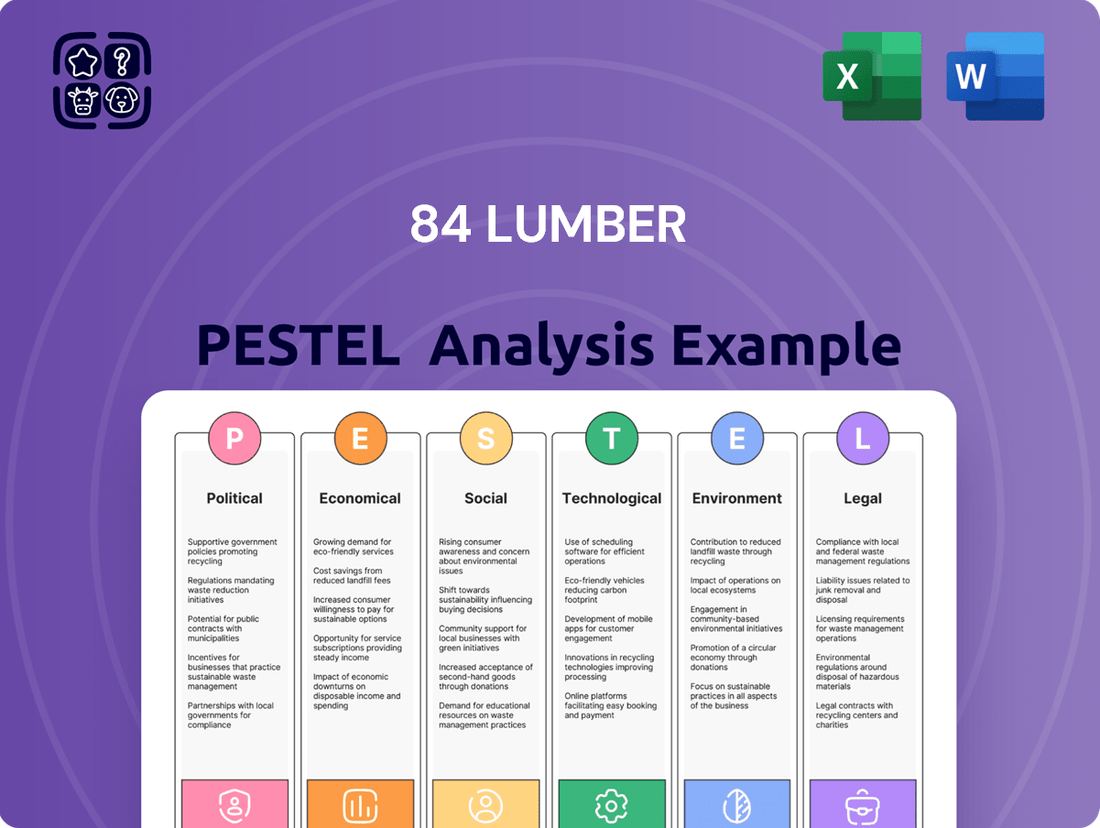

84 Lumber PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

84 Lumber Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping 84 Lumber's trajectory. This comprehensive PESTEL analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full version now to gain the competitive edge you need.

Political factors

Significant federal funding from initiatives like the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA) is allocated for infrastructure projects across the US through 2026. These acts are injecting billions into roads, bridges, public transit, broadband, and clean energy, directly stimulating demand for building materials.

This sustained public spending, estimated to total over $1.2 trillion in infrastructure investments, presents a substantial opportunity for 84 Lumber. As a key supplier of lumber and building materials, the company is well-positioned to capitalize on the increased construction activity driven by these government initiatives.

Changes in trade policies, including potential tariffs on imported construction materials such as softwood lumber from Canada and cement from Mexico, can significantly influence 84 Lumber's material costs. For instance, in early 2024, the U.S. Department of Commerce continued to review and adjust softwood lumber duties, which have historically fluctuated, impacting the landed cost of key building components. These tariffs directly translate to increased operational expenses, potentially forcing 84 Lumber to pass on higher prices to consumers, thereby affecting its market competitiveness and overall profitability, particularly given the lumber supply chain's sensitivity to such trade disruptions.

