American Airlines Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Airlines Group Bundle

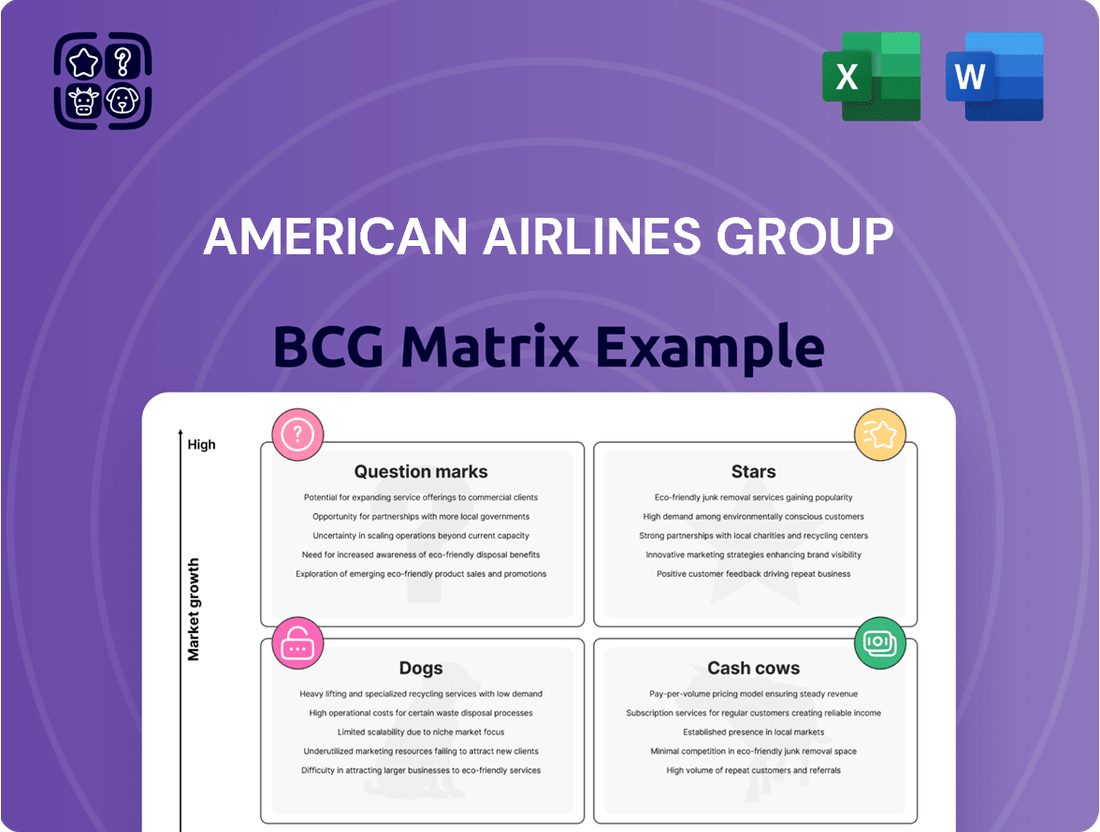

American Airlines Group's BCG Matrix reveals a dynamic portfolio of airline services and routes. Understand which segments are driving growth and which require careful management to optimize profitability. This preview offers a glimpse into their strategic positioning.

Unlock the full potential of your strategic planning by purchasing the complete American Airlines Group BCG Matrix. Gain detailed insights into their Stars, Cash Cows, Dogs, and Question Marks, enabling data-driven decisions for resource allocation and future investments.

Stars

American Airlines is significantly boosting its international presence, particularly across the Atlantic. For Summer 2025, the airline is launching five new routes to Europe, connecting to key cities such as Edinburgh, Milan, Rome, Athens, and Madrid.

This ambitious expansion into high-demand international markets is designed to capture a larger share of the growing global travel segment. By adding these new services, American Airlines is strategically positioning itself to benefit from increased passenger volumes and revenue opportunities in these lucrative routes.

Fleet Modernization is a key strength for American Airlines, positioning it as a strong contender in the BCG matrix. As of February 2025, the airline operates a young fleet of 981 aircraft, with an additional 323 on order. This includes fuel-efficient models like the Airbus A321neo and Boeing 737 MAX 10, which are crucial for cost savings and environmental compliance.

