American Airlines Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Airlines Group Bundle

American Airlines Group's Business Model Canvas reveals a complex network of customer segments, from leisure travelers to corporate clients, all served by a robust value proposition of connectivity and reliability. Key partnerships with other airlines and loyalty programs are crucial for their expansive reach and revenue streams.

Explore the full strategic blueprint of American Airlines Group with our comprehensive Business Model Canvas. This in-depth analysis details their customer relationships, revenue streams, and cost structure, offering invaluable insights for anyone looking to understand airline industry dynamics. Unlock the complete picture and accelerate your own strategic planning.

Partnerships

American Airlines' key partnership with Citi, a 10-year exclusive co-branded credit card agreement commencing in December 2024 and extending to U.S. exclusivity by 2026, is a cornerstone of its loyalty program. This collaboration is projected to be a substantial driver of loyalty revenue, with an anticipated annual growth of 10% from its September 2024 valuation of $5.6 billion. The partnership strategically integrates AAdvantage and Citi ThankYou rewards, fostering deeper customer engagement and offering a distinct competitive advantage in the market.

As a founding member of the oneworld alliance, American Airlines partners with a global network of airlines, including British Airways, Cathay Pacific, and Qantas. This strategic collaboration significantly expands American's reach, providing access to over 900 destinations across more than 170 territories. For instance, in 2023, oneworld airlines collectively carried over 500 million passengers, highlighting the immense scale of this partnership.

These alliances enable American Airlines to offer a more robust and interconnected route network without the substantial capital expenditure of operating every flight itself. This means customers benefit from greater travel options and seamless connections, often with a single booking. The alliance structure allows American to compete effectively on a global scale by leveraging the combined strengths and market presence of its partners.

American Airlines relies heavily on its regional carriers, like those flying under the American Eagle brand, to extend its reach. These vital partnerships allow American to offer comprehensive domestic and regional routes, effectively funneling passengers into its major hubs and ensuring broad network coverage.

The strategic deployment of the full regional fleet, anticipated in 2025, is poised to significantly bolster American's hub operations, addressing capacity gaps and enhancing network efficiency.

Technology and Distribution Partners

American Airlines collaborates with technology providers and distribution partners to manage its sales and reach customers. These include established Global Distribution Systems (GDSs) and newer New Distribution Capability (NDC) channels, which offer more direct and flexible booking options.

The airline is actively prioritizing direct bookings through its own digital platforms and NDC. This strategic shift aims to increase efficiency and provide customers with more tailored travel experiences. By August 2025, American Airlines is targeting 80% of all bookings to be made via these direct and NDC-enabled channels.

- Technology Vendors: Essential for booking systems, customer relationship management, and data analytics.

- Global Distribution Systems (GDSs): Traditional partners like Sabre, Amadeus, and Travelport, critical for reaching a broad travel agency network.

- New Distribution Capability (NDC): An industry standard enabling richer content and personalized offers, facilitating direct connections with travel sellers and corporate buyers.

- Direct Digital Channels: AA.com and the airline's mobile app, which are central to the strategy of increasing direct bookings and reducing reliance on intermediaries.

Airport Authorities and Ground Handlers

American Airlines' partnerships with airport authorities are foundational to its operational success. These collaborations grant crucial access to terminal space, gates, and essential infrastructure, enabling the seamless flow of passengers and baggage. For instance, in 2024, American Airlines operates out of numerous major hubs, each requiring intricate coordination with the respective airport authorities to manage flight schedules and passenger services efficiently.

Ground handling services are another critical partnership. These entities manage vital functions such as baggage loading and unloading, aircraft pushback, and cabin cleaning. Reliable ground handlers are indispensable for minimizing aircraft turnaround times, a key factor in maintaining American Airlines' operational punctuality. In 2023, American Airlines reported an on-time performance of around 80% for its domestic flights, a figure heavily influenced by the efficiency of its ground handling partners.

- Airport Access: Securing prime gate assignments and terminal facilities at key airports like Dallas/Fort Worth (DFW) and Charlotte Douglas International (CLT) is paramount.

- Ground Handling Efficiency: Partnering with specialized ground handling firms ensures rapid baggage transfers and aircraft servicing, directly impacting flight schedules.

- Operational Reliability: These relationships are vital for maintaining consistent service delivery and minimizing delays, contributing to customer satisfaction.

- Cost Management: Negotiating favorable terms with airport authorities and ground handlers helps control operational expenses.

American Airlines' key partnerships are crucial for expanding its network and enhancing customer loyalty. The exclusive 10-year co-branded credit card agreement with Citi, starting in December 2024, is projected to grow loyalty revenue by 10% annually from its September 2024 valuation of $5.6 billion. As a founding member of the oneworld alliance, American partners with over a dozen global airlines, collectively serving over 900 destinations and carrying over 500 million passengers in 2023, significantly extending its reach and competitive advantage.

| Partner Type | Key Partners | Strategic Importance | 2023/2024 Impact |

|---|---|---|---|

| Loyalty Program | Citi | Exclusive co-branded credit card; drives loyalty revenue | Projected 10% annual revenue growth from $5.6B valuation (Sept 2024) |

| Global Alliances | oneworld (e.g., British Airways, Qantas) | Expands global route network, access to 900+ destinations | Carried over 500 million passengers collectively in 2023 |

| Regional Carriers | American Eagle branded carriers | Extends domestic and regional reach, feeds hubs | Strategic fleet deployment in 2025 to address capacity |

