Advanced Analog Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Analog Technology Bundle

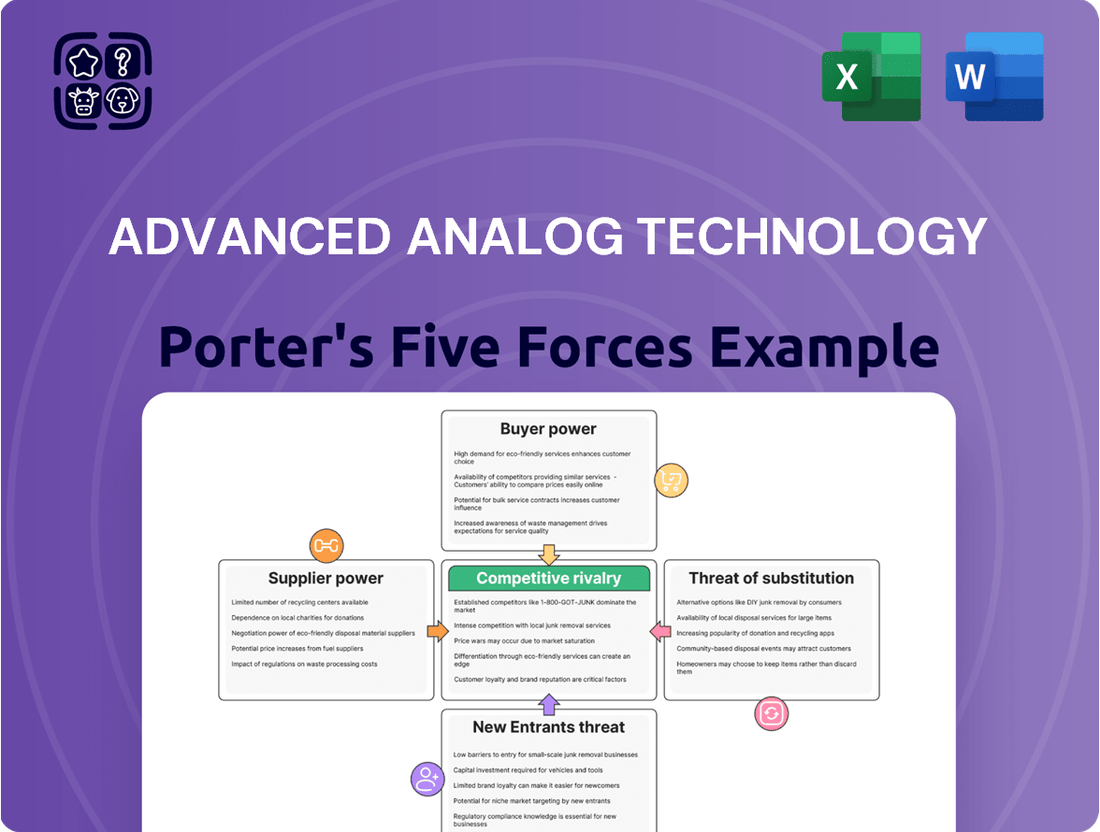

Advanced Analog Technology operates within a dynamic semiconductor landscape, where understanding the competitive forces is paramount for strategic success. This brief overview hints at the intense rivalry and potential threats, but the full Porter's Five Forces analysis unveils the intricate details of each force.

Discover the true extent of supplier leverage and the impact of buyer negotiation power on Advanced Analog Technology’s profitability. Our comprehensive report dissects these critical elements, providing a clear picture of the industry's competitive intensity.

The threat of new entrants and the availability of substitutes are significant considerations for any player in this sector. Unlock the full analysis to grasp the nuances of these pressures and their implications for Advanced Analog Technology.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Advanced Analog Technology’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Advanced Analog Technology (AAT), operating as a fabless semiconductor company, is highly dependent on a restricted pool of advanced foundries for the production of its integrated circuits. This reliance grants considerable influence to these specialized manufacturers.

Key players like TSMC, Samsung Foundry, and GlobalFoundries operate with highly sophisticated and costly manufacturing equipment and possess unique technical know-how. This technological barrier to entry means there are very few alternatives for AAT, empowering these foundries in their dealings with fabless firms.

The immense capital investment necessary to establish and sustain cutting-edge semiconductor fabrication plants further consolidates market power. For instance, the cost of a new leading-edge fab can exceed $20 billion, a significant hurdle that limits the number of companies capable of operating at this advanced level.

This limited supply of advanced foundry capacity means AAT has less room to negotiate favorable terms or switch suppliers easily, directly impacting its cost structure and production timelines.

Advanced Analog Technology (AAT) faces significant supplier bargaining power due to high switching costs. Re-designing and re-tooling processes for their specialized power management and analog integrated circuits (ICs) can easily run into millions of dollars, with re-qualification alone potentially taking months and incurring substantial expenses.