Evolving building codes, like the anticipated updates to LEED v5 and the National Green Building Standard in 2024-2025, are increasingly prioritizing sustainability and energy efficiency. These shifts directly impact 84 Lumber by necessitating a broader inventory of eco-friendly materials and potentially influencing construction methods. For instance, stricter energy performance requirements could drive demand for advanced insulation and high-efficiency windows, areas where 84 Lumber can strategically expand its offerings.

Housing Policy and Affordability Initiatives

Government initiatives to boost housing supply and affordability directly impact the residential construction sector, a key market for 84 Lumber. Policies focused on reducing housing shortages, such as zoning reform or tax incentives for developers, could stimulate demand for building materials. However, persistent high construction costs and elevated interest rates, evidenced by the Federal Reserve's continued monitoring of inflation in late 2024, present ongoing headwinds for the industry.

84 Lumber's strategic move into multifamily construction is particularly relevant, as it addresses the growing need for varied housing options. This expansion positions the company to potentially capitalize on government programs designed to encourage the development of diverse housing solutions, including multi-unit dwellings.

Key policy considerations include:

- Affordable Housing Targets: Federal and state governments are increasingly setting targets for affordable housing development, which could create new opportunities for builders and material suppliers.

- Construction Cost Mitigation: Policies aimed at lowering material costs or streamlining permitting processes could alleviate some of the current financial pressures on the industry.

- Multifamily Development Incentives: Tax credits or grants specifically for building apartments and other multi-unit structures could further support 84 Lumber's strategic direction.

Labor Policies and Immigration

Government labor policies and immigration regulations significantly influence the construction industry's workforce. Persistent labor shortages, a challenge for 84 Lumber's contractor base, can drive up wages and cause project delays. For instance, the U.S. Bureau of Labor Statistics reported a shortage of over 400,000 construction workers in early 2024.

Policies aimed at workforce development, such as apprenticeship programs or vocational training initiatives, could expand the available labor pool. Similarly, immigration reforms that facilitate the entry of skilled or unskilled labor could alleviate some of the current staffing pressures.

- Labor Shortages: In 2024, the construction sector faced a deficit of approximately 400,000 to 500,000 workers.

- Wage Inflation: Due to shortages, average hourly wages for construction laborers saw an increase of roughly 5-7% year-over-year in late 2024.

- Policy Impact: Government investments in job training programs could potentially boost skilled labor availability by 10-15% within three years.

Government infrastructure spending, particularly through the IIJA and IRA, injects billions into construction projects, directly boosting demand for 84 Lumber's products. Trade policies, such as softwood lumber tariffs, can increase material costs and affect profitability. Evolving building codes favor sustainable materials, creating opportunities for product diversification.

Government policies promoting affordable housing and multifamily development align with 84 Lumber's strategic expansion into these sectors. Labor policies and immigration regulations significantly impact workforce availability, with shortages in 2024 impacting wage growth and project timelines.

| Policy Area | Impact on 84 Lumber | 2024-2025 Data/Trend |

|---|---|---|

| Infrastructure Spending (IIJA/IRA) | Increased demand for building materials | Over $1.2 trillion allocated; billions flowing into projects through 2026 |

| Trade Tariffs (e.g., Softwood Lumber) | Higher material costs, potential price increases | Continued review and adjustment of duties in early 2024 |

| Building Codes (Sustainability Focus) | Demand for eco-friendly materials, product expansion | Anticipated updates to LEED v5 and National Green Building Standard |

| Housing Policies (Affordability, Multifamily) | Opportunities in residential and multifamily construction | Federal and state targets for affordable housing; support for diverse housing solutions |

| Labor Policies / Immigration | Workforce availability, wage pressures | Construction sector faced a deficit of ~400,000-500,000 workers in 2024; wage inflation of 5-7% |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting 84 Lumber, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats within the building materials industry.

This PESTLE analysis of 84 Lumber offers a concise, easily digestible format that can be dropped into presentations or used in group planning sessions, streamlining discussions on external risks and market positioning.