What is included in the product

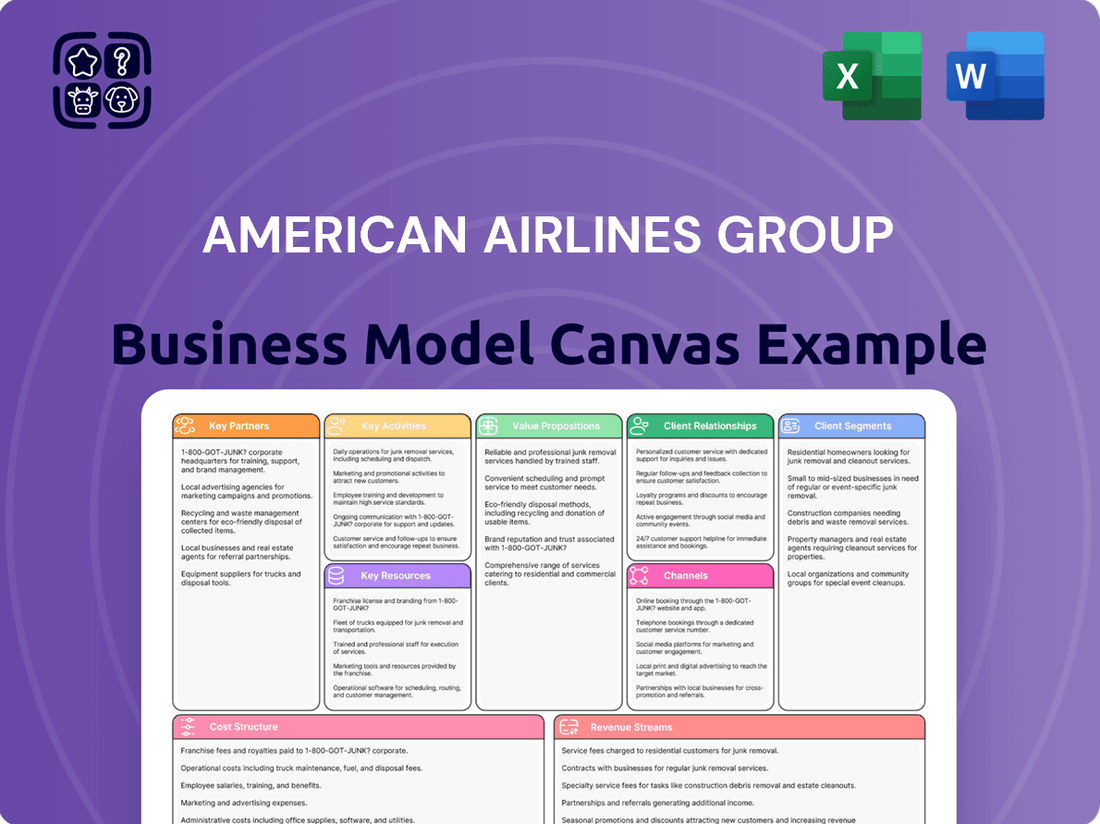

This Business Model Canvas outlines American Airlines Group's strategy, focusing on its vast customer segments, extensive distribution channels, and diverse value propositions, including network reach and loyalty programs.

It reflects the operational realities of a major global airline, detailing key resources, activities, partnerships, cost structure, and revenue streams to inform strategic decisions and stakeholder discussions.

The American Airlines Group Business Model Canvas offers a clear, structured approach to understanding their complex operations, effectively relieving the pain of deciphering intricate airline strategies.

It provides a visual, one-page snapshot that simplifies the identification of key value propositions and customer segments, easing the burden of strategic analysis.

Activities

Airline Operations and Management is the heart of American Airlines Group, focusing on the intricate process of flying passengers and cargo. This encompasses everything from meticulously planning flight schedules and managing a vast fleet of aircraft to ensuring crews are expertly deployed for each journey. In 2024, American Airlines continues to operate a significant number of daily flights, connecting people and businesses to over 365 destinations worldwide, underscoring the scale of their operational reach.

A primary objective within this key activity is achieving operational excellence. This means a constant effort to maintain high standards in on-time performance and proactively minimize disruptions, ensuring a smoother travel experience for customers. For instance, in the first quarter of 2024, American Airlines reported an improved load factor, a key indicator of operational efficiency, demonstrating their commitment to filling their aircraft effectively.

American Airlines meticulously plans its network, strategically allocating capacity to match demand and enhance its hub-and-spoke model, with Dallas/Fort Worth (DFW) serving as its largest operational center. This ensures efficient operations and better connectivity for passengers.

The airline actively explores new route opportunities and strengthens its presence in existing markets. For instance, Chicago (ORD) and Philadelphia (PHL) are anticipated to achieve full recovery in terms of capacity by 2025, reflecting strategic growth initiatives.

American Airlines focuses on key activities like managing customer interactions and enhancing the overall travel experience. This involves everything from booking and check-in to in-flight services and post-flight support, aiming to address passenger inquiries and resolve issues efficiently.

Significant investments are being made to modernize the fleet and improve onboard amenities. By 2025, American Airlines plans to introduce new business-class suites and offer high-speed satellite Wi-Fi across its network, directly impacting customer satisfaction and perceived value.

These efforts are designed to streamline the entire travel journey, from digital interfaces to airport operations. The goal is to create a more seamless and enjoyable experience for every passenger, fostering loyalty and positive word-of-mouth, which is crucial in the competitive airline industry.

Loyalty Program Management

Managing the AAdvantage loyalty program is a core function for American Airlines. This involves the day-to-day operations of enrolling new members, meticulously tracking their earned miles and status points, and ensuring a smooth process for redeeming these rewards for flights, seat upgrades, and various other benefits. This intricate management is vital for maintaining customer engagement and satisfaction.

