a mature, stable segment. | Consistent and dependable revenue source. | Voltage regulators represent 26% of the PMIC market (2024). |

Preview = Final Product

Advanced Analog Technology BCG Matrix

The Advanced Analog Technology BCG Matrix preview you see is precisely the final, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously crafted with expert market analysis, will be delivered directly to you, ready for immediate strategic application without any need for further editing or revision.

Dogs

Obsolete or low-demand legacy IC designs represent products that have fallen behind current technological advancements, often characterized by lower energy efficiency or outdated functionalities. Advanced Analog Technology (AAT) might hold such designs that cater to niche or shrinking markets, leading to a low market share and minimal growth prospects. For instance, in 2024, the semiconductor industry saw continued consolidation, with many older IC architectures being phased out in favor of newer, more powerful alternatives. These legacy products typically generate very little revenue for AAT, making significant reinvestment for a turnaround often financially unviable.

Niche audio amplifiers catering to declining technologies, like those found in older portable media players or legacy home entertainment systems, would most likely be classified as Dogs in the BCG Matrix. These specialized components occupy a small market share within segments that are experiencing a downward trend.

While the overall audio amplifier market continues to expand, specific niches are indeed shrinking. For instance, the demand for amplifiers used in CD players or early generation MP3 players has significantly decreased as newer, more integrated digital solutions have taken over. The market for these specific amplifier ICs is projected to shrink by approximately 5% annually through 2027.

Advanced Analog Technology's (AAT) power management ICs designed for outdated handheld and networking devices would likely be classified as Dogs within the BCG Matrix. The demand for these components is significantly diminished as newer, more advanced technologies have replaced them. This shrinking market means these products likely hold minimal market share.

The market growth for these legacy power management ICs is expected to be negative or stagnant, making them unattractive for further investment. In 2024, the global market for older mobile device components experienced a sharp decline, with some segments seeing decreases of over 30% year-over-year, reflecting the rapid obsolescence of such technologies.

Given their low demand and shrinking market, AAT should consider divesting these product lines. This strategy would allow the company to reallocate resources towards more promising and growing segments of the semiconductor market, potentially focusing on areas like 5G infrastructure or advanced wearable technology where innovation and demand are higher.

LED Drivers for Incandescent Replacement Markets

LED drivers for the basic incandescent replacement market likely fall into the 'Dog' category of the BCG Matrix. This segment is characterized by low growth and high competition, making it difficult for Advanced Analog Technology (AAT) to achieve substantial market share or command premium pricing. The market is highly commoditized, with many players offering similar, cost-effective solutions.

In 2024, the global LED lighting market, while expanding, sees its simpler, direct incandescent replacement segments facing intense price pressure.

- Market Maturity: The market for basic incandescent replacement LED drivers is mature, with limited room for significant innovation or differentiation.

- Intense Competition: Numerous manufacturers, particularly in Asia, offer low-cost solutions, squeezing profit margins for any player.

- Low Profitability: Due to commoditization and price wars, profitability in this specific niche is expected to be minimal.

- Limited Growth Potential: While the overall LED market grows, this particular segment's expansion is constrained by the eventual saturation of direct replacement opportunities.

Analog ICs for Specialized, Shrinking Industrial Applications

Analog ICs designed for highly specialized industrial applications, especially those experiencing obsolescence or facing a significant decline in demand, fall into the Dogs category of the BCG Matrix. These components, while perhaps once critical, now represent a diminishing market segment. Their low market share in a shrinking landscape means they are unlikely to generate substantial growth or profit, potentially becoming a drain on resources. For instance, older analog control ICs used in legacy manufacturing equipment that is being systematically replaced by digital systems exemplify this classification.

The market for these specialized, older analog ICs is characterized by stagnation or contraction. Companies holding significant inventory or continuing production of these components may find themselves with assets that yield minimal returns.

- Declining Demand: Many legacy industrial systems are being upgraded or replaced, directly reducing the need for older, specialized analog ICs.