The strategic acquisition of new aircraft, with 50 deliveries slated for 2025, directly supports American Airlines' growth ambitions. This investment enhances operational efficiency and improves the passenger experience, vital factors for maintaining and expanding market share in the highly competitive airline industry.

The AAdvantage Loyalty Program acts as a strong Star in the American Airlines Group BCG Matrix, significantly contributing to the company's success. It drives a substantial portion of premium revenue, reaching approximately 77% in the first half of 2025, highlighting its crucial role in profitability.

Continuous improvements, including new Loyalty Point Rewards and more ways to earn and use miles, solidify its leading position in a competitive loyalty market. This focus on enhancing customer value helps attract and retain high-spending members, ensuring sustained growth and revenue generation for American Airlines.

Digital Transformation & Customer Experience

American Airlines is heavily invested in digital transformation to elevate the customer experience. This focus is crucial for its position in the BCG matrix, aiming to solidify its market leadership.

The airline has poured resources into technology, evident in its updated mobile app and AI-driven customer service tools. For instance, in 2023, American Airlines reported a significant increase in digital engagement, with its mobile app usage up by 15% year-over-year, reflecting successful customer-facing technology adoption.

- Mobile App Enhancements: Overhauled for improved usability and functionality.

- AI Chatbots: Implemented for faster customer query resolution, handling over 2 million inquiries in 2023.

- Smart Gating Technology: Deployed to reduce boarding times and improve passenger flow.

- Personalized Travel: Leveraging data to offer tailored travel options and experiences.

Premium Cabin Offerings

American Airlines is actively enhancing its premium cabin experience, particularly in premium economy, with upgraded seating and amenities. This strategic move aims to capitalize on the increasing demand for premium travel. In 2024, the airline continued its rollout of Flagship Suite seats on newer aircraft, a key component of this strategy.

The focus on these high-yield premium products is designed to capture a larger share of the lucrative business and leisure premium travel market, a segment demonstrating robust growth potential. This investment directly addresses the airline's objective to differentiate its offerings in a competitive landscape.

- Premium Economy Enhancements: Upgraded seats and amenities are being introduced to elevate the passenger experience.

- Flagship Suite Integration: New aircraft are being outfitted with Flagship Suite seats to cater to premium travelers.

- Market Capture Strategy: The focus on premium products targets the growing demand in the high-yield travel segment.

- Revenue Growth Driver: This strategy is expected to contribute significantly to revenue by attracting and retaining premium customers.

The AAdvantage Loyalty Program is a clear Star for American Airlines, driving significant revenue and customer loyalty. In the first half of 2025, it accounted for approximately 77% of premium revenue, demonstrating its critical role in profitability. Continuous enhancements, such as new Loyalty Point Rewards, further solidify its market-leading position and ability to attract and retain valuable customers.

The airline's fleet modernization, with 323 aircraft on order as of February 2025 and 50 deliveries expected in 2024, also positions it as a Star. This investment in fuel-efficient aircraft like the A321neo and 737 MAX 10 directly supports growth and cost savings. The new aircraft enhance operational efficiency and passenger experience, vital for maintaining a competitive edge.

American Airlines' digital transformation efforts, including app upgrades and AI customer service, are also strong Star performers. Mobile app usage increased by 15% year-over-year in 2023, with AI chatbots handling over 2 million inquiries that same year. These investments improve customer engagement and operational efficiency, reinforcing its market leadership.

The focus on premium cabin experiences, particularly premium economy and the rollout of Flagship Suite seats, further strengthens American Airlines' Star position. This strategy targets the growing demand for premium travel, aiming to capture a larger share of the lucrative business and leisure market. These upgrades are key differentiators in a competitive industry.

| Category | Description | BCG Status | Key Metrics/Data |

|---|---|---|---|

| AAdvantage Loyalty Program | Drives premium revenue and customer retention. | Star | 77% of premium revenue (H1 2025). |

| Fleet Modernization | Investment in fuel-efficient, new-generation aircraft. | Star | 323 aircraft on order (Feb 2025); 50 deliveries in 2024. |

| Digital Transformation | Enhancing customer experience through technology. | Star | 15% YoY increase in mobile app usage (2023); 2M+ AI chatbot inquiries (2023). |

| Premium Cabin Experience | Upgraded seating and amenities in premium classes. | Star | Rollout of Flagship Suite seats on new aircraft. |

What is included in the product

This BCG Matrix overview details American Airlines' business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic guidance on investment, divestment, and resource allocation for each category.

