American Airlines Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Airlines Group Bundle

American Airlines Group operates in a dynamic environment shaped by political shifts, economic fluctuations, and evolving social attitudes towards travel. Understanding these external forces is crucial for strategic planning and mitigating risks. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence to navigate the complexities of the aviation industry.

Gain a competitive edge by leveraging our expertly crafted PESTLE analysis for American Airlines Group. Uncover critical insights into technological advancements, environmental regulations, and legal frameworks impacting the airline's operations and future growth. Download the full version now to equip yourself with the knowledge needed to make informed decisions and secure your market position.

Political factors

Government regulations are a major force shaping American Airlines' operations. These rules span critical areas like ensuring passenger safety, adhering to environmental standards, and protecting consumer rights. For instance, new U.S. Department of Transportation (DOT) regulations implemented in 2024 concerning refunds for significantly delayed or canceled flights, as well as baggage fee transparency, directly impact how American Airlines manages its customer service and financial reporting.

The FAA Reauthorization Act of 2024, for example, continues to set the framework for aviation safety oversight and operational standards, influencing everything from pilot training to aircraft maintenance protocols. These legislative and regulatory shifts require continuous adaptation and investment from American Airlines to maintain compliance and operational integrity.

Trade tensions and tariffs, particularly those impacting imports from nations like Canada and China, directly escalate operating expenses for American Airlines. These tariffs influence the cost of essential aviation fuel and aircraft components, while also potentially softening consumer travel demand by affecting disposable income.

For instance, American Airlines has explicitly referenced these tariff-related pressures as a factor in its decision to withdraw and subsequently reinstate its comprehensive financial forecast for 2025, highlighting the significant impact on financial planning and outlook.

Geopolitical stability and international relations significantly shape American Airlines' global network. For instance, shifts in bilateral aviation agreements, like potential Canadian entry restrictions for certain U.S. carriers in 2025, could directly affect route viability and operational planning.

American Airlines' strategic expansion of transatlantic routes for summer 2025 underscores the critical need for predictable international relations. Stability in these relationships is paramount for ensuring the success and profitability of these international operations.

Government Contracts and Spending

Government contracts and spending represent a crucial element impacting American Airlines. In 2024, these contracts, which include transporting government personnel and mail, constituted a notable portion of the airline's revenue. Any reduction in federal spending or shifts in government priorities could directly diminish this income stream.

The airline's reliance on such contracts makes it susceptible to changes in fiscal policy. For instance, a government-wide budget cut could lead to fewer travel authorizations for federal employees, directly affecting American Airlines' passenger numbers on specific routes.

- Government Contracts in 2024: A significant revenue contributor for American Airlines.

- Impact of Budget Cuts: Potential reduction in government travel and mail transport services.

- Shifting Priorities: Changes in government spending focus can alter demand for airline services.

Airline Industry Deregulation vs. Re-regulation Trends

The airline industry, while largely deregulated since the Airline Deregulation Act of 1978, is experiencing a subtle but significant shift towards increased government oversight. Recent actions by the Department of Transportation (DOT) underscore this trend, particularly concerning passenger rights and fare transparency.

New DOT regulations, implemented in late 2023 and early 2024, mandate automatic refunds for significant flight changes or cancellations, and require airlines to provide clearer information on baggage fees and other ancillary charges. For American Airlines, this means adapting operational processes and potentially increasing compliance staff to ensure adherence to these evolving rules.

These regulatory adjustments could introduce higher operational costs due to new compliance requirements and potential penalties for non-adherence. However, they may also foster greater consumer confidence and potentially boost demand by addressing long-standing passenger grievances.

- Increased Consumer Protection: DOT rules now mandate automatic refunds for significant flight disruptions, a key area of passenger concern.

- Enhanced Transparency: Airlines must provide more upfront information on fees, reducing hidden costs for travelers.

- Potential Cost Increases: Compliance with new regulations may lead to higher operational and administrative expenses for carriers like American Airlines.

- Impact on Demand: Improved passenger trust could translate into stronger booking trends and customer loyalty.

Government policies and regulations continue to be a significant influence on American Airlines' operations and strategic decisions. The airline must navigate a complex web of rules governing safety, consumer protection, and environmental impact. For example, the FAA's continued focus on safety standards, as seen in its oversight of new aircraft technologies, directly impacts operational procedures and investment in training and equipment.

The U.S. government's approach to international trade and aviation agreements also plays a crucial role. Changes in bilateral air service agreements or the imposition of tariffs on aviation-related goods can affect route profitability and operational costs. For instance, ongoing discussions around air service agreements with countries like the UK for 2025 could reshape transatlantic route planning.