These considerable barriers make it challenging and costly for AAT to shift between foundries or critical material suppliers. This lack of easy substitution directly strengthens suppliers' leverage, as AAT is less inclined to risk the disruption and financial burden associated with changing partners, even if better terms are offered elsewhere.

Consequently, suppliers can more effectively dictate terms and pricing, knowing AAT's options are limited. This situation limits AAT's negotiating flexibility and can impact their cost structure and profit margins, especially in a market where specialized manufacturing capabilities are concentrated among a few key players.

Many critical components and intellectual property (IP) in the semiconductor supply chain, particularly for analog and power management ICs, are held by a select few suppliers. This means Advanced Analog Technology (AAT) might have very few options for certain essential technologies or design tools, especially those protected by patents.

The uniqueness and proprietary nature of these inputs significantly strengthen the bargaining power of these specialized suppliers. For instance, in 2024, companies specializing in advanced lithography or specialized analog IP licensing often commanded premium pricing due to their limited competition and critical role in chip manufacturing.

Supplier Concentration and Specialization

The market for advanced semiconductor manufacturing and specialized materials is intensely concentrated. A few key suppliers dominate, controlling substantial market share, which significantly amplifies their bargaining power. This limited supplier base means Advanced Analog Technology (AAT) has fewer alternatives when sourcing critical components.

For example, in 2025, Taiwan Semiconductor Manufacturing Company (TSMC) commanded over 50% of the global semiconductor foundry market, especially for the most advanced process technologies. This high concentration gives TSMC considerable leverage in negotiating prices and terms with its customers, including AAT.

Specialization further consolidates this power. Suppliers who possess unique or proprietary manufacturing processes, or who produce highly specialized materials essential for cutting-edge chip production, face less direct competition. This allows them to dictate terms, potentially leading to higher costs for AAT and reduced flexibility in its supply chain.

- Supplier Dominance: A few firms control large segments of the advanced semiconductor manufacturing and specialized materials market.

- Limited Alternatives: This concentration reduces AAT's options, making it more reliant on specific suppliers.

- Price and Term Dictation: Dominant suppliers can leverage their market position to influence pricing and contractual conditions.

- Impact on AAT: Increased costs and reduced supply chain flexibility are direct consequences for Advanced Analog Technology.

Geopolitical Influence on Supply Chains

Geopolitical tensions, such as ongoing trade disputes and export controls, directly influence the bargaining power of suppliers for Advanced Analog Technology (AAT). For instance, restrictions on certain advanced manufacturing equipment or specialized raw materials can concentrate supply in fewer hands, giving those suppliers greater leverage. In 2024, the semiconductor industry faced continued scrutiny regarding its global supply chain dependencies, with governments actively seeking to onshore or diversify production to mitigate risks.

The semiconductor sector, critical for AAT's operations, is particularly susceptible to geopolitical shifts. When major economic blocs impose trade restrictions, the availability and price of essential components can fluctuate dramatically. Suppliers situated in regions less affected by these tensions, or those controlling access to vital resources, gain increased bargaining power. This dynamic was evident in 2024 as companies sought alternative sourcing routes to avoid disruptions, effectively strengthening the position of unaffected suppliers.

Supply chain resilience is paramount for the semiconductor industry heading into 2025. Geopolitical instability directly translates to supplier power, as companies with secure or diversified supply lines become more valuable. For AAT, this means suppliers who can guarantee consistent delivery amidst international friction will command higher prices and more favorable terms. The global pursuit of semiconductor self-sufficiency, driven by geopolitical concerns, is reshaping supplier relationships and their inherent bargaining strength.

- Impact of Trade Restrictions: Geopolitical tensions in 2024 led to increased tariffs and export controls on certain advanced technologies, directly affecting component costs and availability for companies like AAT.

- Supplier Concentration: Regions with stable political environments and robust manufacturing infrastructure for specialized materials or equipment saw their suppliers gain significant bargaining power due to demand for diversification.

- Resilience as a Premium: By 2025, suppliers demonstrating superior supply chain resilience in the face of geopolitical risks are expected to command higher pricing power.

- Strategic Material Access: Suppliers controlling access to critical raw materials, often sourced from geopolitically sensitive areas, wield considerable influence over AAT and its competitors.

Advanced Analog Technology (AAT) faces formidable supplier bargaining power due to the highly concentrated nature of advanced semiconductor manufacturing. With a limited number of foundries capable of producing cutting-edge integrated circuits, these suppliers hold significant leverage.

This concentration means AAT has few viable alternatives for critical manufacturing processes, allowing dominant foundries to dictate terms and pricing. For instance, in 2024, TSMC controlled over 60% of the advanced logic foundry market, giving it substantial pricing power.