The AAdvantage program represents a significant financial asset for American Airlines. Its success is directly tied to customer retention, encouraging repeat business and fostering a loyal customer base. In 2023, American Airlines reported that its loyalty program contributed approximately $2.6 billion in revenue, highlighting its crucial role in the company's financial health. This revenue is significantly boosted by strategic partnerships, most notably with co-branded credit card issuers.

- AAdvantage Program Operations: Enrolling members, tracking points, and facilitating redemptions for flights and upgrades.

- Financial Significance: The program is a substantial asset, driving customer retention and revenue.

- Partnership Revenue: Co-branded credit card agreements are a major contributor to program revenue.

- 2023 Performance: The loyalty program generated around $2.6 billion in revenue for American Airlines in 2023.

Sales and Distribution Management

American Airlines manages sales through a multi-channel approach, encompassing direct bookings via its website and mobile app, alongside partnerships with travel agencies and corporate clients. This integrated strategy aims to capture a broad customer base.

The company is making a concerted effort to rebuild relationships with both leisure and corporate travel agencies. This initiative is crucial for reclaiming market share that was impacted by earlier shifts in their distribution strategy.

- Direct Channels: Website and mobile app bookings represent a significant portion of sales, offering convenience and often exclusive deals to customers.

- Agency Partnerships: Collaborating with travel management companies and online travel agencies (OTAs) expands reach and caters to different booking preferences.

- Corporate Sales: Dedicated teams manage relationships with businesses to secure corporate travel contracts, a vital revenue stream.

- Distribution Strategy: American Airlines is actively working to improve its standing with travel advisors, recognizing their importance in the overall sales ecosystem. For example, in 2024, the airline announced new incentives and technology enhancements for travel agency partners.

American Airlines Group's key activities are deeply rooted in its operational excellence and customer-centric approach. This includes managing a vast network of flights, ensuring aircraft maintenance, and optimizing crew scheduling to deliver reliable service. In 2024, the airline continued to focus on enhancing passenger experience through fleet modernization and digital improvements.

A significant aspect of their strategy involves managing the AAdvantage loyalty program, a critical driver of customer retention and revenue. This program's success is bolstered by strategic partnerships, particularly with credit card companies, which generated substantial revenue. The airline's sales efforts are multifaceted, leveraging direct booking channels alongside travel agency and corporate partnerships.

Looking ahead, American Airlines is committed to expanding its route network and strengthening its presence in key markets, with a focus on improving capacity and connectivity. Investments in new aircraft and cabin enhancements are also central to their plan for sustained growth and customer satisfaction.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for American Airlines Group you are previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you'll download this exact, fully detailed Business Model Canvas, ready for immediate use and strategic application.

Resources

American Airlines Group's aircraft fleet is a cornerstone of its operations, comprising a significant number of Boeing and Airbus aircraft. This diverse fleet is crucial for supporting both passenger and cargo transportation, enabling the airline to serve a wide network of destinations. As of the first quarter of 2024, American Airlines operated a mainline fleet of 997 aircraft.

The company is actively engaged in fleet modernization, with a strategic focus on introducing newer, more fuel-efficient aircraft. This includes planned deliveries of new planes in 2025, which will further enhance operational efficiency and passenger experience. Alongside new acquisitions, American Airlines is investing in upgrading its existing aircraft, incorporating features like new premium seating and advanced technology.

American Airlines Group's extensive global route network, a cornerstone of its operations, connects passengers to over 350 destinations in more than 50 countries. This vast reach is amplified by its strategically located hubs, including Dallas/Fort Worth (DFW), Charlotte (CLT), Chicago O'Hare (ORD), and Miami (MIA).

In 2024, American Airlines continued to leverage these hubs to facilitate seamless travel across North America, the Caribbean, Latin America, Europe, and the Asia-Pacific region. The airline's commitment to network density and connectivity at these key points remains a significant competitive advantage.

American Airlines' strong brand reputation and its AAdvantage loyalty program are crucial intangible assets. With over 115 million members as of recent reports, the AAdvantage program is a powerful engine for customer retention.

This loyalty program significantly contributes to revenue streams, particularly through lucrative co-branded credit card partnerships. These partnerships not only drive engagement but also provide a consistent and substantial financial contribution to American Airlines.

Skilled Workforce

American Airlines Group's 130,000 global team members are the bedrock of its operations, encompassing pilots, flight attendants, maintenance crews, and administrative staff. These individuals are critical for ensuring operational reliability and delivering consistent service quality to customers.

The company secured significant labor contracts in 2024. These agreements offer long-term cost certainty, a key factor for financial planning, but they also contribute to the overall cost structure of the business.

- Global Workforce: Approximately 130,000 employees worldwide.

- Key Roles: Pilots, flight attendants, maintenance, and administrative staff.

- 2024 Labor Agreements: Provide cost certainty but impact expenses.

- Operational Impact: Essential for reliability and service delivery.

Information Technology Systems and Infrastructure

American Airlines relies heavily on sophisticated Information Technology (IT) systems to manage its core operations, including reservations, ticketing, and flight scheduling. These systems are the backbone of their customer relationship management, enabling personalized service and efficient passenger handling.

In 2024, American Airlines continued to invest in technology to boost efficiency and customer experience. For instance, their ongoing rollout of satellite Wi-Fi across their fleet aims to provide reliable internet access for travelers. Furthermore, the adoption of New Distribution Capabilities (NDC) is a strategic move to offer more flexible and personalized travel options directly to customers and travel agents.

- Reservations & Ticketing: Core systems managing flight availability, booking, and fare processing.