Furthermore, government spending and fiscal policies directly influence demand for air travel, particularly for business and leisure segments. Reductions in government travel budgets or shifts in economic stimulus measures can have a tangible effect on passenger volumes and revenue. American Airlines' reliance on government contracts for mail and personnel transport also makes it sensitive to federal budget allocations.

| Policy Area | Impact on American Airlines | Example/Data Point (2024-2025) |

|---|---|---|

| Consumer Protection Regulations | Increased compliance costs, potential for improved customer trust | DOT's enhanced refund rules for significant delays (implemented 2024) |

| Aviation Safety Oversight | Investment in training, technology, and maintenance | FAA Reauthorization Act of 2024 setting safety standards |

| International Aviation Agreements | Route viability, operational planning, potential revenue impact | Potential adjustments to UK air service agreements for 2025 |

| Government Spending & Fiscal Policy | Influence on business and leisure travel demand, government contract revenue | Sensitivity to federal budget allocations impacting government travel |

What is included in the product

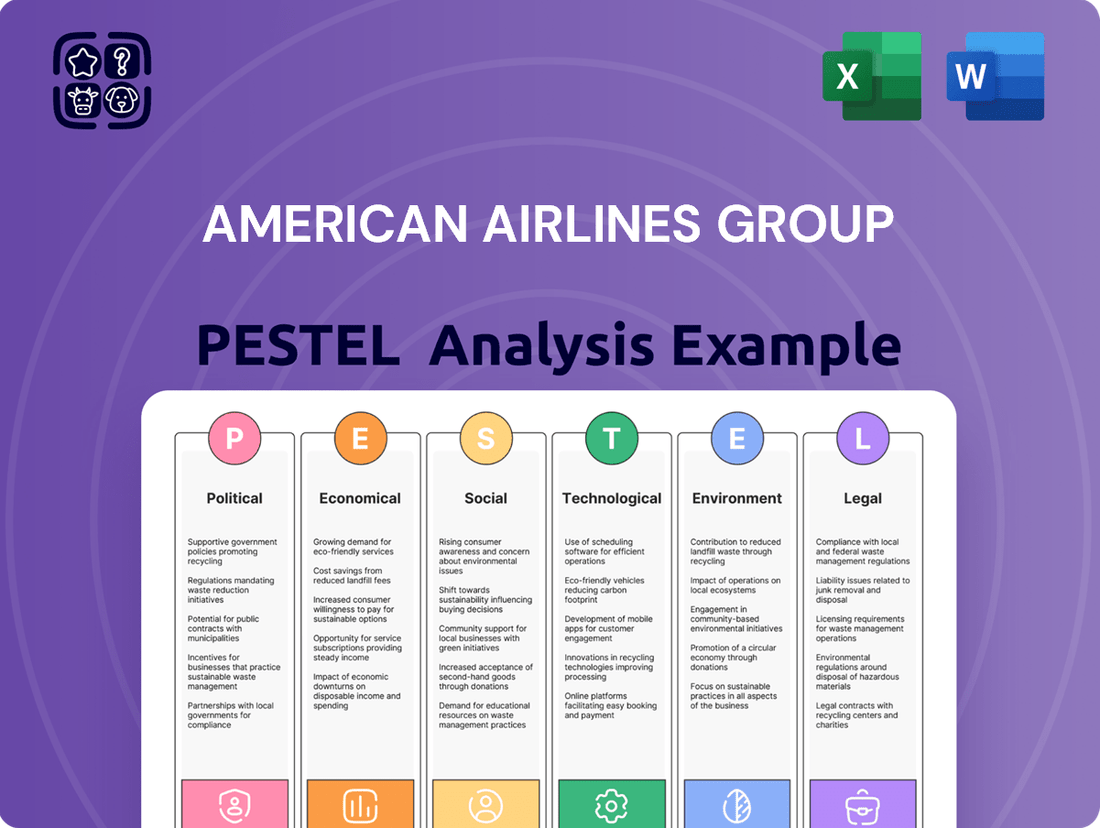

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting American Airlines Group, offering a comprehensive view of the external landscape.

It provides actionable insights for strategic decision-making, highlighting how these macro-environmental factors create both challenges and avenues for growth within the airline industry.

A concise PESTLE analysis for American Airlines Group that highlights key external factors impacting the airline industry, serving as a readily digestible resource for strategic decision-making and risk mitigation.

Economic factors

Fuel costs are a major expense for American Airlines, directly impacting their bottom line. For instance, in the first quarter of 2025, American Airlines reported a decrease in their fuel expense, a positive sign amidst ongoing economic uncertainties.

The price of crude oil, a primary driver of jet fuel costs, is subject to considerable global supply and demand shifts, geopolitical events, and even weather patterns. Tariffs imposed on imported aviation fuel can further exacerbate these price swings, adding another layer of complexity for airline financial planning.