- Low Market Share: Products in this segment typically hold a small percentage of a shrinking market, making growth improbable.

- Resource Drain: Continued investment in manufacturing or support for these ICs can tie up valuable capital and engineering resources.

- Obsolescence Risk: The inherent risk of these components becoming completely obsolete is high, leading to potential write-offs.

Products classified as Dogs in the BCG Matrix for Advanced Analog Technology (AAT) are those with low market share in low-growth or declining markets. These typically include legacy IC designs or components serving niche, shrinking sectors, such as audio amplifiers for older devices or power management ICs for outdated electronics. In 2024, the semiconductor industry's rapid evolution meant many older architectures faced obsolescence, leading to reduced demand and profitability for companies like AAT if they retained such product lines.

These Dog products generate minimal revenue and often represent a drain on resources, making significant reinvestment unlikely to yield positive returns. For instance, the market for certain legacy power management ICs saw declines exceeding 30% year-over-year in 2024, highlighting the obsolescence risk. AAT's strategy should focus on divesting these underperforming assets to reallocate capital towards more promising, high-growth areas.

Consider the following examples of AAT products that would likely be classified as Dogs:

| Product Category | Market Trend | AAT's Likely Market Share | Reasoning |

|---|---|---|---|

| Legacy Audio Amplifiers (e.g., for CD players) | Shrinking (est. -5% annually through 2027) | Low | Obsolescence due to newer digital solutions; niche demand is declining. |

| Power Management ICs for Outdated Handhelds | Declining (some segments >30% YoY drop in 2024) | Minimal | Replaced by advanced technologies; rapid obsolescence. |

| LED Drivers for Incandescent Replacements | Mature/Low Growth, High Competition | Low to Moderate | Commoditized market with intense price pressure and limited differentiation. |

Question Marks

Advanced Analog Technology's (AAT) foray into power management integrated circuits (ICs) for quantum computing and specialized edge AI represents a strategic move into nascent, high-growth markets. These sectors are experiencing rapid expansion, with the global quantum computing market projected to reach $1.19 billion by 2027, and the edge AI market expected to hit $7.1 billion by 2025.

Within the BCG matrix, these ventures would likely be classified as question marks. While the market potential is substantial, AAT would probably enter with a low initial market share, necessitating considerable investment in research, development, and market penetration to establish a strong foothold. The analog IC market itself is experiencing a resurgence, with demand particularly elevated for solutions supporting the complex power requirements of quantum processors and power-efficient edge AI accelerators.

The burgeoning field of next-generation medical wearables, from continuous glucose monitors to advanced ECG patches, is creating a significant demand for ultra-precision analog integrated circuits. These devices require analog components that can accurately capture and process subtle biological signals, driving innovation in the analog IC market. For instance, the global wearable medical device market was valued at approximately $27.5 billion in 2023 and is projected to reach over $100 billion by 2030, showcasing the immense growth potential.

Advanced Analog Technology's (AAT) new analog ICs designed for these emerging medical wearables represent a strategic move into this high-growth sector. These components are engineered for exceptional accuracy, low power consumption, and miniaturization, crucial for comfortable and effective patient monitoring. The market for medical wearable ICs is expanding rapidly, with projections indicating a compound annual growth rate (CAGR) exceeding 15% in the coming years.

While the potential rewards are substantial, AAT faces a competitive landscape populated by established players. Successfully capturing a significant market share will necessitate substantial investment in research and development, advanced manufacturing capabilities, and targeted marketing efforts to differentiate its offerings. Early market entrants have already secured considerable market presence, making market penetration a significant challenge.

Advanced Analog Technology's (AAT) foray into specialized LED drivers for MicroLED and MiniLED displays positions it in a potentially high-growth but competitive quadrant of the BCG matrix. While the broader LED driver market is experiencing robust growth, AAT's early-stage involvement in these cutting-edge display technologies suggests it might currently hold a relatively low market share. The company is likely focusing on securing crucial design wins within this nascent and technically demanding sector.