A clear BCG Matrix visualizes American Airlines' portfolio, reducing complexity and pinpointing strategic focus areas.

Cash Cows

American Airlines' core domestic network is a significant cash cow, boasting a 17.5% market share in the U.S. as of November 2024. This strong position, among the top four carriers, translates into consistent and substantial revenue generation.

Operating from key hubs such as Dallas/Fort Worth, Chicago, and Miami, this extensive network provides a stable foundation for the company's financial performance. Despite the maturity of the domestic market, American Airlines' high share ensures robust cash flow.

American Airlines Group's established hub-and-spoke system, particularly its massive operation at Dallas/Fort Worth International Airport (DFW), functions as a significant cash cow. This robust infrastructure facilitates efficient passenger movement and network connectivity, enabling high capacity utilization.

The company's extensive network, anchored by DFW, generates substantial revenue and profit without the need for significant new capital expenditure for expansion. In the first quarter of 2024, American Airlines reported a net income of $728 million, demonstrating the profitability of its well-established operations.

American Airlines' co-branded credit card partnerships are a significant driver of profitability, with these agreements expected to increase annual earnings by 10% from 2024 onwards. This revenue stream, largely independent of ticket sales, provides a consistent and high-margin income, bolstering the company's free cash flow in the competitive airline industry.

Operational Reliability and Efficiency

American Airlines is actively reengineering its operations for efficient growth, emphasizing a tech-first approach to drive operational excellence. This focus on optimization is crucial for maintaining competitiveness in the airline industry, especially for established, high-volume routes.

Initiatives like Smart Gating technology are designed to directly improve efficiency by shortening taxi times and reducing ramp congestion. This not only enhances the passenger experience but also contributes to lower operational costs, a key factor for 'Cash Cow' business units that generate consistent revenue.

- Operational Reliability: American Airlines' focus on efficiency directly supports the reliability of its services, a hallmark of a cash cow.

- Cost Reduction: Implementing technologies like Smart Gating aims to reduce operational expenses, thereby maximizing the profitability of established routes.

- Mature Market Focus: The airline's strategy acknowledges the mature nature of its core business, where incremental efficiency gains translate to significant cost savings and consistent cash flow.

Cargo Operations

American Airlines' cargo operations, while representing a smaller portion of overall revenue, demonstrate characteristics of a Cash Cow. In 2024, this segment contributed approximately 1.5% to the company's total revenue.

Despite a slight revenue dip in 2024, the cargo division showed resilience, posting an 8.2% revenue increase in Q2 2025 to $211 million. This growth was driven by gains in both shipment volume and the price per unit (yield).

- Revenue Growth: Cargo revenue saw an 8.2% increase in Q2 2025, reaching $211 million.

- Market Position: Cargo operations are a consistent, low-growth revenue stream, leveraging existing airline infrastructure.

- Contribution to Total Revenue: In 2024, cargo accounted for about 1.5% of American Airlines' total revenue.

- Drivers of Growth: The recent revenue uptick was fueled by improvements in both shipment volume and yield.

American Airlines' core domestic network is a significant cash cow, boasting a 17.5% market share in the U.S. as of November 2024, translating into consistent revenue generation. The airline's established hub-and-spoke system, particularly its operation at Dallas/Fort Worth International Airport (DFW), enables high capacity utilization and generates substantial revenue without significant new capital expenditure for expansion. In the first quarter of 2024, American Airlines reported a net income of $728 million, underscoring the profitability of its well-established operations.