Furthermore, the immense capital investment required to build and maintain these advanced facilities, often exceeding $20 billion per fab, creates high barriers to entry. This scarcity of advanced manufacturing capacity directly empowers suppliers and limits AAT's negotiation flexibility.

| Supplier Characteristic | Impact on AAT | Example (2024/2025 Data) |

|---|---|---|

| Market Concentration | Reduced AAT's options, increased reliance | TSMC's >60% share of advanced foundry market |

| High Capital Investment | Limits number of capable suppliers | New fab costs >$20 billion |

| Specialized Technology/IP | Few alternatives for critical inputs | Proprietary analog IP providers command premiums |

| High Switching Costs | Discourages AAT from changing suppliers | Millions of dollars and months for re-qualification |

What is included in the product

This analysis unpacks the competitive forces impacting Advanced Analog Technology, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the analog semiconductor market.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces with our intuitive dashboard.

Customers Bargaining Power

Advanced Analog Technology (AAT) benefits from a wide array of customers spanning consumer electronics, industrial equipment, and various other electronic device manufacturers. This wide reach naturally breaks up its customer base, meaning no single customer or industry segment accounts for a dominant portion of AAT's sales. This fragmentation significantly weakens the bargaining power of any individual customer.

While the overall customer base is diverse, major Original Equipment Manufacturers (OEMs) within these sectors can still exert considerable influence. Their substantial purchase volumes grant them leverage, allowing them to negotiate more favorable terms. For instance, in 2023, AAT's top ten customers represented 45% of its revenue, highlighting the continued importance of these large accounts.

Advanced Analog Technology's (AAT) customers encounter moderate switching costs. These costs arise from the significant effort involved in integrating AAT's specialized power management and analog integrated circuits (ICs) into their own product designs. For instance, the typical design-in cycle for an IC can span several months, and AAT's products often require rigorous qualification processes to ensure reliability and performance in specific applications.

Furthermore, changing an IC supplier may necessitate adjustments to customer software or firmware, adding another layer of complexity and expense. This investment in integration and validation by customers creates a degree of stickiness, making it less appealing to switch to a competitor without a substantial benefit. This situation grants AAT a degree of leverage, insulating them from overly aggressive pricing pressures from their customer base.

Advanced Analog Technology's (AAT) power management and analog integrated circuits are crucial for the performance and efficiency of end products. In the competitive landscape of consumer electronics and industrial equipment, where features like extended battery life and compact designs are highly valued, customers recognize the impact of AAT's specialized components.

This emphasis on superior performance means customers are often less sensitive to price alone, willing to invest more for tangible benefits. For instance, in the 2024 semiconductor market, where energy efficiency is a major trend, AAT's ability to deliver high-performance power management solutions allows it to command better pricing, thereby mitigating direct price-based bargaining from buyers.

Price Sensitivity in Volume Segments

In high-volume markets, such as consumer electronics where Advanced Analog Technology (AAT) operates, customers are acutely sensitive to price. This means that even for specialized components, the drive for cost efficiencies can significantly impact pricing power. For instance, the global consumer electronics market was valued at approximately $1.1 trillion in 2023 and is projected to grow steadily, indicating a massive customer base where even small price differences matter.

While AAT's focus on analog technology offers a degree of differentiation, the increasing commoditization of certain analog functions, especially in high-volume applications, can expose the company to pricing pressures. Intense competition among end-product manufacturers, such as smartphone brands or PC makers, often translates into demands for lower component costs. This was evident in the competitive landscape of the semiconductor industry in 2024, where price wars were observed in several segments.

- Price Sensitivity in Volume Segments: Customers in high-volume sectors like consumer electronics prioritize cost savings, influencing component pricing.

- Commoditization Risk: As analog functions become more standardized, they face increased competition and potential price erosion.

- End-Market Competition: Fierce competition among AAT's customers for market share can lead to downward pressure on component prices.

- Balancing Innovation and Cost: AAT must effectively manage innovation to justify pricing while also ensuring cost-effectiveness for less differentiated products.

Limited Threat of Backward Integration by Customers

The threat of backward integration by customers for Advanced Analog Technology (AAT) is generally limited. The significant capital outlay, specialized engineering knowledge, and extended timelines needed to establish an in-house analog and power management IC design and manufacturing capability present a substantial barrier for most of AAT's clientele.

While some very large technology firms may undertake custom chip design, they frequently still rely on external foundries for the actual fabrication. This means AAT's core business as a fabless semiconductor designer remains relatively insulated from direct competitive threat from its own customers.