Despite recent improvements, the inherent volatility in fuel prices remains a critical economic factor for American Airlines. Managing this volatility through hedging strategies and operational efficiencies is crucial for maintaining profitability in the competitive airline industry.

Consumer discretionary spending is a major driver for air travel, especially for vacations and personal trips. When consumers feel financially secure, they tend to spend more on travel, boosting demand for airlines like American Airlines. Economic uncertainty, however, can cause people to cut back on non-essential expenses, including flights, particularly for domestic travel.

American Airlines has directly addressed this issue, reporting a significant weakening in demand for its domestic main cabin offerings. This softness in consumer willingness to spend on these specific travel segments negatively impacted their financial projections for 2025, highlighting the direct link between consumer sentiment and airline performance.

Labor costs represent a significant operating expense for American Airlines, with recent labor agreements contributing to wage inflation. These increased costs directly impact the company's bottom line, potentially squeezing profit margins.

American Airlines is actively working to manage and moderate this unit cost inflation, with a stated goal of achieving this by the close of 2025. For instance, the airline's Q1 2024 results showed a 3.3% increase in total operating expenses compared to the prior year, partly influenced by higher labor costs.

Economic Growth and GDP Forecasts

Economic growth is a primary driver for air travel demand, and forecasts for Gross Domestic Product (GDP) directly influence passenger traffic. A slowdown in global or U.S. GDP growth can significantly temper the expansion of passenger numbers, impacting airlines like American Airlines Group.

While the airline industry anticipates continued growth through 2025, recent economic outlooks present a more nuanced picture. For instance, projections for North American GDP growth have seen downward revisions, signaling potential headwinds for domestic and international travel demand.

- GDP Growth Impact: A 1% decrease in GDP growth has historically correlated with a roughly 1-2% reduction in air travel demand growth.

- 2025 Forecasts: While global GDP is projected to grow by approximately 2.7% in 2025 according to the IMF (as of April 2024), regional variations are significant.

- North American Slowdown: Downward revisions to North American GDP growth forecasts, particularly in the latter half of 2024 and into 2025, suggest a more cautious outlook for travel spending in the region.

Supply Chain Disruptions and Aircraft Deliveries

Ongoing supply chain challenges continue to impact aircraft manufacturers like Boeing and Airbus, potentially limiting American Airlines' ability to expand its fleet. These disruptions can lead to extended lead times for new aircraft and essential spare parts, directly affecting capacity planning.

Delays in aircraft deliveries and extended maintenance turnaround times are a significant concern. For instance, in early 2024, Boeing faced production issues that impacted its delivery schedules. This mismatch between the airline's desired fleet size and actual availability can hinder revenue growth and operational efficiency, as American Airlines might not be able to meet surging travel demand.

- Aircraft Delivery Delays: Manufacturers like Boeing are working to resolve production bottlenecks, but the full impact on delivery schedules for 2024 and 2025 remains a key factor for airline fleet planning.

- Spare Parts Availability: Shortages in critical aircraft components, such as engines and avionics, can extend aircraft grounding periods for maintenance, reducing the available fleet.

- Impact on Capacity: Limited new aircraft deliveries and longer maintenance times directly constrain American Airlines' ability to increase seat capacity and capitalize on market demand.

Economic growth, particularly GDP, directly influences air travel demand. While global GDP is projected to grow around 2.7% in 2025, North American growth forecasts have been revised downwards, suggesting a potentially softer demand environment for American Airlines in that key region.

Consumer spending is critical, and recent reports indicate a weakening in demand for domestic main cabin travel, impacting American Airlines' financial outlook for 2025. This highlights how consumer confidence and discretionary spending directly affect ticket sales.

Fuel costs remain a significant variable, with crude oil prices subject to global volatility. Despite a reported decrease in fuel expense in Q1 2025 for American Airlines, managing this inherent price fluctuation through hedging is vital for profitability.

Labor costs are also a concern, with recent agreements contributing to wage inflation. American Airlines aims to moderate this unit cost inflation by the end of 2025, a challenge exacerbated by a 3.3% increase in operating expenses noted in Q1 2024 due to higher labor costs.

| Economic Factor | 2024/2025 Impact on American Airlines | Supporting Data/Notes |

|---|---|---|

| GDP Growth | Potential headwinds due to revised North American forecasts | IMF projects ~2.7% global GDP growth for 2025; downward revisions in North America. |

| Consumer Spending | Weakening demand in domestic main cabin impacting revenue | Directly affected American Airlines' 2025 financial projections. |

| Fuel Prices | Ongoing volatility impacts profitability; hedging is crucial | Q1 2025 saw a decrease in fuel expense for American Airlines. |

| Labor Costs | Wage inflation increases operating expenses | American Airlines aims to moderate unit cost inflation by end of 2025; Q1 2024 saw a 3.3% rise in operating expenses partly due to labor. |

Full Version Awaits

American Airlines Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of American Airlines Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline industry.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the strategic landscape and potential challenges and opportunities facing American Airlines Group.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of external forces that shape the operational and strategic decisions of this major airline.