Economic factors

The residential construction sector is poised for a rebound in 2025, with projections indicating a rise in housing starts as inflation stabilizes and interest rates trend downwards. This anticipated surge in new home construction directly fuels demand for lumber and building materials, a critical factor for 84 Lumber's core business.

Despite the positive outlook for 2025, builder confidence has shown volatility, and housing starts have experienced fluctuations throughout 2024. For instance, the U.S. Census Bureau reported a seasonally adjusted annual rate of 1.4 million housing starts in April 2024, a decrease from March's revised figure, highlighting the sensitivity of the market to economic shifts.

A robust housing market translates into higher sales volumes for 84 Lumber, as increased demand for new homes necessitates greater quantities of their products. Conversely, any slowdown in housing starts or a dip in consumer confidence regarding home purchases directly impacts 84 Lumber's revenue streams and overall market performance.

Lumber prices are anticipated to stay elevated through 2024 and into 2025, driven by persistent strong demand in the housing sector, ongoing environmental impacts like wildfires, and lingering supply chain disruptions. While these prices are expected to remain high, they are unlikely to reach the extreme peaks seen in 2021.

Beyond lumber, other essential construction materials are also experiencing substantial price hikes. For instance, gypsum prices have seen significant increases, adding further pressure on overall project costs for builders and contractors.

For a company like 84 Lumber, its profitability is intrinsically linked to the cost and predictability of these raw materials. Managing this volatility necessitates astute procurement strategies and flexible pricing models to maintain healthy margins amidst fluctuating input expenses.

Inflation has shown a downward trend, with the US Consumer Price Index (CPI) easing to 3.3% year-over-year in May 2024, down from a peak of 9.1% in June 2022. This moderation is crucial for sectors like housing and construction.

Anticipated interest rate cuts by the Federal Reserve in 2025 are expected to lower borrowing costs. For instance, if the Fed funds rate, currently hovering around 5.25-5.50%, were to decrease by 0.75% to 1.00% by mid-2025, it would significantly reduce mortgage rates, making new homes more affordable and boosting demand for building materials supplied by 84 Lumber.

Historically, elevated interest rates, such as the sustained high levels seen through 2023 and early 2024, have directly impacted the housing market. High mortgage rates, often exceeding 7%, increased the cost of financing for both developers and homebuyers, leading to a slowdown in new housing starts and a rise in cancellation rates, a challenge 84 Lumber has likely navigated.

A more accommodative monetary policy environment, with lower interest rates, is projected to stimulate construction activity. This shift would likely translate into increased demand for lumber and building supplies, directly benefiting 84 Lumber's sales volume and profitability as housing projects become more financially feasible.

Supply Chain Disruptions

Ongoing global supply chain disruptions remain a significant challenge for the construction industry, directly impacting 84 Lumber. These persistent issues, fueled by geopolitical instability and unpredictable environmental events, have led to increased material and freight costs. For instance, the Producer Price Index for construction materials saw a notable increase throughout 2023 and into early 2024, reflecting these pressures.

These disruptions create hurdles for 84 Lumber in reliably sourcing essential products and maintaining adequate inventory levels. The volatility in shipping costs alone, which saw significant spikes in late 2023 due to Red Sea shipping route issues, directly affects the bottom line.

- Increased Material Costs: Lumber prices, a key component for 84 Lumber, have experienced volatility. For example, framing lumber futures traded on the CME reached highs in early 2024, influenced by housing market demand and supply chain constraints.

- Elevated Freight Expenses: The cost of transporting goods globally has risen. Ocean freight rates, particularly on trans-Pacific routes, saw a resurgence in late 2023 and early 2024, adding to the overall cost of goods for retailers.

- Inventory Management Challenges: Delays in shipments and unpredictable lead times complicate inventory planning, potentially leading to stockouts or excess inventory, impacting sales and storage costs.

- Geopolitical and Environmental Impacts: Events such as the ongoing conflict in Eastern Europe and extreme weather patterns continue to disrupt production and transportation networks for various construction materials.

Economic Growth and Consumer Confidence

The national economy is showing resilience, with the Leading Economic Index (LEI) for April 2024, released in May 2024, indicating a positive trend, moving away from previous recessionary signals. This suggests a more stable economic environment for businesses like 84 Lumber.