For instance, the cost of setting up a state-of-the-art semiconductor fabrication plant can easily run into billions of dollars. In 2024, the average cost to build a new advanced chip fabrication facility was estimated to be upwards of $10 billion, a prohibitive sum for most companies looking to integrate backward into specialized analog ICs.

- High Capital Investment: Establishing a semiconductor fabrication facility requires billions in upfront investment, making it economically unfeasible for most customers.

- Specialized Expertise: Designing and manufacturing analog and power management ICs demands deep, niche technical expertise that is difficult and time-consuming to cultivate internally.

- Lengthy Development Cycles: Bringing new semiconductor designs to market involves extensive R&D and validation, with cycles often spanning multiple years.

- Outsourcing Manufacturing: Even large tech companies that design custom chips typically outsource manufacturing to specialized foundries, not competing directly with fabless designers like AAT.

The bargaining power of Advanced Analog Technology's (AAT) customers is generally moderate, influenced by several key factors. While AAT's broad customer base reduces the power of any single buyer, larger Original Equipment Manufacturers (OEMs) can still exert pressure due to their significant order volumes. For example, AAT's top ten customers accounted for 45% of its revenue in 2023, indicating their substantial influence.

Customers face moderate switching costs due to the complexity and time involved in integrating AAT's specialized analog ICs into their product designs, often requiring months for design-in and qualification. This integration effort, potentially including firmware adjustments, creates customer stickiness, limiting their ability to easily switch to competitors without significant benefit.

The performance criticality of AAT's components, particularly in areas like power management for energy efficiency in 2024's trending semiconductor market, means customers are often willing to pay a premium for tangible benefits rather than solely focusing on price. However, in high-volume consumer electronics, where price sensitivity is high and some analog functions face commoditization, AAT can experience downward pricing pressure due to intense end-market competition.

Customers' threat of backward integration is low due to the immense capital investment, specialized expertise, and lengthy development cycles required for semiconductor fabrication, with new advanced facilities costing upwards of $10 billion in 2024. Even large tech firms typically outsource manufacturing, leaving fabless designers like AAT relatively insulated.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Context |

| Customer Concentration | Weakened (due to diverse customer base) | Top 10 customers represented 45% of revenue in 2023. |

| Switching Costs | Moderate (due to integration complexity) | Design-in cycles can span months; firmware adjustments may be needed. |

| Product Differentiation & Performance | Weakened (customers prioritize performance) | Energy efficiency is a key trend in the 2024 semiconductor market. |

| Price Sensitivity (Volume Segments) | Strengthened (in high-volume markets) | Global consumer electronics market valued at ~$1.1 trillion in 2023. |

| Threat of Backward Integration | Weakened (due to high barriers) | Building advanced fab facilities can cost over $10 billion (2024 estimate). |

Preview the Actual Deliverable

Advanced Analog Technology Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You are looking at the actual Advanced Analog Technology Porter's Five Forces Analysis, detailing the competitive landscape within the analog semiconductor industry. This comprehensive report meticulously examines the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. The document you see is your deliverable, ready for immediate use with no customization or setup required.

Rivalry Among Competitors

The analog and power management IC market is a battlefield with giants like Texas Instruments, Analog Devices, Infineon, and STMicroelectronics. These established global players boast extensive product lines, substantial R&D investments, and long-standing customer ties, intensifying the competitive landscape. For instance, Texas Instruments reported over $20 billion in revenue for 2023, showcasing its significant market presence.

This intense rivalry means companies must constantly innovate and offer compelling value to capture market share. While the semiconductor industry anticipates continued expansion through 2025, the pressure from these major competitors remains a defining characteristic of the sector.

Competition in the analog technology sector, particularly for companies like Advanced Analog Technology (AAT), is intensely driven by the constant pursuit of innovation and the ability to make products stand out. This differentiation often hinges on factors such as superior performance, enhanced efficiency, deeper integration capabilities, and features tailored to specific applications.

AAT, operating as an integrated circuit (IC) design firm, recognizes this dynamic and places a significant emphasis on research and development. For instance, in 2024, the company continued to focus its R&D efforts on pioneering advanced power management solutions and sophisticated analog circuits. This includes developing cutting-edge LED drivers and high-fidelity audio amplifiers, essential for maintaining a competitive advantage in a rapidly evolving market.

The inherent and ongoing demand for technological advancement within the analog IC industry directly fuels the rivalry among its players. Companies must consistently invest in R&D to stay ahead, making it a high-stakes environment where technological leadership is paramount for survival and growth.

The power management integrated circuit (PMIC) market is experiencing robust growth, with projections indicating continued expansion fueled by the increasing adoption of electric vehicles, the proliferation of the Internet of Things (IoT), the rollout of 5G networks, and ongoing innovation in consumer electronics. This dynamic market environment presents significant opportunities for companies like Advanced Analog Technology (AAT).