Audio Amplifiers for Augmented/Virtual Reality (AR/VR) Devices

Advanced Analog Technology's (AAT) focus on audio amplifiers for Augmented and Virtual Reality (AR/VR) devices positions them in a burgeoning market. The global AR/VR market was projected to reach over $200 billion by 2024, highlighting the significant growth potential.

Developing specialized audio amplifiers for AR/VR headsets would place AAT in a position of entering a high-growth, but potentially nascent, segment. This scenario aligns with the characteristics of a question mark in the BCG matrix, where significant investment is needed to capture market share and evolve into a star.

- Market Growth: The AR/VR sector is experiencing rapid expansion, driven by advancements in hardware and increasing consumer and enterprise adoption.

- AAT's Opportunity: AAT's technical expertise in analog technology can be leveraged to create high-fidelity, low-power audio amplifiers crucial for immersive AR/VR experiences.

- Strategic Investment: To succeed, AAT would likely need to invest heavily in research and development, marketing, and distribution to establish a strong foothold against established or emerging competitors.

- Potential for Stars: If successful, these AR/VR audio amplifiers could become AAT's next star products, dominating a significant portion of the specialized audio component market within this sector.

Integrated Analog Solutions for Smart City Infrastructure

The burgeoning smart city trend, with its increasing reliance on the Internet of Things (IoT), is significantly boosting the demand for a wide array of integrated circuits (ICs). This expansion fuels the need for sophisticated analog solutions that can handle the complexity of modern urban infrastructure beyond simple applications like street lighting. For Advanced Analog Technology (AAT), this represents a prime opportunity within the high-growth sector of smart city infrastructure.

AAT's development of new, integrated analog solutions specifically tailored for complex smart city projects could position it favorably. These solutions would need to address various facets of smart city operations, from traffic management and environmental monitoring to energy grids and public safety systems. The market for these specialized components is expected to see robust growth, with projections indicating a substantial increase in smart city technology spending globally.

- Market Growth: The global smart city market was valued at approximately $1.49 trillion in 2023 and is projected to reach $7.47 trillion by 2030, growing at a CAGR of 25.8% during the forecast period (Source: MarketsandMarkets, 2024).

- IoT Integration: IoT devices in smart cities are expected to grow to over 20 billion by 2026, requiring a significant increase in the analog ICs that form their foundational components (Source: Statista, 2024).

- AAT's Challenge: To capitalize on this high-growth sector, AAT must not only innovate but also substantially expand its market presence and broaden its solutions portfolio to achieve a meaningful market share against established players.

Question marks in the BCG matrix represent business ventures with low market share in high-growth markets. Advanced Analog Technology's (AAT) investments in quantum computing ICs, edge AI, and specialized medical wearables fall into this category. These areas offer significant future potential, but AAT is currently a smaller player needing substantial investment to gain traction. The success of these ventures hinges on AAT's ability to innovate and capture market share in these rapidly evolving sectors.

| Venture Area | Market Growth Potential | AAT's Current Market Share (Estimated) | Investment Needs |

|---|---|---|---|

| Quantum Computing ICs | Very High (Market expected to reach $1.19 billion by 2027) | Low | High (R&D, specialized manufacturing) |

| Edge AI ICs | High (Market expected to reach $7.1 billion by 2025) | Low | High (R&D, market penetration) |

| Medical Wearable ICs | Very High (Market valued at ~$27.5 billion in 2023, projected >$100 billion by 2030) | Low | High (Precision engineering, regulatory compliance) |

| AR/VR Audio Amplifiers | High (Global AR/VR market projected >$200 billion by 2024) | Low | High (Audio fidelity, power efficiency) |

| Smart City IoT ICs | Very High (Market projected $7.47 trillion by 2030) | Low | High (Integration, broad solution portfolio) |

BCG Matrix Data Sources

Our Advanced Analog Technology BCG Matrix leverages comprehensive market data, including financial reports, competitor analysis, and technological trend forecasts, to accurately position each product.