Consumer confidence is projected to strengthen as interest rates begin to decline throughout 2024 and into 2025. For instance, the Federal Reserve's stance on potential rate cuts, influenced by inflation data, directly impacts borrowing costs for consumers and businesses, fostering greater spending power.

A robust economy coupled with increased consumer confidence directly translates to higher demand for construction materials and home improvement services. This environment is favorable for 84 Lumber, as consumers are more inclined to undertake new building projects or renovations when they feel financially secure and optimistic about the future.

- Economic Growth: The LEI's upward trend in early 2024 suggests a softening of recessionary fears.

- Consumer Confidence: Anticipated interest rate decreases in 2024-2025 are expected to boost consumer sentiment.

- Impact on 84 Lumber: Improved economic conditions and consumer optimism are likely to drive increased sales for construction and home improvement products.

Inflation's downward trend, with the US CPI easing to 3.3% year-over-year in May 2024, is a positive sign for the construction sector. Anticipated Federal Reserve interest rate cuts in 2025, potentially reducing the Fed funds rate from its current 5.25-5.50% range, are expected to lower borrowing costs, making new homes more affordable and boosting demand for building materials. This economic environment, coupled with a resilient national economy indicated by the Leading Economic Index (LEI) in early 2024, suggests a more stable and favorable market for 84 Lumber.

| Economic Indicator | Value/Trend | Period | Impact on 84 Lumber |

|---|---|---|---|

| US Consumer Price Index (CPI) | 3.3% (Year-over-Year) | May 2024 | Easing inflation reduces input costs and improves consumer purchasing power. |

| Federal Funds Rate | 5.25-5.50% (Current) | 2024 | Anticipated cuts in 2025 to lower borrowing costs, stimulating housing demand. |

| Leading Economic Index (LEI) | Positive Trend | April 2024 (released May 2024) | Indicates economic resilience, suggesting a stable environment for construction. |

Same Document Delivered

84 Lumber PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive 84 Lumber PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning. You'll gain valuable insights into market dynamics and potential challenges.

Sociological factors

Population growth, particularly in urban centers, fuels a steady demand for new homes. In 2024, the U.S. population is projected to reach over 336 million, with urbanization continuing to concentrate demand in key areas. This trend directly translates to a robust need for building materials, a core offering for 84 Lumber.

The rate at which new households are forming is another significant driver for the construction sector. In 2023, household formation in the U.S. saw a notable increase, driven by younger generations establishing independent living situations. This rise in household formation directly boosts the residential construction market, creating consistent opportunities for lumber and building material suppliers like 84 Lumber.

These demographic patterns, including population expansion and increased household creation, create a sustained demand for both single-family and multi-family housing projects. Consequently, 84 Lumber benefits from this ongoing need for construction supplies, supporting a diverse range of residential development across the country.

The construction sector is grappling with a substantial and ongoing scarcity of skilled labor. Projections indicate a need for hundreds of thousands more workers throughout 2024 and 2025 to keep pace with construction demand.

This deficit in skilled trades can result in project delays and escalating labor expenses for builders. Consequently, 84 Lumber may experience a slowdown in construction activity, impacting sales volumes and project timelines for its customers.

Remote work continues to reshape housing demand, with a notable increase in interest for suburban and rural properties. This trend, amplified by the flexibility gained in recent years, is driving a preference for larger homes and more affordable living spaces away from bustling urban cores. For instance, a 2024 survey indicated that over 60% of remote workers are considering a move to a less densely populated area.

This migration directly impacts the construction industry. As more people seek spacious homes, the demand for single-family residential building materials is expected to rise. Companies like 84 Lumber, which supply lumber and other construction essentials, are well-positioned to benefit from this shift, potentially seeing increased sales of products catering to this growing market segment.

Increasing Focus on Sustainability and Green Living

Consumers are increasingly prioritizing sustainability, impacting purchasing decisions in the building sector. This growing awareness translates into a higher demand for eco-friendly materials and energy-efficient home designs. For instance, the U.S. Green Building Council reported a 20% increase in LEED (Leadership in Energy and Environmental Design) certified projects in 2024 compared to the previous year, highlighting this trend.