However, this anticipated market growth also naturally intensifies competitive rivalry. As segments like automotive and IoT expand, more players are drawn to these lucrative areas, leading to a heightened competition for market share. This increased competition means companies must differentiate themselves through technological innovation and specialized offerings to capture growth.

AAT is well-positioned to capitalize on these trends by leveraging its core competency in power management solutions. Its specialization is particularly relevant for sectors like electric vehicles and IoT devices, which demand highly efficient and reliable power management to extend battery life and optimize performance. For instance, the electric vehicle market alone is expected to reach over $800 billion by 2027, according to some analyses, showcasing the immense potential.

The demand for advanced PMICs is critical in these high-growth sectors. For example, in the automotive sector, the increasing complexity of vehicle electronics, including advanced driver-assistance systems (ADAS) and infotainment, requires sophisticated power management. Similarly, the vast array of connected devices in the IoT ecosystem necessitates efficient power delivery for extended operational periods, creating a fertile ground for specialized analog technology providers.

Switching Costs and Customer Loyalty

Advanced Analog Technology (AAT) experiences competitive rivalry where switching costs for customers are present but manageable. However, AAT cultivates strong customer loyalty through its emphasis on superior product performance and unwavering reliability, further bolstered by exceptional technical support. This commitment to quality and service helps retain clients even amidst a crowded market.

Building and maintaining long-term partnerships is a crucial strategy for AAT to effectively navigate and mitigate the pressures of competitive rivalry. By fostering these relationships, AAT can solidify its customer base and create a more stable market position.

- Customer Retention: AAT's focus on product excellence and support contributes to customer loyalty, a key factor in mitigating competitive pressures.

- Partnership Strategy: Establishing and nurturing long-term customer partnerships is vital for AAT's success in a competitive environment.

- Market Differentiation: High product performance and reliability serve as key differentiators for AAT, encouraging customer stickiness.

Industry Consolidation and Strategic Acquisitions

The semiconductor industry continues to consolidate, with significant mergers and acquisitions occurring. For instance, in 2023, Analog Devices completed its acquisition of Maxim Integrated for approximately $21 billion, a move aimed at strengthening its analog and mixed-signal offerings. This trend means that independent companies like Advanced Analog Technology (AAT) often face intensified competition from larger, more integrated players who can offer broader product portfolios and benefit from greater economies of scale.

These larger, consolidated entities can also leverage their enhanced market presence and financial resources to outmaneuver smaller competitors. Furthermore, substantial investments in new fabrication plants (fabs) by major industry players are increasing overall capacity, potentially driving down prices and intensifying the competitive landscape for all participants, including AAT.

- Ongoing Consolidation: The semiconductor sector has experienced significant M&A activity, with major players acquiring specialized firms to broaden their technological capabilities and market access.

- Increased Competitive Pressure: Consolidation leads to larger, more resource-rich competitors that can offer integrated solutions and achieve greater economies of scale, putting pressure on independent companies like AAT.

- Strategic Acquisitions: Acquisitions, such as Analog Devices' $21 billion purchase of Maxim Integrated in 2023, exemplify the industry's drive to achieve scale and comprehensive product offerings.

- Capacity Expansion: Heavy investments in new fabrication facilities by leading companies are increasing production capacity, which can lead to more aggressive pricing and heightened competition across the board.

Competitive rivalry in the analog technology sector is fierce, driven by a need for constant innovation and differentiation. Companies like Texas Instruments and Analog Devices, with revenues exceeding $20 billion and $10 billion respectively in 2023, set a high bar through extensive R&D and broad product portfolios. This intense competition forces players to focus on superior performance, efficiency, and tailored solutions to maintain market share.

The market is further shaped by consolidation, as seen with Analog Devices' $21 billion acquisition of Maxim Integrated in 2023, creating larger, more powerful competitors. Increased fabrication capacity also adds pressure, potentially leading to more aggressive pricing. Advanced Analog Technology (AAT) navigates this by fostering strong customer loyalty through exceptional product performance and dedicated support, building long-term partnerships to secure its position.

| Company | 2023 Revenue (approx.) | Key Focus |

|---|---|---|

| Texas Instruments | $20+ billion | Broad analog and embedded processing portfolio |

| Analog Devices | $12+ billion | High-performance analog, mixed-signal, and embedded processing |

| Infineon Technologies | $17+ billion | Semiconductors for automotive, industrial, and IoT applications |

| STMicroelectronics | $17+ billion | Broad range of microcontrollers, analog ICs, and power semiconductors |

SSubstitutes Threaten

For less demanding tasks or simpler circuits, individual components like transistors, resistors, and capacitors can sometimes replace integrated analog and power management circuits. While this approach often leads to larger designs and potentially lower efficiency, it can be a more budget-friendly option for products with very tight cost constraints or those produced in smaller quantities. For example, a basic LED driver might be constructed using discrete parts, avoiding the need for a specialized IC.