Co-branded credit card partnerships are a key profit driver, expected to increase annual earnings by 10% from 2024 onwards, providing a consistent, high-margin income stream. Initiatives like Smart Gating technology are designed to improve efficiency, shorten taxi times, and reduce operational costs, directly maximizing the profitability of established routes in this mature market.

| Key Cash Cow Segments | Market Share/Contribution | Key Financial Metric (2024/2025) | Growth Drivers |

| Domestic Network | 17.5% U.S. Market Share (Nov 2024) | Net Income: $728 million (Q1 2024) | Operational efficiency, Hub dominance (DFW) |

| Credit Card Partnerships | Expected 10% annual earnings increase (from 2024) | High-margin, consistent revenue | Customer loyalty programs |

| Cargo Operations | ~1.5% of Total Revenue (2024) | Revenue: $211 million (Q2 2025) | Increased shipment volume and yield |

Delivered as Shown

American Airlines Group BCG Matrix

The American Airlines Group BCG Matrix preview you are viewing is the complete and final document you will receive upon purchase, offering an unwatermarked and professionally formatted analysis of their business units. This exact report, devoid of any demo content, is meticulously crafted to provide strategic clarity and actionable insights for immediate business planning and competitive analysis. Once acquired, you will gain full access to this ready-to-use BCG Matrix, enabling you to confidently present its findings or integrate them into your strategic initiatives without any further revisions or surprises.

Dogs

In the current domestic air travel landscape, characterized by decelerated consumer discretionary spending, certain routes are showing signs of underperformance. These routes, facing intensified competition, may struggle with lower demand and reduced yields. For example, in the first quarter of 2024, American Airlines reported a 2.4% decrease in revenue per available seat mile (RASM) for its domestic operations compared to the previous year, indicating a broader trend affecting route profitability.

Routes that consistently operate with low load factors or generate insufficient revenue to cover their operational expenses can be categorized as question marks within a BCG matrix framework. These routes tie up valuable capital and resources without delivering significant returns. By the end of 2023, American Airlines operated over 6,700 daily flights across its network, and a small percentage of these, particularly those on less-trafficked or highly competitive domestic corridors, might fall into this underperforming category.

Older, less fuel-efficient aircraft within American Airlines' fleet can be considered Cash Cows. While these planes might still generate revenue, their operational costs, particularly for fuel and maintenance, are higher than newer models. For instance, as of late 2023, American Airlines was still operating a significant number of Boeing 757s and 767s, which are known for being less fuel-efficient than their modern counterparts.

American Airlines' Basic Economy tickets, while designed to attract price-sensitive travelers, present a challenge in the BCG matrix due to high cancellation rates. Despite efforts to allow cancellations for partial credit on non-refundable tickets, these frequent reversals can erode profitability.

The airline faces a potential revenue leakage issue. If the administrative costs associated with processing these cancellations and managing the associated inventory exceed the value of the partial credits collected, this segment becomes a low-margin, low-return business. For instance, in 2024, the airline industry, including American Airlines, has seen a significant uptick in flexible booking options, which, while customer-friendly, can also contribute to higher churn rates for the most basic fare classes.

Certain Seasonal or Infrequent International Routes

Certain international routes, especially those with demand that spikes seasonally or are served infrequently, can find it challenging to maintain profitability throughout the year. These routes often rely on peak travel periods to generate revenue, and without a strong year-round customer base or facing stiff competition, they risk becoming underperformers.

American Airlines, like other carriers, must closely monitor these specific international routes. For instance, routes to popular vacation destinations that see significantly less traffic in the off-season require careful financial scrutiny. If these routes don't build enough consistent market share or encounter aggressive pricing from rivals, they may need to be re-evaluated for their long-term viability.

- Seasonal Route Profitability: Routes with highly seasonal demand, such as those to European summer destinations or Caribbean winter getaways, can experience significant revenue fluctuations.

- Market Share and Competition: A route's ability to build consistent year-round market share is crucial for weathering off-peak periods and fending off competitors.

- Underperformance Risk: Infrequently served international routes that fail to capture sufficient demand or face intense competition may become cash drains, necessitating strategic decisions.

- 2024 Route Analysis: American Airlines' 2024 performance data will be critical in identifying which of these niche international routes are meeting profitability targets and which require divestment or restructuring.

Inefficient Legacy IT Systems

American Airlines Group (AAL) may still grapple with legacy IT systems, even with their digital transformation efforts. These older systems can be resource drains, consuming cash and human effort without driving significant market growth or providing a competitive edge.