- Operations Management: IT infrastructure for flight planning, crew management, and real-time operational adjustments.

- Customer Relationship Management (CRM): Systems to track customer preferences, loyalty programs, and communication.

- Distribution & Connectivity: Investments in Wi-Fi and NDC to enhance customer interaction and sales channels.

American Airlines Group's key resources include its extensive fleet, vital for covering its vast route network, and its highly valued AAdvantage loyalty program, which fosters strong customer relationships and revenue. The company's dedicated global workforce of approximately 130,000 employees ensures operational reliability and service delivery. Furthermore, robust IT systems underpin all aspects of its business, from reservations to customer management, with ongoing investments in technology like satellite Wi-Fi and NDC enhancing customer experience and distribution.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Aircraft Fleet | Diverse fleet of Boeing and Airbus aircraft. | 997 mainline aircraft operated in Q1 2024; ongoing modernization with new deliveries planned for 2025. |

| Global Route Network | Connects over 350 destinations in more than 50 countries. | Leverages strategic hubs like DFW and MIA for seamless travel across continents. |

| AAdvantage Loyalty Program | Over 115 million members; drives customer retention and revenue. | Significant contribution through co-branded credit card partnerships. |

| Global Workforce | Approximately 130,000 employees across various roles. | Secured significant labor contracts in 2024, impacting cost certainty. |

| Information Technology (IT) Systems | Supports reservations, operations, and customer management. | Investments in satellite Wi-Fi rollout and NDC adoption for enhanced customer experience. |

Value Propositions

American Airlines boasts an extensive global network, linking passengers to over 350 destinations worldwide. In 2024, the airline operated an average of over 5,000 daily flights, underscoring its vast reach across North America, the Caribbean, Latin America, Europe, and the Asia/Pacific region. This expansive connectivity offers unparalleled travel options and convenience for both leisure and business travelers, facilitating seamless journeys across continents.

American Airlines Group is significantly investing in an enhanced travel experience for its customers. This includes the rollout of modern aircraft and the introduction of new premium seating options, such as the highly anticipated Flagship Suites, designed for ultimate comfort and privacy.

Furthermore, complimentary high-speed satellite Wi-Fi is being provided to all AAdvantage members, a move that directly addresses a key customer need for connectivity. In 2024, the airline continued its cabin modernization efforts, aiming to elevate the overall journey for every passenger.

The AAdvantage program is a cornerstone of American Airlines' customer retention strategy, allowing members to earn and redeem points for flights, seat upgrades, and various other travel perks. This creates a strong incentive for repeat business and deepens customer engagement. In 2024, the program continued to leverage its extensive network and partnerships to offer compelling value.

The strategic expansion of the partnership with Citi significantly bolsters the AAdvantage loyalty ecosystem. This collaboration provides co-branded credit card holders with enhanced earning opportunities and exclusive benefits, such as bonus miles and travel credits, further solidifying customer loyalty and driving incremental revenue through card spending.

Reliable and Safe Air Transportation

American Airlines Group places a paramount emphasis on providing reliable and safe air transportation, a cornerstone of its value proposition. This commitment is actively demonstrated through substantial and ongoing investments in rigorous pilot and crew training, the integration of cutting-edge aviation technology, and comprehensive aircraft maintenance programs. For instance, in 2024, the airline continued its focus on fleet modernization and safety enhancements, aligning with industry best practices.

The airline's dedication to operational efficiency and reliability is a critical factor in meeting customer expectations. By actively working to minimize flight delays and disruptions, American Airlines aims to ensure a seamless travel experience for its passengers. This focus on punctuality and dependable service is a key differentiator in the competitive airline market, directly impacting customer satisfaction and loyalty.

- Safety Investment: Continuous allocation of resources to advanced training and maintenance.

- Operational Reliability: Aiming for minimal delays and disruptions to enhance passenger experience.

- Fleet Modernization: Ongoing efforts to update aircraft for improved safety and efficiency.

- Customer Expectation: Meeting the core need for dependable and secure air travel.

Diverse Service Offerings (Passenger & Cargo)

American Airlines Group's value proposition extends beyond simply flying people from point A to point B. They also offer robust cargo services, enabling the global movement of goods and freight.

This dual focus on both passenger and cargo operations allows American Airlines to tap into a wider customer base and diversify its revenue streams. In 2023, American Airlines Cargo generated over $1 billion in revenue, demonstrating the significance of this segment.

- Passenger Transportation: Core service offering connecting millions of travelers worldwide.

- Cargo Services: Facilitates the global shipment of freight, mail, and express packages.

- Revenue Diversification: Cargo operations contribute significantly to overall financial performance.

- Global Reach: Leverages its extensive network to serve diverse cargo needs.

American Airlines provides extensive global connectivity with over 350 destinations served by more than 5,000 daily flights in 2024. This vast network offers unparalleled travel options, complemented by investments in an enhanced customer experience, including new premium seating and complimentary high-speed Wi-Fi for AAdvantage members. The AAdvantage program, strengthened by partnerships like the one with Citi, drives customer loyalty and repeat business by offering valuable earning and redemption opportunities.