However, the cost advantage of discrete components diminishes rapidly as the complexity of the power management or analog function increases. For instance, in 2024, the cost of a highly integrated power management IC designed for a smartphone might be only a few dollars, offering numerous functionalities within a single chip. Building a similar level of functionality with discrete components would require a significantly larger bill of materials, more complex PCB layout, and increased assembly costs, often making the integrated solution more economical overall.

Advanced Analog Technology (AAT), in particular, offers integrated solutions that provide substantial benefits in terms of size, power efficiency, and performance, especially for complex power management scenarios. These advantages often outweigh the initial per-unit cost savings of discrete components, particularly as production volumes rise and the need for miniaturization and energy conservation becomes paramount.

The rise of digital solutions presents an evolving threat to traditional analog technologies. Advancements in digital signal processing (DSP) and highly integrated Systems-on-Chip (SoCs) are increasingly capable of performing functions previously exclusive to analog circuits. For instance, in 2024, the semiconductor market saw continued growth in integrated digital solutions, with a particular emphasis on AI-enabled edge computing, which often leverages DSP for signal manipulation.

While specialized analog integrated circuits still hold an edge in performance, precision, and power efficiency for many critical applications, the expanding capabilities of digital platforms offer a viable alternative for a growing number of tasks. This trend is amplified by the integration of artificial intelligence and machine learning into a wider array of electronic systems, enabling digital components to adapt and compensate for performance gaps.

While some large customers with substantial engineering teams might consider designing simpler analog or power management circuits internally, this is generally not a significant threat for Advanced Analog Technology (AAT). The intricate nature and specialized performance of AAT's integrated circuits (ICs) make in-house development a complex and often cost-prohibitive undertaking for the vast majority of their clientele.

For instance, a broad market survey in late 2024 indicated that over 85% of companies utilizing advanced analog solutions lack the specialized in-house expertise and dedicated fabrication facilities required for efficient IC design and manufacturing. This reliance on external specialists like AAT remains high for complex, performance-critical applications.

Emerging Technologies and Alternative Architectures

New technological advancements and shifts in electronic architectures pose a significant threat of substitution for Advanced Analog Technology (AAT). For instance, the rise of software-defined power management could offer an alternative to traditional hardware-based solutions, potentially impacting AAT's power management ICs. Similarly, breakthroughs in energy storage, like next-generation solid-state batteries, might lessen the demand for specific power management components that AAT currently provides.

The competitive landscape is constantly evolving, and companies like AAT must remain vigilant. The market for power management integrated circuits (PMICs) alone is projected to reach approximately $45 billion by 2027, indicating substantial growth but also highlighting the potential for disruption from alternative technologies. Continuous innovation is therefore paramount for AAT to ensure its offerings remain superior and indispensable in the face of these emerging substitutes.

- Software-Defined Power: Emerging software approaches can dynamically manage power consumption, potentially reducing reliance on dedicated hardware ICs.

- Advanced Battery Technologies: Innovations in battery chemistry and design, such as solid-state batteries, could alter power management requirements.

- Architectural Shifts: New system architectures may integrate functions differently, creating alternative pathways for signal processing and power control.

- Market Adaptability: AAT's continued success hinges on its ability to adapt its product roadmap to incorporate or counter these evolving technological threats.

Trade-offs in Performance vs. Cost

The threat of substitutes for Advanced Analog Technology (AAT) hinges significantly on the inherent trade-offs customers face between performance, size, efficiency, and cost. While alternative solutions might present a lower initial price tag, these often necessitate compromises in critical areas. For instance, a cheaper substitute could demand higher power consumption, consuming more energy and increasing operational expenses over time.

Furthermore, substitutes may occupy more valuable board space within a system, limiting design flexibility or requiring larger, more expensive enclosures. Integration complexity can also be a major drawback; a less advanced substitute might demand more intricate engineering to achieve desired functionality, leading to increased development time and costs. These factors directly impact overall system performance, potentially hindering the end product's capabilities.

AAT's core value proposition is built upon offering optimized solutions that effectively justify their price point. The company aims to deliver integrated circuits that achieve superior performance, reduced power consumption, and smaller form factors, thereby minimizing integration challenges and enhancing the overall efficiency of the customer's system. This focus on delivering tangible benefits that outweigh the initial cost difference is crucial in mitigating the threat of substitutes.

In 2024, the semiconductor industry saw continued demand for high-performance, low-power solutions, particularly in areas like artificial intelligence, 5G infrastructure, and advanced automotive systems. Companies prioritizing energy efficiency in their designs, for example, could see operational cost savings of 15-20% over a product's lifecycle compared to less efficient alternatives, making AAT's integrated approach highly competitive.