Sociological factors

Traveler preferences are shifting, with a strong focus on value and convenience. Many consumers are also seeking more personalized travel experiences. This trend is evident in the increasing demand for seamless booking processes and brands that inspire trust.

While direct bookings are on the rise, travel intermediaries still play a significant role. Airlines must therefore maintain multi-channel strategies and improve their merchandising efforts to cater to this evolving landscape. For instance, in 2024, online travel agencies (OTAs) continued to be a major booking channel for many travelers, highlighting the need for robust partnerships.

The ongoing shift towards remote work continues to reshape business travel patterns, a significant sociological factor impacting airlines like American Airlines. While leisure travel has shown robust recovery, the sustained reduction in traditional corporate trips directly affects American's revenue streams and strategic route development.

For instance, a 2024 report indicated that while overall travel spending was nearing pre-pandemic levels, business travel was still lagging, with many companies adopting hybrid work models permanently. This trend necessitates a strategic adjustment for American Airlines, prompting a greater focus on adapting its offerings to retain and attract corporate clients in this evolving landscape.

American Airlines' proactive approach, including enhanced engagement with corporate customers and tailored travel solutions, demonstrates an understanding of this sociological shift. This strategy aims to secure a stable base of corporate bookings amidst the uncertainty surrounding the long-term normalization of business travel.

Public health concerns continue to shape traveler confidence. While the immediate impact of the COVID-19 pandemic has subsided, the general perception of air travel safety remains a factor. For American Airlines, any renewed concerns about airborne illnesses could dampen demand, especially for leisure travel.

In 2024, passenger confidence is generally high, with air travel volume approaching pre-pandemic levels. However, the lingering awareness of health risks means that any significant outbreak or perceived lapse in safety protocols could quickly impact booking trends. American Airlines, like its competitors, monitors public health advisories closely to gauge potential shifts in travel behavior.

Demographic Shifts and Emerging Markets

Demographic shifts are significantly influencing the aviation industry, with rising air travel demand from burgeoning economies like India presenting substantial growth avenues for American Airlines. This trend is bolstered by a growing middle class in these regions eager to explore global destinations, directly benefiting carriers with extensive international networks.

While the recovery of Chinese international travel to pre-2019 levels remains a point of cautious optimism, its full resurgence would unlock considerable market potential. American Airlines' strategic global network is designed to capitalize on these evolving demographic patterns, connecting a diverse passenger base across continents.

- India's growing middle class: Projected to reach over 475 million people by 2030, driving increased demand for international travel.

- China's travel market: Prior to the pandemic, China was a key market, with millions of outbound tourists annually; its recovery is critical for global aviation.

- American Airlines' network strategy: Focuses on leveraging these demographic trends by offering direct and connecting flights to key emerging markets.

Customer Experience Expectations

Passengers are increasingly demanding a smooth and hassle-free journey, covering everything from booking flights to reaching their final destination. This means they expect easy ways to rebook if their travel plans get disrupted, timely updates about their flights, and better digital tools to manage their travel.

American Airlines is actively investing in technology and enhancing its customer service efforts to align with these evolving passenger demands. For instance, in 2024, the airline continued to roll out upgrades to its mobile app, aiming to provide more intuitive self-service options for passengers, such as managing bookings and checking flight status. This focus on digital improvement is crucial as customer satisfaction scores often hinge on the ease of interaction with an airline's digital platforms.

- Seamless Digital Integration: Passengers expect integrated digital experiences, from booking and check-in to in-flight services and post-flight feedback.

- Proactive Communication: Real-time, personalized updates regarding flight status, gate changes, and rebooking options during disruptions are highly valued.

- Personalized Services: Leveraging data to offer tailored experiences, such as preferred seating or personalized entertainment options, enhances customer loyalty.

Societal expectations around sustainability are increasingly influencing consumer choices, including air travel. Travelers are more aware of the environmental impact of flying and are seeking airlines that demonstrate a commitment to reducing their carbon footprint. This growing consciousness pressures American Airlines to invest in more fuel-efficient aircraft and sustainable aviation fuels.

In 2024, there's a notable consumer preference for brands that align with personal values, including environmental responsibility. Surveys from early 2024 indicated that over 60% of travelers considered an airline's sustainability practices when making booking decisions. This trend necessitates transparent reporting and tangible actions from American Airlines to meet these evolving societal demands.