Safety and operational reliability are paramount, with significant investments in training, technology, and fleet modernization ensuring dependable air transportation. Beyond passenger services, American Airlines' robust cargo division generated over $1 billion in revenue in 2023, diversifying revenue streams and leveraging its global network to move freight worldwide.

| Value Proposition | Description | 2024/2023 Data Point |

|---|---|---|

| Global Network & Connectivity | Extensive reach to over 350 destinations worldwide. | Operated over 5,000 daily flights in 2024. |

| Enhanced Customer Experience | Modern aircraft, premium seating (Flagship Suites), complimentary high-speed Wi-Fi for AAdvantage members. | Continued cabin modernization efforts in 2024. |

| Loyalty Program (AAdvantage) | Earn/redeem points for flights, upgrades, perks; amplified by partnerships (e.g., Citi). | Strategic expansion of Citi partnership in 2024. |

| Safety & Reliability | Commitment to advanced training, technology, and maintenance. | Focus on fleet modernization and safety enhancements in 2024. |

| Cargo Services | Global freight, mail, and express package movement. | Generated over $1 billion in revenue in 2023. |

Customer Relationships

American Airlines cultivates deep customer loyalty via its AAdvantage program, a cornerstone of its customer relationships. This program rewards frequent flyers with escalating benefits across different tiers, from priority boarding to lounge access, directly incentivizing repeat business.

In 2024, the AAdvantage program continues to be a significant driver of customer retention, with millions of members actively engaging with its tiered structure. The perceived value and exclusive perks offered by the program encourage passengers to choose American Airlines consistently, fostering a dedicated customer base.

American Airlines Group enhances customer relationships through personalized digital engagement, utilizing its website and mobile app to tailor booking, check-in, and in-flight experiences. This digital-first approach aims to foster loyalty by offering convenience and customized options.

The airline's commitment to New Distribution Capability (NDC) is a key driver in this strategy, promising customers more tailored choices and access to a wider range of fares. For example, in 2024, American Airlines continued to expand its NDC content, aiming to provide a richer, more personalized booking journey for its customers.

American Airlines provides robust customer service through multiple avenues, including dedicated call centers, knowledgeable airport personnel, and comprehensive online resources. This multi-channel approach ensures travelers can get help with inquiries, booking modifications, and issue resolution.

In 2024, American Airlines continued its focus on strengthening relationships with travel partners. The airline actively re-engaged with both corporate and leisure agency communities, aiming to provide enhanced support and streamline their booking processes, reflecting a commitment to their B2B customer base.

Corporate and Business Travel Programs

American Airlines actively cultivates relationships with corporate clients through specialized sales teams and tailored programs such as AAdvantage Business. These initiatives are designed to foster loyalty and provide customized travel solutions for businesses.

The company is strategically focused on strengthening its engagement with corporate customers. This includes efforts to reclaim market share lost in previous periods and to boost bookings from high-yield corporate travel segments.

- Dedicated Corporate Sales Teams: American Airlines employs specialized teams to manage relationships with corporate accounts, offering personalized service and support.

- AAdvantage Business Program: This program provides businesses with benefits and rewards tailored to their travel needs, encouraging repeat bookings.

- Market Share Recapture Efforts: In 2024, American Airlines has been particularly focused on winning back corporate travel contracts, aiming to increase its presence in this lucrative market.

- Focus on High-Yield Bookings: The airline is prioritizing strategies to attract and retain corporate travelers who generate higher revenue per booking.

Feedback and Continuous Improvement Mechanisms

American Airlines actively solicits customer input through various channels, including post-flight surveys and social media engagement. This direct feedback loop allows them to identify areas for enhancement in their service offerings.

Analyzing this data is paramount for American Airlines’ strategy of continuous improvement. For instance, in 2024, the airline reported a significant increase in customer satisfaction scores following the implementation of feedback-driven changes to their in-flight entertainment system.

- Customer Surveys: Regular surveys capture satisfaction levels across different touchpoints.

- Social Media Monitoring: Real-time tracking of passenger sentiment and specific issues raised online.

- Direct Communication: Channels like customer service calls and email provide detailed qualitative feedback.

- Data Analysis for Improvement: Insights are used to refine services, from cabin comfort to booking processes.

American Airlines prioritizes customer relationships through its robust AAdvantage loyalty program, which saw continued strong engagement in 2024, rewarding frequent flyers with exclusive benefits. The airline also leverages digital channels, including its app and website, to offer personalized experiences and enhance customer interaction, with an expansion of NDC content in 2024 aiming for more tailored booking options.

The company actively nurtures relationships with corporate clients via dedicated sales teams and programs like AAdvantage Business, with a significant 2024 focus on recapturing market share and increasing high-yield corporate bookings. Customer feedback, gathered through surveys and social media, is actively incorporated to drive service improvements, as evidenced by increased satisfaction scores in 2024 following enhancements to their in-flight entertainment system.

| Customer Relationship Aspect | Key Initiatives | 2024 Focus/Data Point |

|---|---|---|

| Loyalty Program | AAdvantage Program | Continued strong member engagement and retention |

| Digital Engagement | Mobile App & Website Personalization | Expansion of NDC content for tailored booking |

| Corporate Clients | Dedicated Sales Teams, AAdvantage Business | Market share recapture and high-yield booking focus |

| Customer Feedback | Surveys, Social Media Monitoring | Increased satisfaction scores from implemented feedback |

Channels

American Airlines' website and mobile app serve as crucial direct sales channels, allowing the company to capture a larger portion of its revenue. This strategy bypasses intermediaries, potentially reducing costs and improving customer relationships.

The airline has set an ambitious goal: by August 2025, they aim for 80% of their bookings to be made through New Distribution Capability (NDC) enabled channels. This includes their own digital platforms, signaling a significant shift towards direct customer engagement.

Global Distribution Systems (GDSs) continue to be a vital sales channel for American Airlines, particularly for travel agencies and corporate clients. Despite a strategic push towards direct and NDC (New Distribution Capability) bookings, American Airlines recognized the enduring importance of GDSs. In 2024, the airline actively worked to restore its content on these platforms, aiming to recapture a significant portion of its indirect sales revenue, which historically represented a substantial share of its overall bookings.