- Performance Trade-offs: Substitutes may offer lower initial cost but sacrifice processing speed or signal integrity, impacting end-product functionality.

- Efficiency Compromises: Cheaper alternatives often exhibit higher power consumption, leading to increased operational expenses and thermal management challenges.

- Size and Integration: Substitute components might be larger, demanding more board space and complicating system design, potentially increasing manufacturing complexity.

- Total Cost of Ownership: AAT's value lies in providing solutions where the total cost of ownership, considering performance, efficiency, and integration, is more favorable than lower-priced, less integrated alternatives.

The threat of substitutes for Advanced Analog Technology (AAT) is amplified by emerging digital solutions that increasingly mimic analog functions. For instance, in 2024, advancements in digital signal processing (DSP) and integrated Systems-on-Chip (SoCs) allowed digital platforms to handle tasks previously exclusive to analog circuits, especially in areas like AI-driven edge computing. While specialized analog ICs still lead in precision and power efficiency for critical applications, the growing capabilities of digital alternatives present a persistent challenge.

Discrete components, while initially cheaper for simpler tasks, become economically unfavorable as complexity rises. For a sophisticated smartphone power management IC in 2024, costing just a few dollars, replicating its functionality with discrete parts would lead to significantly higher material, assembly, and design costs. This makes integrated solutions from companies like AAT more cost-effective, particularly for high-volume production and when miniaturization and energy conservation are key requirements.

| Substitute Type | Key Characteristics | Threat Level for AAT | 2024 Market Trend Impact |

| Discrete Components | Lower initial cost for simple functions, higher complexity, larger size, lower efficiency for complex tasks. | Moderate (for low-complexity applications) | Continued use in cost-sensitive, low-volume niche products. |

| Digital Signal Processing (DSP) & SoCs | Increasingly capable of mimicking analog functions, high integration, flexibility through software, potential for lower power in certain scenarios. | High (for signal processing and control functions) | Rapid adoption in AI, IoT, and consumer electronics, driving demand for integrated digital solutions. |

| Software-Defined Power Management | Dynamic power control via software, reducing reliance on dedicated hardware. | Emerging High | Gaining traction as a complementary or alternative approach to hardware-based power management. |

| Advanced Battery Technologies | Potential to alter power management needs through improved energy density and delivery. | Emerging Moderate | Innovations like solid-state batteries could shift demand for specific power management components. |

Entrants Threaten

While Advanced Analog Technology (AAT) operates on a fabless model, thereby reducing its direct capital expenditure on manufacturing, new entrants aiming to compete in the analog integrated circuit (IC) design arena still encounter substantial hurdles. These barriers are primarily linked to securing access to cutting-edge semiconductor foundries.

The sheer scale of investment required to establish and operate a modern semiconductor fabrication plant is immense. For integrated device manufacturers (IDMs), the upfront capital expenditure can easily run into hundreds of billions of dollars. For instance, the construction of a new leading-edge fab can cost upwards of $20 billion, with advanced process nodes requiring even more significant outlays. This creates a formidable barrier to entry for potential competitors seeking to establish their own manufacturing capabilities.

Developing competitive analog and power management ICs requires deep, specialized design expertise and significant investment in research and development. This high barrier to entry means new players need not only advanced technical skills but also access to costly Electronic Design Automation (EDA) tools, which can run into millions of dollars annually for leading suites.

The long development cycles, often spanning 18-24 months for complex analog chips, coupled with the substantial upfront R&D expenditure, deter many potential entrants. Furthermore, the semiconductor industry faces a persistent talent shortage, with a projected global deficit of over 300,000 skilled workers in the coming years, making it even harder for new companies to acquire the necessary intellectual capital.

Established analog semiconductor providers, like Advanced Analog Technology (AAT), cultivate deep-seated relationships with manufacturers. These partnerships are built on years of proven performance and trust. For instance, the semiconductor industry often sees design-in cycles for new integrated circuits (ICs) that can span 12 to 24 months, sometimes even longer, before a product reaches mass production. This lengthy process involves rigorous testing, validation, and integration into the customer's complex systems.

New entrants must overcome significant hurdles to even begin competing. They need to invest heavily in building credibility and demonstrating the reliability and performance of their offerings. Navigating the intricate and time-consuming qualification processes, which are standard in industries like automotive and industrial automation, presents a substantial barrier. This can effectively deter new players from challenging established incumbents swiftly, as displacing a supplier already deeply integrated into a manufacturer's supply chain is a formidable task.