The desire for authentic and culturally immersive experiences is also shaping travel trends. Passengers are moving beyond traditional tourism, seeking deeper connections with local cultures and communities. This shift encourages airlines to offer more localized content and partnerships that cater to these enriched travel aspirations.

Technological factors

American Airlines is making significant strides in digital transformation, notably through the integration of artificial intelligence (AI) and generative AI across its business. This strategic focus aims to streamline operations and elevate the passenger experience.

The airline is deploying AI-powered chat assistants to help passengers rebook flights during disruptions, a crucial tool for managing the complexities of air travel. Furthermore, predictive analytics are being utilized to optimize the management of connecting flights, thereby reducing delays and improving on-time performance. For instance, in the first quarter of 2024, American Airlines reported a 7% increase in revenue, partly attributed to improved operational efficiency driven by these technological advancements.

American Airlines is heavily invested in technological advancements, particularly in fuel efficiency. A prime example is their significant deployment of the Airbus A321neo, which features advanced wingtip devices called sharklets and more efficient engines. This technology directly translates to lower fuel burn per passenger mile, a critical factor in managing operating costs and environmental impact.

As of early 2024, American Airlines continues to operate one of the youngest mainline fleets in the industry, with an average age around 11 years. This strategic fleet modernization allows for greater adoption of fuel-saving technologies. For instance, the A321neo offers up to 15% better fuel efficiency compared to previous generation aircraft, contributing to American Airlines' sustainability targets and reducing their overall carbon footprint.

American Airlines is making significant strides in Sustainable Aviation Fuel (SAF) development and usage, aiming to replace a portion of its traditional jet fuel with this greener alternative. The airline has committed to ambitious targets for SAF integration, underscoring its dedication to decarbonizing its operations. This strategic focus is crucial for meeting environmental regulations and consumer expectations in the coming years.

The company has secured agreements for SAF, with initial deliveries anticipated in 2025 and 2026. These forward-looking agreements signal a tangible commitment to scaling up SAF adoption, moving beyond pilot programs to widespread implementation. This investment in SAF is a key technological factor shaping the future of aviation and American Airlines' competitive positioning.

Hydrogen-Electric Engine Development

American Airlines is actively exploring hydrogen-electric engine technology, a critical development for achieving net-zero emissions by 2050. Partnerships with innovators like ZeroAvia are central to this strategy, focusing on integrating these cleaner propulsion systems into their aircraft. This technological advancement is currently undergoing testing for shorter flight routes, signaling a future of more sustainable and less noisy air travel.

The development of hydrogen-electric engines is a significant technological factor for American Airlines' long-term operational strategy. By 2024, the aviation industry is seeing increased investment in sustainable aviation fuels (SAFs) and alternative propulsion, with hydrogen being a key focus area. ZeroAvia, for instance, aims to certify its 19-seat hydrogen-electric powertrain for commercial use by 2025, a milestone American Airlines is closely watching.

- Zero-Emission Goal: Targeting net-zero emissions by 2050, with hydrogen-electric engines as a core component.

- Industry Collaboration: Partnering with companies like ZeroAvia to advance hydrogen propulsion technology.

- Short-Haul Testing: Initial applications of hydrogen-electric engines are being tested on shorter flight segments.

- Future Fleet Integration: This technology represents a long-term vision for cleaner and quieter aircraft operations.

Operational Technology and Data Analytics

American Airlines is leveraging advanced technological factors, particularly in operational technology and data analytics, to drive efficiency. Their Smart Gating technology, for instance, utilizes machine learning to intelligently assign gates. This innovation directly impacts operations by minimizing aircraft taxi times, which in turn contributes to significant fuel savings and a reduction in carbon emissions, a crucial aspect of their environmental strategy.

The airline's commitment to data analytics extends beyond gate management. They employ sophisticated data analysis to enhance overall decision-making processes and bolster operational resilience. This data-driven approach allows American Airlines to anticipate potential disruptions and respond more effectively, ensuring smoother operations for both the company and its passengers.

Specific examples of their technological advancements include:

- Smart Gating Technology: Uses machine learning to optimize gate assignments and reduce aircraft taxi times.

- Fuel Savings: Directly linked to reduced taxi times, contributing to cost reduction and environmental goals.

- Operational Resilience: Data analytics are employed to improve decision-making and the ability to manage disruptions.

Technological factors are pivotal for American Airlines' operational efficiency and sustainability goals. The airline is actively integrating AI and predictive analytics to optimize flight rebookings and reduce delays, contributing to their reported 7% revenue increase in Q1 2024. Their fleet modernization, with an average aircraft age of around 11 years as of early 2024, prioritizes fuel-efficient models like the Airbus A321neo, offering up to 15% better fuel efficiency.