Travel agencies, both online platforms like Expedia and traditional brick-and-mortar shops, act as crucial distribution channels for American Airlines. These intermediaries connect a vast customer base to American’s flight inventory, facilitating bookings and often bundling services. In 2024, American Airlines continued its strategic push to strengthen ties with travel advisors, recognizing their significant role in driving revenue and customer loyalty.

American Airlines has been actively re-engaging with the travel agency community, focusing on renegotiating contracts and enhancing partnerships. This initiative aims to improve the overall experience for travel agents and, by extension, their clients, leading to increased sales and a more streamlined booking process. For instance, the airline has been investing in technology and support systems designed to make it easier for agencies to access and manage bookings.

Corporate Sales Teams

American Airlines employs dedicated corporate sales teams to cultivate and manage relationships with businesses, ensuring their travel requirements are met. These teams are crucial for securing bulk travel agreements and fostering loyalty among corporate clients.

The airline is actively investing in strengthening its engagement with corporate customers. This strategic focus aims to boost revenue by attracting and retaining high-yield business travelers, a segment known for its consistent demand and willingness to pay for premium services.

- Dedicated Relationship Management: Teams are structured to provide personalized service, understanding the unique travel patterns and needs of each corporate account.

- Revenue Growth Focus: The strategy prioritizes high-yield business travel, which contributed significantly to airline revenues even in the post-pandemic recovery. For instance, in the first quarter of 2024, American Airlines reported a substantial increase in corporate travel bookings compared to 2023.

- Enhanced Offerings: To further attract and retain these clients, American Airlines continually refines its corporate travel programs, offering tailored solutions and incentives.

Airport Ticket Counters and Kiosks

Airport ticket counters and kiosks are crucial physical touchpoints for American Airlines. These locations offer direct sales opportunities and provide essential customer service for travelers who prefer or require in-person interaction. For instance, in 2024, American Airlines continued to leverage its extensive network of airport facilities to manage passenger needs, from booking changes to baggage inquiries.

These channels are particularly vital for passengers needing assistance with complex itineraries, those making last-minute travel adjustments, or individuals who are less comfortable with digital self-service. The presence of staff at counters ensures a human element in the travel process, fostering customer loyalty and addressing potential issues promptly. Kiosks, on the other hand, streamline check-in and boarding pass issuance, improving efficiency for a significant portion of travelers.

- Direct Sales and Service: Counters and kiosks serve as primary points for ticket purchases, rebookings, and immediate customer support.

- Last-Minute Transactions: These physical channels are essential for passengers who book or modify flights close to departure.

- Customer Preference: They cater to a segment of travelers who value face-to-face interaction and assistance with their travel arrangements.

American Airlines leverages a multi-channel distribution strategy, prioritizing direct bookings via its website and mobile app to enhance customer relationships and revenue capture. The airline is aggressively pursuing an 80% NDC booking target by August 2025, signaling a significant shift toward direct engagement and away from traditional intermediaries.

Global Distribution Systems (GDSs) remain critical for accessing travel agency and corporate bookings, with American Airlines actively working in 2024 to restore content and recapture indirect sales. Travel agencies, including online travel agencies (OTAs) and traditional agents, are vital partners, driving a substantial portion of bookings and requiring ongoing relationship management and technological integration.

Corporate sales teams are instrumental in securing high-yield business travel, focusing on dedicated relationship management and tailored offerings to retain these valuable clients. Airport ticket counters and kiosks provide essential physical touchpoints for direct sales, customer service, and last-minute transactions, catering to travelers who prefer or require in-person assistance.

Customer Segments

Business travelers, including corporate clients and individual road warriors, represent a crucial customer segment for American Airlines Group. This group values dependable schedules, efficient travel experiences, and access to premium services that facilitate productivity and comfort. In 2024, American Airlines continued to strengthen its corporate partnerships, aiming to secure a larger share of business travel spending.

To further cater to this high-value segment, American Airlines is strategically investing in its premium cabin offerings. This includes enhancements to seats, dining, and in-flight amenities designed to meet the specific needs of business travelers. The airline's focus on reliability and service aims to ensure repeat business from these discerning customers.

Leisure travelers, a significant customer segment for American Airlines, encompass individuals and families embarking on vacations. This group is often driven by price, actively seeking the best value for their travel budget, but they also place a high premium on convenience and a pleasant overall journey. In 2024, American Airlines continued to cater to this segment by offering diverse fare classes and an extensive route network, aiming to capture a substantial share of the leisure travel market.

Frequent flyers and loyalty program members, primarily through the AAdvantage program, form a cornerstone of American Airlines' customer base. These individuals are motivated by a tiered system of benefits, including priority boarding, upgrades, and bonus miles, which encourage consistent engagement with the airline.

The AAdvantage program in 2024 continued to be a major driver of customer retention and revenue. In the first quarter of 2024, American Airlines reported that its loyalty segment revenue increased by 10% year-over-year, reaching $1.1 billion.

Elite status tiers within AAdvantage, such as Executive Platinum and Platinum Pro, foster a strong sense of loyalty and provide significant incentives for members to choose American Airlines for their travel needs. This segment is crucial for generating predictable, recurring revenue and acts as a powerful source of brand advocacy, often influencing the travel decisions of their peers.

International Travelers

International travelers, particularly those journeying between continents like Europe and Asia/Pacific, are a significant focus for American Airlines Group. This segment shows robust growth potential.