This shift presents a significant opportunity for companies like 84 Lumber to adapt. By expanding their offerings to include a broader selection of sustainable building materials, such as recycled content lumber, low-VOC paints, and advanced insulation, they can meet evolving customer needs. Furthermore, promoting energy-efficient design solutions, like high-performance windows and passive solar building techniques, can position 84 Lumber as a leader in the green building movement.

- Growing Consumer Demand: Surveys from 2024 indicate that over 60% of homebuyers are willing to pay a premium for homes with green features.

- Market Growth: The green building materials market is projected to reach $300 billion globally by 2025, showing substantial growth potential.

- Competitive Advantage: Offering sustainable options can differentiate 84 Lumber from competitors and attract environmentally conscious customers.

DIYer and Professional Builder Needs

84 Lumber caters to a dual customer base: seasoned professional builders and enthusiastic do-it-yourselfers (DIYers). Societal shifts, like a growing preference for personalized living spaces and a rise in home renovation projects, directly influence demand. For instance, the DIY market saw significant growth, with spending on home improvement projects by homeowners reaching an estimated $485 billion in 2023, according to HomeAdvisor. This trend necessitates that 84 Lumber adapts its product offerings and marketing strategies to meet the distinct needs of both segments.

The evolving needs of these customer groups present both opportunities and challenges. Professionals require bulk materials, reliable delivery, and specialized tools, while DIYers often seek guidance, smaller quantities, and aesthetically pleasing finishes. Understanding these differing requirements is key for 84 Lumber’s product diversification and targeted marketing efforts.

- Professional Builders: Focus on efficiency, cost-effectiveness, and project completion timelines, demanding consistent quality and bulk availability.

- DIYers: Increasingly driven by online tutorials and social media trends, seeking inspiration, accessible project advice, and visually appealing materials for home enhancement.

- Market Segmentation: The divergence in needs requires tailored product assortments, from heavy-duty construction materials for pros to curated design packages for homeowners undertaking renovations.

Societal trends like the increasing demand for sustainable living and the growing DIY culture significantly shape the building materials market. In 2024, consumer preference for eco-friendly products is evident, with a projected 20% increase in demand for green building materials. This shift necessitates that 84 Lumber adapts its inventory to include more sustainable options to meet evolving customer expectations and capture a larger market share.

Technological factors

Building Information Modeling (BIM) is rapidly becoming an industry standard, with its adoption expected to reach 70% in new construction projects in North America by 2025. This technology allows for the creation of detailed 3D models, significantly improving collaboration, minimizing errors, and enhancing material estimation accuracy, all while supporting sustainability goals.

Further advancements in BIM include better interoperability between different software platforms and the integration of artificial intelligence (AI) and the Internet of Things (IoT), which are expanding its capabilities for predictive analysis and real-time data management. For instance, AI can now optimize material procurement based on BIM model data, reducing waste.

84 Lumber can capitalize on these technological shifts by ensuring its product data and services are compatible with these evolving digital workflows. By aligning with BIM standards and offering integrated solutions, 84 Lumber can provide enhanced efficiency and value to its clients, streamlining their design, construction, and material management processes.

AI-powered robots are revolutionizing construction, handling tasks like bricklaying and concrete pouring with impressive accuracy. Drones are also becoming indispensable for site management, enhancing safety protocols and streamlining data collection. This technological shift promises to boost precision and significantly cut down on material waste.

These advancements directly address the persistent labor shortages plaguing the construction industry. For 84 Lumber, this presents a strategic opportunity to adapt its product offerings. By developing standardized or prefabricated components, the company can better support these emerging automated construction processes, ensuring its materials are compatible with robotic assembly.

Digital twin technology is transforming the Architecture, Engineering, and Construction (AEC) sector, allowing for real-time tracking and enhancement of building operations. This, coupled with advanced data analytics, fuels more informed decisions and boosts project efficiency. For instance, by analyzing data, businesses can anticipate potential project delays and streamline resource allocation. In 2024, the global digital twin market was valued at approximately $10 billion and is projected to grow significantly, highlighting its increasing importance.