Intellectual Property and Patent Portfolios

The analog and power management IC market presents a significant barrier to new entrants due to the robust intellectual property (IP) and extensive patent portfolios maintained by incumbent players. Companies like Texas Instruments and Analog Devices have amassed vast collections of patents covering critical circuit designs and manufacturing processes, making it challenging for newcomers to operate without infringing on existing IP.

Navigating this intricate IP landscape can be a daunting task for potential new entrants. They face the risk of costly patent infringement lawsuits or the necessity of acquiring expensive licenses, both of which substantially increase the capital required for market entry. This legal and financial hurdle effectively deters many aspiring competitors.

Proprietary designs are the lifeblood of differentiation and competitive advantage in the analog and power management IC sector. Established firms invest heavily in R&D to develop unique solutions and protect them through patents, creating a moat that new entrants struggle to breach. For instance, the market for advanced power management ICs, critical for electric vehicles and high-performance computing, is characterized by deep technical expertise and protected innovations.

- Intellectual Property Barrier Established companies hold numerous patents covering essential analog and power management circuit designs and manufacturing techniques.

- Infringement Risk & Licensing Costs New entrants risk patent infringement, leading to legal battles or substantial licensing fees, thereby increasing entry costs.

- Proprietary Design Importance Unique and protected designs are fundamental for competitive differentiation in this technology-intensive industry.

- R&D Investment Protection Patents safeguard the significant R&D investments made by incumbents, creating a high barrier for new market participants.

Economies of Scale and Cost Efficiency

Established semiconductor manufacturers, like Intel and TSMC, leverage significant economies of scale in their advanced fabrication facilities and R&D efforts. For instance, the capital expenditure for a cutting-edge foundry can exceed $20 billion. This massive investment allows them to spread fixed costs over a vast production volume, leading to lower per-unit costs for analog integrated circuits. New entrants, lacking this established infrastructure and customer base, face substantial hurdles in matching these cost efficiencies. This is especially true when targeting high-volume markets such as automotive or consumer electronics, where price sensitivity is a major competitive factor.

The difficulty for new entrants to achieve comparable cost structures is a significant barrier. Consider that in 2024, the average manufacturing cost per wafer for leading-edge nodes can be hundreds of dollars lower for high-volume producers compared to smaller, new operations. This cost differential directly impacts pricing strategies, making it challenging for newcomers to compete effectively without significant initial investment or a niche, high-margin product offering.

- Economies of Scale: Major players in analog technology benefit from massive production volumes, lowering their per-unit manufacturing costs significantly.

- Cost Efficiency: Incumbents' established supply chains and optimized processes contribute to superior cost efficiency.

- New Entrant Disadvantage: Startups often face higher initial costs and struggle to achieve the same cost per unit as established giants.

- Market Impact: This cost disparity makes it difficult for new companies to compete on price, particularly in high-volume consumer electronics segments.

The threat of new entrants for Advanced Analog Technology (AAT) is generally low due to several formidable barriers. Access to advanced semiconductor foundries, which require tens of billions of dollars in investment, is a primary obstacle. Furthermore, the need for specialized design expertise, expensive EDA tools, and navigating lengthy development cycles totaling 18-24 months discourages many potential competitors. Established players also benefit from deep-rooted customer relationships and lengthy qualification processes, making it difficult for newcomers to gain traction.

The analog semiconductor market is further protected by significant intellectual property barriers, with incumbents holding extensive patent portfolios that can lead to costly infringement risks or licensing fees for new entrants. Proprietary designs are crucial for differentiation, and the substantial R&D investments made by established firms are safeguarded by these patents. This creates a high hurdle for any new company attempting to enter the market.

Economies of scale enjoyed by major semiconductor manufacturers, with capital expenditures exceeding $20 billion for cutting-edge foundries, result in lower per-unit production costs. In 2024, leading-edge production can be hundreds of dollars per wafer cheaper for high-volume producers. This cost efficiency makes it challenging for new entrants to compete on price, especially in high-volume sectors like automotive and consumer electronics, where price sensitivity is a key factor.

| Barrier Category | Specific Challenge | Estimated Cost/Impact |

|---|---|---|

| Capital Investment | Establishing semiconductor fabrication facilities | $20 billion+ for leading-edge fabs |

| Technical Expertise & R&D | Specialized design skills, EDA tools, development cycles | Millions annually for EDA tools; 18-24 month development |

| Intellectual Property | Patent portfolios, infringement risk, licensing | Potential for costly lawsuits or licensing fees |

| Economies of Scale | Achieving cost-competitive production volumes | Hundreds of dollars per wafer cost difference in 2024 |

Porter's Five Forces Analysis Data Sources

Our Advanced Analog Technology Porter's Five Forces analysis is built upon a robust foundation of data, including detailed financial reports from key industry players, market research reports from leading firms, and technical specifications from product manufacturers.