These inefficient systems can be considered 'cash cows' in a negative sense, as they require substantial ongoing investment for maintenance and upgrades. For instance, in 2023, AAL reported operating expenses of $38.7 billion, a portion of which would inevitably be allocated to maintaining and modernizing its IT infrastructure.

The challenge lies in balancing the need to maintain these essential, albeit outdated, systems with the investment required for new technologies. This can slow down innovation and impact the airline's ability to adapt quickly to market changes.

- Legacy IT Systems as Cash Drains: Older systems require significant maintenance and upgrade costs, diverting funds from growth initiatives.

- Hindrance to Agility: Inefficient IT infrastructure can slow down the implementation of new technologies and business processes.

- Resource Allocation Dilemma: Airlines must decide whether to invest further in legacy systems or commit to full replacement, impacting capital expenditure.

- Impact on Customer Experience: Outdated systems can sometimes lead to operational inefficiencies that indirectly affect passenger services.

Certain routes within American Airlines' network, particularly those with consistently low passenger numbers and high operating costs, can be classified as Dogs in the BCG matrix. These routes consume resources without generating substantial returns, potentially dragging down overall profitability. For example, while specific route performance data is proprietary, analysis of industry trends in 2024 suggests that smaller, less-trafficked domestic corridors are facing increased pressure due to reduced travel demand in certain segments.

These underperforming routes often suffer from a lack of competitive advantage or are situated in markets with declining economic activity. The airline's strategy might involve either divesting these routes or finding ways to significantly reduce their operating costs. By the end of 2023, American Airlines operated a vast network, and identifying and addressing these Dog segments is crucial for optimizing resource allocation.

The airline's focus in 2024 is on network optimization, which includes evaluating the viability of all routes. Routes that consistently fail to meet profitability benchmarks, even after cost-saving measures, are prime candidates for divestment. This strategic pruning allows the company to reallocate capital to more promising areas of the business.

Identifying these "Dog" routes is an ongoing process. Factors such as fuel costs, aircraft utilization, and competitive pricing on adjacent routes all play a role. For instance, a route that might have been profitable in previous years could become a Dog if operating expenses rise significantly or if a new, low-cost competitor enters the market. American Airlines' commitment to fleet modernization, with new, more fuel-efficient aircraft entering service, also impacts route economics, making older, less efficient aircraft on less profitable routes even more challenging.

Question Marks

American Airlines is actively pursuing Sustainable Aviation Fuel (SAF), aiming to replace 10% of its jet fuel with SAF by 2030 and achieve net-zero emissions by 2050. This ambitious target involves a commitment to over 620 million gallons of SAF. The company's investment in SAF development places it in the 'Question Mark' category of the BCG matrix.

The SAF market is a high-growth area for aviation decarbonization, but significant hurdles remain. Current SAF availability is limited, and production costs are considerably higher than conventional jet fuel. These factors necessitate substantial investment to scale up production and drive down prices, positioning SAF as a strategic, yet uncertain, future growth opportunity for American Airlines.

American Airlines' five new transatlantic routes for Summer 2025, including services to Edinburgh and Milan, are currently in the early stages of development. These routes are considered Question Marks within the BCG matrix, signifying their high growth potential in markets where the airline aims to build or strengthen its foothold.

These new international services require significant initial investment for marketing and capacity to capture market share and demonstrate long-term viability. For instance, American Airlines reported a 10.5% increase in international capacity in Q1 2024 compared to the previous year, highlighting their commitment to expanding their global network and investing in these emerging routes.

American Airlines has placed a significant order for 20 Boom Overture supersonic jets, signaling a bold move into the future of air travel. This initiative represents a high-risk, high-reward venture, characteristic of a Question Mark in the BCG matrix.

The development of supersonic commercial flight faces substantial technological hurdles and requires considerable capital investment, positioning the Overture as a long-term play. Success hinges on the aircraft's ability to achieve commercial viability and market acceptance, potentially transforming it into a Star performer.

AI-Powered Customer Service & Operational Tools

American Airlines is actively exploring AI-powered tools to enhance customer service and streamline operations. For instance, they are piloting generative AI chat assistants aimed at simplifying the rebooking process for passengers. This initiative is part of a broader strategy to leverage technology for improved customer interactions.