The airline has observed sustained strength in its international unit revenue, indicating healthy demand and pricing power on these long-haul routes. This performance is a key driver for the company's financial results.

Demand for premium cabin seats on international flights remains particularly strong. This suggests that travelers are willing to pay a premium for enhanced comfort and services on extended journeys.

- Growth Area: Passengers traveling across continents, especially to and from Europe and Asia/Pacific, are a key growth segment.

- Revenue Strength: American Airlines has experienced continued strength in international unit revenue.

- Premium Demand: There's ongoing high demand for premium cabin seats on long-haul international routes.

Cargo Clients

American Airlines Group's cargo clients encompass a broad range of businesses and individuals who need reliable and efficient transportation for their goods and freight. This segment relies on the airline's expansive global network to move various types of cargo, from time-sensitive perishables to large industrial equipment.

In 2024, American Airlines Cargo continued to be a significant player in the air freight market. For instance, the airline's cargo revenue in the first quarter of 2024 reached approximately $250 million, demonstrating the ongoing demand for their services.

- Businesses needing to ship products internationally: Companies across various industries utilize American Airlines Cargo for the timely and secure delivery of their goods to global markets.

- E-commerce fulfillment centers: The growth of online retail drives demand for air cargo services to ensure swift delivery of parcels to consumers.

- Logistics and freight forwarders: These intermediaries often partner with airlines like American Airlines to manage and transport shipments on behalf of their clients.

- Specialized cargo handlers: Businesses dealing with pharmaceuticals, live animals, or high-value goods rely on the specialized handling and temperature-controlled options offered by cargo divisions.

The AAdvantage loyalty program members represent a highly valuable customer segment for American Airlines. These frequent flyers are motivated by tiered benefits and rewards, driving significant retention and revenue. In Q1 2024, loyalty segment revenue grew 10% year-over-year to $1.1 billion, highlighting the program's importance.

Business travelers, including corporate clients and individual road warriors, are another critical segment. They prioritize reliability, efficiency, and premium services. American Airlines actively strengthens corporate partnerships to capture more business travel spending.

Leisure travelers, a large segment, seek value and convenience for their vacations. American Airlines caters to them with diverse fare options and an extensive route network.

International travelers, especially those on long-haul routes to Europe and Asia/Pacific, are a key growth area. Demand for premium international cabins remains robust, contributing significantly to revenue.

Cargo clients rely on American Airlines' global network for efficient freight transport. In Q1 2024, cargo revenue was approximately $250 million, reflecting consistent demand from businesses and logistics partners.

Cost Structure

Fuel represents a significant and unpredictable portion of American Airlines' operational expenditures. In 2024, fuel costs are a primary concern, directly impacting the bottom line.

American Airlines does not engage in fuel hedging strategies. This lack of hedging leaves the company highly vulnerable to the volatile swings in global oil prices, directly affecting their financial performance.

American Airlines' labor costs are a significant component of its overall expenses. This includes wages and salaries for pilots, flight attendants, mechanics, and ground staff, along with benefits packages and other related employee expenditures.

The company's labor expenses were notably impacted by new labor contracts ratified in 2024. These agreements have resulted in higher per-employee costs, creating a headwind for the airline's profitability and requiring careful management of operational efficiency.

Aircraft ownership and maintenance represent a substantial portion of American Airlines' cost structure. In 2024, the company's fleet of over 1,300 aircraft incurs significant expenses related to leases, depreciation, and essential upkeep. These costs are critical for maintaining safety standards and ensuring the operational reliability of their extensive network.

Ongoing maintenance and repair programs are a continuous investment, with American Airlines dedicating considerable resources to keep its fleet in peak condition. This includes scheduled heavy maintenance checks, component replacements, and engine overhauls, all vital for flight safety and fuel efficiency. The company's commitment to fleet modernization also contributes to these costs, as newer, more fuel-efficient aircraft are acquired to replace older models, impacting depreciation figures.

Airport and Navigation Fees

American Airlines, like all carriers, faces significant costs related to airport and navigation fees. These are essential for operating flights and include charges for landing at airports, using gates, and air traffic control services. These expenses are a fundamental part of the airline's cost structure, directly impacting profitability.

In 2024, the airline industry's reliance on these fees remains a constant. For American Airlines, these costs are incurred at every single destination they serve, adding up across their extensive network. These fees are not static; they can vary based on airport size, traffic volume, and the specific services utilized.

- Landing Fees: Charges levied by airports for the use of runways and associated facilities.

- Gate Usage Fees: Costs for occupying and utilizing terminal gates for boarding and deplaning passengers.

- Air Traffic Control (ATC): Fees paid for navigation and flight management services provided by aviation authorities.

- Other Airport Services: Including charges for baggage handling, ground power, and passenger facility fees.

Sales, Marketing, and Distribution Costs

American Airlines' cost structure heavily features expenses associated with reaching and retaining customers. This includes significant outlays for advertising campaigns, targeted promotional offers, and the ongoing management of their AAdvantage loyalty program, a critical driver of repeat business. In 2023, American Airlines reported total operating expenses of $43.1 billion, with a substantial portion dedicated to sales, marketing, and distribution efforts.

Commissions paid to travel agencies and global distribution systems (GDS) also represent a considerable cost. These intermediaries are vital for booking flights, but their fees add up. The airline's strategic shift towards New Distribution Capability (NDC) is designed to create more direct channels, aiming to streamline these distribution costs and offer more personalized content to customers.

- Advertising and Promotion: Funds allocated to brand building and customer acquisition.

- Loyalty Program: Costs associated with managing and rewarding AAdvantage members.

- Distribution Fees: Payments to travel agencies and GDS for booking services.