American Airlines is also investing heavily in Sustainable Aviation Fuel (SAF), with agreements for deliveries starting in 2025-2026, and exploring hydrogen-electric engine technology through partnerships like the one with ZeroAvia, aiming for net-zero emissions by 2050. Their Smart Gating technology, utilizing machine learning, further enhances efficiency by minimizing aircraft taxi times.

| Technology | Impact | Status/Target |

|---|---|---|

| AI & Predictive Analytics | Streamlined operations, reduced delays, improved passenger experience | Deployed for rebooking, optimizing connecting flights |

| Fuel-Efficient Aircraft (e.g., A321neo) | Lower fuel burn per passenger mile, reduced operating costs, environmental benefits | Part of a young fleet (avg. age ~11 years in early 2024), offers up to 15% better fuel efficiency |

| Sustainable Aviation Fuel (SAF) | Decarbonization of operations, meeting environmental regulations | Agreements for deliveries starting 2025-2026 |

| Hydrogen-Electric Engines | Net-zero emissions goal by 2050, cleaner and quieter air travel | Partnerships with ZeroAvia, initial testing on shorter routes |

| Smart Gating Technology | Minimized aircraft taxi times, fuel savings, reduced carbon emissions | Utilizes machine learning for intelligent gate assignments |

Legal factors

Recent U.S. Department of Transportation (DOT) regulations, effective in 2024 and 2025, significantly bolster consumer protections. These rules mandate airlines to provide automatic refunds for flights experiencing substantial delays or cancellations, and for ancillary services that are not delivered as promised. This directly impacts American Airlines' operational procedures and customer service policies, requiring robust systems for tracking and processing these refunds promptly.

Furthermore, the DOT's updated legal framework also enforces timely refunds for baggage that is significantly delayed. For American Airlines, this means enhancing their baggage handling and tracking systems to meet these new statutory requirements. Non-compliance can lead to substantial fines, underscoring the critical need for strict adherence to these consumer-focused mandates to avoid financial penalties and reputational damage.

American Airlines, as a significant player in the global aviation market, faces constant oversight under antitrust and competition laws. These regulations are designed to prevent monopolies and ensure fair competition, impacting everything from ticket pricing to partnership agreements.

The airline industry is particularly sensitive to these laws, with past mergers and acquisitions often drawing scrutiny from regulatory bodies like the U.S. Department of Justice. For instance, the 2013 merger between American Airlines and US Airways, while approved, came with conditions aimed at preserving competition.

Ongoing legal challenges, including potential antitrust lawsuits, could significantly shape American Airlines' future operational strategies and financial health. Such litigation, especially concerning route sharing or code-sharing agreements, might lead to restrictions on its flexibility and could necessitate costly settlements or adjustments to its business model.

American Airlines operates under a complex web of labor laws and collective bargaining agreements with numerous unions, including the Allied Pilots Association and the Association of American Flight Attendants. These agreements significantly influence the airline's operational flexibility and overall cost structure, particularly concerning wages, benefits, and work rules.

Recent labor negotiations have resulted in substantial wage increases for pilots and flight attendants. For instance, the new pilot contract ratified in late 2023 is estimated to add hundreds of millions of dollars annually to American Airlines' labor costs. This trend highlights the ongoing challenge of balancing competitive compensation with financial sustainability.

Compliance with federal and state labor regulations, such as those enforced by the National Labor Relations Board (NLRB), is a critical legal imperative. Effectively managing these union relationships and navigating potential labor disputes are paramount to ensuring smooth operations and mitigating risks that could disrupt service or impact financial performance.

Environmental Regulations and Emissions Standards

American Airlines, like all major carriers, faces increasing pressure to adhere to stringent environmental regulations and evolving emissions standards. These regulations, designed to curb the aviation industry's significant carbon footprint, are becoming more comprehensive. For instance, by 2030, the airline aims to achieve net-zero carbon emissions by 2050, aligning with global climate goals. This commitment involves substantial investments in more fuel-efficient aircraft and sustainable aviation fuels (SAFs).

The airline has publicly committed to science-based targets for emissions reduction, a move that underscores its acknowledgment of the urgency in addressing climate change. These targets are crucial for demonstrating accountability and guiding operational strategies. American Airlines is actively exploring and investing in SAFs, which are seen as a key pathway to decarbonization. In 2023, they announced plans to increase SAF usage, aiming for a significant percentage of their fuel supply to be sustainable in the coming years, although specific, publicly disclosed figures for 2024/2025 are still emerging as the industry transitions.

- Net-Zero Target: American Airlines has committed to achieving net-zero carbon emissions by 2050.

- SAF Investment: The company is actively investing in and increasing its use of Sustainable Aviation Fuels.

- Emissions Reduction Goals: The airline has established science-based targets to guide its emissions reduction efforts.