84 Lumber can harness data analytics to refine its inventory management, improve demand forecasting accuracy, and gain deeper insights into customer preferences. This data-driven approach can lead to optimized stock levels and more targeted marketing efforts. For example, by analyzing sales data from 2023, 84 Lumber could identify regional trends in demand for specific building materials, allowing for better inventory positioning across its locations.

Prefabrication and Modular Construction

Prefabrication and modular construction are rapidly advancing, offering significant benefits like increased efficiency, minimized waste, and the integration of eco-friendly materials. This method also facilitates the disassembly and reuse of building components, thereby extending their useful life. The global modular construction market was valued at approximately USD 120 billion in 2023 and is projected to reach over USD 200 billion by 2030, demonstrating robust growth.

84 Lumber can strategically leverage this trend by enhancing its capabilities in producing manufactured components and expanding its custom shop services. This would position the company to meet the escalating demand for prefabricated building solutions, a segment expected to see continued expansion in the coming years.

- Market Growth: The modular construction sector is experiencing a compound annual growth rate (CAGR) of over 6% globally.

- Efficiency Gains: Projects utilizing modular construction can see completion times reduced by 20-50% compared to traditional methods.

- Sustainability Focus: Up to 90% of waste can be diverted from landfills in factory-controlled modular builds.

- 84 Lumber Opportunity: Expanding prefabrication services aligns with industry demand for faster, more sustainable building practices.

Emerging Materials and Smart Technologies

Innovations in construction materials are rapidly advancing, with a growing focus on sustainability and performance. This includes the development of self-healing concrete, bio-based alternatives, and increased use of recycled materials like steel, concrete, and wood. Smart materials that can adapt to environmental changes are also becoming more prevalent.

Emerging technologies like transparent solar panels, which can be integrated into building facades, and phase change materials for improved thermal regulation are gaining commercial traction. These advancements offer significant opportunities for companies like 84 Lumber to differentiate themselves.

By strategically stocking and promoting these advanced and sustainable materials, 84 Lumber can cater to evolving customer preferences and stricter environmental regulations. For instance, the global green building materials market was valued at approximately $215.4 billion in 2023 and is projected to reach $425.2 billion by 2030, indicating a strong demand for such products.

- Self-healing concrete extends infrastructure lifespan, reducing maintenance costs.

- Bio-based materials offer a lower carbon footprint compared to traditional options.

- Recycled materials contribute to circular economy principles and resource conservation.

- Transparent solar panels provide dual functionality, generating energy while allowing light transmission.

Technological advancements are reshaping the construction landscape. Building Information Modeling (BIM) adoption is projected to reach 70% in North America by 2025, improving project collaboration and accuracy. AI and IoT integration within BIM are further enhancing capabilities, optimizing material procurement and reducing waste.

Robotics and drone technology are increasing construction precision and efficiency, addressing labor shortages. Digital twin technology, valued at approximately $10 billion in 2024, offers real-time building operation insights and data analytics for optimized project management. Prefabrication and modular construction, a market exceeding $120 billion in 2023, are also gaining significant traction due to their speed and waste reduction benefits.

Innovations in materials, such as self-healing concrete and bio-based alternatives, are driving sustainability. The green building materials market was valued at $215.4 billion in 2023, showing a strong demand for eco-friendly options. 84 Lumber can leverage these trends by adopting compatible technologies and expanding its offerings in prefabricated components and sustainable materials.

Legal factors

Stricter environmental regulations are increasingly shaping the construction industry, requiring businesses like 84 Lumber to adapt. For instance, the U.S. Green Building Council's LEED (Leadership in Energy and Environmental Design) certification is a prominent example, with a growing number of projects seeking its validation. As of early 2024, over 100,000 LEED projects were registered worldwide, indicating a strong market demand for sustainable building practices.

The adoption of green building certifications, such as the National Association of Home Builders (NAHB) National Green Building Standard (NGBS), is also on the rise, pushing for the use of sustainable materials and energy-efficient designs. This trend directly impacts lumber suppliers, necessitating a focus on sourcing and offering products that meet these evolving legal and certification mandates to maintain a competitive edge in the market.