- NDC Transition: Investments in technology to reduce intermediary costs and improve direct sales.

American Airlines' cost structure is dominated by several key areas, with fuel being a primary and volatile expense. In 2024, the airline's decision not to hedge fuel prices leaves it exposed to significant price fluctuations, directly impacting profitability. Labor costs, particularly after new contracts in 2024, represent another substantial outlay, covering a large workforce and associated benefits.

Aircraft ownership, including leases and depreciation, alongside continuous maintenance and repair programs, forms a significant fixed and variable cost base. These expenses are critical for fleet reliability and modernization efforts. Furthermore, airport and navigation fees, encompassing landing charges, gate usage, and air traffic control services, are incurred across their extensive network, adding to the overall operational expenditure.

Customer acquisition and retention costs are also a major component. This includes substantial investment in advertising, promotions, and the management of the AAdvantage loyalty program. Distribution costs, such as commissions paid to travel agencies and GDS providers, are also significant, though American Airlines is working to reduce these through initiatives like NDC.

| Cost Category | 2024 Impact/Considerations | Key Components |

|---|---|---|

| Fuel | High volatility due to no hedging; significant operational expense. | Jet fuel prices, consumption rates. |

| Labor | Increased costs from 2024 labor contracts; impacts profitability. | Wages, salaries, benefits for pilots, flight attendants, mechanics, ground staff. |

| Aircraft Ownership & Maintenance | Substantial costs for over 1,300 aircraft; fleet modernization. | Lease payments, depreciation, scheduled/unscheduled maintenance, engine overhauls. |

| Airport & Navigation Fees | Essential for operations across all destinations; can vary. | Landing fees, gate usage fees, ATC charges, passenger facility fees. |

| Sales, Marketing & Distribution | Significant investment in customer acquisition and retention. | Advertising, promotions, AAdvantage program costs, travel agency commissions, GDS fees. |

Revenue Streams

Passenger ticket sales are the lifeblood of American Airlines, generating the vast majority of its income. This revenue comes from selling seats on both domestic and international routes, catering to a range of travelers with different cabin options like Economy, Premium Economy, Business, and First Class. In the first quarter of 2024, American Airlines reported total operating revenue of $12.3 billion, with passenger revenue making up a significant portion of that figure.

American Airlines' AAdvantage loyalty program is a substantial revenue driver, primarily fueled by its lucrative co-branded credit card partnerships. In 2024, the airline reported a significant $6.1 billion in cash remuneration from these collaborations, underscoring the program's vital role in its financial performance.

Ancillary services are a significant revenue driver for American Airlines, encompassing fees for checked baggage, preferred seat selection, early boarding privileges, and various in-flight purchases. In 2023, American Airlines reported over $6.5 billion in ancillary revenue, demonstrating the substantial contribution of these customizable options to their overall financial performance. This strategy allows passengers to tailor their travel experience while simultaneously creating diverse income streams beyond the base ticket price.

Cargo Services Revenue

American Airlines Group generates significant income by transporting cargo and freight across its global network. This revenue stream plays a vital role in the company's overall financial health, offering a valuable diversification beyond passenger travel.

In 2024, American Airlines' cargo operations demonstrated robust performance, contributing positively to the company's financial results. This segment benefits from the airline's extensive fleet and route capabilities, allowing for efficient movement of goods worldwide.

- Cargo Revenue Contribution: American Airlines' cargo services contribute a meaningful portion to its total revenue.

- 2024 Performance Highlights: The cargo division experienced strong operational and financial performance throughout 2024.

- Diversification Benefit: This revenue stream helps mitigate risks associated with passenger demand fluctuations.

Premium Cabin Sales

Premium cabin sales, encompassing First Class, Business Class, and Premium Economy, are a cornerstone of American Airlines' revenue generation. These seats command significantly higher fares, directly contributing to increased revenue per passenger. The airline has consistently observed robust demand for these premium offerings, particularly on lucrative long-haul international routes.

In the first quarter of 2024, American Airlines reported a notable increase in premium cabin passenger revenue, reflecting the sustained appeal of these enhanced travel experiences. This segment continues to be a critical driver for the company's financial performance, especially as global travel rebounds.

- Higher Yields: Premium cabins generate substantially higher revenue per seat compared to standard economy.

- International Strength: Demand for premium seats is particularly strong on international long-haul flights.

- Q1 2024 Performance: American Airlines saw positive growth in premium cabin passenger revenue in early 2024.

American Airlines' revenue streams are diverse, extending beyond simple ticket sales to include loyalty program partnerships and ancillary services. The airline also leverages its extensive network for cargo operations, providing a valuable diversification. Premium cabin sales remain a critical component, offering higher yields and contributing significantly to overall financial performance.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Passenger Tickets | Sales of seats on domestic and international flights across various cabin classes. | Q1 2024 operating revenue of $12.3 billion included significant passenger revenue. |

| AAdvantage Loyalty Program | Revenue generated primarily through co-branded credit card partnerships. | $6.1 billion in cash remuneration from collaborations in 2024. |

| Ancillary Services | Fees for services like baggage, seat selection, and in-flight purchases. | Over $6.5 billion in ancillary revenue in 2023. |

| Cargo Operations | Revenue from transporting freight and mail across the airline's network. | Strong operational and financial performance in 2024. |

| Premium Cabin Sales | Fares from First Class, Business Class, and Premium Economy seats. | Notable increase in premium cabin passenger revenue in Q1 2024. |

Business Model Canvas Data Sources

The American Airlines Group Business Model Canvas is informed by a blend of internal financial disclosures, comprehensive market research reports, and operational data. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.