- Regulatory Compliance: Adherence to evolving environmental regulations and emissions standards is a key operational consideration.

Accessibility and Disability Rights Laws

The Air Carrier Access Act (ACAA) and its associated regulations are critical legal factors for American Airlines. These laws explicitly forbid discrimination against passengers with disabilities, ensuring they receive equitable treatment and access to air travel. Failure to comply can lead to significant legal repercussions.

American Airlines has encountered legal challenges and financial penalties stemming from instances where it did not sufficiently assist passengers with disabilities. For example, in 2023, the Department of Transportation (DOT) finalized consent orders with several airlines, including American, for violations of the ACAA, resulting in commitments to improve accessibility services and potential fines. This underscores the necessity for rigorous adherence to these accessibility mandates.

- The ACAA mandates that airlines provide assistance to passengers with disabilities, including during boarding, deplaning, and in-flight.

- In 2023, the DOT reported a 20% increase in disability-related complaints filed against airlines compared to the previous year, indicating heightened scrutiny.

- Non-compliance can result in substantial fines, with penalties potentially reaching tens of thousands of dollars per violation.

The legal landscape for airlines is dynamic, with new consumer protection regulations from the U.S. Department of Transportation (DOT) taking effect in 2024 and 2025. These rules require automatic refunds for significant delays or cancellations and for services not rendered, directly impacting American Airlines' operational and customer service protocols. Non-compliance can lead to substantial fines, making adherence a critical financial and reputational imperative.

Antitrust and competition laws continue to shape the industry, with regulatory bodies like the Department of Justice closely monitoring airline practices. American Airlines, having faced scrutiny in past mergers, must navigate these regulations to prevent anti-competitive behavior, which could affect pricing strategies and partnership agreements.

Labor laws and collective bargaining agreements remain a significant legal factor, influencing American Airlines' cost structure and operational flexibility. Recent contract ratifications, such as the 2023 pilot agreement, have led to substantial wage increases, adding hundreds of millions to annual labor costs and requiring careful financial management.

Environmental regulations are increasingly stringent, pushing airlines like American Airlines to invest in sustainable aviation fuels (SAFs) and more fuel-efficient aircraft to meet net-zero targets by 2050. The airline's commitment to science-based emissions reduction targets and increased SAF usage, with plans to significantly boost its adoption in the coming years, reflects this growing legal and societal pressure.

Environmental factors

American Airlines acknowledges climate change as a major environmental concern, actively pursuing strategies to shrink its carbon footprint. The company has established significant climate objectives, aiming for net-zero greenhouse gas emissions by 2050.

A key interim goal is to reduce greenhouse gas emission intensity by 45% by 2035, demonstrating a commitment to near-term progress. These targets align with global efforts to mitigate the impacts of aviation on the environment.

The availability and scaling of Sustainable Aviation Fuel (SAF) production are critical environmental factors for American Airlines. While the airline has set ambitious goals to incorporate SAF, its widespread adoption hinges on the industry's capacity to produce and distribute it efficiently.

As of early 2024, SAF production remains a significant bottleneck, with global output far below the demand needed to meet airline sustainability targets. For instance, in 2023, SAF accounted for only a tiny fraction of total jet fuel consumption. American Airlines' commitment to achieving net-zero carbon emissions by 2050 is directly tied to the growth of this nascent market.

American Airlines is heavily focused on operating a modern, fuel-efficient fleet to reduce its environmental footprint. This strategy is crucial for minimizing operating costs and meeting increasingly stringent environmental regulations.

As of late 2024, American Airlines continues its fleet modernization, with a significant portion of its fleet comprising newer, more fuel-efficient aircraft. For example, the Airbus A321neo, which American Airlines has been actively integrating, offers up to 15% better fuel efficiency compared to older models in its class. This translates to substantial reductions in fuel burn and carbon emissions per passenger mile.

These investments are not just about environmental responsibility; they directly impact the bottom line. Fuel is a major operating expense for airlines, and improved efficiency means lower costs. For instance, in 2023, American Airlines reported a significant portion of its fleet was comprised of next-generation aircraft, contributing to an overall improvement in fuel cost management.

Waste Management and Recycling Initiatives

American Airlines is actively engaged in enhancing its waste management and recycling efforts. These initiatives are crucial for reducing the company's environmental footprint and aligning with growing consumer and regulatory expectations. For instance, the airline has been expanding its in-flight recycling programs, aiming to divert more materials from landfills.

A significant focus is placed on exploring and integrating recycled plastic alternatives into various aspects of operations, from cabin amenities to operational supplies. This move not only supports a circular economy but also addresses the substantial volume of plastic waste generated by the aviation industry. In 2023, the airline reported increasing its recycling rate for in-flight materials by 15% compared to the previous year.