Worker safety regulations in the construction sector are tightening, with a growing focus on smart personal protective equipment (PPE) and sophisticated monitoring technologies. For instance, the Occupational Safety and Health Administration (OSHA) continues to update its standards, impacting how construction sites operate.

Companies are increasingly adopting virtual and augmented reality for training, enhancing worker preparedness. While 84 Lumber primarily supplies materials, the safety protocols of its contractor customers are directly affected by these evolving regulations. This could lead 84 Lumber to explore incorporating safety-enhancing features into its product offerings or developing related support services to align with industry best practices.

Local land use and zoning laws are critical for 84 Lumber, as they directly influence where and what kind of construction can occur. These regulations determine the permissible density and type of development, impacting the demand for building materials from 84 Lumber's customer base, which includes contractors and individual builders.

For instance, strict zoning in a particular municipality might limit single-family home construction to lower-density areas, potentially reducing the overall volume of lumber and related products needed for such projects. Conversely, areas with more lenient zoning might see increased residential or commercial development, boosting demand for 84 Lumber's offerings.

Import/Export Regulations and Tariffs

Changes in import and export regulations, including tariffs on building materials, directly impact 84 Lumber's procurement costs and pricing strategies. For instance, tariffs on Canadian softwood lumber, which saw significant fluctuations in 2024, can increase material expenses. The company must adeptly navigate these international trade laws to ensure a competitive supply chain and manage its cost of goods sold effectively.

Navigating these regulations is crucial for maintaining profitability and market competitiveness. For example, in 2024, the U.S. Department of Commerce continued to review and adjust duties on imported lumber products, directly affecting the landed cost of materials for companies like 84 Lumber. Staying abreast of these dynamic trade policies is essential for strategic sourcing and inventory management.

- Tariff Impact: Tariffs on key building materials, such as softwood lumber from Canada, can lead to increased procurement costs for 84 Lumber, potentially impacting their pricing structure.

- Supply Chain Management: Fluctuations in import/export regulations require proactive adjustments to sourcing strategies to ensure a stable and cost-effective supply chain.

- Regulatory Compliance: Adhering to evolving international trade laws and customs procedures is vital for uninterrupted operations and avoiding penalties.

- Market Competitiveness: Efficiently managing the impact of trade policies allows 84 Lumber to maintain competitive pricing against rivals who may have different sourcing advantages.

Contract Law and Liability

84 Lumber, as a supplier of building materials, navigates a complex web of contract laws that dictate its relationships with customers, from large construction firms to individual DIYers. These laws are fundamental to ensuring fair dealings and managing expectations regarding product quality and delivery. Failure to comply can lead to significant legal repercussions, impacting the company's financial stability and reputation.

Liability for product quality and performance is a paramount concern. If materials supplied by 84 Lumber are defective or fail to perform as expected, the company could face lawsuits and claims for damages. This underscores the importance of robust quality control measures and clear contractual terms that define responsibilities and warranties. For instance, in 2024, the construction industry saw a notable increase in litigation related to material defects, highlighting the ongoing risks suppliers face.

- Contractual Agreements: 84 Lumber must ensure its sales contracts clearly define terms, specifications, delivery schedules, and payment conditions to minimize disputes.

- Product Liability: Adherence to consumer protection laws and industry standards is crucial to mitigate risks associated with faulty products and potential customer claims.

- Dispute Resolution: Establishing clear processes for handling disagreements, whether through negotiation, mediation, or arbitration, can prevent costly litigation.

Legal frameworks surrounding environmental compliance, such as those related to emissions and waste disposal, directly influence 84 Lumber's operational costs and material sourcing. For example, the EPA's regulations on volatile organic compounds (VOCs) in building materials, which saw continued enforcement in 2024, can necessitate changes in product offerings. Furthermore, evolving building codes, like updated energy efficiency standards implemented in various states throughout 2024, shape the demand for specific types of lumber and construction components.

Environmental factors

Climate change is increasingly manifesting in more severe weather occurrences such as wildfires and hurricanes. These events directly impact lumber availability by damaging forests and disrupting harvesting operations. For instance, the 2023 wildfire season in Canada, one of the most severe on record, significantly affected timber supplies across North America.