These emerging digital tools are currently in the 'Question Mark' category of the BCG Matrix. This classification stems from their early stage of implementation, which involves significant investment in development and testing. While they consume resources now, their potential to transform customer experience and operational efficiency is substantial.

- Generative AI Chatbots: Piloted for customer rebooking, aiming to reduce wait times and improve self-service options.

- Missed Connection Prevention Systems: Being tested at major hubs like Dallas/Fort Worth (DFW) and Charlotte (CLT) to proactively manage flight disruptions.

- Investment in Emerging Tech: Represents a significant capital outlay in research and development for future growth.

- Potential for High Growth: Successful scaling of these AI tools could lead to substantial improvements in customer satisfaction and operational cost savings.

Expansion into Niche or Underserved International Markets

American Airlines might consider expanding into niche or underserved international markets, potentially placing these initiatives in the question mark category of the BCG matrix. This strategy involves identifying routes with less competition or unmet demand, such as specific destinations in South America or the Pacific, which the airline has signaled interest in for Winter 2025/2026. Such ventures require significant upfront investment in marketing and operations to build brand awareness and capture market share in these less-traveled territories.

These new or expanded routes are often characterized by lower initial market awareness, necessitating substantial marketing and operational investment. For instance, while American Airlines is a major player on transatlantic routes, venturing into less-served regions requires a different approach to customer acquisition and route development. The airline's reported plans to increase capacity to certain South American and Pacific destinations for Winter 2025/2026 exemplify this strategic consideration.

- Market Penetration: Focus on increasing passenger volume on existing routes to underserved regions.

- Route Development: Introduce new direct flights to destinations with limited air connectivity.

- Partnerships: Collaborate with local tourism boards and businesses to promote new destinations.

- Investment: Allocate capital for marketing campaigns and operational adjustments to support new international routes.

American Airlines' ventures into Sustainable Aviation Fuel (SAF) and supersonic jet technology represent significant investments with uncertain but potentially high returns. The airline's commitment to 10% SAF by 2030 and the order for 20 Boom Overture jets highlight their pursuit of future growth avenues. These initiatives, while consuming resources now, are positioned as potential game-changers for the company's long-term competitive advantage and sustainability goals.

The airline's exploration of AI for customer service, such as generative AI chat assistants for rebooking, also falls into the Question Mark category. These technologies require substantial upfront investment for development and integration. However, their successful implementation could dramatically improve customer experience and operational efficiency, driving future growth and cost savings.

American Airlines' strategic expansion into new international markets for Summer 2025 and Winter 2025/2026, particularly in South America and the Pacific, are also classified as Question Marks. These routes demand significant investment in marketing and operations to build awareness and capture market share in less-established territories. For example, American Airlines reported a 10.5% increase in international capacity in Q1 2024, signaling a broader push into global expansion.

| Initiative | BCG Category | Investment Rationale | Potential Impact | Current Status/Data |

| Sustainable Aviation Fuel (SAF) | Question Mark | Achieve net-zero emissions by 2050, meet growing demand for sustainable travel. | Enhanced brand reputation, potential cost savings as SAF scales. | Commitment to over 620 million gallons of SAF by 2030. |

| Supersonic Jet Orders (Boom Overture) | Question Mark | Future-proofing fleet, offering premium travel experiences, potential market differentiation. | Significant revenue potential from premium routes, disruption of traditional long-haul travel. | Order for 20 Boom Overture supersonic jets. |

| AI-Powered Customer Service Tools | Question Mark | Improve customer satisfaction, streamline rebooking and operational processes, reduce costs. | Enhanced customer loyalty, increased operational efficiency, competitive edge. | Piloting generative AI chat assistants for rebooking. |

| New International Routes (e.g., South America, Pacific) | Question Mark | Tap into underserved markets, diversify revenue streams, expand global network. | Increased market share in new regions, higher overall revenue. | Plans for increased capacity to certain South American and Pacific destinations for Winter 2025/2026; 10.5% increase in international capacity in Q1 2024. |

BCG Matrix Data Sources

Our American Airlines Group BCG Matrix leverages comprehensive data, including financial reports, industry growth rates, and market share analysis, to accurately position business units.