Furthermore, American Airlines is implementing sustainable practices within its catering facilities. These efforts are designed to minimize food waste and reduce the overall contribution to landfills. By optimizing food sourcing, preparation, and distribution, the company aims to achieve a 20% reduction in food waste by the end of 2025.

Key waste management and recycling initiatives include:

- Expansion of in-flight recycling programs: Increasing the types of materials accepted for recycling onboard flights.

- Use of recycled materials: Incorporating recycled plastics and other sustainable materials in cabin products and operational equipment.

- Food waste reduction in catering: Implementing strategies to decrease food waste at catering facilities and during service.

- Partnerships for waste diversion: Collaborating with external organizations to find innovative solutions for recycling and waste management.

Noise Pollution and Local Community Impact

Aviation operations are a significant source of noise pollution, directly affecting residents living near airports. American Airlines, like its competitors, is under increasing scrutiny to lessen these noise disturbances. This involves adopting quieter flight paths and investing in newer, less noisy aircraft models. In 2024, the airline continued its fleet modernization efforts, with a focus on acquiring more fuel-efficient and quieter planes, contributing to its stated environmental policy of noise reduction.

The impact on local communities is a critical consideration for American Airlines. The company's commitment to reducing its noise footprint is not just an environmental imperative but also a community relations strategy. For instance, the airline participates in airport noise abatement programs, aiming to balance operational needs with the quality of life for nearby residents. These efforts are ongoing, with continuous evaluation of operational procedures to minimize noise during takeoff and landing phases.

American Airlines' environmental policy explicitly addresses noise pollution. The airline aims to achieve this through several key strategies:

- Fleet Modernization: Investing in new aircraft, such as the Airbus A321neo and Boeing 787 Dreamliner, which are demonstrably quieter than older models.

- Operational Procedures: Implementing noise abatement procedures, including optimized flight paths and altitude restrictions during sensitive hours.

- Community Engagement: Collaborating with local authorities and communities to address noise concerns and share information about noise monitoring.

- Technology Investment: Exploring and adopting new technologies that can further reduce aircraft noise at the source.

American Airlines is actively working to reduce its environmental impact, with a clear focus on combating climate change and promoting sustainability. The company has set ambitious goals, including achieving net-zero greenhouse gas emissions by 2050 and a 45% reduction in emission intensity by 2035. These targets are closely linked to the availability and increased use of Sustainable Aviation Fuel (SAF), which currently faces production challenges. As of early 2024, SAF production remains a critical bottleneck for the entire industry.

Fleet modernization is a cornerstone of American Airlines' environmental strategy, with a significant portion of its fleet now comprising newer, more fuel-efficient aircraft like the Airbus A321neo, offering up to 15% better fuel efficiency. This focus on efficiency not only lowers operating costs but also directly contributes to reducing fuel burn and carbon emissions per passenger mile. In 2023, the airline reported substantial progress in integrating these next-generation aircraft.

Beyond emissions, American Airlines is enhancing its waste management and recycling programs, aiming to divert more materials from landfills. In 2023, the airline reported a 15% increase in its in-flight recycling rate. Efforts include expanding recycling programs, utilizing recycled materials in cabin products, and implementing strategies to reduce food waste in catering operations, with a target of a 20% reduction in food waste by the end of 2025.

Noise pollution is another key environmental concern addressed by American Airlines through fleet upgrades and operational adjustments. Investments in quieter aircraft models and the implementation of noise abatement procedures, such as optimized flight paths, are ongoing. The airline also actively engages with local communities and authorities to manage noise impacts, demonstrating a commitment to balancing operations with the quality of life for residents near airports.

| Environmental Focus | Key Initiatives & Goals | Progress/Data Points (as of late 2024/early 2025) |

|---|---|---|

| Climate Change & Emissions | Net-zero GHG emissions by 2050; 45% GHG emission intensity reduction by 2035; Increased SAF usage | SAF production remains a bottleneck; 2023 saw minimal SAF usage globally. |

| Fleet Efficiency | Modernize fleet with fuel-efficient aircraft | Ongoing integration of Airbus A321neo (up to 15% more fuel efficient); Significant portion of fleet comprises next-gen aircraft. |

| Waste Management & Recycling | Expand in-flight recycling; Use recycled materials; Reduce food waste | 15% increase in in-flight recycling rate (2023); Target of 20% food waste reduction by end of 2025. |

| Noise Pollution | Fleet modernization; Noise abatement procedures; Community engagement | Continued investment in quieter aircraft; Implementation of optimized flight paths. |

PESTLE Analysis Data Sources

Our American Airlines Group PESTLE analysis draws on a comprehensive blend of official government data, reputable aviation industry reports, and economic forecasting from leading global institutions. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the airline.