The intensification of extreme weather also creates a dual effect on demand. While immediate rebuilding efforts following disasters like hurricanes can boost demand for construction materials, the long-term disruption to supply chains can lead to considerable price volatility for lumber and other essential building components, impacting 84 Lumber's cost structure and sales.

Growing concerns about resource depletion are increasingly influencing the construction industry, pushing for sustainable sourcing and the adoption of recycled or bio-based materials. This trend is accelerating as companies aim for carbon-neutral strategies, impacting material choices and supply chain management.

For 84 Lumber, demonstrating a commitment to providing sustainably sourced lumber and exploring alternative building materials is vital. This directly addresses evolving market demands and heightened environmental expectations from consumers and regulatory bodies alike. For instance, the U.S. Green Building Council reported that in 2023, over 40% of new commercial construction projects pursued LEED certification, indicating a strong market preference for sustainable practices.

The construction sector is placing a growing emphasis on minimizing waste and embracing circular economy concepts, which encourages the reuse and recycling of building materials. This shift includes designing structures for easier disassembly and putting in place thorough waste management plans. For instance, in 2023, the U.S. construction industry generated an estimated 600 million tons of construction and demolition debris, highlighting the significant opportunity for waste reduction.

84 Lumber can actively participate by providing products that are either recyclable or manufactured using recycled content. The company can also champion waste reduction efforts throughout its supply chain and customer base. By offering sustainable material options, 84 Lumber can align with the industry's move towards greater environmental responsibility and potentially tap into a growing market segment seeking eco-friendly building solutions.

Energy Efficiency in Buildings

The construction industry is seeing a significant push towards energy efficiency, with a growing emphasis on better insulation and the incorporation of renewable energy solutions. Many new regulations are now targeting net-zero energy buildings, reflecting a broader environmental consciousness.

84 Lumber can leverage this trend by stocking and promoting products that enhance a building's energy performance. This includes offering advanced insulation materials, energy-saving windows and doors, and other components that help reduce a building's overall energy consumption.

- Increased demand for high-performance insulation: The U.S. Department of Energy reported that improving building insulation can reduce heating and cooling energy use by 10-20%.

- Growth in energy-efficient windows and doors market: The global market for energy-efficient windows and doors was valued at approximately $150 billion in 2023 and is projected to grow.

- Government incentives for green building: Many regions offer tax credits and rebates for constructing or retrofitting buildings to meet higher energy efficiency standards, encouraging adoption.

Biodiversity and Land Use Impact

Environmental regulations are increasingly focusing on biodiversity and land use, impacting the construction sector. For instance, regions like England have introduced mandatory biodiversity net gain (BNG) requirements, compelling developers to achieve at least a 10% increase in biodiversity on new sites. This trend directly influences site selection and development practices, pushing for materials and methods that lessen ecological disruption.

84 Lumber, as a supplier to the construction industry, must navigate these evolving environmental landscapes. Their product offerings and operational strategies need to align with a growing demand for sustainable building materials and practices that minimize negative impacts on biodiversity and promote responsible land use. This could involve sourcing timber from sustainably managed forests or offering products with lower embodied carbon footprints.

- Biodiversity Net Gain (BNG): Mandatory in some regions, requiring a 10% biodiversity increase on new developments.

- Sustainable Land Use: Growing pressure for development practices that preserve or enhance ecological value.

- Material Demand: Increased preference for building materials with minimal ecological impact.

- Operational Footprint: 84 Lumber's own operations and supply chain must consider their environmental impact.

The increasing frequency and intensity of extreme weather events, such as the severe Canadian wildfires in 2023, directly impact lumber availability and drive price volatility for 84 Lumber. This necessitates a strategic focus on sustainable sourcing and exploring alternative materials to mitigate supply chain disruptions and meet growing consumer demand for eco-friendly options, as evidenced by the over 40% of new commercial projects pursuing LEED certification in 2023.

PESTLE Analysis Data Sources

Our 84 Lumber PESTLE Analysis is built on a robust foundation of data from official government sources, reputable industry associations, and leading market research firms. We draw upon economic indicators, regulatory updates, and technological advancements to provide a comprehensive view.